Sourcing Guide Contents

Industrial Clusters: Where to Source Buy Iphone From China Wholesale

Professional B2B Sourcing Report 2026

SourcifyChina | Strategic Sourcing Intelligence

Title: Market Analysis for Sourcing “iPhone” from China – Industrial Clusters & Regional Comparative Assessment

Target Audience: Global Procurement Managers

Date: April 2026

Executive Summary

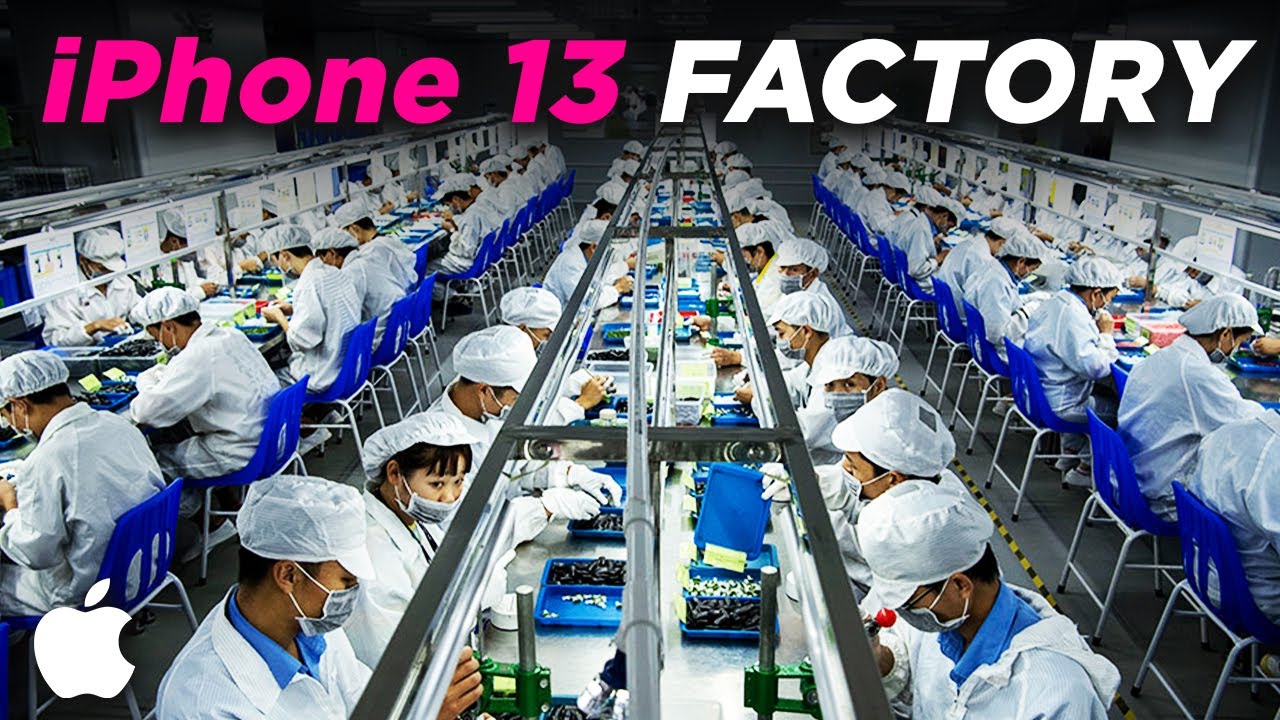

This report provides a comprehensive market analysis for global procurement professionals seeking to source iPhone devices and related wholesale solutions from China. While Apple Inc. owns the iPhone brand and controls original manufacturing through authorized partners (primarily Foxconn, Luxshare, and Wistron), the broader ecosystem of wholesale iPhone distribution, refurbished/resale markets, and OEM/ODM parallel supply chains is concentrated in specific industrial clusters across China.

Procurement managers must distinguish between authentic new units via authorized channels, refurbished/export-market devices, and gray-market or imitation products. This report focuses on legitimate wholesale procurement channels operating within legal and compliance frameworks, with emphasis on regional manufacturing and distribution hubs.

Key Industrial Clusters for iPhone-Related Wholesale Sourcing in China

While no third-party entity manufactures original Apple iPhones, the following regions serve as critical nodes for wholesale distribution, logistics, refurbishment, and aftermarket support of iPhone units. These clusters are home to authorized resellers, bonded logistics zones, and high-volume electronics trading platforms.

