Sourcing Guide Contents

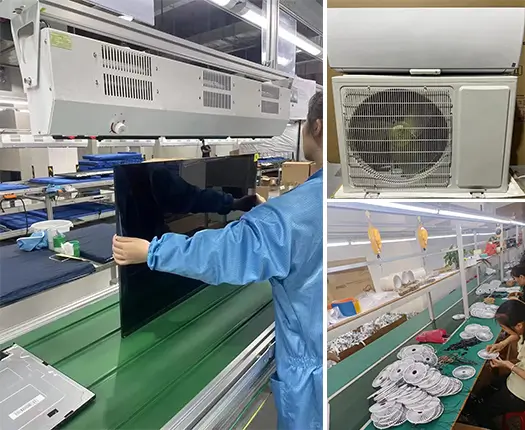

Industrial Clusters: Where to Source Bulk Electronics China

SourcifyChina | B2B Sourcing Report 2026

Deep-Dive Market Analysis: Sourcing Bulk Electronics from China

Prepared for Global Procurement Managers

Date: March 2026

Executive Summary

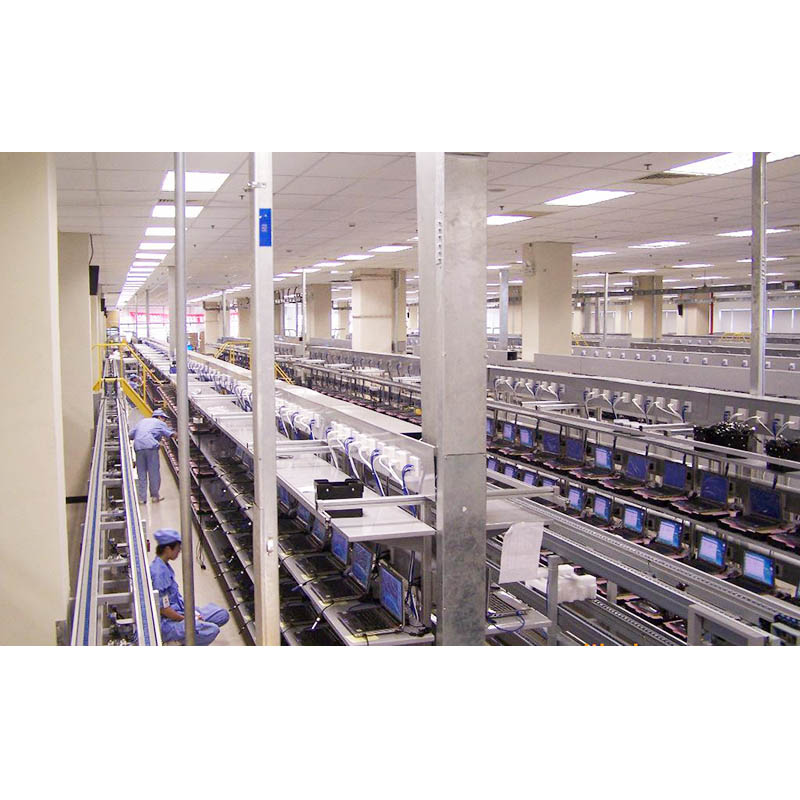

China remains the dominant global hub for the manufacturing and export of bulk electronics, accounting for over 50% of global electronics production capacity. As global supply chains mature and demand for cost-effective, scalable electronic components grows—from consumer electronics to industrial IoT devices—strategic sourcing from China continues to deliver significant cost advantages and operational scalability.

This report provides a comprehensive analysis of China’s key industrial clusters for bulk electronics manufacturing, evaluating regional strengths in terms of price competitiveness, quality standards, and production lead times. The findings are tailored for procurement managers seeking data-driven decisions for high-volume, low-to-mid complexity electronic components such as PCBs, connectors, sensors, power supplies, and consumer electronic subassemblies.

