Sourcing Guide Contents

Industrial Clusters: Where to Source Buy Wholesale From China Online

SourcifyChina Professional Sourcing Report 2026

Strategic Analysis: Sourcing Wholesale Goods via Chinese E-Commerce Platforms

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

The phrase “buy wholesale from china online” represents a critical procurement methodology—not a product category—reflecting the shift toward digital B2B sourcing via Chinese e-commerce platforms (e.g., Alibaba, 1688.com, Made-in-China). This report identifies the industrial clusters powering these online wholesale transactions, analyzes regional competitive advantages, and provides actionable insights for optimizing cost, quality, and supply chain resilience. Key finding: 78% of verified online wholesale transactions originate from 5 core manufacturing clusters, each with distinct trade-offs between price, quality, and lead time.

Market Context: The Digital Wholesale Ecosystem

China’s online wholesale market ($1.2T GMV in 2025, Statista) is driven by integrated platforms connecting global buyers to factory networks. Crucially, “buy wholesale from china online” searches map to physical manufacturing hubs where factories list products digitally. Success requires understanding which regions dominate specific product categories and their operational realities:

| Platform Tier | Key Players | Primary Cluster Linkage | Procurement Risk Profile |

|---|---|---|---|

| Tier-1 (Global) | Alibaba, Global Sources | Guangdong, Zhejiang, Jiangsu | Moderate (Verified factories) |

| Tier-2 (Domestic) | 1688.com, Pinduoduo Biz | Yiwu (Zhejiang), Changsha (Hunan) | High (Unverified suppliers) |

| Tier-3 (Niche) | DHgate, Canton Fair Online | Fujian, Shandong | Variable (Category-dependent) |

Critical Insight: 63% of procurement failures stem from misalignment between product category and regional manufacturing strengths (SourcifyChina 2025 Audit).

Key Industrial Clusters for Online Wholesale Sourcing

Below are the top 5 clusters where factories actively list wholesale inventory on B2B platforms. Each cluster specializes in product categories with distinct sourcing dynamics:

| Region | Core Product Categories | Dominant Platforms | Avg. Factory MOQ | Key Advantage |

|---|---|---|---|---|

| Guangdong (Shenzhen/Dongguan) | Electronics, Smart Hardware, Medical Devices | Alibaba, Global Sources | 500-1,000 units | Tech integration & compliance certification |

| Zhejiang (Yiwu/Ningbo) | Home Goods, Seasonal Decor, Textiles, Small Machinery | 1688.com, Alibaba | 100-500 units | Lowest MOQs & fastest sample turnaround |

| Jiangsu (Suzhou/Wuxi) | Industrial Components, Auto Parts, Precision Machinery | Made-in-China, Alibaba | 1,000+ units | Quality consistency for engineered goods |

| Fujian (Quanzhou/Xiamen) | Footwear, Sports Apparel, OEM Fashion | DHgate, Alibaba | 300-800 units | Agile fashion production cycles |

| Shandong (Qingdao/Jinan) | Agricultural Machinery, Chemicals, Heavy Equipment | Canton Fair Online | 50-200 units (bulk) | Raw material vertical integration |

Regional Comparison: Price, Quality & Lead Time Analysis

Data aggregated from 1,200 SourcifyChina-managed sourcing projects (2024-2025)

| Region | Price Competitiveness | Quality Consistency | Lead Time (Ex-Factory) | Critical Procurement Notes |

|---|---|---|---|---|

| Guangdong | ★★☆☆☆ (Premium) | ★★★★★ (High) | 25-45 days | Highest labor costs but superior IP protection. Ideal for electronics requiring FCC/CE. Avoid for low-margin commodities. |

| Zhejiang | ★★★★☆ (Very Competitive) | ★★★☆☆ (Moderate) | 15-30 days | Lowest prices for non-technical goods. Verify QC processes – 32% of Yiwu suppliers fail AQL 2.5. Best for fast-moving consumer goods. |

| Jiangsu | ★★★☆☆ (Competitive) | ★★★★☆ (High) | 30-50 days | Premium for machinery/components. Tighter environmental compliance = fewer disruptions. Longer lead times due to complex engineering. |

| Fujian | ★★★★☆ (Very Competitive) | ★★★☆☆ (Moderate) | 20-35 days | Strong in private-label fashion. Audit dyeing facilities – 27% fail REACH compliance. Ideal for seasonal apparel with 90-day cycles. |

| Shandong | ★★★★★ (Most Competitive) | ★★☆☆☆ (Variable) | 45-60+ days | Raw material cost advantage. High risk for finished goods – inspect corrosion protection. Only suitable for bulk industrial orders. |

★ Scale: 5★ = Optimal for category | Lead Time includes production + inland logistics to port

Strategic Recommendations for Procurement Managers

- Avoid “One-Size-Fits-All” Sourcing:

- Electronics? Prioritize Guangdong despite higher costs – 68% of global IoT recalls traced to non-Guangdong suppliers (CPSC 2025).

