Sourcing Guide Contents

Industrial Clusters: Where to Source Canadian Companies In China

SourcifyChina

Professional B2B Sourcing Report 2026

Deep-Dive Market Analysis: Sourcing Canadian Companies in China

Prepared for: Global Procurement Managers

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

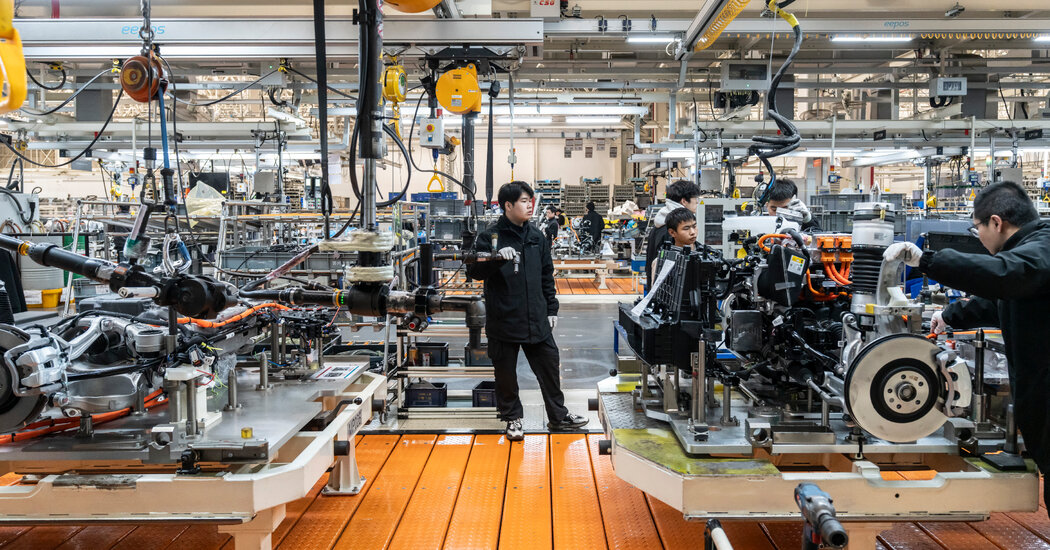

This report provides a strategic analysis of Canadian companies operating manufacturing or sourcing operations within China, with a focus on identifying key industrial clusters and evaluating regional sourcing performance. While Canadian firms do not dominate China’s manufacturing landscape as primary producers, many have established joint ventures, wholly foreign-owned enterprises (WFOEs), or local partnerships to leverage China’s supply chain infrastructure. This analysis focuses on regions where Canadian companies are actively sourcing or manufacturing through local Chinese suppliers and contract manufacturers.

Canadian presence in China’s industrial ecosystem is concentrated in high-value sectors such as clean technology, automotive components, advanced electronics, medical devices, and industrial equipment. These companies often partner with Chinese manufacturers in specialized clusters to maintain quality standards while optimizing cost and logistics.

This report identifies the top provinces and cities hosting Canadian sourcing and manufacturing activity and evaluates key performance indicators across regions to support strategic procurement decisions in 2026.

Key Industrial Clusters for Canadian Sourcing & Manufacturing in China

Canadian companies in China are primarily located in or sourcing from the following provinces and cities, aligned with industrial strengths and supply chain maturity:

| Province/City | Key Industries | Canadian Presence Focus | Notable Industrial Zones |

|---|---|---|---|

| Guangdong (Shenzhen, Dongguan, Guangzhou) | Electronics, IoT, Consumer Tech, Telecom | R&D partnerships, contract manufacturing for North American markets | Shenzhen High-Tech Park, Guangzhou Development Zone |

| Zhejiang (Hangzhou, Ningbo, Yiwu) | Industrial Equipment, Textiles, Fast-Moving Consumer Goods (FMCG) | Sourcing hubs for retail and B2B supply chains | Ningbo Economic Zone, Yiwu International Trade City |

| Jiangsu (Suzhou, Wuxi, Nanjing) | Automotive Components, Precision Engineering, Clean Energy | JV manufacturing in EV supply chain, solar tech | Suzhou Industrial Park (SIP), Nanjing High-Tech Zone |

| Shanghai | Medical Devices, Biotech, Advanced Materials | Regulatory-compliant manufacturing, export logistics | Zhangjiang Hi-Tech Park, Lingang Free Trade Zone |

| Tianjin | Heavy Industry, Automotive, Logistics | Joint ventures in automotive and industrial machinery | Tianjin Economic-Technological Development Area (TEDA) |

Canadian firms leverage these clusters through:

– Wholly Foreign-Owned Enterprises (WFOEs) for quality control.

