The global flexible cable market is experiencing robust growth, driven by rising demand across industries such as automation, robotics, renewable energy, and electric vehicles. According to a 2023 report by Mordor Intelligence, the market was valued at USD 14.2 billion in 2022 and is projected to grow at a CAGR of 6.8% from 2023 to 2028. This expansion is fueled by the increasing need for high-performance cables capable of withstanding repetitive motion, extreme temperatures, and mechanical stress in dynamic environments. Similarly, Grand View Research highlights the surge in industrial automation and the rapid adoption of Industry 4.0 technologies as key growth accelerators, noting a growing preference for customized, durable, and high-flex cables. As demand intensifies, a select group of manufacturers has emerged as leaders—combining advanced materials, innovative design, and scalable production to meet evolving global standards. The following list identifies the top 10 flexible cable manufacturers shaping the future of connectivity and industrial performance.

Top 10 Cable Flexible Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Wire and Cable Manufacturers

Domain Est. 1996

Website: encorewire.com

Key Highlights: Encore Wire is the leading manufacturer of copper and aluminum for residential, commercial and industrial wire needs. We’re unlike any other wire company….

#2 AFC Cable Systems

Domain Est. 2010

Website: atkore.com

Key Highlights: AFC Cable Systems, Inc., a part of Atkore International, is a leading designer, manufacturer and supplier of electrical distribution products….

