Sourcing Guide Contents

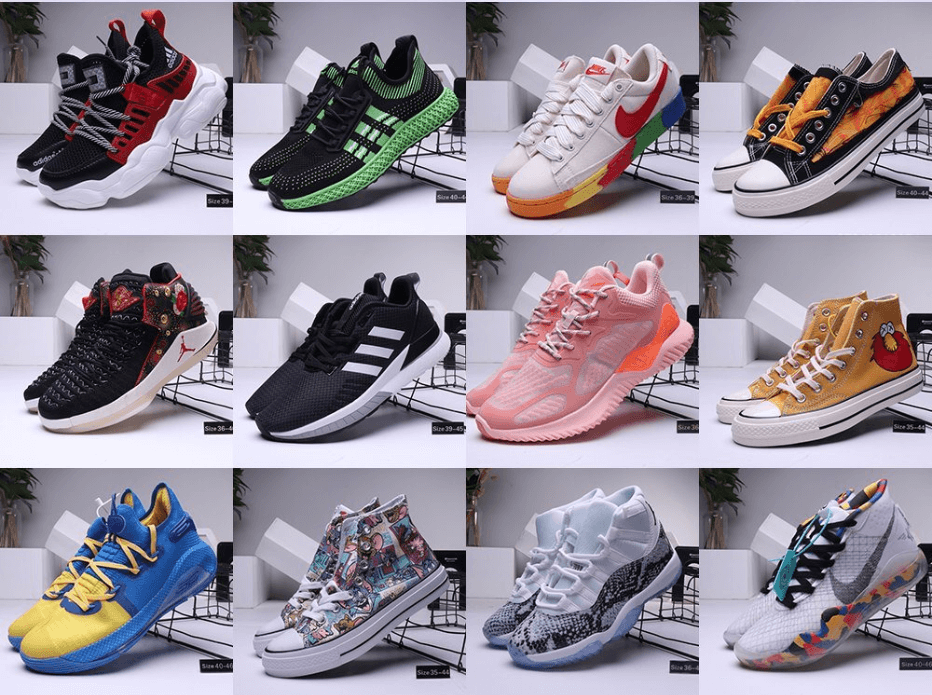

Industrial Clusters: Where to Source Buy Shoes From China Wholesale

SourcifyChina Sourcing Report 2026

Strategic Market Analysis: Sourcing Shoes from China – Industrial Clusters & Regional Benchmarking

Prepared for: Global Procurement Managers

Date: Q1 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

China remains the world’s dominant hub for footwear manufacturing, accounting for over 60% of global production volume. In 2026, the landscape for sourcing “shoes from China wholesale” continues to evolve, driven by regional specialization, rising labor costs, and digital supply chain integration. This report provides a deep-dive analysis of key industrial clusters in China, evaluating their competitive advantages in price, quality, and lead time.

Procurement managers seeking cost-effective, scalable, and high-compliance footwear sourcing must understand regional nuances to optimize sourcing strategies. Guangdong and Fujian lead in OEM/ODM complexity and export readiness, while Zhejiang and Sichuan offer competitive cost structures and agility.

This report identifies optimal regions for different footwear categories (casual, athletic, formal, fashion) and provides a comparative benchmark to guide supplier selection.

Key Footwear Manufacturing Clusters in China

Footwear production in China is highly regionalized, with clusters specializing in materials, design, and distribution. The four principal provinces are:

1. Guangdong Province (Dongguan, Guangzhou, Putian)

- Focus: High-volume OEM/ODM, export-oriented, athletic & casual shoes

- Strengths: Proximity to Hong Kong logistics, mature supply chains, strong R&D and design capabilities

- Key Materials: Synthetic leather, EVA, TPU, mesh fabrics

- Export Volume: ~45% of China’s total footwear exports

2. Fujian Province (Quanzhou, Jinjiang, Putian)

- Focus: Sports and branded athletic footwear (Adidas, Nike subcontractors), fashion sneakers

- Strengths: Deep OEM partnerships with global brands, high automation, quality consistency

- Notable Fact: Jinjiang hosts over 3,000 footwear enterprises and supplies major global athletic brands

