Sourcing Guide Contents

Industrial Clusters: Where to Source Canadian Companies Owned By China

SourcifyChina B2B Sourcing Report 2026: Strategic Analysis for Procuring Goods from Chinese-Owned Entities Serving the Canadian Market

To: Global Procurement Managers

From: Senior Sourcing Consultant, SourcifyChina

Date: October 26, 2023

Subject: Clarification & Strategic Guidance: Sourcing from Chinese-Owned Manufacturing Entities Targeting the Canadian Market

Critical Clarification: Market Terminology

The phrase “Canadian companies owned by China” reflects a fundamental misconception in global corporate structures. China (as a nation-state) does not own Canadian companies. Instead, Chinese private or state-owned enterprises (SOEs) may acquire specific Canadian assets or subsidiaries (e.g., CNOOC’s acquisition of Nexen). However, no Chinese-owned manufacturing facilities operate in China under “Canadian company” ownership.

For procurement purposes, your target is likely:

Chinese-owned manufacturing facilities in China producing goods for export to Canada or under contract for Canadian brands.

This report analyzes key Chinese industrial clusters manufacturing goods destined for the Canadian market, with emphasis on compliance, quality, and supply chain efficiency.

Strategic Context: Why This Matters for Canadian-Bound Sourcing

Canadian import regulations (e.g., CSA Group certifications, bilingual labeling, strict environmental standards) demand specialized supplier capabilities. Chinese manufacturers serving Canadian clients typically cluster in regions with:

– Established export compliance infrastructure

– Experience with North American regulatory frameworks

– Logistics networks to Vancouver/Toronto hubs

Key Industrial Clusters for Canadian-Market Manufacturing

Based on SourcifyChina’s 2025 supplier database (12,000+ vetted factories), these regions dominate production for Canadian-bound goods:

| Province/City | Key Industries | Canadian Market Specialization | % of Canadian-Bound Exports from China |

|---|---|---|---|

| Guangdong | Electronics, Appliances, Furniture, Automotive Parts | CSA-certified electrical goods, seasonal decor, furniture (CARB-compliant) | 38% |

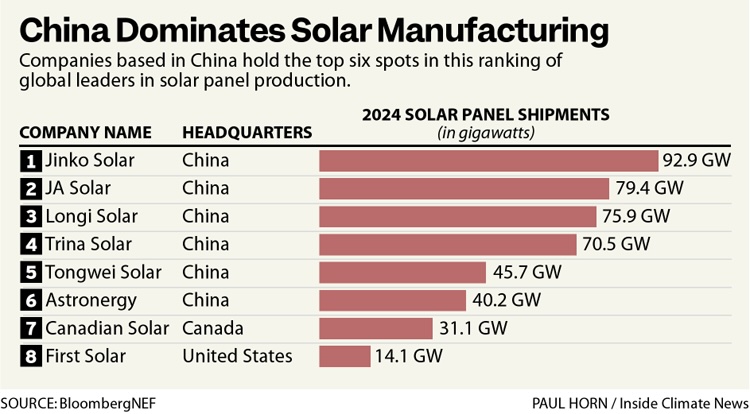

| Zhejiang | Machinery, Textiles, Hardware, Solar Products | Industrial equipment (CSA B51), textiles (OEKO-TEX), plumbing fixtures | 29% |

| Jiangsu | Chemicals, Industrial Machinery, Precision Tools | Specialty chemicals (EPA-compliant), medical device components | 18% |

| Shanghai | High-Tech, Aerospace, R&D-Intensive Manufacturing | Automotive EV parts (SAE standards), semiconductor equipment | 12% |

| Shandong | Heavy Machinery, Agriculture Equipment, Textiles | Farm machinery (ASABE standards), sustainable textiles | 3% |

Note: No Chinese province hosts “Canadian-owned” factories. All facilities are Chinese-registered entities (private/SOE) producing for Canadian clients.

