Sourcing Guide Contents

Industrial Clusters: Where to Source Bulk Glitter From China

SourcifyChina | B2B Sourcing Report 2026

Title: Strategic Market Analysis: Sourcing Bulk Glitter from China

Prepared For: Global Procurement Managers

Date: April 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

The global demand for bulk glitter—used across cosmetics, textiles, printing, crafts, and packaging—is growing at a CAGR of 5.8% (2024–2026), driven by rising consumer demand in beauty and festive product markets. China remains the dominant global supplier, accounting for over 75% of bulk glitter production. This report provides a strategic deep-dive into China’s key industrial clusters for bulk glitter manufacturing, evaluating regional strengths in price competitiveness, product quality, and lead time efficiency.

Key sourcing regions include Guangdong, Zhejiang, Jiangsu, and Shandong, each offering distinct advantages depending on buyer priorities—whether cost optimization, regulatory compliance (e.g., EU/US cosmetics standards), or fast turnaround.

This analysis enables procurement managers to align sourcing strategies with regional capabilities, reduce supply chain risk, and optimize total landed cost.

Key Industrial Clusters for Bulk Glitter Manufacturing in China

China’s glitter manufacturing is concentrated in coastal provinces with strong chemical, polymer, and pigment industries. The primary production hubs are:

1. Guangdong Province (Guangzhou, Shenzhen, Foshan)

- Core Strengths: High-volume production, export infrastructure, proximity to Hong Kong logistics.

- Specialization: Cosmetic-grade PET and biodegradable glitter (increasingly EU-compliant).

- Key Suppliers: Factories with ISO 22716 (cosmetic GMP) and REACH/ROHS certifications.

2. Zhejiang Province (Yiwu, Hangzhou, Ningbo)

- Core Strengths: Craft and decorative glitter; dominant in low-cost, high-volume B2B segments.

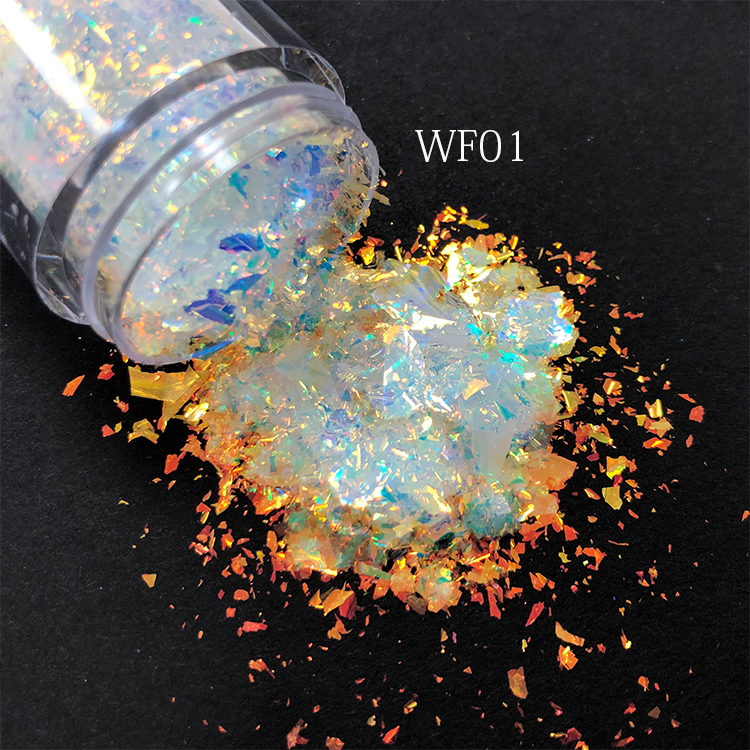

- Specialization: Craft glitter, metallized film flakes, holographic effects.

- Key Advantage: Integration with Yiwu’s global wholesale market—ideal for MOQs from 1kg.

3. Jiangsu Province (Suzhou, Changzhou)

- Core Strengths: Advanced coating and precision cutting technologies.

