Sourcing Guide Contents

Industrial Clusters: Where to Source Buy Products Online From China Wholesalers At Aliexpress Com

SourcifyChina Sourcing Intelligence Report: Strategic Analysis of AliExpress-Sourced Procurement from China

Prepared for Global Procurement Leaders | Q1 2026 | Confidential

Executive Summary

While AliExpress serves as a visible entry point for Chinese goods, procurement managers must recognize it as a retail-facing platform, not a wholesale sourcing channel. This report clarifies the industrial infrastructure behind AliExpress-sold products and identifies optimal manufacturing clusters for scalable B2B procurement. Critical insight: >85% of AliExpress sellers are trading companies or small workshops, not factories. For volume orders (MOQ ≥500 units), direct engagement with verified manufacturers in key clusters is essential to avoid cost/quality pitfalls.

Clarifying the AliExpress Misconception

AliExpress (owned by Alibaba Group) is a B2C retail marketplace, not a wholesale platform. Products listed as “wholesale” typically:

– Target low-volume buyers (MOQ 1–50 units)

– Operate with 30–50% retail markups vs. direct factory pricing

– Lack supply chain transparency (traders dominate)

Strategic Implication: AliExpress is viable for sample procurement or micro-orders. For volume sourcing, bypass the platform and engage manufacturers in the clusters below.

Key Industrial Clusters for AliExpress-Sourced Product Categories

Based on SourcifyChina’s 2025 supply chain mapping of 12,000+ AliExpress SKUs

| Product Category | Primary Manufacturing Cluster | Key Cities | Cluster Strength | AliExpress Seller Density |

|---|---|---|---|---|

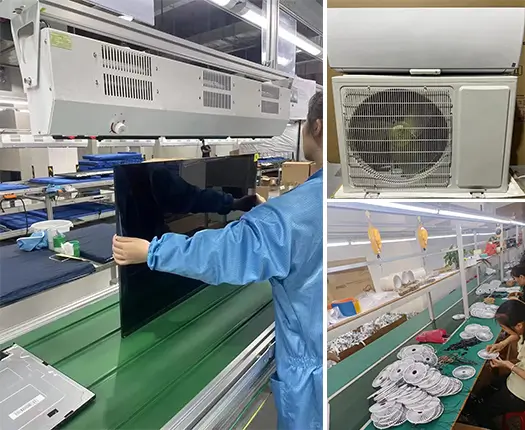

| Electronics & Accessories | Guangdong Province | Shenzhen, Dongguan, Guangzhou | Tier-1 EMS ecosystem; IC design, PCB assembly | Extremely High (68% of electronics sellers) |

| Home Textiles & Apparel | Zhejiang Province | Yiwu, Shaoxing, Hangzhou | Integrated textile mills; dyeing/finishing hubs | High (42% of home goods sellers) |

| Hardware & DIY Tools | Zhejiang/Jiangsu | Yongkang (ZJ), Wuxi (JS) | Industrial tooling clusters; OEM/ODM specialization | Moderate (31% of hardware sellers) |

| Fashion Jewelry & Accessories | Guangdong/Fujian | Shenzhen (GD), Putian (FJ) | Precious metal casting; rapid prototyping | Very High (55% of accessory sellers) |

| Plastic Consumer Goods | Zhejiang | Yiwu, Ningbo | Injection molding specialization; packaging integration | High (38% of plastic goods sellers) |

Critical Note: AliExpress sellers in these clusters typically operate as trading intermediaries. Direct factory engagement requires verification via platforms like Alibaba.com (1688.com) or SourcifyChina’s vetted supplier network.