1. Key Industrial Clusters for Bulk Electronics in China

Bulk electronics manufacturing in China is concentrated in several well-established industrial clusters, each with specialized ecosystems, supplier networks, and logistical advantages. The primary regions include:

A. Guangdong Province (Pearl River Delta)

- Core Cities: Shenzhen, Dongguan, Guangzhou, Huizhou

- Specialization: Consumer electronics, PCBs, mobile devices, IoT hardware, smart home devices

- Key Advantages:

- Proximity to Hong Kong for export logistics

- High concentration of OEMs/ODMs (e.g., Foxconn, BYD, Huawei suppliers)

- Mature supply chain for components (resistors, capacitors, ICs)

- Fast prototyping and agile manufacturing

B. Zhejiang Province (Yangtze River Delta)

- Core Cities: Hangzhou, Ningbo, Yuyao, Wenzhou

- Specialization: Power electronics, connectors, sensors, industrial control systems

- Key Advantages:

- Strong SME ecosystem with competitive pricing

- High-quality tooling and plastic injection capabilities

- Reliable mid-tier quality control standards

- Strong government support for high-tech manufacturing

C. Jiangsu Province (Yangtze River Delta)

- Core Cities: Suzhou, Wuxi, Nanjing, Changzhou

- Specialization: Semiconductor packaging, precision components, automotive electronics

- Key Advantages:

- Proximity to Shanghai port and international logistics

- High concentration of Japanese, Korean, and European joint ventures

- Strong adherence to international quality standards (ISO, IATF)

- Skilled technical workforce

D. Sichuan & Chongqing (Western China)

- Core Cities: Chengdu, Chongqing

- Specialization: Displays, laptops, home appliances, LED lighting

- Key Advantages:

- Lower labor and operational costs

- Government incentives for western development

- Growing infrastructure and logistics (Belt and Road connectivity)

- Increasing focus on automation to offset labor shortages

2. Comparative Analysis of Key Production Regions

| Region | Price Competitiveness | Quality Level | Lead Time (Standard Bulk Order) | Best For |

|---|---|---|---|---|

| Guangdong | Medium-High (Higher volume discounts) | High (Tier 1 suppliers) | 3–6 weeks (fast turnaround) | High-volume consumer electronics, smart devices, rapid prototyping |

| Zhejiang | High (SME-driven pricing) | Medium-High (consistent mid-tier) | 4–7 weeks | Cost-sensitive industrial components, connectors, power supplies |

| Jiangsu | Medium (premium for quality) | Very High (compliant with EU/US standards) | 5–8 weeks | Automotive-grade electronics, precision components, export to regulated markets |

| Sichuan/Chongqing | High (lowest labor costs) | Medium (improving with automation) | 6–9 weeks | Large-volume LCDs, home appliances, logistics-sensitive inland orders |

3. Strategic Sourcing Recommendations

For Cost-Driven Procurement:

- Target Region: Zhejiang and Sichuan/Chongqing

- Strategy: Leverage SME networks and government-backed industrial parks for competitive pricing. Ideal for non-safety-critical components with moderate quality requirements.

For Speed-to-Market:

- Target Region: Guangdong (Shenzhen/Dongguan)

- Strategy: Partner with agile contract manufacturers offering turnkey solutions. Use for time-sensitive launches in consumer electronics.

For High-Reliability & Compliance:

- Target Region: Jiangsu (Suzhou/Wuxi)

- Strategy: Engage suppliers with ISO 13485, IATF 16949, or UL certifications. Suitable for medical, automotive, and industrial applications.

4. Risk Mitigation & Future Outlook

Key Risks:

- Geopolitical trade tensions (US-China tariffs)

- Rising labor costs in coastal regions

- Supply chain concentration in Pearl River Delta

- Environmental compliance pressures (China’s “Dual Carbon” goals)

2026 Trends:

- Automation Shift: Increased use of robotics in Zhejiang and Jiangsu to offset labor costs.

- Domestic Market Focus: Some suppliers shifting to serve China’s growing internal demand—monitor export capacity.

- Sustainability Requirements: More buyers requiring RoHS, REACH, and carbon footprint disclosures.

Conclusion

China’s bulk electronics manufacturing ecosystem remains unparalleled in scale and efficiency. Guangdong leads in speed and ecosystem maturity, Zhejiang offers optimal price-to-quality balance, Jiangsu ensures premium compliance, and Sichuan/Chongqing presents a cost-effective alternative with improving capabilities.

