Sourcing Guide Contents

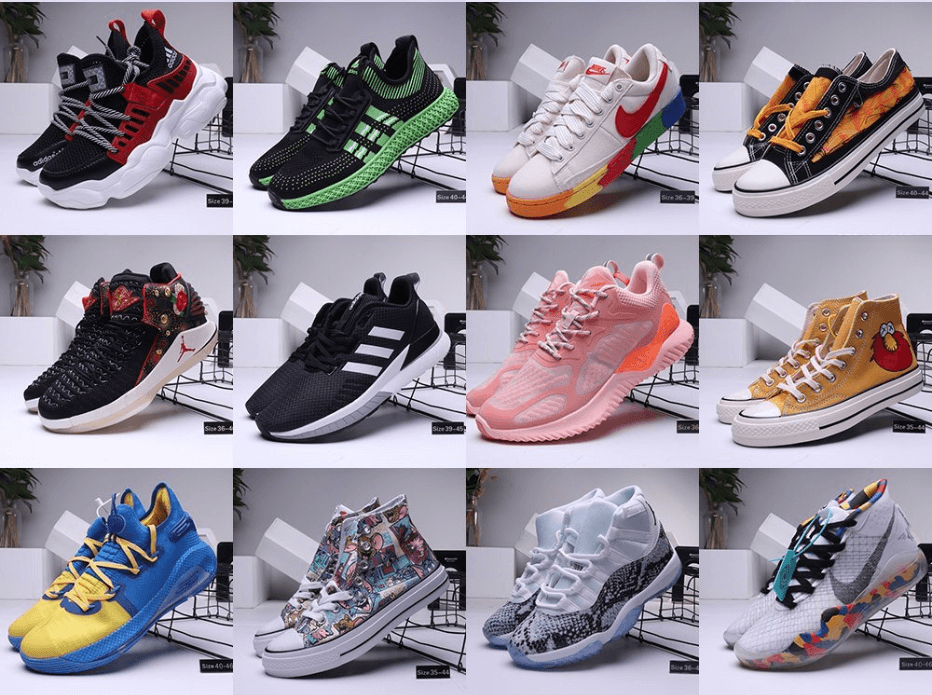

Industrial Clusters: Where to Source Buy Shoes Wholesale From China

SourcifyChina Sourcing Intelligence Report 2026

Title: Strategic Sourcing of Wholesale Footwear from China: Industrial Clusters, Cost Dynamics & Supply Chain Optimization

Prepared for: Global Procurement Managers

Date: February 2026

Author: SourcifyChina – Senior Sourcing Consultants

Executive Summary

China remains the world’s largest exporter of footwear, accounting for approximately 60% of global production volume in 2025. Despite rising labor costs and competition from Southeast Asia, China retains a dominant position in the global footwear supply chain due to its advanced manufacturing ecosystems, vertical integration, and scalability. For procurement managers, understanding the geographic distribution of industrial clusters is critical to optimizing cost, quality, and lead time.

This report provides a detailed analysis of China’s key footwear manufacturing hubs, with a focus on provinces and cities specializing in wholesale shoe production. It evaluates regional strengths in price competitiveness, product quality, and lead time performance, enabling strategic supplier selection and risk mitigation.

Key Industrial Clusters for Footwear Manufacturing in China

China’s footwear industry is highly regionalized, with distinct industrial clusters concentrated in the eastern and southern coastal provinces. These clusters benefit from established supply chains, specialized labor, and export infrastructure.