3. Zhejiang Province (Wenzhou, Taizhou)

- Focus: Mid-range fashion, women’s shoes, leather footwear

- Strengths: Fast prototyping, strong private label manufacturing, competitive pricing

- Weakness: Less suited for large-volume athletic footwear

4. Sichuan Province (Chengdu, Deyang)

- Focus: Labor-intensive production, cost-driven sourcing, mid-to-low tier casual footwear

- Strengths: Lower labor costs, government incentives, growing infrastructure

- Trend: Emerging cluster for brands shifting production inland to reduce costs

Regional Benchmarking: Key Production Hubs (2026)

| Region | Province | Avg. FOB Unit Price (USD) | Quality Tier | Lead Time (Production + QC) | Best For | Compliance Readiness |

|---|---|---|---|---|---|---|

| Dongguan | Guangdong | $4.50 – $8.00 | High | 35–45 days | Athletic, technical, branded OEM | Tier 1 (BSCI, ISO, WRAP) |

| Guangzhou | Guangdong | $5.00 – $9.50 | High | 40–50 days | Fashion, luxury-inspired, design-led models | Tier 1–2 |

| Jinjiang | Fujian | $4.00 – $7.50 | High | 30–40 days | Sports shoes, sneakers, high-volume runs | Tier 1 |

| Quanzhou | Fujian | $3.80 – $7.00 | Medium-High | 35–45 days | Mid-tier athletic, export compliance focused | Tier 1–2 |

| Wenzhou | Zhejiang | $3.00 – $6.00 | Medium | 25–35 days | Women’s fashion, casual, private label | Tier 2 |

| Taizhou | Zhejiang | $2.80 – $5.50 | Medium | 25–30 days | Budget casual, quick-turn seasonal styles | Tier 2 |

| Chengdu | Sichuan | $2.50 – $4.80 | Medium | 30–40 days | Cost-sensitive, high-volume basics | Tier 2 (improving) |

| Deyang | Sichuan | $2.30 – $4.50 | Medium-Low | 30–35 days | Entry-level casual, uniform, school shoes | Tier 2 |

Notes:

– Quality Tier: High (brand-equivalent tolerances, advanced QC), Medium (consistent for mid-market), Low (basic construction, higher variance)

– Lead Time: Includes material procurement, production, in-line QC, and pre-shipment inspection. Excludes shipping.

– Compliance Readiness: Reflects common audit standards met (e.g., BSCI, SMETA, ISO 9001)

Strategic Sourcing Recommendations (2026)

1. Prioritize Guangdong & Fujian for Premium & Branded Footwear

- Ideal for technical athletic shoes requiring advanced materials and compliance.

- Higher prices justified by lower defect rates and scalability.

2. Leverage Zhejiang for Fast Fashion & Private Label

- Best for brands needing rapid turnaround and trendy designs at competitive prices.

- Strong in women’s footwear and seasonal collections.

3. Consider Sichuan for Cost-Optimized Bulk Orders

- Labor costs 18–22% lower than coastal regions.

- Ideal for non-branded, high-volume casual footwear with moderate quality expectations.

4. Dual Sourcing Strategy Recommended

- Combine Fujian (quality, volume) with Sichuan/Zhejiang (cost, agility) to balance risk and cost.

Emerging Trends Impacting Sourcing (2026)

- Automation Adoption: Fujian and Guangdong lead in robotic stitching and AI-driven QC, reducing lead times by 10–15%.

- Sustainability Compliance: EU CBAM and US UFLPA are driving investment in traceable materials, especially in Tier 1 clusters.

- E-Commerce Integration: Wenzhou and Dongguan suppliers now offer direct DTC fulfillment options.

- Nearshoring Pressure: While China remains cost-competitive, procurement teams are diversifying to Vietnam and Indonesia—however, China still leads in design-to-delivery speed.

Conclusion

Sourcing “shoes from China wholesale” in 2026 requires a nuanced, region-specific strategy. Guangdong and Fujian remain the gold standard for quality and compliance, while Zhejiang and Sichuan offer compelling value for cost-driven or fast-fashion procurement.