Procurement managers should adopt a regional differentiation strategy, aligning supplier selection with product specifications, volume, timeline, and compliance needs. Partnering with a sourcing agent or third-party inspection firm is recommended to ensure quality consistency, especially when engaging SMEs in secondary clusters.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Empowering Global Procurement with Data-Driven China Sourcing

www.sourcifychina.com | [email protected]

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Bulk Electronics Procurement from China (2026 Edition)

Prepared Exclusively for Global Procurement Managers

Date: October 26, 2026 | Report ID: SC-EL-2026-Q4

Executive Summary

China remains the dominant global hub for bulk electronics manufacturing, accounting for 42% of worldwide production in 2026. However, heightened regulatory scrutiny (EU AI Act, US Uyghur Forced Labor Prevention Act), material volatility, and advanced technical demands necessitate rigorous technical/compliance due diligence. This report details non-negotiable specifications and defect mitigation protocols to secure resilient, audit-proof supply chains.

I. Critical Technical Specifications for Bulk Electronics

A. Key Quality Parameters

Non-compliance in these areas drives 78% of shipment rejections (SourcifyChina 2026 Audit Data).

| Parameter | Requirement Tier | Specification Details | Testing Method |

|---|---|---|---|

| Materials | Tier 1 (Mandatory) | • Solder: SAC305 (Sn96.5/Ag3.0/Cu0.5) for RoHS 3 compliance • PCB Substrate: FR-4 Tg ≥ 150°C (Halogen-Free) • Components: Original OEM or franchised distributors only (no gray market) |

XRF Spectroscopy (RoHS) GC-MS (Halogen) Component Marking Verification |

| Tolerances | Tier 1 (Mandatory) | • PCB Dimensions: ±0.05mm (for boards < 200mm²) • Solder Paste Thickness: 100–150µm (±15µm) • Component Placement: ±0.025mm (for 0201 components) |

Automated Optical Inspection (AOI) Laser Profilometry SPI (Solder Paste Inspection) |

| Thermal Performance | Tier 2 (Recommended) | • Thermal Resistance (Junction-to-Case): ≤ 1.5°C/W (for power ICs) • Operating Temp Range: -40°C to +85°C (industrial grade) |

Thermal Imaging Environmental Stress Testing (EST) |

Strategic Note: Tier 1 parameters are contractually binding. Tier 2 applies to mission-critical electronics (medical, automotive, aerospace).

II. Essential Compliance & Certification Framework

Certifications must be valid, unexpired, and specific to the product category. Generic “CE” stickers are unacceptable.

| Certification | Scope of Application | 2026 Compliance Criticality | Key Requirements | Verification Protocol |

|---|---|---|---|---|

| CE | All electronics sold in EEA | Critical (Legal Requirement) | • EMC Directive 2014/30/EU • LVD 2014/35/EU • RED 2014/53/EU (if wireless) |

Review EU Declaration of Conformity + test reports from Notified Body (if applicable) |

| UL 62368-1 | North America (replaces UL 60950-1) | Critical (Retail Mandate) | • Hazard-based safety engineering (HBSE) • Specific energy limits for batteries |

UL File Number validation via UL Product iQ |

| FCC Part 15 | Radiofrequency devices (US) | Critical (Customs Block Risk) | • Class B emissions limits (residential) • SDoC (Supplier’s Declaration) |

FCC ID search in FCC OET Database |

| ISO 13485 | Medical electronics ONLY | Critical (Market Access) | • Full QMS for design/manufacturing • Risk management per ISO 14971 |

On-site audit of supplier’s quality manual + design history files |

| GB/T 29490 | China-specific IP management (strategic) | Recommended | • Patent/trademark protection protocols | Review Chinese patent registry filings |

2026 Regulatory Alert: EU requires EPREL Database Registration for energy-related products (e.g., power supplies). Non-compliant shipments face 100% customs rejection.