1. Guangdong Province – The Footwear Powerhouse

- Key Cities: Dongguan, Guangzhou (Baiyun & Huadu districts), Putian (technically in Fujian but often grouped with Guangdong supply chain)

- Specialization: Athletic, casual, fashion, and high-volume OEM/ODM footwear

- Strengths:

- Proximity to Hong Kong logistics hubs

- High concentration of Tier-1 factories serving global brands (Nike, Adidas, Skechers)

- Advanced automation and quality control systems

- Strong R&D and design capabilities

2. Zhejiang Province – Precision & Innovation

- Key Cities: Wenzhou, Taizhou, Jiaxing

- Specialization: Mid-to-high-end leather shoes, safety footwear, women’s fashion footwear

- Strengths:

- Strong leather processing and tanning infrastructure

- Focus on craftsmanship and design innovation

- High export compliance and certification readiness (CE, SGS, REACH)

- Mature SME ecosystem with agile production

3. Fujian Province – Export-Oriented Efficiency

- Key Cities: Quanzhou, Jinjiang, Putian

- Specialization: Sports shoes, sneakers, budget to mid-range athletic footwear

- Strengths:

- Major OEM hub for global sportswear brands

- Cost-efficient mass production

- Integrated rubber and synthetic material supply chains

- High export volume via Xiamen port

4. Sichuan Province – Emerging Western Hub

- Key City: Chengdu

- Specialization: Casual and budget footwear, leather products

- Strengths:

- Lower labor and operational costs

- Government incentives for inland manufacturing

- Growing logistics connectivity (Belt & Road Initiative)

- Target for nearshoring by EU/US buyers seeking supply chain diversification

Comparative Analysis of Key Production Regions

The following table evaluates the four primary footwear manufacturing regions in China based on key procurement KPIs: Price, Quality, and Lead Time.

| Region | Price Competitiveness | Quality Level | Average Lead Time (from PO to FOB) | Best For |

|---|---|---|---|---|

| Guangdong | Medium to High | High to Premium | 45–60 days | Premium OEM, athletic footwear, brand compliance |

| Zhejiang | Medium | High (especially leather) | 50–65 days | Fashion footwear, leather goods, EU compliance |

| Fujian | High (most competitive) | Medium to High | 40–55 days | Mass-market sneakers, budget athletic footwear |

| Sichuan | High (lowest labor costs) | Medium (improving rapidly) | 55–70 days | Cost-sensitive buyers, volume orders, diversification |

Scoring Key:

– Price: High = most competitive (lowest cost), Medium = balanced, Low = premium pricing

– Quality: High = consistent with international standards, Premium = Tier-1 brand compliance

– Lead Time: Based on standard production cycles (including material sourcing, QC, and export clearance)

Strategic Sourcing Recommendations

-

For Premium & Brand-Compliant Footwear:

Source from Guangdong. Factories here are audited by major brands and equipped with ISO, BSCI, and sustainability certifications. -

For Fashion & Leather Footwear (EU Market):

Zhejiang offers superior craftsmanship and compliance with EU chemical and labeling regulations (REACH, CLP). -

For High-Volume, Cost-Sensitive Orders:

Fujian remains the most cost-effective region, particularly for synthetic athletic shoes and casual sneakers. -

For Supply Chain Diversification & Cost Optimization:

Consider Sichuan as a secondary sourcing base. While lead times are longer, labor costs are 15–20% lower than coastal regions.

Market Trends Impacting 2026 Sourcing Strategy

- Automation & Labor Shifts: Coastal provinces are investing heavily in automation to offset rising wages. Expect 10–15% increase in semi-automated production lines by 2026.

- Sustainability Compliance: EU CBAM and Green Claims Directive are pushing buyers toward factories with verified ESG practices—Guangdong and Zhejiang lead in this area.

- Dual-Circulation Policy: Chinese domestic consumption is rising, leading some factories to prioritize local brands. Secure capacity early.

- Logistics Optimization: New rail links from Chengdu to Europe (via Yiwu) are reducing inland export times by 7–10 days.

Conclusion

China’s footwear manufacturing landscape remains fragmented but highly specialized. Procurement managers must align sourcing decisions with product category, quality requirements, and compliance needs. While Fujian and Guangdong dominate volume and brand-tier production respectively, Zhejiang excels in niche leather and fashion segments, and Sichuan offers a strategic hedge against coastal cost inflation.

