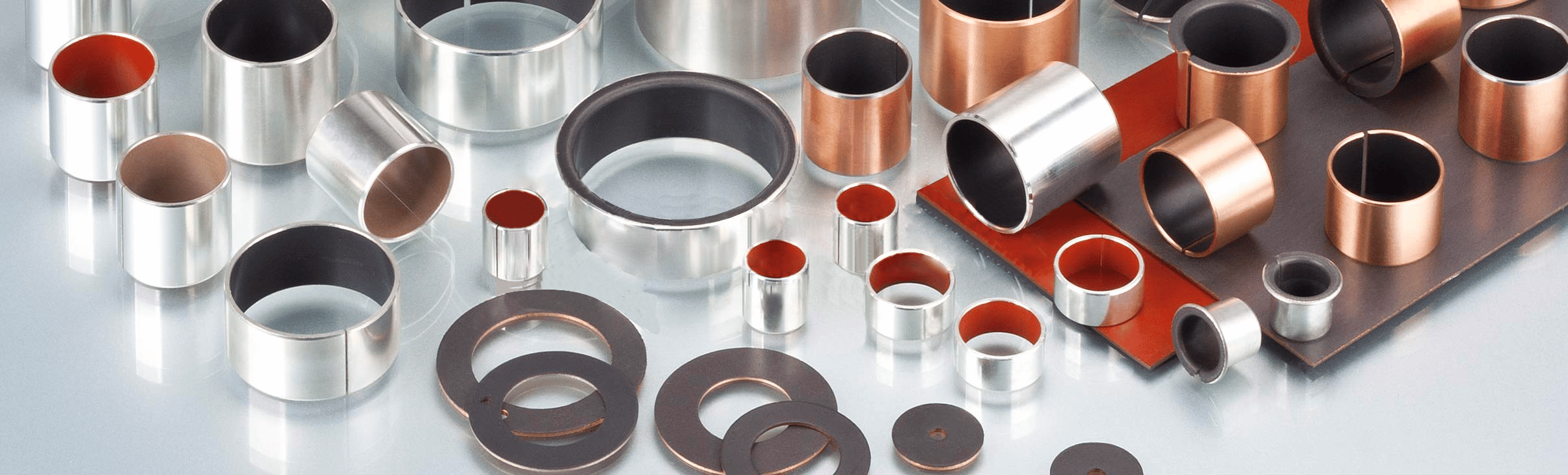

The global bushing compliance market is experiencing steady expansion, driven by increasing demand for precision components in automotive, industrial machinery, and electrical systems. According to Grand View Research, the global bushing market size was valued at USD 7.2 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 5.8% from 2023 to 2030. This growth is fueled by rising vehicle production, heightened focus on vibration control, and the need for durable, noise-reducing components across sectors. Moreover, advancements in material science—particularly in polymer and elastomeric composites—are enabling manufacturers to produce bushings with enhanced load-bearing capacity and extended service life. As regulatory standards for performance and safety tighten globally, compliance with ISO, ASTM, and OEM-specific standards has become a critical differentiator among suppliers. In this evolving landscape, a select group of manufacturers are leading through innovation, stringent quality control, and alignment with international compliance frameworks—setting the benchmark for reliability and performance. The following analysis highlights the top nine bushing compliance manufacturers shaping the future of the industry.

Top 9 Bushing Compliance Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 ISO Certified

Domain Est. 1999 | Founded: 2002

Website: bushingsinc.com

Key Highlights: ISO Certified Manufacturer of Rubberflex Bushings and Dual-Flex Mounts. Our quality system is ISO 9001:2015 certified, compliant since 2002….

#2 ASC Engineered Solutions

Domain Est. 2020

Website: asc-es.com

Key Highlights: Manufacturer and solutions provider of precision-engineered pipe joining products, valves, and related services for the entire construction project ……

#3 Bushings

Domain Est. 1996

Website: trelleborg.com

Key Highlights: The bushings are dimensionally stable, wear resistant and provide excellent performance under dry and boundary lubrication conditions. Technical drawing. Home….

#4 NSK Global

Domain Est. 1996

Website: nsk.com

Key Highlights: Global leader in Motion & Control. NSK keeps the world moving with bearings, ball screws, linear guides, auto parts, and precision machinery solutions….

