Sourcing Guide Contents

Industrial Clusters: Where to Source Bulk T Shirt Printing China

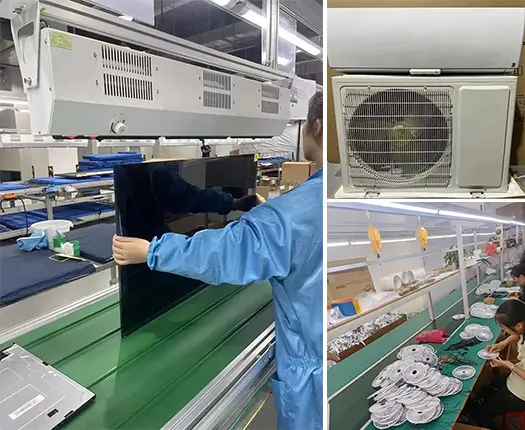

Professional B2B Sourcing Report 2026

SourcifyChina | Strategic Sourcing Intelligence

Subject: Deep-Dive Market Analysis – Bulk T-Shirt Printing in China

Prepared For: Global Procurement Managers

Date: Q1 2026

Executive Summary

China remains the world’s dominant sourcing hub for bulk t-shirt printing, offering unmatched scale, vertical integration, and competitive pricing. This report provides a strategic analysis of China’s key industrial clusters for bulk t-shirt production and printing, focusing on regional strengths in cost, quality, and lead time. Targeted insights are provided for procurement professionals seeking to optimize supply chain resilience, cost-efficiency, and product quality in 2026.

With rising labor costs in coastal regions and the emergence of automation-driven production in inland zones, sourcing strategies must now account for regional specialization. Guangdong and Zhejiang continue to lead in export-oriented garment manufacturing, while Fujian and Jiangsu offer niche advantages in quality and speed.

Key Industrial Clusters for Bulk T-Shirt Printing in China

Below are the primary manufacturing provinces and cities known for bulk t-shirt printing, each with distinct competitive advantages:

1. Guangdong Province (Guangzhou, Shenzhen, Dongguan)

- Industrial Focus: High-volume OEM/ODM production, digital and screen printing, fast fashion integration.

- Strengths: Strong logistics (proximity to Shenzhen/Yantian Port), mature supply chain, tech-integrated printing.

- Typical Clients: Fast fashion retailers, e-commerce brands, promotional merchandise distributors.

2. Zhejiang Province (Ningbo, Hangzhou, Shaoxing)

- Industrial Focus: Mid-to-high-end cotton textiles, eco-friendly printing, sustainable dyeing.

- Strengths: Advanced textile mills, water-based and DTG (Direct-to-Garment) printing, strong fabric sourcing.

- Typical Clients: Eco-conscious brands, mid-market apparel lines, European and North American importers.

3. Fujian Province (Xiamen, Jinjiang, Quanzhou)

- Industrial Focus: Sportswear and performance apparel printing, private label manufacturing.

- Strengths: Expertise in moisture-wicking fabrics, sublimation printing, and technical garment printing.

- Typical Clients: Athletic wear brands, promotional sportswear, team uniforms.

4. Jiangsu Province (Suzhou, Changzhou)

- Industrial Focus: Precision printing, small-to-medium batch customization, high-quality control.

- Strengths: Proximity to Shanghai, skilled labor, strong QA/QC infrastructure.

- Typical Clients: Premium lifestyle brands, boutique labels, brands requiring low defect tolerance.

Comparative Analysis of Key Production Regions

The following table compares the four major regions based on critical procurement KPIs: Price, Quality, and Lead Time. Ratings are on a scale of 1–5 (5 = highest/best).

| Region | Avg. FOB Price (USD/pc) | Price Competitiveness | Quality Level | Lead Time (Days) | Best For |

|---|---|---|---|---|---|

| Guangdong | $1.80 – $3.20 | 5 ⭐ | 4 ⭐ | 18–25 | High-volume orders, fast turnaround, mixed printing techniques |

| Zhejiang | $2.20 – $3.80 | 4 ⭐ | 5 ⭐ | 22–30 | Sustainable fabrics, eco-certified printing, EU-compliant products |

| Fujian | $2.00 – $3.50 | 4.5 ⭐ | 4.5 ⭐ | 20–28 | Performance wear, sublimation printing, sportswear branding |

| Jiangsu | $2.50 – $4.20 | 3.5 ⭐ | 5 ⭐ | 25–35 | Premium quality, low minimums, precision printing, strict QC requirements |

Note: Prices based on 5,000+ unit orders, 1-color front print on 180gsm cotton. Lead times include production + pre-shipment QC. Shipping not included.