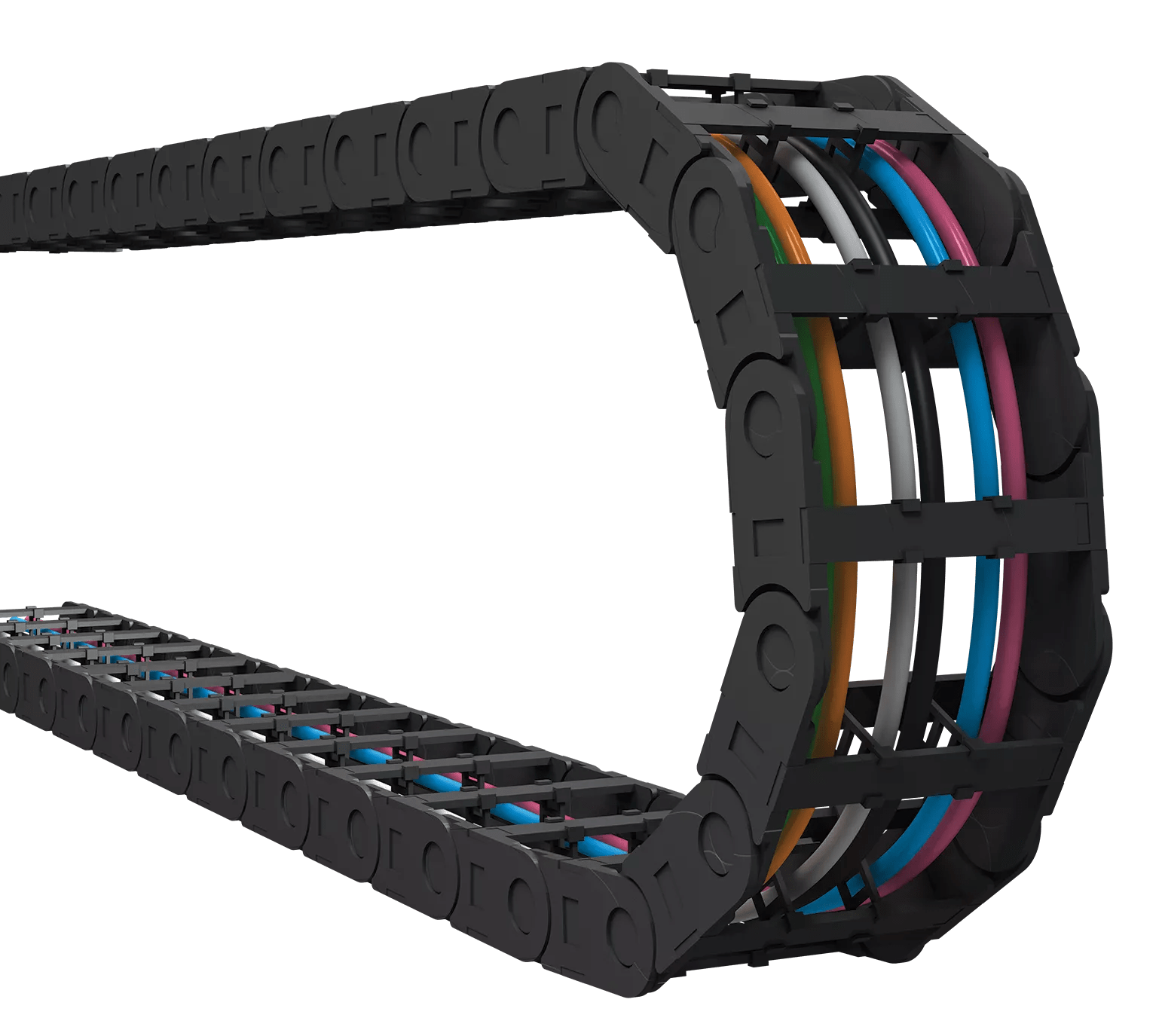

#3 chainflex® Flexible Cable For Moving Applications

Domain Est. 1995

Website: igus.com

Key Highlights: Flexible cable designed for durable & reliable performance in industrial moving applications. Buy online from stock with no minimum requirements….

#4 Connectors, Cables, Optics, RF, Silicon to Silicon Solutions

Domain Est. 1995

Website: samtec.com

Key Highlights: Samtec is the service leader in the electronic interconnect industry and a global manufacturer of Connectors, Cables, Optics and RF Systems, ……

#5 We Are Champlain Cable

Domain Est. 1996

Website: champcable.com

Key Highlights: America’s premier cable innovator & manufacturer, providing solutions to the toughest problems in the world’s most extreme environments for 60+ years….

#6 Southwire

Domain Est. 1994

Website: southwire.com

Key Highlights: Choose Southwire for your wire and cable needs – we offer high-performance products that are built to last….

#7 Flat Flexible Cable (FFC)

Domain Est. 1996

Website: johnsonelectric.com

Key Highlights: Parlex has years of expertise with a wide range of laminated flexible flat cable to provide superior reliability solutions in dynamic flex and service loop ……

#8 Flexible wires

Domain Est. 1996

Website: axon-cable.com

Key Highlights: High flexible wires made by Axon’ Cable are designed to ease mechanical installation in limited available space. They are insulated with a think wall FEP jacket ……

#9 Flex Cable

Domain Est. 1997

Website: belden.com

Key Highlights: Flexible cables designed for tight spaces while maintaining physical and mechanical requirements needed for rigorous motion….

#10 Flexible Wires Cables

Domain Est. 2010

Website: microflexwire.com

Key Highlights: We specialize in flexible cables for medical, electronic, electrical, mechanical, or robotic application with Silicone, Teflon or any thermoplastics….

Expert Sourcing Insights for Cable Flexible

H2: 2026 Market Trends for Flexible Cables

The global flexible cable market is poised for significant transformation and expansion by 2026, driven by technological innovation, evolving industrial demands, and a growing emphasis on automation and energy efficiency. The second half of the decade (H2) is expected to accelerate existing trends while introducing new dynamics shaped by sustainability mandates, digitalization, and supply chain resilience.

1. Rising Demand in Automation and Robotics

Flexible cables—particularly highly dynamic, torsion-resistant, and high-cycle variants—are becoming essential components in industrial automation, robotics, and machinery requiring continuous motion. By 2026, the proliferation of smart factories and Industry 4.0 initiatives will significantly increase demand, especially in automotive, electronics, and logistics sectors. Cables used in robotic arms, automated guided vehicles (AGVs), and collaborative robots (cobots) will require enhanced flexibility, durability, and EMI shielding.