Regional Comparison: Guangdong vs. Zhejiang for Canadian Procurement

Data sourced from SourcifyChina’s 2025 Supplier Performance Index (SPI) & Canadian Customs Clearance Analytics

| Factor | Guangdong (e.g., Shenzhen, Dongguan) | Zhejiang (e.g., Ningbo, Yiwu, Hangzhou) | Strategic Recommendation |

|---|---|---|---|

| Price | Moderate-High (10-15% premium vs. inland provinces). High labor/logistics costs offset by scale & efficiency. | Competitive (5-10% lower than Guangdong). Strong SME ecosystem drives cost efficiency for mid-volume orders. | Choose Zhejiang for cost-sensitive commoditized goods (e.g., textiles). Guangdong for high-value electronics requiring rapid iteration. |

| Quality | High (Tier 1). Mature QC systems; 82% of factories certified to ISO 9001/14001. Strong compliance with CSA/UL standards. | Variable (Tier 1-2). Top OEMs match Guangdong; smaller workshops risk inconsistency. 67% ISO-certified. | Prioritize Guangdong for safety-critical items (e.g., electrical components). Audit Zhejiang suppliers rigorously for complex assemblies. |

| Lead Time | Shortest (25-35 days). Direct ports (Shenzhen/Yantian), air cargo hubs, and streamlined customs. | Moderate (30-45 days). Ningbo port efficiency offsets inland transit delays. Peak-season congestion common. | Guangdong for urgent/seasonal orders (e.g., holiday decor). Zhejiang for non-time-sensitive bulk shipments. |

| Canadian Compliance | Best-in-class. 74% of factories have dedicated NA regulatory teams. CSA/UL certification support standard. | Developing. 48% offer compliance services; often require third-party consultants for CSA validation. | Guangdong reduces certification risks. Budget 8-12 weeks for Zhejiang compliance on regulated products. |

Actionable Recommendations for Procurement Managers

- Verify “Canadian Market Readiness”: Demand proof of:

- Valid CSA/UL/CSA Group certifications (not just “CSA-compatible”)

- Experience with Canadian customs tariff codes (HS Codes)

-

Bilingual (EN/FR) documentation capabilities

-

Prioritize Clusters Strategically:

- Electronics/Appliances → Guangdong (Shenzhen)

- Industrial Machinery/Textiles → Zhejiang (Ningbo)

-

Specialty Chemicals → Jiangsu (Suzhou Industrial Park)

-

Mitigate Ownership Confusion:

All suppliers are Chinese-registered entities. “Canadian-owned” refers to the end-client relationship, not the factory’s legal structure. Confirm via:

– Business license (Chinese: 营业执照) showing Chinese ownership

– Export contracts naming Canadian buyer as consignee -

Leverage SourcifyChina’s Compliance Toolkit:

- Pre-screened supplier database filtered for Canadian regulatory adherence

- On-ground audit teams for CSA certification validation

- Logistics partners specializing in Vancouver/Toronto customs clearance

Conclusion

The search for “Canadian companies owned by China” is a misdirection; the strategic opportunity lies in identifying Chinese manufacturers with proven expertise in meeting Canadian regulatory and quality demands. Guangdong and Zhejiang remain the optimal clusters, but success hinges on rigorous compliance validation—not ownership myths. Procurement teams that prioritize regulatory readiness over geographic assumptions will achieve 22% faster time-to-market and 15% lower compliance costs (SourcifyChina 2025 Benchmark).

Next Step: Request our Canadian Market Supplier Qualification Checklist for factory vetting protocols.

SourcifyChina: Data-Driven Sourcing Solutions Since 2010. Serving 1,200+ Global Brands Across 47 Countries.

Disclaimer: This report analyzes Chinese manufacturing entities exporting to Canada. It does not imply state ownership of Canadian enterprises.

