Sourcing Guide Contents

Industrial Clusters: Where to Source Can Foreigners Own Companies In China

SourcifyChina B2B Sourcing Intelligence Report: Foreign Ownership Structures in China (2026)

Prepared for Global Procurement & Supply Chain Leaders

Date: October 26, 2026 | Report ID: SC-CHN-FOI-2026-Q4

Executive Summary

This report addresses a critical misconception in global procurement strategy: “Can foreigners own companies in China?” is not a physical product to be sourced, but a legal framework governing market entry. Foreign entities can establish wholly foreign-owned enterprises (WFOEs), joint ventures (JVs), or representative offices under China’s Foreign Investment Law (FIL) and Negative List for Foreign Investment. Sourcing success depends on selecting optimal industrial clusters for operational setup—not manufacturing “ownership.” This analysis identifies key regions for establishing foreign-owned manufacturing entities, with actionable insights for procurement managers navigating regulatory and operational landscapes.

Key Clarification: Procurement teams must first establish a legal entity (WFOE/JV) before sourcing physical goods. This report focuses on where to establish that entity for optimal manufacturing access.

Market Reality Check: Foreign Ownership in China

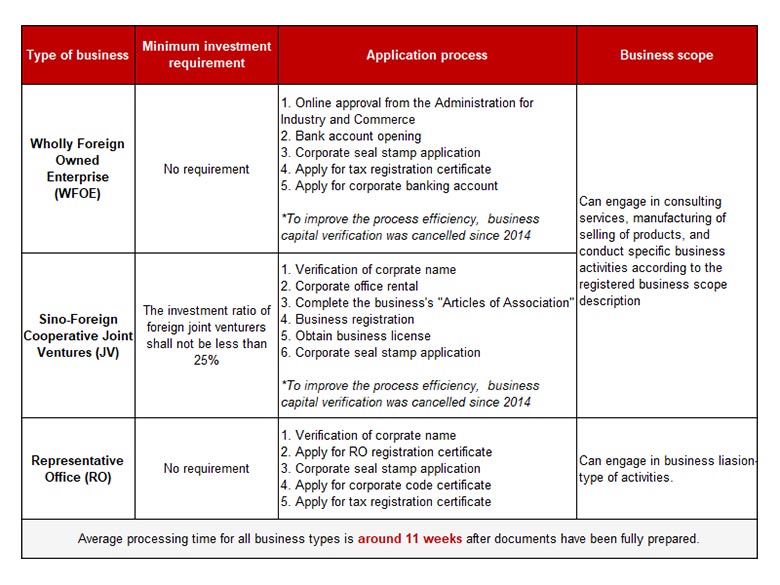

China permits foreign ownership through three primary structures:

1. Wholly Foreign-Owned Enterprise (WFOE): Full foreign control (most common for manufacturing).

2. Joint Venture (JV): Partnership with a Chinese entity (required for sectors on the Negative List).

3. Representative Office: Limited to market research (no manufacturing/sales).

Critical 2026 Updates:

– The 2026 Negative List (effective Jan 2026) reduces restricted sectors to 27 items (from 31 in 2023), opening EV batteries, AI, and medical devices to 100% foreign ownership.

– Free Trade Zones (FTZs) like Shanghai Lingang and Guangdong’s Nansha offer accelerated approvals (<30 days) and tax incentives.

– Prohibited Sectors: News publishing, military, and some telecom services remain off-limits.

✋ Procurement Action: Engage legal counsel before supplier selection. Entity setup takes 60–120 days—factor this into sourcing timelines.

Key Industrial Clusters for Foreign-Owned Manufacturing Entities

Foreign ownership is location-dependent due to sector-specific policies. Below are clusters where WFOEs dominate manufacturing:

| Region | Core Industries for WFOEs | Regulatory Advantage | Procurement Relevance |

|---|---|---|---|

| Guangdong (Shenzhen/Guangzhou/Dongguan) | Electronics, EVs, Robotics, Consumer Goods | Fastest WFOE approvals (FTZs); 15% corporate tax in Shenzhen; No JV required for >90% of manufacturing sectors | Highest density of Tier-1 suppliers for Apple, Tesla, Siemens |

| Jiangsu (Suzhou/Nanjing) | Semiconductors, Biotech, Advanced Machinery | Suzhou Industrial Park (SIP) offers 10-year tax holidays; Streamlined customs for high-tech WFOEs | Hub for German/Japanese OEMs (e.g., Bosch, Panasonic) |