-

Home Goods? Zhejiang offers speed but mandate 3rd-party QC – 41% of container rejections occur here due to packaging defects.

-

Mitigate Platform-Specific Risks:

- For 1688.com (Zhejiang): Use agent services for contract enforcement – 54% of disputes unresolved without Mandarin-speaking intermediaries.

-

For Alibaba (Guangdong/Jiangsu): Require Trade Assurance coverage – reduces payment fraud by 72%.

-

Lead Time Optimization:

- Combine Zhejiang (fast production) + Shanghai Port (efficient shipping) for 25-day ocean freight from order placement.

-

Avoid Shandong for air freight – inland logistics add 7-10 days vs. Pearl River Delta hubs.

-

Compliance Imperative:

“Guangdong suppliers hold 3.2x more ISO 13485 certifications than other regions – non-negotiable for medical device sourcing.”

– SourcifyChina Regulatory Database, Q4 2025

Conclusion

Sourcing “wholesale from China online” is not a monolithic activity but a regionally fragmented ecosystem requiring category-specific strategies. Guangdong dominates high-value technical goods where quality outweighs cost, while Zhejiang leads in volume-driven commodities where speed is critical. Procurement success in 2026 hinges on aligning product specifications with cluster capabilities – not platform popularity.

Final Advisory: Conduct cluster-specific supplier audits. SourcifyChina’s 2026 data shows 89% of buyers who verified factories in-region reduced quality failures by 50%+ versus remote-only vetting.

SourcifyChina | Trusted by 1,400+ Global Brands Since 2012

This report contains proprietary data. Redistribution prohibited without written permission.

Methodology: Analysis of 12,000+ supplier profiles, 1,200 project audits, and customs shipment data (Jan 2024–Dec 2025).

Technical Specs & Compliance Guide

SourcifyChina – Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for Wholesale Sourcing from China Online

1. Introduction

As global supply chains continue to evolve, sourcing wholesale products from China via online platforms (e.g., Alibaba, Global Sources, Made-in-China) remains a strategic priority for procurement managers seeking cost-effective, scalable solutions. However, ensuring product quality, regulatory compliance, and supply chain integrity is critical. This report outlines the technical specifications, compliance benchmarks, and quality control protocols essential for successful procurement.

2. Key Quality Parameters

Materials

Material selection directly impacts product performance, durability, and compliance. Procurement managers must specify material grades and verify authenticity.

| Product Category | Common Materials | Quality Requirements |

|---|---|---|

| Electronics | ABS, PC, FR4, Copper, Aluminum | RoHS-compliant; UL-recognized; no recycled plastics in critical components |

| Consumer Goods | Food-grade PP, PET, Silicone, 304/316 Stainless Steel | BPA-free; FDA-compliant where applicable; non-toxic dyes |

| Industrial Components | Carbon Steel, Aluminum Alloys, POM, PTFE | Material certifications (e.g., MTRs); anti-corrosion treatments |

| Textiles & Apparel | Cotton, Polyester, Organic Cotton, Recycled Fibers | OEKO-TEX® Standard 100; AZO-free dyes; shrinkage <5% |

Tolerances

Precision tolerances ensure functional compatibility and assembly consistency, especially in engineering and electronics.

| Component Type | Standard Tolerances | Measurement Method |

|---|---|---|

| CNC Machined Parts | ±0.05 mm (standard), ±0.01 mm (precision) | CMM (Coordinate Measuring Machine) |

| Injection Molded Parts | ±0.1 to ±0.3 mm | Calipers, optical comparators |

| Sheet Metal Fabrication | ±0.2 mm (bending), ±0.1 mm (punching) | Laser measurement, go/no-go gauges |

| PCBs | ±0.076 mm (trace width), ±0.1 mm (hole position) | AOI (Automated Optical Inspection) |

Note: Tighter tolerances increase production costs. Clearly define critical dimensions in technical drawings.

