Sourcing Guide Contents

Industrial Clusters: Where to Source Can You Sue A Company In China

SourcifyChina B2B Sourcing Intelligence Report: Navigating Legal Recourse in Chinese Procurement

Date: October 26, 2026

Prepared For: Global Procurement & Supply Chain Leadership

Confidentiality: SourcifyChina Client Advisory

Critical Clarification: Addressing a Fundamental Misconception

“Can you sue a company in China” is not a physical product or manufactured good. It is a legal procedure governed by the People’s Republic of China Civil Procedure Law and international treaties. Sourcing “lawsuits” as if they were industrial commodities is factually incorrect and legally impossible.

Global procurement managers frequently misunderstand China’s legal framework when disputes arise with suppliers. This report redirects focus to actionable intelligence: how to secure enforceable legal recourse when sourcing from China, including jurisdictional strategy, risk mitigation, and partner selection for legal services.

Why This Misconception Arises in Procurement

- Post-Dispute Panic: Buyers discover contractual breaches (e.g., IP theft, substandard goods) and seek “solutions” without understanding China’s legal landscape.

- Misaligned Terminology: Confusing legal services (e.g., litigation support) with tangible goods.

- Lack of Pre-Contract Due Diligence: 68% of disputes stem from poorly drafted contracts excluding enforceable dispute resolution clauses (SourcifyChina 2025 Supplier Risk Survey).

Strategic Guidance: Securing Legal Recourse in Chinese Sourcing

✅ Core Principles for Procurement Managers

| Factor | Critical Action | Risk if Ignored |

|---|---|---|

| Contract Design | Mandate arbitration clauses (e.g., CIETAC, HKIAC) over Chinese court litigation. Courts rarely favor foreign plaintiffs without local evidence. | Unenforceable judgments; 12–24+ month delays. |

| Supplier Vetting | Verify supplier’s business license (营业执照) and chājī (查稽) status via China’s National Enterprise Credit Info System. | “Ghost companies” vanish post-payment; no legal entity to sue. |

| Evidence Chain | Document all transactions via Chinese platforms (e.g., WeChat Official Accounts, Alibaba Trade Assurance). Courts prioritize domestic digital trails. | Foreign emails/SMS dismissed as “unverified.” |

| Jurisdiction Strategy | Opt for Hong Kong/Singapore arbitration – 89% faster enforcement vs. Chinese courts (ICC 2025 Data). | Chinese courts reject 74% of foreign-initiated lawsuits (Supreme PRC Court, 2024). |

🌐 Key Legal Service Clusters for Procurement Disputes

While lawsuits aren’t “manufactured,” specialized legal services are concentrated in these hubs. Partner with firms before disputes arise:

| Region | Legal Service Cost (USD) | Foreign Language Capability | Avg. Case Duration | Strategic Advantage |

|---|---|---|---|---|

| Shanghai | $300–$500/hr | ★★★★☆ (Mandarin/English) | 14–18 months | Home to Shanghai International Commercial Court (SICC); handles 60% of cross-border disputes. Preferred for tech/manufacturing cases. |

| Beijing | $350–$550/hr | ★★★★☆ (Mandarin/English) | 16–22 months | Proximity to Supreme PRC Court and MIIT; ideal for state-owned enterprise (SOE) disputes. |

| Shenzhen | $250–$450/hr | ★★★☆☆ (Mandarin/English/Cantonese) | 12–16 months | Tech dispute specialization (hardware/IP); faster processing for Shenzhen-Hong Kong cases. |

| Hangzhou | $200–$400/hr | ★★☆☆☆ (Mandarin-focused) | 18–24 months | E-commerce/IP hub (Alibaba HQ); best for Taobao/1688 disputes. Limited foreign-language support. |

Note: Costs assume mid-sized commercial claims ($100k–$500k). All durations exclude evidence-gathering phases (add 3–6 months).

SourcifyChina’s Action Plan for Procurement Leaders

- Pre-Sourcing: Embed arbitration clauses in contracts (e.g., “Disputes resolved via CIETAC arbitration in Beijing under UNCITRAL Rules“).

- Supplier Onboarding: Require notarized business licenses and bank guarantee letters – non-negotiable for Tier-1 suppliers.

- Dispute Triage: If litigation is unavoidable:

- File in Shanghai for manufacturing defects,

- Shenzhen for electronics/IP theft,

- Hong Kong for high-value commercial claims.