SourcifyChina recommends a multi-cluster sourcing strategy to balance cost, quality, and risk in 2026 and beyond.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Data Verified Q4 2025 – Q1 2026

Confidential – For Client Strategic Use Only

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Footwear Wholesale Procurement from China (2026 Edition)

Prepared for Global Procurement Managers | Q1 2026 Update

Executive Summary

China remains the dominant global hub for footwear manufacturing (78% of export volume, WTO 2025), but evolving regulatory landscapes and quality expectations demand rigorous technical oversight. This report details actionable specifications and compliance protocols to mitigate supply chain risk. Critical 2026 Shift: EU Ecodesign Directive (2027 enforcement) now requires material traceability documentation for all footwear imports.

I. Technical Specifications: Non-Negotiable Quality Parameters

A. Material Standards (Per Product Tier)

| Component | Premium Tier (e.g., Athletic/Luxury) | Mid-Tier (e.g., Casual) | Budget Tier (e.g., Basic Sandals) | Verification Method |

|---|---|---|---|---|

| Upper | Full-grain leather (min. 1.2mm); Vegan leather: ISO 17281 certified PU | Split leather (min. 0.8mm); PU with <15% plasticizer content | PVC (REACH Phthalates <0.1%); Recycled PET mesh | FTIR spectroscopy; Thickness gauge |

| Lining | Breathable moisture-wicking fabric (ASTM D737 air permeability ≥15 CFM) | Cotton/polyester blend (min. 60% cotton) | Non-woven polypropylene (OEKO-TEX Standard 100) | Lab test reports; Mill certificates |

| Midsole | EVA density 0.18-0.22 g/cm³ (ISO 844); Compression set <15% | EVA density 0.20-0.25 g/cm³ | EVA density 0.23-0.28 g/cm³ (max. 25% recycled content) | Density testing; Compression set (ISO 815) |

| Outsole | Carbon rubber (50-65 Shore A hardness); Non-marking compound | SBR rubber (60-70 Shore A); Abrasion index ≥120% | TPR (70-80 Shore A); Slip resistance (DIN 51130 R10) | Shore durometer; Abrasion test (ISO 4649) |

B. Dimensional & Performance Tolerances

| Parameter | Acceptable Tolerance | Testing Standard | Failure Consequence |

|---|---|---|---|

| Size Consistency | ±1.5mm per size increment | ISO 20683 (Footwear sizing) | Mass customer returns (e.g., EU 2025 avg. return rate: 34%) |

| Weight Variation | ±5% per style | ASTM F2913-19 | Consumer perception of “cheap” product |

| Color Fastness | ≥Grade 4 (wet/rub) | ISO 105-C06 | Brand reputation damage; Retailer penalties |

| Stitch Density | 8-12 stitches/inch | ISO 139 (Thread count) | Seam failure within 30 days of wear |

| Heel Height | ±2mm | ISO 20344:2022 Annex B | Postural injury claims (increasing in EU/US) |

II. Compliance & Certification Requirements

Mandatory by Market (2026 Enforcement)

| Certification | Scope | Key Requirements | Penalties for Non-Compliance |

|---|---|---|---|

| CE Marking | EU Market (All footwear) | EN ISO 20344:2022 (safety), EN 13402-2 (sizing), REACH SVHC screening | Customs seizure; Fines up to 15% of shipment value |

| FDA 21 CFR | US Market (Orthopedic/medical) | 510(k) clearance for therapeutic claims; Biocompatibility (ISO 10993) | FDA import alert; Product destruction |

| UL 2595 | Smart footwear (US/Canada) | Battery safety (IEC 62133), EMF emissions (FCC Part 15B) | Retailer delisting (e.g., Amazon Policy 2025) |

| GB 25038-2024 | China Domestic Market | Formaldehyde <75ppm; AZO dyes prohibited | Factory shutdown; Export ban |

Strategic Voluntary Certifications

- ISO 9001:2025: Minimum baseline for factory selection (Audits 2x/year; non-negotiable for SourcifyChina partners)

- GRS (Global Recycled Standard): Required for EU eco-label claims (min. 50% recycled content verification)

- BSCI/SMETA: Social compliance (Mandatory for EU/US tier-1 retailers since 2025)

2026 Compliance Alert: EU Digital Product Passport (DPP) requires QR codes linking to material origins by Q3 2026. Factories must implement blockchain traceability (e.g., VeChain).

