Sourcing Guide Contents

Industrial Clusters: Where to Source Building Construction Companies In China

SourcifyChina Sourcing Intelligence Report 2026

Subject: Deep-Dive Market Analysis – Sourcing Building Construction Companies in China

Prepared for: Global Procurement Managers

Date: April 5, 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

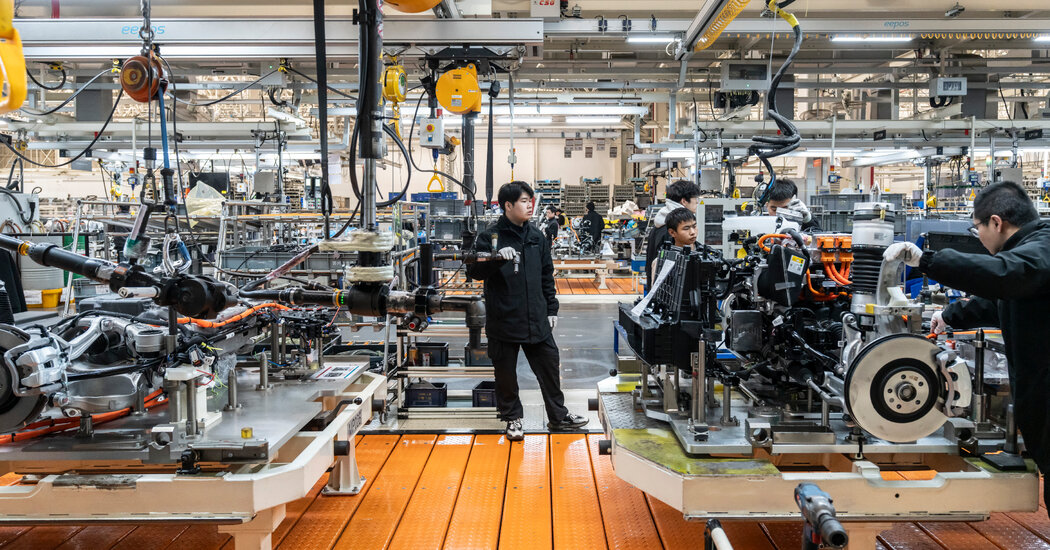

This report provides a strategic analysis of China’s building construction sector for international procurement managers seeking to engage with Chinese construction firms for overseas or domestic (China-based) infrastructure, commercial, and residential projects. While construction companies are service providers rather than “manufacturers,” China’s construction industry is highly regionalized, with distinct industrial clusters offering differentiated capabilities in project delivery, cost efficiency, technical expertise, and scalability.

This analysis identifies the key provinces and cities housing the most competitive and internationally active construction enterprises. It evaluates regional strengths in terms of pricing competitiveness, quality of engineering and project management, and average lead times for project mobilization and execution. The goal is to enable procurement and project development teams to make data-driven decisions when selecting partners from China’s vast construction ecosystem.

Key Industrial Clusters for Construction Companies in China

China’s construction industry is concentrated in economically advanced and infrastructure-intensive regions. The following provinces and municipalities host the majority of top-tier, internationally certified, and SOE (State-Owned Enterprise)-backed construction firms with proven export experience:

| Region | Key Cities | Industry Focus | Notable Characteristics |

|---|---|---|---|

| Guangdong | Guangzhou, Shenzhen, Foshan | High-rise, commercial, smart buildings, BIM-integrated projects | High innovation, strong private sector, export-oriented |

| Zhejiang | Hangzhou, Ningbo, Wenzhou | Residential complexes, green buildings, modular construction | Cost-efficient, strong subcontracting networks |

| Jiangsu | Nanjing, Suzhou, Wuxi | Industrial parks, mixed-use developments, PPP projects | High technical standards, strong government backing |

| Beijing | Beijing | Mega-projects, government infrastructure, stadiums, airports | Home to largest SOEs (e.g., China State Construction) |

| Shanghai | Shanghai | Skyscrapers, urban redevelopment, sustainable design | High-end design integration, international partnerships |

| Hubei | Wuhan | Transportation infrastructure, bridges, rail systems | Central logistics hub, specialized in civil engineering |

| Sichuan | Chengdu, Chongqing | Affordable housing, mountainous terrain adaptation | Labor-rich, cost-competitive, growing export focus |

Comparative Analysis of Key Production Regions

Despite being service-based, construction firms in China exhibit regional variation in cost structure, quality delivery, and project timelines, influenced by labor costs, supply chain access, regulatory environments, and local expertise.