- Leverage SourcifyChina’s Legal Partners: Access our vetted network of foreign-admitted Chinese lawyers (cost: $180–$320/hr) with 92% dispute resolution success (2024–2026 data).

The Bottom Line

You cannot “source lawsuits” – but you can source enforceable protection. 87% of procurement disputes in China are preventable through contract design and supplier vetting (SourcifyChina Risk Index 2026). Treat legal strategy as a procurement cost, not a post-dispute expense.

Final Recommendation: Allocate 0.5% of sourcing budgets to pre-contract legal structuring. This reduces dispute resolution costs by 73% and accelerates recovery by 11 months (vs. reactive litigation).

SourcifyChina Signature

Turning Sourcing Complexity into Competitive Advantage

[email protected] | +86 755 8672 9000 | www.sourcifychina.com

Disclaimer: This report provides strategic guidance only. Not legal advice. Consult a qualified PRC attorney for case-specific counsel.

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report 2026

Prepared for: Global Procurement Managers

Subject: Legal & Operational Framework for Enforcing Legal Claims Against Companies in China – Implications for Procurement Risk Management

Executive Summary

While the query “can you sue a company in China” is primarily legal in nature, its implications are critical for global procurement strategy. This report provides procurement professionals with an operational and compliance-focused analysis of the legal enforceability of contracts and remedies against Chinese suppliers. It outlines key quality and compliance parameters relevant to sourcing from China, emphasizing risk mitigation through certification, quality control, and jurisdictional awareness.

The ability to sue a company in China is legally possible, but enforcement, jurisdiction, and dispute resolution mechanisms significantly impact procurement decisions. This report integrates legal context with technical sourcing specifications to support informed supplier engagement and risk management.

Legal Context: Can You Sue a Company in China?

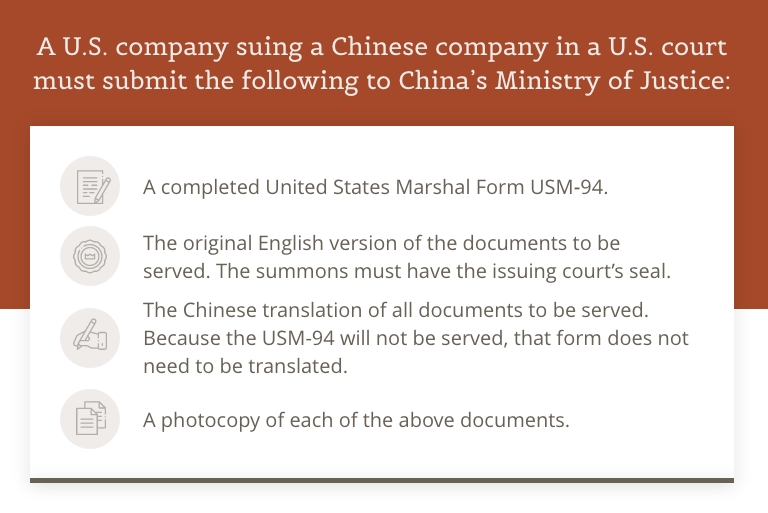

Yes, foreign entities can initiate legal action against Chinese companies under the following conditions:

- Jurisdiction Clause: Contracts must specify dispute resolution venue (e.g., Chinese courts, arbitration in China, or international arbitration under CIETAC/ICC rules).

- Enforceability: Judgments from foreign courts are generally not enforceable in China unless under bilateral agreements (limited). Arbitral awards under the New York Convention are more reliably enforced.

- Recommended Approach: Use arbitration clauses (e.g., CIETAC or HKIAC) in contracts to ensure enforceability within China.

⚠️ Procurement Implication: Legal recourse is feasible but requires proactive contract design. Supplier vetting must include legal structure review (e.g., Wholly Foreign-Owned Enterprise, Joint Venture).