2. Expansion in Renewable Energy and EV Infrastructure

The transition to clean energy and the mass adoption of electric vehicles (EVs) are key drivers for flexible cable demand. In wind turbines, flexible cables are used in pitch and yaw systems requiring constant movement. Similarly, EV charging infrastructure requires durable, high-performance flexible cables capable of handling high currents and repeated plugging. By 2026, investments in offshore wind and fast-charging networks are expected to boost the market, particularly in Europe and North America.

3. Technological Advancements and Material Innovation

Manufacturers are focusing on next-generation materials such as thermoplastic elastomers (TPE), silicone rubber, and halogen-free compounds to improve flexibility, flame resistance, and environmental performance. By 2026, we anticipate wider adoption of smart cables embedded with sensors for predictive maintenance and real-time monitoring, enhancing reliability in critical applications.

4. Growth in Asia-Pacific Markets

Asia-Pacific, led by China, India, and Southeast Asian nations, will remain a key growth engine due to rapid industrialization, government support for manufacturing, and expanding infrastructure projects. Local production of electronics, EVs, and industrial machinery will drive regional demand for high-quality flexible cables, encouraging global players to establish local partnerships and manufacturing hubs.

5. Sustainability and Regulatory Pressures

Environmental regulations, such as the EU’s Green Deal and RoHS compliance, are pushing manufacturers toward eco-friendly, recyclable, and halogen-free cable solutions. By 2026, sustainable sourcing of raw materials and circular economy practices will become competitive differentiators. Demand for cables with longer lifespans and reduced environmental impact will rise across all sectors.

6. Supply Chain Resilience and Localization

Geopolitical tensions and post-pandemic disruptions have prompted companies to reevaluate global supply chains. By 2026, there will be a continued trend toward regionalization and nearshoring of cable production, especially in North America and Europe, to ensure reliability and reduce lead times.

Conclusion

The H2 2026 outlook for the flexible cable market is robust, with growth fueled by digital transformation, clean energy transition, and advanced manufacturing. Companies that invest in innovation, sustainability, and supply chain agility are best positioned to capitalize on emerging opportunities. As applications become more demanding and connected, flexible cables will evolve from passive components into intelligent, integral parts of next-generation systems.

Common Pitfalls Sourcing Cable Flexible (Quality, IP)

Sourcing flexible cables—especially for industrial, automation, or high-performance applications—requires careful attention to both quality and Ingress Protection (IP) ratings. Overlooking key aspects can lead to premature failures, safety hazards, and costly downtime. Below are common pitfalls to avoid:

Inadequate Assessment of Flex Life and Mechanical Durability

Flexible cables are designed for repeated movement, but not all cables are created equal. A common mistake is selecting a cable based solely on price or basic specifications without verifying its rated flex life (e.g., number of bending cycles). Using standard fixed cables in dynamic applications leads to conductor breakage, shielding failure, or jacket cracking.

Ignoring Environmental and IP Rating Requirements

Many buyers assume a flexible cable is inherently protected against dust and moisture. However, IP ratings (e.g., IP65, IP67, IP69K) must be explicitly verified. Using a cable with insufficient IP protection in wet, dusty, or washdown environments can result in short circuits, corrosion, or contamination ingress—especially at connection points or cable glands.

Overlooking Material Compatibility

The cable jacket material (e.g., PUR, PVC, TPE) must be suitable for the operating environment. For example, PUR offers excellent oil, UV, and abrasion resistance, while PVC degrades faster in industrial settings. Selecting the wrong material leads to jacket cracking, reduced flexibility, and compromised protection.

Assuming All “Flexible” Cables Meet Industry Standards

Not all suppliers adhere to recognized standards such as UL, CE, or TÜV. Some low-cost cables may claim flexibility or IP ratings without third-party testing or certification. This creates risks in safety compliance and long-term reliability, especially in regulated industries.