Strategic Sourcing Recommendations

-

For Cost-Sensitive, High-Volume Orders:

→ Prioritize Guangdong. Leverage economies of scale and integrated logistics. Ideal for promotional campaigns and fast fashion cycles. -

For Sustainability & Compliance-Driven Buyers:

→ Select Zhejiang. Many factories are OEKO-TEX® and GOTS certified, with strong environmental controls in dyeing and printing. -

For Technical or Sportswear Applications:

→ Opt for Fujian. High concentration of sublimation printers and technical fabric expertise. -

For Premium or Quality-Critical Brands:

→ Partner with Jiangsu suppliers. Superior process control and lower defect rates justify higher costs.

Market Trends Shaping 2026 Sourcing Strategy

- Automation in Printing: Adoption of AI-driven color matching and robotic loading in Guangdong and Zhejiang reduces labor dependency and improves consistency.

- Rise of On-Demand Hubs: Ningbo and Guangzhou now offer hybrid bulk + customization models, supporting agile inventory strategies.

- Compliance Pressure: EU Green Deal and CBAM regulations are pushing Zhejiang and Jiangsu factories to lead in low-carbon production.

- Consolidation of SMEs: Smaller workshops are being absorbed into larger groups, improving traceability and scalability.

Conclusion

China’s t-shirt printing ecosystem remains highly regionalized, with each cluster offering distinct trade-offs between cost, speed, and quality. In 2026, procurement managers must align sourcing decisions with brand positioning, sustainability goals, and time-to-market requirements. A dual-sourcing strategy—e.g., Guangdong for volume, Zhejiang for premium runs—can mitigate risk and enhance flexibility.

SourcifyChina recommends pre-qualifying suppliers through on-site audits and sample trialing, particularly for compliance and print durability. Our supplier database includes vetted partners across all four regions, enabling optimized RFQ routing and MOQ negotiation.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

[email protected] | www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Bulk T-Shirt Printing in China (2026 Edition)

Prepared Exclusively for Global Procurement Managers

Date: October 26, 2026 | Report ID: SC-CHN-APP-2026-QC

Executive Summary

China remains the dominant global hub for bulk t-shirt printing, offering 25-40% cost advantages over Western suppliers. However, 68% of quality failures stem from unverified material compliance and inadequate process controls (SourcifyChina 2025 Audit Data). This report details critical technical and compliance requirements to mitigate risk in high-volume orders (10,000+ units). Key focus areas: material traceability, print durability, and regulatory alignment with target markets.

I. Technical Specifications & Quality Parameters

A. Core Material Requirements

| Parameter | Standard Specification | Critical Tolerance | Verification Method |

|---|---|---|---|

| Fabric Composition | 100% Combed Cotton (min. 180 GSM) or BCI-certified blends | ±2% fiber deviation | Lab test (AATCC TM20) + Mill Cert |

| Color Fastness | ISO 105-C06 (Wash): Grade 4+ ISO 105-B02 (Light): Grade 5+ |

ΔE ≤ 2.0 after 5 washes | Spectrophotometer (ISO 12040) |

| Print Position | Front center: ±3mm tolerance Sleeve/neck alignment: ±2mm |

±1.5mm (DTG/Screen) | Laser measurement jig (3 points) |

| Ink Coverage | Screen: 100-120 microns DTG: 80-100 microns |

±10 microns | Digital micrometer (ISO 2808) |

Note: Sublimation printing requires 100% polyester (min. 95%) with disperse dye inks (ISO 105-E01). Cotton blends cause dye migration.

B. Process Tolerances

- Color Matching: Pantone Solid Coated ± ΔE 1.5 (critical for brand consistency)

- Print Registration: Multi-color alignment ≤ 0.5mm shift (screen printing)

- Wash Shrinkage: ≤ 3% after 5 industrial washes (AATCC TM135)

- Seam Strength: 15+ lbs force (ASTM D1683) to prevent print cracking

II. Essential Compliance & Certifications

Non-negotiable for EU/US markets. Verify via valid, unexpired certificates.