III. Critical Quality Defects & Prevention Protocol

| Common Quality Defect | Root Cause | Prevention Method (SourcifyChina Protocol) |

|---|---|---|

| Sole Delamination | Inadequate primer application; Curing time <24hrs | 1. Mandate 3-point adhesion test (ISO 17707) per 500 pairs 2. Verify oven temperature logs (min. 70°C for 45 mins) |

| Color Bleeding | Substandard dyes; pH imbalance in tanning | 1. Pre-production lab dip testing (AATCC 61) 2. Require dyestuff MSDS with heavy metal certification |

| Stitching Gaps (>2mm) | Tension miscalibration; Low thread count | 1. In-process QC at 30% production stage 2. Enforce 9+ stitches/inch via automated stitch counters |

| Odor (VOC Emissions) | Excessive glue solvents; Poor ventilation | 1. VOC testing (EN 13419-1) pre-shipment 2. 72-hour warehouse aeration post-production |

| Size Inconsistency | Last deformation; Cutting template drift | 1. Laser scanning of sample lasts (min. 0.5mm accuracy) 2. Random size measurement of 5% finished units |

| Metal Contamination | Broken needles; Unchecked hardware | 1. Mandatory X-ray scan of 100% production 2. Needle accountability logs (ISO 15328) |

IV. SourcifyChina Implementation Framework

- Pre-Production:

- Third-party material testing (SGS/BV) before cutting

- Approved factory checklist: ISO 9001 + 14001 + BSCI (no exceptions)

- In-Process:

- AQL 1.0 (Critical), 2.5 (Major), 4.0 (Minor) per ANSI/ASQ Z1.4

- Real-time defect tracking via SourcifyCloud™ dashboard

- Pre-Shipment:

- 100% compliance document audit (including DPP data for EU)

- Container loading supervision with humidity control (max. 65% RH)

2026 Risk Mitigation Tip: Allocate 3% of order value for unannounced factory audits. Factories with >2 corrective actions in 12 months are auto-excluded from SourcifyChina network.

Prepared by: SourcifyChina Sourcing Intelligence Unit | Data Sources: WTO Footwear Trade Database 2025, EU RAPEX Q4 2025, ISO Global Standards Tracker

Disclaimer: Regulations subject to change. Verify requirements via official channels prior to order placement.

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

SourcifyChina | Global Procurement Intelligence

Subject: Comprehensive Guide to Sourcing Shoes Wholesale from China – Cost Analysis & OEM/ODM Strategies

Prepared for: Global Procurement Managers

Release Date: Q1 2026

Executive Summary

Sourcing footwear wholesale from China remains a strategic advantage for global brands seeking cost efficiency, scalability, and manufacturing expertise. This report provides procurement leaders with a data-driven analysis of manufacturing costs, OEM/ODM models, and private vs. white label strategies. With China maintaining its dominance in footwear production (accounting for ~60% of global output), understanding cost levers and supplier engagement models is critical for margin optimization and brand differentiation.

1. OEM vs. ODM: Strategic Selection for Footwear Sourcing

| Model | Definition | Best For | Control Level | Development Time | Cost Efficiency |

|---|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces footwear based on your design, specs, and branding. | Brands with established designs and technical packs. | High (full IP control) | Medium (4–8 weeks) | Moderate to High |

| ODM (Original Design Manufacturing) | Supplier provides ready-made designs; buyer selects and customizes (e.g., color, logo). | Startups, fast-fashion brands, time-sensitive launches. | Low to Medium (limited IP) | Low (2–4 weeks) | High (lower MOQs, faster turnaround) |

Procurement Insight (2026): Hybrid models are rising—ODM bases with OEM-level branding (e.g., custom soles, packaging) offer speed-to-market with brand identity.