Poor Attention to Shielding and EMC Performance

In environments with high electromagnetic interference (EMI), inadequate shielding (e.g., insufficient braid coverage or lack of foil shielding) can disrupt signal integrity. Flexible cables subjected to constant movement may suffer from shield fatigue, so robust EMC design is essential.

Mismatched Cable Construction for Application Type

Using the wrong type of flexible cable—such as torsion-unrated cables in robotic arms or continuous rotation applications—can lead to internal damage. Cables must be matched to the specific motion profile: linear, torsional, or multidirectional.

Underestimating the Importance of Supplier Qualification

Sourcing from unverified suppliers or gray-market distributors increases the risk of counterfeit or substandard products. Reliable suppliers provide traceability, test reports, and technical support—critical when troubleshooting field failures or validating IP claims.

Neglecting Installation and Bending Radius Specifications

Even high-quality flexible cables fail prematurely if installed with too tight a bend radius or excessive tension. Buyers and installers must follow manufacturer guidelines to maintain IP integrity and mechanical performance.

Avoiding these pitfalls requires due diligence in specification, supplier selection, and application analysis. Always validate claims with documentation and, when possible, conduct real-world testing before full-scale deployment.

Logistics & Compliance Guide for Cable Flexible

This guide outlines the essential logistics considerations and compliance requirements for the handling, transportation, storage, and regulatory adherence of Cable Flexible products. Adherence ensures product integrity, safety, and legal conformity across global supply chains.

Product Overview

Cable Flexible refers to a category of highly durable, bendable electrical cables designed for dynamic applications involving constant movement, such as robotics, automated machinery, and industrial equipment. These cables are engineered to withstand torsion, flexing, and environmental stressors. Common types include data, power, and hybrid cables, often featuring specialized insulation (e.g., PUR, PVC), shielding, and jacketing.

Regulatory Compliance

Compliance with international and regional standards is mandatory for market access and safe operation. Key regulations include:

-

CE Marking (EU): Required for all electrical equipment placed on the European market. Cable Flexible must comply with the Low Voltage Directive (2014/35/EU) and the Electromagnetic Compatibility Directive (2014/30/EU). Flame retardancy and halogen-free properties may require additional assessments under CPR (Construction Products Regulation) for fixed installations.

-

RoHS (EU): Restriction of Hazardous Substances Directive limits the use of lead, mercury, cadmium, and other substances. Ensure material declarations confirm compliance with RoHS 2 (2011/65/EU).

-

REACH (EU): Registration, Evaluation, Authorisation and Restriction of Chemicals. Suppliers must provide SVHC (Substances of Very High Concern) information if concentrations exceed 0.1%.

-

UL/CSA (North America): Cables must be listed by a Nationally Recognized Testing Laboratory (NRTL) such as UL or CSA. Common standards include UL 62, UL 44, and CSA C22.2 No. 21. Flame ratings (e.g., CM, CMX, CMR) and temperature classes must be clearly marked.

-

IEC Standards (International): IEC 60227 and IEC 60245 define performance and testing for flexible cables. IEC 60332 covers flame propagation testing.

-

Country-Specific Requirements:

- UKCA (UK): Post-Brexit marking for Great Britain.

- CCC (China): Compulsory Certification for select cable types.

- PSE (Japan): Required for certain electrical products under DENAN law.

Ensure certificates of conformity (CoC), test reports, and technical documentation are maintained and available upon request.

Packaging & Labeling

Proper packaging and labeling are crucial for traceability and regulatory compliance.

-

Primary Packaging: Use non-reactive materials (e.g., polyethylene wraps) to prevent surface damage. Spooled cables must be secured to prevent unwinding.

-

Secondary Packaging: Use sturdy, moisture-resistant cartons or reels. Include desiccants if shipping to humid climates. Reels must meet drop-test standards.