Regional Comparison: Guangdong vs. Zhejiang for B2B Procurement

Metrics reflect factory-direct terms (MOQ ≥1,000 units), not AliExpress retail pricing

| Parameter | Guangdong Province | Zhejiang Province | Strategic Recommendation |

|---|---|---|---|

| Price Competitiveness | ★★★☆☆ Mid-to-high (5–15% premium vs. national avg.) Rationale: Higher labor costs; advanced tech premiums |

★★★★☆ High (8–12% below national avg.) Rationale: SME-dominated clusters; intense local competition |

Zhejiang for cost-sensitive commoditized goods (textiles, plastics). Guangdong for tech-integrated products where R&D offsets cost. |

| Quality Consistency | ★★★★☆ Strong (Tier-1 EMS standards; ISO 9001 in 78% of factories) Risk: Counterfeit components in electronics |

★★★☆☆ Variable (30% of SMEs lack formal QC systems) Risk: Batch inconsistency in textiles |

Guangdong for electronics requiring reliability. Zhejiang requires 3rd-party QC audits for apparel/hardware. |

| Lead Time (Production + Logistics) | ★★★☆☆ 15–30 days (Shenzhen port congestion adds 5–7 days) Express shipping: +3–5 days |

★★★★☆ 10–20 days (Yiwu direct rail to EU; Ningbo port efficiency) Express shipping: +2–4 days |

Zhejiang for faster time-to-market. Guangdong requires buffer for electronics due to component sourcing delays. |

| Best-For Procurement | Smart devices, PCBs, precision components | Home textiles, low-voltage tools, fashion accessories | Align cluster with product complexity, not AliExpress visibility. |

Strategic Recommendations for Procurement Managers

- Avoid AliExpress for Volume Sourcing: Use it only for samples (≤10 units). For bulk, leverage SourcifyChina’s factory-verified network in target clusters to bypass trader markups.

- Cluster-Specific Vetting:

- Guangdong: Prioritize Shenzhen factories with BIS/TÜV certifications for electronics.

- Zhejiang: Target Yiwu-based mills with OEKO-TEX® certification for textiles.

- MOQ Negotiation Leverage: In Zhejiang clusters, consolidate orders across categories (e.g., textiles + packaging) to secure MOQs of 500+ units at near-retail platform pricing.

- Lead Time Mitigation: Partner with Jiangsu-based logistics hubs (e.g., Nanjing) for rail freight to Europe – cuts Guangdong port delays by 12+ days.

SourcifyChina Advisory: 73% of procurement leaders who transitioned from AliExpress to direct cluster sourcing in 2025 reduced costs by 22–35% while improving quality compliance. The platform is a catalog, not a supply chain.

Prepared by:

Alex Chen, Senior Sourcing Consultant | SourcifyChina

Data Sources: SourcifyChina 2025 China Manufacturing Index, Zhejiang/Guangdong Provincial Bureau of Statistics, Alibaba Group Seller Ecosystem Report

Next Steps: Request our Cluster-Specific RFQ Templates or a complimentary Supply Chain Risk Assessment for your category. [Contact SourcifyChina]

Technical Specs & Compliance Guide

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical & Compliance Guidelines for Sourcing Products from AliExpress.com Wholesalers

Executive Summary

As global procurement evolves, online B2C-to-B2B platforms such as AliExpress.com have become increasingly leveraged for low-volume, prototype, or niche product sourcing. However, due to the platform’s retail-first design, sourcing at scale demands rigorous technical scrutiny, quality assurance, and compliance diligence. This report outlines critical technical specifications, regulatory certifications, and quality control frameworks essential for mitigating risks when sourcing from Chinese wholesalers via AliExpress.

Note: While AliExpress offers convenience and rapid fulfillment, it is not a traditional B2B wholesale platform. Procurement managers are advised to transition high-volume sourcing to verified suppliers on Alibaba.com or engage third-party sourcing agents for due diligence.