#5 PEM – PennEngineering

Domain Est. 1996

Website: pemnet.com

Key Highlights: PEM offers innovative fastening solutions for a variety of applications across industries like Automotive Electronics, Consumer Electronics, Datacom and more….

#6 Front Compliance Bushing Pillowball #TH

Domain Est. 2009

#7 Front Lower Compliance Fore & Lateral Aft Arms with Spherical …

Domain Est. 2013

Website: unpluggedperformance.com

Key Highlights: Installation guide for Tesla Model S/X Front Lower Compliance Fore & Lateral Aft Arms with Spherical Bushings – step-by-step upgrade instructions….

#8 Bushes and bushings of great reliability

Domain Est. 2018

Website: isb-industries.com

Key Highlights: On the ISB Industries website you will find a wide range of bushes and bushings of great reliability and functionality: discover the entire selection….

#9 Lower Control Arm Bushing Manufacturer MIVO ultimate guide

Domain Est. 2024

Website: mivoparts.com

Key Highlights: High Quality Lower Control Arm Bushing Manufacturer MIVO :20 years manufacturing experience , Monthly production capacity of 100000+ pieces….

Expert Sourcing Insights for Bushing Compliance

H2: 2026 Market Trends for Bushing Compliance

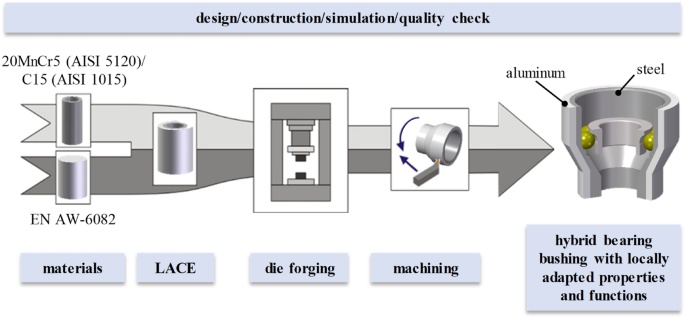

As the global industrial and automotive sectors evolve toward greater efficiency, sustainability, and digital integration, bushing compliance is expected to play a pivotal role in product design, manufacturing standards, and regulatory adherence by 2026. Bushings—critical components used to reduce friction, support shafts, and dampen vibration—are subject to increasingly stringent compliance requirements due to safety, environmental, and performance standards. The following analysis outlines key market trends shaping bushing compliance in 2026.

-

Stricter Environmental and Material Regulations

By 2026, environmental compliance will be a dominant driver in bushing material selection and manufacturing. Regulations such as REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) in the EU and similar standards in North America and Asia are pushing manufacturers to eliminate hazardous substances like phthalates, heavy metals, and certain polymers. This shift is accelerating the adoption of eco-friendly materials such as thermoplastic elastomers (TPE), recycled polymers, and bio-based composites that meet compliance without sacrificing durability. -

Growth in Electric Vehicles (EVs) and Noise, Vibration, and Harshness (NVH) Standards

The global expansion of electric vehicle production is influencing bushing compliance through heightened NVH performance requirements. EVs, lacking engine noise, make mechanical vibrations more noticeable, necessitating advanced bushings that ensure quiet and smooth operation. Regulatory bodies and OEMs are implementing stricter NVH compliance benchmarks, pushing suppliers to innovate with compliant, high-damping bushing solutions made from polyurethane, rubber composites, and hybrid materials. -

Standardization and Global Harmonization

International standards such as ISO 9001 (quality management) and ISO 14001 (environmental management) are being more tightly integrated into bushing supply chains. Additionally, sector-specific standards like ISO 18061 for elastomeric bushings in railway applications are being adopted globally, promoting harmonization. By 2026, manufacturers will need to meet multiple regional compliance frameworks simultaneously, increasing demand for third-party certifications and traceability in production processes. -

Digital Compliance and Smart Manufacturing

Industry 4.0 technologies are transforming compliance monitoring. In 2026, digital twins, IoT-enabled testing systems, and blockchain-based supply chain tracking will support real-time compliance verification. Automated quality control systems can instantly flag deviations from tolerance standards, ensuring bushings meet dimensional, load-bearing, and durability specifications. This digital shift reduces non-compliance risks and supports audit readiness. -

Increased Scrutiny in Aerospace and Rail Industries

High-reliability sectors like aerospace and rail are tightening compliance protocols for bushings due to safety-critical applications. Standards such as AS9100 (aerospace) and EN 45545 (railway fire safety) mandate rigorous testing for flame resistance, wear, and fatigue life. By 2026, bushing suppliers will need to provide comprehensive compliance documentation, including lifecycle testing data and failure mode analysis. -

Regional Divergence and Trade Implications

While global harmonization progresses, regional differences in compliance requirements persist. For instance, China’s GB standards, India’s BIS certifications, and U.S. FDA regulations for food-grade bushings create a complex compliance landscape. Trade agreements and geopolitical factors may further influence material sourcing and testing protocols, requiring manufacturers to adopt flexible, region-specific compliance strategies.

