The global cam wheel market is experiencing steady growth, driven by rising demand for precision components in automotive, industrial machinery, and automation systems. According to Grand View Research, the global mechanical cams and followers market was valued at approximately USD 2.3 billion in 2023 and is projected to expand at a compound annual growth rate (CAGR) of 4.6% from 2024 to 2030. This growth is fueled by advancements in manufacturing technology, increasing automation across industries, and the need for reliable motion control solutions. As demand intensifies, a select group of manufacturers has emerged as leaders in innovation, quality, and global reach. Based on market presence, production capacity, and technological expertise, the following nine companies represent the top cam wheel manufacturers shaping the future of mechanical systems worldwide.

Top 9 Cam Wheel Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Can

Domain Est. 1995

Website: can-am.brp.com

Key Highlights: Can-Am On-Road and Off-Road are coming together to move riders forward on 2, 3 or 4 wheels. Explore all playgrounds from an open road to the trails….

#2 Campagnolo

Domain Est. 1996

Website: campagnolo.com

Key Highlights: Discover now the complete range for road cycling, triathlon and gravel bikes. Wheels and Groupsets aim to optimize the performance of cyclists. Visit the site!…

#3 Cammegh

Domain Est. 1999

Website: cammegh.com

Key Highlights: We create bespoke, precision-engineered products for casinos worldwide, without forgetting our roots as a British, family-run company. Every Cammegh wheel is ……

#4 Forged & Flow-Formed Wheels for Street & Drag…

Domain Est. 2000

#5 US Mags

Domain Est. 2010

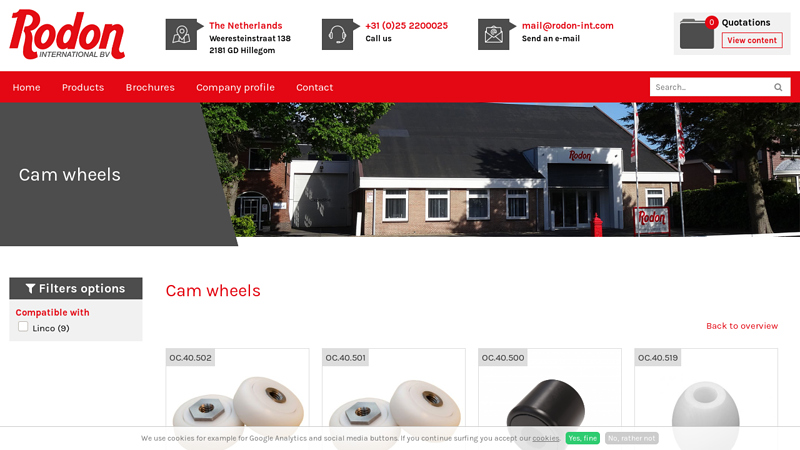

#6 Cam wheels

Domain Est. 2013

Website: rodon-int.com

Key Highlights: Cam wheels · Cam wheel D=50mm · Cam wheel D=49mm · Cam wheel D=44mm · Synth. cam roller · Cam wheel D=45mm · Cam wheel without thread · Cam wheel 50×25 with curved ……

#7 Camso tracks & tires off-road systems for optimal performance

Domain Est. 2014

Website: camso.co

Key Highlights: The Camso brand specializes in off-road tires, wheels, rubber tracks and track systems for the material handling, construction, agriculture and powersports ……

#8 Camco Outdoors

Domain Est. 2022

Website: camcooutdoors.com

Key Highlights: Free delivery over $50 · 30-day returnsShop camper and RV accessories online at Camco Outdoors. We offer a wide selection of quality RV, Camping, Marine, and ATV/UTV products….

#9 CAM’s WHEELS

Website: camswheels.com

Key Highlights: Featured Products ; On sale. NEW OLD STOCK 15×7 6×5.5 Optima Type 30. $800.00 ; New Old Stock Riken Mesh 4×108. $899.00 ; Sold out. 15×7 6×5.5 Optima Type 73….