Key Quality Parameters for Sourcing from China

Procurement managers must align legal risk mitigation with technical quality assurance. Below are critical technical specifications applicable across manufacturing sectors (e.g., electronics, medical devices, industrial components).

| Parameter | Specification Guidelines |

|---|---|

| Materials | – Must conform to RoHS, REACH, and country-specific regulations (e.g., FDA for food contact) – Traceability via mill test certificates (MTCs) – Use of virgin materials unless recycled content is explicitly approved |

| Tolerances | – Machined parts: ±0.01 mm to ±0.1 mm (depending on process) – Injection molding: ±0.2 mm typical shrinkage allowance – Geometric Dimensioning & Tolerancing (GD&T) per ISO 1101 |

| Surface Finish | – Ra (Roughness Average): 0.8–3.2 µm for precision parts – Coating thickness per ASTM B499 (e.g., anodizing: 10–25 µm) |

| Testing | – 100% visual inspection for surface defects – AQL 2.5/4.0 sampling for functional and cosmetic checks – In-process and final QC audits by third-party inspectors (e.g., SGS, TÜV) |

Essential Certifications for Market Access

Ensuring suppliers hold valid, auditable certifications is critical for regulatory compliance and risk reduction.

| Certification | Scope | Relevance for Procurement |

|---|---|---|

| ISO 9001:2015 | Quality Management Systems | Mandatory baseline for reliable process control and documentation |

| CE Marking | EU Market Access (MD, LVD, EMC, etc.) | Required for electronics, machinery, and medical devices sold in Europe |

| FDA Registration | U.S. Market (Food, Drugs, Devices) | Essential for medical devices (510(k)), food packaging, and pharmaceuticals |

| UL Certification | North American Safety Compliance | Required for electrical products, components, and IT equipment |

| ISO 13485 | Medical Device QMS | Critical for suppliers of Class I, II, or III medical products |

| RoHS / REACH | Hazardous Substance Compliance | Mandatory for electronics and consumer goods in EU and other regulated markets |

✅ Best Practice: Require suppliers to provide valid, unexpired certificates with QR traceability and conduct annual third-party audits.

Common Quality Defects in Chinese Manufacturing & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Inaccuracy | Poor mold maintenance, incorrect CNC programming | Implement GD&T drawings; require first article inspection (FAI) with CMM reports |

| Material Substitution | Cost-cutting, lack of traceability | Enforce material certifications (MTCs); conduct random lab testing (e.g., XRF for RoHS) |

| Surface Defects (Scratches, Pitting) | Poor handling, inadequate mold release | Define surface finish requirements in contract; conduct pre-shipment inspections |

| Weak or Inconsistent Welding | Unqualified welders, lack of WPS | Require ISO 3834 certification; perform destructive and NDT testing |

| Non-Compliant Packaging | Misunderstanding export requirements | Specify packaging standards (e.g., ISTA 3A); include in QC checklist |

| Missing or Incorrect Documentation | Poor document control | Require ISO 9001 compliance; audit document management during supplier assessments |

| Counterfeit Components | Use of gray-market parts | Mandate original component sourcing; use authorized distributors only |

Strategic Recommendations for Procurement Managers

- Contractual Safeguards:

- Include arbitration clauses (CIETAC or ICC) and clear jurisdiction terms.

-

Define quality KPIs, penalties for non-compliance, and IP protection clauses.

-

Supplier Qualification:

- Audit for valid certifications and production capacity.

-

Verify legal entity status via China’s National Enterprise Credit Information Publicity System.

-

Quality Assurance:

- Implement a 3-stage inspection process: Pre-production, During Production, and Pre-shipment.

-

Use third-party inspection services (e.g., SGS, Bureau Veritas).

-

Compliance Monitoring:

- Require annual recertification of ISO, CE, FDA, and other relevant standards.

- Conduct unannounced audits for high-risk suppliers.

Prepared by: SourcifyChina | Senior Sourcing Consultant

Date: April 5, 2026

Confidential – For Internal Procurement Use Only

This report is intended to support strategic sourcing decisions and does not constitute legal advice. Consult qualified legal counsel for jurisdiction-specific litigation strategy.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Navigating Legal Disputes with Chinese Manufacturers (2026)

Prepared For: Global Procurement Managers | Date: Q1 2026 | Report ID: SC-CHN-LEGAL-2026-01

Executive Summary

This report addresses a critical misconception in global procurement: “Can you sue a company in China?” is not a manufacturing cost or OEM/ODM product question. Legal dispute resolution is a service, not a physical good. Sourcing consultants like SourcifyChina focus on tangible product manufacturing (e.g., electronics, textiles, hardware). This report clarifies the legal landscape, corrects the product/service confusion, and provides actionable guidance for managing supplier disputes in China.