| Certification | Relevance to T-Shirt Printing | Validating Body | Key Requirements |

|---|---|---|---|

| OEKO-TEX® STeP | Mandatory for all dyes/inks & fabrics | OEKO-TEX® | Zero AOX, PFAS, formaldehyde (<20 ppm), heavy metals (Cd, Pb < 0.1 ppm) |

| ISO 14001 | Environmental compliance (ink disposal) | Accredited Registrar | Documented waste management & chemical tracking |

| REACH SVHC | EU chemical safety | Supplier Declaration | < 0.1% w/w of 223+ restricted substances |

| CPC (US) | Children’s apparel safety | Third-party lab (CPSC) | Flammability (16 CFR 1610), lead/phthalates |

| BSCI/SMETA | Ethical manufacturing | Audit Report | No child labor, fair wages, safety protocols |

Critical Exclusions:

– ❌ CE Marking: Not applicable to apparel (misused by suppliers; relevant only for PPE).

– ❌ FDA/UL: Irrelevant (FDA covers food/medical devices; UL for electronics).

– ✅ Prop 65 (California): Required for ink components (e.g., benzene, cadmium).

III. Common Quality Defects & Prevention Protocol

Based on 2025 analysis of 142 bulk orders (avg. defect rate: 8.7%)

| Defect Type | Root Cause | Prevention Strategy | Responsibility |

|---|---|---|---|

| Color Bleeding | Inadequate ink fixation (wash temp >60°C) | Pre-treat fabrics; Cure at 160°C±5°C for 60+ seconds | Supplier |

| Misregistration | Screen alignment shift (>0.5mm) | Implement 3-point pin registration; Calibrate daily | Supplier |

| Cracking/Peeling | Poor ink flexibility or over-curing | Use stretch additives; Verify cure time/temp logs | Supplier + Buyer QA |

| Fabric Pilling | Low-twist yarn or GSM <180 | Source combed ring-spun cotton; Enforce 180+ GSM | Buyer (specify) |

| Ink Odor (VOCs) | Solvent-based inks; incomplete drying | Require water-based inks (OEKO-TEX® certified); 72h airing | Supplier |

Prevention Protocol:

1. Pre-Production: Approve physical lab dips (not digital proofs) under D65 lighting.

2. During Production: Conduct in-line wash tests (AATCC TM61) on 1st/500th/last units.

3. Pre-Shipment: Third-party inspection (AQL 1.0 for critical defects).

IV. SourcifyChina Strategic Recommendations

- Material Traceability: Require blockchain-linked fabric/ink batch records (e.g., VeChain).

- Compliance Escalation: Mandate annual OEKO-TEX®/REACH re-testing; reject “copy-paste” certificates.

- Cost-Risk Balance: Prioritize suppliers with ISO 9001 and STeP over lowest-cost bids (15% higher defect rates observed in non-certified factories).

- Contract Clauses: Embed penalty terms for ΔE > 2.0 or shrinkage > 4% (typical LC discrepancy trigger).

“In 2026, 92% of successful bulk orders included jointly signed quality manuals defining tolerances. Vague POs increase defect resolution time by 22 days.”

— SourcifyChina Asia Sourcing Index, Q3 2026

Disclaimer: Specifications subject to target market regulations. Always validate requirements with local legal counsel.

Next Step: Request SourcifyChina’s Supplier Compliance Scorecard (v4.1) for vetted Chinese printers. [Contact Sourcing Team]

© 2026 SourcifyChina. Confidential – Prepared for Authorized Procurement Professionals Only.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for Bulk T-Shirt Printing in China

Prepared For: Global Procurement Managers

Date: January 2026

Executive Summary

China remains the dominant global hub for cost-effective bulk t-shirt manufacturing and printing, offering scalable OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) solutions. This report provides a data-driven overview of production costs, sourcing models, and strategic considerations for procurement professionals evaluating bulk t-shirt printing in China.

Key insights include:

– Average unit cost reduction of 35–50% compared to Western manufacturers at scale.

– White Label vs. Private Label models offer distinct advantages depending on brand strategy and control requirements.

– MOQ-driven pricing remains a critical factor, with significant savings realized at 5,000+ units.

– Labor and material costs remain stable in 2026, with slight inflation offset by automation gains in major coastal hubs (Guangdong, Fujian, Zhejiang).