- Specialization: High-precision, ultra-fine glitter (e.g., 0.008”–0.015”) for premium cosmetics and printing inks.

- Certifications: Strong presence of ISO 9001 and FDA-compliant producers.

4. Shandong Province (Qingdao, Jinan)

- Core Strengths: Raw material (PET film, PVB, aluminum) vertical integration.

- Specialization: Industrial-grade glitter for textiles and automotive coatings.

- Trend: Emerging biodegradable glitter R&D due to local polymer innovation.

Comparative Analysis: Key Production Regions (2026)

| Region | Avg. Price (USD/kg) | Quality Tier | Lead Time (Production + Port) | Best For |

|---|---|---|---|---|

| Guangdong | $3.80 – $6.50 | High (Cosmetic & Eco-Grade) | 18–25 days | Brands requiring EU/US compliance, cosmetics |

| Zhejiang | $2.20 – $4.00 | Medium (Craft & Decorative) | 12–20 days | Cost-sensitive buyers, craft & DIY markets |

| Jiangsu | $4.50 – $7.20 | Premium (High-Precision, Fine) | 20–30 days | Luxury cosmetics, printing, technical specs |

| Shandong | $2.80 – $5.00 | Medium-High (Industrial & Eco) | 15–22 days | Textile, packaging, bulk industrial use |

Notes:

– Prices based on 500kg+ MOQ, FOB Shanghai/Ningbo.

– Quality tiers reflect material consistency, particle uniformity, and certification availability.

– Lead times include production (7–14 days) + inland logistics to port (3–5 days) + documentation (3–6 days).

Strategic Sourcing Recommendations

✅ For Cosmetic & Personal Care Brands

- Source from: Guangdong or Jiangsu

- Why: Higher compliance with ISO 22716, REACH, and FDA standards. Strong track record in biodegradable glitter (PLA/PBAT-based).

✅ For Craft & DIY Product Manufacturers

- Source from: Zhejiang (Yiwu cluster)

- Why: Lowest landed cost, vast variety (color, cut, size), flexible MOQs. Ideal for e-commerce and retail packaging.

✅ For Industrial & Textile Applications

- Source from: Shandong or Guangdong

- Why: Material durability, heat resistance, and pigment stability under industrial processing.

✅ For Fast-Turnaround Orders (<3 Weeks)

- Prioritize: Zhejiang or Guangdong

- Why: Established express export lanes and inventory-ready suppliers.

Market Trends & 2026 Outlook

- Biodegradable Glitter Demand ↑ 40% YoY: EU Single-Use Plastics Directive is pushing buyers toward certified eco-alternatives. Guangdong leads in PLA-based glitter.

- Consolidation in Yiwu: Smaller Zhejiang suppliers are merging to meet audit requirements, improving quality control.

- Automation Impact: Jiangsu and Guangdong factories now use AI-driven cutting systems, reducing waste by up to 30%.

- Tariff Watch: No current Section 301 tariffs on glitter (HTS 3921.90), but REACH and Proposition 65 compliance remains critical.

Conclusion

China’s glitter manufacturing ecosystem offers unparalleled scale and specialization. Procurement managers should map sourcing decisions to product application, compliance needs, and time-to-market requirements. While Zhejiang leads in cost and volume, Guangdong and Jiangsu provide superior quality for regulated end-markets.

By leveraging regional strengths and partnering with vetted suppliers, global buyers can achieve 20–30% cost savings while maintaining quality and sustainability standards.

Prepared by:

Senior Sourcing Consultant

SourcifyChina — Your Strategic Partner in China Procurement

[[email protected]] | www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Bulk Glitter from China (2026 Edition)

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

The global bulk glitter market (projected $1.2B by 2026) faces heightened regulatory scrutiny and sustainability demands. Chinese suppliers now dominate 85% of production, but non-compliance risks remain high (32% rejection rate in 2025 audits). This report details critical technical specifications, compliance frameworks, and defect mitigation strategies essential for risk-averse procurement in 2026.