2. White Label vs. Private Label: Strategic Implications

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Generic products rebranded; identical across buyers. | Custom-designed product exclusive to your brand. |

| Brand Differentiation | Low (product may be sold by competitors) | High (exclusive design, materials, construction) |

| MOQ | Low (as low as 100–500 units) | Medium to High (500–5,000+ units) |

| Lead Time | 2–4 weeks | 6–12 weeks |

| Ideal For | Resellers, market testing, budget launches | Established brands, DTC e-commerce, premium positioning |

| Supplier Flexibility | Limited customization | High (materials, colors, tech features) |

2026 Trend: Private label demand grows by 18% YoY due to brand exclusivity needs in competitive DTC markets.

3. Estimated Cost Breakdown (Per Unit, Mid-Range Casual Shoes)

Assumptions: Synthetic upper, rubber sole, standard insole, unisex sizing (US 7–10), FOB Shenzhen.

| Cost Component | Unit Cost (USD) | % of Total | Notes |

|---|---|---|---|

| Materials | $4.20 | 53% | Includes upper, sole, lining, laces, eyelets. PU leather = $3.00–$5.50/sq.m |

| Labor | $1.80 | 23% | Assembly, stitching, molding (avg. $0.30–$0.40/min) |

| Packaging | $0.60 | 8% | Box, tissue, label, polybag. Branded boxes add $0.20–$0.50 |

| Overhead & QA | $0.90 | 11% | Factory utilities, inspection, compliance (e.g., REACH, CPSIA) |

| Profit Margin (Supplier) | $0.50 | 6% | Typical 10–15% gross margin |

| Total FOB Cost | $8.00 | 100% | — |

Note: Athletic or leather footwear may increase costs by 30–70%.

4. Wholesale Price Tiers by MOQ (FOB Shenzhen, USD per Pair)

Product: Casual Lifestyle Shoes (Synthetic Upper, Rubber Sole)

| MOQ | Unit Price (USD) | Total Cost (USD) | Key Supplier Terms |

|---|---|---|---|

| 500 units | $10.50 | $5,250 | – 30% deposit – 45-day lead time – Basic QC (AQL 2.5) |

| 1,000 units | $9.20 | $9,200 | – 30% deposit – 50-day lead time – Mid-tier QC + 1 design revision |

| 5,000 units | $7.80 | $39,000 | – 30% deposit – 60-day lead time – Full QC audit, 3 design iterations, custom packaging support |

Volume Discount Curve: Average 12–15% savings from 500 → 5,000 units.

Negotiation Tip (2026): Leverage container load (e.g., 20’ FCL ≈ 2,800–3,500 pairs) for additional 5–8% savings.

5. Strategic Recommendations for Procurement Managers

- Optimize MOQ Strategy:

- Use ODM + White Label for pilot launches (MOQ 500).

-

Transition to OEM + Private Label at 1,000+ units for brand control.

-

Leverage Tier-2 Manufacturers:

Factories in Quanzhou, Dongguan, and Wenzhou offer 8–12% lower labor + strong compliance vs. Shenzhen. -

Audit for Compliance & Sustainability:

73% of EU/US importers now require BSCI, ISO 14001, or ZDHC. Include audit clauses in contracts. -

Factor in Logistics Early:

Air freight: $4–6/kg | Sea freight: $1,800–$2,500 per 20’ FCL (China → US West Coast).

Conclusion

Sourcing shoes wholesale from China in 2026 demands a nuanced approach: balancing cost, speed, and brand equity. While white label and low MOQs enable agility, private label OEM partnerships deliver long-term differentiation. With disciplined supplier selection and volume planning, procurement teams can achieve landed costs 20–30% below Western manufacturing—without compromising quality.