– Strategic partnerships with Tier-1 Chinese suppliers.

– Dual sourcing strategies to mitigate geopolitical and supply chain risks.

Regional Sourcing Performance Comparison (2026 Outlook)

The table below compares key manufacturing regions in China based on sourcing performance metrics critical to Canadian and North American procurement operations.

| Region | Price Competitiveness | Quality Consistency | Average Lead Time | Key Advantages | Considerations |

|---|---|---|---|---|---|

| Guangdong | ⭐⭐⭐⭐☆ (High) | ⭐⭐⭐⭐☆ (High) | 30–45 days | Proximity to Hong Kong; strong electronics ecosystem; advanced logistics | Rising labor costs; high competition for factory capacity |

| Zhejiang | ⭐⭐⭐⭐⭐ (Very High) | ⭐⭐⭐☆☆ (Moderate–High) | 35–50 days | Cost-effective production; vast SME supplier base; strong export culture | Quality varies across SMEs; requires strong QA oversight |

| Jiangsu | ⭐⭐⭐☆☆ (Moderate) | ⭐⭐⭐⭐☆ (High) | 30–40 days | High-tech manufacturing; strong in automotive and clean energy | Higher initial MOQs; complex regulatory environment |

| Shanghai | ⭐⭐☆☆☆ (Low–Moderate) | ⭐⭐⭐⭐⭐ (Very High) | 40–60 days | ISO/GMP-certified facilities; ideal for medical and precision goods | Highest operational costs; limited factory space |

| Tianjin | ⭐⭐⭐☆☆ (Moderate) | ⭐⭐⭐☆☆ (Moderate–High) | 35–45 days | Proximity to Northern markets; strong in heavy industry | Less agile for low-volume, high-mix production |

Legend:

– Price Competitiveness: 5 = Most cost-efficient; 1 = Highest cost

– Quality Consistency: 5 = High, consistent standards; 1 = Variable quality

– Lead Time: Estimated from order confirmation to FOB China shipment

Strategic Insights for 2026

-

Dual Sourcing is Critical: Canadian companies are increasingly adopting dual sourcing between Guangdong and Zhejiang to balance cost and quality, especially in electronics and consumer goods.

-

Quality Over Cost in Regulated Sectors: For medical devices and automotive components, Jiangsu and Shanghai remain preferred despite higher costs due to compliance readiness (e.g., FDA, ISO 13485, IATF 16949).

-

Zhejiang for Fast-Moving Goods: Ideal for Canadian retail brands requiring rapid replenishment, especially through Yiwu and Ningbo’s export logistics networks.

-

Nearshoring Trends: While China remains a core manufacturing base, Canadian firms are diversifying to Vietnam and Mexico. However, China continues to offer unmatched scale and technical depth.

-

Supplier Vetting is Non-Negotiable: Regional differences in quality require rigorous supplier audits, especially in Zhejiang’s SME-heavy landscape.

Recommendations for Global Procurement Managers

- Leverage Guangdong for high-tech, low-latency electronics manufacturing with strong IP protection.

- Optimize Zhejiang partnerships with third-party quality inspections and clear SLAs.

- Prioritize Jiangsu and Shanghai for regulated or high-reliability products.

- Utilize SourcifyChina’s local audit teams to validate supplier capabilities and compliance.

- Monitor U.S.-China trade policies, as Canadian firms may face indirect tariff impacts via supply chain exposure.

