The global livestock equipment market, which includes cage panels, was valued at approximately USD 6.8 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 6.3% from 2023 to 2030, according to Grand View Research. This growth is driven by increasing demand for efficient animal housing solutions amid rising livestock production and advancements in farm automation. Cage panels, in particular, are gaining traction due to their durability, modular design, and role in enhancing biosecurity and animal welfare. With North America and Europe leading adoption and Asia Pacific emerging as a fast-growing region, manufacturers are focusing on galvanized steel construction, customizable sizing, and rapid assembly features to meet evolving industry needs. Based on market presence, product innovation, and geographic reach, the following nine manufacturers stand out as key players in the global cage panel industry.

Top 9 Cage Panels Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Hammond Manufacturing

Domain Est. 1996

Website: hammfg.com

Key Highlights: Hammond Manufacturing is a leading manufacturer of industrial enclosures, electronic enclosures, racks & rack cabinets, transformers, outlet strips and ……

#2 WireCrafters ®

Domain Est. 1996

Website: wirecrafters.com

Key Highlights: These wire mesh panels bolt directly to the back of your existing pallet rack uprights creating a sturdy barrier between stored items and the ground below….

#3 Wire Cage Enclosures

Domain Est. 1996

Website: chatsworth.com

Key Highlights: Server & Network Cabinets; Open Racks for OCP; Wall-Mount Cabinets; Zone Enclosures; Consolidation Point Enclosures; Wire Cage Enclosures; Accessories ……

#4 Cage Panels

Domain Est. 1999

Website: srs-i.com

Key Highlights: Cage panels are ideal for protecting valuable machinery and tools and segregating work areas into separate zones. Visit srs-i.com for quality cage panels….

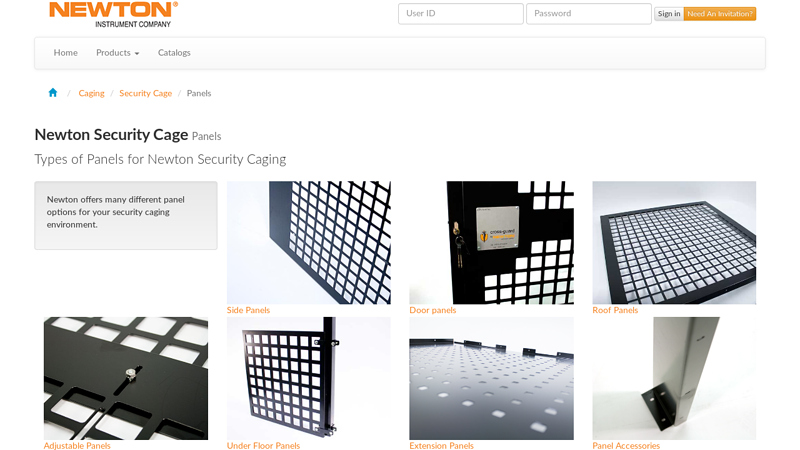

#5 Newton Security Cage Panels

Domain Est. 1999

Website: enewton.com

Key Highlights: Newton offers many different panel options for your security caging environment. Side Panels. Door panels. Roof Panels….

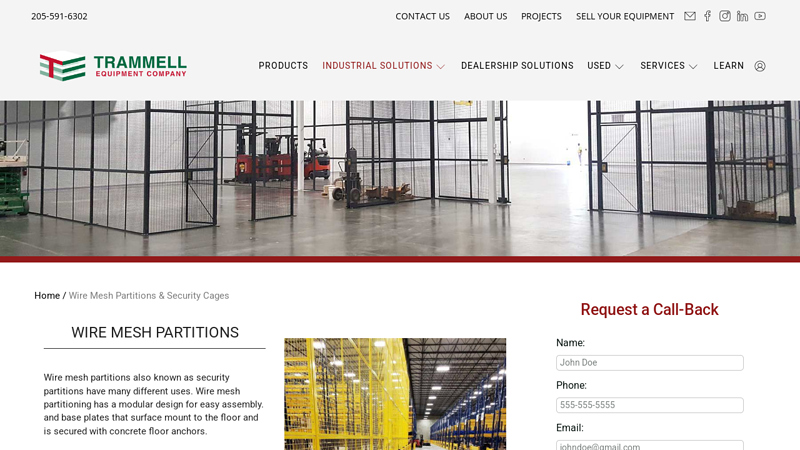

#6 Wire Mesh Partitions & Security Cages

Domain Est. 1999

Website: trammellequipment.com

Key Highlights: Wire mesh partitions also known as security partitions have many different uses. Wire mesh partitioning has a modular design for easy assembly….

#7 Wire Security Cages Storage

Domain Est. 2004

Website: olpingroup.com

Key Highlights: Wire cages avert theft of equipment, tooling, and finished goods. It’s flexible design allows for multiple configurations to accommodate all types of spaces….