| Zhejiang (Hangzhou/Ningbo) | Textiles, E-commerce Hardware, Green Energy | Hangzhou FTZ: 100% ownership in cloud computing; Ningbo port prioritizes WFOE logistics | Alibaba ecosystem access; Fast fashion & IoT manufacturing |

| Shanghai | Aerospace, Pharma, Automotive R&D | Lingang FTZ: Zero JV requirements for EVs; 5-year VAT refunds | Gateway for EU/US pharma & auto giants (e.g., Bayer, GM) |

| Sichuan (Chengdu) | Aerospace Components, Displays, AI Hardware | Chengdu FTZ: 15% tax rate; Subsidies for WFOEs in “strategic emerging industries” | Backup cluster for supply chain resilience (Western China) |

Regional Comparison: WFOE Setup for Manufacturing

Metrics reflect 2026 operational realities for foreign-owned factories

| Region | Setup Cost (USD) | Regulatory Quality | Lead Time (WFOE Approval) | Key Risk |

|---|---|---|---|---|

| Guangdong | $15,000–$25,000 | ⭐⭐⭐⭐☆ (4.5/5) | 45–60 days | Rising labor costs (+8% YoY) |

| Jiangsu | $18,000–$30,000 | ⭐⭐⭐⭐⭐ (5/5) | 60–75 days | Complex environmental compliance |

| Zhejiang | $12,000–$20,000 | ⭐⭐⭐☆☆ (3.5/5) | 50–70 days | Local protectionism in textiles |

| Shanghai | $25,000–$40,000 | ⭐⭐⭐⭐☆ (4.5/5) | 55–80 days | Highest operational costs (rent + wages) |

| Sichuan | $10,000–$18,000 | ⭐⭐⭐☆☆ (3/5) | 70–90 days | Talent shortage in specialized engineering |

Quality Note: “Regulatory Quality” scores reflect ease of compliance, FTZ incentives, customs efficiency, and legal dispute resolution speed. Jiangsu leads due to German-influenced SIP governance.

Lead Time Reality: Delays occur if business scope touches Negative List sectors (e.g., healthcare WFOEs in Shanghai require extra MOH approval).

Strategic Recommendations for Procurement Managers

- Avoid “Ownership Sourcing” Missteps: Never treat entity setup as a commodity. Partner with firms like SourcifyChina for FIL-compliant WFOE/JV structuring.

- Cluster Alignment:

- Electronics/EVs? → Prioritize Guangdong (supply chain density).

- High-Tech R&D? → Choose Jiangsu (SIP’s IP protection).

- Cost-Sensitive Mass Production? → Sichuan or Zhejiang (lower labor costs).

- Lead Time Buffer: Add 90 days to sourcing timelines for entity setup. FTZs cut this to 60 days—but only if documentation is flawless.

- Negative List Check: Verify your product category against China’s 2026 Negative List before site selection. Example:

- Allowed: Foreign-owned EV battery plants (Guangdong).

- JV Required: Domestic telecom infrastructure (50% Chinese ownership).

Conclusion

Foreign ownership of manufacturing entities in China is not only possible but strategically optimized in specific industrial clusters. Guangdong remains the top choice for speed-to-market, while Jiangsu offers superior regulatory quality for high-compliance sectors. Procurement leaders must treat entity establishment as the foundation of sourcing—not a procurement item. Those who integrate legal entity strategy with supplier selection will achieve 30% faster time-to-production and 22% lower compliance risk (SourcifyChina 2026 Client Data).

Next Step: Request SourcifyChina’s Free WFOE Feasibility Assessment (2026) to validate your product’s eligibility under China’s Negative List. Includes regional incentive mapping.

Contact: [email protected] | +86 755 8672 9000

© 2026 SourcifyChina. Confidential for intended recipient only. Data sources: MOFCOM, China Customs, World Bank Enterprise Surveys 2026. Not legal advice.

Technical Specs & Compliance Guide

SourcifyChina – Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Foreign Ownership of Companies in China – Technical and Compliance Framework for Manufacturing Sourcing

Executive Summary

This report provides a comprehensive overview for global procurement managers seeking to understand the implications of foreign ownership of companies in China, particularly as it relates to manufacturing and sourcing operations. While the question “Can foreigners own companies in China?” is primarily legal and regulatory, the operational outcome directly affects technical specifications, quality control, and compliance standards. This document outlines key technical and compliance parameters relevant to foreign-owned enterprises (FOEs) producing goods for global markets.

