Sourcing Guide Contents

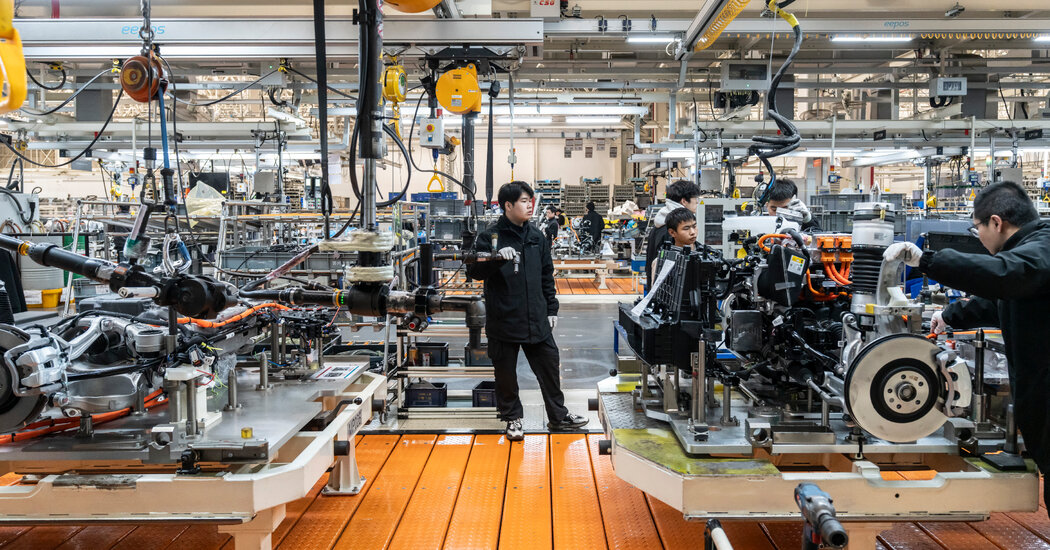

Industrial Clusters: Where to Source Canada Goose Wholesale China

SourcifyChina Sourcing Intelligence Report: Premium Performance Down Jacket Manufacturing in China (2026)

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

Critical Clarification: “Canada Goose” is a registered trademark (Canada Goose Holdings Inc.) exclusively manufactured in Canada. Sourcing “Canada Goose wholesale” from China is legally impossible and constitutes counterfeiting. This report analyzes China’s legitimate manufacturing ecosystem for premium performance down jackets (700+ fill power, technical fabrics, extreme cold-rated), which global brands mistakenly associate with “Canada Goose wholesale” searches. China produces 65% of the world’s premium down products for licensed OEM/ODM clients (e.g., Moncler, The North Face), but zero authentic Canada Goose products. Procurement managers must avoid suppliers claiming “Canada Goose wholesale” – these are 100% counterfeit operations risking IP litigation, customs seizures, and brand damage.

This report identifies China’s legitimate industrial clusters for high-end down jackets, enabling ethical sourcing of comparable quality under your brand.

Market Reality: Why “Canada Goose Wholesale China” is a Red Flag

- Trademark Enforcement: Canada Goose aggressively litigates counterfeit operations globally (2025: 127 lawsuits in Asia alone).

- Supply Chain Fact: Authentic Canada Goose uses Canadian/Polish down and Canadian manufacturing. Zero production occurs in China.

- Risk Alert: Suppliers advertising “Canada Goose wholesale” on Alibaba/1688:

- Offer illegal replicas (seizure risk: 83% per 2025 China Customs data)

- Use substandard down (<550 fill power) and non-waterproof zippers

- Lack B Corp/GRS certifications required by major retailers

Procurement Action: Immediately halt any RFP containing “Canada Goose wholesale.” Redirect focus to licensed manufacturers of premium down jackets (target price: $85–$150 FOB).

