The global calcium formate market is experiencing steady growth, driven by increasing demand across key industries such as animal feed, construction, and leather tanning. According to Grand View Research, the global calcium formate market was valued at USD 297.3 million in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 4.8% from 2023 to 2030. This growth is largely attributed to its role as a mold inhibitor and growth promoter in animal nutrition, as well as its use as an accelerator in cement production. With regulatory shifts in several regions restricting the use of antibiotics in animal feed, calcium formate has emerged as a viable alternative, further boosting market demand. As production capacity expands across Asia-Pacific and Europe—regions that collectively dominate global supply—a select group of manufacturers have positioned themselves at the forefront of innovation, scale, and market reach. Below, we spotlight the top nine calcium formate manufacturers shaping the industry landscape in 2024.

Top 9 Calcium Formate Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Industrial Grade Calcium Formate Supplier

Domain Est. 2022

Website: wotaichem.com

Key Highlights: WOTAIchem is a trusted high quality calcium formate supplier and manufacturer. We committed to delivering excellent products tailored to your industrial needs….

#2 Calcium formate manufacturer_Sodium formate manufacturer

Domain Est. 2011

Website: ruibaochem.com

Key Highlights: Zibo Ruibao Chemical Co., Ltd. is a modern chemical production enterprise which mainly produces fine chemical products. Its main products are calcium ……

#3 Calcium formate

Domain Est. 1997

Website: quimidroga.com

Key Highlights: In this article, we will explore in depth the distinctive properties of calcium formate and its specific applications in these crucial industrial areas….

#4 Calcium Formate tech

Domain Est. 1995

Website: perstorp.com

Key Highlights: Calcium Formate is an additive designed to significantly improve the qualities and properties of tile adhesives. As an additive it prolongs open time, ……

#5 Buy Calcium Formate from brenntag Italy suppliers 544

Domain Est. 1998

Website: brenntag.com

Key Highlights: Buy customized variations and grades of Calcium Formate Ca(HCO2)2 from Brenntag; safe delivery, in stock in Brenntag Italy, find MSDS, quote, sample now!…

#6 Calcium Formate Supplier and Distributor

Domain Est. 1999

Website: gjchemical.com

Key Highlights: GJ Chemical offers Calcium Formate. Available in various grades, packaging and quantities from LTL to Bulk. Speak to one of our technical experts today!…

#7 Calcium formate

Domain Est. 2004

Website: lanxess.com

Key Highlights: Manufacturing of glues and adhesives. Synonyms. Formic acid calcium salt. Cafo. Calcium formate. On this Page. Product Information; Product Applications ……

#8 Calcium Formate Supplier & Distributor

Domain Est. 2010

Website: connectionchemical.com

Key Highlights: Connection Chemical LP is your reliable supplier of top-quality Calcium Formate. We provide dependable supply chain solutions to meet the diverse needs of our ……

#9 Calcium formate

Domain Est. 2018

Website: en.cd1958.com

Key Highlights: English name: Calcium formate. Molecular formula : Ca (HCOO)2. Property: White crystal or powder. Packing instruction: Paper bag or PP-PE bag….

Expert Sourcing Insights for Calcium Formate

H2: Analysis of 2026 Market Trends for Calcium Formate

The global calcium formate market is projected to experience steady growth by 2026, driven by rising demand across key industrial sectors such as animal feed, construction, and leather processing. This analysis highlights the primary market trends shaping the calcium formate landscape in 2026 under the influence of technological advancements, regional dynamics, regulatory developments, and evolving end-user applications.