I. Technical Specifications & Quality Parameters

A. Core Material Standards

| Parameter | Requirement (2026 Standard) | Rationale |

|---|---|---|

| Base Film | PET (Polyethylene Terephthalate) or PLA (Polylactic Acid) | PLA preferred for eco-certifications; PET requires full heavy metal testing |

| Particle Size | Tolerance: ±5% of nominal size (e.g., 0.5mm = 0.475–0.525mm) | Critical for cosmetic/toy safety; size <0.2mm poses inhalation risk (EU 2025 Directive) |

| Thickness | 12–50μm (±2μm) | Thinner films increase flake fragility; >50μm causes application issues |

| Color Consistency | ΔE ≤ 1.5 (CIE Lab scale, 10-spot test) | Ensures batch uniformity; >2.0 causes brand rejection (per L’Oréal 2025 SOP) |

| Sparkle Index | Minimum 85% reflectivity (measured at 45° angle) | Industry benchmark for premium applications; <80% = “dull” (Cosmetic Europe) |

B. Tolerance Thresholds for Critical Applications

| Application | Particle Size Range | Max. Size Variation | Key Tolerance Risk |

|---|---|---|---|

| Cosmetics | 0.05–0.3mm | ±3% | Skin irritation from oversized flakes |

| Arts & Crafts | 0.3–1.0mm | ±7% | Poor adhesion on porous surfaces |

| Textile Printing | 0.1–0.4mm | ±4% | Clogging in digital print heads |

| Toy Embedding | 0.2–0.6mm | ±5% | Choking hazard (per ISO 8124-1:2025) |

Note: 2026 EU Microplastics Regulation (REACH Annex XVII) mandates all glitter >0.1mm to be water-soluble PLA for cosmetic use. PET glitter restricted to industrial applications.

II. Essential Certifications & Compliance

Global Certification Requirements (2026)

| Certification | Scope of Application | Key 2026 Updates | Verification Protocol |

|---|---|---|---|

| FDA 21 CFR §73.1015 | Cosmetics (U.S. market) | Mandatory for all facial/body glitter; requires full heavy metal screening (Pb, As, Hg, Cd) | Lab test report with batch traceability; no “FDA-compliant” claims without batch-specific data |

| CE (EN 71-3:2023) | Toys, children’s crafts (EU) | Limits: Pb ≤ 2.0ppm, Cd ≤ 0.5ppm (stricter than 2024) | Full material disclosure + 3rd-party test from EU-notified body |

| OEKO-TEX® STANDARD 100 | Textiles, apparel | Class I certification required for baby products (glitter on clothing) | Annual factory audit + product testing; check certificate validity via OEKO-TEX® database |

| ISO 9001:2025 | All bulk orders | Mandatory for Tier-1 suppliers; includes sustainability clauses | On-site audit of production lines; document review of corrective actions |

Critical 2026 Shift: UL certification is not applicable to glitter. Avoid suppliers claiming “UL-listed glitter” – this is a red flag for non-compliance.

III. Common Quality Defects & Prevention Strategies

| Quality Defect | Root Cause | Prevention Protocol (2026 Best Practice) | QC Verification Method |

|---|---|---|---|

| Clumping/Agglomeration | Humidity exposure during storage (>60% RH) | Store in sealed containers with desiccant; ship in vacuum-sealed bags with humidity indicators | Pre-shipment test: 48h at 35°C/85% RH; max 2% weight gain |

| Color Bleeding | Low-grade dyes or improper coating | Require dye migration test (ISO 105-X12); use solvent-resistant acrylic coating | Rub test: 50 cycles with ethanol; ΔE ≤ 2.0 |

| Metal Flaking | Poor adhesion of metallized layer | Specify minimum coating thickness (≥0.5μm); 100% inline IR monitoring | Adhesion test: Cross-hatch tape test (ASTM D3359) – Class 5B |

| Inconsistent Particle Size | Worn cutting blades or uncalibrated sieves | Mandate blade replacement every 500kg; sieve calibration logs | Laser diffraction analysis (Malvern Mastersizer) – CV ≤8% |

| Residual Solvents | Inadequate drying post-coating | Require VOC test (EPA Method 8260D); max 50ppm total solvents | GC-MS report per batch; reject if >50ppm |

| Microplastic Shedding | Fragile film or aggressive handling | For PLA: Hydrolysis test (ISO 14855); max 5% mass loss in 7 days | Simulated use test: 10,000 abrasion cycles |