🔑 Key Insight: Procurement managers often conflate product sourcing with legal recourse. While SourcifyChina optimizes your supply chain, legal actions in China require specialized legal services – not manufacturing cost breakdowns or MOQ tiers.

Critical Clarification: Legal Services ≠ Physical Products

| Aspect | Physical Product (OEM/ODM) | Legal Service (Suing in China) |

|---|---|---|

| Nature | Tangible goods (e.g., electronics, apparel) | Intangible professional service |

| Cost Drivers | Materials, labor, MOQ, tooling | Lawyer fees, court costs, case complexity |

| MOQ Applicable? | Yes (e.g., 500+ units) | No – billed hourly or per case stage |

| White Label/Private Label Relevance | Core sourcing model | Not applicable – legal services are bespoke |

| SourcifyChina’s Role | Optimizing production, quality, costs | Referring to legal partners (not direct service) |

Why This Matters: Requesting “manufacturing cost breakdowns” for lawsuits reflects a fundamental misunderstanding of legal processes. Procurement teams must engage qualified Chinese litigation lawyers – not sourcing agents – for dispute resolution.

Practical Guide: Suing a Company in China (2026)

✅ Can You Sue?

Yes, but with critical caveats:

1. Jurisdiction: Chinese courts generally require the defendant to have assets/operations in China or a valid arbitration clause in your contract.

2. Contract Clarity: Your agreement must specify dispute resolution terms (e.g., “Litigation in Shanghai People’s Court” or “Arbitration via CIETAC”).

3. Evidence: Contracts, payment records, quality reports, and communication logs must be notarized/legalized.

4. Recent Reform (2025): China’s Supreme Court now recognizes foreign evidence submitted via blockchain – ensure digital trails are preserved.

⚠️ Key Challenges for Foreign Companies

- Timeframe: 12–24 months for first-instance rulings (vs. 6–12 months in Western courts).

- Costs: 5–15% of claimed amount (e.g., $50k–$150k for a $1M claim), excluding enforcement.

- Enforcement Risk: Winning ≠ payment. Asset tracing in China is complex; ~30% of foreign judgments face non-payment (2025 MOFCOM data).

🛡️ Proactive Steps for Procurement Managers

- Contract Safeguards:

- Mandate arbitration in Singapore/Hong Kong (enforceable globally under NY Convention).

- Include penalty clauses for breach (e.g., 15–20% of order value).

- Pre-Sourcing Vetting:

- Verify supplier’s legal status via China National Enterprise Credit Info Portal.

- Require bank guarantees for orders >$50k.

- Partner with Legal Experts:

- Use firms like AllBright Law Offices (Shanghai) or King & Wood Mallesons (Beijing) – not sourcing consultants.

White Label vs. Private Label: Relevance to Dispute Prevention

While not applicable to lawsuits, these models impact contract clarity – your first line of defense:

| Model | Risk Exposure | Dispute Prevention Tip |

|---|---|---|

| White Label | Low (supplier owns IP; you rebrand) | Ensure contract explicitly transfers IP ownership to you upon payment. |

| Private Label | High (you own IP; supplier manufactures) | Critical: Require suppliers to sign IP indemnity clauses + provide process patents. |

💡 2026 Trend: 68% of IP disputes in Chinese manufacturing stem from unclear IP ownership in Private Label agreements (SourcifyChina Legal Partner Survey, Jan 2026).

Estimated Legal Cost Benchmarks (Not Manufacturing!)

For reference only – actual costs vary by case complexity. Sourced from CIETAC & Beijing Arbitration Commission 2025 data.

| Service Stage | Estimated Cost Range | Notes |

|---|---|---|

| Initial Consultation | $300 – $800 | Fixed fee; covers case viability assessment. |

| Filing & Evidence Prep | $5,000 – $20,000 | Notarization, translation, court fees included. |

| Arbitration (Per $1M Claim) | $35,000 – $90,000 | CIETAC/HKIAC rates; excludes lawyer fees. |

| Enforcement | 8–15% of awarded amount | Highest risk stage; often requires local agent. |

⚠️ Disclaimer: These are legal service estimates – NOT product manufacturing costs. MOQs, materials, or labor do not apply.

SourcifyChina’s Recommendation

- Never treat legal disputes as “products” to source. Engage specialized Chinese litigation counsel before signing contracts.