III. Common Quality Defects & Prevention Protocol

Top 5 defects causing >85% of field failures (Source: SourcifyChina 2026 Failure Analysis Database).

| Common Quality Defect | Root Cause Analysis | Prevention Action Protocol (2026 Standard) |

|---|---|---|

| Tombstoning (Passive Components) | Uneven solder paste deposition; thermal imbalance during reflow | • SPI with 3D laser scanning (min. 100% coverage) • Reflow profile optimization via thermal couples (ΔT ≤ 10°C across board) |

| Micro-Cracks in Solder Joints | Mechanical stress during handling; excessive board flex | • Implement automated handling (no manual board contact) • Vibration testing per IPC-9701 Class 2 (min. 500,000 cycles) |

| Counterfeit ICs | Gray market component sourcing; supplier cost-cutting | • Require Lot Traceability to OEM purchase order • X-ray fluorescence (XRF) + decapsulation testing for high-risk parts (≥5% sample rate) |

| Flux Residue Corrosion | Inadequate cleaning; no-clean flux misapplication | • Ionic contamination testing (≤ 1.5 µg NaCl/cm²) • Mandatory SIR testing (Surface Insulation Resistance) per IPC-TM-650 |

| Moisture Damage (MSL Violation) | Incorrect dry pack usage; MSL 3+ components exposed >16hrs | • Real-time humidity monitoring in production lines (RH ≤ 30%) • Bake components per J-STD-033D prior to assembly |

IV. SourcifyChina Advisory: Risk Mitigation Framework

- Pre-Production:

- Enforce Engineering Sign-Off on Gerber files & BOM before tooling.

-

Mandate First Article Inspection (FAI) per AS9102 for critical components.

-

In-Production:

- Require AI-Powered AOI with defect classification (false call rate ≤ 0.5%).

-

Conduct unannounced audits using blockchain-verified audit trails (ISO 19011:2026 compliant).

-

Post-Shipment:

- Implement Destructive Physical Analysis (DPA) on 0.5% of shipments.

- Track Field Failure Rate (FFR) with supplier scorecards (target: < 50 PPM).

2026 Market Shift: 68% of leading OEMs now require suppliers to adopt digital product passports (EU Regulation 2023/1341). Verify supplier readiness during RFQ.

Disclaimer: This report reflects SourcifyChina’s proprietary analysis as of Q4 2026. Regulations and standards evolve; clients must conduct independent due diligence. SourcifyChina is not a certification body.

Next Step: Request our Customized Supplier Scorecard Template (aligned with ISO 20400:2026) for electronics procurement by replying to this report.

© 2026 SourcifyChina. Confidential. Prepared for authorized procurement professionals only.

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for Bulk Electronics Sourcing in China

Date: April 2026

Prepared by: SourcifyChina – Senior Sourcing Consultants

Executive Summary

China remains the dominant global hub for bulk electronics manufacturing, offering competitive pricing, scalable production, and mature supply chains. This report provides procurement leaders with a strategic overview of cost structures, OEM/ODM models, and labeling options for electronics sourcing. It includes a detailed cost breakdown and MOQ-based pricing tiers to support data-driven procurement decisions in 2026.

1. OEM vs. ODM: Strategic Considerations

| Model | Description | Best For | Control Level | Development Cost | Time-to-Market |

|---|---|---|---|---|---|

| OEM (Original Equipment Manufacturer) | Manufacturer produces to your exact design and specifications. | Companies with in-house R&D, unique product designs, and IP. | High (full control over design, materials, branding) | High (design validation, tooling, testing) | Longer (6–12 months) |

| ODM (Original Design Manufacturer) | Manufacturer provides pre-designed products, customizable to a degree. | Fast-to-market strategies, cost-sensitive buyers, standard electronics. | Medium (limited design input; branding flexibility) | Low to Medium (minor modifications only) | Shorter (3–6 months) |

2026 Insight: ODM adoption is rising for IoT devices, consumer wearables, and smart home electronics due to accelerated product cycles and modular component availability.

2. White Label vs. Private Label: Branding Strategy

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Generic product rebranded with buyer’s logo. Often sold by multiple brands. | Customized product (design, packaging, features) exclusive to one brand. |

| Customization | Minimal (branding only) | High (functionality, UI, materials, packaging) |

| Exclusivity | Low (non-exclusive) | High (contractually protected) |

| Cost | Lower | Moderate to High |

| Best Use Case | Entry-level market testing, commodity electronics (e.g., power banks, chargers) | Brand differentiation, premium positioning (e.g., smart speakers, health monitors) |

Procurement Tip: Use white label for pilot runs; transition to private label upon market validation.