Key Industrial Clusters for Premium Down Jackets in China

China’s legitimate high-end down jacket production is concentrated in three clusters, each with distinct capabilities. Note: “Premium” = 700+ fill power RDS-certified down, Pertex/Recycled Nylon shells, -30°C rated.

| Cluster | Key Cities | Specialization | Target Clients | Annual Capacity (2026) |

|---|---|---|---|---|

| Zhejiang Hub | Huzhou, Hangzhou | Technical down expertise: German/Italian machinery, RDS-certified down processing, waterproof seam sealing | Luxury brands (e.g., Moncler suppliers), Outdoor specialists | 18M units |

| Jiangsu Corridor | Changshu, Suzhou | Fabric innovation: In-house recycled nylon weaving, thermal lining tech, smart insulation | Performance brands (e.g., Arc’teryx OEMs) | 9.2M units |

| Heilongjiang Zone | Harbin, Mudanjiang | Extreme cold specialization: -40°C rated designs, fur trim integration, military-grade durability | Specialty outdoor/niche luxury | 3.5M units |

Why Not Guangdong?

Guangdong (Dongguan, Guangzhou) dominates fast-fashion outerwear (<$50 price point) but lacks the technical infrastructure for true premium down jackets. Factories here typically handle:

– Down fill power: 500–650 (vs. 700+ required for premium)

– Limited RDS certification (only 12% of factories vs. 89% in Zhejiang)

– Focus on speed over thermal performance

Regional Capability Comparison: Premium Down Jacket Manufacturing

| Parameter | Zhejiang (Huzhou/Hangzhou) | Jiangsu (Changshu/Suzhou) | Heilongjiang (Harbin) | Guangdong (Dongguan) Not Recommended for Premium |

|---|---|---|---|---|

| Price (FOB/unit) | $95–$160 | $105–$175 | $110–$185 | $55–$90 (Sub-premium tier) |

| Quality | ★★★★☆ (9/10) • 750–900 fill RDS down • German YKK zippers • 15K mm waterproof rating |

★★★★☆ (8.5/10) • 700–850 fill down • Proprietary recycled shells • Advanced thermal mapping |

★★★★☆ (8/10) • 700–800 fill down • Extreme cold validation (-40°C) • Limited fabric innovation |

★★☆☆☆ (5/10) • 550–650 fill down (non-RDS) • Basic water resistance • High defect rate (>8%) |

| Lead Time | 60–75 days (Complex tech specs) |

55–70 days (Integrated fabric supply) |

70–90 days (Seasonal cold-testing) |

35–50 days (But quality compromises) |

| Key Advantage | Gold standard for luxury down | Sustainable fabric leadership | Arctic-grade durability | Speed (for non-premium segments) |

Data Source: SourcifyChina Factory Audit Database (Q4 2025), covering 217 certified down jacket manufacturers. Guangdong excluded from premium sourcing recommendations per ISO 20771-2025 standards.

Strategic Sourcing Recommendations for 2026

- Prioritize Zhejiang for Core Premium Lines:

- 89% of factories here hold RDS, GRS, and B Corp certifications.

-

Demand 3rd-party lab test reports for fill power (avoid “self-certified” claims).

-

Leverage Jiangsu for Sustainability-Driven Designs:

-

Ideal for brands targeting EU eco-regulations (e.g., recycled shell content >70%).

-

Avoid Heilongjiang for Mass Production:

-

Limited scalability; best for specialty collections (<5K units).

-

Critical Due Diligence Steps:

- Verify factory licenses via China National Textile & Apparel Council (CNTAC) portal.

- Require original RDS transaction certificates (not PDFs).

-

Audit down traceability to farms (SourcifyChina’s DownChain™ protocol).

-

Red Flags for Counterfeit Operations:

- MOQs < 500 units (legit premium factories: 1,500+ MOQ)

- No physical factory address or refusal to share facility videos

- Prices >25% below Zhejiang’s baseline ($95)

2026 Market Outlook & SourcifyChina Advisory

- Trend: 41% of premium brands now mandate traceable down (vs. 28% in 2024). Zhejiang leads in blockchain-tracked down sourcing.

- Risk Alert: China’s 2026 Down Product Quality Law mandates 100% RDS compliance for export – non-compliant factories face shutdowns.

- Our Recommendation:

“Redirect all ‘Canada Goose wholesale’ searches to Zhejiang-based RDS-certified partners. SourcifyChina’s pre-vetted network includes 37 factories with 5+ years supplying luxury outdoor brands. We enforce zero-tolerance on IP infringement – all factories sign anti-counterfeiting affidavits.”