-

Expansion in Animal Feed Applications

Calcium formate continues to gain prominence as a preservative and acidifier in livestock feed due to its antimicrobial properties and ability to improve feed digestibility. By 2026, the shift toward antibiotic-free animal production—driven by regulatory restrictions in the EU, North America, and parts of Asia—is expected to significantly boost demand. The compound’s role in enhancing gut health and performance in swine and poultry makes it a preferred alternative to traditional growth promoters, supporting market growth. -

Growth in Construction and Deicing Uses

In the construction industry, calcium formate is valued as an accelerating admixture in cement and concrete, particularly in cold climates where it enhances setting times and early strength development. With infrastructure development projects increasing in emerging economies and colder regions focusing on winter-ready construction materials, demand in this segment is projected to rise. Additionally, its use as an environmentally safer deicing agent compared to chloride-based alternatives is gaining traction, especially in Europe and North America, driven by environmental regulations. -

Regional Market Dynamics

Asia-Pacific is anticipated to dominate the calcium formate market by 2026, with China and India leading in both production and consumption. The region’s expanding livestock industry, rapid urbanization, and government investments in infrastructure are key growth drivers. Europe maintains a strong market presence due to stringent regulations on feed additives and environmental standards favoring eco-friendly chemicals. North America shows moderate growth, influenced by sustainable deicing solutions and specialty construction applications. -

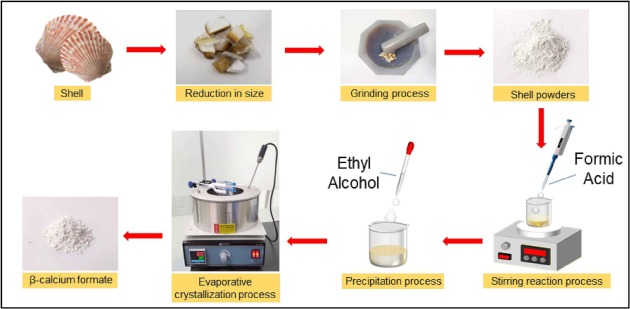

Technological and Production Innovations

Manufacturers are investing in greener production methods, such as utilizing renewable feedstocks and improving process efficiency to reduce carbon footprint. By 2026, advancements in synthesis techniques—particularly those integrating formic acid recovery processes—are expected to lower production costs and improve supply chain resilience. This innovation supports competitive pricing and enhances the attractiveness of calcium formate in cost-sensitive markets. -

Regulatory and Environmental Influences

Environmental policies are increasingly shaping market trends. Calcium formate’s biodegradability and low toxicity give it a regulatory advantage over conventional alternatives like calcium chloride or formaldehyde-based products. In the EU, REACH and biocidal product regulations continue to favor safer chemical substitutes, reinforcing calcium formate’s position. However, compliance with safety data sheet (SDS) requirements and transportation regulations remains critical for global trade. -

Competitive Landscape and Supply Chain Considerations

The market is moderately consolidated, with key players in China, Germany, and the United States expanding capacity to meet rising demand. Strategic partnerships, vertical integration, and R&D collaborations are emerging as common strategies. Supply chain resilience remains a concern due to dependence on formic acid, a key raw material; fluctuations in formic acid prices can impact calcium formate profitability. By 2026, companies with secured raw material sourcing and diversified production bases are expected to gain a competitive edge.

Conclusion

The calcium formate market in 2026 is poised for robust growth, underpinned by its versatility and alignment with sustainability trends. Key drivers include regulatory support for safer chemicals, rising demand in animal nutrition, and infrastructure development. However, market participants must navigate raw material volatility and regional regulatory variations to capitalize on emerging opportunities. Overall, the outlook for calcium formate remains positive, with innovation and environmental compliance serving as critical success factors.

H2: Common Pitfalls in Sourcing Calcium Formate (Quality and Intellectual Property)

Sourcing calcium formate—commonly used as a de-icing agent, preservative, leather tanning aid, and in animal feed—can present several challenges, particularly relating to product quality and intellectual property (IP) considerations. Being aware of these pitfalls helps ensure reliable supply, regulatory compliance, and protection against legal or operational risks.

1. Inconsistent Product Quality

- Variable Purity Levels: Suppliers may offer calcium formate with purity ranging from 85% to over 96%. Lower purity can affect performance, especially in sensitive applications like animal feed or pharmaceutical intermediates.