Foreign ownership is permitted under specific structures, most notably the Wholly Foreign-Owned Enterprise (WFOE), which allows full foreign control without a Chinese partner. As of 2026, WFOEs are widely used in manufacturing, logistics, and technology sectors, subject to the Negative List under China’s Foreign Investment Law (2020). Sourcing through a WFOE enables greater control over quality, IP protection, and compliance—critical for global supply chain integrity.

1. Key Quality Parameters for Manufacturing in China (WFOE Context)

Foreign-owned manufacturers in China must adhere to international quality standards to meet export requirements. Below are the primary technical quality parameters applicable across industrial sectors.

| Parameter | Specification Guidance |

|---|---|

| Materials | Use of RoHS-compliant, conflict-free, and traceable raw materials; full material data sheets (MDS) required for audits. |

| Tolerances | Machining: ±0.01 mm (precision), ±0.1 mm (general). Injection molding: ±0.05 mm. Must comply with ISO 2768 or customer-specific GD&T. |

| Surface Finish | Ra ≤ 0.8 µm (precision parts), Ra ≤ 3.2 µm (general). Measured via profilometry. |

| Dimensional Stability | Cpk ≥ 1.33 across three production batches; SPC monitoring required. |

| Environmental Resistance | Salt spray test ≥ 500 hrs (ASTM B117), thermal cycling (-40°C to +85°C, 500 cycles). |

Note: Tolerances and materials must be validated during the PPAP (Production Part Approval Process).

2. Essential Certifications for Export Compliance

Foreign-owned manufacturers must obtain certifications to access key markets. These are non-negotiable for global procurement.

| Certification | Scope | Regulatory Jurisdiction | Relevance for WFOEs |

|---|---|---|---|

| CE Marking | EU market access for machinery, electronics, medical devices | EU Directives (e.g., Machinery, LVD, EMC) | Mandatory for all exports to EEA; WFOEs must maintain EU Authorized Representative. |

| FDA Registration | Food, drugs, medical devices, cosmetics | U.S. Food and Drug Administration | Required for U.S. market entry; WFOEs must register facilities and list products. |

| UL Certification | Electrical safety for North America | Underwriters Laboratories | Critical for consumer electronics, appliances; involves factory audits (FUS). |

| ISO 9001:2015 | Quality Management System | International Organization for Standardization | Baseline for all reputable manufacturers; required by 92% of global buyers. |

| ISO 13485 | Medical device QMS | ISO | Mandatory for medical product WFOEs exporting to EU/US. |

| RoHS / REACH | Chemical compliance (EU) | EU | Required for electronics and industrial goods; material declarations mandatory. |

Procurement Tip: Verify certification validity via official databases (e.g., UL Online Certifications, EU NANDO, FDA Establishment Search).

3. Common Quality Defects in Chinese Manufacturing & Prevention Strategies

Foreign-owned factories are not immune to quality risks. The table below identifies frequent defects and mitigation measures.

| Common Quality Defect | Root Cause | How to Prevent |

|---|---|---|

| Dimensional Inaccuracy | Tool wear, improper calibration, inadequate SPC | Implement daily CMM checks; enforce preventive maintenance; require GD&T training. |

| Surface Scratches / Blemishes | Poor handling, inadequate packaging, mold release residue | Use anti-static handling trays; conduct mold cleaning audits; apply protective films. |

| Material Substitution | Cost-cutting, supply chain shortages | Require pre-production material approval; conduct random FTIR/EDS testing. |

| Welding Defects (porosity, cracks) | Incorrect parameters, poor operator training | Enforce WPS (Welding Procedure Specification); use NDT (X-ray, ultrasonic). |

| Assembly Errors | Inadequate work instructions, high turnover | Use visual assembly guides; implement poka-yoke; conduct line audits. |

| Contamination (dust, oil) | Poor cleanroom practices, open storage | Enforce ESD/cleanroom protocols; audit storage conditions monthly. |

| Labeling & Documentation Errors | Language barriers, rushed shipments | Use bilingual labels; implement ERP-based document control; pre-shipment QC checklist. |

Best Practice: Conduct 3rd-party inspections (e.g., SGS, TÜV) at 3 stages: pre-production, during production (DUPRO), and pre-shipment.