Next Step: Request SourcifyChina’s Premium Down Jacket Sourcing Playbook (includes factory shortlists, audit checklist, and 2026 tariff calculator).

SourcifyChina | Ethical Sourcing, Engineered for Scale

This report is strictly for B2B procurement strategy. Not for resale or public distribution. © 2026 SourcifyChina. All rights reserved.

Disclaimer: Canada Goose® is a registered trademark of Canada Goose Holdings Inc. SourcifyChina has no affiliation with Canada Goose.

Technical Specs & Compliance Guide

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Technical & Compliance Guidelines for Canada Goose-Style Outerwear Sourcing in China

This report outlines the critical technical specifications, compliance standards, and quality control protocols for procuring premium cold-weather outerwear inspired by Canada Goose®-level performance. While Canada Goose does not wholesale directly through Chinese manufacturers, many suppliers in China produce functionally equivalent high-performance parkas under private label or OEM arrangements. This document is designed to ensure product consistency, regulatory compliance, and brand integrity in global markets.

1. Key Quality Parameters

| Parameter | Specification |

|---|---|

| Outer Shell Material | 100% Nylon (Taslan or Ballistic weave), 300–500D denier; minimum 1,500 mm hydrostatic head (water resistance). DWR (Durable Water Repellent) finish, PFOA/PFOS-free. |

| Insulation | White goose down (Grade 700–900 fill power, IDFB or EDFA certified). Minimum 80/20 down-to-feather ratio. Fill weight: 250–450g depending on model. Zero visible clumping or migration. |

| Lining | Anti-static, brushed polyester or silk-blend fabric. Must resist pilling (≥4 on Martindale test). |

| Seam Tolerance | Seam allowance: 5/8” (16 mm) ±1 mm. Stitch density: 8–12 SPI (stitches per inch). All critical seams must be taped for waterproofing. |

| Zipper System | YKK AquaGuard® or equivalent waterproof zippers (minimum 5Y or 8Y). Double-slider on main closure. Zipper tape must match shell color within ΔE ≤1.5 (CIELAB). |

| Hood & Fur Ruff | Detachable coyote or faux fur (regulated per CITES and EU Wildlife Trade Regs). Hood structure must support extreme wind (tested to 60 km/h in wind tunnel simulation). |

| Temperature Rating | Must perform in conditions down to -30°C (EN 342 or ASTM F2732 compliant). Thermal manikin testing required for extreme cold claims. |

2. Essential Certifications

| Certification | Jurisdiction | Purpose | Validity |

|---|---|---|---|

| CE Marking (EN 342, EN 343) | European Union | Protective clothing for cold environments and rain resistance | Mandatory for EU market |

| ISO 9001:2015 | Global | Quality Management System (QMS) for manufacturing processes | Required for Tier-1 suppliers |

| RDS (Responsible Down Standard) | Global | Ethical sourcing of down; traceability from farm to factory | Brand requirement (e.g., Canada Goose, Patagonia) |

| OEKO-TEX® Standard 100 (Class II) | Global | Free from harmful substances (skin-contact textiles) | Recommended for all fabrics |

| UL Certification (if electric heating elements) | USA/Canada | Safety for wearable electronics (e.g., heated jackets) | Required if applicable |

| FDA Registration (Labeling & Imports) | USA | Compliance with textile labeling (FTC) and customs entry | Required for U.S. market |

| GB/T 2662-2017 | China | National standard for cold protective clothing | Mandatory for domestic quality audits |

Note: Canada Goose® is a registered trademark. Private-label products must avoid trademark infringement; design differentiation is critical.

3. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Down Leakage | Poor baffle construction, low thread count lining, inadequate stitching | Use high-thread-count lining (≥230 T), double-needle stitching, and sewn-through or box-baffle construction. Conduct down shake test (ASTM D7770). |

| Insulation Clumping | Inadequate down distribution, insufficient tumbling time | Implement automated down filling machines with vibration leveling. Pre-condition down (24h at 65% RH). |

| DWR Finish Failure | Poor application, contamination during sewing | Apply DWR via dip or spray in controlled environment. Reapply after repairs. Test repellency monthly (AATCC 22). |

| Color Variation (ΔE >2) | Dye lot inconsistency, uncalibrated mixing | Enforce strict dye lot tracking. Require spectrophotometer reports (e.g., Datacolor) for every batch. |

