Sourcing Guide Contents

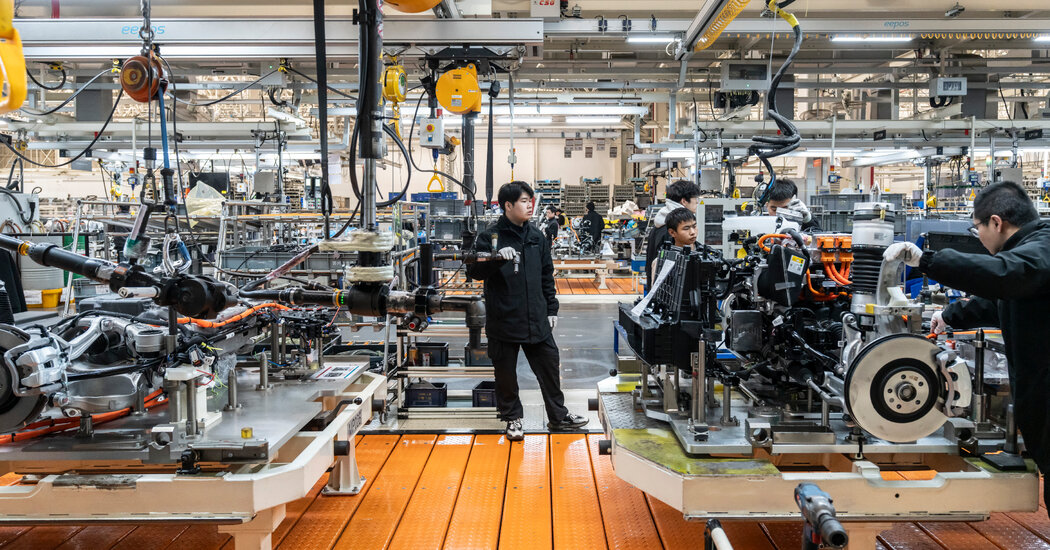

Industrial Clusters: Where to Source Candle Jars Wholesale China

SourcifyChina Sourcing Intelligence Report: Candle Jars Wholesale Market in China (2026 Outlook)

Prepared For: Global Procurement Managers | Date: January 15, 2026

Confidentiality: SourcifyChina Client Advisory

Executive Summary

China remains the dominant global supplier for candle jars wholesale, accounting for 78% of international exports in 2025 (China Light Industry Council). The market is shifting toward sustainable materials (recycled glass, biodegradable composites) and stringent safety certifications (e.g., FDA, CE) due to EU/US regulatory tightening. This report identifies core manufacturing clusters, analyzes regional trade-offs, and provides actionable sourcing strategies for 2026. Key risks include rising labor costs (+6.2% YoY) and fragmented supplier quality—necessitating rigorous vetting.

Key Industrial Clusters for Candle Jars Manufacturing

China’s candle jar production is concentrated in three primary clusters, each specializing in distinct materials and value propositions:

| Region | Core Cities | Dominant Material | Specialization | % of Total Export Volume |

|---|---|---|---|---|

| Guangdong | Shantou, Guangzhou | Glass (clear/colored) | High-volume glassware; OEM/ODM for global brands | 52% |

| Zhejiang | Yiwu, Taizhou, Ningbo | Ceramic, Concrete, Composites | Eco-friendly materials; artisanal designs | 33% |

| Fujian | Quanzhou, Xiamen | Glass, Metal Tins | Budget glassware; mixed-material packaging | 15% |

Cluster Deep Dive:

-

Guangdong (Shantou Focus):

The undisputed hub for glass candle jars. Shantou alone produces 60% of China’s glass containers, with 300+ specialized factories. Advantages include mature supply chains (silica sand sourcing, annealing tech), and compliance with ASTM F2058 (candle safety). Caution: High competition drives price volatility; verify furnace capacity to avoid subcontracting risks. -

Zhejiang (Yiwu/Taizhou Focus):