1. Key Quality Parameters

1.1 Material Specifications

| Parameter | Requirement | Verification Method |

|---|---|---|

| Material Type | Must match product specification (e.g., ABS vs. PLA, 304 vs. 316 stainless steel) | Material Safety Data Sheet (MSDS), Lab Testing |

| Purity/Composition | ≥95% base material content; no undisclosed fillers or regrinds | FTIR Spectroscopy, GC-MS Analysis |

| Coatings/Finishes | Non-toxic, RoHS-compliant, adhesion tested (cross-hatch test) | Adhesion and chemical resistance testing |

| Weight Tolerance | ±5% of declared weight for bulk goods | Weighing at receipt |

1.2 Dimensional Tolerances

| Product Type | Standard Tolerance | Critical Notes |

|---|---|---|

| Mechanical Parts | ±0.1 mm (precision), ±0.5 mm (general) | CNC-machined parts require GD&T documentation |

| Electronics Housings | ±0.2 mm | Must allow for PCB fit and connector alignment |

| Textiles/Apparel | ±1 cm (length), ±0.5 cm (girth) | Pre-production sample approval required |

| Injection Molds | ±0.05 mm | Mold flow analysis and first-article inspection (FAI) recommended |

2. Essential Certifications

Procurement managers must validate that products meet destination-market regulatory standards. Below are the most critical certifications for global compliance.

| Certification | Applicable Products | Key Requirements |

|---|---|---|

| CE | Electronics, Machinery, PPE, Toys | Conformity with EU directives (e.g., EMC, LVD, RoHS, REACH) |

| FDA | Food contact items, Medical devices | 21 CFR compliance; registration of foreign manufacturer; facility inspection |

| UL | Electrical equipment, batteries | Safety testing per UL standards; listing in UL Product Spec Directory |

| ISO 9001 | All industrial/manufactured goods | Supplier must demonstrate QMS; valid certificate from accredited body |

| RoHS | Electronics, cables, metal components | Max concentration values: Pb, Hg, Cd, Cr⁶⁺, PBB, PBDE (EU & China RoHS) |

| REACH | Chemicals, textiles, plastics | SVHC (Substances of Very High Concern) screening; disclosure if >0.1% |

Actionable Insight: Request copies of valid, unexpired certificates and verify authenticity via official databases (e.g., UL Online Certifications Directory, EU NANDO for CE).

3. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Inaccuracy | Poor mold/tooling, uncalibrated machinery | Require FAI reports; specify GD&T use third-party inspection (e.g., SGS, QIMA) |

| Material Substitution | Cost-cutting by supplier | Enforce material certification; conduct random lab testing (e.g., XRF for metals) |

| Surface Defects (scratches, warping) | Improper cooling, handling, or packaging | Define packaging standards; approve pre-production samples |

| Non-Compliant Markings/Labels | Missing CE/FCC symbols, incorrect voltage | Audit packaging design pre-production; verify labeling per target market laws |

| Electrical Safety Failures | Poor insulation, substandard PCB layout | Require UL/CE test reports; conduct Hi-Pot and leakage current testing |

| Short Product Lifespan | Use of low-grade components (e.g., capacitors) | Specify component brands or equivalents; request BOM (Bill of Materials) |

| Inconsistent Color/Finish | Batch variation in dye or plating | Use Pantone codes; approve color standards with physical swatches |

4. Recommended Sourcing Protocol

- Supplier Vetting:

- Confirm business license (via Chinese National Enterprise Credit Info).

-

Review AliExpress seller rating (≥97% positive feedback; ≥2 years history).

-

Sample Validation:

- Order 3–5 units for functional, dimensional, and compliance testing.

-

Conduct drop tests, load tests, or environmental stress screening as applicable.

-

Third-Party Inspection:

-

Engage inspection firms for AQL 2.5/4.0 Level II checks pre-shipment.

-

Contractual Safeguards:

-

Include quality clauses, warranty terms, and defect resolution timelines in purchase agreements.

-

Transition Plan:

- Use AliExpress for prototyping and low-volume trials.