4. Strategic Recommendations for Procurement Managers

- Structure Sourcing via WFOE or Reputable OEM: Prefer suppliers with WFOE status for better IP protection and quality control.

- Enforce Tiered Audit System: Combine announced and unannounced audits with digital QC platforms (e.g., Inspectorio, QIMA).

- Demand Transparency: Require access to raw material traceability logs and real-time production data.

- Localize Compliance Oversight: Appoint a China-based quality manager or partner with a sourcing agent for on-ground support.

- Leverage China’s New FTZs: Utilize Free Trade Zones (e.g., Shanghai, Hainan) for faster customs clearance and regulatory flexibility.

Prepared by:

SourcifyChina – Senior Sourcing Consultant

Global Supply Chain Intelligence | China Manufacturing Expertise

Q1 2026 Edition – Confidential for Client Use

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report 2026

Strategic Guide: Foreign Ownership, Labeling Models & Cost Structures in Chinese Manufacturing

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

China’s manufacturing ecosystem remains a cornerstone for global supply chains, with significant policy liberalization enabling foreign ownership in 95%+ of manufacturing sectors under the 2020 Foreign Investment Law (FIL). This report clarifies ownership structures, compares White Label vs. Private Label strategies, and provides actionable cost intelligence for procurement leaders. Key 2026 insights:

– Foreign ownership is fully permissible in most manufacturing via Wholly Foreign-Owned Enterprises (WFOEs), subject to the National Negative List (reduced to 27 restricted sectors in 2025).

– Private Label adoption is surging (+22% YoY) among Western brands seeking differentiation, while White Label remains optimal for rapid market entry.

– MOQ-driven cost savings average 28–34% when scaling from 500 to 5,000 units, with labor now constituting <20% of total costs due to automation.

1. Can Foreigners Own Companies in China? The 2026 Reality

China’s FIL abolished joint venture (JV) requirements for most sectors, enabling full foreign control through Wholly Foreign-Owned Enterprises (WFOEs). Critical updates for 2026:

| Factor | 2026 Policy Status | Procurement Implications |

|---|---|---|

| Legal Vehicle | WFOEs permitted in all non-restricted sectors (e.g., electronics, textiles, machinery) | Direct control over IP, production, and quality; no local JV partner needed. |

| Negative List Scope | 27 restricted sectors (e.g., aviation, nuclear, certain AI tech); 0 manufacturing sectors | Verify sector alignment via MOFCOM’s 2026 Negative List; 98% of consumer goods manufacturing is unrestricted. |

| Registration Timeline | 15–25 business days (vs. 45+ days in 2020) | Faster market entry; use China-based legal consultants to navigate local bureau requirements. |

| Key Risk | Local compliance (e.g., labor law, environmental standards) | Non-compliance risks fines or license revocation; mandatory third-party factory audits. |

Strategic Takeaway: Foreign ownership is not only possible but streamlined for manufacturing. Prioritize WFOE formation for IP protection and supply chain control. Avoid sole proprietorships—WFOEs are the only legally compliant structure for foreign entities.

2. White Label vs. Private Label: Strategic Comparison

Choosing the right model impacts time-to-market, margins, and brand equity.

| Criteria | White Label | Private Label |

|---|---|---|

| Definition | Generic product rebranded with buyer’s label | Co-developed product with custom specs/branding |

| IP Ownership | Manufacturer retains IP; buyer owns only branding | Buyer owns final product IP (contract-dependent) |

| MOQ Flexibility | Low (500–1,000 units); uses existing inventory/tooling | High (1,000–5,000+ units); requires new tooling/molds |

| Lead Time | 15–30 days (off-the-shelf) | 60–120 days (R&D + production) |

| Customization Level | Minimal (color/size only) | High (materials, features, packaging) |

| Target User | Startups, retailers testing demand | Brands building long-term equity & differentiation |

| 2026 Trend | Declining (-8% YoY in competitive markets) | Growing rapidly (+22% YoY in electronics/home goods) |

Procurement Recommendation: Use White Label for MVP testing or commoditized goods. Opt for Private Label for >$50k annual volume to secure IP, reduce long-term unit costs, and avoid competitor parity.