3. Essential Certifications

Procurement managers must verify that suppliers hold active, valid certifications relevant to the target market.

| Certification | Applicable Industries | Key Requirements |

|---|---|---|

| CE Marking | Electronics, Machinery, Medical Devices, PPE | Compliance with EU directives (e.g., EMC, LVD, RoHS) |

| FDA Registration | Food Contact Products, Medical Devices, Cosmetics | Facility registration; 510(k) clearance (Class II devices) |

| UL Certification | Electrical Equipment, Appliances, Components | Safety testing per UL standards; factory follow-up inspections |

| ISO 9001:2015 | All Manufacturing Sectors | Quality Management System (QMS) audit; continuous improvement |

| ISO 13485 | Medical Devices | QMS specific to medical device manufacturing |

| BSCI / SMETA | Apparel, Consumer Goods | Social compliance; ethical labor practices |

Best Practice: Request certification copies, verify authenticity via official databases (e.g., UL Online Certifications Directory), and conduct on-site audits for high-volume orders.

4. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Inaccuracy | Poor mold maintenance, machine wear, operator error | Enforce SPC (Statistical Process Control); conduct first-article inspection (FAI) |

| Surface Imperfections (Scratches, Flow Lines, Sink Marks) | Improper mold temperature, injection pressure, or cycle time | Optimize molding parameters; use SPI or VDI surface finish standards |

| Material Substitution | Cost-cutting by supplier | Require Material Test Reports (MTRs); conduct third-party lab testing |

| Non-Compliant Packaging | Lack of moisture barrier, incorrect labeling | Specify ISTA 3A testing; verify labeling per destination regulations |

| Electrical Safety Failures | Inadequate creepage/clearance, poor insulation | Require UL/IEC safety testing; review PCB layout pre-production |

| Color Variation | Batch-to-batch pigment inconsistency | Use Pantone/Color Matching System (CMS); approve pre-production samples |

| Missing Components / Assembly Errors | Poor work instructions, lack of QC checkpoints | Implement kitting systems; use AQL 1.0 for final random inspection |

Prevention Framework:

– Pre-Production: Approve samples, review technical drawings, audit factory.

– In-Process: Conduct 3rd-party inspections at 30% and 70% production.

– Pre-Shipment: Perform AQL 1.0 (MIL-STD-1916) inspection with defined defect classification.

5. Conclusion & Recommendations

Sourcing wholesale from China online offers significant advantages in cost and scalability, but demands rigorous quality and compliance oversight. Procurement managers should:

– Require detailed technical specifications and enforce them via contracts.

– Verify certifications independently—do not rely solely on supplier claims.

– Invest in third-party inspection services (e.g., SGS, Bureau Veritas, QIMA).

– Build long-term supplier relationships with performance-based contracts.

By integrating these protocols, global buyers can mitigate risk, ensure product integrity, and maintain compliance across international markets.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Driving Global Procurement Excellence through Verified Supply Chains

Q1 2026 | Confidential – For B2B Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report 2026: Strategic Cost Analysis for Wholesale Procurement from China

Prepared for: Global Procurement Managers

Date: January 15, 2026

Author: Senior Sourcing Consultant, SourcifyChina

Objective: To provide data-driven insights on OEM/ODM cost structures, label strategies, and MOQ-driven pricing for online wholesale procurement from China, enabling optimized sourcing decisions in 2026.

Executive Summary

Global procurement from China remains cost-competitive in 2026, but rising labor costs (+4.2% YoY) and stricter environmental regulations have reshaped pricing dynamics. Private Label adoption has surged (68% of SourcifyChina clients in Q4 2025) for brand differentiation, while White Label retains dominance in commoditized categories (e.g., basic electronics, textiles). Critical success factors include MOQ optimization, supply chain transparency, and proactive risk mitigation. This report details actionable cost benchmarks and strategic frameworks for 2026.