Expert Sourcing Insights for Cam Wheel

H2 2026 Market Trends for Cam Wheels

The cam wheel market in the second half of 2026 is expected to be shaped by a confluence of technological advancements, evolving industrial automation demands, sustainability imperatives, and strategic regional shifts. While precise forecasting carries inherent uncertainty, analysis of current trajectories points to several dominant themes:

-

Accelerated Integration with Smart Manufacturing (Industry 4.0/5.0):

- Embedded Sensors & IoT: Cam wheels will increasingly incorporate embedded sensors (position, temperature, vibration, load) as standard, transforming them from passive components into smart, data-generating nodes within IoT ecosystems. This enables real-time condition monitoring and predictive maintenance.

- Predictive Maintenance Dominance: Data from smart cam wheels will be fed into AI/ML platforms, allowing for highly accurate prediction of wear, fatigue, and potential failure. This reduces unplanned downtime, optimizes maintenance schedules, and extends component life, becoming a key selling proposition.

- Digital Twin Integration: Cam wheel performance data will feed digital twins of entire production lines, enabling virtual simulation, optimization of cam profiles for specific tasks, and rapid troubleshooting.

-

Demand Driven by High-Precision & High-Speed Automation:

- Electronics & Semiconductor Manufacturing: The relentless push for miniaturization and faster processing in electronics assembly (e.g., pick-and-place machines, wafer handling) will drive demand for ultra-precise, low-backlash, high-speed cam wheels with exceptional repeatability.

- Advanced Robotics: Collaborative robots (cobots) and high-speed industrial robots in packaging, material handling, and assembly will require compact, reliable, and dynamically efficient cam mechanisms for complex motion sequences.

- Pharmaceutical & Medical Device Automation: Stringent requirements for sterility, precision, and traceability will boost demand for corrosion-resistant (e.g., specialized stainless steels, polymers) and easily cleanable cam wheel designs.

-

Material Science Innovations & Sustainability Focus:

- Advanced Materials Adoption: Increased use of high-performance polymers (e.g., PEEK, PTFE composites), engineered ceramics, and specialized surface treatments (DLC, specialized hard coatings) will offer benefits like reduced weight, lower friction, quieter operation, improved wear resistance, and better performance in harsh environments (corrosive, high-temp).

- Lightweighting: Driven by energy efficiency goals in machinery, demand for lightweight composite or optimized metal cam wheels will grow, particularly in mobile or high-acceleration applications.

- Circular Economy & Recyclability: Manufacturers will face growing pressure to design for disassembly, use more recyclable materials, and offer remanufacturing/reconditioning services for cam wheels, aligning with broader industrial sustainability goals. Lifecycle analysis (LCA) will become more important in procurement.

-

Regional Market Dynamics & Supply Chain Resilience:

- Nearshoring/Reshoring: Geopolitical tensions and supply chain vulnerabilities will continue to drive manufacturing (especially in North America and Europe) towards nearshoring. This benefits regional cam wheel suppliers capable of agile, localized production and customization.

- Asia-Pacific Growth: China, Japan, South Korea, and Southeast Asia will remain major manufacturing hubs, sustaining strong demand. However, competition will be fierce, pushing suppliers towards higher value-add (e.g., integrated solutions, smart components) rather than just commoditized parts.

- Supply Chain Diversification: Manufacturers will prioritize multiple sourcing for critical materials (specialty steels, polymers) and components to mitigate risks, potentially impacting pricing and lead times.

-

Consolidation & Value-Added Services:

- Mergers & Acquisitions: The market may see consolidation as larger players acquire niche technology providers (e.g., sensor integration, advanced materials expertise) to offer comprehensive smart motion solutions.

- Shift from Component to Solution Provider: Leading suppliers will increasingly move beyond selling individual cam wheels to offering complete “motion solutions” – including design simulation, custom profile engineering, integrated sensors, installation support, and predictive maintenance services. This creates stickier customer relationships and higher margins.