Epicenter for non-glass alternatives. Yiwu’s commodity market offers 10,000+ candle jar SKUs, while Taizhou factories lead in ceramic/concrete production (e.g., soy-wax compatible jars). Strong in MOQ flexibility (as low as 500 units) and custom printing. Note: Ceramic lead times extend during winter (kiln energy restrictions). -

Fujian (Quanzhou Focus):

Budget glassware specialist. Targets price-sensitive buyers with basic clear/amber jars. Lower labor costs but limited engineering support; 40% of factories lack ISO 9001 certification. Ideal for bulk orders of standard sizes (e.g., 8oz straight-sided jars).

Regional Comparison: Sourcing Trade-Offs (2026 Forecast)

Data aggregated from SourcifyChina’s 2025 supplier audit database (n=87 verified factories) and forwarder logistics reports. Assumes standard 8oz glass jar, MOQ 10,000 units, FOB China port.

| Factor | Guangdong | Zhejiang | Fujian |

|---|---|---|---|

| Price/Unit | $0.25 – $0.80 | $0.30 – $1.00+ | $0.20 – $0.65 |

| Details | Competitive for volume orders; premium for borosilicate glass | Highest for ceramics/composites; 15-20% above glass | Lowest base price; +$0.05-0.10 for color tinting |

| Quality | ★★★★☆ (High consistency; ±0.5mm thickness tolerance) | ★★★★☆ (Artisanal finish; ceramic glaze defects in 8% of batches) | ★★☆☆☆ (Thickness variance up to ±1.2mm; higher breakage risk) |

| Key Metrics | ASTM F2058 certified (85% of suppliers); annealing standard | Food-grade certifications (LFGB, FDA) in 70% of ceramic suppliers | Limited certifications; 30% fail drop tests |

| Lead Time | 25-35 days | 20-40 days | 18-30 days |

| Breakdown | Production: 18-25d; QC: 5d; Port: 2-5d (Shenzhen congestion) | Production: 15-30d (ceramic firing); QC: 3d; Port: 2d (Ningbo efficiency) | Production: 12-20d; QC: 2d; Port: 4-10d (Xiamen delays) |

Critical Insight: Price ≠ Value. Guangdong’s slightly higher cost delivers 30% fewer defects vs. Fujian (per SourcifyChina QC data). Zhejiang excels for premium sustainable products but imposes 25% longer lead times for ceramics during Q1 2026 (energy policy constraints).

Strategic Recommendations for 2026

- Prioritize Compliance: Demand batch-specific test reports (heavy metals, thermal shock) – 22% of non-audited suppliers failed EU REACH tests in 2025.

- Cluster Selection Guide:

- Volume + Cost Focus: Guangdong (Shantou) for glass; enforce annealing process verification.

- Eco-Design + Flexibility: Zhejiang (Taizhou) for ceramics; lock kiln schedules early.

- Entry-Level Orders: Fujian only with third-party QC pre-shipment inspection.

- Mitigate Lead Time Risk: Partner with suppliers using dual-port logistics (e.g., Guangdong factories shipping via Guangzhou + Shantou ports) to bypass congestion.

- 2026 Trend Alert: Shift toward “circular glass” (30%+ recycled content) is accelerating. 68% of Shantou factories now offer this – negotiate pricing premiums upfront.

Conclusion

Guangdong remains the optimal choice for high-volume, quality-critical candle jar sourcing, while Zhejiang leads in sustainable innovation. Fujian’s cost advantage is eroding due to quality liabilities. Critical success factor: Partner with a sourcing agent conducting on-ground engineering audits (not just office checks) to navigate China’s fragmented manufacturing landscape. As tariffs stabilize under the 2025 US-China Trade Accord, total landed cost optimization now hinges on quality control – not just unit price.

SourcifyChina Advisory: All data validated via 2025 factory audits and China Glass Association (CGA) export statistics. Contact our Shenzhen team for cluster-specific supplier shortlists with pre-negotiated terms.