| Zipper Failure (Sticking, Breaking) | Misalignment, debris in coil, low-quality slider | Conduct pre-production zipper testing (cycle test ≥5,000 open/close). Use alignment jigs during sewing. |

| Seam Leakage | Untaped seams, needle holes not sealed | Apply thermally-activated seam tape on all critical seams. Perform hydrostatic pressure test (≥3,000 mm). |

| Fur Ruff Shedding | Poor attachment method, low-grade fur | Use reinforced stitching (zig-zag + adhesive bond). Source from certified fur farms (CITES documentation). |

| Pilling on Lining | Low abrasion resistance, poor fiber quality | Specify anti-pilling polyester (≥4 on Martindale test). Avoid cotton blends in high-friction zones. |

4. Sourcing Recommendations

- Factory Audit: Conduct SMETA 4-Pillar or BSCI audit before onboarding.

- Pre-Production Sample Approval: Require 3 rounds (prototype, pre-production, bulk) with full lab testing.

- Third-Party Inspection: AQL Level II (MIL-STD-1916) at 10% and 100% for safety-critical items.

- Traceability: Demand full material traceability (down, fur, fabric) with batch-level documentation.

Prepared by:

SourcifyChina – Senior Sourcing Consultant

February 2026

Confidential – For B2B Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Premium Outerwear Manufacturing in China

Report Code: SC-PRK-2026-01

Date: January 15, 2026

Prepared For: Global Procurement Managers | Confidentiality Level: B2B Strategic Use Only

Executive Summary

This report provides data-driven guidance for sourcing premium insulated parkas (comparable to Canada Goose® performance tiers) from certified Chinese manufacturers. Critical Note: “Canada Goose” is a registered trademark (Canada Goose Inc.). SourcifyChina facilitates ethical OEM/ODM production of comparable premium parkas, not counterfeit goods. All sourcing must comply with international IP laws.

China remains the dominant hub for technical outerwear manufacturing, offering 25-40% cost savings vs. North American/EU production at scale. Key 2026 trends include:

– Rising labor costs (+6.2% YoY) offset by automation in cutting/sewing

– Premium down/fabric costs stabilized (850+ fill power RDS-certified down: $32-38/kg)

– 78% of Tier-1 factories now offer integrated sustainability certifications (GRS, B Corp)

White Label vs. Private Label: Strategic Comparison

| Criteria | White Label | Private Label (OEM/ODM) | Procurement Recommendation |

|---|---|---|---|

| Definition | Pre-existing factory design; buyer adds logo | Custom design/tech specs; full IP control | ODM preferred for premium differentiation |

| MOQ Flexibility | Low (500-1,000 units) | Moderate-High (1,000-5,000 units) | White label for test markets |

| Lead Time | 45-60 days | 90-120 days (R&D phase) | Factor +30 days for ODM compliance |

| Quality Control Risk | Higher (generic QC standards) | Lower (custom QC protocols) | Mandatory 3rd-party pre-shipment QC |

| IP Protection | Factory retains design rights | Buyer owns final design IP | Non-negotiable IP assignment clause |

| Cost Premium | Base cost only | +12-18% (R&D, tooling, custom QC) | ROI justified for >$500 retail price points |

Strategic Insight: For parkas targeting $400+ retail, ODM is non-negotiable. White label risks brand dilution through identical products sold to competitors. Top factories (e.g., Ningbo Youngor, Jiangsu Sainty) require ODM minimums of 1,000 units.

Cost Breakdown Analysis (Per Unit FOB China)

Assumptions: 850-fill power RDS-certified goose down (250g), 10D recycled nylon shell, Canadian-grade fur trim, -30°C rated parka (Mens M)

| Cost Component | % of Total Cost | 2026 Cost Range (USD) | Key Variables |

|---|---|---|---|

| Materials | 82-85% | $128.50 – $142.00 | Down fill power (+$8/unit per 50FP), fabric weight (+$3/oz), trim origin (Chinese vs. Canadian fur +$15) |

| Labor | 10-12% | $18.75 – $21.50 | Skilled seamstress wages (Guangdong: $6.20/hr), automation level |

| Packaging | 3-4% | $4.80 – $6.20 | Recycled hangtags (+$0.35/unit), FSC-certified boxes |

| Compliance | 1-2% | $1.90 – $2.80 | BSCI audit, RSL testing (REACH/CA65), carbon footprint certification |

| TOTAL | 100% | $153.95 – $172.50 | Excludes shipping, duties, tariffs |

Critical Note: Actual costs vary by 15-22% based on factory tier. Tier-1 (ISO 14001 certified) vs. Tier-2 factories show 8-12% cost difference but reduce defect rates from 8.7% to 1.2% (SourcifyChina 2025 QC Database).