Conclusion

By 2026, bushing compliance will be shaped by environmental mandates, technological innovation, and sector-specific safety standards. Companies that proactively align with evolving regulations, invest in sustainable materials, and leverage digital compliance tools will gain competitive advantage. As global markets demand higher performance and accountability, compliance will no longer be a checkbox—but a core component of product innovation and market access.

Common Pitfalls Sourcing Bushing Compliance (Quality, IP)

Sourcing bushings—especially for critical applications in industries like aerospace, automotive, or medical devices—requires careful attention to compliance with quality standards and intellectual property (IP) regulations. Overlooking key aspects can lead to operational failures, legal liabilities, or supply chain disruptions. Below are common pitfalls organizations encounter when sourcing compliant bushings.

Quality Compliance Pitfalls

Inadequate Supplier Qualification

Failing to thoroughly vet suppliers based on their quality management systems (e.g., ISO 9001, AS9100) can result in inconsistent bushing performance. Suppliers without robust quality controls may deliver products with dimensional inaccuracies, material defects, or non-conformance to specified tolerances.

Lack of Material Traceability

Bushing performance heavily depends on material composition (e.g., bronze, polymer, stainless steel). Sourcing without documented material traceability increases the risk of counterfeit or substandard materials, jeopardizing product reliability and regulatory compliance.

Insufficient Testing and Certification

Accepting bushings without proper test reports (e.g., hardness, wear resistance, dimensional inspection) or third-party certifications (e.g., RoHS, REACH, ASTM standards) can lead to undetected quality issues that only manifest in field use.

Overlooking Environmental and Operational Requirements

Bushing performance varies under different conditions (temperature, load, corrosion exposure). Failing to match bushing specifications to actual operating environments—such as high-temperature or corrosive settings—results in premature failure and non-compliance with application-specific standards.

Intellectual Property (IP) Compliance Pitfalls

Sourcing from Unauthorized Manufacturers

Procuring bushings from suppliers that replicate patented designs (e.g., proprietary geometries, coatings, or composite materials) without licensing exposes the buyer to IP infringement claims, even if unintentional. This is especially prevalent with off-brand or gray-market suppliers.

Inadequate Documentation of IP Rights

Failing to obtain documentation confirming the supplier’s right to manufacture and sell the bushing design can create legal risk. Without clear IP indemnification clauses in contracts, the end-user may bear liability in case of infringement.

Reverse Engineering Without Permission

In some cases, organizations source bushings based on reverse-engineered designs without securing appropriate IP licenses. This constitutes patent or design infringement and can result in costly litigation and product recalls.

Ignoring Trademark and Branding Issues

Using bushings that mimic branded components (e.g., identical logos or part numbers) may violate trademark laws, even if the functional specifications are met. This undermines brand integrity and invites legal action from original equipment manufacturers (OEMs).

Mitigation Strategies

To avoid these pitfalls, organizations should:

– Conduct rigorous supplier audits and require quality certifications.

– Demand full material and test traceability with each batch.

– Include IP warranties and indemnification clauses in procurement contracts.

– Work only with authorized distributors or licensed manufacturers.

– Consult legal counsel when sourcing technical components with potential IP sensitivities.

Proactive due diligence in both quality and IP compliance ensures reliable performance and protects against regulatory and legal exposure when sourcing bushings.

Logistics & Compliance Guide for Bushing Compliance

Overview of Bushing Compliance Requirements

Bushing compliance refers to adherence to regulatory, safety, and quality standards governing the import, export, transportation, storage, and use of bushings—mechanical components used in various industries such as automotive, aerospace, and industrial machinery. Compliance ensures that bushings meet material, dimensional, performance, and environmental standards set by international and regional regulatory bodies.