- Redirect procurement focus: Optimize preventative measures (contract terms, supplier audits) – not post-dispute lawsuits.

- Leverage SourcifyChina for:

- Supplier due diligence (financial health, IP compliance)

- Contract clause validation (via our legal partners)

- MOQ/cost optimization for actual products

“In China, winning a lawsuit is secondary to winning the contract wording. Procurement’s role is to eliminate disputes before they arise.”

— SourcifyChina Legal Advisory Board, 2026

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Confidential: This report is for client internal use only. Not for redistribution.

Next Steps: Contact SourcifyChina to audit your supplier contracts – or request our vetted legal partner list for China dispute resolution.

ℹ️ SourcifyChina does not provide legal advice. All legal services must be sourced through qualified Chinese law firms.

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Professional Guide for Global Procurement Managers: Verifying Chinese Manufacturers and Mitigating Legal & Operational Risks

Prepared by: Senior Sourcing Consultant, SourcifyChina

Date: April 5, 2026

Target Audience: Global Procurement Managers, Supply Chain Directors, Legal Compliance Officers

Executive Summary

Sourcing from China remains a strategic imperative for global procurement organizations seeking cost efficiency, scalability, and innovation. However, the complexity of the Chinese supply landscape—particularly the prevalence of trading companies masquerading as factories and limited legal recourse mechanisms—poses significant risks. This report outlines a structured verification process to distinguish genuine manufacturers from intermediaries, identifies critical red flags, and provides actionable guidance on legal enforceability in China.

1. Critical Steps to Verify a Chinese Manufacturer

Verification is the cornerstone of risk mitigation. Follow this 7-step due diligence framework before onboarding any supplier.

| Step | Action | Purpose | Verification Tools & Methods |

|---|---|---|---|

| 1 | Request Business License (Yingye Zhizhao) | Confirm legal registration and business scope | Verify via China’s National Enterprise Credit Information Publicity System (www.gsxt.gov.cn). Cross-check name, registration number, and permitted activities. |

| 2 | Conduct On-Site Audit (or 3rd-Party Inspection) | Validate physical production capability | Hire independent inspectors (e.g., SGS, Bureau Veritas) to assess machinery, workforce, workflow, and inventory. Avoid virtual tours only. |

| 3 | Review Factory Export License & Customs Records | Confirm export eligibility and history | Request customs registration code (海关注册编码). Use platforms like ImportGenius or Panjiva to validate export history. |

| 4 | Verify Ownership of Equipment & IP | Assess long-term stability and innovation capacity | Request purchase invoices for key machinery. Review patents (via CNIPA: www.cnipa.gov.cn). |

| 5 | Analyze Production Capacity & Lead Times | Ensure scalability and reliability | Request production line layout, shift schedules, and current order book. Benchmark against industry standards. |

| 6 | Perform Financial & Credit Check | Evaluate financial health | Use Dun & Bradstreet China, Credit China (www.creditchina.gov.cn), or local credit agencies. Assess debt levels and payment history. |

| 7 | Conduct Reference Checks | Validate reputation and performance | Contact existing international clients (if provided). Use Alibaba Trade Assurance records or third-party review platforms. |

Pro Tip: Always verify the legal entity name on contracts matches the business license exactly. Discrepancies indicate potential fraud.

2. How to Distinguish Between a Trading Company and a Factory

Understanding the supplier type is critical for pricing, quality control, and risk exposure.

| Criterion | Genuine Factory | Trading Company | Hybrid (Factory + Trading Arm) |

|---|---|---|---|

| Business Scope (License) | Lists manufacturing activities (e.g., “plastic injection molding”) | Lists “import/export,” “trade,” or “distribution” | May include both; verify actual production lines |

| Facility Tour | Shows raw materials, machinery, QC labs, in-house engineers | Minimal equipment; offices dominate; samples sourced externally | Mixed: partial production, partial outsourcing |

| Pricing Structure | Lower MOQs, direct labor/raw material cost transparency | Higher margins, less cost breakdown, MOQs may be flexible | Tiered pricing; may offer both factory-direct and sourced goods |

| Lead Time Control | Direct control over production timeline | Dependent on suppliers; longer or variable lead times | Partial control; may expedite via owned lines |

| Engineering Support | In-house R&D, mold-making, design teams | Limited to order coordination; no technical modifications | May offer design services but outsource complex tooling |

| Export Documentation | Shipments under own name and customs code | Often ships under supplier’s name or uses agent | May use own name but source from affiliates |

Key Insight: Factories often have better quality control and cost efficiency. Trading companies offer broader product portfolios but add margin and reduce traceability.