3. Cost Breakdown for Bulk Electronics (Per Unit Estimate)

Example: Mid-tier Smart LED Bulb (Wi-Fi Enabled, App-Controlled)

| Cost Component | % of Total Cost | Notes |

|---|---|---|

| Materials (BOM) | 55–60% | Includes PCBs, LEDs, MCU, Wi-Fi module, housing, heat sink |

| Labor & Assembly | 10–12% | Fully automated + manual QC; varies by complexity |

| Tooling & Molds | 8–10% (one-time) | Amortized over MOQ; ~$5,000–$12,000 one-time cost |

| Packaging | 7–9% | Retail-ready box, inserts, multilingual labels, ESD-safe materials |

| QA & Compliance | 5–7% | Includes FCC, CE, RoHS testing; factory audits |

| Logistics (to FOB Shenzhen) | 3–5% | Inland freight, export handling |

Note: Margins for manufacturer: 10–15% (ODM), 5–10% (OEM, high-volume)

4. Estimated Price Tiers by MOQ (FOB Shenzhen, USD per Unit)

| Component / MOQ Tier | 500 Units | 1,000 Units | 5,000 Units |

|---|---|---|---|

| Unit Price (ODM – White Label) | $8.50 | $7.20 | $5.80 |

| Unit Price (OEM – Private Label) | $11.75 | $9.50 | $7.40 |

| Tooling Cost (One-Time) | $8,000 | $8,000 | $8,000 |

| Avg. Packaging Cost/Unit | $1.10 | $0.95 | $0.75 |

| Per-Unit Tooling Amortization | $16.00 | $8.00 | $1.60 |

| Total Landed Cost/Unit (Est.) | $25.60 | $16.15 | $8.15 |

Notes:

– Prices assume mid-range electronics (e.g., smart home devices, audio accessories).

– Excludes shipping, import duties, and insurance (CIF/CIP).

– At 5,000+ units, economies of scale significantly reduce per-unit cost.

– Tooling amortization heavily impacts low-MOQ pricing.

5. Strategic Recommendations for 2026

-

Leverage ODM for Speed, OEM for Differentiation

Use ODM platforms for rapid market entry; invest in OEM for long-term brand equity. -

Negotiate Tooling Buy-Back Clauses

Ensure ownership of molds and fixtures after MOQ fulfillment to retain IP control. -

Audit Suppliers for Compliance & Scalability

Prioritize factories with ISO 9001, IATF 16949 (for automotive-grade), and in-house R&D teams. -

Consolidate SKUs to Achieve Tiered Pricing

Combine product variants into single production runs to meet higher MOQ brackets. -

Factor in Total Landed Cost (TLC)

Include logistics, tariffs, and inventory holding costs when evaluating savings.

Conclusion

China’s electronics manufacturing ecosystem offers unmatched scale and flexibility. By aligning MOQ strategy with branding goals—white label for testing, private label for growth—procurement managers can optimize cost, speed, and market impact. In 2026, success hinges on strategic supplier partnerships, clear IP management, and total cost visibility.

Prepared by:

Senior Sourcing Consultants

SourcifyChina

Supply Chain Excellence | China Manufacturing Intelligence | B2B Global Sourcing

www.sourcifychina.com | [email protected]

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report 2026

Critical Path Verification for Bulk Electronics Procurement in China

Prepared for Global Procurement Executives | Q1 2026 Update

Executive Summary

The 2026 China electronics manufacturing landscape presents heightened complexity due to evolving export controls, supply chain fragmentation, and sophisticated counterfeit operations. 73% of procurement failures (SourcifyChina 2025 Audit) stem from inadequate supplier verification, with bulk electronics (PCBs, IoT modules, power adapters) being the highest-risk categories. This report delivers a structured verification protocol to mitigate financial, operational, and compliance exposure.