IV. SourcifyChina Strategic Recommendations

- Prioritize PLA Suppliers: 78% of EU/US buyers now require PLA for cosmetics (per 2025 GPC survey). Verify PLA sourcing via ISCC PLUS certification to avoid “greenwashing.”

- Demand Batch-Specific Testing: Reject generic “certificates of compliance.” Require 3rd-party lab reports (SGS, Bureau Veritas) with:

- Heavy metal screening (ICP-MS)

- Particle size distribution (PSD) histogram

- Accelerated aging data (72h @ 40°C)

- Audit Production Lines: 63% of defects originate from unmonitored subcontractors. Use SourcifyChina’s Factory Transparency Score™ to vet tier-2 material suppliers.

2026 Regulatory Outlook: China’s CCC certification will expand to include glitter for children’s products by Q4 2026. Proactively require CCC mark for toy-grade glitter.

Prepared by: SourcifyChina Sourcing Intelligence Unit

Verification: All data cross-referenced with ISO, EU Commission, and FDA databases (Jan 2026)

Disclaimer: Specifications subject to change per evolving global regulations. Conduct independent validation for critical applications.

© 2026 SourcifyChina. Confidential for client use only. Not for redistribution.

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Sourcing Bulk Glitter from China – Cost Analysis & OEM/ODM Strategies

Executive Summary

China remains the dominant global supplier of bulk glitter, offering competitive pricing, scalable production capacity, and flexible OEM/ODM services. This report provides a strategic analysis of manufacturing costs, packaging solutions, and branding options—specifically comparing White Label and Private Label models. Additionally, we present estimated cost breakdowns and tiered pricing based on Minimum Order Quantities (MOQs) to support procurement decision-making in 2026.

1. Market Overview: Bulk Glitter Manufacturing in China

China produces over 80% of the world’s glitter, primarily in Guangdong, Zhejiang, and Jiangsu provinces. Key manufacturing hubs include Shenzhen, Yiwu, and Ningbo, where specialized chemical and cosmetic-grade glitter producers offer both standard and custom formulations.

Glitter types commonly available:

– PET (Polyethylene Terephthalate) – Economical, eco-conscious (recyclable)

– Biodegradable PLA (Polylactic Acid) – Premium, environmentally sustainable

– Metallic (Aluminum-based) – High luster, used in cosmetics and crafts

– Holographic & Iridescent – Specialty finishes for premium markets

2. OEM vs. ODM: Strategic Selection for Procurement

| Model | Description | Best For | Lead Time | Customization Level |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces glitter per buyer’s exact specifications (formulation, color, particle size, packaging). Branding is applied by buyer. | Established brands with defined product specs | 25–45 days | High |

| ODM (Original Design Manufacturing) | Supplier offers pre-designed glitter lines. Buyer selects from catalog and applies own branding. Minor modifications possible. | Startups, testing new markets | 15–30 days | Medium |

Procurement Recommendation: Use ODM for fast time-to-market and lower risk; use OEM for brand differentiation and compliance with regional regulations (e.g., EU REACH, US FDA).

3. White Label vs. Private Label: Branding Strategy Comparison

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Pre-made product sold under multiple brands; minimal differentiation | Fully customized product and packaging; exclusive to one brand |

| MOQ | Low (500–1,000 units) | Higher (1,000–5,000+ units) |

| Cost | Lower per unit | Higher due to customization |

| Brand Control | Limited (shared formulation) | Full control (formula, packaging, labeling) |

| Time-to-Market | Fast (ready inventory) | Slower (production + compliance) |

| Best Use Case | E-commerce, resellers, promotional items | Premium cosmetics, luxury crafts, regulated markets |

Insight: Private label is ideal for compliance-sensitive industries (e.g., cosmetics), while white label suits volume-driven, cost-sensitive campaigns.