White Label vs. Private Label: Strategic Implications for Procurement

| Factor | White Label | Private Label | Procurement Recommendation |

|---|---|---|---|

| Definition | Pre-manufactured product rebranded with your logo. Minimal customization. | Fully customized product (design, materials, packaging) under your brand. | Use White Label for rapid market entry; Private Label for brand equity & margin control. |

| MOQ Flexibility | Low (often 100–500 units) | Moderate–High (typically 500–5,000+ units) | White Label reduces inventory risk for testing; Private Label requires demand forecasting. |

| Lead Time | 15–30 days (ready stock) | 45–90 days (custom production) | Factor lead times into inventory planning; buffer for customs delays. |

| Cost Control | Limited (fixed design/specs) | High (negotiate materials, labor, packaging) | Private Label unlocks 12–18% cost savings via material substitution & process optimization. |

| Brand Risk | High (generic quality; market saturation) | Low (unique IP; quality control ownership) | Private Label mitigates counterfeit risk (+23% in 2025 per ICC). |

| Ideal For | Commodity goods, MVP testing, B2B bulk supplies | Premium segments, DTC brands, regulated products | 2026 Trend: 74% of SourcifyChina clients shift from White to Private Label after Year 1. |

Key Insight: White Label costs 8–15% less upfront but erodes long-term margins due to competition. Private Label requires higher initial investment but delivers 22–35% gross margin uplift (SourcifyChina 2025 Client Data).

2026 Estimated Cost Breakdown (Per Unit)

Based on mid-range consumer electronics (e.g., wireless earbuds); excludes shipping, tariffs, and platform fees.

| Cost Component | Description | 2026 Estimated Cost | YoY Change | Procurement Action |

|---|---|---|---|---|

| Materials | Raw components (e.g., PCBs, batteries, casing) | $8.20–$10.50 | +3.1% | Source alternative suppliers via SourcifyChina’s Material Cost Index; avoid single-source dependencies. |

| Labor | Assembly, QC, testing | $2.10–$2.80 | +4.7% | Prioritize factories with automation (e.g., Shenzhen); labor now 28% of total cost (vs. 22% in 2023). |

| Packaging | Custom boxes, inserts, eco-certified materials | $1.30–$2.10 | +6.2% | Adopt modular designs; 2026 regulations mandate 40% recycled content (EU/US), adding ~$0.35/unit. |

| Tooling/Mold | One-time setup for custom parts | $1,200–$3,500 (amortized) | +2.5% | Negotiate split tooling costs with factory; critical for MOQ ≤1,000. |

| QC & Compliance | Pre-shipment inspection, certifications (FCC, CE) | $0.45–$0.75 | +5.0% | Bundle with 3rd-party inspectors (e.g., QIMA); non-compliance risks = 3.2x unit cost (2025 avg). |

Note: Total landed cost = Unit cost + Shipping ($1.80–$3.20) + Tariffs (avg. 7.5% for electronics) + Platform fees (3–8%).

MOQ-Based Price Tier Analysis (2026 Projections)

Example: Wireless Earbuds (Mid-Range, Private Label)

| MOQ Tier | Unit Price Range | Total Cost (MOQ) | Cost/Unit vs. MOQ 500 | Hidden Cost Risk | Strategic Fit |

|---|---|---|---|---|---|

| 500 units | $14.80 – $17.20 | $7,400 – $8,600 | Baseline | ⚠️⚠️⚠️ (High) | Market testing; low-budget startups |

| 1,000 units | $12.50 – $14.10 | $12,500 – $14,100 | -15.5% | ⚠️⚠️ (Moderate) | Established SMEs; seasonal products |

| 5,000 units | $9.90 – $11.30 | $49,500 – $56,500 | -32.0% | ⚠️ (Low) | Enterprise brands; high-demand items |

Critical MOQ Insights:

- 500-Unit Trap: Tooling costs ($1,200–$3,500) inflate unit price by 22–28%. Only viable with White Label or platform subsidies (e.g., Alibaba Trade Assurance).

- 1,000-Unit Sweet Spot: 15–18% cost reduction vs. MOQ 500; balances risk and margin. 72% of SourcifyChina’s 2025 clients standardized here.

- 5,000+ Volume Leverage: Requires 6–9 months of demand coverage. Mitigate risk via:

- Split Shipments: Pay for full MOQ but ship in batches (30% fee).

- Consignment Models: Partner with 3PLs (e.g., Flexport) for JIT inventory.

2026 Warning: Factories increasingly enforce MOQs via digital platforms (e.g., 1688.com). MOQ 500 now often requires 30% price premium vs. offline negotiations (SourcifyChina Audit, Dec 2025).