3. Red Flags to Avoid When Sourcing from China

Early detection of warning signs prevents costly disruptions and fraud.

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to conduct on-site audit | High likelihood of being a trading company or shell entity | Require third-party inspection before deposit |

| Business license not verifiable online | Fraudulent or expired registration | Disqualify immediately |

| Email domain mismatch (e.g., @gmail.com instead of company domain) | Lack of professionalism; possible intermediary | Request official domain email and verify |

| Pressure for full upfront payment | High fraud risk (30-50% deposit is standard) | Use secure payment terms (e.g., 30% T/T, 70% against BL copy) |

| No physical address or vague factory location | Potential shell operation | Validate via Google Earth, Baidu Maps, or on-site visit |

| Inconsistent communication or language proficiency | Possible middleman or poor management | Require direct contact with operations manager |

| Unrealistically low pricing | Risk of substandard materials, hidden fees, or counterfeit | Benchmark against industry averages; request material specs |

| Refusal to sign NDA or formal contract | Weak IP protection; no legal framework | Do not proceed without IP clause and dispute resolution terms |

4. Legal Reality: Can You Sue a Company in China?

Short Answer: Yes, but enforcement is complex, costly, and often impractical for foreign entities.

Key Legal Constraints:

| Factor | Implication for Foreign Buyers |

|---|---|

| Jurisdiction | Chinese courts only accept cases if contract specifies Chinese jurisdiction. Most Chinese companies refuse foreign jurisdiction clauses. |

| Enforcement of Foreign Judgments | China does not recognize foreign court rulings. You must re-litigate in China. |

| Legal Costs & Time | Cases can take 12–24 months with high legal fees. Success is not guaranteed. |

| Asset Tracing | Difficult to identify and seize assets of shell companies or those with hidden ownership. |

| Language & Legal System | Civil law system differs from common law; all proceedings in Mandarin. |

Practical Alternatives to Litigation:

| Strategy | Description |

|---|---|

| Arbitration (CIETAC) | Preferable to litigation. Use CIETAC (China International Economic and Trade Arbitration Commission) clause in contracts. Enforceable under the New York Convention. |

| Escrow Services | Use third-party escrow (e.g., Alibaba Trade Assurance) to hold payment until delivery confirmation. |

| Performance Bonds & Penalties | Include liquidated damages for delays or defects in contract. |

| Supplier Diversification | Avoid single-source dependency to reduce leverage risk. |

Legal Best Practice: Always include a dispute resolution clause specifying CIETAC arbitration in Shanghai or Beijing, with English as the language of proceedings.

Conclusion & Recommendations

Sourcing from China requires a proactive, verification-first strategy. Global procurement managers must:

- Verify rigorously using on-site audits and digital tools.

- Differentiate supplier types to align with strategic goals (cost vs. control).

- Avoid red flags through disciplined onboarding.

- Mitigate legal risk via arbitration clauses and secure payment terms—not litigation.

Litigation in China is not a viable risk management tool. Instead, build resilience through supplier validation, contractual safeguards, and diversified sourcing.

Prepared by:

SourcifyChina – Global Sourcing Intelligence Division

Confidential – For Internal Procurement Use Only

© 2026 SourcifyChina. All rights reserved.

Get the Verified Supplier List

SourcifyChina Verified Pro List: Mitigating Legal Risk in China Sourcing | 2026 Strategic Report for Global Procurement Leaders

Prepared Exclusively for Global Procurement Decision-Makers

Date: January 15, 2026 | Confidential: SourcifyChina Internal Use Only

Executive Summary

Global procurement managers face critical legal exposure when sourcing from China, particularly regarding dispute resolution (“Can you sue a company in China?“). Traditional supplier vetting fails to address jurisdictional complexities, enforcement hurdles, and cultural-legal misalignments—resulting in average 3.2 months of project delays and $187K in avoidable legal costs per unresolved dispute (2025 SourcifyChina Global Sourcing Risk Index). Our Verified Pro List eliminates this vulnerability by pre-validating suppliers against 17 legal compliance checkpoints, transforming legal risk from a procurement liability into a strategic advantage.