- Moisture Content: High moisture levels (>5%) can lead to caking, reduced shelf life, and handling difficulties. Poor drying processes during manufacturing are a common cause.

- Impurity Profiles: Presence of chloride, sulfate, heavy metals (e.g., lead, arsenic), or residual methanol from synthesis may exceed acceptable limits, especially if sourced from low-cost manufacturers without stringent quality control.

- Incorrect Particle Size or Flow Properties: Depending on application (e.g., feed premixes), inconsistent granulometry can impact mixing efficiency and dosing accuracy.

Best Practice: Require a Certificate of Analysis (CoA) for each batch, including assay, moisture, pH, and heavy metals. Conduct third-party testing during supplier qualification.

2. Lack of Regulatory Compliance

- Food or Feed Grade Certification: For use in animal nutrition, calcium formate must comply with standards such as FCC (Food Chemicals Codex), EU Regulation (e.g., EC 1810/2006), or FAMI-QS. Not all suppliers hold these certifications.

- REACH, FDA, or Other Jurisdictional Requirements: Non-compliant documentation or undeclared substances can lead to shipment rejections or legal liabilities.

Best Practice: Verify regulatory status and request full compliance documentation prior to contract finalization.

3. Intellectual Property (IP) Risks

- Patented Production Processes: Some manufacturers use proprietary methods to produce high-purity calcium formate (e.g., from sustainable feedstocks or via catalytic routes). Sourcing from a supplier using an infringing process—even unknowingly—may expose buyers to indirect IP liability, especially in export markets with strict enforcement (e.g., the U.S. or EU).

- Formulation IP in End Products: If calcium formate is used in a patented formulation (e.g., a feed additive blend), unauthorized use or reverse engineering could lead to IP disputes.

- Supplier Misrepresentation: A supplier may claim their process is proprietary or patented without proper registration, creating false confidence or misleading business decisions.

Best Practice: Conduct due diligence on the supplier’s production methods. Request evidence of freedom-to-operate (FTO) or licensing where applicable, particularly for large-volume or long-term contracts.

4. Supply Chain Opacity and Traceability

- Raw Material Sourcing: Calcium formate is typically made from formic acid and calcium hydroxide/carbonate. If formic acid is derived from non-sustainable or fossil-based routes, it may conflict with ESG goals.

- Lack of Traceability: Some suppliers cannot provide full traceability, increasing risks related to contamination or ethical sourcing.

Best Practice: Insist on supply chain transparency and audit rights, especially for regulated or sustainability-sensitive industries.

5. Inadequate Technical Support and Documentation

- Missing or incomplete Safety Data Sheets (SDS), technical data sheets (TDS), or stability studies can hinder safe handling and regulatory submissions.

Best Practice: Evaluate supplier support capabilities as part of the sourcing decision—beyond just price and volume.

Conclusion

To mitigate these pitfalls, adopt a structured sourcing strategy that emphasizes quality verification, regulatory alignment, IP due diligence, and supply chain transparency. Engaging with reputable, certified suppliers and incorporating contractual quality and IP indemnity clauses can significantly reduce risk in calcium formate procurement.

H2: Logistics & Compliance Guide for Calcium Formate

Calcium formate (CAS No. 544-17-2) is a white, crystalline powder commonly used in industrial applications such as cement production, animal feed additives, and de-icing agents. Proper logistics handling and regulatory compliance are essential to ensure safe transportation, storage, and use. This guide outlines key considerations under the H2 section for Calcium Formate.

H2.1 Chemical Identification and Properties

– Chemical Name: Calcium Formate

– CAS Number: 544-17-2

– Formula: Ca(HCOO)₂

– Molecular Weight: 130.11 g/mol

– Appearance: White crystalline powder

– Solubility: Soluble in water, slightly soluble in ethanol

– Melting Point: Decomposes at ~360°C

– pH (1% solution): ~7–9 (slightly alkaline)

– Density: ~1.55 g/cm³

H2.2 Hazard Classification

Calcium formate is generally considered low in toxicity but must still be handled with care. According to GHS (Globally Harmonized System):

- GHS Classification (as per available data):

- Not classified as flammable

- Not classified for acute toxicity (oral, dermal, inhalation)

- May cause eye or respiratory irritation (depends on form and dust generation)

- Not classified as environmentally hazardous

⚠️ Note: Always consult the Safety Data Sheet (SDS) from your supplier, as formulations and impurities may affect classification.