-

Labeling Requirements:

- Manufacturer name and address

- Product identification (type, gauge, voltage rating)

- Compliance marks (CE, UL, RoHS, etc.)

- Batch/lot number and manufacturing date

- Length (in meters or feet)

- Direction of unwinding (if applicable)

- Handling symbols (e.g., “Do Not Drop,” “Protect from Moisture”)

Labels must be durable and legible throughout the distribution cycle.

Storage Conditions

Maintain cable integrity through appropriate storage:

- Temperature: Store between -10°C and +50°C. Avoid extreme heat or freezing conditions.

- Humidity: Relative humidity should not exceed 75% to prevent jacket degradation and conductor oxidation.

- Light Exposure: Shield from direct sunlight and UV radiation to prevent jacket cracking.

- Positioning: Store spools vertically on flat, level surfaces. Never stack spools unless designed for it.

- Shelf Life: While cables have long shelf lives, inspect for brittleness or deformation after extended storage (>5 years). Follow manufacturer recommendations.

Transportation & Handling

Safe handling minimizes mechanical damage and ensures compliance with carrier regulations.

- Loading/Unloading: Use appropriate equipment (e.g., forklifts with reel clamps). Never roll spools on their side.

- Transportation Modes:

- Road/Rail: Secure spools with straps or braces. Protect from vibration and moisture.

- Air: Comply with IATA regulations. No special restrictions unless batteries are integrated.

- Sea: Use moisture barriers and desiccants. Avoid saltwater exposure. Follow IMDG Code if applicable (rare for standalone cables).

- Minimum Bending Radius: Always observe the specified minimum bending radius during installation and transit to avoid internal damage.

- Tension Control: Avoid excessive pulling force; use tension monitoring devices during installation.

Documentation & Traceability

Complete and accurate documentation supports compliance and quality control.

- Required Documents:

- Commercial Invoice

- Packing List

- Bill of Lading / Air Waybill

- Certificate of Conformity (CoC)

- Material Safety Data Sheet (MSDS/SDS) – if requested

- Test Reports (e.g., flame, conductivity, flex life)

-

Origin Certificate (for tariff purposes)

-

Traceability: Maintain batch-level tracking from production to delivery. Implement a system to trace materials back to source and forward to end customer.

Environmental & Sustainability Compliance

Adhere to environmental regulations and sustainability goals:

- WEEE (EU): Producers must register and support recycling programs for electrical waste. Provide take-back information if applicable.

- End-of-Life Management: Design for recyclability. Use recyclable reel materials (e.g., wood, recyclable plastic).

- Carbon Reporting: Track and report logistics-related emissions where required (e.g., EU CSRD).

Quality Assurance & Audits

Regular audits ensure compliance and identify process improvements:

- Supplier Audits: Assess material sourcing and manufacturing compliance.

- Internal Audits: Review packaging, labeling, and storage practices quarterly.

- Customer Complaints: Investigate and document any non-conformities related to logistics or compliance.

Conclusion

Effective logistics and strict compliance are critical for the reliable distribution of Cable Flexible products. By following this guide, organizations can ensure regulatory adherence, product safety, and operational efficiency across global markets. Always consult the latest versions of applicable standards and local regulations prior to shipment.

Conclusion:

Sourcing flexible cables requires a strategic approach that balances quality, cost, durability, and application-specific requirements. It is essential to partner with reliable suppliers who adhere to international standards and provide consistent product performance. Factors such as material composition, temperature resistance, flexibility, shielding, and environmental conditions must be carefully evaluated to ensure optimal functionality and longevity. Conducting thorough supplier assessments, requesting samples, and performing regular quality checks are key steps in minimizing risks and avoiding operational disruptions. Ultimately, effective sourcing of flexible cables contributes to improved system reliability, reduced maintenance costs, and enhanced overall efficiency in industrial, automation, and electronic applications.