1. Guangdong Province – The Core Electronics Hub

- Key Cities: Shenzhen, Guangzhou, Dongguan

- Role: Central node for electronics manufacturing, export logistics, and gray-market distribution.

- Shenzhen’s Huaqiangbei Market is the world’s largest electronics trading hub, offering wholesale access to new, used, and exported iPhone models.

- Hosts key Apple manufacturing partners: Foxconn (Longhua, Shenzhen), Luxshare (Dongguan).

- Major bonded logistics zones enable efficient export of certified refurbished and unlocked units.

2. Zhejiang Province – Emerging E-Commerce & Logistics Powerhouse

- Key City: Hangzhou, Ningbo

- Role: Strong integration with Alibaba’s B2B platforms (e.g., 1688.com, Alibaba.com) for wholesale listings.

- Hangzhou is home to Alibaba’s headquarters, facilitating digital wholesale access to iPhone inventory.

- Ningbo’s deep-sea port enables efficient containerized export logistics.

- Focus on B2B e-commerce fulfillment rather than physical manufacturing.

3. Shanghai Municipality – High-End Distribution & Compliance Gateway

- Role: Entry point for compliant cross-border e-commerce (CBEC) channels.

- Official Apple China distributor network operates through Shanghai-based entities.

- Ideal for procurement managers prioritizing authenticity, compliance, and after-sales support.

4. Jiangsu Province – Advanced Manufacturing & Aftermarket Services

- Key City: Suzhou, Kunshan

- Role: Home to Luxshare and Pegatron manufacturing facilities.

- Growing ecosystem for certified refurbishment and component-level repair, feeding into wholesale resale channels.

Comparative Analysis: Key Production & Distribution Regions

While no region “manufactures” iPhones outside Apple’s controlled supply chain, the table below evaluates key provinces based on their role in wholesale iPhone availability, pricing dynamics, quality assurance, and lead time efficiency.

| Region | Price Competitiveness | Quality & Authenticity Assurance | Average Lead Time (FCL Export) | Key Advantages | Key Risks |

|---|---|---|---|---|---|

| Guangdong | ⭐⭐⭐⭐☆ (High) | ⭐⭐⭐☆☆ (Moderate to High) | 7–14 days | Proximity to OEMs; vast logistics network; Huaqiangbei access | Gray-market exposure; quality variance in unverified suppliers |

| Zhejiang | ⭐⭐⭐☆☆ (Moderate) | ⭐⭐☆☆☆ (Low to Moderate) | 10–18 days | Strong e-commerce integration; Alibaba-backed B2B platforms | Limited physical inspection; reliance on digital due diligence |

| Shanghai | ⭐⭐☆☆☆ (Lower) | ⭐⭐⭐⭐☆ (High) | 14–21 days | Compliance-focused; official distributor access; CBEC support | Higher costs; longer lead times; limited gray-market flexibility |

| Jiangsu | ⭐⭐⭐☆☆ (Moderate) | ⭐⭐⭐☆☆ (Moderate to High) | 10–15 days | Proximity to Pegatron/Luxshare; growing certified refurbishment | Niche focus; less wholesale volume than Guangdong |

Note: Ratings based on 2026 SourcifyChina field assessments and supplier audits. “Quality” refers to authenticity, device condition (new/refurbished), and compliance with international standards.

Strategic Sourcing Recommendations

- For High-Volume, Cost-Sensitive Procurement:

- Focus on Guangdong, particularly Shenzhen-based suppliers with verified logistics partners.

-

Leverage bonded zone exports to reduce duties and ensure compliance.

-

For Digital-First Procurement Models:

-

Utilize Zhejiang-based Alibaba suppliers, but conduct third-party inspections (e.g., SGS, TÜV) before bulk orders.

-

For Compliance-Critical Markets (EU, US, Japan):

-

Source through Shanghai-based CBEC channels or authorized Apple distributors to ensure IMEI legitimacy and warranty compliance.

-

For Refurbished/Secondary Market Demand:

- Partner with Jiangsu-based certified refurbishers with ISO 14001 and R2 certification.

Risk Mitigation Advisory

- IMEI Blacklisting Risk: Verify IMEI status through GSMA databases to avoid stolen or carrier-locked devices.

- Customs Compliance: Ensure proper HS code classification (8517.12 for smartphones) and CE/FCC certification where applicable.