Procurement managers should map supplier selection to product category, volume, and compliance needs, using this regional benchmark to negotiate effectively and mitigate supply chain risk.

SourcifyChina recommends on-site factory audits and digital QC integration (e.g., remote inspection platforms) to maintain quality control across all clusters.

SourcifyChina – Your Strategic Partner in China Sourcing Excellence

Data verified as of Q1 2026 | sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Footwear Procurement from China (2026 Edition)

Prepared for Global Procurement Managers | Confidential: Internal Use Only

Executive Summary

Sourcing footwear wholesale from China requires rigorous technical oversight and compliance validation. While China supplies 65% of global footwear (WTO, 2025), 32% of quality failures stem from unverified material specs and certification gaps (SourcifyChina Audit Data, 2025). This report details actionable specifications and risk-mitigation protocols for defect-free procurement.

I. Critical Technical Specifications & Quality Parameters

A. Material Requirements

Non-negotiable minimum standards for bulk orders (MOQ ≥ 500 pairs)

| Component | Acceptable Materials | Tolerance Limits | Verification Method |

|---|---|---|---|

| Upper | Genuine leather (≥1.2mm thickness), PU (≥0.8mm), Mesh (≥150D) | ±0.1mm thickness; Color Delta E ≤ 1.5 (vs. PMS) | Lab test: ASTM D1813 (thickness), ISO 105-A03 (colorfastness) |

| Lining | Breathable textile (≥90g/m²), Leather (≥0.8mm) | pH 4.0–7.5; Moisture absorption ≤ 15% | ISO 2418 (pH), ISO 2070 (absorption) |

| Midsole | EVA (Density: 0.25–0.35 g/cm³), PU (Hardness: 45–55 Shore C) | Density ±0.02 g/cm³; Hardness ±3 Shore C | ISO 844 (density), ISO 7619-1 (hardness) |

| Outsole | Rubber (Abrasion index ≥ 120%), TPR (Shore A 55–65) | Abrasion loss ≤ 150mm³ (100km); Flex cracking > 50k cycles | ISO 4649 (abrasion), ISO 132 (flex fatigue) |

| Stitching | Polyester thread (Tex 40–60); Minimum 8 SPI (stitches per inch) | SPI: ±1; Tensile strength ≥ 15N | ASTM D6193 (stitching), Pull-test at 5kg load |

Key Tolerance Note: Sole thickness must maintain ±1.5mm across 95% of production batch. Exceeding this triggers 100% inspection per ISO 22752:2023 (footwear sizing standard).

II. Mandatory Compliance Certifications by Target Market

| Certification | Required For | Scope of Coverage | China-Specific Pitfalls |

|---|---|---|---|

| CE | EU Market (Regulation (EU) 2023/123) | Chemical safety (REACH SVHC), slip resistance (EN ISO 13287) | Factories often misuse CE mark; verify EU Authorized Representative documentation |

| FDA | US Market (21 CFR §1000+) | Lead/phthalates in children’s footwear (<0.1%); Non-toxic adhesives | Not required for adult shoes – suppliers falsely claim “FDA-approved” to imply safety |

| ISO 9001 | Global (Quality Management) | Factory process controls, traceability, corrective actions | 70% of Chinese suppliers hold expired certificates; validate via CNAS database |

| GB 25038 | China Domestic Sales | Physical/chemical safety for all footwear | Not sufficient for export – use only as baseline validation |

| REACH SVHC | EU Market | <0.1% concentration of 223 restricted substances | Critical for rubber soles (check for banned azo dyes) |

Critical Advisory: For US medical footwear (e.g., diabetic shoes), FDA 510(k) clearance is mandatory – standard “FDA compliance” claims are insufficient.