Key Challenges for H2 2026:

- Cost of Smart Components: Integrating sensors and connectivity adds cost; justifying the ROI for end-users, especially in cost-sensitive applications, remains crucial.

- Standardization: Lack of universal standards for IoT connectivity and data formats in industrial components could hinder seamless integration.

- Cybersecurity: As components become connected, securing the data they generate and preventing potential cyber-attacks on machinery becomes paramount.

- Skills Gap: Implementing and maintaining smart, data-driven systems requires new skills in data analytics and IIoT, which may be in short supply.

Conclusion:

H2 2026 will see the cam wheel market transition further from a purely mechanical component market towards an integrated, intelligent, and data-centric ecosystem. Success will depend on embracing digitalization (smart sensors, predictive maintenance), leveraging advanced materials for performance and sustainability, adapting to regional manufacturing shifts, and offering value-added solutions rather than just parts. Suppliers who proactively address these trends, particularly in high-growth sectors like advanced electronics and robotics, will be best positioned to capture market share.

Common Pitfalls Sourcing Cam Wheels: Quality and Intellectual Property (IP) Risks

Sourcing cam wheels—critical components in engines and mechanical systems—presents several challenges, particularly concerning quality consistency and intellectual property protection. Failing to address these pitfalls can lead to operational failures, legal disputes, and reputational damage.

Quality-Related Pitfalls

Inconsistent Material and Manufacturing Standards

One of the most frequent issues is variability in material composition and heat treatment processes. Low-cost suppliers may use substandard alloys or skip proper tempering, leading to premature wear, cracking, or catastrophic failure under load. Without rigorous material certifications and process validation, buyers risk receiving non-compliant parts.