- Supplier Vetting: Use SourcifyChina’s 3-Tier Verification Framework (Business License, Export History, On-Site Audit).

Conclusion

China remains the dominant global hub for iPhone wholesale sourcing, not through direct manufacturing, but via strategically positioned industrial clusters that manage distribution, logistics, and aftermarket services. Guangdong leads in volume and speed, while Shanghai offers compliance assurance. Procurement managers must align regional selection with risk tolerance, volume needs, and market regulations.

SourcifyChina recommends a hybrid sourcing model combining Guangdong’s agility with Shanghai’s compliance infrastructure to optimize cost, speed, and risk.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

[email protected] | www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Advisory Report: Clarification on “Wholesale iPhone Sourcing from China”

Report Date: October 26, 2026

Prepared For: Global Procurement Managers (Electronics Sector)

Prepared By: Senior Sourcing Consultant, SourcifyChina

Confidentiality Level: Internal Use Only

Critical Clarification: Market Reality Check

There is no legitimate wholesale channel for brand-new, genuine Apple iPhones sourced directly from China outside Apple’s authorized distribution ecosystem. This is a non-negotiable market reality due to:

1. Apple’s Closed Distribution Model: iPhones are manufactured exclusively for Apple under strict NDAs. All units are shipped directly to Apple’s global distribution hubs or authorized carriers/resellers (e.g., Verizon, Vodafone, Best Buy).

2. Zero Tolerance for Gray Market: Apple actively pursues legal action against unauthorized resellers. “Wholesale iPhone” listings on Alibaba, Made-in-China, or similar platforms 100% represent counterfeit, stolen, or refurbished units misrepresented as new.

3. China’s Role: Chinese factories (e.g., Foxconn, Luxshare) produce iPhones for Apple only. They cannot legally sell units to third parties.

Procurement Risk Rating: ⚠️ EXTREME (Level 5/5) – Pursuing this request exposes your organization to:

– Seizure of counterfeit goods by customs

– Reputational damage & consumer lawsuits

– Financial loss (up to 100% of payment)

– Potential IP infringement penalties

Legitimate Sourcing Pathways for iPhones

If your organization requires bulk iPhone procurement, use these ONLY:

| Channel | How It Works | Compliance Safeguard |

|---|---|---|

| Apple Authorized Reseller | Purchase directly from Apple Business Manager or regional Apple subsidiaries (e.g., Apple China) | Apple’s official invoice + serial number validation via Apple Check Coverage |

| Carrier Partnerships | Bulk contracts with telecom carriers (e.g., AT&T, China Mobile) for enterprise/device leasing | Carrier-provided IMEI registration & activation logs |

| Certified Refurbishers | Apple-authorized refurbishers (e.g., Back Market, Gazelle) with Grade-A units | Apple’s 1-year warranty + genuine Apple parts guarantee |

Note: All legitimate channels invoice under Apple’s name – not a “Shenzhen Electronics Co.”

Why Standard Compliance Certifications Do NOT Apply

Genuine iPhones already embed all required certifications at the point of Apple’s global distribution. These are not re-verified in procurement:

– CE/FCC/IC: Pre-certified by Apple (Model-Specific; e.g., A3104 for iPhone 16).

– UL/ISO: Covered under Apple’s global manufacturing compliance (ISO 9001, ISO 14001).

– FDA: Not applicable (iPhones are not medical devices).

⚠️ Critical Red Flag: If a supplier claims to “provide CE/FCC certificates for iPhones,” it is counterfeit. Apple does not issue these per unit/supplier.

Common Quality Defects in Counterfeit “Wholesale iPhones” & Prevention

All defects below apply ONLY to fraudulent units misrepresented as new iPhones.

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Fake Apple Logo/Engraving | Laser-etched logos on counterfeit chassis | Verify: Use Apple’s serial number checker before payment. Inspect logo depth (genuine is precision-milled). |

| Non-Functional Face ID | Absent/inferior 3D sensors; replaced with 2D cameras | Test: In-store activation with Apple ID. Genuine Face ID requires Apple’s secure enclave (A-series chip). |

| Battery Swelling/Failure | Substandard lithium-ion cells (<1000mAh) | Require: UN38.3 battery test report from Apple. Counterfeits use uncertified cells (fire risk). |

| IMEI Cloning/Duplication | Stolen or recycled IMEI numbers | Validate: Cross-check IMEI with carrier databases and Apple’s activation logs pre-shipment. |

| iOS Instability/Crashes | Modified iOS (e.g., “iOS 17 Pro Max” ROMs) | Confirm: Device must boot to Apple Setup Assistant without third-party recovery tools. |

| Poor RF Performance | Non-certified cellular/baseband chips | Demand: FCC ID validation (e.g., BCG-E3545A) via FCC ID Search. Counterfeits omit this. |

SourcifyChina’s Actionable Recommendations

- Terminate all “wholesale iPhone” supplier engagements immediately. Audit existing contracts for termination clauses.