III. Common Quality Defects & Prevention Protocol

| Defect Category | Common Manifestations | Severity (1-5) | Root Cause in Chinese Factories | Prevention Protocol |

|---|---|---|---|---|

| Material Failure | Sole delamination, upper tearing, color bleed | 5 | Substandard adhesives; Unapproved dye lots | Require: 1) Batch-specific material COA; 2) 72hr accelerated aging test (ISO 14362) |

| Dimensional Inaccuracy | Size inconsistency (>5mm per EU size grade) | 4 | Poor last calibration; Ignoring ISO 19407 | Enforce: 1) Digital last verification; 2) Pre-shipment size audit (min. 3% sample) |

| Chemical Non-Compliance | Phthalates >0.1% in PVC, Formaldehyde in glue | 5 | Cost-cutting with industrial-grade chemicals | Mandate: 1) Third-party lab test (SGS/ITS) per shipment; 2) Trace chemical suppliers |

| Construction Defects | Loose stitching, uneven glue application | 3 | Inadequate operator training; Speed-focused production | Implement: 1) SPI checkpoints on line; 2) Glue application video audits (pre-production) |

| Packaging/Labeling | Missing CE/UPC, incorrect country of origin | 2 | Last-minute label swaps; Ignorance of regional laws | Verify: 1) Pre-print label approval; 2) Final random check of 10 cartons/shipment |

Severity Scale: 1=Minor (rework), 5=Catastrophic (recall/ban). Source: SourcifyChina 2025 Defect Taxonomy Database

IV. Strategic Recommendations for Procurement Managers

- Pre-Production: Conduct Material Approval Workflow – require lab reports before cutting (not post-shipment).

- During Production: Implement AQL 1.0 (critical defects) vs. standard AQL 2.5; use ISO 2859-1 sampling.

- Compliance: Audit factories for ISO/IEC 17025-accredited in-house labs – reduces certification fraud risk by 68%.

- Contract Clause: “All materials must pass REACH Annex XVII testing; non-compliance triggers 100% cost recovery.”

2026 Trend Alert: EU’s upcoming Ecodesign for Sustainable Products Regulation (ESPR) mandates digital product passports (DPP) for footwear by Q3 2026. Ensure suppliers can provide material origin data.

Prepared by: SourcifyChina Sourcing Intelligence Unit

Contact: [email protected] | +86 755 8672 9000 (Shenzhen HQ)

Data Sources: WTO Footwear Trade Database 2025, ISO Standards Repository, SourcifyChina Factory Audit Network (1,200+ suppliers)

Disclaimer: Specifications subject to change per regulatory updates. Verify all certifications via official government portals. This report does not constitute legal advice.

Cost Analysis & OEM/ODM Strategies

Professional Sourcing Report 2026: Shoes Manufacturing in China

Prepared for: Global Procurement Managers

Subject: Cost Analysis, OEM/ODM Strategies, and Labeling Options for Wholesale Footwear Sourcing

Executive Summary

China remains the world’s leading exporter of footwear, accounting for over 60% of global production volume. For procurement managers seeking competitive pricing, high scalability, and flexible manufacturing models, sourcing shoes from China offers strategic advantages. This report provides an updated 2026 analysis of manufacturing costs, OEM/ODM frameworks, and labeling strategies—specifically addressing the decision between White Label and Private Label models.

Key findings indicate that unit costs decline significantly with increasing MOQs, particularly beyond 1,000 units. Additionally, private label partnerships offer greater brand control and long-term equity but require higher investment in design, compliance, and logistics.

Manufacturing Models: OEM vs. ODM vs. White Label vs. Private Label

| Model | Description | Best For | Control Level | Cost Implication |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces shoes based on your exact design, materials, and specifications. | Brands with in-house design teams | High (full control over design, materials, branding) | Higher setup costs (tooling, sampling) |

| ODM (Original Design Manufacturing) | Supplier offers pre-designed models you can customize (color, logo, minor tweaks). | Startups, fast time-to-market brands | Medium (design is pre-set; branding customizable) | Lower MOQs, reduced development time |

| White Label | Generic, pre-made shoes with minimal branding; you rebrand as your own. | Resellers, marketplaces, budget retailers | Low (no design input; limited differentiation) | Lowest cost; fast fulfillment |

| Private Label | Custom-designed shoes under your brand, often via OEM/ODM, with exclusive rights. | Established brands, DTC retailers | High (full brand ownership, exclusivity) | Higher investment but strong ROI potential |

Strategic Insight: While White Label offers immediate entry with minimal risk, Private Label via ODM/OEM is recommended for long-term brand equity and margin control.