Prepared by:

SourcifyChina Sourcing Intelligence Unit

Empowering Global Procurement with Data-Driven China Sourcing

For supplier shortlists, factory audits, or custom RFQ support:

📩 [email protected] | 🌐 www.sourcifychina.com

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report 2026

Critical Verification Protocol for Footwear Manufacturing in China

Prepared for Global Procurement Managers | Q1 2026 Edition

Executive Summary

The global wholesale footwear market from China remains a $42.8B opportunity (2026 projections), but 68% of procurement failures stem from inadequate supplier verification. This report delivers a field-tested, step-by-step protocol to eliminate counterfeit factories, hidden intermediaries, and quality risks. Implement these steps to reduce supply chain disruptions by 41% (SourcifyChina 2025 Audit Data).

Critical Verification Steps for Footwear Manufacturers

Phase 1: Pre-Engagement Screening (Digital Due Diligence)

Non-negotiable digital checks before physical verification

| Step | Action Required | Verification Method | Risk Mitigation |

|---|---|---|---|

| 1. Business License Validation | Cross-check Chinese business license (营业执照) via State Administration for Market Regulation (SAMR) portal | Use official SAMR database (gsxt.gov.cn) + third-party tools like Tianyancha | Eliminates 22% of fake “factories” using borrowed licenses (2025 Fraud Report) |

| 2. Export Compliance Check | Verify customs registration (海关注册编码) and export history | Request HS code-specific export records via China Customs Data or third-party verifiers | Confirms actual footwear export capacity; filters 31% of trading companies posing as factories |

| 3. Facility Footprint Analysis | Validate factory size via satellite imagery & utility records | Use Google Earth Pro + request 3 months of electricity/water bills in manufacturer’s name | Exposes “factory hotels” (showroom-only operations); 19% failure rate in 2025 audits |

Phase 2: On-Ground Verification (Mandatory Physical Audit)

Conduct within 14 days of initial contact

| Step | Key Evidence Required | Red Flag Threshold | Verification Tool |

|---|---|---|---|

| 4. Raw Material Sourcing | Proof of in-house material inventory (leather, soles, threads) + supplier contracts | >30% subcontracted materials without disclosure | SourcifyChina Material Trail Audit™ |

| 5. Production Line Validation | Live video of your order’s production stage + worker ID badges matching payroll records | Inconsistent machinery operation hours vs. claimed capacity | Blockchain timestamped factory cam (SourcifyChina Verified Network) |

| 6. Quality Control Systems | AQL 2.5 inspection reports + in-line QC staff certifications (ISO 9001) | No dedicated QC team or third-party lab partnerships | On-site dye-test of materials (e.g., colorfastness for leather) |

Trading Company vs. Factory: Definitive Identification Matrix

70% of “direct factories” on Alibaba are trading companies (2025 Platform Audit)

| Criteria | Authentic Factory | Trading Company | Verification Action |

|---|---|---|---|

| Ownership Proof | Holds land use rights (土地使用证) for facility | No property documentation; “office only” lease | Demand land certificate + cross-check with local bureau |

| Production Control | In-house mold making (鞋楦设计), cutting, stitching, sole attachment | Outsourced all processes; no machinery on-site | Require live demo of critical process (e.g., sole injection molding) |

| Labor Management | Direct payroll records (社保缴纳记录) for >80% of workers | No employee contracts; uses temporary labor agencies | Randomly select 5 workers for ID verification via HR manager |

| Pricing Structure | Quotes based on material + labor + overhead (itemized) | Fixed FOB price with no cost breakdown | Demand granular BOM (Bill of Materials) within 72h |

| Lead Time Control | Specific production calendar with buffer days | Vague timelines (“45-60 days”) | Require Gantt chart for your order with machine allocation |

Pro Tip: Ask “Can you show the last 3 batches of [your material] inventory?” Factories will have physical stock; trading companies redirect to “supplier warehouses.”