H2.3 Storage Requirements

– Conditions: Store in a cool, dry, well-ventilated area.

– Containers: Keep in tightly sealed, moisture-resistant containers.

– Compatibility: Store away from strong acids and oxidizing agents.

– Hygroscopic Nature: Calcium formate is hygroscopic—protect from moisture to prevent caking.

– Shelf Life: Typically stable for 2+ years if stored properly.

H2.4 Handling Precautions

– Use appropriate personal protective equipment (PPE): gloves, safety goggles, and dust mask in high-dust environments.

– Avoid inhalation of dust; use local exhaust ventilation when handling powders.

– Prevent skin and eye contact. Wash hands after handling.

– Do not eat, drink, or smoke in areas where the chemical is handled.

H2.5 Transportation (Global Regulations)

– UN Number: Not regulated as hazardous under most transport regulations (e.g., ADR/RID, IMDG, IATA).

– Proper Shipping Name: Not applicable (non-hazardous for transport)

– Classification: Not classified as dangerous goods when transported in solid form under normal conditions.

– Packaging: Use durable, sealed bags or containers (e.g., multi-wall paper bags with poly liner, HDPE drums).

– Labeling: While not requiring hazard labels for transport, proper identification (name, CAS number) is recommended.

H2.6 Regulatory Compliance

– REACH (EU): Registered under REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals). Ensure your supplier is compliant.

– TSCA (USA): Listed on the TSCA Inventory.

– Globally: No major restrictions, but verify local regulations for industrial or agricultural use.

– Food/Feed Grade: If used in animal feed, ensure compliance with EU Regulation (EC) No 1831/2003 or equivalent local standards.

H2.7 Environmental and Disposal Considerations

– Ecotoxicity: Low environmental impact; not classified as hazardous to aquatic life.

– Spill Management: Sweep or vacuum spilled material; avoid creating dust. Collect in a sealed container for reuse or disposal.

– Disposal: Dispose of in accordance with local, regional, and national regulations. Can typically be landfilled as non-hazardous waste if uncontaminated.

H2.8 Documentation

– Safety Data Sheet (SDS): Must be available and compliant with local regulations (e.g., EU Regulation 1907/2006, OSHA HazCom 2012).

– Certificates: Request COA (Certificate of Analysis), REACH/TSCA compliance statements, and food/feed-grade certification if applicable.

H2.9 Special Considerations

– Dust Explosion Risk: While not classified as combustible, fine powders can form explosive mixtures in air under extreme conditions. Avoid excessive dust accumulation and ignition sources.

– Customs and Import: Declare using correct HS Code (e.g., 2915.15.00 for formates in many jurisdictions).

✅ Summary: Calcium formate is a low-risk chemical with minimal regulatory burden, but adherence to safe handling, storage, and documentation practices is essential for compliance and operational safety.

Always refer to the most current version of the SDS and consult local regulatory authorities when in doubt.

In conclusion, sourcing calcium formate requires a careful evaluation of several key factors, including supplier reliability, product quality, pricing, and logistical considerations. As a versatile chemical used in industries such as animal feed, construction, and environmental management, ensuring a consistent and high-purity supply is crucial. Buyers should prioritize suppliers with established quality control certifications (e.g., ISO, FAMI-QS), transparent manufacturing processes, and proven experience in delivering bulk quantities on time. Additionally, considering sustainability practices and regulatory compliance can further enhance supply chain integrity. By conducting thorough due diligence and fostering strong supplier relationships, organizations can secure a reliable source of calcium formate that meets their technical and operational requirements efficiently and cost-effectively.