#8 Custom Wire Security Cages

Domain Est. 2014

Website: apexwireworks.com

Key Highlights: Apex Iron Works’ custom and modular wire mesh security cages help you protect inventory, reduce theft, restrict access in authorized areas, and enhance safety….

#9 Security Caging

Domain Est. 2019

Website: securitycaging.com

Key Highlights: With our modular, customizable security cage system, build wire cages of any size or configuration. Our partitions are fully framed wire mesh panels that bolt ……

Expert Sourcing Insights for Cage Panels

2026 Market Trends for Cage Panels

The cage panel market is poised for dynamic shifts by 2026, influenced by evolving industrial demands, technological innovation, and sustainability priorities. Here are the key trends shaping the landscape:

Increasing Demand from Livestock and Poultry Sectors

Growth in global protein consumption, especially in emerging economies, will continue to drive demand for efficient animal housing solutions. Cage panels used in poultry farming (for laying hens and broiler breeders) and swine operations are expected to see steady growth due to rising adoption of intensive farming practices. By 2026, automation-friendly modular cage systems will gain traction, enabling better herd management and biosecurity.

Emphasis on Animal Welfare and Regulatory Compliance

Stricter animal welfare regulations, particularly in the EU and North America, will push producers to adopt cage panel designs that offer improved space, ventilation, and comfort. Enriched cage systems and non-cage alternatives are emerging, but high-quality, welfare-compliant cage panels will remain essential in transition periods. Manufacturers will focus on designs that meet new legislative standards to maintain market access.

Shift Toward Sustainable and Durable Materials

Environmental concerns will accelerate the adoption of recyclable and corrosion-resistant materials such as galvanized steel, powder-coated metals, and composite polymers. Cage panels with longer lifespans and lower maintenance requirements will be preferred, reducing total cost of ownership and environmental footprint. By 2026, sustainability credentials will become a key differentiator among suppliers.

Technological Integration and Smart Farming

The integration of IoT sensors and smart monitoring systems into cage panel infrastructure will rise. Panels may embed sensors to track animal health, feed consumption, and environmental conditions. This trend supports data-driven farming, improving productivity and early disease detection. While still emerging, smart cage systems will represent a growing niche by 2026.

Regional Market Diversification

While North America and Europe remain significant markets, Asia-Pacific—especially China, India, and Southeast Asia—will lead volume growth due to expanding livestock sectors and modernization of farming practices. Localized manufacturing and supply chains will develop to meet regional demands, reducing logistics costs and increasing customization.

Growth in Non-Agricultural Applications

Beyond agriculture, cage panels will see increased use in industrial security, material handling, and construction site enclosures. Urbanization and infrastructure development will fuel demand for modular, reusable barrier systems. This diversification will open new revenue streams for cage panel manufacturers.

In conclusion, the 2026 cage panel market will be defined by innovation, sustainability, and regulatory adaptation. Companies that invest in advanced materials, smart technologies, and region-specific solutions will be best positioned to capture growth in this evolving industry.

Common Pitfalls Sourcing Cage Panels (Quality, IP)

When sourcing cage panels—commonly used in construction, agriculture, security, or industrial applications—organizations often face critical challenges related to product quality and intellectual property (IP) risks. Overlooking these areas can lead to safety hazards, project delays, legal disputes, and reputational damage. Below are key pitfalls to avoid:

Poor Material Quality and Structural Integrity

Many suppliers offer cage panels made from substandard materials such as low-grade steel or improperly coated metals, leading to premature rusting, warping, or failure under load. Buyers may not conduct adequate material testing or verify compliance with industry standards (e.g., ASTM, ISO), resulting in panels that fail safety or durability requirements.

Inconsistent Manufacturing Tolerances

Low-cost manufacturers may lack precision in welding, mesh spacing, or frame alignment. Inconsistent dimensions can make installation difficult, compromise security, or violate building codes. Without clear specifications and third-party inspections, these inconsistencies often go unnoticed until deployment.

Lack of Certification and Compliance Documentation

Suppliers may claim compliance with safety or environmental standards without providing verifiable certifications. This is particularly risky when sourcing internationally, where regulatory oversight varies. Absence of proper documentation can expose buyers to liability and compliance issues.

Counterfeit or IP-Infringing Designs

Some cage panel designs—especially patented security or modular systems—are copied without authorization. Sourcing from unauthorized manufacturers may result in the delivery of products that infringe on intellectual property rights. Buyers risk legal action, shipment seizures, or being forced to remove installed products.

Inadequate IP Due Diligence in Supplier Vetting

Purchasers often fail to investigate whether suppliers have legitimate rights to produce a given cage panel design. This is especially common with innovative or branded products. Without contractual IP warranties or proof of licensing, buyers assume unintended legal exposure.