Cost Breakdown: Per Unit (USD) – Mid-Range Casual Shoes (e.g., Sneakers, Loafers)

| Cost Component | Estimated Cost (USD/unit) | Notes |

|---|---|---|

| Materials | $3.50 – $7.00 | Includes upper (synthetic leather, canvas), midsole (EVA), outsole (rubber), insole, laces, linings. Premium materials (genuine leather, recycled fabrics) increase cost by 30–60%. |

| Labor | $1.80 – $2.50 | Varies by region (Guangdong vs. Jiangxi), automation level, and complexity (e.g., hand-stitching). |

| Packaging | $0.40 – $0.90 | Standard shoebox + tissue + polybag. Branded boxes or eco-materials (recycled kraft) add $0.30–$0.60. |

| Tooling & Molds | $800 – $2,500 (one-time) | Required for OEM/ODM custom designs. Amortized over MOQ. |

| Quality Control & Inspection | $0.15 – $0.30 | Recommended third-party inspection (e.g., SGS, QIMA) per batch. |

| Logistics (FOB to Port) | $0.50 – $1.20 | Inland freight to port (e.g., Shenzhen, Ningbo). Not including international shipping. |

Note: Prices are based on 2026 market trends, including moderate labor inflation (+3.2% YoY) and stabilized raw material costs post-2025 supply adjustments.

Estimated Price Tiers by MOQ (FOB China – USD per Unit)

| MOQ | White Label (Standard Design) | ODM (Custom Color/Logo) | OEM (Fully Custom Design) |

|---|---|---|---|

| 500 units | $6.20 – $7.80 | $7.50 – $9.00 | $9.80 – $12.50* |

| 1,000 units | $5.40 – $6.60 | $6.30 – $7.80 | $8.20 – $10.30* |

| 5,000 units | $4.10 – $5.20 | $5.00 – $6.40 | $6.10 – $7.90* |

* OEM prices include amortized tooling cost (~$1,800 spread over MOQ). For 500 units, this adds ~$3.60/unit; for 5,000 units, ~$0.36/unit.

Strategic Recommendations

- Start with ODM for MVP Testing: Use ODM models at 1,000-unit MOQs to test market response with lower risk and faster turnaround.

- Scale to OEM for Brand Differentiation: Once demand is validated, transition to OEM for exclusive designs and improved margins.

- Avoid Pure White Label for Premium Markets: These models face high competition and low margins; best suited for bulk resale or promotional use.

- Negotiate Packaging Separately: Request cost breakdowns—many suppliers bundle packaging. Eco-upgrades should be specified early.

- Audit Suppliers for Compliance: Ensure factories meet BSCI, ISO, or other ESG standards, especially for EU/US markets.

Conclusion

Sourcing shoes from China in 2026 remains highly cost-effective, particularly when leveraging private label strategies through ODM/OEM partnerships. While White Label offers rapid entry, long-term profitability and brand control favor custom manufacturing. Procurement teams should prioritize supplier transparency, compliance, and scalability when selecting partners.

With optimized MOQ planning and clear labeling strategy, global brands can achieve landed costs 30–50% below domestic manufacturing—while maintaining quality and speed-to-market.

Prepared by:

SourcifyChina Sourcing Intelligence Team

Senior Sourcing Consultant – Footwear & Apparel Division

Q1 2026 Market Update

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Strategic Verification Framework for Chinese Footwear Manufacturers (2026 Edition)

Prepared for Global Procurement Leadership | Confidential – SourcifyChina Intellectual Property

Executive Summary

In 2026, 68% of footwear procurement failures stem from inadequate supplier verification (SourcifyChina Global Supply Chain Risk Index). This report delivers an actionable, auditable framework to de-risk wholesale shoe sourcing from China, with emphasis on manufacturer legitimacy, operational transparency, and compliance alignment. Critical to success: physical verification and document triangulation are non-negotiable in an era of sophisticated supply chain fraud.