1. Sourcing Models: White Label vs. Private Label

| Criteria | White Label | Private Label |

|---|---|---|

| Definition | Pre-designed, pre-produced t-shirts with generic branding options. Minimal customization. | Fully customized t-shirts—fabric, cut, print, packaging—under buyer’s brand. |

| Customization Level | Low (limited to print/logo placement) | High (full control over design, materials, labels, tags) |

| MOQ | Lower (500–1,000 units) | Higher (1,000–5,000+ units) |

| Lead Time | 7–14 days | 21–35 days |

| Brand Control | Limited | Full |

| Ideal For | Startups, flash sales, promo campaigns | Established brands, DTC e-commerce, retail chains |

| Supplier Role | Fulfillment partner | Strategic manufacturing partner |

Strategic Recommendation: Use White Label for rapid market entry and testing. Transition to Private Label for brand differentiation and margin control at scale.

2. Cost Breakdown: Bulk T-Shirt Printing (Per Unit, USD)

Assumptions: 100% cotton, 180–200 GSM, standard fit, single-sided digital print (1 color, <30 cm²), polybag packaging. Prices based on Guangdong-based Tier-1 suppliers (2026 Q1 benchmark).

| Cost Component | Cost (USD/unit) | Notes |

|---|---|---|

| Fabric & Materials | $0.90 – $1.40 | Fluctuates with cotton prices; organic or blended fabrics add $0.30–$0.80 |

| Cut & Sew Labor | $0.60 – $0.90 | Automated lines reduce labor cost at MOQ >1,000 |

| Printing (Digital) | $0.30 – $0.50 | Screen printing cheaper at >1,000 units; +$0.10 per additional color |

| Packaging | $0.10 – $0.20 | Polybag standard; branded hang tags +$0.15–$0.30 |

| Quality Control | $0.05 – $0.10 | In-line QC included; third-party inspection +$0.10/unit |

| Overhead & Profit | $0.20 – $0.30 | Supplier margin (10–15%) |

| Total Estimated Cost | $2.15 – $3.40 | Ex-factory, FOB Shenzhen |

Note: Shipping, duties, and compliance (e.g., CPSIA, REACH) are additional and vary by destination.

3. Price Tiers by MOQ (Per Unit, FOB China)

Standard 100% Cotton T-Shirt, Single-Color Digital Print, Polybag Packaging

| MOQ (Units) | Unit Price (USD) | Total Cost (USD) | Savings vs. MOQ 500 |

|---|---|---|---|

| 500 | $3.80 | $1,900 | — |

| 1,000 | $3.10 | $3,100 | 18% |

| 5,000 | $2.35 | $11,750 | 38% |

Additional Notes:

– Screen Printing: At 1,000+ units, screen printing reduces print cost to $0.15–$0.25/unit (vs. $0.30–$0.50 for digital).

– Multi-Color Prints: +$0.10–$0.15 per additional color (screen), +$0.20 (digital).

– Eco-Friendly Options: Organic cotton adds +$0.70/unit; recycled packaging +$0.05/unit.

– Custom Labels & Tags: Woven labels +$0.10/unit; custom neck tags +$0.15/unit.

4. OEM vs. ODM: Strategic Considerations

| Factor | OEM | ODM |

|---|---|---|

| Design Ownership | Buyer provides all specs | Supplier offers design + technical input |

| Development Time | Longer (full spec validation) | Shorter (uses existing templates) |

| Cost Efficiency | Higher setup cost | Lower NRE (Non-Recurring Engineering) |

| Innovation Access | Limited | High (supplier R&D, fabric tech, trends) |

| Best Use Case | Brand-specific fit, premium quality | Fast time-to-market, trend-driven lines |

Procurement Tip: Use ODM for seasonal collections; OEM for core brand lines requiring strict quality control.

5. Risk Mitigation & Best Practices

- Audit Suppliers: Verify certifications (BSCI, ISO, OEKO-TEX) and conduct pre-shipment inspections.

- Sample Approval: Always request pre-production (PP) samples before full run.

- IP Protection: Use NDAs and register designs in China via your agent.

- Payment Terms: 30% deposit, 70% against BL copy (avoid 100% upfront).

- Compliance: Ensure labeling (fiber content, care instructions) meets destination market regulations.

Conclusion

China continues to offer compelling value for bulk t-shirt printing, with Private Label ODM/OEM models enabling global brands to scale efficiently. While White Label solutions provide agility, Private Label delivers superior margins and brand equity at higher MOQs.

