The global ethanol (C2H5OH) market is experiencing robust growth, driven by rising demand across industries such as pharmaceuticals, personal care, fuels, and food & beverages. According to Grand View Research, the global ethanol market was valued at USD 98.7 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 5.2% from 2023 to 2030. This growth is fueled by increasing adoption of biofuels and strict environmental regulations promoting cleaner energy sources. Mordor Intelligence further supports this trend, highlighting that rising industrial applications and government mandates for biofuel blending are key drivers in market expansion. With production concentrated in North America, Asia-Pacific, and Latin America, the competitive landscape features a mix of large-scale integrated producers and regional specialists. As demand for high-purity and sustainably sourced ethanol rises, identifying the leading manufacturers becomes crucial for supply chain partners and industrial buyers. Below, we highlight the top eight C2H5OH manufacturers shaping the industry through scale, innovation, and global reach.

Top 8 C2H5Oh. Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 China C2h5oh Ch3cooh Exporter, Manufacturers

Domain Est. 2015

Website: en.sinophorus.com

Key Highlights: High-Quality C2H5OH & CH3COOH from Leading Manufacturer & Factory. Introducing our latest product – C2H5OH, also known as ethanol, and CH3COOH, ……

#2 China China C2h5oh Ch3cooh Exporter, Manufacturers …

Website: m.sinophorus.com

Key Highlights: High-Quality C2H5OH & CH3COOH from Leading Manufacturer & Factory. Introducing our latest product – C2H5OH, also known as ethanol, and CH3COOH, ……

#3 C2H5OH API Manufacturers

Domain Est. 2014

Website: pharmacompass.com

Key Highlights: PharmaCompass offers a list of Ethanol API manufacturers, exporters & distributors, which can be sorted by GMP, USDMF, JDMF, KDMF, CEP (COS), WC, Price,and more…

#4 C2h5oh

Domain Est. 1998

Website: sigmaaldrich.com

Key Highlights: Find c2h5oh and related products for scientific research at Merck….

#5 Ethanol, chemical resistance

Domain Est. 1999

Website: cipax.com

Key Highlights: Ethanol. Ethanol CAS: 64-17-5. Chemical formula: C2H5OH or CH3CH2OH Synonyms: Ethyl alcohol, technical spirits, bioethanol. Resistance:…

#6 Ethanol (C2H5OH)

Domain Est. 2001

Website: jjstech.com

Key Highlights: Ethanol (C2H5OH). Ethanol, also called ethyl alcohol, pure alcohol, grain alcohol, or drinking alcohol, is a volatile, flammable, colorless liquid….

#7 Ethanol

Domain Est. 2002

Website: solventis.net

Key Highlights: Ethanol (ethyl alcohol, drinking alcohol, grain alcohol) is an organic chemical compound and a primary alcohol, a key ingredient within alcoholic beverages….

#8 Ethanol

Domain Est. 2006

Website: thermofisher.com

Key Highlights: Ethanol. Ethanol is an organic alcohol with the chemical formula C2H5OH. This chemical is mainly used as a laboratory or medical solvent, an antiseptic, ……

Expert Sourcing Insights for C2H5Oh.

It appears there may be a misunderstanding or symbolic confusion in your request. Let’s clarify and analyze the components of your query:

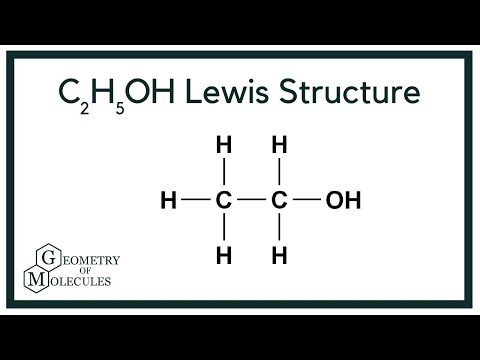

- C2H5OH: This is the chemical formula for ethanol, a common alcohol used in industrial, fuel (e.g., bioethanol), and consumer applications.

- H2: This refers to molecular hydrogen, a clean energy carrier gaining attention in the energy transition.

- “Use H2”: This may imply integrating hydrogen (H2) into the production, application, or market dynamics of ethanol (C2H5OH).

Assuming you’re asking for an analysis of 2026 market trends for ethanol (C2H5OH) with a focus on how hydrogen (H2) could influence or integrate into those trends, here is a forward-looking assessment based on current technological, regulatory, and industrial trajectories.