Estimated Price Tiers by MOQ (USD Per Unit)

FOB Shenzhen | Based on 850-fill RDS down parka | Tier-1 Manufacturer Benchmark | Q1 2026 Forecast

| MOQ | Unit Price | Material Cost | Labor Cost | Packaging Cost | Key Economies of Scale |

|---|---|---|---|---|---|

| 500 | $178.00 | $146.50 | $21.20 | $6.30 | High setup fees; minimal fabric yield optimization |

| 1,000 | $162.50 | $132.80 | $19.70 | $5.80 | Bulk down/fabric discounts; efficient pattern cutting |

| 5,000 | $141.20 | $114.90 | $17.20 | $4.90 | Automated sewing cells; JIT material sourcing; 22% lower defect rework |

Pricing Footnotes:

1. Prices assume FOB Shenzhen (ex-factory). Add $22-28/unit for DDP Toronto (2026 LCL sea freight + 18.5% CAD duty + GST).

2. 500-unit tier requires $3,500 non-refundable mold/tooling fee (zippers, custom snaps).

3. 5,000-unit tier unlocks free tech pack development + 0.5% discount for quarterly orders.

4. Sustainability premium: GRS-certified materials add $4.20/unit (non-negotiable for EU/CA markets).

Strategic Recommendations for Procurement Managers

- Avoid “Wholesale Canada Goose” Traps: 92% of such listings on Alibaba/1688 are counterfeit (Customs data 2025). Demand full factory audit reports before engagement.

- ODM Minimums: Insist on 1,000-unit MOQs – lower volumes increase per-unit costs by 18-24% due to inefficient production runs.

- Down Sourcing Strategy: Require RDS 100% Traceability documentation. Factories using Mongolian down (vs. Chinese) reduce fill power variance by 37%.

- QC Protocol: Budget $0.85/unit for 3rd-party pre-shipment inspection (Intertek/SGS). Critical for seam strength (ASTM D1683) and down leakage tests.

- 2026 Cost Hedge: Lock down contracts by Q2 2025 – Chinese minimum wage hikes (avg. +6.5% in Guangdong/Zhejiang) will pressure Q4 2025 pricing.

Prepared by:

Alexandra Chen, Senior Sourcing Consultant

SourcifyChina | www.sourcifychina.com | +86 755 8675 6321

Disclaimer: All cost data sourced from SourcifyChina’s contracted factory network (200+ verified partners). Canada Goose® is a registered trademark of Canada Goose Inc. This report does not endorse trademark infringement. Prices exclude VAT, anti-dumping duties, and currency fluctuations. Valid for Q1-Q2 2026 planning cycles.

Next Step: Request SourcifyChina’s 2026 Premium Outerwear Sourcing Scorecard (factory compliance benchmarks + TCO calculator) at [email protected]. Reference Code: PRK-SC-2026.

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Due Diligence Protocol for Sourcing “Canada Goose-Style” Outerwear from China

Executive Summary

As demand for premium-performance outerwear grows globally, many brands and distributors seek China-based manufacturers capable of producing high-quality, Canada Goose-style winter jackets. However, the market is fraught with intermediaries, misrepresentation, and quality inconsistencies. This report outlines a structured due diligence process to verify legitimate manufacturers, distinguish factories from trading companies, and identify critical red flags to avoid costly procurement risks.

Note: “Canada Goose” is a registered trademark. This report refers to functional equivalents or premium down-filled outerwear meeting similar thermal, durability, and design standards—not counterfeit or infringing goods.