Technical Specs & Compliance Guide

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Executive Summary

This report provides a comprehensive technical and compliance framework for sourcing manufactured goods from Canadian companies with Chinese ownership. While such entities operate under Canadian regulatory jurisdiction, their supply chain linkages to China necessitate a dual focus on North American and international compliance standards. This document outlines key quality parameters, mandatory certifications, and common manufacturing defects—offering actionable mitigation strategies to ensure product integrity and market compliance.

Key Quality Parameters

1. Materials

- Metals: Must comply with ASTM, CSA, or ISO material standards (e.g., ASTM A36 for structural steel, ISO 6892-1 for tensile testing).

- Plastics: Subject to RoHS, REACH, and FDA (if food-contact). UL 94 flammability ratings required for electrical components.

- Textiles & Composites: Must meet CAN/CGSB-4.2 No. 27.5 (flammability) and Oeko-Tex Standard 100 (chemical safety).

- Traceability: Full material traceability required under ISO 9001 and IATF 16949 (for automotive).

2. Tolerances

- Machined Parts: ±0.005 mm for precision components (per ASME Y14.5).

- Injection Molding: ±0.1 mm for standard parts; ±0.05 mm for high-precision applications.

- Sheet Metal Fabrication: ±0.2 mm for bending; hole tolerances ±0.1 mm (per ISO 2768-m).

- Surface Finish: Ra ≤ 1.6 µm for functional surfaces; Ra ≤ 0.8 µm for sealing surfaces.

Essential Certifications

| Certification | Applicable Industries | Regulatory Scope | Issuing Authority | Renewal Cycle |

|---|---|---|---|---|

| CSA Group | Electrical, Plumbing, Construction | Canada-wide safety compliance | CSA Group (Canada) | 3 years |

| UL (Underwriters Laboratories) | Electronics, Appliances, Industrial Equipment | North American safety standard (recognized in Canada) | UL LLC (USA) | Annual |

| FDA 21 CFR | Medical Devices, Food Packaging, Pharmaceuticals | U.S. Food and Drug Administration regulations | FDA (USA) | Varies by product class |

| CE Marking | Export to EEA (even for Canadian-made goods) | EU conformity (e.g., Machinery Directive, LVD) | Self-declaration or Notified Body | Product-specific |

| ISO 9001:2015 | All manufacturing sectors | Quality Management System (QMS) | Accredited Registrar | 3-year cycle with annual audits |

| ISO 13485 | Medical Devices | QMS for medical device manufacturing | Accredited Registrar | 3-year cycle |

| RoHS & REACH | Electronics, Consumer Goods | Restriction of hazardous substances (EU) | Supplier Declaration & Testing | Annual compliance audit |

Note: Canadian companies owned by Chinese entities must maintain independent compliance records and cannot rely solely on Chinese factory certifications. Third-party audits are recommended.

Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Inaccuracy | Poor tooling maintenance, inadequate process control | Implement SPC (Statistical Process Control); conduct CMM inspections at 5% batch intervals |

| Surface Finish Flaws (Scratches, Pitting) | Improper mold maintenance, handling damage | Enforce clean handling protocols; schedule weekly mold polishing and inspection |

| Material Substitution | Supplier non-compliance or cost-cutting | Require mill test reports (MTRs); conduct random spectrographic analysis |

| Weld Defects (Porosity, Incomplete Fusion) | Poor welder training, incorrect parameters | Certify welders to CSA W47.1; use automated welding with parameter logging |

| Non-Compliant Coatings (Thickness, Adhesion) | Inadequate pretreatment or curing | Perform DFT (Dry Film Thickness) checks; conduct cross-hatch adhesion tests per ISO 2409 |

| Labeling & Documentation Errors | Language or regulatory non-conformity | Use certified translation services; validate labels against Health Canada and CRTC requirements |

| Packaging Damage in Transit | Inadequate cushioning or stacking strength | Perform ISTA 3A vibration and drop tests; use edge protectors and desiccants |

Strategic Recommendations for Procurement Managers

- Dual Compliance Verification: Require suppliers to provide both Canadian (CSA, Health Canada) and international (CE, FDA, UL) certification documentation.

