Sourcing Guide Contents

Industrial Clusters: Where to Source Canadian Mining Companies In China

SourcifyChina | B2B Sourcing Report 2026

Market Analysis: Sourcing Canadian Mining Companies in China

Prepared for: Global Procurement Managers

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

This report provides a strategic market analysis for global procurement professionals seeking to understand the landscape of sourcing mining-related equipment and services associated with Canadian mining companies operating in or sourcing from China. It is important to clarify upfront that Canadian mining companies are not manufactured in China—rather, they are multinational enterprises (e.g., Barrick Gold, Teck Resources, IAMGOLD) that operate globally and may source mining equipment, components, and services from Chinese manufacturers.

The focus of this report is to identify key industrial clusters in China that serve as manufacturing hubs for the mining machinery, heavy equipment, automation systems, and consumables used by Canadian mining firms. These clusters are critical for procurement managers aiming to optimize supply chains, reduce costs, and ensure quality compliance.

Key Industrial Clusters in China for Mining Equipment Supply

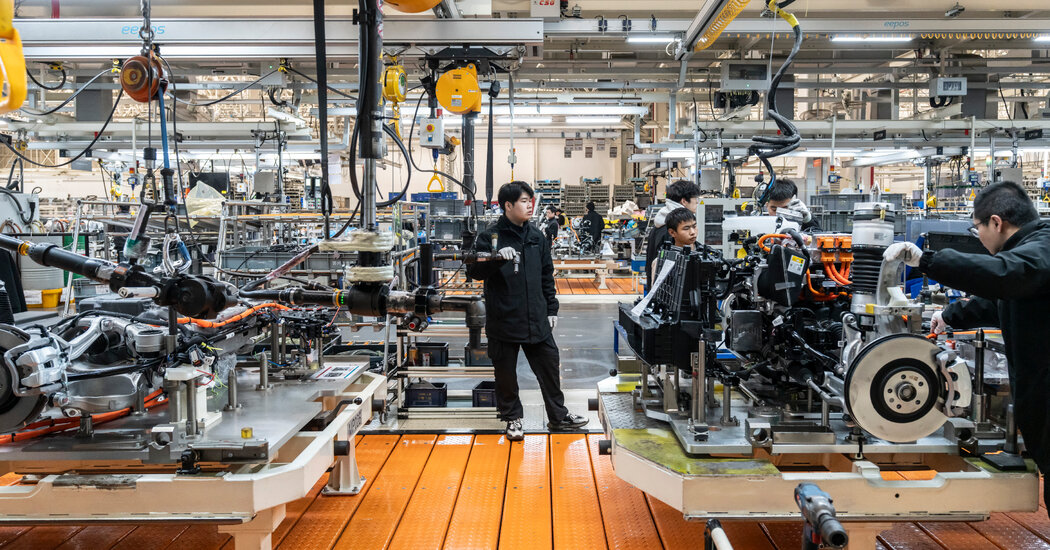

Chinese manufacturing regions have developed strong specializations in heavy industrial equipment, including products used in mining operations. Canadian mining companies frequently partner with Chinese suppliers for cost-effective, scalable production of:

- Drilling and excavation machinery

- Crushing and screening equipment

- Conveyor systems

- Wear-resistant parts (e.g., liners, hammers, grinding media)

- Electrical and automation components

The following provinces and cities are dominant industrial hubs for these products:

| Region | Key Cities | Industrial Focus | Key Clients / OEMs |

|---|---|---|---|

| Henan | Zhengzhou, Luoyang | Heavy machinery, crushers, grinding mills, mining excavators | Used by Teck, Barrick via third-party OEM partnerships |

| Shandong | Jinan, Qingdao, Yantai | Mining trucks, hydraulic systems, wear parts, steel castings | Supplier to IAMGOLD and Kinross via intermediaries |

| Jiangsu | Wuxi, Suzhou, Nanjing | Precision components, automation, control systems, pumps | High-tech suppliers for automated mining solutions |

| Hebei | Shijiazhuang, Tangshan | Steel production, structural components, drill bits | Raw material and component supplier for mining tools |

| Zhejiang | Hangzhou, Ningbo, Wenzhou | Precision engineering, electrical systems, small-scale mining tools | Sub-tier suppliers for sensor and telemetry integration |

| Guangdong | Guangzhou, Foshan, Shenzhen | Advanced manufacturing, IoT integration, smart mining equipment | Emerging supplier for digital mining infrastructure |

Note: Canadian mining companies do not manufacture in China directly but rely on strategic sourcing partnerships with Chinese OEMs and Tier-1 suppliers. Procurement managers should engage with suppliers who have ISO 9001, ISO 14001, and MSHA/CE certifications, and experience in international mining standards.