Applicable Regulatory Standards

Bushings must comply with a range of standards depending on the region and application. Key standards include:

– ISO 3547: Dimensional and tolerancing standards for plain bearings (including bushings).

– RoHS (Restriction of Hazardous Substances): Restricts the use of specific hazardous materials in electrical and electronic equipment (relevant for bushings in electronics).

– REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals): Governs chemical substances used in manufacturing, including lubricants or coatings on bushings.

– ITAR/EAR (International Traffic in Arms Regulations / Export Administration Regulations): Applicable if bushings are used in defense-related applications.

– ASTM Standards: Material-specific standards (e.g., ASTM B271 for copper alloy castings).

Documentation and Certification

Proper documentation is essential for bushing compliance in logistics:

– Certificate of Conformance (CoC): Confirms that bushings meet specified standards.

– Material Test Reports (MTRs): Provide chemical and mechanical properties of raw materials.

– RoHS/REACH Compliance Declarations: Required for shipments into the EU and other regulated markets.

– Customs Documentation: Includes commercial invoices, packing lists, and import/export declarations with accurate HS (Harmonized System) codes (e.g., 8483.30 for plain shaft bearings).

Packaging and Labeling Requirements

Bushings must be packaged to prevent damage during transit and labeled to ensure traceability and regulatory compliance:

– Use anti-corrosive packaging (e.g., VCI paper) for metallic bushings.

– Label packages with part numbers, batch/lot numbers, material type, and compliance markings (e.g., RoHS logo).

– Include handling instructions (e.g., “Fragile,” “Do Not Stack”).

– For hazardous materials (e.g., lubricated bushings), comply with GHS labeling and transport regulations (e.g., UN numbers, hazard pictograms).

Transportation and Logistics Considerations

- Mode of Transport: Choose based on bushing type, volume, and destination. Air freight may be used for high-value or urgent shipments; sea freight for bulk.

- Temperature and Humidity Control: Required for bushings with elastomeric components or sensitive coatings.

- Customs Clearance: Ensure all compliance documents are submitted in advance to avoid delays. Use licensed customs brokers for complex jurisdictions.

- Incoterms: Clearly define responsibilities (e.g., FOB, DDP) to allocate compliance duties between buyer and seller.

Import and Export Controls

- Verify if bushings are subject to export licensing (e.g., under EAR99 or specific ECCN codes).

- Screen end-users and destinations against denied party lists (e.g., U.S. BIS, EU Consolidated List).

- Apply for necessary permits when shipping to restricted countries or for dual-use applications.

Quality Assurance and Auditing

- Implement a quality management system (e.g., ISO 9001) to maintain traceability and consistency.

- Conduct regular supplier audits to ensure raw materials and manufacturing processes meet compliance requirements.

- Perform incoming and outgoing inspections based on AQL (Acceptable Quality Level) standards.

Non-Conformance and Corrective Actions

- Establish procedures for handling non-compliant bushings (e.g., quarantine, rework, or return).

- Report major non-conformances to regulatory authorities when required (e.g., under EU GPSR).

- Document root cause analysis and implement corrective actions to prevent recurrence.

Training and Compliance Culture

- Train logistics, procurement, and quality teams on current compliance regulations and internal procedures.

- Maintain up-to-date regulatory intelligence to respond to changes in standards or trade policies.

Conclusion

Effective bushing compliance in logistics requires a coordinated approach across procurement, manufacturing, documentation, transportation, and regulatory reporting. By adhering to international standards and maintaining rigorous documentation and quality controls, organizations can ensure smooth global supply chain operations and avoid penalties, delays, or reputational risk.

Conclusion for Sourcing Bushing Compliance:

In conclusion, ensuring compliance in the sourcing of bushings is critical to maintaining product quality, reliability, and adherence to industry standards. A robust sourcing strategy must include rigorous supplier qualification, verification of material certifications, conformity to international standards (such as ISO, ASTM, or DIN), and consistent quality control processes. Engaging with reputable suppliers who demonstrate regulatory compliance, traceability, and a commitment to sustainability further mitigates risks related to performance failures, safety concerns, and supply chain disruptions. Ultimately, a compliant sourcing approach not only supports operational excellence but also strengthens customer trust and regulatory alignment across the supply chain. Regular audits and continuous monitoring are recommended to sustain long-term compliance and continuous improvement.