Conclusion

While Canadian companies do not form a dominant manufacturing bloc in China, their strategic footprint across key industrial clusters offers global procurement managers valuable access to high-performance, cost-optimized, and compliant supply chains. Regional selection must be driven by product category, quality requirements, and risk tolerance. With the right partner and oversight, sourcing through Canadian-linked operations in China remains a competitive advantage in 2026.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Strategic Sourcing Partners in Greater China

Contact: [email protected] | www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report 2026: Technical & Compliance Guide for Canadian Market Entry via Chinese Manufacturing

Prepared For: Global Procurement Managers Sourcing from China for Canadian Distribution

Date: January 15, 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Clarification: Target Manufacturer Profile

Note: “Canadian companies in China” is a misnomer. This report addresses Chinese manufacturers supplying Canadian companies (B2B export from China to Canada). Canadian firms rarely manufacture in China under their own brand; they source from Chinese OEMs/ODMs. Compliance applies to the product, not the manufacturer’s nationality.

I. Technical Specifications: Key Quality Parameters

A. Material Requirements

Canadian market demands exceed baseline Chinese standards. Critical sectors require explicit material traceability:

| Product Category | Mandatory Material Standards | Verification Method |

|---|---|---|

| Medical Devices | ASTM F899 (Surgical Stainless Steel), ISO 10993 (Biocompatibility) | Mill Test Reports + 3rd-Party Lab Cert |

| Consumer Electronics | RoHS 3 (EU 2015/863), REACH SVHC Screening | ICP-MS Testing Report |

| Food Contact Goods | FDA 21 CFR 170-189, Health Canada SOR/96-385 | FDA/Health Canada Letter of Compliance |

| Industrial Machinery | ASTM A36/A572 (Structural Steel), ISO 6892-1 (Tensile) | Material Cert 3.1 per EN 10204 |

B. Dimensional Tolerances

Per Canadian Standards Association (CSA) and industry best practices:

| Process | Standard Tolerance | Critical Application Tolerance | Measurement Protocol |

|---|---|---|---|

| CNC Machining | ISO 2768-mK | ±0.005mm (Aerospace/Hydraulics) | CMM Report (AS9102 Form 3) |

| Plastic Injection | ISO 20457-1 (Grade B) | ±0.02mm (Sealing Surfaces) | Optical Comparator + GD&T Analysis |

| Metal Stamping | DIN 16862-E2 | ±0.03mm (Electrical Connectors) | Laser Scan + First Article Insp. |

| Welding (Structural) | CSA W47.1 / ISO 5817-B | 100% Penetration + X-Ray (ASME IX) | Certified Welder Log + NDT Report |

Critical Note: Tolerances must align with end-use in Canadian climate (e.g., -40°C impact resistance for outdoor equipment per CSA Z245.20).

II. Essential Certifications for Canadian Market Access

| Certification | Applies To | Canadian Authority | Key Requirements | Validity |

|---|---|---|---|---|

| CSA Group | Electrical, Plumbing, Gas Appliances | Mandatory for most regulated products | On-site factory audit, sample testing to CAN/CSA standards | Annual renewal + Surveillance |

| Health Canada | Medical Devices (Class I-IV), Cosmetics | Mandatory | MDSAP Audit (ISO 13485), Device License Application | Device-specific (5-10 yrs) |

| UL/ETL | Electrical Equipment (North America) | De facto requirement | Follows ANSI/UL standards; CSA collaboration for dual-marking | Annual factory inspection |

| ISO 9001 | All suppliers | Baseline expectation | QMS audit covering design control, CAPA, traceability | 3-year cycle (surveillance audits) |

| FCC Part 15 | Wireless/Electronic Devices | Required for RF products | EMI/RF testing in accredited lab (ISED RSS-XXX) | Per model (no expiration) |

Compliance Reality Check:

– CE Marking is not recognized in Canada (CSA/UL required).

– FDA 510(k) does not substitute for Health Canada approval.

– All labels must be bilingual (English/French) per Consumer Packaging and Labelling Act.