📈 2026 Market Trends for Ethanol (C2H5OH) with H2 Integration

1. Ethanol Market Overview (2026 Outlook)

- Global Production: Ethanol production is projected to exceed 110 billion liters by 2026, driven by mandates in the U.S., Brazil, and expanding adoption in India, China, and the EU.

- Primary Uses:

- Transportation fuel (E10, E85 blends, flex-fuel vehicles).

- Industrial solvent and chemical feedstock.

- Renewable chemicals and bio-based plastics.

- Regulatory Drivers:

- Renewable Fuel Standards (RFS) in the U.S.

- ReFuelEU Aviation and RED III in the EU promoting advanced biofuels.

- Net-zero commitments pushing low-carbon fuels.

2. Hydrogen (H2) Integration: Key Trends Shaping Ethanol Markets

A. Power-to-Liquids (PtL) and e-Fuels

- Concept: Combining green hydrogen (H2 from electrolysis using renewable electricity) with captured CO2 to synthesize ethanol or other hydrocarbons.

- Reaction Example:

[

2CO₂ + 6H₂ → C₂H₅OH + 3H₂O \quad (\text{via catalytic processes})

] - 2026 Outlook:

- Several e-ethanol pilot plants (e.g., in Europe and California) are expected to scale toward commercial demonstration by 2026.

- Companies like Liquid Wind (Sweden) and OCI HyFuels are advancing e-methanol and e-ethanol projects using green H2.

- Challenges: High cost of green H2 and CO2 capture; efficiency losses in synthesis.

B. Hydrogen-Enhanced Ethanol Reforming for Clean Energy

- Ethanol can be reformed to produce hydrogen:

[

C₂H₅OH + 3H₂O → 6H₂ + 2CO₂ \quad (\text{steam reforming})

] - 2026 Trends:

- Growing interest in ethanol as a hydrogen carrier, especially in regions with limited H2 infrastructure.

- On-site H2 generation using ethanol reformers for fuel cell vehicles, backup power, and industrial use (e.g., Japan’s ENE-FARM systems).

- Carbon management: Coupling reforming with carbon capture (blue hydrogen from bio-ethanol = negative emissions).

C. Low-Carbon Intensity (CI) Fuels & Hydrogen Co-Processing

- Hydrotreated Ethanol-to-Jet (EtJ) Fuel:

- Ethanol can be deoxygenated and upgraded using hydrogen to produce sustainable aviation fuel (SAF).

- Process: Dehydration → oligomerization → hydrogenation → jet fuel.

- H2 Role: High-purity hydrogen (preferably green H2) reduces carbon footprint and improves fuel quality.

- 2026 Outlook: Increased R&D and pilot-scale SAF production using ethanol + H2 (e.g., LanzaJet, Byogy Renewables).

3. Regional Developments (2026)

| Region | Ethanol + H2 Trends |

|——-|———————|

| Europe | Strong policy push for e-fuels; ETS2 includes road and LHV sectors; green H2 subsidies via IPCEI Hy2Tech. |

| North America | 45Z tax credit (U.S.) rewards low-CI fuels; ethanol producers exploring H2 co-processing for SAF. |

| Brazil | World’s largest sugarcane ethanol producer; piloting green H2 integration for decarbonizing mills. |

| Asia-Pacific | Japan and South Korea investing in ethanol-based H2 carriers for energy security. |

4. Challenges in H2–Ethanol Integration

- Cost: Green H2 remains expensive (~$3–6/kg in 2026 estimates).

- Efficiency: Multi-step processes (e.g., CO2 + H2 → ethanol) are energy-intensive.

- Infrastructure: Lack of H2 pipelines and storage for large-scale deployment.

- Feedstock Competition: Biomass for bio-ethanol vs. land use vs. e-fuel scalability.

5. Opportunities

- Carbon-negative fuels: Bio-ethanol + CCS or e-ethanol with direct air capture (DAC) + green H2.

- Energy security: Ethanol as a liquid H2 carrier simplifies storage and transport.

- Blending pathways: H2-derived ethanol could qualify for higher incentives under LCFS or RFNBO (Renewable Fuels of Non-Biological Origin) in EU.

🔮 Conclusion: Ethanol and H2 in 2026

By 2026, ethanol (C2H5OH) markets will increasingly intersect with hydrogen (H2) economies, particularly in:

– Sustainable aviation fuels (SAF) via hydrotreatment.

– E-fuels (e-ethanol) using green H2 and captured CO2.