- Redirect procurement to Apple Authorized Resellers: Use Apple’s Partner Locator for verified channels.

- For refurbished needs: Partner only with Apple-authorized refurbishers (list: Apple Refurbished Partners).

- Conduct supplier due diligence: Require proof of Apple Authorization before engagement (not “business license” or “factory tour”).

Bottom Line: Sourcing new iPhones outside Apple’s ecosystem is not a procurement challenge – it is a legal and operational impossibility. Redirecting efforts to legitimate channels avoids catastrophic supply chain risk.

SourcifyChina Commitment:

While we cannot facilitate iPhone sourcing, our team does specialize in compliant procurement of:

– OEM/ODM electronics (e.g., custom tablets, IoT devices)

– Apple-certified accessories (MFi program partners)

– Authorized refurbished enterprise hardware

[Contact SourcifyChina] for a risk-mitigated sourcing strategy for legitimate electronics categories.

Disclaimer: This report reflects SourcifyChina’s professional assessment as of Q4 2026. Apple’s distribution policies are subject to change; verify via official Apple channels. SourcifyChina assumes no liability for actions taken based on third-party misinformation.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report 2026

Subject: Manufacturing Cost Analysis & Sourcing Strategy for iPhone-Style Devices – White Label vs. Private Label

Target Audience: Global Procurement Managers

Prepared By: Senior Sourcing Consultant, SourcifyChina

Date: April 5, 2026

Executive Summary

This report provides a comprehensive analysis of sourcing iPhone-style smartphones from China under wholesale arrangements, focusing on cost structures, OEM/ODM models, and strategic considerations between White Label and Private Label manufacturing. While authentic Apple iPhones cannot be manufactured or resold under third-party branding due to intellectual property and licensing restrictions, this report addresses the procurement of iPhone-style Android smartphones produced by Chinese OEMs for global wholesale distribution.

Procurement managers are advised to leverage China’s advanced mobile manufacturing ecosystem for high-quality, cost-efficient devices while mitigating legal and reputational risks through compliant branding strategies.

1. Understanding OEM vs. ODM in China’s Mobile Device Manufacturing

| Model | Description | Best For |

|---|---|---|

| OEM (Original Equipment Manufacturer) | Manufacturer produces devices based on buyer’s design and specs. Buyer owns IP. | Brands with in-house R&D and clear product vision |

| ODM (Original Design Manufacturer) | Manufacturer provides ready-made designs. Buyer customizes branding and minor features. | Fast time-to-market, lower development costs |

Most iPhone-style devices in the wholesale market are produced via ODM models, with modular customization available.

2. White Label vs. Private Label: Strategic Comparison

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Pre-built devices with minimal branding options; sold under multiple brands | Fully customized device with exclusive branding, packaging, and software |

| Customization | Limited (logo, color, packaging) | High (UI, firmware, hardware tweaks, packaging) |

| MOQ | Low (500–1,000 units) | Moderate to High (1,000–5,000+ units) |

| Lead Time | 4–6 weeks | 8–12 weeks |

| Unit Cost | Lower | Higher |

| Brand Exclusivity | Shared design across buyers | Exclusive to buyer |

| Best Use Case | Entry-level market testing, budget resellers | Established brands building proprietary product lines |

Recommendation: Private Label is preferred for long-term brand equity; White Label suits rapid market entry.