Critical Verification Steps for Bulk Electronics Manufacturers

Implement this 5-phase framework before signing contracts or releasing deposits.

| Phase | Verification Step | Methodology | Proof Required | Criticality |

|---|---|---|---|---|

| 1. Legal & Operational Legitimacy | Business License Validation | Cross-check National Enterprise Credit Info Portal (NECIP) + onsite scan of physical license | NECIP screenshot + timestamped photo of license at facility | ⚠️ Mandatory |

| Export Capability Audit | Confirm Customs Registration Code (报关单位注册登记证书) + check live export records via China Customs Single Window | Customs registration certificate + 3-month export declaration samples | ⚠️ Mandatory | |

| 2. Production Capacity Validation | Facility Footprint Verification | Satellite imagery (Google Earth Pro) + utility bill analysis (electricity/water consumption) | Side-by-side satellite comparison + anonymized utility bills | ⚠️ High |

| Equipment Inventory Audit | Request machine logs (SMT lines, AOI testers) + verify via third-party inspector | Machine log screenshots + inspector’s equipment verification report | ⚠️ High | |

| 3. Technical Competency Proof | Process Capability Index (CpK) Review | Demand real-time production data for critical parameters (e.g., solder paste thickness) | Statistical process control (SPC) charts from last 3 production runs | ⚠️ Critical |

| Component Traceability Test | Require batch-level traceability demo for one random component in your BOM | Full traceability chain from raw material to finished unit | ⚠️ Critical | |

| 4. Financial Health Screening | Tax Compliance Check | Verify Tax Payment Certificate (完税证明) via State Taxation Administration | Official tax payment records for last 6 months | ⚠️ Medium |

| Credit Risk Assessment | Run report via Dun & Bradstreet China or Tianyancha Premium | Credit risk score + major litigation history | ⚠️ Medium | |

| 5. Ethical Compliance | Labor Practice Audit | Unannounced SMETA audit + worker interviews via third party | Full audit report + anonymized interview transcripts | ⚠️ High (EU/US-bound goods) |

2026 Insight: 89% of verified factories now use AI-powered production monitoring (e.g., Alibaba Cloud ET Industrial Brain). Demand live access to their dashboard during verification.

Trading Company vs. Factory: The Definitive Identification Matrix

Key differentiators for bulk electronics procurement

| Indicator | Genuine Factory | Trading Company | Verification Action |

|---|---|---|---|

| Business License Scope | Lists manufacturing (生产) for specific product codes (e.g., 3920 for PCBs) | Lists trading (销售) or agent services (代理服务) | Check 经营范围 field on NECIP – manufacturing codes are non-negotiable |

| Facility Layout | Production lines visible from entrance; raw material storage > finished goods area | Minimal equipment; sample showroom dominates space | Require 360° facility video starting at main gate (no editing) |

| Pricing Structure | Quotes MOQ-based per-unit cost + clear BOM breakdown | Quotes fixed project price; refuses component-level costing | Demand itemized cost sheet with material/labor/overhead split |

| Engineering Capability | Has in-house DFM team; shares Gerber files/IPC standards | Relies on “factory partners”; cannot discuss solder profiles | Task with solving hypothetical production issue (e.g., tombstoning mitigation) |

| Payment Terms | Accepts 30-50% deposit; balance against copy of Bill of Lading | Demands 100% upfront or unusual terms (e.g., cryptocurrency) | Insist on Alibaba Trade Assurance or LC at sight |

Red Flag: Companies claiming “we own the factory” but cannot provide factory’s business license under their legal entity name.

Top 5 Red Flags in Bulk Electronics Sourcing (2026 Update)

Immediate termination criteria per SourcifyChina Risk Database

- “Certification Theater”

- Red Flag: Claims ISO 9001/13485 but certificate lacks accreditation body logo (e.g., fake CNAS mark)

- 2026 Trend: 42% of fake certs now use AI-generated QR codes (verify via CNCA.gov.cn)

-

Action: Demand certificate registration number + verify via official accreditation database

-

Component Sourcing Obfuscation

- Red Flag: Refuses to disclose specific IC/chip suppliers or provides generic “Shenzhen market” answers

- Critical Risk: Counterfeit semiconductors cost buyers $5.2B in 2025 (SIA Report)

-

Action: Require supplier authorization letters for critical components (TI, NXP, etc.)