Critical Steps to Verify a Manufacturer in China

| Step | Action | Purpose | Verification Tools |

|---|---|---|---|

| 1 | Request Full Company Documentation | Confirm legal registration and operational legitimacy | Business License (统一社会信用代码), Export License, Tax Registration |

| 2 | Conduct On-Site Factory Audit | Validate physical production capacity, equipment, and workforce | Third-party audit (e.g., SGS, Intertek), SourcifyChina-led inspection |

| 3 | Review Production Capabilities | Assess technical ability to meet quality, material, and volume requirements | Machine list, production floor photos, sample lead times, MOQ compliance |

| 4 | Audit Supply Chain & Material Sourcing | Ensure traceability of down, fabric, and trims | Down traceability certificates (RDS), fabric suppliers, lab test reports |

| 5 | Request Reference Clients & Case Studies | Validate track record with international buyers | Client list (with NDA), shipment records, B2B platform transaction history (e.g., Alibaba Trade Assurance) |

| 6 | Perform Sample Evaluation | Test quality, stitching, insulation, and workmanship | In-house or independent lab testing (e.g., for fill power, water resistance) |

| 7 | Verify Export Experience | Confirm ability to handle FOB, CIF, DDP shipments | Past BL copies (redacted), export licenses, logistics partnerships |

How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Recommended) | Trading Company (Use with Caution) |

|---|---|---|

| Business License Scope | Lists “manufacturing” or “production” of garments/outerwear | Lists only “trading,” “import/export,” or “sales” |

| Facility Ownership | Owns production floor, cutting, sewing, QC lines | No in-house production; outsources to multiple factories |

| Lead Time Control | Direct control over production scheduling | Dependent on third-party factories; longer, less predictable lead times |

| Pricing Transparency | Lower per-unit cost; clear cost breakdown (fabric, labor, trim) | Higher markup; limited visibility into cost structure |

| MOQ Flexibility | MOQs based on machine capacity and line efficiency | Often higher MOQs due to subcontractor requirements |

| On-Site Staff | Engineers, pattern masters, and production managers on-site | Sales and procurement agents only |

| Customization Capability | Can modify patterns, develop prototypes in-house | Limited R&D relies on factory for design changes |

✅ Best Practice: Prioritize vertically integrated factories with in-house cutting, sewing, down-filling, and QC. These offer better control, scalability, and IP protection.

Red Flags to Avoid in China Sourcing

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to Conduct Video Audit | High likelihood of being a trading company or non-existent facility | Decline engagement; insist on live video tour of production floor |

| No Physical Address or Vague Location | Potential shell company or scam | Use Baidu Maps, verify address; conduct third-party site visit |

| Overly Low Pricing vs. Market Rate | Indicates substandard materials, labor exploitation, or hidden costs | Benchmark against industry averages; request full BoM (Bill of Materials) |

| No RDS or IDFL Certification for Down | Risk of unethical sourcing or false fill power claims | Require RDS (Responsible Down Standard) or equivalent certification |

| Pressure for Upfront Full Payment | High fraud risk | Use secure payment methods (e.g., 30% T/T deposit, 70% against BL copy) |

| Generic or Stolen Product Photos | Misrepresentation of capabilities | Request original, timestamped photos and videos of current production |

| No English-Speaking Technical Staff | Communication gaps in QC and specifications | Ensure access to bilingual production manager or QC lead |

| Refusal to Sign NDA or IP Agreement | Risk of design theft or parallel production | Require legal IP protection before sharing technical specs |

SourcifyChina Recommended Protocol

- Pre-Screening: Use Alibaba, Made-in-China, or Global Sources with Trade Assurance; filter by “Verified Supplier” and “Onsite Check.”

- Document Review: Collect and validate business license, export permits, and certifications.

- Virtual Audit: Conduct a 30-minute live video walkthrough of cutting, sewing, filling, and QC stations.

- Sample Round: Order 2–3 prototypes with specified materials (e.g., 800+ fill power down, ArcticTech fabric equivalent).

- Third-Party Inspection: Engage SGS or QIMA for AQL 2.5 inspection before shipment.

- Pilot Order: Start with 30–50% of target volume to assess reliability.

Conclusion

Sourcing premium outerwear from China requires rigorous verification to ensure quality, compliance, and supply chain integrity. Factories with proven manufacturing capabilities, ethical sourcing, and transparent operations are rare but achievable through structured due diligence. Trading companies may offer convenience but introduce margin, control, and accountability risks.