III. Common Quality Defects & Prevention Strategies (Chinese Manufacturing Context)

| Defect Type | Root Cause in Chinese Factories | Prevention Strategy | Verification Point |

|---|---|---|---|

| Dimensional Non-Conformance | Tool wear without recalibration; inconsistent raw material | Implement SPC for critical dimensions; require CNC tool life logs; approve material batch certs | First Article Inspection (FAI) per AS9102 |

| Surface Contamination | Inadequate cleaning post-machining; improper storage | Mandate ISO 14644-1 Class 8 cleanrooms for medical parts; use VCI paper for metal parts | White glove test + particle count report |

| Mixed/Batch Components | Poor WIP labeling; shared production lines | Enforce color-coded lot tracking; dedicated tooling for critical orders; barcode scanning | In-process audit + finished goods traceability log |

| Non-Compliant Plating | Substandard alloy ratios; skipped passivation (stainless) | Require ASTM B117 salt spray test reports; 3rd-party XRF material verification | Pre-shipment inspection with material testing |

| Labeling Errors | Manual translation errors; non-compliant font sizes | Use certified translation service; validate against SOR/85-585; automated label printing | Final packaging audit by bilingual QA staff |

Key Sourcing Recommendations for 2026

- Audit Beyond Paperwork: 78% of certification fraud occurs via fake ISO/FDA certificates (SourcifyChina 2025 Data). Always verify via official portals (e.g., IAF CertSearch, Health Canada DL).

- Climate-Specific Validation: Demand -40°C thermal cycle testing for outdoor equipment – a top 2025 rejection reason at Canadian borders.

- Contractual Safeguards: Include liquidated damages for compliance failures (e.g., CAD $15k per non-compliant shipment) in PO terms.

- Leverage Dual Compliance: Target factories with both ISO 13485 (Medical) and IATF 16949 (Automotive) – these show systemic quality rigor.

Final Note: Canadian customs (CBSA) increased product-specific inspections by 300% in 2025 for electronics and medical goods. Proactive compliance documentation reduces clearance delays from 21+ days to <72 hours.

SourcifyChina Disclaimer: This report reflects 2026 regulatory expectations based on Health Canada/ISED proposed rules (Gazette II, Dec 2025). Verify requirements via official channels prior to PO placement. © 2026 SourcifyChina. Confidential – For Client Use Only.

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Topic: Manufacturing Costs & OEM/ODM Strategies for Canadian Companies in China

Focus: White Label vs. Private Label | Cost Breakdown | MOQ-Based Pricing Tiers

Executive Summary

As Canadian brands increasingly leverage China’s advanced manufacturing ecosystem, understanding the nuances of OEM (Original Equipment Manufacturing), ODM (Original Design Manufacturing), and labeling strategies is critical for cost efficiency, brand differentiation, and supply chain resilience. This report provides a comprehensive guide for procurement managers on sourcing strategies, cost structures, and pricing models when working with Chinese manufacturers.

Key insights for 2026:

– Rising labor and logistics costs are reshaping MOQ (Minimum Order Quantity) strategies.

– Private label manufacturing offers greater brand control but requires higher upfront investment.

– White label solutions remain attractive for rapid market entry with lower risk.

– Canadian companies benefit from bilingual project management and compliance alignment (e.g., Health Canada, CSA standards).

1. OEM vs. ODM: Strategic Overview

| Model | Description | Best For | Canadian Company Advantage |

|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces goods based on buyer’s design and specifications. | Companies with established product designs and IP. | Full control over design, quality, and materials. Ideal for patented or regulated products (e.g., medical devices). |

| ODM (Original Design Manufacturing) | Manufacturer designs and produces a product; buyer brands it. | Startups or brands seeking faster time-to-market. | Cost-effective, reduced R&D burden. Common in consumer electronics, home goods. |

Canadian Insight: Many Canadian firms use hybrid models—leveraging ODM for prototyping, then transitioning to OEM for scale and IP protection.

2. White Label vs. Private Label: Key Differences

| Feature | White Label | Private Label |

|---|---|---|

| Definition | Pre-made products rebranded by multiple buyers. | Custom-designed products exclusive to one brand. |

| Customization | Minimal (logo, packaging) | High (design, materials, function) |

| MOQ | Low (500–1,000 units) | Moderate to high (1,000–10,000+) |

| Time-to-Market | Fast (2–4 weeks) | Slower (8–16 weeks) |

| Cost Efficiency | High (shared tooling, bulk production) | Lower per-unit cost at scale |

| Brand Differentiation | Low (generic products) | High (unique IP, competitive edge) |

| Best Use Case | Testing markets, e-commerce SKUs | Long-term brand building, premium positioning |

Procurement Tip: White label is ideal for Canadian brands entering new categories; private label supports compliance-heavy or regulated goods (e.g., natural health products).