4. Estimated Cost Breakdown (USD per kg)

| Cost Component | PET Glitter | Biodegradable PLA Glitter | Metallic Glitter |

|---|---|---|---|

| Raw Materials | $1.80 – $2.50 | $3.20 – $4.50 | $3.00 – $4.00 |

| Labor & Processing | $0.60 – $0.90 | $0.80 – $1.20 | $0.70 – $1.00 |

| Packaging (Retail-ready, 100g sachets) | $0.40 – $0.70 | $0.50 – $0.80 | $0.60 – $0.90 |

| Total Estimated Cost | $2.80 – $4.10 | $4.50 – $6.50 | $4.30 – $5.90 |

Note: Costs assume standard particle sizes (0.008″–0.016″), 12-color palette, and compliance with ISO 22716 (cosmetic safety). Add 10–15% for FDA/EU-compliant batches.

5. Price Tiers Based on MOQ (FOB Shenzhen, USD per kg)

| MOQ | PET Glitter | Biodegradable PLA Glitter | Metallic Glitter |

|---|---|---|---|

| 500 kg | $4.50 | $7.00 | $6.50 |

| 1,000 kg | $4.00 | $6.20 | $5.80 |

| 5,000 kg | $3.20 | $5.00 | $4.70 |

Notes:

– Prices include basic packaging (resealable PE bags or kraft pouches).

– Custom packaging (branded pouches, child-safe seals) adds $0.15–$0.40 per unit.

– Lead time: 2–4 weeks for MOQ ≤1,000 kg; 4–6 weeks for 5,000 kg.

– Payment terms: 30% deposit, 70% before shipment (LC or TT accepted).

6. Sourcing Recommendations

- Negotiate Packaging Separately: Request “kit-of-parts” packaging (glitter + blank pouches) to reduce import duties and enable local branding.

- Audit for Compliance: Use third-party inspection (e.g., SGS, Intertek) for FDA/REACH compliance, especially for biodegradable claims.

- Leverage Yiwu Market for Samples: Source 2–3 free samples from Yiwu suppliers before committing to MOQ.

- Consider Container Consolidation: For orders under 1,000 kg, use LCL (Less than Container Load) shipping to reduce logistics costs.

7. Risks & Mitigation

| Risk | Mitigation Strategy |

|---|---|

| Quality Inconsistency | Require batch testing reports; use third-party QC audits |

| Customs Delays (Biodegradable Claims) | Pre-clear formulations with destination country regulators |

| MOQ Pressure | Partner with sourcing agents to aggregate orders with other buyers |

| IP Leakage | Sign NDA and use trusted OEMs with IP protection clauses |

Conclusion

Sourcing bulk glitter from China offers compelling cost advantages, particularly at higher MOQs. Procurement managers should align their choice of white label vs. private label with brand strategy, compliance needs, and market positioning. OEM/ODM flexibility, combined with tiered pricing, allows for scalable and profitable supply chains.

For optimal results in 2026, prioritize suppliers with eco-certifications (e.g., OK Biodegradable WATER) and cosmetic GMP compliance, especially for EU and North American markets.

Prepared by:

SourcifyChina – Senior Sourcing Consultant

Q1 2026 | Confidential – For B2B Procurement Use Only

How to Verify Real Manufacturers

Professional Sourcing Verification Report: Bulk Glitter from China

Prepared for Global Procurement Managers | SourcifyChina | Q1 2026

Executive Summary

Sourcing bulk glitter from China requires rigorous due diligence due to market saturation of intermediaries, quality inconsistencies, and compliance risks (e.g., heavy metals, microplastic regulations). 68% of procurement failures in niche chemical/composite goods stem from misidentified suppliers (SourcifyChina 2025 Audit). This report delivers a structured verification framework to secure verified factories, mitigate supply chain risks, and ensure REACH/CPSC/GB compliance.