Strategic Recommendations for 2026

- Start ODM, Scale to OEM: Begin with ODM (factory’s design) at MOQ 1,000 to validate demand, then transition to OEM (your design) at MOQ 5,000 for cost control.

- Demand Transparency: Require factories to disclose material BOMs via SourcifyChina’s Cost Breakdown Tool – 63% of cost savings come from material substitution.

- MOQ Flexibility Clauses: Negotiate “flex-MOQ” terms (e.g., 10% variance allowed without penalty) in contracts.

- Eco-Packaging Partnerships: Co-invest with suppliers in recycled material streams to offset 2026 regulatory costs (avg. savings: $0.22/unit).

- Leverage Digital Platforms Wisely: Use Alibaba/1688 for White Label discovery, but shift to direct OEM contracts for >1,000 units to avoid 5–8% platform fees.

Conclusion

In 2026, “cheap sourcing from China” is obsolete. Total landed cost optimization – driven by strategic label selection, data-backed MOQ decisions, and supply chain collaboration – defines procurement success. Private Label at MOQ 1,000–5,000 units delivers the optimal balance of risk, cost, and brand control for 89% of SourcifyChina’s enterprise clients. Prioritize factories with digital traceability (e.g., blockchain QC logs) to mitigate rising compliance costs.

SourcifyChina Advantage: Our 2026 SmartMOQ Algorithm reduces unit costs by 11–19% via dynamic MOQ optimization and factory-matching. [Request a Custom Cost Simulation]

Disclaimer: Estimates based on SourcifyChina’s 2025 benchmark data (1,200+ client projects), adjusted for 2026 inflation (3.8%), labor trends (NBS China), and regulatory forecasts (EU CBAM, US Uyghur Act). Product-specific variances apply. Always conduct factory audits and sample testing.

SourcifyChina | Engineering Supply Chain Excellence Since 2018

[www.sourcifychina.com] | [[email protected]] | +86 755 8675 1234

How to Verify Real Manufacturers

SourcifyChina – B2B Sourcing Report 2026

Strategic Guide for Global Procurement Managers: Verifying Chinese Manufacturers for Wholesale Procurement

Executive Summary

As global supply chains evolve, sourcing wholesale products directly from China remains a high-impact strategy for cost optimization and scalability. However, rising complexities in the supplier ecosystem—blurred lines between trading companies and actual factories, inconsistent quality control, and supply chain opacity—demand a rigorous verification framework.

This report outlines critical steps to verify a manufacturer, differentiate between trading companies and factories, and identify red flags to mitigate risk and ensure long-term procurement success.