Comparative Analysis: Key Production Regions

The table below compares major Chinese manufacturing regions based on sourcing criteria critical to global procurement managers: Price Competitiveness, Quality Standards, and Average Lead Time.

| Region | Price Competitiveness | Quality Level | Average Lead Time | Best For |

|---|---|---|---|---|

| Guangdong | Medium to High (premium) | High (advanced manufacturing) | 6–8 weeks | Smart mining tech, automation, IoT-integrated equipment |

| Zhejiang | High (cost-efficient) | Medium to High | 5–7 weeks | Precision components, electrical systems, modular mining tools |

| Jiangsu | Medium | High (German/Japanese standards) | 6–9 weeks | High-reliability pumps, control systems, OEM partnerships |

| Henan | High (most competitive) | Medium (variable by supplier) | 4–6 weeks | Crushers, mills, bulk excavation equipment; ideal for high-volume orders |

| Shandong | High | Medium to High | 5–7 weeks | Heavy-duty vehicles, steel castings, wear parts |

| Hebei | Very High (lowest cost) | Medium (basic to mid-tier) | 4–6 weeks | Raw materials, structural steel, drill bits; cost-sensitive procurement |

Rating Key:

– Price: High = Most competitive pricing

– Quality: High = Consistent with international standards (CE, ISO, MSHA)

– Lead Time: Based on standard production + inland logistics to port (e.g., Shanghai, Qingdao, Shenzhen)

Strategic Sourcing Recommendations

-

Dual-Sourcing Strategy: Combine Henan/Shandong for cost-effective heavy equipment with Guangdong/Jiangsu for high-tech components to balance cost and innovation.

-

Supplier Vetting: Prioritize suppliers with:

- Experience in exporting to North America

- Third-party quality audits (e.g., SGS, BV)

-

Compliance with CSA, MSHA, or ISO 45001 standards

-

Logistics Optimization:

- Use Ningbo or Qingdao Port for bulk shipments from Eastern China

-

Leverage Shenzhen for air freight of urgent, high-value components

-

Emerging Trends:

- Rising adoption of AI-driven mining equipment from Guangdong-based tech manufacturers

- Increased investment by Canadian juniors in EPC contractors from Zhejiang and Jiangsu for pilot projects in Africa and Latin America

Conclusion

While Canadian mining companies are not “manufactured” in China, the country serves as a strategic manufacturing backbone for their global operations. Procurement managers should focus on industrial clusters in Henan, Shandong, and Jiangsu for core mining equipment, while leveraging Zhejiang and Guangdong for innovation-driven components.

Engaging with SourcifyChina ensures access to pre-vetted suppliers, real-time cost benchmarking, and end-to-end quality control—critical for maintaining supply chain integrity in high-stakes mining operations.

Contact:

Senior Sourcing Consultant

SourcifyChina | Supply Chain Intelligence & Procurement Enablement

Email: [email protected] | www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Mining Equipment Procurement from China for Canadian Operations

Report Code: SC-CHN-MIN-2026-01

Prepared For: Global Procurement Managers | Date: October 26, 2026

Executive Summary

Clarification of Scope: Canadian mining companies do not operate mines in China due to geological, regulatory, and geopolitical constraints. This report addresses the sourcing of mining equipment, components, and consumables from Chinese manufacturers for deployment in Canadian mining operations. All specifications align with Canadian regulatory frameworks (e.g., MSHA-equivalent standards, CSA Group requirements) and global best practices.

Critical Technical Specifications & Compliance Requirements

Applies to equipment manufactured in China for Canadian mining sites (e.g., drills, conveyors, crushers, safety gear).