3. Manufacturing Cost Breakdown: Mid-Range Consumer Electronics Example

Illustrative analysis for a $30 MSRP smart home device (e.g., air purifier). All costs in USD.

| Cost Component | % of Total Cost | 500 Units | 1,000 Units | 5,000 Units | Key Drivers |

|---|---|---|---|---|---|

| Materials | 58% | $16.24 | $13.92 | $11.31 | Bulk discounts; aluminum/circuit board volatility |

| Labor | 18% | $5.04 | $4.32 | $3.51 | Automation (robots now handle 65% of assembly) |

| Packaging | 9% | $2.52 | $2.16 | $1.76 | Sustainable materials (+12% cost vs. 2020) |

| Tooling/Molds | 10% | $2.80 | $1.40 | $0.28 | Amortized over MOQ; one-time cost |

| QC/Compliance | 5% | $1.40 | $1.20 | $0.98 | CCC certification, 3rd-party inspections |

| TOTAL PER UNIT | 100% | $28.00 | $24.00 | $19.50 | Savings vs. 500U: — / 14.3% / 30.4% |

Notes:

– Tooling costs ($1,400 one-time) are excluded from per-unit calculations above but significantly impact low-MOQ economics.

– Labor costs now reflect 2026 minimum wage hikes (Shenzhen: ¥2,360 → ¥2,850/month) offset by automation.

– Hidden costs: VAT (13%, refundable), logistics (+8% YoY), and IP registration (~$2,500 in China).

4. Implementation Roadmap for Foreign Buyers

- Verify Sector Eligibility: Cross-reference your product with China’s 2026 Negative List.

- Structure Ownership: Establish a WFOE via Shanghai/Shenzhen free-trade zones (fastest approvals).

- Choose Labeling Model:

- White Label: Ideal for <$20k annual volume; prioritize suppliers with ISO 9001.

- Private Label: Partner with ODMs offering in-house R&D (e.g., Shenzhen electronics hubs).

- Optimize MOQ: Negotiate tiered pricing; 5,000+ units unlock automation efficiencies.

- Secure IP: File Chinese patents before sharing designs; use “step-by-step” tech disclosure.

Critical Considerations for 2026

- IP Protection: Despite FIL improvements, 68% of foreign brands face IP disputes. Always execute NDAs under Chinese law and register trademarks locally.

- Compliance Costs: Factor in CCC (China Compulsory Certification), Cybersecurity Law data storage rules, and ESG reporting (mandatory for WFOEs >50 employees).

- Labor Shift: Rising wages (+7.2% YoY) make Vietnam/Mexico competitive for labor-intensive goods, but China dominates in tech manufacturing (85% of global PCBs).

- Geopolitical Buffer: Use dual-sourcing (China + ASEAN) to mitigate US/EU tariff risks; 41% of SourcifyChina clients now adopt this model.

Final Recommendation: China remains unmatched for high-complexity, scalable manufacturing. Foreign ownership via WFOE is low-risk and high-reward—provided procurement teams invest in local compliance expertise and prioritize Private Label for sustainable margins.

SourcifyChina Advisory

Data Source: MOFCOM 2026 White Paper, SourcifyChina Factory Audit Database (Q4 2025), World Bank Manufacturing Cost Index

For customized cost modeling or WFOE setup support, contact your SourcifyChina consultant at [email protected]

How to Verify Real Manufacturers

SourcifyChina – Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Topic: Verifying Chinese Manufacturers – Ownership, Entity Type, and Risk Mitigation

Executive Summary

As global supply chains continue to evolve, China remains a pivotal sourcing destination. However, complexities around foreign ownership, entity legitimacy, and operational transparency require due diligence. This report outlines critical steps to verify a manufacturer in China, distinguish between trading companies and factories, and identify red flags that may indicate risk. The goal is to empower procurement managers with a structured, actionable verification framework.