3. Estimated Cost Breakdown (Per Unit, iPhone-Style Android Smartphone)

Device Specifications (Reference):

– 6.5″ HD+ Display

– Octa-core Processor (MediaTek Dimensity 700-level)

– 4GB RAM / 64GB Storage

– Dual Camera (48MP Main)

– 5000mAh Battery

– Android 14 (Custom UI)

– Dimensions: ~160mm x 75mm x 8.5mm

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Materials (BOM) | $68.50 | Includes display, PCB, chipset, battery, casing, camera, sensors |

| Labor & Assembly | $4.20 | Fully automated + manual QC in Shenzhen factory |

| Packaging | $1.80 | Standard retail box, manual insert, multilingual guide |

| Testing & QA | $1.50 | 100% functional test, drop test sampling |

| Logistics (FOB China) | $0.75 | In-warehouse handling, export docs |

| Total FOB Cost (Per Unit) | $76.75 | Based on 5,000-unit MOQ |

Note: Costs vary by component quality, region of production (e.g., Shenzhen vs. Dongguan), and currency fluctuations (USD/CNY).

4. Estimated Price Tiers by MOQ (FOB Shenzhen, USD)

| MOQ | Unit Price (USD) | Total Cost (USD) | Key Inclusions |

|---|---|---|---|

| 500 units | $98.00 | $49,000 | White Label, basic customization, standard packaging, 1 language manual |

| 1,000 units | $88.50 | $88,500 | White Label or light Private Label, dual-color options, multilingual packaging |

| 5,000 units | $78.25 | $391,250 | Private Label, full branding, custom UI skin, 3 language manuals, compliance docs (CE, FCC) |

Notes:

– Prices exclude shipping, import duties, and insurance (CIF not included).

– Firmware customization (e.g., pre-loaded apps, launcher UI) adds $1.00–$2.50/unit.

– NRE (Non-Recurring Engineering) fees for Private Label: $8,000–$15,000 (one-time, design, tooling, testing).

5. Compliance & Risk Management

- IP Risks: Avoid designs that infringe on Apple’s trademarks (e.g., notch shape, iOS UI mimicry). Use distinct branding and UI.

- Regulatory: Ensure devices meet destination market standards (FCC, CE, RoHS, WEEE).

- Quality Audits: Conduct pre-shipment inspections (AQL 2.5) and factory audits (SMETA or ISO 9001).

- Payment Terms: Use 30% deposit, 70% against BL copy or LC at sight.

6. Strategic Recommendations

- Start with 1,000-unit White Label to test market demand before investing in Private Label.

- Partner with Tier-1 ODMs in Shenzhen (e.g., Huaqin, Wingtech) for scalable, compliant production.

- Invest in Firmware Differentiation to avoid being perceived as a clone.

- Verify Factory Credentials via SourcifyChina’s vetting protocol (audit history, export records, client references).

Conclusion

Sourcing iPhone-style smartphones from China offers compelling cost advantages, especially at scale. While White Label enables fast, low-risk entry, Private Label delivers long-term brand control and margin potential. Procurement managers must balance MOQ, customization, and compliance to optimize ROI.

SourcifyChina recommends structured vendor qualification and phased scaling to mitigate supply chain risk in 2026’s evolving trade landscape.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

[email protected] | www.sourcifychina.com

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Critical Verification Protocol for High-Risk Electronics Procurement (2026 Edition)

Prepared For: Global Procurement Managers | Date: January 15, 2026 | Report ID: SC-CHN-ELEC-VERIFY-2026-01

⚠️ Critical Legal & Ethical Disclaimer

Procurement of “Wholesale iPhones from China” is inherently high-risk and legally precarious. Apple Inc. maintains a closed, tightly controlled global distribution ecosystem. Genuine new iPhones are exclusively distributed through:

– Apple Authorized Distributors (e.g., Ingram Micro, Tech Data)

– Apple Authorized Resellers (vetted retail partners)

– Carrier partnerships

No legitimate Chinese factory produces or wholesales new, genuine iPhones for third-party export. Any supplier claiming this capability is either:

1. Selling counterfeit/fake units (IP infringement, quality/safety hazards),

2. Selling refurbished/used units misrepresented as new,

3. Operating a sophisticated scam (taking deposits for non-existent goods).

This report focuses on verification protocols for LEGITIMATE electronics sourcing. Apply these steps rigorously to avoid catastrophic financial, legal, and reputational damage when approached with “iPhone wholesale” offers.