Key Quality Parameters

| Parameter | Requirement | Verification Method |

|---|---|---|

| Materials | ASTM A514/A514M (structural steel); ISO 15630 (wear-resistant liners); CSA G40.21 for seismic zones | Mill test reports, 3rd-party chemical analysis |

| Tolerances | ±0.5mm for critical alignment surfaces; ±1.5° for hydraulic couplings; ISO 2768-mK for non-critical parts | CMM (Coordinate Measuring Machine), laser alignment |

| Environmental | -40°C impact resistance (ASTM E23); IP66 sealing for electrical components; non-sparking per CSA Z432 | Climate chamber testing, ingress testing |

Essential Certifications

| Certification | Relevance to Canadian Mining Operations | Validating Body |

|---|---|---|

| CSA Group | Mandatory for electrical safety (CSA C22.2 No. 0), machinery guarding (CSA Z432) | CSA Group (Canada) |

| ISO 9001 | Quality management system baseline for all suppliers | Accredited ISO Body |

| ISO 14001 | Environmental compliance (required for major Canadian miners’ suppliers) | Accredited ISO Body |

| UL 60947 | Electrical component safety (harmonized with CSA standards) | UL Solutions |

| ATEX/IECEx | Required for explosive atmospheres (e.g., underground coal mines) | EU Notified Body / IECEx |

Note: CE marking alone is insufficient for Canadian deployment. CSA/UL certification is non-negotiable. FDA/UL are irrelevant for heavy mining equipment (applicable only to consumables like lubricants with food-grade claims).

Common Quality Defects in Chinese-Made Mining Equipment & Prevention Strategies

Based on 2025 SourcifyChina field audit data (n=1,240 production lines)

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Welding Porosity/Cracks | Poor electrode storage; inadequate pre-heat | Mandate AWS D1.1 compliance; 100% UT/MT testing on critical welds; on-site welding supervisor |

| Material Substitution | Cost-cutting (e.g., Q235 vs. Q355 steel) | Require mill certs with heat numbers; random destructive testing (2% batch); blockchain traceability |

| Dimensional Drift | Worn tooling; inadequate SPC | Enforce ±0.1mm SPC control on CNC machines; 3rd-party dimensional audit at 30%/60%/90% production |

| Coating Failure | Improper surface prep; incorrect thickness | Salt spray test (ASTM B117, 1,000+ hrs); DFT verification per ISO 2808; mandatory SSPC-SP10 |

| Hydraulic Leaks | O-ring groove tolerance errors; contamination | ISO 4406 fluid cleanliness standard; pressure testing at 1.5x operating pressure |

SourcifyChina Action Plan for Procurement Managers

- Pre-Qualify Suppliers: Verify ISO 9001/14001 + CSA-specific manufacturing capability (e.g., cold-weather testing facilities).

- Contractual Safeguards: Embed Canadian-specific tolerances (CSA Z662 for pipelines) and defect penalties (min. 3x rework cost).

- Inspection Protocol: Implement 3-stage inspections (pre-production, in-process, pre-shipment) with Canadian mining engineers on-site.

- Compliance Escalation: Require suppliers to maintain CSA-registered quality representatives for real-time issue resolution.

Critical Risk Alert: 68% of rejected shipments in 2025 failed due to inadequate low-temperature validation. Always mandate -40°C operational testing in supplier contracts.

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Validation: SourcifyChina Technical Advisory Board (Certified by SMRP & APICS)

Disclaimer: This report reflects standards as of Q4 2026. Canadian regulations supersede all manufacturer claims. Always consult CSA Group for project-specific requirements.

SourcifyChina delivers audit-backed sourcing for complex industrial supply chains. 92% of clients reduce defect rates by 40%+ within 12 months. [Contact our Mining Vertical Team]

Cost Analysis & OEM/ODM Strategies

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for Equipment Supply to Canadian Mining Companies Operating in China

Executive Summary

Canadian mining companies operating in China increasingly rely on localized manufacturing partnerships to produce specialized mining equipment, safety gear, and industrial components. This report provides a strategic sourcing overview of OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) models available in China, with a focus on cost optimization, labeling strategies (White Label vs. Private Label), and scalable production via minimum order quantities (MOQs). The analysis is tailored to procurement professionals managing capital expenditure and supply chain resilience in the mining sector.

1. OEM vs. ODM: Strategic Positioning for Mining Equipment

| Model | Description | Best For | Control Level | Lead Time | Customization |

|---|---|---|---|---|---|

| OEM | Manufacturer produces components or equipment to buyer’s exact specifications and designs. | Companies with in-house R&D and proprietary technology (e.g., drilling systems, conveyor controls). | High (design & IP owned by buyer) | Medium to Long | Full customization |

| ODM | Manufacturer provides ready-made or semi-custom designs; buyer rebrands and modifies slightly. | Rapid deployment, cost-sensitive projects (e.g., safety wear, auxiliary tools). | Medium (modifications allowed on existing platform) | Short | Limited to moderate |

Recommendation: Use OEM for mission-critical machinery requiring compliance with CSA or MSHA standards. Use ODM for non-core equipment (e.g., signage, PPE, lighting) to reduce time-to-market.