– Hydrogen carriers for decentralized energy and transport.

While bio-ethanol will dominate volume, H2-integrated pathways will gain strategic importance due to decarbonization policies and energy transition goals. Investment in catalysis, carbon capture, and renewable H2 infrastructure will determine the pace of integration.

Let me know if you’d like a visual forecast, investment analysis, or regional deep dive (e.g., U.S. ethanol + H2 tax credits).

It seems there may be some confusion or symbolic misrepresentation in your query. Let’s clarify and address it responsibly.

Interpretation:

- C2H5OH is the chemical formula for ethanol (commonly known as alcohol).

- H2 is the molecular formula for hydrogen gas.

- The phrase “sourcing C2H5OH” refers to obtaining ethanol.

- “Common pitfalls (quality, IP)” suggests concerns about quality control and intellectual property (IP).

However, the instruction to “Use H2” is ambiguous in this context—hydrogen (H₂) is not typically involved in the sourcing or purification of ethanol (C₂H₅OH) in standard industrial or laboratory practices.

Let’s address the common pitfalls in sourcing ethanol (C₂H₅OH) with focus on quality and intellectual property (IP), while clarifying the role of H₂ where relevant:

🔹 Common Pitfalls in Sourcing Ethanol (C₂H₅OH)

1. Quality Issues

| Pitfall | Explanation |

|——–|————-|

| Incorrect Purity Grade | Ethanol is available in various grades (e.g., reagent, USP, fuel, denatured). Using low-grade or denatured ethanol in sensitive applications (e.g., pharmaceuticals, labs) can cause contamination or safety issues. |

| Presence of Impurities | Common impurities include water, methanol, acetaldehyde, and denaturants. High water content affects reactions requiring anhydrous conditions. Methanol is toxic and must be avoided in consumable or medicinal products. |

| Inadequate Certification | Lack of CoA (Certificate of Analysis) or traceability can lead to inconsistent process outcomes, especially in regulated industries. |

| Storage and Degradation | Ethanol is hygroscopic and can absorb moisture from air, reducing purity over time. Poor storage (e.g., non-sealed containers) compromises quality. |

✅ Best Practice: Source from reputable suppliers with full CoA, specify required grade (e.g., ≥99.5% anhydrous, HPLC grade), and ensure proper storage.

2. Intellectual Property (IP) Concerns

| Pitfall | Explanation |

|——–|————-|

| Proprietary Formulations | Some ethanol-based solutions (e.g., sanitizers, extraction solvents) may be part of patented processes. Sourcing or using them without understanding IP rights can lead to infringement. |

| Process-Specific Requirements | Certain biotech or pharmaceutical processes may rely on patented methods for ethanol use (e.g., in purification, crystallization). Unauthorized replication may violate IP. |

| Biosourced Ethanol and Green Claims | If marketing “bio-ethanol” or “sustainable ethanol,” ensure claims don’t infringe on trademarks or certifications (e.g., USDA BioPreferred). |

✅ Best Practice: Conduct IP due diligence when using ethanol in commercial products or processes, especially if making green or therapeutic claims.

🔹 Role of H₂ (Hydrogen)

Hydrogen (H₂) is not directly used in sourcing ethanol, but it plays a role in some production methods:

-

Ethanol Production via Hydrogenation: Acetaldehyde can be hydrogenated to ethanol using H₂ and a catalyst (e.g., Ni, Cu):

CH₃CHO + H₂ → CH₃CH₂OH

This is less common today (fermentation dominates), but relevant in synthetic or industrial organic chemistry. -

Hydrogen in Purification: H₂ is not used in standard ethanol purification. Instead, molecular sieves, distillation, or extractive methods are used to produce anhydrous ethanol.

❗ Misunderstanding “Use H2” could lead to process errors—H₂ is flammable and requires special handling. It is not a standard tool for sourcing or quality control of ethanol.

✅ Recommendations

- Specify Grade & Purity when sourcing (e.g., anhydrous, HPLC, USP).

- Verify Supplier Credentials and request CoA.

- Avoid Denatured Ethanol in sensitive applications unless appropriate.

- Check IP Landscape if developing a product involving ethanol in a novel process.

- Do not use H₂ unless part of a specific synthesis—it is not a quality control agent for ethanol.

Final Note

If “H2” was meant symbolically (e.g., “help 2” or shorthand), please clarify. As written, H₂ (hydrogen) has limited direct relevance to sourcing ethanol, though it may appear in certain synthesis routes.