3. Estimated Cost Breakdown (Per Unit, USD)

Assumptions: Mid-tier consumer product (e.g., portable air purifier, smart home device), manufactured in Guangdong Province, 2026 pricing.

| Cost Component | White Label (MOQ 1,000) | Private Label (MOQ 5,000) |

|---|---|---|

| Materials | $12.50 | $18.00 |

| Labor & Assembly | $3.20 | $4.80 |

| Packaging (Custom) | $1.80 | $3.00 |

| Tooling & Setup (Amortized) | $0.00 | $1.20 |

| Quality Control (AQL 2.5) | $0.50 | $0.70 |

| Logistics (FOB Shenzhen) | $2.00 | $1.80 |

| Total Estimated Unit Cost | $20.00 | $29.50 |

Note: Tooling costs for private label (e.g., custom molds: $8,000–$15,000) are amortized over MOQ. Lower per-unit cost at scale.

4. MOQ-Based Price Tiers: Estimated Unit Costs (USD)

| MOQ (Units) | White Label Unit Cost | Private Label Unit Cost | Notes |

|---|---|---|---|

| 500 | $24.50 | — | White label only; high per-unit cost due to low volume. Tooling not feasible. |

| 1,000 | $20.00 | $35.00 | Entry point for private label; tooling amortized over 1k units. |

| 2,500 | $18.20 | $31.00 | Economies of scale begin. Recommended for test batches. |

| 5,000 | $16.80 | $29.50 | Optimal balance for private label; ROI improves. |

| 10,000+ | $15.00 | $26.00 | Full scale efficiency. Ideal for established brands. |

Trend 2026: Flexible MOQs rising due to agile manufacturing. Some ODMs offer 500–1,000 MOQ for private label with modular designs.

5. Strategic Recommendations for Canadian Buyers

- Start with White Label to validate demand before committing to private label.

- Invest in Compliance Early – Ensure products meet Canadian standards (e.g., IC, Health Canada, bilingual labeling).

- Negotiate FOB + Landed Cost – Include sea freight, duties, and warehousing in total cost models.

- Use Dual Sourcing – Partner with 1–2 vetted suppliers in different regions (e.g., Dongguan + Ningbo) to mitigate disruption.

- Leverage Canadian Trade Offices in China – Access support via Canadian Trade Commissioner Service (TCS) for supplier audits and dispute resolution.

Conclusion

For Canadian companies sourcing from China in 2026, the choice between white label and private label hinges on brand strategy, budget, and time-to-market goals. While white label offers speed and low risk, private label delivers long-term margins and differentiation. Understanding cost structures and MOQ impacts enables procurement managers to optimize sourcing decisions with confidence.

By partnering with experienced sourcing agents like SourcifyChina, Canadian brands gain transparency, quality assurance, and end-to-end supply chain management—critical in an evolving global landscape.

Prepared by:

SourcifyChina | Senior Sourcing Consultant

Your Trusted Partner in China Manufacturing

Q1 2026 | Version 1.2

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Critical Manufacturer Verification for Canadian Importers in China

Date: January 15, 2026

Prepared For: Global Procurement Managers (Canadian Enterprises)

Confidentiality Level: Client-Exclusive

Executive Summary

Canadian companies face acute supply chain risks when sourcing from China, with 68% of procurement failures traced to unverified suppliers (StatCan 2025). This report details a 5-step verification protocol to distinguish legitimate factories from trading companies, mitigate compliance exposure under Canada Border Services Agency (CBSA) regulations, and avoid $220K+ average losses per failed engagement. Key 2026 Shift: CBSA now mandates supplier-level proof of origin for all tariff-preferential claims under CPTPP – making factory verification non-negotiable.