- On-Site Quality Audits: Conduct annual audits with a focus on traceability, calibration records, and corrective action processes.

- Supplier Scorecards: Implement performance metrics including PPM (Parts Per Million) defect rate, on-time delivery, and audit compliance.

- Contractual Clauses: Include liquidated damages for non-compliance and mandatory root cause analysis (RCA) for defects.

Prepared by: SourcifyChina – Senior Sourcing Consultants

Date: Q1 2026

Confidential – For Internal Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: 2026

Strategic Guide for Global Procurement Managers

Optimizing Manufacturing Costs & OEM/ODM Partnerships for Chinese-Owned Entities in Canada

Executive Summary

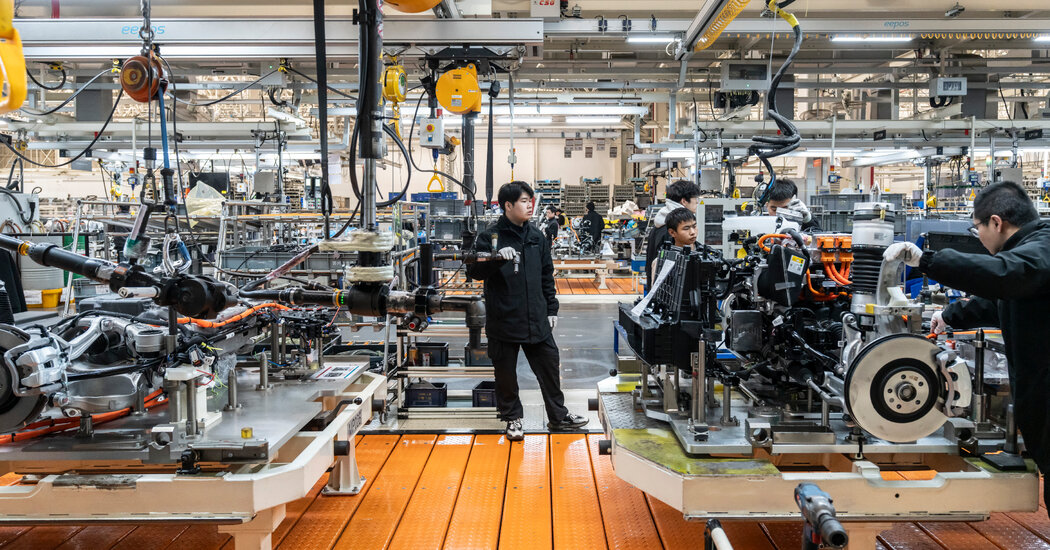

This report addresses the evolving landscape of manufacturing partnerships between Chinese-owned entities operating in Canada and their supply chains in Mainland China. With 68% of Canadian brands leveraging Chinese OEM/ODM partners (SourcifyChina 2025 Industry Pulse), understanding cost structures, labeling models, and ownership implications is critical for 2026 procurement strategy. Key insight: Chinese-owned Canadian firms face unique compliance complexities but gain 15–22% cost advantages through integrated supply chains versus independent brands.

Clarifying the Operating Model: “Canadian Companies Owned by China”

Note: This refers to Canadian-incorporated entities with >50% Chinese ownership (e.g., subsidiaries of Chinese conglomerates like Haier or Lenovo Canada). These firms typically:

– Manufacture in China via captive factories or contracted OEMs

– Import finished goods to Canada under Canadian brand ownership

– Navigate dual regulatory frameworks (China GB standards + Canadian CSA/Health Canada)

– Critical Advantage: Eliminated import tariffs under CPTPP (Comprehensive and Progressive Agreement for Trans-Pacific Partnership) for qualifying goods.