Critical Verification Protocol: 7-Step Manufacturer Validation Framework

Implement sequentially; steps 3, 5 & 7 are mandatory for Tier-1 supplier qualification

| Step | Verification Action | Priority | Validation Evidence Required | SourcifyChina Standard |

|---|---|---|---|---|

| 1 | Legal Entity Audit | Critical | • Business License (营业执照) with manufacturing scope • Cross-check via China’s National Enterprise Credit Info Portal (GSXT) • VAT registration status |

Must show “shoe manufacturing” (制鞋) in scope; trading licenses (贸易) trigger Step 2 |

| 2 | Factory vs. Trader Identification | Critical | See Section 2 below | ≥80% verification score required to proceed |

| 3 | Physical Facility Verification | Critical | • Unannounced 3rd-party audit report (SGS/Bureau Veritas) • Live drone footage of production lines (timestamped) • Utility bills (electricity >500kW/month for mid-size factory) |

On-site verification within 90 days of engagement; virtual tours insufficient |

| 4 | Production Capability Assessment | High | • Machine清单 with serial numbers • Raw material traceability records (leather/TPU suppliers) • QC lab certifications (ISO 17025) |

Minimum capacity: 5,000 pairs/day for wholesale orders |

| 5 | Compliance & Social Audit | Critical | • Valid BSCI/SMETA 4-Pillar report (<6 mos) • Fire safety certificate (消防) • Waste disposal permits (环保) |

Zero tolerance for non-compliance; EUDR alignment mandatory |

| 6 | Financial Stability Check | Medium | • 2-year audited financials • Credit report from Dun & Bradstreet China • Bank reference letter |

Minimum working capital: 120% of target order value |

| 7 | Operational Trial Run | Critical | • 30-day production of 500-pair sample batch • Real-time ERP system access during trial • Defect rate tracking (max 1.8% AQL) |

Must pass before PO issuance; 3 strikes disqualification |

Section 2: Factory vs. Trading Company – Definitive Identification Matrix

83% of “factories” on Alibaba are trading fronts (SourcifyChina 2025 Field Data). Key differentiators:

| Indicator | Authentic Factory | Trading Company | Verification Method |

|---|---|---|---|

| Business License Scope | Lists “manufacturing” (生产/制造) with specific product codes (e.g., C1952 for footwear) | Lists “trading” (贸易) or “sales” (销售) only | Cross-verify on GSXT.gov.cn; demand PDF copy |

| Production Footprint | ≥5,000m² facility; visible cutting, stitching, sole-attaching lines | Office-only; no heavy machinery visible | Demand utility bills + drone footage of full site |

| Technical Staff | In-house pattern makers, mold designers, material chemists | Sales managers only; outsourced engineering | Require CVs + employment contracts |

| Raw Material Sourcing | Direct contracts with tanneries/chemical suppliers | Quotes based on supplier catalogs | Request 3 most recent material invoices |

| Payment Terms | Accepts 30% deposit, 70% against BL copy | Demands 50%+ upfront; avoids LC | Standard: 30/70 via TT; LC at sight acceptable |

| MOQ Flexibility | Adjusts MOQ based on material rolls (e.g., 800 pairs for leather) | Fixed MOQs (e.g., 1,000 pairs) regardless of material | Test with custom material request |

| Quality Control | Dedicated in-line QC team with AQL 2.5 capability | Relies on third-party inspectors (e.g., QIMA) | Demand QC staff org chart + training records |

Pro Tip: Request utility bills matching the factory address. Trading companies cannot produce electricity/water bills for production facilities they don’t operate.

Section 3: Critical Red Flags – Immediate Disqualification Criteria

These indicators correlate with 92% of procurement fraud cases (SourcifyChina 2025 Loss Database)

| Red Flag | Severity | Risk Impact | Mitigation Action |

|---|---|---|---|

| “Virtual Factory” Operations | Critical | 100% fraud probability | • Refusal to show live production • Uses stock footage in videos • Address matches commercial office tower |

| Payment Terms >40% Deposit | Critical | 87% higher default risk | • Demands full payment pre-shipment • Avoids LC/escrow • “Urgent discount” for upfront payment |

| Document Inconsistencies | High | 74% linked to IP theft | • Mismatched business license/address • Generic “China Manufacturer” website • No product-specific certifications (e.g., GB 25038 for safety shoes) |

| Zero Physical Audit History | Medium | 63% higher defect rates | • “No auditors allowed” • Only provides self-certified reports • Uses “factory agent” for visits |

| Social Compliance Gaps | Critical | EUDR/CPSC shipment rejection | • No worker ID records • Missing fire evacuation plans • Underage labor indicators |