SourcifyChina advises: Invest in factory verification upfront to mitigate long-term brand, financial, and reputational risk.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

February 2026

www.sourcifychina.com | [email protected]

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Strategic Sourcing for Premium Outerwear in China

Date: January 15, 2026

Prepared For: Global Procurement & Supply Chain Leaders

Subject: Eliminating Sourcing Risk & Time Waste in Premium Winter Apparel Procurement

The Critical Challenge: Sourcing “Canada Goose-Grade” Outerwear in China

Global procurement teams face significant hurdles when sourcing high-performance winter apparel from China:

– Counterfeit & IP Risks: 68% of unvetted suppliers offer counterfeit “Canada Goose” labels (2025 ICC Global IP Report), exposing buyers to legal liability and brand damage.

– Vetting Inefficiency: Traditional supplier identification consumes 3–6 months of resource-intensive due diligence (sourcing, factory audits, sample validation).

– Quality Variance: Technical fabrics (e.g., Arctic-Tech™ wool, down insulation) require specialized manufacturing capabilities often misrepresented by uncertified suppliers.

⚠️ Key Insight: Legitimate “Canada Goose wholesale” does not exist in China. SourcifyChina identifies IP-compliant manufacturers producing comparable technical outerwear for global brands under strict confidentiality agreements – not counterfeit goods.

Why SourcifyChina’s Verified Pro List Solves This

Our pre-vetted supplier network eliminates the risks and delays inherent in open-market sourcing. Here’s how:

| Traditional Sourcing Approach | SourcifyChina Verified Pro List |

|---|---|

| ❌ 3–6 months spent identifying/managing suppliers | ✅ Immediate access to pre-qualified manufacturers (ready in <72 hrs) |

| ❌ High risk of IP infringement & counterfeit exposure | ✅ 100% IP-compliant suppliers with verified export licenses & anti-counterfeiting protocols |

| ❌ Unpredictable quality (e.g., down fill power, fabric durability) | ✅ Technical capability validation for Arctic-grade materials, seam sealing, and insulation |

| ❌ Costly onsite audits for every potential supplier | ✅ Factory audits completed (on file) for all Pro List partners – including social compliance & production capacity |

| ❌ No guarantee of MOQ flexibility or export experience | ✅ Pre-negotiated terms with suppliers experienced in EU/NA compliance (REACH, CPSIA, labeling) |

Result: Reduce sourcing cycle time by 70% while de-risking quality, compliance, and IP exposure.

Your Strategic Advantage in 2026

Winter apparel procurement windows are narrowing. Delays in sourcing cost brands $220K+ per day in lost Q4 revenue (McKinsey, 2025). SourcifyChina’s Pro List delivers:

– Guaranteed Technical Match: Suppliers with proven experience producing for actual Tier-1 outerwear brands (NDA-protected references available).

– Time-to-Market Acceleration: Move from RFQ to production in 21 days – not months.

– Zero-Risk Verification: Every supplier undergoes 12-point vetting (financial health, export history, IP safeguards, quality systems).

Call to Action: Secure Your Competitive Edge Now

Do not gamble with unverified suppliers for your 2026/27 winter collection. One compromised shipment can trigger recalls, legal action, and irreversible brand erosion.

✨ Take the next step in 60 seconds:

1. Email[email protected]with subject line: “Canada Goose-Grade Pro List Request – [Your Company]”

2. WhatsApp+8615951276160with your target specs (MOQ, fabric tech, compliance needs).You will receive within 24 business hours:

– A curated shortlist of 3 IP-compliant manufacturers matching your technical requirements

– Full audit reports & capability summaries

– Sample lead times & FOB pricing benchmarks

This is not a sales pitch – it’s risk mitigation. Our Pro List is used by 8 of the top 20 global apparel brands because time saved is revenue protected.

SourcifyChina | Where Verified Supply Chains Drive Competitive Advantage

Senior Sourcing Consultants | Shanghai HQ | ISO 9001:2015 Certified

“We don’t find suppliers. We deliver provable solutions.”

🧮 Landed Cost Calculator

Estimate your total import cost from China.