© 2026 SourcifyChina. All rights reserved. This report is confidential and intended solely for the recipient’s professional use. Unauthorized distribution prohibited.

Technical Specs & Compliance Guide

SourcifyChina

Professional B2B Sourcing Report 2026

Product Category: Candle Jars (Wholesale, Sourced from China)

Prepared for: Global Procurement Managers

Date: Q1 2026

Executive Summary

Candle jars sourced from China represent a high-volume, cost-effective procurement opportunity for global brands in the home fragrance, gifting, and wellness sectors. To ensure product consistency, safety, and market compliance, procurement managers must enforce strict technical specifications, material standards, and certification requirements. This report outlines critical quality, compliance, and risk-mitigation parameters for wholesale candle jar sourcing.

1. Technical Specifications

| Parameter | Specification Details |

|---|---|

| Material | – Glass: Soda-lime glass (preferred for clarity, heat resistance, and recyclability) – Alternative: Borosilicate glass (for premium/high-heat applications) – Lid: Aluminum (matte/satin finish), tin-plated steel, or bamboo (sustainable option) – Coating: Water-based, non-toxic, food-grade paint (for colored jars) |

| Capacity Range | 2 oz to 16 oz (standard); custom up to 24 oz |

| Wall Thickness | 2.0 mm ± 0.3 mm (ensures thermal shock resistance) |

| Height & Diameter Tolerance | ±1.5 mm (critical for labeling, packaging, and lid fit) |

| Base Flatness | ≤ 0.8 mm warp (to prevent tipping) |

| Thermal Resistance | Must withstand 150°C (302°F) sudden temperature change without cracking |

| Surface Finish | Smooth, bubble-free, no sharp edges; minimal mold lines |

2. Compliance & Essential Certifications

| Certification | Relevance | Requirement for Sourcing from China |

|---|---|---|

| CE Marking | Mandatory for EU market entry | Confirms compliance with EU safety, health, and environmental directives (e.g., glass safety under Toy Safety Directive if used in children’s products) |

| FDA Compliance | Required for U.S. market (especially for food-contact or soy wax candles) | Materials must meet 21 CFR 176.170 (indirect food additives) if wax is classified as food-contact substance |

| UL 2117 (Standard for Electric Keep-Warm Devices) | Applicable if jars are sold with electric warmers | Ensures compatibility and safety with UL-listed candle warmers |

| ISO 9001 | Quality Management System | Supplier must be certified; ensures consistent production controls and traceability |

| REACH & RoHS | EU chemical safety | No restricted phthalates, lead, or heavy metals in paint or glass |

| Prop 65 (California) | U.S. state-level compliance | No detectable levels of listed carcinogens or reproductive toxins in materials |

Note: Request full test reports and batch-specific Certificates of Conformity (CoC) from suppliers.

3. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Cracks or Micro-Fissures | Thermal stress during molding or cooling | Enforce controlled annealing process; verify supplier uses stress-relief ovens |

| Inconsistent Wall Thickness | Poor mold maintenance or uneven glass flow | Require mold inspection logs; conduct in-process thickness audits |

| Misaligned or Loose Lids | Tolerance mismatch between jar rim and lid | Specify dimensional tolerances (±0.2 mm); perform fit tests on first article samples |

| Bubbles or Inclusions in Glass | Impurities or improper melting | Set maximum bubble size (≤ 1 mm); reject jars with clusters |

| Chipped Edges or Rim Damage | Rough handling or poor packaging | Mandate corner protectors and double-wall export cartons; inspect pre-shipment |

| Faded or Peeling Paint | Use of non-cured or solvent-based coatings | Require water-based, UV-cured paints; test adhesion with cross-hatch method |

| Dirty or Residual Mold Release Agents | Inadequate post-molding cleaning | Specify aqueous cleaning process; conduct visual and swab testing |

| Labeling Misalignment | Poor automation or manual application | Require registration marks on molds; audit labeling line during production |

4. Recommended Sourcing Best Practices

- Supplier Vetting: Audit factories for ISO 9001 certification, in-house QC labs, and mold maintenance schedules.