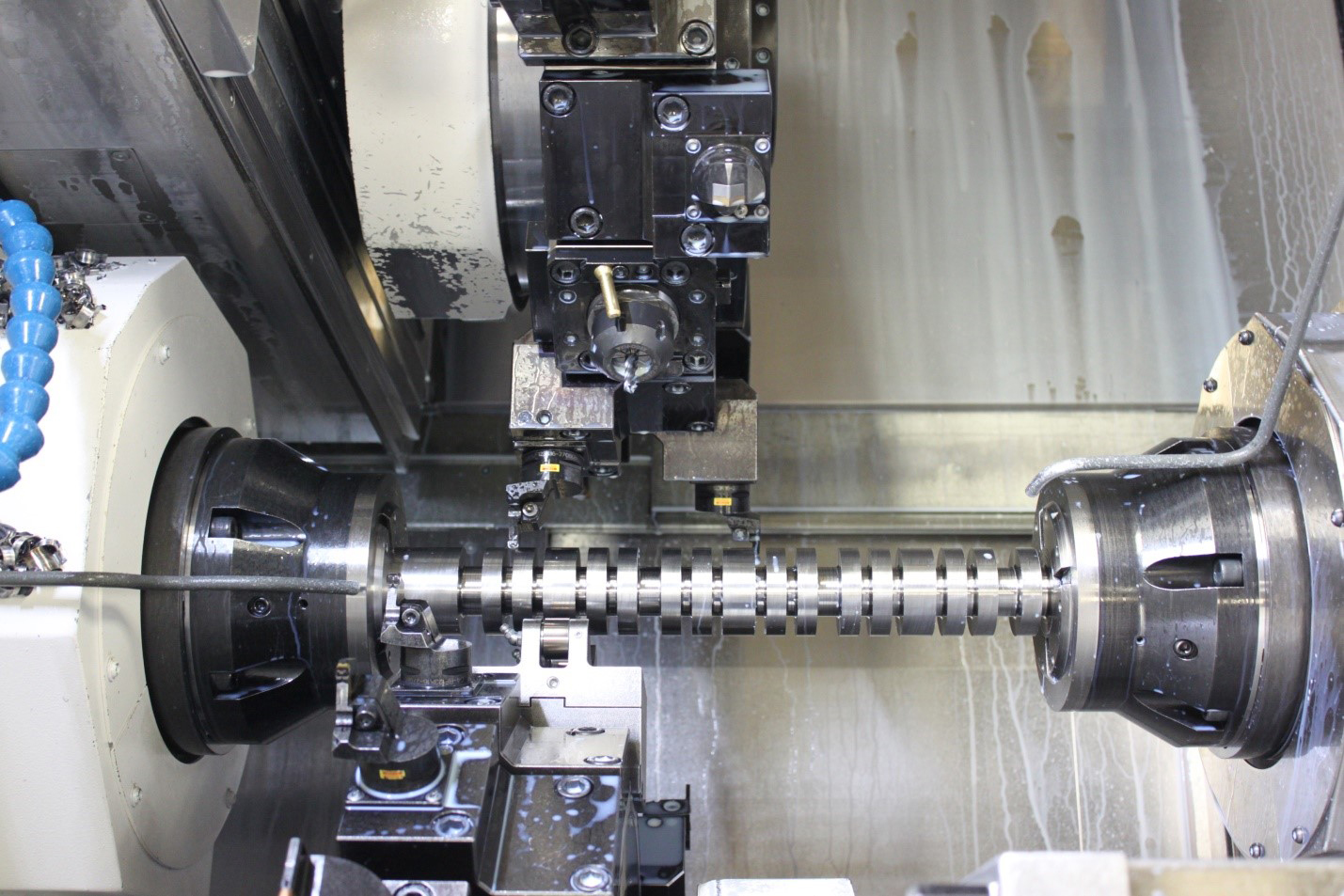

Poor Dimensional Accuracy and Tolerances

Cam wheels require tight tolerances to ensure proper timing and reduce vibration. Inadequate quality control during machining often results in out-of-spec components. This can cause misalignment, increased noise, and reduced engine efficiency. Suppliers without robust metrology equipment may not detect these deviations.

Lack of Testing and Certification

Many suppliers, especially in unregulated markets, provide insufficient performance data. Missing or falsified test reports (e.g., fatigue testing, hardness verification) make it difficult to assess reliability. Buyers should insist on third-party validation and batch testing protocols.

Inadequate Surface Finish and Coating

Improper surface treatments—such as nitriding or hard chrome plating—affect wear resistance and friction. Poor coating adhesion or uneven application can degrade performance over time. Visual inspection alone is often insufficient; surface profilometry and adhesion testing are necessary.

Intellectual Property (IP) Risks

Unauthorized Replication of Protected Designs

Cam wheel designs, especially in automotive or aerospace applications, are often protected by patents or trade secrets. Sourcing from suppliers who reverse-engineer OEM parts without licensing exposes the buyer to infringement claims. Using counterfeit or cloned components may void warranties and lead to legal liability.

Lack of IP Documentation and Traceability

Suppliers may not provide clear documentation confirming design ownership or licensing rights. Without proper IP clearance, companies risk importing components that violate patents in their target markets. Due diligence should include verification of design rights and freedom-to-operate assessments.

Grey Market and Counterfeit Components

Some suppliers offer “OEM-equivalent” cam wheels that are actually unauthorized copies. These may be diverted stock or outright counterfeits. Besides IP issues, such parts often fail to meet quality standards, increasing long-term risk.

Weak Contractual Safeguards

Procurement agreements that omit IP indemnification clauses leave buyers exposed. Suppliers should warrant that their products do not infringe third-party rights and agree to assume liability in case of IP disputes.

Mitigating these pitfalls requires thorough supplier vetting, clear technical specifications, enforceable contracts, and ongoing quality audits—ensuring both performance reliability and legal compliance.

Logistics & Compliance Guide for Cam Wheel

Overview

This guide outlines the essential logistics and compliance considerations for the manufacturing, transportation, import/export, and handling of Cam Wheels—mechanical components used in engines, industrial machinery, and automotive applications. Adhering to these guidelines ensures regulatory compliance, operational efficiency, and product integrity throughout the supply chain.