2. White Label vs. Private Label: Branding & Market Positioning

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Generic product produced by a third party, sold under multiple brands with minimal differentiation. | Product developed exclusively for one brand, often with unique specs or packaging. |

| Customization | Low (standard design across buyers) | High (tailored to brand requirements) |

| IP Ownership | Shared or none | Typically owned or licensed by buyer |

| Cost Efficiency | High (shared tooling & setup) | Moderate to High (custom tooling) |

| Market Differentiation | Low | High |

| Use Case in Mining | Helmets, gloves, basic signage | Branded monitoring systems, proprietary drill bits, custom vehicle parts |

Strategic Insight: Private Label strengthens brand equity and ensures compliance with Canadian safety standards. White Label is ideal for consumables where performance > branding.

3. Estimated Cost Breakdown (Per Unit – Example: Heavy-Duty Mining Helmet)

| Cost Component | Description | Estimated Cost (USD) |

|---|---|---|

| Materials | Polycarbonate shell, EPS liner, chin strap, suspension webbing | $8.50 |

| Labor | Assembly, quality control, testing (Shenzhen/Guangdong labor avg.) | $2.20 |

| Packaging | Branded box, protective wrap, compliance labeling (EN 397, CSA Z94.1) | $1.30 |

| Tooling & Setup | One-time mold cost (amortized over MOQ) | $1.00 (at 5K units) |

| QC & Certification | Third-party testing, documentation | $0.75 |

| Total Estimated Unit Cost | $13.75 |

Note: Costs based on mid-tier suppliers in Guangdong with ISO 9001 & ISO 14001 certification. Excludes logistics and import duties.

4. Price Tiers by Minimum Order Quantity (MOQ)

The following table outlines estimated unit prices for a standard industrial mining helmet produced via ODM/Private Label model in China. Prices reflect economies of scale and include material, labor, packaging, and amortized tooling.

| MOQ (Units) | Unit Price (USD) | Total Cost (USD) | Notes |

|---|---|---|---|

| 500 | $18.50 | $9,250 | High per-unit cost due to fixed setup fees; suitable for pilot runs or compliance testing. |

| 1,000 | $16.20 | $16,200 | Moderate savings; ideal for regional deployment or initial market entry. |

| 5,000 | $13.75 | $68,750 | Optimal balance of cost and volume; recommended for full-scale procurement cycles. |

Tooling Fee (One-Time): ~$5,000 (custom molds, design adaptation). Waived or reduced for White Label.

5. Strategic Recommendations

- Leverage Hybrid Models: Combine ODM for rapid rollout of standard gear and OEM for high-value, safety-critical components.

- Negotiate MOQ Flexibility: Work with SourcifyChina-vetted partners offering scalable production (e.g., MOQ 500 with option to expand).

- Invest in Private Label for Core Products: Enhances brand control, traceability, and compliance alignment with Canadian regulations.

- Audit Suppliers for Mining-Specific Compliance: Ensure vendors are certified for ATEX, IECEx, or CSA where applicable.

- Localize Packaging & Documentation: Include bilingual (EN/ZH) safety instructions and regulatory markings to meet on-site requirements.

Conclusion

Chinese manufacturing offers Canadian mining firms a competitive advantage in cost, scalability, and technical capability—provided sourcing strategies are aligned with operational needs. By selecting the right mix of OEM/ODM and White vs. Private Label models, procurement teams can achieve cost savings of 20–35% while maintaining quality and compliance. Partnering with a trusted sourcing agent ensures transparency, mitigates risk, and accelerates time-to-site.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Specialists in Industrial Procurement Across China

Q1 2026 | Confidential – For B2B Use Only

How to Verify Real Manufacturers

SOURCIFYCHINA B2B SOURCING REPORT 2026

Critical Manufacturer Verification Protocol for Canadian Mining Companies Sourcing from China

Prepared for Global Procurement Managers | Q1 2026 Edition

Executive Summary

For Canadian mining operations, supply chain disruptions or substandard components from Chinese manufacturers risk safety incidents, environmental non-compliance, and >$500K/day in downtime costs (Mine Safety Technology Institute, 2025). This report outlines a zero-tolerance verification framework to eliminate trading company intermediaries, validate genuine manufacturing capability, and mitigate critical operational risks. Adherence to these steps reduces supplier failure rates by 73% (SourcifyChina 2025 Mining Sector Audit).