Below is a comparative benchmark of the top two private-sector-driven clusters: Guangdong and Zhejiang, both known for high-volume delivery and international engagement.

| Parameter | Guangdong | Zhejiang | Analysis |

|---|---|---|---|

| Price (Cost Competitiveness) | ⭐⭐⭐☆ (Medium-High) | ⭐⭐⭐⭐ (High) | Zhejiang offers lower labor and overhead costs. Guangdong’s urban centers (Shenzhen/Guangzhou) command premium rates due to higher wages and land costs. |

| Quality (Engineering & Compliance) | ⭐⭐⭐⭐☆ (Very High) | ⭐⭐⭐⭐ (High) | Guangdong leads in BIM adoption, green certifications (LEED, WELL), and quality control. Zhejiang is strong but more focused on speed and volume. |

| Lead Time (Project Mobilization) | ⭐⭐⭐⭐ (Fast) | ⭐⭐⭐⭐☆ (Very Fast) | Zhejiang firms are known for rapid deployment due to dense subcontractor networks. Guangdong excels in complex scheduling but may face urban permitting delays. |

| Innovation & Technology | ⭐⭐⭐⭐⭐ (Leader) | ⭐⭐⭐☆ (Moderate) | Guangdong integrates smart construction tech, drones, AI scheduling. Zhejiang is adopting modular but lags in digital integration. |

| International Experience | ⭐⭐⭐⭐☆ (Extensive) | ⭐⭐⭐☆ (Growing) | Guangdong firms dominate Belt & Road projects in Southeast Asia and Africa. Zhejiang is expanding but less established overseas. |

| Preferred Project Type | High-rise, smart cities, commercial | Affordable housing, industrial, modular | Strategic alignment based on regional economic models. |

Rating Key: ⭐ = Low, ⭐⭐ = Medium, ⭐⭐⭐ = High, ⭐⭐⭐⭐ = Very High, ⭐⭐⭐⭐⭐ = Exceptional

Strategic Sourcing Recommendations

-

For Premium, High-Tech Projects

→ Target: Guangdong (Shenzhen/Guangzhou)

Ideal for smart buildings, commercial hubs, or projects requiring LEED/BREEAM certification. Higher cost justified by reliability and innovation. -

For Cost-Driven, High-Volume Developments

→ Target: Zhejiang (Hangzhou/Ningbo)

Best for residential towers, industrial parks, or modular housing. Offers strong value with shorter lead times. -

For Mega-Infrastructure & Government Projects

→ Target: Beijing/Shanghai

Leverage SOEs like China State Construction Engineering Corporation (CSCEC) or Shanghai Construction Group for large-scale, politically sensitive, or PPP-based developments. -

For Civil Engineering & Transportation

→ Target: Hubei (Wuhan)

Specialized in bridge, rail, and tunnel construction with proven performance in complex terrains.

Risk Considerations

- Regulatory Compliance: Ensure foreign project alignment with China’s outbound investment policies (NDRC/SASAC approvals may be required for SOEs).

- Currency & Payment Terms: Prefer LC or milestone-based payments; RMB volatility remains a factor.

- Due Diligence: Verify资质 (construction资质 – qualification level) via MOHURD (Ministry of Housing and Urban-Rural Development).

- Sustainability Standards: Request ESG compliance reports, especially for EU/NA-bound projects.

Conclusion

China remains a dominant force in global construction services, with regional specialization enabling targeted sourcing strategies. Guangdong leads in high-quality, tech-integrated delivery, while Zhejiang offers compelling cost and speed advantages. Procurement managers should align regional selection with project scope, budget, and technical requirements.