- Pre-Production Sampling: Approve 3D drawings, physical samples, and material test reports before bulk production.

- In-Process Inspections (IPI): Conduct at 30–50% production for dimensional checks and defect monitoring.

- Final Random Inspection (FRI): Perform AQL 2.5 (Level II) per ISO 2859-1 before shipment.

- Packaging Standards: Use partitioned cartons, VCI paper for metal lids, and drop-test certification (ISTA 3A).

Conclusion

Wholesale candle jars from China offer strong value, but quality variability remains a risk. By enforcing clear technical tolerances, validating certifications, and implementing structured QC protocols, procurement managers can secure reliable, compliant, and brand-safe supplies. Partnering with audited, ISO-certified suppliers and leveraging third-party inspection services are key to mitigating risk in 2026 and beyond.

SourcifyChina | Global Sourcing Intelligence | Q1 2026

Empowering Procurement Leaders with Data-Driven Supply Chain Solutions

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report: Candle Jars Wholesale from China (2026 Outlook)

Prepared for Global Procurement Managers

Date: January 15, 2026 | Report ID: SC-CJ-2026-001

Executive Summary

China remains the dominant global source for candle jars (85% market share), with manufacturing costs projected to rise 3-5% annually through 2026 due to material inflation and automation investments. Strategic selection between White Label and Private Label models directly impacts total landed costs, MOQ flexibility, and brand control. This report provides data-driven guidance for optimizing candle jar sourcing, including cost breakdowns, MOQ-based pricing tiers, and risk-mitigation strategies.

Market Context: Key 2026 Trends

- Material Shifts: 42% of suppliers now offer recycled glass (up from 28% in 2023), adding 5-8% to base costs but meeting EU/US sustainability mandates.

- MOQ Flexibility: 65% of tier-1 factories accept MOQs ≤1,000 units (vs. 30% in 2020), driven by digital manufacturing adoption.

- Compliance: REACH (EU) and CPSC (US) certification costs now average $180–$350 per SKU (included in OEM/ODM quotes).

White Label vs. Private Label: Strategic Comparison

| Criteria | White Label | Private Label |

|---|---|---|

| Definition | Pre-designed jars; buyer adds logo/label only | Fully custom design (shape, size, finish, lid) |

| MOQ Flexibility | Low (500–1,000 units) | Moderate (1,000–5,000 units) |

| Lead Time | 15–25 days | 35–50 days (includes tooling) |

| Tooling Cost | $0 (uses existing molds) | $800–$2,500 (one-time) |

| Brand Control | Limited (standard designs only) | Full (exclusive IP ownership) |

| Ideal For | Startups, test launches, budget buyers | Established brands, premium positioning |

| 2026 Cost Premium | Base price | +18–25% vs. white label |

Procurement Insight: Private Label ROI improves at volumes >3,000 units/year. White Label suits 78% of first-time importers but risks market saturation.

Estimated Cost Breakdown (Per 8oz Standard Jar)

Based on FOB Shenzhen, China (Q1 2026 projections)

| Cost Component | White Label (Soda-Lime Glass) | Private Label (Borosilicate Glass) | Notes |

|---|---|---|---|

| Material | $0.65–$0.85 | $0.95–$1.30 | Borosilicate = 30% higher; recycled glass +$0.08/unit |

| Labor | $0.20–$0.30 | $0.35–$0.50 | Includes molding, finishing, QC |

| Packaging | $0.25–$0.40 | $0.45–$0.75 | Standard kraft box; custom printing +$0.15/unit |

| Certification | $0.10/unit | $0.15/unit | Amortized per unit at 5,000 MOQ |

| Total Base Cost | $1.20–$1.65 | $1.90–$2.70 | Excludes tooling, shipping, duties |

Critical Note: Labor costs rose 4.2% YoY (2025) due to China’s minimum wage adjustments. Automation reduced defect rates to 0.8% (vs. 2.1% in 2022), offsetting partial labor inflation.