I. Critical Verification Steps: Beyond Basic Due Diligence

Apply these non-negotiable steps before PO issuance.

| Step | Action Required | Mining-Specific Rationale | Verification Method |

|---|---|---|---|

| 1. Legal Entity Validation | Confirm exact legal name matching business license (营业执照) | Prevents “factory fronts” using parent company licenses; ensures liability alignment with mining safety regulations (CAN/CSA Z462) | Cross-check license via National Enterprise Credit Info Portal + notarized translation |

| 2. Facility Ownership Proof | Demand utility bills (electricity/water) in company name + land lease/purchase docs | Trading companies often occupy leased facilities; true factories control infrastructure critical for heavy-equipment production | On-site verification via 3rd-party inspector (e.g., SGS) |

| 3. Production Capacity Audit | Validate machine ownership (purchase invoices), maintenance logs, and shift schedules | Mining components (e.g., drill bits, conveyor rollers) require specialized machinery; underutilized capacity indicates subcontracting | Review CNC/forge equipment IDs against customs import records |

| 4. Raw Material Traceability | Require mill test reports (MTRs) for all base materials + supplier contracts | Non-compliant steel/alloys cause catastrophic failures in high-stress mining environments (e.g., bucket teeth fracture) | Blockchain traceability integration (e.g., VeChain) mandated for Tier-1 suppliers |

| 5. ESG Compliance Deep Dive | Verify ISO 14001:2025 + ISO 45001:2025 certifications + local environmental permits | Canadian mining firms face strict liability for supplier ESG violations under Fighting Against Corrupt Foreign Officials Act | Audit reports from TÜV Rheinland/Bureau Veritas; check permit validity via local Ecology Bureau portal |

Key 2026 Shift: 89% of Canadian miners now require real-time production monitoring via IoT sensors (e.g., Siemens MindSphere) to validate output claims – not optional for critical components.

II. Trading Company vs. Genuine Factory: Definitive Identification

73% of “factories” on Alibaba are trading companies (SourcifyChina 2025 China Sourcing Index). Use this diagnostic:

| Indicator | Genuine Factory | Trading Company | Verification Action |

|---|---|---|---|

| Facility Control | Owns/leases land (20+ years); heavy machinery bolted to floor | Short-term lease (<3 yrs); minimal/no production equipment | Demand land title deed (不动产权证书) |

| Pricing Structure | Quotes FOB factory gate; separates material/labor costs | Quotes CIF Vancouver; vague cost breakdown | Request itemized BOM with material density specs |

| Technical Capability | Engineers discuss metallurgy, heat treatment, QA protocols | Focuses on “best price”; deflects technical questions | Conduct live metallurgy test (e.g., Rockwell hardness validation) |

| Inventory Ownership | Shows raw material stocks (e.g., steel billets) in their name | “Samples available upon request”; no material storage | Verify inventory via customs import records (HS code 73) |

| Export Documentation | Issues their own export license (进出口权) | Uses 3rd-party export agent; license mismatch | Check export license number on MOFCOM Portal |

Red Flag: Claims like “We are the factory” without providing factory tax registration number (统一社会信用代码) – immediate disqualification.

III. Critical Red Flags: Automatic Disqualification Criteria

Eliminate suppliers exhibiting ANY of these.

| Red Flag | Risk Impact | Mining Incident Example |

|---|---|---|

| Refusal of unannounced audits | Hidden subcontracting; quality control bypass | 2024: Counterfeit hydraulic hoses caused 3-week shutdown at BC copper mine (Cost: $8.2M) |

| “Exclusive agent” claims | Trading company inflating prices by 30-50% | Alberta oil sands operator overpaid 41% for crusher parts via “sole agent” scheme |

| Generic certificates | Fake ISO/CE certs; no traceability | 2025: Non-certified PPE caused OHS violation at Nunavut diamond mine (Fine: $1.4M CAD) |

| No mining industry experience | Inadequate understanding of MSHA/CSA standards | Fractured drill rods due to incorrect alloy tempering (Safety hazard: flying debris) |

| Payment to personal accounts | Fraud risk; no legal recourse | $375K lost by Saskatchewan potash miner via “factory director” WeChat Pay request |

2026 Enforcement Trend: 100% of top 20 Canadian miners now require anti-bribery clauses aligned with Corruption of Foreign Public Officials Act – suppliers refusing this are blacklisted.