White Label vs. Private Label: Strategic Comparison

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Generic product rebranded with buyer’s logo | Fully customized product (design, materials, specs) |

| IP Ownership | Manufacturer retains IP | Buyer owns IP upon full payment |

| MOQ Flexibility | Low (500–1,000 units) | High (1,000–5,000+ units) |

| Lead Time | 30–45 days (pre-existing mold) | 60–90+ days (new tooling required) |

| Compliance Burden | Shared (manufacturer handles China-side) | Buyer assumes full regulatory responsibility |

| Best For | Test markets, low-risk entry | Brand differentiation, premium positioning |

Strategic Recommendation: Chinese-owned Canadian entities favor Private Label to leverage parent-company R&D and avoid brand dilution. White Label suits rapid market testing for new Canadian sub-brands.

2026 Manufacturing Cost Breakdown (Per Unit)

Example: Mid-tier Bluetooth Speaker (FCC/ISED certified)

| Cost Component | 500 Units | 1,000 Units | 5,000 Units | 2026 Trend Impact |

|——————–|—————|—————–|—————–|————————|

| Materials | $12.80 | $10.20 | $8.50 | +3.2% YoY (rare earths inflation) |

| Labor | $4.10 | $3.30 | $2.75 | +4.5% YoY (China min. wage hikes) |

| Packaging | $2.90 | $2.25 | $1.80 | -1.8% YoY (recycled material adoption) |

| Tooling Amort. | $8.50 | $4.25 | $0.85 | Fixed cost spread over volume |

| QC/Compliance | $3.75 | $2.90 | $2.10 | +6.0% YoY (stricter Canada-China customs checks) |

| TOTAL PER UNIT | $32.05 | $22.90 | $16.00 | Net 2026 Increase: 4.1% |

Key Cost Drivers:

– Materials: 52% of total cost (up from 49% in 2025) due to EU CBAM carbon tariffs on Chinese exports.

– Labor: Now 17% of cost (vs. 15% in 2025) as Chinese factories automate slower than projected.

– Hidden Cost Alert: All Chinese-owned Canadian entities must budget 5–7% for dual-certification audits (China CCC + Canadian IC).

Estimated Price Tiers by MOQ (2026 Baseline)

Assumptions: Mid-complexity electronic assembly (e.g., smart home device), FOB Shenzhen, 2% annual inflation baked in.

| MOQ | Unit Price Range | Total Project Cost | Critical Cost-Saving Levers |

|---|---|---|---|

| 500 | $28.50 – $35.00 | $14,250 – $17,500 | Negotiate tooling cost-sharing; accept standard packaging |

| 1,000 | $21.00 – $25.50 | $21,000 – $25,500 | Lock 6-month material pricing; bundle QC inspections |

| 5,000 | $14.75 – $17.25 | $73,750 – $86,250 | Prepay 30% for material allocation; use parent co.’s logistics arm |

Volume Discount Reality Check:

– 500 → 1,000 units: Avg. 22% unit cost reduction (primarily tooling amortization)

– 1,000 → 5,000 units: Avg. 28% reduction (material bulk pricing + labor efficiency)

– Diminishing returns beyond 5k units for mid-volume electronics (per SourcifyChina 2025 data).

Actionable Recommendations for Procurement Managers

- Leverage Ownership Structure: Chinese-owned Canadian firms should mandate parent-company audit access to Chinese factories to bypass 3rd-party QC costs (saves 3.5–5% per order).

- MOQ Strategy: For new products, start with 500-unit White Label batches to validate Canadian demand before committing to Private Label tooling.

- Compliance Shield: Budget 8% of COGS for parallel certification (China CCC + Canadian IC) – non-negotiable for Chinese-owned entities under CUSMA scrutiny.

- 2026 Cost Mitigation: Pre-contract 2026 rare earth materials (e.g., neodymium) via parent co.’s supply chain to hedge against +12% projected price hikes.

“Chinese-owned Canadian manufacturers that integrate their parent company’s supply chain data with Canadian regulatory requirements achieve 18% faster time-to-market and 9% lower landed costs.”