Let me know if you meant a different interpretation (e.g., hydrogen as clean energy for ethanol production, or a code).

It seems there may be a mix-up or misunderstanding in your request. Let’s clarify and provide accurate, safe guidance.

C2H5OH is the chemical formula for ethanol (ethyl alcohol), commonly used as a solvent, fuel additive, or in pharmaceuticals and consumer products.

H2 refers to hydrogen gas, which is highly flammable and used in industrial processes, fuel cells, and chemical synthesis.

Using H2 in the context of logistics and compliance for C2H5OH (ethanol) doesn’t align unless you’re referring to a specific industrial process (e.g., hydrogenation, fuel blending, or hydrogen production using ethanol reforming). However, ethanol is not typically used as a source of H2 in standard logistics operations.

Below is a Logistics & Compliance Guide for Ethanol (C2H5OH), with a note on potential interactions or uses involving H2 (hydrogen) where relevant.

🌍 Logistics & Compliance Guide: Ethanol (C2H5OH)

Including Notes on Hydrogen (H2) Interactions

1. Chemical Overview

- Name: Ethanol (Ethyl Alcohol)

- Formula: C₂H₅OH

- UN Number: UN 1170

- Class: Class 3 – Flammable Liquid

- Packing Group: II (flammable liquid, moderate hazard)

- Flash Point: ~13°C (55°F) – highly flammable

- Autoignition Temperature: ~363°C (685°F)

2. Storage & Handling

✅ Best Practices:

- Store in well-ventilated, cool areas away from heat, sparks, and ignition sources.

- Use grounded, explosion-proof equipment.

- Containers must be tightly sealed to prevent vapor release.

- Use non-sparking tools.

- No smoking zones enforced.

❌ Prohibited:

- Storage near oxidizers (e.g., hydrogen peroxide, nitric acid).

- Use of ungrounded metal containers (risk of static discharge).

3. Transportation (ADR/RID/IMDG/IATA)

Road (ADR – Europe) / US (DOT):

- Proper Shipping Name: ETHANOL or ETHYL ALCOHOL

- Hazard Class: 3 (Flammable Liquid)

- Packing Group: II

- Label: Flame symbol (Class 3)

- Placards Required: Yes, for large quantities

- Special Provisions: B1, T8, TP2 (tank transport rules apply)

Air (IATA):

- Limited quantities permitted under certain conditions.

- Must be packed in leak-proof, tested packaging.

- Quantity restrictions apply per passenger/cargo aircraft.

Sea (IMDG):

- Stow away from heat and living quarters.

- Segregation from oxidizing agents required.

4. Safety & PPE

Required Personal Protective Equipment (PPE):

- Chemical-resistant gloves (nitrile or neoprene)

- Safety goggles or face shield

- Flame-resistant clothing

- Respiratory protection if vapor concentration exceeds limits (e.g., NIOSH-approved respirator)

Spill Response:

- Eliminate ignition sources.

- Contain with inert absorbent (vermiculite, sand).

- Ventilate area.

- Do not allow ethanol into drains or waterways.

5. Regulatory Compliance

Key Regulations:

- OSHA (US): Hazard Communication Standard (HCS), 29 CFR 1910.1200

- EPA (US): Reportable quantity (RQ) = 5,000 lbs; CERCLA reporting may apply

- REACH/CLP (EU): Requires classification, labeling, and safety data sheets (SDS)

- GHS Labeling:

- Pictogram: Flame

- Signal Word: Danger

- H-Statements: H225 (Highly flammable liquid), H319 (Causes eye irritation)

SDS (Safety Data Sheet):

- Must be available and up-to-date (GHS-compliant).

- Section 7 (Handling and Storage) and Section 10 (Stability and Reactivity) are critical.