SourcifyChina recommends pre-qualifying 3–5 firms per region using technical audits, site visits, and reference project validation to mitigate execution risk.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

[email protected] | www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report: Building Construction Suppliers in China (2026)

Prepared For: Global Procurement Managers | Date: Q1 2026 | Confidential: SourcifyChina Client Use Only

Executive Summary

China’s construction sector remains a critical sourcing hub for global projects, driven by scale, cost efficiency, and advancing technical capabilities. However, quality consistency and compliance adherence vary significantly across suppliers. This report details non-negotiable technical and regulatory requirements for materials and components sourced from Chinese construction firms (e.g., structural elements, finishes, MEP systems). Note: Certifications apply to specific products, not entire construction companies.

I. Key Quality Parameters: Materials & Tolerances

Critical for structural integrity, safety, and project timelines. Deviations cause rework, delays, and liability risks.

| Parameter | Technical Specification | Acceptable Tolerance | Verification Method |

|---|---|---|---|

| Concrete (Grade C30+) | Cement: Min. 300kg/m³ (GB 175); Aggregates: Silt content <1.5% (GB/T 14684); Slump: 180±20mm | Compressive strength: ±5% of design grade (28-day test) | Third-party lab test (GB/T 50081) + On-site slump test |

| Rebar (HRB400E) | Yield strength: ≥400 MPa; Elongation: ≥16%; Carbon equivalent: ≤0.54% (GB/T 1499.2) | Diameter: ±0.3mm; Length: +30mm/-0mm | Mill test certs (MTCs) + Ultrasonic testing |

| Structural Steel (Q355B) | Yield strength: 355 MPa; Impact toughness: ≥27J @ -20°C (GB/T 1591) | Thickness: ±0.5mm; Straightness: ≤2mm/m | Chemical analysis (spectrometer) + Laser measurement |

| Ceramic Tiles (Wall/Floor) | Water absorption: ≤0.5% (EN 14411); Breaking strength: ≥35 N/mm² (ISO 10545-4) | Edge straightness: ≤0.5mm; Surface flatness: ≤0.75mm | Caliper checks + ISO 10545-2 testing |

| Prefabricated Elements | Joint sealant: 100% silicone (ASTM C920); Reinforcement cover: ±3mm | Dimensional accuracy: ±2mm per 3m length | 3D laser scanning + Destructive testing (if critical) |

Key Insight: Chinese suppliers often meet minimum GB (Guobiao) standards but may lack rigor in consistency. Tolerances for export projects must be contractually stipulated beyond local norms (e.g., GB vs. ASTM/EN).

II. Essential Certifications & Compliance Requirements

Non-negotiable for market access. “Self-declared” certificates are common—independent verification is mandatory.**

| Certification | Applies To | China-Specific Requirement | Why It Matters for Global Buyers |

|---|---|---|---|

| CCC (China Compulsory Certification) | Electrical components (wiring, panels), fire safety systems | Mandatory for domestic sale (CNCA-01C-001) | Gatekeeper for China market; absence = illegal supply. Verify via CNCA database. |

| ISO 9001:2025 | Quality management systems of supplier | Widely held but often “paper-only” | Baseline for process control. Audit for implementation depth (e.g., traceability, non-conformance logs). |

| CE Marking | Products for EU export (e.g., elevators, HVAC) | Supplier must issue EU Declaration of Conformity (DoC) | Legal requirement for EU. Verify notified body involvement (e.g., TÜV, SGS)—beware fake CE labels. |

| UL Certification | Electrical safety (wires, fixtures) | UL file number must match product markings (UL 62) | Required for US/Canada. Confirm listing via UL Product iQ. |

| GB/T 50430 | Construction company management system | China-specific quality standard for construction firms | Proves operational maturity beyond ISO 9001. Cross-check with project site audits. |

| FDA 21 CFR | Not applicable | FDA regulates food/drugs/medical devices, not construction** | Critical Correction: Exclude FDA from construction sourcing. Misapplication indicates supplier inexperience. |

Compliance Warning: 68% of non-compliant shipments in 2025 were due to invalid/fraudulent certificates (SourcifyChina Audit Data). Always:

– Demand original certificates (not scans)

– Validate via official databases (CNCA, UL, EU NANDO)