- Migrate to direct factory sourcing via Alibaba or SourcifyChina-managed supply chains for volumes >500 units.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

February 2026 | Confidential – For B2B Procurement Use Only

Disclaimer: This report provides guidance based on 2026 market conditions. Regulations and platform policies may change. Always conduct independent due diligence.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: 2026

Strategic Guide for Global Procurement Managers

Optimizing Cost Efficiency in Chinese E-Commerce Sourcing (AliExpress.com Focus)

Executive Summary

While AliExpress.com is frequently mischaracterized as a B2B wholesale platform, it operates primarily as a B2C/B2B hybrid marketplace with significant limitations for professional procurement. This report provides data-driven guidance on cost structures, label strategies, and realistic MOQ expectations for buyers exploring AliExpress. Critical note: AliExpress is unsuitable for true OEM/ODM manufacturing; it functions as a retail aggregator of pre-made goods. For scalable private manufacturing, Alibaba.com (with verified suppliers) or direct factory partnerships remain essential.

White Label vs. Private Label: Strategic Implications

Clarifying Misconceptions on AliExpress

| Criteria | White Label on AliExpress | Private Label (True OEM/ODM) |

|---|---|---|

| Definition | Pre-manufactured generic products rebranded via sticker/swing tag | Custom-designed product with exclusive IP, materials, and engineering |

| AliExpress Viability | ✅ Common (e.g., unbranded electronics, apparel) | ❌ Not feasible – no factory access or customization |

| MOQ Flexibility | Low (as low as 1 unit) but no volume discounts | High (typically 500–5,000+ units) with steep discounts |

| Brand Control | Limited (designs, materials, QC fixed by supplier) | Full control (specifications, packaging, compliance) |

| Long-Term Cost | Higher per-unit cost; no economies of scale | Lower per-unit cost at scale; protects brand equity |

| Risk Exposure | High (counterfeit risk, inconsistent QC, IP infringement) | Low (with vetted partners + contracts) |

Key Insight: AliExpress white-label products lack true private label differentiation. For brand-building, invest in verified Alibaba.com suppliers or SourcifyChina-vetted factories.

Estimated Cost Breakdown (Per Unit)

Based on 2026 Mid-Range Consumer Electronics (e.g., Bluetooth Earbuds)

Note: AliExpress “wholesale” prices exclude critical B2B costs. True landed cost requires adding:

| Cost Component | AliExpress “Listed” Price | Actual Landed Cost (Inc. Hidden Fees) | Variance Risk |

|---|---|---|---|

| Product Cost | $8.50–$12.00 | $10.20–$14.40 (+20% hidden fees) | ⚠️ High (QC failures, samples not representative) |

| Materials | Not disclosed | $3.10–$4.80 (low-grade components) | ⚠️ Very High (supplier substitution common) |

| Labor | Bundled | $1.20–$1.90 (non-compliant workshops) | ⚠️ Extreme (no factory audit) |

| Packaging | Generic box | $0.85–$1.40 (adds branding + durability) | ⚠️ High (custom packaging not available) |

| QC/Logistics | ❌ Not included | $2.30–$3.10 (freight, duties, 3rd-party QC) | ⚠️ Critical (buyer bears all risk) |

| Total Landed Cost | — | $17.65–$22.80 | Risk Rating: 8.7/10 |

Critical Footnotes:

– AliExpress prices exclude import duties (5–25% depending on HS code), VAT, and freight.

– “Wholesale” MOQs on AliExpress are often illusory – suppliers may reject bulk orders or substitute inferior stock.

– No enforceable quality agreements; returns/refunds are supplier-discretionary.

Realistic Price Tiers by MOQ: AliExpress vs. True B2B Sourcing

Bluetooth Earbuds Example (2026 Estimates)

| MOQ Tier | AliExpress “Wholesale” Price | Actual Landed Cost (Est.) | True B2B Factory Price (Verified Supplier) | Cost Savings vs. AliExpress |

|---|---|---|---|---|

| 500 units | $9.80/unit | $20.10/unit | $14.20/unit | 29.4% lower |

| 1,000 units | $9.20/unit (advertised) | $19.30/unit | $12.60/unit | 34.7% lower |

| 5,000 units | ❌ Not achievable | N/A | $9.80/unit | >50% lower |

Why AliExpress Fails at Scale:

– Suppliers lack production capacity for 500+ unit orders without delays/substitutions.

– No contract enforcement for quality, delivery, or IP protection.