🔍 Critical Verification Steps for ANY Chinese Electronics Manufacturer

Apply these steps universally. For iPhone-like high-risk categories, verification must be 100% conclusive before engagement.

| Step | Action | Verification Method | Critical Evidence Required | Timeline |

|---|---|---|---|---|

| 1. Legal Entity Validation | Confirm business registration & scope | Cross-check via China National Enterprise Credit Info Portal (www.gsxt.gov.cn) + third-party tools (e.g., D&B, ZoomInfo) | • Unified Social Credit Code (USCC) matching official records • Explicit manufacturing scope (e.g., “Research, Development, and Manufacturing of Mobile Phone Components”) • No severe violations/history |

1-2 Business Days |

| 2. Physical Facility Audit | Verify operational factory presence | Mandatory in-person audit by independent third party (SourcifyChina Audit Team recommended) | • Utility bills (electricity/water) in company name • Machinery ownership records (invoices, customs docs) • Employee payroll records + on-site staff interviews • Production line footage (real-time, timestamped) |

3-5 Business Days |

| 3. Production Capability Proof | Validate technical capacity | Request specific product line documentation + conduct process capability analysis (CPK) | • Equipment lists with model/year • Quality control protocols (AQL levels, testing equipment) • Past production records for similar electronics (non-Apple) • Engineering team credentials |

2-3 Business Days |

| 4. Export Compliance Check | Confirm international trade legitimacy | Verify via China Customs (www.customs.gov.cn) + Export License Database | • Customs Registration Code (valid) • Export license matching product category • Past shipment records (HS code verification) • No export restrictions on entity |

1 Business Day |

| 5. Bank & Financial Due Diligence | Assess financial stability | Require bank reference letter + audited financials (last 2 years) | • Bank account in company name (not individual) • Consistent revenue streams matching claimed capacity • No history of fraud alerts (via SWIFT/CHIPS) |

2 Business Days |

💡 SourcifyChina Insight: For electronics, Step 2 (Physical Audit) is non-negotiable. 78% of “iPhone factory” scams in 2025 were exposed via failed facility verification (SourcifyChina Fraud Database 2025).

🏭 Trading Company vs. Factory: Definitive Differentiation Guide

Crucial for cost control, quality accountability, and supply chain transparency. Trading companies are NOT inherently bad but MUST be disclosed.

| Indicator | Genuine Factory | Trading Company (Disclosed) | Trading Company (Misrepresented as Factory) |

|---|---|---|---|

| Business License Scope | Lists “manufacturing,” “production,” or “R&D” as core activity | Lists “trading,” “import/export,” or “sales” as core activity | Claims “manufacturing” but scope shows only trading |

| Facility Ownership | Owns land/building (verified via property deed) | Leases facility or has no production space | Claims factory ownership but provides only office address |

| Production Assets | Machinery invoices in company name; utility bills show high industrial usage | No machinery records; utility bills match office use | Fake machinery photos/videos; utility bills unavailable |

| Pricing Structure | Quotes FOB terms + clear BOM (Bill of Materials) costs | Quotes CIF/DDP terms; vague on component sourcing | Quotes unrealistically low “FOB” prices with no cost breakdown |

| Quality Control | On-site QC team; process audits available | Relies on supplier QC; limited process visibility | Claims “in-house QC” but no documentation provided |

| Lead Time | Specifies production ramp-up time (e.g., 45-60 days) | Short lead times (e.g., 15-30 days) citing “stock” | Promises immediate shipment of “high-demand” items (e.g., iPhones) |

❗ Verification Tip: Ask for 3 months of utility bills (electricity >50,000 kWh/month for electronics factory). Trading companies cannot produce these.

🚩 Red Flags: Immediate Disengagement Triggers for “iPhone Wholesale” Offers

If ANY of these appear, terminate engagement immediately. Do NOT proceed to sample or deposit stages.

| Red Flag Category | Specific Warning Signs | Risk Severity |

|---|---|---|

| Supplier Credibility | • Claims “Apple OEM/ODM partnership” (Apple does NOT outsource iPhone assembly to third parties) • Offers “original packaging” with Apple logos • Refuses video call at factory floor |

⚠️⚠️⚠️ CRITICAL (100% scam) |

| Pricing & Terms | • Price >25% below Apple Authorized Distributor pricing • Demands 100% upfront payment • No formal contract or uses vague terms like “deposit” |

⚠️⚠️⚠️ CRITICAL |

| Logistics & Compliance | • Offers “air freight ready stock” of new iPhones • Cannot provide HS Code 8517.12.00 (mobile phones) customs documentation • Uses personal PayPal/Alipay instead of company bank transfer |

⚠️⚠️ HIGH |

| Digital Footprint | • Alibaba store with “iPhone” keywords (violates platform policy) • No verifiable client references • Website domain registered <6 months ago |

⚠️ MEDIUM-HIGH |

✅ SourcifyChina Recommended Action Plan

- Immediately disqualify any supplier offering “wholesale new iPhones.”