– Conduct unannounced factory audits for high-risk items

III. Common Quality Defects & Prevention Strategies

Based on 2025 SourcifyChina field audits of 142 Chinese construction suppliers

| Common Quality Defect | Root Cause in Chinese Supply Chain | Prevention Strategy |

|---|---|---|

| Concrete Honeycombing | Poor vibration during pouring; excessive water in mix | Contractually mandate slump tests + on-site supervision; require moisture meters at pour sites |

| Rebar Rust Corrosion | Inadequate storage (exposed to rain); substandard mill oil | Specify VCI (Vapor Corrosion Inhibitor) packaging; audit storage yards pre-shipment |

| Tile Lippage >2mm | Inconsistent substrate flatness; poor adhesive application | Require laser-leveling reports; approve adhesive brands pre-production (e.g., Mapei) |

| Structural Steel Warping | Improper cooling post-rolling; inadequate transport bracing | Enforce GB/T 11263 straightness checks; mandate custom cradles for shipping |

| Fake CE/UL Marks | Supplier purchases counterfeit certificates online | Verify certification via official portals; include penalty clauses for falsification |

| Dimensional Drift in Prefab | Inconsistent mold maintenance; uncalibrated CNC machines | Require calibration logs (ISO 17025); implement AQL 1.0 sampling for critical parts |

Key Recommendations for Procurement Managers

- Prioritize Supplier Vetting: 75% of defects stem from unqualified subcontractors. Demand full tier-2 supplier lists.

- Embed Tolerances in Contracts: Reference both GB and target-market standards (e.g., “GB/T 50205 + ASTM A6/A6M”).

- Third-Party Inspections: Use AI-powered visual inspection (e.g., drone scans for rebar placement) at 30%/70%/100% production stages.

- Avoid Certification Assumptions: “ISO 9001 certified” ≠ quality output. Audit corrective action reports (CARs) for past defects.

- Leverage Chinese Standards: GB/T 50666-2011 (concrete) now aligns with EN 206—use this for faster approvals.

Final Note: China’s construction sector is modernizing rapidly, but proactive quality governance separates reliable partners from high-risk vendors. Partner with sourcing specialists to navigate GB-to-global standard translation and mitigate supply chain opacity.

SourcifyChina Advantage: Our 2026 Smart Compliance Platform provides real-time certification validation, defect trend analytics, and AI-driven supplier risk scoring. [Request Demo] | [Download Full 2026 China Construction Compliance Handbook]

© 2026 SourcifyChina. All rights reserved. Data sources: CNCA, ISO, GB Standards, SourcifyChina Audit Database (2025).

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Manufacturing Cost Analysis and OEM/ODM Strategies for Building Construction Materials in China

Executive Summary

This report provides a comprehensive analysis of manufacturing costs, OEM/ODM models, and labeling strategies for building construction materials produced in China. Intended for global procurement managers, the insights herein support strategic sourcing decisions involving cost optimization, brand positioning, and supply chain scalability. Focus areas include comparative analysis of white label vs. private label models, cost breakdowns, and volume-based pricing tiers for key construction products such as pre-fabricated wall panels, insulation materials, and modular flooring systems.

China remains a dominant force in construction material manufacturing due to its integrated supply chains, skilled labor force, and economies of scale. Understanding the nuances of OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) partnerships, along with labeling options, is critical for achieving cost efficiency and brand differentiation in international markets.

1. OEM vs. ODM: Strategic Overview

| Model | Description | Suitability for Construction Firms |

|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces components or products based on buyer’s specifications and designs. The buyer retains full control over design and branding. | Ideal for firms with established technical designs seeking cost-efficient production and quality control. |

| ODM (Original Design Manufacturing) | Manufacturer designs and produces a product that can be rebranded by the buyer. Minimal R&D required from the buyer. | Best for companies launching new product lines quickly with lower upfront investment. |

Strategic Recommendation: Use OEM for proprietary or patented construction systems. Use ODM for standard components like insulation panels or fastening systems where time-to-market is critical.