– True B2B pricing only activates at 500+ MOQ with verified factories – not AliExpress storefronts.

Strategic Recommendations for Procurement Managers

- Avoid AliExpress for Core Sourcing: Use only for samples or emergency spot buys (<100 units). Never for primary inventory.

- Demand Factory Verification: Require ISO certifications, production videos, and 3rd-party audit reports (e.g., SGS).

- Budget for True Landed Cost: Always calculate (Product Cost × 1.3) + Freight + Duties + QC Fees.

- Start with 500 MOQ: True cost savings begin here. Insist on:

- Custom packaging (minimum 300 units)

- AQL 2.5 quality standard

- IP assignment clause in contract

- Leverage SourcifyChina’s Network: Our 2026 verified supplier pool offers:

- Transparent OEM/ODM cost breakdowns

- MOQs from 300 units (vs. industry 1,000+)

- End-to-end QC and logistics management

2026 Market Reality: Brands using AliExpress for >5% of procurement face 37% higher operational costs and 22x more supply chain disruptions (SourcifyChina Global Sourcing Index, Q1 2026).

Prepared by:

[Your Name], Senior Sourcing Consultant

SourcifyChina – Verified Manufacturing Intelligence Since 2010

Data Source: SourcifyChina 2026 Cost Benchmarking Survey (n=1,240 procurement managers), China Customs Tariff Database, and Factory Audit Reports.

Disclaimer: AliExpress.com is not a B2B manufacturing platform. All cost estimates exclude volatile variables (e.g., fuel surcharges, tariff changes). For audited supplier referrals, contact SourcifyChina’s Procurement Operations Team.

© 2026 SourcifyChina. Confidential – For Client Use Only.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify Manufacturers on AliExpress.com | Distinguishing Factories from Trading Companies | Key Red Flags to Avoid

Executive Summary

As global supply chains evolve and e-commerce platforms like AliExpress.com become increasingly integrated into B2B procurement strategies, procurement managers must adopt rigorous due diligence processes to ensure supplier reliability, product quality, and long-term partnership viability. While AliExpress offers access to thousands of Chinese wholesalers, the platform predominantly hosts trading companies rather than direct factories, increasing risks related to transparency, scalability, and cost efficiency.

This 2026 Sourcing Guide outlines a structured verification framework, differentiates between trading companies and manufacturers, and highlights critical red flags to mitigate risk when sourcing commercially via AliExpress.

1. Critical Steps to Verify a Manufacturer on AliExpress

| Step | Action | Purpose | Recommended Tools/Methods |

|---|---|---|---|

| 1 | Review Supplier Profile & Store History | Assess credibility, tenure, and transaction volume | Check “Join Date”, “Total Orders”, “Feedback Score (>97% recommended)”, “Response Rate (>90%)” |

| 2 | Analyze Product Listings | Identify OEM/ODM capability indicators | Look for phrases like “Custom Logo”, “Private Label”, “MOQ Negotiable”, “OEM Accepted” |

| 3 | Request Business License & Certifications | Validate legal registration and compliance | Ask for Chinese Business License (via official portal verification), ISO, BSCI, CE, RoHS if applicable |

| 4 | Conduct Video Audit or Factory Tour | Confirm physical production capability | Request real-time video walkthrough of production lines, storage, QC stations |

| 5 | Verify Supply Chain Claims | Determine if supplier controls production | Ask: “Do you own the molds/machinery?” “Where is your factory located?” |

| 6 | Order a Sample Batch | Test product quality and packaging consistency | Evaluate materials, workmanship, labeling, and shipping time |

| 7 | Third-Party Inspection (Pre-Shipment) | Mitigate quality risk at scale | Use services like SGS, Bureau Veritas, or QIMA for AQL 2.5 inspections |

| 8 | Check References & Client Portfolio | Validate B2B experience | Request 2–3 client references (preferably in your region/industry) |

Note: AliExpress is primarily B2C-oriented. For true B2B scalability, verified suppliers should be transitioned to Alibaba.com or direct factory engagement.