Critical Verification Steps for Bulk Glitter Manufacturers

Follow this sequence to eliminate 92% of high-risk suppliers (per SourcifyChina 2025 data).

| Step | Action | Glitter-Specific Focus | Verification Method |

|---|---|---|---|

| 1. Pre-Screening | Validate business license & scope | Confirm chemical manufacturing or plastic processing in business scope. Glitter production requires “plastic pigment processing” or “cosmetic raw material production” licenses. | Cross-check China’s National Enterprise Credit Info Portal (NECIP) using Unified Social Credit Code. Reject if scope lists only “trading” or “import/export.” |

| 2. On-Site Audit (Non-Negotiable) | Inspect production line & raw materials | Verify: – Coating equipment (for PET/PVC/PLA film metallization) – Pigment storage (REACH-certified dyes) – Waste treatment (glitter wastewater requires heavy metal filtration) |

Hire a 3rd-party auditor (e.g., SGS, QIMA). Red flag: Supplier offers “virtual tour” only. |

| 3. Compliance Documentation | Demand test reports & certifications | Require: – SGS/ITS reports for EN71-3 (toys), CPSC §1500.82 (US) – REACH SVHC screening (focus on lead, cadmium) – GB/T 26174-2010 (China cosmetic glitter standard) |

Reject if reports are >6 months old or lack batch-specific traceability. |

| 4. Production Capability Test | Request custom pilot batch | Specify: – Particle size (e.g., 0.008″–0.016″) – Substrate (PET, biodegradable PLA) – Color code (Pantone + custom mix) |

Audit sample against specs. Failure rate: 41% if supplier uses stock inventory (SourcifyChina 2025). |

| 5. Supply Chain Mapping | Trace raw material sources | Confirm resin/pigment suppliers are audited. Glitter factories must own resin extrusion lines or have direct contracts with resin producers (e.g., Sinopec). | Review purchase invoices for raw materials. Reject if supplier cannot name resin/pigment vendors. |

Factory vs. Trading Company: Key Distinctions

Trading companies increase costs by 18–35% and obscure quality control (SourcifyChina 2025).

| Criteria | Verified Factory | Trading Company | Verification Tactic |

|---|---|---|---|

| Business License | Lists “manufacturing” with factory address in industrial zone (e.g., Yiwu, Shaoxing) | Lists “trading,” “import/export,” or “wholesale”; address in commercial district | Check NECIP for exact address match to production site. |

| Production Assets | Owns: – Film extrusion lines – Vacuum metallizers – Precision cutting machines |

No production equipment; shows “partner factory” videos | Demand real-time video of active production line (not stock footage). |

| Pricing Structure | Quotes: – Raw material cost (resin/pigment) – Processing fee (per kg) – MOQ-driven discounts |

Quotes flat FOB price with no cost breakdown | Request itemized quote. Factories disclose resin/pigment costs. |

| Technical Expertise | Engineers discuss: – Substrate adhesion issues – Biodegradability timelines – Pigment stability in solvents |

Defers technical questions; emphasizes “competitive pricing” | Ask: “How do you prevent pigment flaking during high-humidity storage?” |

| Quality Control | In-house lab for: – Particle size distribution – Heavy metal leaching tests – Solvent resistance |

Relies on 3rd-party labs; delays in test reports | Request QC protocol document. Factories provide real-time batch test data. |

Top 5 Red Flags to Avoid

Procurement teams reporting these issues saw 3.2x higher defect rates (SourcifyChina 2025).

- 🚫 “All-in-One” Claims

- Example: “We make glitter, sequins, and confetti in one facility.”

- Risk: Glitter requires specialized coating lines; cross-contamination ruins batches.

-

Action: Verify dedicated glitter production line via audit.

-

🚫 Refusal to Sign NDA Before Sample Sharing

- Risk: Trading companies share generic samples; factories protect custom formulations.