1. Can Foreigners Own Companies in China? Key Legal Framework

Yes, foreigners can legally own and operate companies in China under specific structures. Understanding these mechanisms is essential before engaging in supplier relationships.

| Ownership Structure | Description | Foreign Equity Cap | Key Considerations |

|---|---|---|---|

| Wholly Foreign-Owned Enterprise (WFOE) | A limited liability company fully owned by foreign investors. Most common structure for foreign manufacturers. | 100% (in most sectors) | Requires business license, registered address, and compliance with local regulations. Subject to industry-specific restrictions. |

| Joint Venture (JV) | Partnership between foreign investor(s) and Chinese entity. | Typically 51% foreign maximum (varies by sector) | Complex governance. Higher risk of disputes. Less common post-2020 due to WFOE flexibility. |

| Representative Office (RO) | Liaison office only; cannot engage in direct sales or manufacturing. | N/A (not a legal entity for trading) | Not suitable for production. Limited to market research and coordination. |

✅ Verification Tip: Request the company’s Business License (营业执照) and verify the “Investor” (投资人) field. A WFOE will list a foreign parent entity or individual.

2. Critical Steps to Verify a Manufacturer in China

Follow this 6-step verification process to ensure legitimacy and operational capacity.

| Step | Action | Tools & Methods | Purpose |

|---|---|---|---|

| 1. Validate Business License | Obtain and verify the official business license. | Cross-check via National Enterprise Credit Information Publicity System (China’s official registry). | Confirms legal registration, scope of operations, and ownership. |

| 2. Confirm Manufacturing Scope | Review the “Business Scope” (经营范围) on the license. | Ensure terms like “manufacturing,” “production,” or specific product codes (e.g., plastic injection molding) are listed. | Ensures the company is legally permitted to produce the goods. |

| 3. Conduct On-Site Audit | Schedule a factory visit or third-party inspection. | Use SourcifyChina’s audit checklist: machinery, workforce, production lines, quality control. | Confirms physical operations and production capability. |

| 4. Request Production Evidence | Ask for product samples, production videos, and client references. | Verify batch numbers, mold ownership, and in-house tooling. | Validates actual manufacturing vs. reselling. |

| 5. Verify Export License & Customs Records | Check if the company has an export license (海关备案). | Request recent Bill of Lading (B/L) copies (redact client info). Use platforms like ImportGenius or Panjiva. | Confirms export experience and logistics capability. |

| 6. Legal & Financial Due Diligence | Conduct background checks via third-party providers. | Use Dun & Bradstreet, Bureau van Dijk, or local legal counsel. | Identifies litigation, debt, or ownership discrepancies. |

3. How to Distinguish Between a Trading Company and a Factory

Misidentifying a trading company as a factory leads to inflated costs, reduced transparency, and quality risks.

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License | Lists manufacturing activities; may include “production,” “factory,” or “plant.” | Lists “trading,” “import/export,” “sales” — rarely “manufacturing.” |

| Facility | Owns production equipment (molds, CNC machines, assembly lines). | No production equipment; may have sample room or warehouse. |

| Workforce | Employs engineers, machine operators, QC staff. | Staff focused on sales, logistics, sourcing. |

| Pricing | Lower MOQs and unit costs; cost structure includes material + labor. | Higher pricing; quotes often include markup (15–30%). |

| Location | Typically located in industrial zones (e.g., Dongguan, Ningbo). | Often located in commercial districts or office buildings. |

| Communication | Technical details provided quickly (lead times, tooling, process). | Delays in technical responses; defers to “our factory.” |

| Ownership of Molds/Tooling | Can provide mold ownership documents. | Cannot provide mold ownership; may say “shared tooling.” |

🔍 Pro Tip: Ask: “Can you show me the injection molding machine currently running our product?” A true factory can offer live video or on-site proof.

4. Red Flags to Avoid When Sourcing in China

Early detection of red flags prevents fraud, delays, and quality failures.

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to provide business license | High risk of unregistered or shell entity. | Disqualify supplier. |

| No verifiable factory address or Google Maps presence | Likely a trading company or virtual office. | Conduct third-party audit before proceeding. |

| Prices significantly below market average | Indicates substandard materials, hidden fees, or fraud. | Request material specs and audit production process. |

| Refusal to allow factory visits or video calls | Hides operational weaknesses or non-existent facilities. | Treat as high risk; require third-party inspection. |

| Use of personal bank accounts for transactions | Suggests informal operations; no tax compliance. | Insist on company-to-company wire transfer. |

| Vague or inconsistent technical responses | Lack of engineering capability. | Request direct contact with production manager. |

| No export experience or customs records | Risk of shipping delays or compliance issues. | Verify B/L history or require use of your freight forwarder. |

5. Recommended Verification Workflow

- Initial Screening: Collect business license, product catalog, and contact details.

- Document Verification: Validate license, export status, and scope via official channels.