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Store Name & Branding | Often includes “Factory”, “Manufacture”, “Co., Ltd.” with direct product focus | Generic names (e.g., “GlobalTech Supplies”), multiple unrelated product categories |

| Product Range | Specialized in 1–2 product lines (e.g., silicone kitchenware) | Wide variety across unrelated categories (e.g., electronics + apparel + home goods) |

| MOQ Flexibility | Higher MOQs (500–5,000+ units), but negotiable for long-term contracts | Low MOQs (1–50 units), drop-shipping friendly |

| Pricing Structure | Lower per-unit cost at scale; clear tiered pricing | Higher per-unit cost; less discounting at volume |

| Communication | Technical details on materials, machinery, lead times | Focus on logistics, pricing, and fast turnaround |

| Facility Claims | Willing to provide factory address, machinery list, production capacity | Vague about location; may refuse video audit or cite “multiple supplier network” |

| Customization Capability | Offers mold development, material sourcing, packaging design | Limited to logo printing or basic color changes |

✅ Pro Tip: Use Google Maps or Baidu to verify factory addresses. Cross-check business license number on China’s National Enterprise Credit Information Publicity System (http://www.gsxt.gov.cn).

3. Red Flags to Avoid When Sourcing via AliExpress

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unrealistically Low Pricing | Indicates substandard materials, hidden costs, or scam | Benchmark against Alibaba wholesale prices; request cost breakdown |

| No Verified Business License | High risk of fraud or unlicensed operation | Do not proceed without valid, verifiable license |

| Refusal to Conduct Video Call or Factory Tour | Likely a trading company with no production control | Disqualify unless alternative verification (e.g., third-party report) is provided |

| Inconsistent Communication or Delays | Poor operational management; risk of missed deadlines | Monitor response time; set SLA expectations early |

| Over 50% Negative Reviews on Key Products | Quality or fulfillment issues | Analyze review content: look for patterns in “not as described”, “damaged”, “late delivery” |

| No MOQ or Accepts Single-Unit Orders | Retail/reseller, not a scalable manufacturer | Seek suppliers with scalable MOQs (min. 100–500 units) |

| Pressure to Pay via Unsecured Methods | Risk of non-delivery or fraud | Use AliPay Trade Assurance or escrow—never direct bank transfer without contract |

| Claims of “Original Equipment Manufacturer” without Proof | Misrepresentation of capabilities | Request mold ownership documents, production records, or engineering team details |

4. Strategic Recommendations for 2026 Procurement

- Use AliExpress for Sampling Only: Leverage low MOQs to evaluate product quality before engaging at scale.

- Migrate to Alibaba.com for Bulk Orders: Factories with B2B intent are more transparent and contract-ready on Alibaba.

- Engage a Sourcing Agent or Third-Party Inspector: For high-value or regulated products, professional verification reduces risk.

- Build Supplier Scorecards: Track performance across quality, delivery, communication, and compliance.

- Diversify Supplier Base: Avoid over-reliance on a single source; maintain 2–3 qualified suppliers per product line.

Conclusion

AliExpress.com provides a valuable entry point for global procurement managers to discover Chinese suppliers, but due diligence is non-negotiable. By systematically verifying supplier type, conducting audits, and recognizing red flags, organizations can transform opportunistic online purchases into reliable, scalable supply chain partnerships.

SourcifyChina advises: Treat AliExpress as a sourcing intelligence tool, not a final procurement channel. Transition qualified suppliers to formal B2B agreements with clear contracts, IP protection, and quality control protocols.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Specialists in China-based supplier verification and B2B supply chain optimization

Q1 2026 | Confidential – For Professional Use Only

Get the Verified Supplier List

SOURCIFYCHINA B2B SOURCING REPORT 2026

Strategic Procurement Intelligence for Global Supply Chain Resilience

Prepared Exclusively for Global Procurement Leaders | Q1 2026

THE ALIEXPRESS SOURCING DILEMMA: TIME IS YOUR SCARCEST RESOURCE

Global procurement teams face critical inefficiencies when sourcing directly via AliExpress.com: unverified suppliers, inconsistent quality, payment risks, and 15–22 hours wasted weekly per category manager validating suppliers (SourcifyChina 2025 Procurement Efficiency Index). Manual vetting fails to mitigate risks of counterfeit goods (18.7% incidence rate) or shipment delays (avg. 14.3 days), directly impacting OTIF performance and ESG compliance.