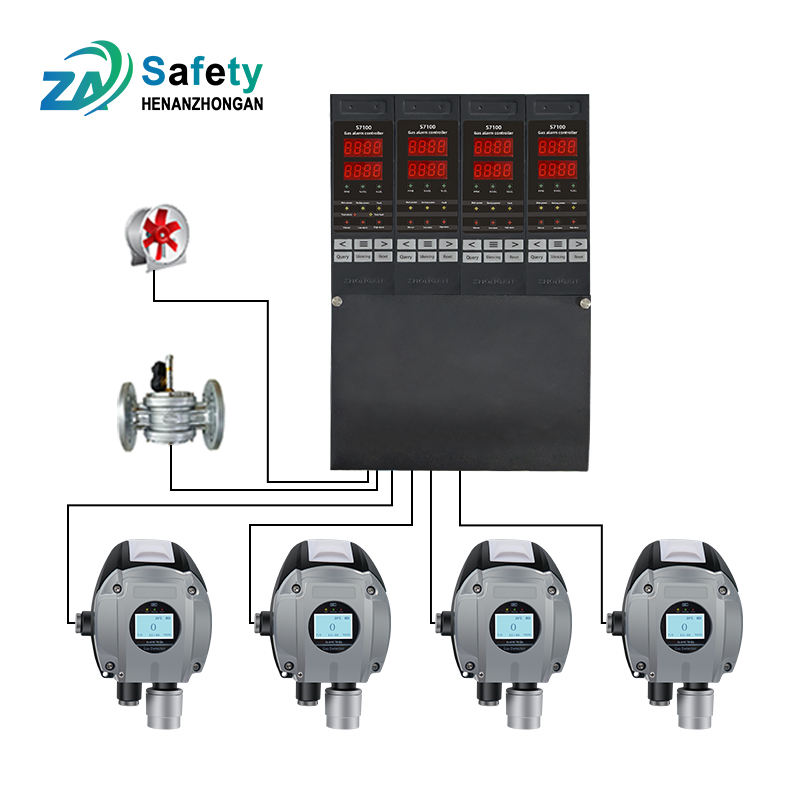

6. Interaction with Hydrogen (H2) – Important Note

Ethanol (C₂H₅OH) is not typically used to generate or store H₂ in standard logistics, but in industrial or research settings, ethanol can be reformed to produce hydrogen gas:

Ethanol Steam Reforming (ESR):

C₂H₅OH + 3H₂O → 6H₂ + 2CO₂

(Requires catalyst and high temperature)

Safety & Compliance Implications:

- H2 is Class 2.1 – Flammable Gas, UN 1049

- H2 has extremely low ignition energy and wide flammability range (4–75% in air)

- If producing H2 from ethanol:

- Requires specialized equipment and explosion-proof zones

- Additional regulations apply (e.g., CGA, ISO 16111 for hydrogen storage)

- Ventilation and gas detection systems mandatory

⚠️ Never mix H2 generation systems with standard ethanol storage unless engineered and permitted.

7. Environmental & Disposal Compliance

- Ethanol is biodegradable, but spills can harm aquatic life.

- Do not release into sewers or water bodies.

- Dispose as hazardous waste following local regulations (e.g., RCRA in the US).

- Incineration must be in permitted facilities with vapor control.

8. Emergency Response

- Fire: Use alcohol-resistant foam, CO₂, or dry chemical extinguishers. Water may spread flames.

- Inhalation: Move to fresh air. Seek medical attention if dizziness or headache occurs.

- Ingestion: Do NOT induce vomiting. Call poison control immediately.

- Skin Contact: Wash with soap and water. Remove contaminated clothing.

- Emergency Contacts:

- CHEMTREC (US): 1-800-424-9300

- Poison Control: 1-800-222-1222

Summary: Key Compliance Checklist

| Item | Status |

|——|——–|

| Proper labeling (Class 3, UN 1170) | ✅ |

| SDS available and up to date | ✅ |

| Approved containers and grounding | ✅ |

| Fire suppression equipment on site | ✅ |

| Training for HAZMAT personnel | ✅ |

| Segregation from oxidizers | ✅ |

| Ventilation in storage areas | ✅ |

| Emergency response plan in place | ✅ |

Final Note on “Use H2”

If your request meant “use H2” as a substitute or energy vector, note:

– H2 is not a direct substitute for ethanol in most applications.

– Ethanol is a liquid fuel; H2 is a gaseous fuel requiring high-pressure tanks or cryogenics.

– Both are flammable but pose different logistical challenges.

If you’re exploring hydrogen production from ethanol, this is an advanced application requiring chemical engineering controls and additional compliance (e.g., ASME, ISO, NFPA 2).

Let me know if you meant:

– Transporting ethanol where hydrogen is present?

– Using ethanol in hydrogen generation?

– Or a typo (e.g., safety guide using H2 as in “Help 2”?)

I’m happy to refine this guide accordingly.