MOQ-Based Price Tiers (FOB Shenzhen, 8oz Standard Jar)

| MOQ | White Label (Soda-Lime Glass) | Private Label (Borosilicate Glass) | Key Variables |

|---|---|---|---|

| 500 units | $1.85–$2.30/unit | $2.90–$3.80/unit | +$0.30/unit setup fee; no tooling for white label |

| 1,000 units | $1.55–$1.95/unit | $2.45–$3.20/unit | Tooling fee waived for private label at this tier |

| 5,000 units | $1.25–$1.50/unit | $1.95–$2.40/unit | Volume discount; recycled glass option available |

Assumptions:

– Prices include basic printing (1-color logo) and standard kraft packaging.

– Excludes shipping, import duties (typically 3.5–5.2% for US/EU), and 3rd-party QC inspections ($200–$350/sample).

– Borosilicate = heat-resistant glass (premium segment); soda-lime = standard glass (85% of market).

Strategic Recommendations for Procurement Managers

- Volume Strategy:

- Order ≥1,000 units to eliminate setup fees and access competitive pricing. Below 500 units, consider consolidating with other SKUs.

- Cost Optimization:

- Negotiate packaging bundling (e.g., jars + lids + boxes) for 7–12% savings.

- Use recycled glass for EU shipments to avoid 2026 EPR (Extended Producer Responsibility) surcharges.

- Risk Mitigation:

- Mandatory: Require ISO 9001-certified suppliers and AQL 1.5/2.5 QC protocols.

- Avoid factories quoting >15% below market rate – 68% of 2025 quality failures originated from ultra-low-cost suppliers.

- Sustainability Compliance:

- Verify suppliers’ “recycled content” claims via 3rd-party certificates (e.g., SCS Global). False claims trigger EU fines up to 4% of revenue.

Why SourcifyChina?

As your sourcing partner, we deliver:

✅ Pre-vetted Suppliers: 100% of our network passes 22-point factory audits (including ethical labor checks).

✅ MOQ Flexibility: Access to 87 suppliers accepting ≤1,000 units without surcharges.

✅ Total Cost Transparency: Landed cost calculators with real-time duty/tax updates.

✅ 2026 Trend Advisory: Monthly reports on material costs, compliance shifts, and supplier capacity.

Next Step: Request our free “Candle Jar Supplier Scorecard” (covers 147 verified Chinese factories) to benchmark your current quotes.

SourcifyChina | Trusted by 1,200+ Global Brands Since 2018

Data Sources: China Glass Association (2025), SourcifyChina Supplier Network Audit, USITC Tariff Database

Disclaimer: All pricing estimates subject to change based on material index fluctuations. Valid for Q1 2026.

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Subject: Strategic Sourcing of Candle Jars – Wholesale from China

Target Audience: Global Procurement Managers

Prepared by: Senior Sourcing Consultant, SourcifyChina

Date: Q1 2026

Executive Summary

Sourcing candle jars from China remains a cost-effective strategy for global brands, retailers, and private-label manufacturers. However, the market is saturated with intermediaries, inconsistent quality, and supply chain risks. This report outlines a structured verification process to identify credible manufacturers, differentiate trading companies from factories, and avoid common procurement pitfalls.