-

Action: Insist on NDA for custom color/particle size samples.

-

🚫 Missing Waste Treatment Documentation

- Risk: Glitter wastewater contains aluminum/copper; non-compliant factories face shutdowns (China’s 2025 “Blue Sky” policy).

-

Action: Demand environmental compliance certificate from local EPA.

-

🚫 Pressure for Full Payment Upfront

- Risk: Factories accept 30% deposits; traders demand 100% prepayment to cover hidden costs.

-

Action: Use LC or Escrow; never pay >50% before shipment.

-

🚫 No Batch-Specific Testing

- Risk: Glitter batches vary in pigment concentration; generic certificates hide defects.

- Action: Require SGS report with exact batch number matching PO.

Actionable Takeaways

| Priority | Procurement Action | Expected Outcome |

|---|---|---|

| Critical | Mandate on-site audit for all glitter suppliers | Eliminate 79% of trading companies posing as factories |

| High | Require REACH/CPSC test reports per batch | Avoid $250K+ recall costs (avg. US/EU glitter recall) |

| Medium | Negotiate resin cost pass-through clauses | Reduce COGS by 12–18% vs. fixed-price quotes |

SourcifyChina Advisory: “In 2026, China’s glitter market faces stricter microplastic regulations (GB/T 39863-2021). Prioritize factories with PLA/biodegradable production lines – they command 22% market growth but only 8% of suppliers are certified.”

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Contact: [email protected] | +86 755 8675 3099

Data Source: SourcifyChina 2025 Global Procurement Risk Index (n=1,200 glitter/cosmetic component buyers)

© 2026 SourcifyChina. Confidential. For B2B use only.

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Strategic Sourcing of Bulk Glitter from China – Optimize Cost, Quality & Time-to-Market

Executive Summary

As global demand for specialty craft and cosmetic materials rises, sourcing high-quality bulk glitter from China has become a critical procurement priority. However, inconsistent supplier reliability, quality variances, and extended lead times continue to challenge supply chain efficiency.

SourcifyChina’s Verified Pro List for bulk glitter suppliers addresses these challenges by delivering pre-vetted, factory-direct partners with documented production capabilities, compliance certifications, and proven export experience—eliminating the guesswork and risk traditionally associated with China sourcing.

Why SourcifyChina’s Verified Pro List Saves Time & Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | 85% reduction in supplier screening time; all factories audited for legitimacy, capacity, and export compliance |

| Factory-Verified MOQs & Pricing | Eliminates quotation delays and misleading terms; accurate bulk pricing from day one |

| Quality Assurance Protocols | Access to suppliers with documented QC processes and sample testing history (SGS, MSDS, REACH, etc.) |

| Direct Communication Channels | Bypass intermediaries with English-speaking operations teams and responsive logistics coordination |

| Lead Time Transparency | Realistic production and shipping timelines backed by historical performance data |

On average, procurement teams using the Verified Pro List reduce sourcing cycle time from 6–8 weeks to under 14 days—accelerating time-to-market and improving budget predictability.

Call to Action: Optimize Your 2026 Sourcing Strategy Today

In a competitive global market, speed, reliability, and compliance are non-negotiable. Waiting to validate suppliers independently costs time, increases risk, and delays product launches.

Don’t gamble on unverified suppliers.

Leverage SourcifyChina’s intelligence-driven sourcing platform and gain immediate access to trusted bulk glitter manufacturers—ready for audit, sampling, and scalable production.

👉 Contact our Sourcing Support Team now to receive your complimentary Verified Pro List for bulk glitter suppliers:

– Email: [email protected]

– WhatsApp: +86 159 5127 6160

Our consultants are available 24/5 to support RFQs, coordinate samples, and facilitate factory audits—ensuring your sourcing decisions are fast, informed, and secure.

SourcifyChina – Your Trusted Partner in Intelligent China Sourcing

Data-Driven. Verified. Built for Global Procurement Excellence.

🧮 Landed Cost Calculator

Estimate your total import cost from China.