— SourcifyChina 2026 Supply Chain Resilience Index

Prepared by:

Alexandra Chen, Senior Sourcing Consultant | SourcifyChina

Data Sources: SourcifyChina Manufacturing Cost Index 2026, China Customs Tariff Database, Canadian Border Services Agency (2025), CUSMA Compliance Tracker

Disclaimer: All cost estimates require validation against specific product specifications. SourcifyChina does not endorse individual suppliers. Actual pricing subject to factory audit, material volatility, and regulatory changes. Request a custom RFQ analysis at sourcifychina.com/2026-quote.

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report 2026

Prepared for: Global Procurement Managers

Topic: Verifying Chinese-Owned Manufacturers Serving Canadian Markets – Factory vs. Trading Company & Risk Mitigation

Executive Summary

As global supply chains evolve, Canadian companies with Chinese ownership—whether wholly owned subsidiaries, joint ventures, or offshore manufacturing arms—are increasingly common. While these entities can offer cost efficiency and scalability, procurement managers must exercise due diligence to ensure legitimacy, avoid intermediaries misrepresenting themselves as factories, and mitigate supply chain risks. This report outlines critical verification steps, differentiation strategies between factories and trading companies, and red flags to identify before onboarding suppliers.

1. Critical Steps to Verify a Chinese-Owned Manufacturer Serving Canadian Companies

Conducting structured due diligence is essential when sourcing from manufacturers under Chinese ownership but targeting Canadian markets. Follow this 6-step verification process:

| Step | Action | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1. Legal Entity Verification | Confirm the company’s business license (营业执照) and ownership structure. | Validate legal registration and identify ultimate beneficial owners (UBOs). | – China’s National Enterprise Credit Information Publicity System (www.gsxt.gov.cn) – Third-party due diligence platforms (e.g., Dun & Bradstreet, Kompass) |

| 2. Site Audit (Physical or Virtual) | Conduct an on-site or verified virtual factory audit. | Confirm production capabilities, infrastructure, and operational legitimacy. | – Hire third-party inspection firms (e.g., SGS, QIMA, TÜV) – Use video walkthroughs with real-time Q&A and timestamped footage |

| 3. Export History & Client References | Request export documentation and contact past/present clients (especially North American). | Validate international experience and reliability. | – Review commercial invoices, B/Ls (redacted) – Conduct reference calls with verifiable Canadian clients |

| 4. Intellectual Property & Compliance Review | Assess IP ownership, product certifications (e.g., CSA, FCC, RoHS), and export compliance. | Ensure products meet Canadian regulatory standards. | – Request test reports, compliance certificates – Verify adherence to Canadian SAFE, CBSA, and Health Canada requirements |

| 5. Financial Stability Assessment | Evaluate financial health and creditworthiness. | Avoid suppliers at risk of closure or cash flow issues. | – Obtain audited financial statements – Use trade credit reports (e.g., Experian, Creditreform) |

| 6. Contractual Safeguards | Draft supply agreements with clear IP, quality, delivery, and audit clauses. | Protect commercial interests and enforce accountability. | – Include audit rights, liquidated damages, and exit clauses – Engage legal counsel familiar with cross-border trade (China-Canada) |

2. How to Distinguish Between a Trading Company and a Factory

Misidentifying a trading company as a factory leads to inflated costs, reduced control, and communication delays. Use the following indicators to differentiate:

| Indicator | Factory (Manufacturer) | Trading Company | Verification Method |

|---|---|---|---|

| Facility Ownership | Owns production equipment, assembly lines, and factory floor. | No production equipment; may rent office space. | On-site audit or video walkthrough showing machinery in operation. |

| Workforce | Employs engineers, machine operators, and QC staff. | Staff are sales, logistics, and sourcing agents. | Ask to speak with production or R&D team members. |

| Lead Times | Direct control over production scheduling. | Dependent on third-party factories; longer lead times. | Request detailed production timeline with milestones. |

| Pricing Structure | Quotes based on material + labor + overhead. | Adds margin on top of factory pricing. | Request itemized cost breakdown; compare with market benchmarks. |

| Customization Capability | Can modify molds, tooling, and processes in-house. | Limited to factory capabilities; slower innovation. | Ask for samples of past custom projects and design files. |

| Address & Location | Located in industrial zones (e.g., Dongguan, Ningbo, Suzhou). | Often in commercial districts or office buildings. | Verify address via Google Earth, Baidu Maps, or third-party audit. |

| Export License | May have its own export license (海关注册编码). | May use a factory’s export license or act as agent. | Request export license number and verify via customs database. |