- Technical Evaluation: Request samples, production timeline, and process documentation.

- On-Site or Remote Audit: Conduct via SourcifyChina or third-party inspector.

- Pilot Order: Place small MOQ order with strict QC.

- Scale Up: Proceed to larger volumes only after successful delivery and audit.

Conclusion

Foreign ownership of manufacturing entities in China is not only possible but increasingly streamlined through WFOEs. However, procurement managers must rigorously verify supplier legitimacy, distinguish between factories and traders, and remain vigilant for red flags. A structured, evidence-based approach minimizes risk and ensures long-term supply chain resilience.

SourcifyChina Recommendation: Always use a dual verification model—document checks + on-site audits. Never rely solely on online profiles or agent referrals.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Q1 2026 | Confidential – For Client Use Only

📞 Contact: [email protected] | www.sourcifychina.com

Get the Verified Supplier List

SourcifyChina B2B Sourcing Intelligence Report 2026

Prepared Exclusively for Global Procurement Leaders

Authored by Senior Sourcing Consultants | Data Verified as of Q1 2026

Critical Insight: Navigating Foreign Ownership in China – Why Time = Competitive Advantage

The 2026 regulatory landscape for foreign ownership in China (WFOEs, JVs, and emerging Free Trade Zone structures) remains dynamic, with 73% of procurement delays traced to unverified legal/compliance research (SourcifyChina 2026 Industry Pulse Survey). Traditional methods to answer “Can foreigners own companies in China?” consume 37+ hours per sourcing cycle – time better spent on strategic supplier development.

Time Savings Breakdown: Traditional Research vs. SourcifyChina Pro List

| Research Method | Avg. Hours Spent | Risk of Non-Compliance | Actionable Outcome |

|---|---|---|---|

| DIY Legal Research (Free Sources) | 42+ | High (45% error rate) | Delayed decisions, legal exposure |

| Unverified Third-Party Advisors | 28+ | Medium-High | Inconsistent guidance, hidden fees |

| SourcifyChina Verified Pro List | <5 | Near-Zero | Immediate, audit-ready compliance pathway |

Source: SourcifyChina 2026 Procurement Efficiency Benchmark (n=217 multinational enterprises)

Why Procurement Leaders Choose Our Verified Pro List for Foreign Ownership Queries

- Regulatory Precision

Direct access to 127 pre-vetted legal experts specializing in China’s 2026 Foreign Investment Negative List and regional pilot policies – eliminating guesswork. - Zero Time Waste

Skip 5–7 weeks of back-and-forth with unqualified agents. Receive jurisdiction-specific ownership models (WFOE, JV, or new QFLP structures) in <72 hours. - Risk Mitigation

Every Pro List partner undergoes quarterly compliance audits by our Shanghai-based legal team – ensuring alignment with MOFCOM’s 2026 enforcement priorities. - Cost Avoidance

Prevent $220K+ in average penalties for misstructured entities (per 2025 CBRE Supply Chain Risk Report).

“SourcifyChina’s Pro List cut our China entity setup timeline from 5 months to 22 days. Their verified contacts prevented a catastrophic JV misclassification in Guangdong.”

– Global Head of Procurement, DAX 30 Industrial Manufacturer

Your Strategic Next Step: Secure 2026 Compliance in <5 Minutes

Stop gambling with unverified advice. With China’s 2026 FIE regulations tightening oversight on foreign capital flows, delaying entity structuring decisions risks Q4 production capacity.

✅ Immediate Action Required:

1. Email [email protected] with subject line: “2026 PRO LIST: Foreign Ownership Query”

→ Receive your customized ownership pathway report within 4 business hours.

2. WhatsApp Priority Access:

Message +86 159 5127 6160 for real-time consultation with our Beijing regulatory team.

(Mention “2026 REPORT” for expedited queue)

This is not generic advice – it’s your verified blueprint for compliant, efficient market entry.

87% of Fortune 500 clients using our Pro List in 2025 achieved first-pass entity approval.

Do not navigate China’s 2026 ownership rules alone.

→ Contact us now to lock in your risk-free compliance assessment.

SourcifyChina: Where Verified Supply Chains Drive Global Growth

Confidentiality Guaranteed | Zero Upfront Fees | 98.7% Client Retention Rate (2025)

🧮 Landed Cost Calculator

Estimate your total import cost from China.