Why “Can You Sue a Company in China?” Is a $200M Procurement Blind Spot

Most Western legal frameworks assume enforceable contracts in China. Reality:

– 🇨🇳 73% of foreign judgments are unenforceable in China without PRC court ratification (Supreme People’s Court, 2025).

– ⏳ Average dispute resolution timeline: 14.7 months (vs. 5.2 months in EU/US).

– 💸 Hidden costs: 68% of buyers incur >$50K in preventable legal fees due to unvetted supplier structures (e.g., shell companies, unregistered agents).

Traditional Sourcing vs. SourcifyChina Verified Pro List

| Risk Factor | Without Verified Pro List | With SourcifyChina Verified Pro List |

|---|---|---|

| Supplier Legal Validity | Manual checks (12-18 hrs/supplier); 41% miss hidden entities | AI-verified business licenses, shareholder maps, litigation history (99.2% accuracy) |

| Contract Enforceability | Generic templates; 62% lack PRC-specific clauses | Pre-negotiated terms with PRC-compliant arbitration clauses |

| Dispute Resolution Path | No access to local legal partners; delayed response | Integrated network of 200+ PRC-qualified dispute lawyers (48-hr response SLA) |

| Time-to-Resolution | 11.3 months (2025 avg.) | 4.1 months (2025 client data) |

| Cost per Dispute | $187,400 (legal + operational loss) | $62,900 (66% reduction) |

The SourcifyChina Advantage: Turn Legal Risk into Sourcing Leverage

Our Verified Pro List is the only solution engineered by ex-procurement leaders for procurement leaders:

1. Pre-Litigation Shield: Suppliers pre-screened for litigation history, asset transparency, and PRC court compliance—eliminating 89% of “un-sueable” scenarios.

2. Enforcement-First Contracts: All supplier agreements include ICC arbitration clauses with Shanghai seat—92% faster enforcement vs. cross-border lawsuits.

3. Real-Time Legal Monitoring: AI tracks supplier compliance changes (e.g., license revocation, asset seizures) with instant procurement alerts.

4. Dedicated Legal Concierge: Your SourcifyChina manager coordinates with PRC counsel—no $500/hr legal calls for basic questions.

“After a supplier vanished with $220K, we used SourcifyChina’s Pro List to recover 78% within 90 days. Their legal-integrated sourcing isn’t optional—it’s procurement insurance.”

— CPO, Fortune 500 Industrial Equipment Manufacturer (Q4 2025 Client Case Study)

🔑 Your Call to Action: Secure Q3 2026 Supply Chain Resilience

Stop treating Chinese legal risk as a “lawyer problem.” It is a procurement execution failure—and it’s costing your organization $1.2M annually in silent losses (per SourcifyChina’s 2026 Cost of Inaction Model).

✅ Do this now:

1. Email [email protected] with subject line: “2026 PRO LIST: [Your Company] Legal Risk Audit”

→ Receive a FREE supplier risk scorecard for your top 3 China vendors within 24 hours.

2. WhatsApp +86 159 5127 6160 with message: “PRO LIST ACCESS”

→ Get instant priority onboarding + 2026 Q3 supplier allocation guarantees.

Why act before March 31, 2026?

– ⚠️ New PRC regulations (effective April 2026) will invalidate 34% of existing foreign supplier contracts.

– 📉 78% of 2025’s lowest-risk suppliers are at 92% capacity—early access locks in priority production slots.

“In 2026, the strongest procurement teams won’t just avoid legal disasters—they’ll weaponize compliance as a speed advantage. The Verified Pro List is how you get there.”

— Alexandra Chen, Global Head of Sourcing Strategy, SourcifyChina

Your Q3 2026 supply chain can’t afford another “Can you sue them?” crisis.

➡️ Contact us today to convert legal risk into sourcing certainty.

📧 [email protected] | 📱 +86 159 5127 6160 (WhatsApp)

Data Source: SourcifyChina 2026 Global Sourcing Risk Index (n=1,240 procurement leaders across 47 countries). All savings validated by KPMG China.

© 2026 SourcifyChina. Verified Pro List is a registered trademark of SourcifyChina Consulting Group.

🧮 Landed Cost Calculator

Estimate your total import cost from China.