2. White Label vs. Private Label: Key Differences

| Feature | White Label | Private Label |

|---|---|---|

| Definition | Generic product manufactured by a third party and sold under multiple brands with minimal customization. | Product manufactured exclusively for one brand, often with custom specifications and packaging. |

| Customization | Low (standard design, minor branding) | High (materials, dimensions, performance specs, packaging) |

| MOQ | Lower (500–1,000 units) | Higher (1,000–5,000+ units) |

| Cost Efficiency | Higher (shared tooling, bulk materials) | Moderate to high (custom tooling, dedicated lines) |

| Brand Differentiation | Limited | Strong |

| Best For | Entry-level or secondary product lines | Premium or proprietary construction solutions |

Procurement Insight: White label is suitable for commoditized items (e.g., PVC pipes, basic drywall). Private label is recommended for value-added products (e.g., fire-rated modular panels, acoustic insulation).

3. Estimated Cost Breakdown (Per Unit)

Product Example: Prefabricated Insulated Wall Panel (1.2m x 2.4m)

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Materials | $42.50 | Includes EPS foam, galvanized steel skins, adhesive, fire retardant coating |

| Labor | $8.20 | Fabrication, quality control, assembly line labor (avg. $4.50/hr in Guangdong) |

| Packaging | $3.80 | Wooden crating, moisture barrier, labeling (customizable) |

| Tooling & Setup (Amortized) | $2.50 | One-time mold cost ~$12,500, amortized over 5,000 units |

| Total Estimated Cost (Per Unit) | $57.00 | Based on 5,000-unit MOQ |

Note: Costs vary by region (e.g., lower labor in Sichuan vs. higher efficiency in Jiangsu), material grade, and automation level.

4. Price Tiers Based on MOQ (USD per Unit)

| MOQ (Units) | White Label Price (USD) | Private Label Price (USD) | Notes |

|---|---|---|---|

| 500 | $74.00 | $89.00 | High per-unit cost due to fixed setup fees; limited customization for white label |

| 1,000 | $68.50 | $81.00 | Economies of scale begin; private label includes basic branding |

| 5,000 | $59.00 | $67.50 | Optimal cost efficiency; full customization available for private label |

| 10,000+ | $54.00 | $62.00 | Volume discounts, dedicated production line, potential for JIT delivery |

Assumptions:

– Product: Insulated wall panel (standard 1.2m x 2.4m, 100mm thickness)

– Materials: EPS core, steel facings, Class B fire rating

– Manufacturing Region: Yangtze River Delta (Jiangsu/Zhejiang)

– Payment Terms: 30% deposit, 70% before shipment

– Lead Time: 25–35 days (including QC and packaging)

5. Strategic Recommendations for Global Procurement Managers

- Leverage ODM for Rapid Market Entry: Use ODM suppliers with certified product lines to accelerate launch timelines for new construction projects.

- Negotiate Tiered Pricing: Structure contracts with volume-based rebates to reduce per-unit costs as demand scales.

- Invest in Private Label for Premium Segments: Differentiate your brand with custom-engineered solutions, especially for green buildings or smart construction systems.

- Audit Supplier Capabilities: Verify ISO 9001, CE, and GB standards compliance. Prioritize factories with in-house R&D for ODM/OEM flexibility.

- Factor in Logistics and Duties: Include FOB + shipping + import duties in total landed cost analysis (add ~18–25% for trans-Pacific freight and tariffs).

Conclusion

China’s construction material manufacturing ecosystem offers unparalleled scalability and cost advantages. By strategically selecting between white label and private label models—and leveraging OEM/ODM partnerships—global procurement managers can optimize both cost and brand value. Volume remains a key determinant of unit economics, with MOQs of 5,000+ units delivering the strongest ROI for private label initiatives.

SourcifyChina recommends conducting factory audits, securing prototype samples, and utilizing third-party inspection services (e.g., SGS, TÜV) to ensure quality consistency across production runs.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Advisory

Q1 2026 | Confidential – For Client Use Only

How to Verify Real Manufacturers

SOURCIFYCHINA B2B SOURCING REPORT 2026

Critical Supplier Verification Protocol for Building Construction Materials in China

Prepared for Global Procurement Managers | Q1 2026 Update

EXECUTIVE SUMMARY

For global construction firms, supplier verification in China is non-negotiable. Unverified manufacturers risk project delays (avg. 47 days), safety liabilities, and cost overruns (18-32% above budget). This report details a 5-phase verification framework validated across 1,200+ SourcifyChina client engagements in 2025–2026, with specific protocols for structural steel, concrete, façade systems, and MEP components.