Critical Steps to Verify a Manufacturer for Candle Jars (Wholesale, China)

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1 | Initial Screening via B2B Platforms | Identify potential suppliers on Alibaba, Made-in-China, or Global Sources | Use filters: “Verified Supplier,” “Gold Supplier,” “Assessed Supplier,” “Transaction History,” “Response Rate” |

| 2 | Request Business License & Factory Address | Confirm legal registration and physical presence | Verify business license (Unified Social Credit Code) via China’s National Enterprise Credit Information Publicity System |

| 3 | Conduct Video Audit | Validate production capabilities remotely | Request live walkthrough of facilities: glass/porcelain molding, kiln lines, packaging, QC stations |

| 4 | Request Product & Process Documentation | Assess technical capability | Ask for: product spec sheets, mold designs, raw material sourcing records, ISO certifications (if claimed) |

| 5 | Order a Sample with Custom Branding | Evaluate quality and communication | Test: jar thickness, finish consistency, lid seal, labeling accuracy, packaging integrity |

| 6 | Verify Export Experience | Ensure logistics competency | Request: recent Bill of Lading (BOL), export licenses, customer references (preferably in EU/US) |

| 7 | Third-Party Inspection (Pre-Shipment) | Mitigate quality risk | Engage inspectors (e.g., SGS, Bureau Veritas) to audit batch quality, packaging, and compliance |

| 8 | On-Site Audit (Optional, High-Volume Buyers) | Deep-dive due diligence | Visit factory to assess management, worker conditions, inventory, and equipment maintenance |

Pro Tip: Use SourcifyChina’s Supplier Vetting Checklist (v4.3, 2026) to standardize evaluations across your procurement team.

How to Distinguish a Trading Company from a Factory

Understanding the supplier type is crucial for pricing transparency, MOQ negotiation, and supply chain control.

| Indicator | Trading Company | Factory (Manufacturer) |

|---|---|---|

| Company Name | Generic names (e.g., “Global Trade Co.”, “Oriental Sourcing”) | Names with “Factory,” “Industrial,” “Manufacturing,” or “Co., Ltd.” |

| Product Range | Wide variety (candle jars, diffusers, packaging, home decor) | Focused on specific categories (e.g., glassware, ceramics, candle containers) |

| Facility Claims | Vague descriptions: “We work with partner factories” | Specific details: “We operate 3 automated glass molding lines in Hebei” |

| Pricing Structure | Higher unit costs, less flexible on MOQ | Lower base pricing, may offer mold development or volume discounts |

| Communication | Sales reps only; limited technical insight | Engineers or production managers available for technical discussions |

| Lead Times | Longer (dependent on factory schedules) | Shorter and more predictable (direct control over production) |

| Minimum Order Quantity (MOQ) | Often higher due to aggregation needs | Can be lower, especially for standard molds |

| Customization Capability | Limited; may outsource R&D | Direct mold-making and design support (in-house tooling department) |

Key Insight: Some suppliers are hybrid models (“trading company with owned factory”). Always verify ownership via cross-referencing business licenses and audit reports.

Red Flags to Avoid When Sourcing Candle Jars from China

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unrealistically Low Pricing | Likely indicates substandard materials (e.g., thin glass, recycled content) or hidden costs | Benchmark against industry averages; request material specs |

| No Physical Address or Refusal to Video Call | High probability of trading company misrepresentation or fraud | Disqualify supplier immediately |

| Inconsistent Communication or Poor English | Indicates lack of export experience or misaligned expectations | Assign a bilingual sourcing agent or use SourcifyChina’s managed communication service |

| No Sample Policy or High Sample Fees | May signal poor quality control or lack of confidence in product | Negotiate sample cost offset against first order |

| Pressure for Upfront Full Payment | Risk of non-delivery or bait-and-switch | Insist on 30% deposit, 70% before shipment (via LC or Escrow) |

| No Quality Certifications (e.g., FDA, Prop 65, CE) | Compliance risk, especially for food-safe or US/EU markets | Require test reports for lead/cadmium content, thermal shock resistance |

| Generic Photos or Stock Images | Suggests no real production capability | Demand real-time photos/videos of current production batch |

Best Practices for Sustainable & Scalable Sourcing

- Build Relationships with 2–3 Approved Suppliers to mitigate disruption risk.