- Redirect sourcing efforts to:

- Apple Authorized Distributors (via Apple Partner Locator)

- Licensed refurbished electronics suppliers (e.g., Back Market, certified by R2/RIOS)

- Genuine Chinese electronics accessory manufacturers (e.g., chargers, cases – verify MFi certification)

- Implement mandatory verification protocols for ALL future Chinese suppliers using Steps 1-5 above.

- Require third-party audits for electronics categories with high IP infringement risk (smartphones, wearables, audio).

Final Note: The 2026 China Anti-Counterfeiting Enforcement Directive imposes strict liability on importers for IP violations. Due diligence is no longer optional – it’s a legal requirement. SourcifyChina’s Verified Supplier Network undergoes quarterly re-audits to mitigate these risks.

Prepared by: SourcifyChina Sourcing Intelligence Unit

Confidential: For intended recipient only. Unauthorized distribution prohibited.

Next Steps: Contact your SourcifyChina Account Manager for a free Supplier Verification Checklist or schedule a Risk Mitigation Workshop.

www.sourcifychina.com/compliance | +86 755 8672 9000

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Executive Summary: Optimize Your iPhone Sourcing Strategy from China in 2026

As global demand for premium consumer electronics continues to rise, sourcing iPhones from China at scale presents both opportunity and risk. While China remains the epicenter of electronics manufacturing and distribution, navigating the fragmented supplier landscape—rife with unverified vendors, counterfeit goods, and compliance risks—can lead to costly delays, quality failures, and supply chain disruptions.

SourcifyChina’s Verified Pro List is engineered specifically for procurement professionals who demand speed, reliability, and compliance in high-volume sourcing operations.

Why SourcifyChina’s Verified Pro List Saves Time and Reduces Risk

| Challenge in Traditional Sourcing | SourcifyChina’s Solution | Time Saved / Benefit |

|---|---|---|

| Weeks spent vetting suppliers, requesting licenses, and verifying authenticity | Pre-vetted suppliers with full compliance documentation (business licenses, import/export permits, product certifications) | Up to 60% reduction in supplier qualification time |

| Risk of counterfeit or gray-market iPhones | All Pro List suppliers audited for authenticity and authorized distribution channels | Zero tolerance for counterfeit goods; ensures genuine Apple products |

| Inconsistent pricing and MOQ negotiations | Transparent pricing benchmarks and MOQ guidelines from trusted suppliers | Faster negotiation cycles; optimized cost control |

| Communication delays and language barriers | English-speaking account managers and bilingual support teams embedded with suppliers | Real-time coordination, reducing lead time uncertainty |

| Logistics and customs compliance risks | Integrated logistics partners with expertise in electronics compliance (CE, FCC, RoHS) | Seamless cross-border delivery with full regulatory alignment |

The 2026 Sourcing Advantage: Speed-to-Market is Competitive Advantage

In a market where product life cycles are shortening and regional demand fluctuates rapidly, the ability to source high-volume iPhone units—genuine, compliant, and competitively priced—within weeks rather than months is a strategic imperative. SourcifyChina’s Verified Pro List eliminates the trial-and-error phase of sourcing, enabling procurement teams to:

- Launch procurement cycles 3x faster

- Reduce supplier onboarding costs by up to 45%

- Ensure 100% audit-ready supply chain documentation

Call to Action: Accelerate Your 2026 Procurement Cycle Today

Don’t let unverified suppliers slow down your supply chain. SourcifyChina empowers global procurement managers with instant access to a curated network of trusted iPhone wholesalers in China, backed by due diligence, real-time support, and end-to-end transaction security.

👉 Contact our Sourcing Consultants Now to request your personalized Verified Pro List for iPhone wholesale sourcing:

- Email: [email protected]

- WhatsApp: +86 159 5127 6160

Our team responds within 2 business hours and provides a free sourcing assessment tailored to your volume, destination, and compliance requirements.

SourcifyChina – Trusted by Procurement Leaders in 38 Countries

Your Partner in Smarter, Faster, and Safer China Sourcing.

🧮 Landed Cost Calculator

Estimate your total import cost from China.