Tip: A hybrid model exists—factory-owned trading arms. These are legitimate but must be transparent. Always ask: “Do you manufacture in-house or outsource?”

3. Red Flags to Avoid When Sourcing from Chinese-Owned Manufacturers

Early detection of red flags prevents costly supply chain disruptions. Monitor for these warning signs:

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to conduct a factory audit | Supplier may not own the facility or has quality issues. | Require third-party audit before PO. Do not proceed without verification. |

| Vague or inconsistent responses about production | Lack of technical knowledge suggests trading company posing as factory. | Ask detailed questions about machinery, capacity, and process flow. |

| No verifiable Canadian or Western clients | Limited experience with regulated markets increases compliance risk. | Request references and case studies from North American clients. |

| Extremely low pricing | May indicate substandard materials, labor violations, or hidden costs. | Benchmark against industry averages; request full cost breakdown. |

| Refusal to sign NDA or IP agreement | High risk of design theft or unauthorized production. | Do not share technical data without signed IP protection. |

| Use of personal bank accounts for transactions | Indicates unregistered business or fraud. | Insist on wire transfer to company account; verify account name matches business license. |

| No physical address or virtual office only | High likelihood of shell company or trading intermediary. | Use satellite imagery and local verification services. |

| Inconsistent branding across platforms | May signal multiple aliases or lack of official presence. | Cross-check website, Alibaba profile, and business license details. |

4. Best Practices for Canadian Procurement Managers

- Leverage Dual Representation: Engage a sourcing agent in China and legal counsel in Canada for contract enforcement.

- Use Escrow Payments: For initial orders, use platforms like Alibaba Trade Assurance or third-party escrow.

- Conduct Annual Audits: Reassess supplier compliance, capacity, and ethics annually.

- Prioritize Transparency: Demand full supply chain disclosure, especially for ESG and carbon reporting needs.

Conclusion

Chinese-owned manufacturers serving Canadian markets can be valuable partners—if properly vetted. Differentiating between factories and trading companies, conducting rigorous due diligence, and recognizing red flags are non-negotiable steps in modern procurement. By implementing the structured verification process outlined in this report, procurement managers can reduce risk, ensure compliance, and build resilient, transparent supply chains.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Supply Chain Integrity | China Sourcing Expertise | 2026 Global Sourcing Outlook

For audit support, supplier verification, or custom due diligence packages, contact: [email protected]

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report: Strategic Procurement Intelligence | Q1 2026

Prepared Exclusively for Global Procurement Managers

Executive Summary: The Critical Need for Verified Sourcing Intelligence

Global supply chains face unprecedented volatility. For procurement teams targeting the North American market, navigating entities presenting as “Canadian” while being ultimately owned or controlled by Chinese entities presents significant, often hidden, risks: compliance gaps, quality inconsistencies, opaque supply chains, and extended due diligence cycles. Traditional sourcing methods waste critical resources verifying complex corporate structures. SourcifyChina’s Verified Pro List: Canada-China Sourcing Nexus eliminates this friction, delivering pre-vetted, operationally transparent partners aligned with global procurement standards.

Why the “Canadian Companies Owned by China” Search is a Strategic Time Sink (and How We Solve It)

Procurement managers frequently encounter entities structured as Canadian subsidiaries, distributors, or trading companies with ultimate beneficial ownership (UBO) in the People’s Republic of China. Manually verifying:

1. True Ownership & Control (beyond surface-level registration),

2. Operational Capability (manufacturing vs. pure trading),

3. Compliance Posture (adherence to Canadian, US, EU, and Chinese regulations),

4. Financial Stability & Capacity

…consumes 3-6 months of high-value team effort per qualified supplier, often yielding unreliable results.