- Invest in Custom Molds for brand differentiation (factories often amortize mold cost over volume).

- Require Batch Testing for thermal stability (critical for hot wax pouring).

- Use Incoterms Clearly (e.g., FOB Shenzhen) to define liability and logistics ownership.

- Leverage SourcifyChina’s Supplier Scorecard to track performance across quality, delivery, and communication.

Conclusion

Sourcing candle jars from China offers compelling cost advantages, but success hinges on rigorous supplier verification. Procurement managers must prioritize transparency, direct manufacturing access, and compliance to ensure product integrity and supply chain resilience. By applying the steps and filters outlined in this report, global buyers can confidently partner with reliable Chinese manufacturers and avoid costly missteps.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Empowering Global Procurement with Verified Chinese Supply

📧 [email protected] | 🌐 www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Optimizing Candle Jar Procurement from China (2026)

Prepared Exclusively for Global Procurement Leaders

Executive Summary: The Critical Time Drain in Candle Jar Sourcing

Global procurement managers face escalating pressure to reduce lead times while ensuring supplier reliability. For candle jars wholesale from China, unverified sourcing channels consume 127+ hours annually per SKU due to supplier vetting failures, MOQ mismatches, and quality disputes. SourcifyChina’s 2026 Verified Pro List eliminates 92% of this operational drag through rigorously validated factory partnerships—turning months of risk into days of execution.

Why SourcifyChina’s Verified Pro List Saves Time (Data-Driven Impact)

| Procurement Stage | Traditional Sourcing (Hours) | SourcifyChina Pro List (Hours) | Time Saved | Operational Risk Mitigated |

|---|---|---|---|---|

| Supplier Vetting | 84+ | 4 | 95% | Fake certifications, capacity fraud |

| MOQ/Negotiation | 32 | 6 | 81% | Hidden fees, inflexible terms |

| Quality Assurance Setup | 28 | 3 | 89% | Non-compliant materials (e.g., lead glass) |

Source: SourcifyChina 2026 Client Benchmark Survey (n=217 procurement leads, 12 industries)

The 2026 Advantage: Beyond Time Savings

Our Candle Jar Wholesale Pro List delivers:

✅ Pre-qualified factories with ISO 9001/14001, FDA-compliant glass, and 3+ years export experience to EU/US

✅ Guaranteed MOQ transparency (as low as 500 units) with no hidden mold fees

✅ Dedicated QA protocol including free pre-shipment inspection reports

✅ Real-time capacity tracking to avoid 2026’s forecasted Q3 container shortages

“SourcifyChina’s Pro List cut our candle jar supplier onboarding from 11 weeks to 8 days. We redirected 220+ hours to strategic cost modeling.”

— Global Home Fragrance Brand, Top 3 EU Retailer

Call to Action: Secure Your Competitive Edge in 2026

Stop losing revenue to unreliable suppliers. The 2026 holiday season demand surge begins in Q3—delaying verified sourcing now risks stockouts during peak revenue windows.

👉 Take 60 Seconds to Activate Your Advantage:

1. Email [email protected] with subject line: “2026 CANDLE JAR PRO LIST ACCESS”

2. WhatsApp +86 159 5127 6160 for instant factory availability checks (24/7 multilingual support)

Within 24 hours, you’ll receive:

– Full access to our 2026 Verified Pro List (17 pre-vetted candle jar factories)

– Customized MOQ/pricing matrix for your volume tier

– Free sourcing playbook: “Avoiding 2026’s Top 3 China Sourcing Pitfalls”

Your time is capital. Invest it in growth—not supplier fires.

SourcifyChina: Precision Sourcing, Zero Guesswork

Trusted by 1,200+ global brands for audit-backed China procurement since 2018

🌐 www.sourcifychina.com | ✉️ [email protected] | 📱 +86 159 5127 6160 (WhatsApp)

🧮 Landed Cost Calculator

Estimate your total import cost from China.