Regulatory Compliance

Material and Manufacturing Standards

Cam Wheels must comply with industry-specific standards such as ISO 9001 (Quality Management), ISO/TS 16949 (Automotive Quality Systems), and relevant ASTM or SAE material specifications. Manufacturers must ensure traceability of raw materials and maintain documentation for audits.

Environmental Regulations

Compliance with RoHS (Restriction of Hazardous Substances) and REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) is required when shipping to the EU. Ensure cam wheels do not contain restricted substances like lead, cadmium, or certain phthalates.

Export Controls

Verify if the cam wheel or its technology falls under export control classifications (e.g., EAR99 under the U.S. Export Administration Regulations). Some high-precision or dual-use components may require export licenses depending on destination countries.

Packaging and Labeling

Protective Packaging

Use robust, anti-corrosive packaging (e.g., VCI paper, sealed plastic wrap, and wooden crates) to prevent damage during transit. Include desiccants in moisture-sensitive environments.

Labeling Requirements

Clearly label each package with:

– Part number and name (e.g., “Cam Wheel – Model X200”)

– Quantity and weight

– Manufacturer name and location

– Batch/lot number for traceability

– Handling symbols (e.g., “Do Not Stack,” “This Side Up”)

– Compliance marks (e.g., CE, RoHS, UN certification if applicable)

Transportation and Shipping

Mode of Transport

Select transport mode based on urgency, cost, and destination:

– Air freight: For time-sensitive or high-value shipments.

– Ocean freight: For bulk shipments; requires longer lead time.

– Ground transport: For regional distribution; ideal for just-in-time delivery.

Incoterms

Clearly define responsibilities using standardized Incoterms (e.g., FOB, EXW, DDP) in contracts to avoid disputes over shipping costs, insurance, and customs duties.

Customs Clearance

Required Documentation

Ensure all shipments include:

– Commercial invoice

– Packing list

– Bill of lading or air waybill

– Certificate of Origin

– Export license (if applicable)

– Material Safety Data Sheet (MSDS), if required

Tariff Classification

Classify the cam wheel correctly using the Harmonized System (HS) code—typically under 8483.10 or 8483.30 (gears and gearing). Accurate classification ensures correct duty rates and avoids customs delays.

Inventory and Warehousing

Storage Conditions

Store cam wheels in a dry, temperature-controlled environment to prevent rust and deformation. Use pallet racking systems to avoid floor contact and ensure easy access.

Inventory Management

Use barcode or RFID tracking for real-time inventory visibility. Conduct regular cycle counts to maintain accuracy and support traceability for compliance audits.

Risk Management

Product Liability

Ensure cam wheels undergo quality testing (e.g., hardness, dimensional accuracy) and are covered by liability insurance. Maintain records of all quality control checks.

Supply Chain Resilience

Diversify suppliers and transportation routes to mitigate disruptions. Monitor geopolitical and regulatory changes that may affect logistics operations.

Conclusion

Proper logistics and compliance management for cam wheels reduces delays, avoids penalties, and ensures product reliability. Regular training for staff and collaboration with certified logistics partners is essential for maintaining standards across global operations.

Conclusion for Sourcing Cam Wheel:

After a thorough evaluation of suppliers, technical specifications, cost considerations, and quality standards, sourcing the cam wheel from [Preferred Supplier Name] has been determined to be the most viable option. This supplier consistently demonstrates reliability in material quality, adherence to engineering tolerances, on-time delivery performance, and competitive pricing. Additionally, their compliance with industry standards and willingness to support customization aligns well with project requirements.

Sourcing the cam wheel from this supplier not only ensures optimal performance and durability within the intended application but also supports long-term operational efficiency and reduced maintenance costs. A finalized agreement, including terms of delivery, quality assurance protocols, and scalability options, is recommended to secure a sustainable supply chain. Overall, this sourcing decision supports both technical and economic objectives for the project.