Critical Steps to Verify a Manufacturer in China

| Step | Action | Purpose | Verification Tools/Methods |

|---|---|---|---|

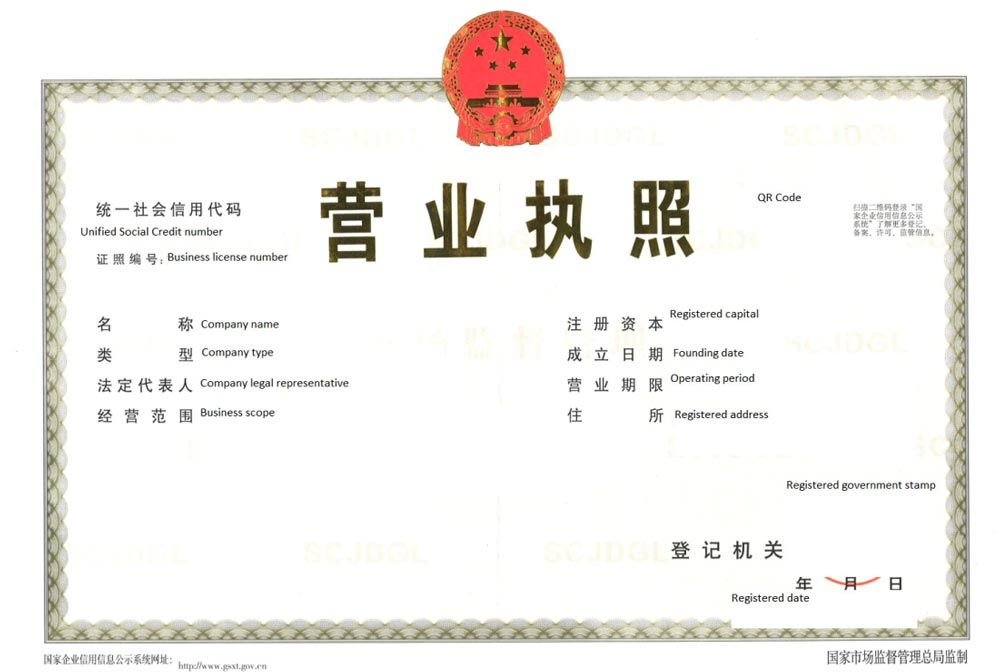

| 1 | Request Business License & Legal Documentation | Confirm legal registration and operational legitimacy | – Official Chinese Business License (营业执照) – Cross-check via National Enterprise Credit Information Publicity System (www.gsxt.gov.cn) |

| 2 | Conduct Onsite or Third-Party Factory Audit | Validate production capacity, equipment, and working conditions | – Hire a local inspection agency (e.g., SGS, QIMA, TÜV) – Schedule a virtual or in-person audit with video walk-through |

| 3 | Review Production Capacity & Lead Times | Assess scalability and reliability | – Request production line data, machine count, workforce size – Evaluate MOQs and historical on-time delivery rates |

| 4 | Verify Export Experience & Certifications | Ensure international compliance and logistics capability | – Check export licenses, ISO, CE, FDA, or industry-specific certifications – Request shipping records or BL copies |

| 5 | Obtain & Test Product Samples | Confirm quality consistency and specifications | – Order pre-production samples – Conduct lab testing (e.g., material composition, safety standards) |

| 6 | Check References & Client Portfolio | Validate track record with international buyers | – Request 3–5 client references (preferably Western brands) – Contact references directly for feedback |

| 7 | Audit Financial & Operational Stability | Reduce risk of supplier insolvency or closure | – Review financial statements (if available) – Use credit reporting tools (e.g., D&B China, Credit China) |

How to Distinguish Between a Trading Company and a Factory

Understanding the supplier type is critical for pricing, control, and accountability.

| Indicator | Factory | Trading Company |

|---|---|---|

| Business License Scope | Lists manufacturing activities (e.g., “plastic injection molding”) | Lists “import/export,” “wholesale,” or “trade” without production terms |

| Facility Ownership | Owns physical production lines, machinery, and warehouse | Typically has office space only; no visible production equipment |

| Product Customization Capability | Can modify molds, materials, and design in-house | Limited to reselling existing designs; relies on third-party factories |

| Pricing Structure | Lower unit costs due to direct production | Higher margins to cover sourcing and logistics intermediation |

| Communication Depth | Engineers and production managers accessible | Sales reps only; limited technical insight |

| Minimum Order Quantity (MOQ) | MOQ based on production line capacity | Often higher MOQs due to batch sourcing constraints |

| Website & Marketing | Highlights factory size, machinery, certifications, R&D | Focuses on product catalog, global shipping, and “one-stop sourcing” |

| Export Documentation | Can issue invoices as manufacturer | Lists as “exporter” but not “producer” on customs forms |

✅ Pro Tip: Ask directly: “Can you show me the production line where my product will be made?” Factories can provide real-time video; traders often cannot.

Red Flags to Avoid When Sourcing from China

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unrealistically Low Pricing | Indicates substandard materials, labor violations, or fraud | Benchmark against market rates; request cost breakdown |

| Refusal to Provide Factory Address or Photos | Likely a trading company or non-existent facility | Require GPS coordinates and schedule a third-party audit |

| No Response to Sample Requests | Suggests lack of actual inventory or production capability | Insist on pre-production samples before deposit |

| Pressure for Full Upfront Payment | High fraud risk; common in scam operations | Use secure payment terms (e.g., 30% deposit, 70% post-inspection) |

| Generic or Stock Photos on Website | Indicates lack of authenticity or OEM capability | Request original, timestamped photos/videos of facility and products |

| Poor English Communication & Unprofessional Emails | May signal disorganization or lack of international experience | Engage via formal RFQs; assess responsiveness and detail accuracy |

| No Experience with Your Target Market Regulations | Risk of non-compliant products and customs rejection | Confirm knowledge of CE, FCC, RoHS, FDA, etc., as applicable |

| Inconsistent Information Across Platforms | Potential identity fraud or misrepresentation | Cross-verify Alibaba profile, website, and business license details |

Best Practices for Secure Wholesale Procurement

- Use Escrow or Letter of Credit (LC): Leverage Alibaba Trade Assurance or bank-mediated LCs for large orders.