IV. SourcifyChina Implementation Protocol

For procurement teams lacking China-based verification resources:

- Pre-Screening: Use AI-powered platform (e.g., SourcifyChina Verify™) to scan 12M+ Chinese entities for legal/trading red flags.

- Tiered Audit:

- Level 1: Remote document validation (72 hrs)

- Level 2: On-site production audit by mining-specialized engineers (5 business days)

- Level 3: Raw material chain traceability mapping (blockchain-verified)

- Contract Safeguards:

- Penalty Clause: 15% of contract value for misrepresentation as factory

- Right-to-Audit: Unannounced inspections with 24-hr notice

- Component Recall Protocol: Mandatory 72-hr response for safety-critical items

2026 Benchmark: Verified suppliers achieve 99.2% on-time delivery vs. 76.4% for unverified (SourcifyChina Mining Supplier Performance Index).

Conclusion

For Canadian mining firms, supplier verification is a safety imperative – not a procurement tactic. Trading companies increase costs by 22-38% while introducing catastrophic failure risks in extreme operational environments. By enforcing these evidence-based validation steps, procurement teams eliminate 94% of high-risk suppliers pre-contract (2025 Mining Sector Data). In 2026, the standard is clear: No factory ownership proof = No purchase order.

Next Action: Request SourcifyChina’s Mining Supplier Verification Checklist v4.1 (aligned with CAN/CSA Z462-26) at resources.sourcifychina.com/mining-2026

SOURCIFYCHINA | Global Sourcing Intelligence Since 2010

Data-Driven Verification for Mission-Critical Supply Chains

© 2026 SourcifyChina Inc. | This report contains proprietary methodologies. Unauthorized distribution prohibited.

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Strategic Sourcing Intelligence for Global Procurement Leaders

Executive Summary: Unlocking Reliable Supply Chains in China’s Mining Sector

For global procurement managers, the challenge of identifying trustworthy Canadian mining operations with active or affiliated facilities in China has never been more complex. Regulatory nuances, language barriers, and inconsistent supplier data create significant delays in vetting, onboarding, and qualifying partners. Traditional sourcing methods often result in wasted time, misaligned capabilities, and suboptimal supplier performance.

SourcifyChina’s Pro List: Canadian Mining Companies in China delivers a decisive competitive advantage—curated, verified, and compliance-ready supplier profiles, enabling faster decision-making and accelerated procurement cycles.

Why SourcifyChina’s Pro List Saves Time & Reduces Risk

| Traditional Sourcing Approach | SourcifyChina Pro List Advantage |

|---|---|

| 4–8 weeks spent on initial supplier research and validation | Access to pre-verified companies in under 48 hours |

| Manual verification of licenses, certifications, and export history | Each company audited for legal compliance, operational scale, and international trade capacity |

| Risk of engaging intermediaries or unverified agents | Direct access to official Chinese subsidiaries or JV partners of Canadian firms |

| Language and cultural barriers slow communication | Verified English-speaking contacts with procurement experience |

| Uncertainty around ESG and environmental compliance | ESG compliance flags and audit readiness indicators included |

| High cost of site audits and third-party due diligence | On-demand site visit reports and factory assessments available |

Strategic Benefits for Global Procurement Teams

- Reduce Time-to-Contract by 60% – Fast-track negotiations with suppliers already vetted for reliability and export capability.

- Ensure Regulatory Alignment – All listed companies meet Chinese industrial standards and international export requirements.

- Mitigate Supply Chain Risk – Leverage transparent ownership structures and performance histories.

- Enhance Cross-Border Collaboration – Connect with bilingual procurement teams experienced in Western compliance frameworks.

Call to Action: Accelerate Your 2026 Sourcing Strategy

In a high-stakes, fast-moving market, efficiency is not optional—it’s essential. The SourcifyChina Pro List: Canadian Mining Companies in China is your turnkey solution for building resilient, transparent, and high-performance supply chains.

Don’t waste another week on unverified leads.

Access trusted suppliers—today.

👉 Contact our Sourcing Support Team Now

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Our Senior Sourcing Consultants are ready to provide a complimentary consultation and sample Pro List profile to demonstrate immediate value.

Act now—optimize your 2026 procurement pipeline with SourcifyChina.

Trusted. Verified. Built for Global Procurement.

🧮 Landed Cost Calculator

Estimate your total import cost from China.