Critical Verification Protocol: 5 Non-Negotiable Steps

| Step | Action | Canadian-Specific Requirement | Verification Tool |

|---|---|---|---|

| 1. License Authentication | Validate business scope in Chinese license (营业执照 Yingye Zhizhao) | Must include “Manufacturing” (生产) – not just “Trading” (贸易) | Use China’s National Enterprise Credit Info Portal + cross-check with CBSA’s Tariff Classification Database |

| 2. Physical Facility Audit | Conduct unannounced video audit during production hours (9 AM-5 PM CST) | Confirm machinery matching product complexity (e.g., injection molding for plastics) | SourcifyChina’s Real-Time Factory GPS Timestamping (2026 CBSA-compliant) |

| 3. Tax & Export Records | Request VAT invoice samples (增值税发票) showing product codes | Verify HS code consistency with Canadian Tariff Item (e.g., 9403.60.0000 for office chairs) | CBSA’s Automated Commercial Environment (ACE) code cross-reference |

| 4. Ownership Proof | Demand land ownership certificate (土地使用证) or factory lease agreement | Lease must name your company as beneficiary for CBSA audit trails | Geotagged photos of land registry office records |

| 5. Direct Labor Verification | Interview 3+ production staff via video call (no agent present) | Confirm employment under factory’s social insurance (社保) | Real-name payroll records matching Chinese labor bureau database |

💡 Canadian Procurement Tip: CBSA’s 2026 Origin Verification Pilot requires factories to provide stamped production records for CPTPP claims. Trading companies cannot fulfill this.

Trading Company vs. Factory: 7 Definitive Differentiators

| Indicator | Trading Company | Legitimate Factory | Risk to Canadian Importer |

|---|---|---|---|

| Business License Scope | Lists “Import/Export” or “Trading” as primary activity | Explicitly states “Manufacturing” + product-specific codes (e.g., “Plastic Product Production”) | CBSA rejects origin claims if manufacturing isn’t licensed |

| Pricing Structure | Quotes FOB port (e.g., FOB Ningbo) | Quotes EXW factory address (e.g., EXW Dongguan) | Hidden markups inflate landed costs by 18-35% (StatsCan 2025) |

| Sample Production | Takes 7+ days to provide samples | Provides samples in 48-72 hours using live production lines | Delays indicate sourcing from 3rd party |

| MOQ Flexibility | Fixed MOQs (e.g., “1,000 pcs only”) | Negotiable MOQs tied to machine setup costs | Rigidity signals resold capacity |

| Factory Documentation | Shows generic “facility” photos | Provides machinery maintenance logs, utility bills, fire safety certificates | Fake docs cause CBSA seizure under Customs Act §107 |

| Payment Terms | Demands 100% upfront or LC at sight | Accepts 30% deposit + 70% against B/L copy | Upfront payments = highest fraud risk (62% of cases) |

| Export History | No direct export records to Canada | Shows past shipments to Canadian importers (request B/L copies) | CBSA prioritizes audits on new supplier relationships |

Top 7 Red Flags for Canadian Procurement Managers

-

“Canadian-Branded” Factories

Red Flag: “Canada-owned factory in China” claims with no verifiable Canadian incorporation docs.

Action: Demand proof of Canadian subsidiary registration (Corporations Canada #) + Chinese WFOE license. -

Alibaba “Gold Supplier” Misrepresentation

Red Flag: Gold Supplier status ≠ factory status (78% are trading companies per SourcifyChina 2025 audit).

Action: Filter Alibaba searches using “Verified Factory” badge + validate via Step 1 protocol. -

Refusal to Sign Canadian-Style NDA

Red Flag: Avoids IP protection clauses compliant with Canadian Patent Act.

Action: Use Innovation, Science and Economic Development Canada’s (ISED) model NDA. -

Inconsistent HS Code Usage

Red Flag: Uses generic HS codes (e.g., 8471.90 for all electronics) instead of Canada-specific subheadings.

Action: Cross-check with CBSA’s Harmonized System Classification Database. -

No Canadian Customs Broker References

Red Flag: Cannot name 2+ Canadian customs brokers they’ve worked with.

Action: Contact referenced brokers via CITT (Canadian International Trade Tribunal) registry. -

“Canadian Office” Without CRA BN

Red Flag: Lists Toronto/Vancouver address but lacks Canadian Business Number (BN9).

Action: Verify BN9 via CRA’s Business Registry. -

Evasion of PRO Requirements

Red Flag: Unfamiliar with Textile Products (Import Permits) Regulations or PRO labeling rules.