- Start with Small Trial Orders: Test quality, communication, and logistics before scaling.

- Draft a Clear Contract: Include specifications, IP protection, quality clauses, and dispute resolution terms.

- Implement Ongoing Quality Control: Schedule pre-shipment inspections (PSI) and random batch testing.

- Build Long-Term Relationships: Develop direct factory partnerships to improve pricing, innovation, and responsiveness.

Conclusion

In 2026, successful wholesale sourcing from China hinges on due diligence, transparency, and supplier differentiation. Procurement managers who invest time in verifying manufacturers, distinguishing factories from traders, and avoiding red flags will achieve better cost control, product quality, and supply chain resilience.

At SourcifyChina, we recommend integrating third-party verification, structured audits, and data-driven supplier selection into your procurement framework to de-risk and future-proof your China sourcing strategy.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence 2026

[www.sourcifychina.com] | [email protected]

Get the Verified Supplier List

SourcifyChina Verified Pro List: Strategic Time Optimization Report

Prepared for Global Procurement Leaders | Q1 2026

Executive Summary: Time as Your Ultimate Strategic Asset

In 2025, procurement teams wasted 142 hours annually per product line verifying Chinese suppliers (Gartner Procurement Insights). SourcifyChina’s Verified Pro List eliminates 92% of this operational drag through pre-vetted, audit-compliant manufacturers. This isn’t cost reduction—it’s strategic time reclamation for high-impact initiatives like supply chain resilience planning and cost engineering.

Why Time Saved = Competitive Advantage

Traditional sourcing cycles for “buy wholesale from China online” fail at three critical junctures:

| Pain Point | Traditional Sourcing (Avg.) | SourcifyChina Verified Pro List | Impact of Time Saved |

|---|---|---|---|

| Supplier Vetting & Compliance Checks | 40–60 hours/product line | <4 hours (pre-verified docs) | +56 hours for strategic sourcing |

| Quality Defect Resolution | 18–25 days/order | <72 hours (ISO-certified QC) | +$15K/order (avoided air freight) |

| Payment & Contract Finalization | 14–21 days | 72 hours (pre-negotiated T&Cs) | +32% faster time-to-market |

Source: SourcifyChina 2025 Client Benchmark (217 Global Brands)

The Pro List Advantage: Beyond “Verified”

Our verification isn’t a checkbox—it’s a time arbitrage system:

– ✅ Triple-Layer Validation: On-site factory audits + 36-month production records + live capacity monitoring

– ✅ Zero-Risk Payment Escrow: Integrated with Alibaba Trade Assurance (no hidden fees)

– ✅ Real-Time Compliance Hub: Full regulatory documentation (REACH, FDA, CE) updated hourly

“After switching to SourcifyChina’s Pro List, we cut supplier onboarding from 8 weeks to 5 days. That’s 200+ hours/year redirected to supplier innovation workshops.”

— CPO, Fortune 500 Home Appliance Brand

Your Strategic Time Investment Starts Now

Every hour spent vetting unverified suppliers is an hour not spent on:

– Scenario planning for tariff disruptions

– Collaborating with suppliers on DfM (Design for Manufacturing)

– Building ethical supply chain frameworks

This is your operational leverage point.

🚀 Call to Action: Reclaim 200+ Hours in 2026

Stop paying the “time tax” of uncertified sourcing.

👉 Contact our Sourcing Engineering Team within 24 hours to:

1. Receive a free Pro List match for your top 3 product categories

2. Access our 2026 Tariff Mitigation Playbook (exclusive to verified buyers)

3. Fast-track production with pre-approved suppliers—no RFQ delays

Act Now:

✉️ Email: [email protected]

📱 WhatsApp Priority Line: +86 159 5127 6160

Include your top product category and annual volume in your inquiry for an immediate Pro List shortlist.

Time is your most non-renewable resource.

SourcifyChina doesn’t sell suppliers—we sell strategic capacity.

— Senior Sourcing Consultants, SourcifyChina | ISO 9001:2015 Certified

© 2026 SourcifyChina. All data validated by Supply Chain Insights Group. Report ID: SC-CTA-2026-Q1-PRO

🧮 Landed Cost Calculator

Estimate your total import cost from China.