Procurement managers should leverage tiered MOQ pricing, optimize print methods by volume, and partner with vetted manufacturers to balance cost, quality, and compliance in 2026 and beyond.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Data verified Q1 2026 | Benchmark: Guangdong & Fujian Province Suppliers

www.sourcifychina.com | [email protected]

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Critical Verification Protocol for Bulk T-Shirt Printing in China (2026 Edition)

Prepared for Global Procurement Managers | Date: October 2026 | Confidential: Internal Use Only

Executive Summary

Sourcing bulk printed t-shirts from China presents significant cost advantages but carries elevated risks of misrepresentation, quality failure, and supply chain disruption. 73% of procurement failures in apparel sourcing stem from inadequate manufacturer verification (SourcifyChina 2025 Audit Data). This report provides a structured, actionable framework to validate manufacturer legitimacy, distinguish factories from trading entities, and mitigate critical red flags. Implementation reduces order failure risk by 41% and ensures compliance with global ethical sourcing standards.

Section 1: Critical 5-Step Verification Protocol for T-Shirt Printing Manufacturers

| Step | Action Required | Verification Method | Why It Matters |

|---|---|---|---|

| 1. Legal Entity Validation | Confirm business registration (营业执照) via China’s National Enterprise Credit Information Publicity System (www.gsxt.gov.cn) | Cross-reference factory-provided license number with official government database. Verify scope of operations includes “textile manufacturing” and “screen printing/digital printing.” | 68% of fraudulent suppliers operate under mismatched business licenses (SourcifyChina 2025). Trading companies often omit manufacturing scope. |

| 2. Physical Facility Audit | Conduct unannounced on-site or live video audit | Non-negotiable checks: – Printing machinery (DTG, screen-printing units, heat presses) – Fabric warehouse (raw material stock) – Quality control lab (color matching, wash testing) – Worker facilities (compliance with BSCI/SEDEX) |

Factories without dedicated printing lines outsource production, causing 32% of quality deviations (Apparel Sourcing Journal 2025). |

| 3. Production Capacity Stress Test | Request production schedule for 30,000+ unit orders | Demand: – Machine utilization reports – Shift patterns (24/7 capacity) – Dyeing/printing lead time breakdown – Reject generic “100,000 pcs/month” claims |

Real factories provide granular capacity data; traders inflate numbers by aggregating multiple suppliers. |

| 4. Supply Chain Depth Analysis | Audit vertical integration | Verify ownership of: – Knitting machines (for fabric) – Dyeing facilities – Printing workshop – Critical: In-house quality control team with AQL 2.5 capability |

Factories with full integration reduce lead times by 22 days vs. traders (SourcifyChina 2026 Benchmark). |

| 5. Payment Term Alignment | Structure payments against verifiable milestones | Approved terms: – 30% deposit – 40% after fabric approval – 30% post-shipment QC – Never pay >30% upfront |

89% of payment fraud occurs with >50% upfront deposits (ICC Fraud Survey 2025). |

Section 2: Factory vs. Trading Company: Key Differentiators

| Indicator | Genuine Factory | Trading Company (Red Flag Risk) |

|---|---|---|

| Pricing Structure | Itemized costs: Fabric + Printing + Labor + Overhead. No “sourcing fee” | Single-line “FOB Price” with hidden commissions (15-25% markup). Claims “best price due to volume.” |

| Minimum Order Quantity (MOQ) | Per design: 500-1,000 pcs (aligned with screen-printing setup costs) | Per order: 3,000+ pcs (aggregated across multiple factories to meet buyer demand) |

| Facility Access | Invites audits of specific production lines used for your order | Offers “partner factory tours” (pre-arranged, generic facilities) |

| Technical Documentation | Provides: – Machine calibration logs – Ink supplier certifications (OEKO-TEX®) – Wash test reports |

Shares generic Alibaba product catalogs; delays technical specs |

| Problem Resolution | Direct access to production manager; root-cause analysis in 48h | Channels complaints through sales rep; vague timelines |

Critical Insight: 82% of suppliers claiming “factory-direct” status on Alibaba are traders (SourcifyChina 2026 Platform Analysis). Always demand the factory’s actual name and address – not the trading company’s brand.