Hidden Costs from Rework and Replacement

Compromising on quality or IP compliance often leads to higher long-term costs. Defective panels may require replacement, and IP-infringing products might be recalled or litigated, resulting in project downtime, contract penalties, and reputational harm.

Mitigation Strategies

To avoid these pitfalls, buyers should:

– Require material test reports and third-party certifications

– Conduct factory audits or pre-shipment inspections

– Include IP indemnification clauses in supplier contracts

– Verify patent and trademark status of proprietary designs

– Source from reputable suppliers with proven track records

Proactively addressing quality and IP concerns during procurement ensures safer, legally compliant, and cost-effective outcomes.

Logistics & Compliance Guide for Cage Panels

This guide outlines key considerations for the safe, efficient, and compliant handling, transportation, and use of cage panels—commonly used in animal housing, construction, agriculture, and industrial applications.

Product Identification and Specifications

Ensure all cage panels are clearly labeled with:

– Material type (e.g., galvanized steel, stainless steel, PVC-coated wire)

– Dimensions (height, width, mesh size)

– Load capacity and structural ratings

– Manufacturer name and batch/lot number

– Compliance markings (e.g., ISO, ASTM, CE if applicable)

Maintaining accurate product specifications supports proper logistics planning and end-use compliance.

Packaging and Handling Requirements

Cage panels must be:

– Bundled securely using steel or plastic strapping to prevent shifting

– Protected with edge guards or corner protectors to avoid damage during transit

– Stacked flat on pallets whenever possible to avoid warping

– Stored in dry, covered areas to prevent corrosion (especially for metal variants)

Use appropriate lifting equipment (e.g., forklifts with spreader bars) to prevent deformation during loading and unloading.

Transportation Guidelines

- Load Securing: Panels must be tightly secured on flatbeds or in containers using ratchet straps, load bars, or dunnage bags to prevent movement.

- Stacking Limits: Observe manufacturer-recommended stacking heights to avoid bottom-panel crushing.

- Environmental Protection: Cover loads with waterproof tarps if transported in open vehicles to protect against moisture and contaminants.

- Weight Distribution: Ensure even weight distribution across transport vehicles to comply with axle load regulations.

Import/Export and Regulatory Compliance

When shipping internationally:

– Verify adherence to destination country standards (e.g., USDA, EU animal welfare directives, local building codes).

– Provide required documentation: commercial invoice, packing list, certificate of origin, and material safety data sheet (MSDS) if applicable.

– Confirm compliance with phytosanitary and customs regulations, especially if wooden pallets are used (ISPM 15 certification required).

Industry-Specific Compliance

- Agriculture & Animal Welfare: Cage panels used in livestock or research facilities must meet space, ventilation, and safety standards (e.g., Guide for the Care and Use of Laboratory Animals, EU Directive 2010/63/EU).

- Construction & Safety: Panels used in temporary fencing or scaffolding must comply with OSHA (U.S.) or equivalent workplace safety standards.

- Food Processing: Stainless steel or food-grade coated panels must meet FDA or EHEDG hygiene requirements.

Environmental and Sustainability Considerations

- Recycle packaging materials (e.g., steel strapping, wooden pallets) in accordance with local regulations.

- Choose suppliers with environmental management systems (e.g., ISO 14001) and sustainable sourcing practices.

- Consider end-of-life recyclability of materials (e.g., galvanized steel is 100% recyclable).

Quality Assurance and Traceability

- Maintain a traceability system using batch numbers and shipping records.

- Conduct periodic inspections upon receipt to verify product integrity and compliance.

- Report and document any non-conformances to suppliers for corrective action.

Adhering to this logistics and compliance guide ensures the safe delivery, regulatory alignment, and optimal performance of cage panels across diverse applications.

Conclusion for Sourcing Cage Panels

In conclusion, sourcing cage panels requires a strategic approach that balances quality, durability, cost-effectiveness, and compliance with relevant safety and industry standards. After evaluating various suppliers, materials (such as galvanized steel, powder-coated steel, or stainless steel), and design specifications, it is evident that selecting the right cage panels is crucial for ensuring long-term security, operational efficiency, and regulatory compliance.

Prioritizing suppliers with proven track records, certifications, and the ability to provide customization options ensures that the cage panels meet specific operational needs, whether for storage, security, or safety applications. Additionally, considering factors such as lead times, warranty offerings, and after-sales support contributes to a reliable and sustainable supply chain.

Ultimately, a well-informed sourcing decision not only enhances asset protection and workplace safety but also delivers long-term value and scalability for future requirements. By leveraging market research, supplier evaluations, and stakeholder input, organizations can establish a robust procurement process that supports both immediate and long-term objectives.