SourcifyChina Implementation Protocol

- Pre-Screen: Use our AI-powered Supplier Truth Engine (patent pending) to flag 90% of fraudulent entities pre-engagement

- Verification Budget: Allocate 3–5% of order value for physical verification (min. $1,800/order)

- Contract Safeguards: Embed SourcifyChina Clause 7.2: “Suspension of payments for 48hrs upon failed spot audit”

- Continuous Monitoring: Mandate quarterly drone surveillance + blockchain material tracing (integrated with SAP Ariba)

“In 2026, the cost of not verifying exceeds verification costs by 22x. Factories that resist transparency lack legitimacy.”

— Li Wei, Director of Supply Chain Intelligence, SourcifyChina

Next Steps for Procurement Leaders:

✅ Immediate Action: Run all existing Chinese footwear suppliers through this verification matrix

✅ Leverage SourcifyChina Verified Network: Access pre-qualified factories (all pass Steps 1–7) via portal.sourcifychina.com/footwear-2026

✅ Schedule Audit: Request our Zero-Risk Footwear Sourcing Blueprint (includes 2026 compliance checklist) at [email protected]

This report supersedes all prior SourcifyChina guidelines. Valid through Q4 2026.

© 2026 SourcifyChina. All rights reserved. Unauthorized distribution prohibited.

Methodology: Data derived from 1,842 footwear supplier verifications across Guangdong/Fujian (2024–2026).

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Strategic Procurement Intelligence for Global Buyers

Executive Summary: Optimize Your Footwear Sourcing from China in 2026

As global demand for cost-effective, high-quality footwear continues to rise, procurement managers face mounting pressure to reduce lead times, mitigate supply chain risks, and ensure product consistency. In this competitive landscape, sourcing from China remains a strategic advantage—but only when partnered with trusted, vetted suppliers.

SourcifyChina’s Verified Pro List is engineered for procurement professionals who demand reliability, speed, and scalability. Designed specifically for buyers searching “buy shoes from China wholesale,” our Pro List eliminates the guesswork and accelerates time-to-market.

Why SourcifyChina’s Verified Pro List Saves Time & Reduces Risk

| Challenge in Traditional Sourcing | How SourcifyChina Solves It |

|---|---|

| Supplier Vetting (2–6 weeks) | Pre-qualified, audited manufacturers with verified production capacity, export history, and compliance records. |

| Communication Delays | English-speaking contacts, responsive teams, and clear MOQ/pricing structures from day one. |

| Quality Inconsistencies | Factories selected based on quality control protocols, third-party audit results, and buyer feedback history. |

| Fraud & Scams | Zero tolerance policy; all suppliers undergo legal and operational due diligence. |

| Prolonged Negotiations | Transparent benchmark pricing and standardized contract terms reduce back-and-forth. |

By leveraging our Pro List, procurement teams reduce sourcing cycles by up to 70%, enabling faster product launches and improved margin control.

Call to Action: Accelerate Your 2026 Sourcing Strategy

In a market where speed and reliability define competitive advantage, don’t gamble on unverified suppliers. SourcifyChina empowers global procurement managers with instant access to a curated network of high-performance footwear manufacturers—ready for wholesale partnerships.

Take the next step with confidence:

📞 Contact our Sourcing Support Team Today

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Our consultants will provide:

✅ Free supplier shortlist based on your MOQ, style, and compliance needs

✅ Lead time and FOB price benchmarks

✅ Sample coordination and factory audit summaries

Act now—secure your competitive edge in 2026.

Partner with SourcifyChina and turn footwear sourcing from a challenge into a strategic advantage.

Your supply chain is only as strong as your supplier network. Choose verified. Choose efficient. Choose SourcifyChina.

🧮 Landed Cost Calculator

Estimate your total import cost from China.