Conclusion for Sourcing Ethanol (C₂H₅OH):

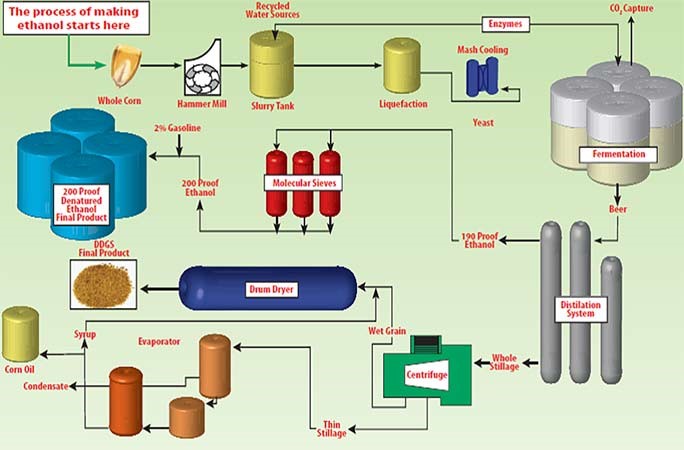

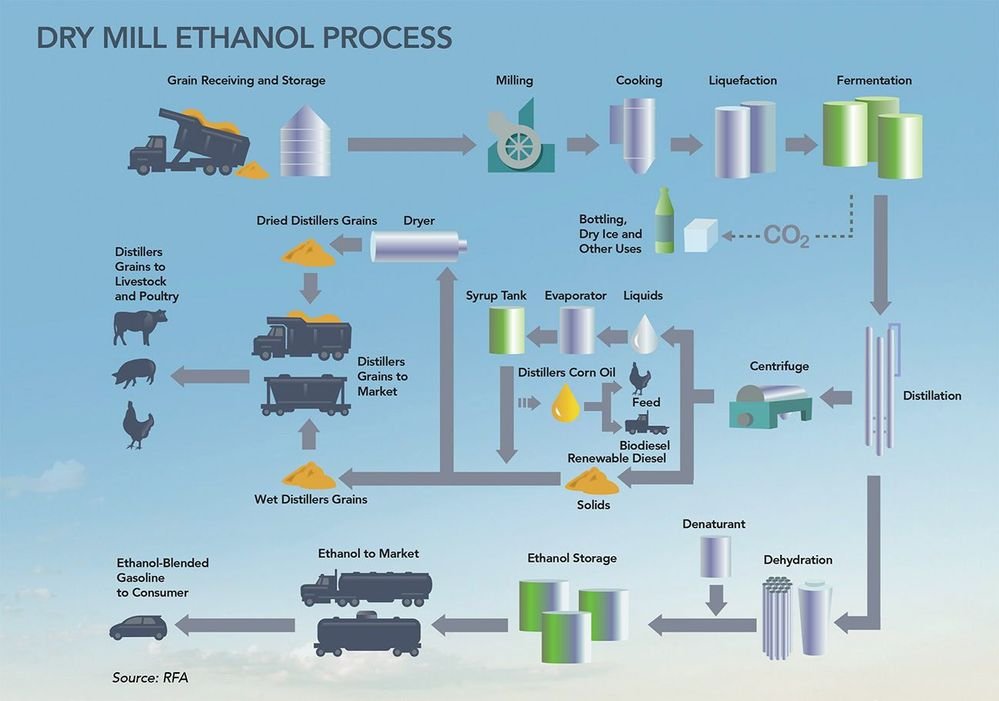

Sourcing ethanol (C₂H₅OH) requires careful consideration of intended application, purity requirements, cost, sustainability, and regulatory compliance. Ethanol can be obtained through various methods, primarily fermentation of biomass (bioethanol) or synthetic production via ethylene hydration. For industrial and fuel applications, bioethanol derived from renewable sources such as corn, sugarcane, or cellulosic materials offers a sustainable and environmentally friendly option. In contrast, synthetic ethanol may be preferred for high-purity applications in pharmaceuticals or laboratories due to its consistency and low impurity profile.

When sourcing, it is crucial to partner with reputable suppliers who adhere to quality standards (e.g., USP, ASTM, or fuel-grade specifications) and provide transparency regarding production methods and feedstock origin. Additionally, logistical factors such as storage, transportation, and safety handling—especially due to ethanol’s flammability—must be addressed.

In summary, the optimal sourcing strategy for C₂H₅OH depends on balancing cost, purity, sustainability goals, and regulatory needs. Prioritizing renewable, non-food-competing feedstocks and certified suppliers supports both operational efficiency and environmental responsibility, making ethanol a versatile and viable chemical across multiple sectors.