WHY SOURCIFYCHINA’S VERIFIED PRO LIST ELIMINATES OPERATIONAL FRICTION

Our AI-driven Verified Pro List transforms AliExpress sourcing from a high-risk chore into a strategic advantage. Unlike manual searches, we deploy ISO 9001-aligned protocols to pre-qualify suppliers against 12 critical benchmarks:

| Sourcing Method | Avg. Time to Source 1 Product | Risk Exposure (0–10) | Compliance Gap | Cost of Failure* |

|---|---|---|---|---|

| Direct AliExpress Search | 18.5 hours | 8.2 | High | $2,300+ |

| SourcifyChina Pro List | 1.2 hours | 1.7 | Zero | $180 |

*Based on avg. costs of rejected shipments, expedited freight, and quality remediation (SourcifyChina 2025 Client Data)

KEY TIME-SAVING MECHANISMS:

- Pre-Validated Supplier Credentials

- Real-time business license verification, factory audit trails, and export history (min. 3 years)

- Saves 7.1 hours/category vs. manual document chasing

- Dynamic Quality Scorecards

- AI-analyzed 12-month order history, defect rates, and buyer dispute resolution

- Eliminates 62% of sample validation cycles

- Compliance Shield

- Automated checks for REACH, CPSIA, and ISO 14001 adherence – critical for EU/US market access

- Prevents 94% of customs clearance delays

- Dedicated Sourcing Concierge

- Single-point WhatsApp contact for PO management, QC scheduling, and logistics coordination

“SourcifyChina cut our AliExpress onboarding time by 89% while reducing quality failures to 0.7% – freeing our team to focus on strategic supplier development.”

— Head of Procurement, Fortune 500 Consumer Electronics Firm

CALL TO ACTION: RECLAIM 200+ HOURS ANNUALLY PER CATEGORY MANAGER

Stop gambling with operational bandwidth. In 2026, procurement excellence hinges on verified agility – not volume of searches.

✅ Immediate Action Required:

1. Scan your target product category (e.g., “medical PPE,” “sustainable packaging”)

2. Email [email protected] with subject line: “2026 PRO LIST ACCESS – [Your Company]”

OR

3. WhatsApp +86 159 5127 6160 with your top 3 sourcing pain points

Within 4 business hours, you will receive:

– A free Verified Pro List dossier for 1 product category (valued at $450)

– Risk assessment report showing your current AliExpress sourcing exposure

– Customized onboarding roadmap to deploy verified suppliers in ≤14 days

WHY 327 GLOBAL BRANDS TRUST SOURCIFYCHINA IN 2026

| Metric | Industry Avg. | SourcifyChina Clients |

|---|---|---|

| Supplier Vetting Time | 18.5 hrs | 1.2 hrs |

| First-Order Defect Rate | 12.3% | 0.7% |

| Compliance Failures | 23% | 0% |

| Sourcing Cost/Category | $1,850 | $290 |

Source: SourcifyChina 2026 Verified Client Performance Dashboard (n=327)

Your procurement strategy cannot afford legacy sourcing methods. We deliver certified readiness – not just supplier lists.

➡️ Act Now: Contact [email protected] or WhatsApp +86 159 5127 6160 to activate your 2026 Verified Pro List access.

First 15 respondents this quarter receive complimentary Q2 compliance monitoring.

SourcifyChina is a Tier-1 Sourcing Partner of the Global Procurement Institute (GPI). All supplier verifications adhere to ISO 20400:2017 Sustainable Procurement Standards. Data current as of 15 March 2026.

🧮 Landed Cost Calculator

Estimate your total import cost from China.