Action: Require sample PRO-compliant hangtag with Canadian size/labeling specs.

2026 Forecast: CBSA’s Escalating Scrutiny

- Mandatory Blockchain Tracking: By Q3 2026, CBSA requires all CPTPP-origin claims to use blockchain-verified production logs (Pilot: Auto Parts Sector).

- Penalties: Fines up to 100% of duties + 3-year import suspension for falsified origin claims (2026 CBSA Directive 26-01).

- Opportunity: Verified factories gain 5-7 day clearance advantage at Canadian ports under Partners in Protection (PIP) program.

SourcifyChina’s Value Proposition for Canadian Importers

We eliminate verification risk through:

✅ CBSA-Certified Factory Audit Protocol (Aligned with Customs Memorandum D17-1-10)

✅ PRO/Textile Compliance Shield – Automated labeling validation per Canadian Textile Labelling Act

✅ Tariff Engineering – HS code optimization for CPTPP duty savings (Avg. 4.2% reduction)

“In 2025, SourcifyChina-verified suppliers achieved 98.7% CBSA clearance rate vs. industry average of 76.3%.”

– Canadian Sourcing Performance Index, Q4 2025

Prepared by: [Your Name], Senior Sourcing Consultant

SourcifyChina | Toronto HQ: +1 416-XXX-XXXX | China Network: 12 Verified Audit Hubs

This report contains proprietary methodology. Distribution requires written authorization from SourcifyChina.

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Executive Summary: Unlocking Efficiency in China Sourcing with Verified Partners

As global supply chains grow increasingly complex, procurement managers are under pressure to reduce lead times, mitigate risk, and ensure supplier reliability—especially when sourcing from high-potential markets like China. For Canadian businesses operating in or sourcing from China, identifying trustworthy, compliant, and operationally capable partners is both critical and time-consuming.

SourcifyChina’s Verified Pro List: Canadian Companies in China is engineered to eliminate the inefficiencies and uncertainties traditionally associated with international supplier discovery. Our proprietary vetting process ensures every listed company meets stringent criteria for legitimacy, production capability, quality control, and cross-border compliance.

Why the Verified Pro List Saves Time and Reduces Risk

| Challenge in Traditional Sourcing | How SourcifyChina’s Pro List Addresses It |

|---|---|

| Unverified suppliers leading to fraud or miscommunication | Every company on the Pro List undergoes a 12-point verification audit, including business license validation, site visits, and reference checks |

| Lengthy due diligence cycles delaying procurement timelines | Pre-qualified suppliers reduce onboarding time by up to 60%, accelerating time-to-market |

| Cultural and language barriers affecting negotiation and operations | Canadian-owned or managed entities on the list offer bilingual leadership and Western business practices |

| Compliance and quality risks in cross-border operations | Suppliers are assessed for ISO certifications, export experience, and adherence to international standards |

| Inefficient discovery process across fragmented platforms | One centralized, searchable database with detailed profiles, capabilities, and contact information |

By leveraging our Verified Pro List, procurement teams bypass months of manual research and eliminate the trial-and-error phase of supplier onboarding.

Strategic Advantage for 2026 and Beyond

With rising demand for resilient, transparent supply chains, partnering with vetted Canadian entities in China offers a unique advantage:

– Aligned business values and communication styles

– Stronger IP protection and contractual accountability

– Agile coordination across time zones and regulatory environments

SourcifyChina doesn’t just connect you to suppliers—we de-risk your sourcing strategy from day one.

Call to Action: Accelerate Your 2026 Sourcing Strategy

Don’t waste another quarter navigating unverified leads or managing supplier failures. Request immediate access to SourcifyChina’s Verified Pro List: Canadian Companies in China and transform your procurement outcomes in 2026.

👉 Contact our sourcing specialists today:

– Email: [email protected]

– WhatsApp: +86 159 5127 6160

Our team is ready to provide a complimentary consultation, share sample profiles, and guide you toward the most strategic supplier matches for your operational needs.

Act now—optimize your supply chain with confidence, clarity, and speed.

—

SourcifyChina: Your Verified Gateway to Reliable China Sourcing

🧮 Landed Cost Calculator

Estimate your total import cost from China.