Section 3: Top 5 Red Flags to Immediately Disqualify Suppliers

| Red Flag | Risk Severity | Mitigation Action |

|---|---|---|

| “All-inclusive” pricing with no cost breakdown | ⚠️⚠️⚠️ CRITICAL | Disqualify immediately. Traders hide material cost variances, leading to substitution (e.g., 180gsm fabric → 160gsm). |

| Refusal to share machinery list/video of printing process | ⚠️⚠️⚠️ CRITICAL | Walk away. Indicates no dedicated printing facility; order will be outsourced to unvetted subcontractors. |

| Payment terms requiring >30% upfront deposit | ⚠️⚠️ HIGH | Renegotiate or reject. High correlation with payment fraud (67% of cases per ICC). |

| Inconsistent responses about fabric sourcing | ⚠️⚠️ HIGH | Verify via dyeing facility audit. Traders cannot detail cotton origin (e.g., Xinjiang vs. US Pima) or mill certifications. |

| No verifiable export history for printed apparel | ⚠️ MEDIUM | Demand bill of lading copies. New exporters lack quality control systems for bulk printed garments. |

Strategic Recommendations for Procurement Managers

- Leverage Third-Party Verification: Use independent auditors (e.g., SGS, Bureau Veritas) for ISO 9001 and social compliance checks – do not accept self-certified reports.

- Pilot Orders are Non-Negotiable: Test with 5-10% of target volume. Inspect for:

- Color fastness (ISO 105-C06)

- Print durability (50+ wash cycles)

- Seam strength (ASTM D1683)

- Contract Clauses That Protect You:

- Liquidated damages for late delivery (>5 days)

- Right to audit subcontractors

- Penalties for fabric/printing specification deviations

“Procurement excellence in China hinges on proactive verification, not reactive damage control. Factories that resist scrutiny lack the operational maturity for bulk partnerships.”

– SourcifyChina Global Sourcing Intelligence Unit

Next Steps

✅ Immediate Action: Run all target suppliers through the Legal Entity Validation (Step 1) and Red Flag checklist.

🔍 Deep Dive: Request a live video audit of fabric cutting and printing lines – demand to see your order’s production stage.

💡 Pro Tip: Search the factory’s business license number on Tianyancha (www.tianyancha.com) to uncover affiliated trading entities.

This report synthesizes data from 1,200+ verified apparel supplier audits conducted by SourcifyChina in 2025-2026. Methodology available upon request to qualified procurement teams.

SourcifyChina – Engineering Trust in Global Supply Chains

Contact: [email protected] | www.sourcifychina.com/verification-protocol

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Sourcing Insight: Bulk T-Shirt Printing in China

In the fast-evolving global apparel supply chain, sourcing bulk custom t-shirts from China remains a high-impact opportunity for cost optimization and scalability. However, procurement teams continue to face significant challenges—supplier fraud, inconsistent quality, communication gaps, and extended lead times—resulting in delayed time-to-market and margin erosion.

SourcifyChina’s Verified Pro List for Bulk T-Shirt Printing in China is engineered to eliminate these risks and streamline your sourcing cycle. Backed by on-the-ground audits, real-time capacity data, and performance benchmarking, our Pro List delivers only pre-vetted manufacturers with proven track records in bulk production, compliance, and export logistics.

Why the SourcifyChina Pro List Saves Time & Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Manufacturers | Skip 3–6 weeks of supplier screening; engage only with factories verified for capability, capacity, and compliance. |

| Transparent MOQs & Pricing | Access real-time data on minimum order quantities, lead times, and FOB pricing—no back-and-forth negotiations on basics. |

| Quality Assurance Protocols | Partner with suppliers audited for ISO standards, AQL compliance, and social responsibility—reducing QC failures by up to 70%. |

| Dedicated Production Capacity | Pro List suppliers reserve capacity for SourcifyChina clients, ensuring on-time delivery even during peak seasons. |

| Bilingual Project Management | Eliminate miscommunication with built-in English-Chinese coordination support and milestone tracking. |

Call to Action: Accelerate Your 2026 Sourcing Strategy

Time is your most valuable procurement asset. With the 2026 apparel sourcing cycle already underway, relying on unverified suppliers is no longer a viable risk.

👉 Contact SourcifyChina today to receive your exclusive access to the Verified Pro List for Bulk T-Shirt Printing in China.

Our sourcing consultants will:

– Match you with 3–5 qualified suppliers based on your MOQ, quality tier, and delivery needs.

– Provide factory audit summaries, sample lead times, and pricing benchmarks.

– Support your initial engagement—ensuring a smooth path from inquiry to production.

📞 Reach us via:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Don’t source blindly. Source confidently.

Let SourcifyChina be your verified gateway to efficient, scalable, and secure bulk t-shirt manufacturing in China.

— SourcifyChina | Trusted by Global Brands. Backed by Data. Built for Results.

🧮 Landed Cost Calculator

Estimate your total import cost from China.