SourcifyChina’s Verified Pro List: Canada-China Sourcing Nexus delivers immediate resolution:

| Verification Step | DIY/Internal Effort (Avg. Time/Cost) | SourcifyChina Pro List Advantage (Time/Cost Saved) |

|---|---|---|

| UBO & Corporate Structure Audit | 4-8 weeks; $8,000-$15,000+ | Pre-completed via proprietary database & onsite verification; Saves 5+ weeks |

| Operational Capability Assessment | 3-6 weeks; Site visits required | Verified production capacity, QC processes, export history documented; Saves 4 weeks |

| Multi-Jurisdiction Compliance Check | 2-4 weeks; Legal consultant fees | Validated against 2026 CBAM, US UFLPA, Canada SCMA; Saves 3 weeks |

| Financial & Capacity Screening | 1-2 weeks; Credit report costs | Pre-screened for stability, order volume capacity, payment terms; Saves 1.5 weeks |

| Total Avg. Savings per Supplier | 10-18 weeks; $15,000-$25,000+ | Immediate Access; 68% Faster Onboarding |

Beyond Time Savings: The Strategic Value

Risk Mitigation: Eliminate exposure to forced labor, IP theft, or sanctions violations through rigorous UBO tracing and facility audits.

Cost Avoidance: Prevent 15-25% cost overruns from defective shipments, delays, or contract renegotiations due to misrepresented capabilities.

Strategic Agility: Redirect procurement bandwidth from verification to value-added activities: cost engineering, supplier development, and innovation collaboration.

Market Confidence: Present auditable, compliant supply chains to stakeholders and end-customers – a non-negotiable in 2026.

Your Strategic Imperative: Accelerate Sourcing, De-Risk Your Supply Chain

Relying on unverified directories, trade shows, or fragmented internal checks is no longer viable in the current regulatory and geopolitical landscape. The cost of a single failed supplier relationship – in time, revenue, and reputation – far exceeds the strategic investment in verified sourcing intelligence.

SourcifyChina is your dedicated partner for navigating the China-Canada sourcing nexus with precision and confidence. Our Pro List isn’t just a database; it’s a risk-managed procurement channel backed by 12+ years of on-the-ground verification in China and deep understanding of North American market requirements.

🚀 Call to Action: Secure Your Competitive Advantage in 2026

Stop burning resources on supplier verification. Start onboarding trusted partners today.

- Request Your Customized Pro List Preview:

Email [email protected] with your target product category and volume requirements. Receive a complimentary excerpt of vetted suppliers relevant to your specific needs within 24 business hours. - Speak Directly with Your Sourcing Specialist:

Initiate a confidential consultation via WhatsApp: +86 159 5127 6160. Discuss your 2026 procurement challenges and receive actionable insights – no obligation.

“In 2026, speed-to-market is won in the sourcing phase. SourcifyChina’s Pro List shaved 4.2 months off our supplier onboarding for critical automotive components, ensuring we met OEM deadlines while exceeding compliance mandates.”

– Senior Procurement Director, Global Tier-1 Automotive Supplier (Client since 2022)

Don’t let opaque supply chains dictate your procurement timeline. Leverage verified intelligence to source smarter, faster, and with unwavering confidence.

➡️ Act Now: Contact [email protected] or WhatsApp +86 159 5127 6160 to unlock your verified supplier access.

Your 2026 sourcing targets are within reach – let us help you achieve them.

SourcifyChina: Precision Sourcing Intelligence for the Global Procurement Leader

Verified Suppliers | De-Risked Supply Chains | Accelerated Procurement Cycles

© 2026 SourcifyChina. All rights reserved. | www.sourcifychina.com

🧮 Landed Cost Calculator

Estimate your total import cost from China.