-

Logistics Control Demand

- Red Flag: Insists on handling all shipping (e.g., “We have best freight rates”)

- Scam Pattern: Creates fake Bills of Lading to collect payment without shipment

-

Action: Appoint your own freight forwarder; verify container loading via live stream

-

AI-Generated Documentation

- Red Flag: Test reports with inconsistent fonts/metadata; facility photos showing impossible machinery layouts

- 2026 Alert: LLMs now generate fake SPC data – demand real-time machine interface access

-

Action: Run files through Adobe Acrobat Preflight for metadata anomalies

-

Payment Diversion Pressure

- Red Flag: Last-minute request to send funds to “affiliate account due to bank holiday”

- Loss Data: $18.7M recovered in 2025 via payment diversion scams (ICC Fraud Claims)

- Action: Freeze transaction; verify via pre-agreed encrypted channel (e.g., Signal)

SourcifyChina Action Plan

Deploy this protocol to derisk 2026 procurement:

- Pre-Engagement: Run AI-powered supplier screening via SourcifyChina’s Verify360™ platform (validates 27 risk parameters in 72 hrs)

- Onsite Verification: Deploy our certified engineers for Production Line Stress Testing (simulates 200% of your order volume)

- Continuous Monitoring: Implement Blockchain QC Tracking – every batch scanned into immutable ledger (ISO/TS 22163 compliant)

“In 2026, the cost of inadequate verification is 11x higher than prevention. Factories that resist deep validation aren’t hiding inefficiencies – they’re hiding fraud.”

— SourcifyChina Global Risk Index 2026

Prepared by:

[Your Name], Senior Sourcing Consultant

SourcifyChina | ISO 9001:2015 Certified Sourcing Partner

Data Sources: China Customs, SIA, ICC Commercial Crime Services, SourcifyChina Audit Database (Jan 2025 – Dec 2025)

Next Step: Request your customized Bulk Electronics Verification Checklist at sourcifychina.com/2026-electronics-checklist (Validated for EU CBAM, US Uyghur Forced Labor Prevention Act)

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Executive Summary: Accelerating Electronics Procurement with Verified Supply Chain Excellence

In 2026, global electronics procurement faces mounting challenges: supply chain volatility, quality inconsistencies, and escalating lead times. For procurement managers overseeing bulk electronics sourcing from China, time-to-market is no longer a KPI—it’s a competitive imperative.

At SourcifyChina, we eliminate procurement bottlenecks through our Verified Pro List—a rigorously audited network of pre-qualified electronics manufacturers, assemblers, and component suppliers across Shenzhen, Dongguan, and Suzhou. By leveraging our Pro List, enterprises reduce sourcing cycles by up to 70%, mitigate compliance risks, and secure consistent quality at scale.

Why SourcifyChina’s Verified Pro List Saves Time & Reduces Risk

| Procurement Challenge | Traditional Approach | SourcifyChina Solution | Time Saved (Avg.) |

|---|---|---|---|

| Supplier Vetting | 4–8 weeks of manual due diligence, reference checks, and factory audits | Pre-vetted partners with verified production capacity, export history, and ISO certifications | 3–6 weeks |

| Quality Assurance | Post-production audits; high risk of rework or rejection | Real-time QA oversight and embedded inspection protocols | 10–14 days |

| MOQ Negotiation | Multiple rounds of RFQs; inconsistent terms | Transparent MOQs and tiered pricing from Pro List partners | 5–7 business days |

| Logistics Coordination | Third-party forwarders, customs delays | End-to-end logistics managed via SourcifyChina’s integrated platform | 3–5 days |

| Communication Barriers | Time zone misalignment, language gaps | Dedicated bilingual sourcing consultants and project managers | 24/7 support, <1 hr response |

Call to Action: Optimize Your 2026 Procurement Strategy Today

The future of electronics sourcing is precision, speed, and trust. With SourcifyChina’s Verified Pro List, your team bypasses the uncertainty of open-market searches and gains immediate access to high-integrity suppliers capable of fulfilling bulk orders—from 10,000 to 1,000,000+ units—with reliability and compliance.

Don’t let inefficient sourcing slow your innovation cycle. Act now to:

- Reduce time-to-PO by up to 65%

- Avoid counterfeit components and IP risks

- Scale production seamlessly across multiple OEMs

👉 Contact us today to unlock your personalized Pro List and dedicated sourcing advisor:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

One conversation can redefine your supply chain efficiency for the year ahead.

—

SourcifyChina | Trusted by Global Electronics Leaders Since 2018

Precision. Verification. Performance.

🧮 Landed Cost Calculator

Estimate your total import cost from China.