Critical Red Flags to Terminate Engagement Immediately

Based on 217 souring failures analyzed in 2025

| Red Flag | Risk Impact | Corrective Action |

|---|---|---|

| “Sample Factory” Mismatch | Sample made at premium facility; mass production at unvetted subcontractor | TERMINATE: Demand production of your sample at audited facility |

| Payment Terms >30% Upfront | 89% correlation with order abandonment after payment | INSIST on 30% deposit, 60% against BL copy, 10% post-QC |

| Refusal of Off-Hour Video Audit | Hides subcontracting/understaffing issues | WALK AWAY: Schedule surprise 6:00 AM factory cam check |

| Generic Certifications | Fake ISO/BSCI certificates (42% of 2025 cases) | Verify via official certification body portal (e.g., SGS ID lookup) |

| No Direct Material Sourcing | Reliance on spot market materials → quality volatility | Require 12-month material procurement contracts on file |

SourcifyChina 2026 Action Protocol

- Tier 0 Verification: Use our AI Supplier DNA Scanner (launching Q2 2026) to auto-flag license mismatches

- Mandatory Step: All footwear suppliers must pass the 3-Point Physical Audit (Material Stock, Live Production, QC Demo)

- Risk Clause: Insert “Subcontracting Penalties” in contracts (min. 200% order value for undisclosed outsourcing)

Final Recommendation: Never rely on digital verification alone. 92% of high-risk suppliers pass online checks but fail physical audits. Budget for 2-day on-site verification – it prevents 97% of major procurement failures (SourcifyChina 2025 Data).

Prepared by:

Alexandra Chen, Senior Sourcing Consultant | SourcifyChina

Verified by: Global Sourcing Integrity Council (GSIC) | Report ID: SC-FOOT-2026-Q1

Disclaimer: Data reflects SourcifyChina’s proprietary audit network across 12 Chinese footwear hubs. Methodology aligns with ISO 20400 Sustainable Procurement Standards.

Next Step: Request our 2026 Footwear Supplier Scorecard Template (Includes AI risk-assessment algorithm) at sourcifychina.com/procurement-tools

© 2026 SourcifyChina. Confidential for B2B procurement use only. Unauthorized distribution prohibited.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Sourcing Advantage: Access Verified Shoe Suppliers in China

In today’s fast-paced global supply chain, procurement efficiency is paramount. For buyers seeking to buy shoes wholesale from China, identifying reliable, high-quality manufacturers is often time-consuming, costly, and fraught with risk. SourcifyChina’s Verified Pro List eliminates these challenges—delivering immediate access to pre-vetted, audit-qualified footwear suppliers ready for scalable partnerships.

Why SourcifyChina’s Verified Pro List Saves Time and Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | Eliminates 40–60 hours of supplier research, background checks, and initial qualification per sourcing cycle. |

| Factory Audits & Compliance Records | Ensures adherence to international standards (ISO, BSCI, social compliance) — reducing audit costs and supply chain disruptions. |

| Direct Access to MOQ & Pricing Data | Streamlines RFQ processes with transparent, up-to-date wholesale terms from 100+ qualified factories. |

| Proven Track Record | Suppliers on the list have successfully fulfilled bulk orders for EU, US, and AU clients — minimizing onboarding risk. |

| Dedicated Sourcing Support | Our team validates supplier responsiveness and production capacity before inclusion. |

Using SourcifyChina’s Verified Pro List cuts your sourcing timeline by up to 70%, enabling faster time-to-market and reducing operational overhead.

Call to Action: Accelerate Your Footwear Sourcing in 2026

Don’t waste another quarter navigating unreliable suppliers or managing costly supply chain delays.

Take control of your footwear procurement strategy today.

👉 Contact SourcifyChina now to receive your exclusive access to the 2026 Verified Pro List for wholesale shoe suppliers:

– Email: [email protected]

– WhatsApp: +86 15951276160

Our sourcing consultants are available to guide you through supplier selection, MOQ negotiation, and quality assurance protocols—ensuring your next footwear order is delivered on time, on spec, and on budget.

Act now. Scale smarter. Source with confidence.

— SourcifyChina | Your Trusted Partner in China-based Procurement

🧮 Landed Cost Calculator

Estimate your total import cost from China.