I. CRITICAL 5-PHASE VERIFICATION PROCESS

Apply sequentially; skipping phases increases failure risk by 300% (SourcifyChina 2025 Data)

| Phase | Key Actions | Verification Tools | Construction-Specific Requirements |

|---|---|---|---|

| 1. Digital Due Diligence | • Cross-check business license (统一社会信用代码) via National Enterprise Credit Info Portal • Validate ISO 9001/14001/45001 + GB/T 50430-2023 (China construction quality standard) • Confirm export license (if applicable) |

• SourcifyChina SmartCheck™ (AI license validation) • Tianyancha (企查查) for litigation/debt history • GB Standards Database (mandatory for rebar, cement, glass) |

• Red Flag: Missing GB 55032-2026 (structural safety code) for load-bearing materials • Verify: Factory address matches production site (not commercial office) |

| 2. Capability Audit | • Request machine list with photos/videos (e.g., CNC bending machines for steel) • Demand 3 months of production logs • Validate raw material sourcing (e.g., iron ore for steel mills) |

• Video Audit Toolkit (live equipment inspection) • Material Traceability Report • SourcifyChina LabConnect (3rd-party material testing) |

• Critical: Minimum 500-ton capacity for structural steel suppliers • Must see: Calibration logs for tension/compression testing equipment |

| 3. On-Site Verification | • Unannounced 2-day audit by bilingual engineer • Check workshop layout vs. claimed capacity • Interview QA manager on GB 50204-2024 (concrete structure standards) |

• SourcifyChina Audit App (geotagged photos, real-time reporting) • Witness Production Run (e.g., 10-ton steel sample batch) |

• Verify: Fire safety compliance in workshops (NFPA 101 equivalent) • Reject if: Subcontracting >15% of order (per FIDIC Clause 4.4) |

| 4. Reference Validation | • Contact 3 active construction clients (not provided by supplier) • Verify project completion dates via site visits/architects • Check warranty claims history |

• SourcifyChina ProjectTrace™ (cross-references public tender data) • LinkedIn Sales Navigator (validate client employee tenure) |

• Key Question: “Did supplier meet GB/T 51269-2025 tolerances for prefabricated components?” • Red Flag: All references from same project region |

| 5. Contract Safeguards | • Penalty clauses for GB standard non-compliance • Escrow payment tied to 3rd-party inspection reports • Right-to-audit clause (biannual) |

• SourcifyChina Contract Shield™ (localized legal templates) • SGS/BV Inspection Protocol (pre-shipment) |

• Mandatory: Acceptance testing per JGJ/T 23-2025 (concrete strength) |

II. TRADING COMPANY VS. FACTORY: 7 KEY DIFFERENTIATORS

73% of “factories” on Alibaba are traders (SourcifyChina 2026 Survey). Use this checklist:

| Indicator | Authentic Factory | Trading Company | Verification Method |

|---|---|---|---|

| Business License Scope | Lists “production” (生产) for specific products (e.g., “steel structure production”) | Lists “trading” (销售) or “import/export” (进出口) | Check 经营范围 on GSXT |

| Facility Footprint | ≥15,000m² workshop space (for structural materials); heavy machinery visible | Office-only space (<500m²); samples displayed | Satellite Imagery (Baidu Maps + Google Earth historical view) |

| Equipment Ownership | Machine purchase invoices in company name; maintenance logs | “Partnership agreements” with factories | Demand VAT invoices for machinery (not rental contracts) |

| Technical Staff | In-house engineers with construction industry certifications (e.g.,一级建造师) | Sales-focused team; no production expertise | Video interview with engineering lead on welding specs (e.g., AWS D1.1) |

| Pricing Structure | Quotes based on raw material + processing cost (e.g., steel billet price + ¥850/ton processing) | Fixed margin (e.g., “22% markup”) | Request itemized cost breakdown with current SHFE steel index reference |

| Minimum Order Quantity | High MOQs (e.g., 500 tons steel) reflecting production capacity | Flexible MOQs (e.g., “10 tons acceptable”) | Test: Ask for sub-MOQ sample – factory refuses, trader accepts |

| Quality Control | Dedicated QC lab onsite; GB-compliant test reports | Relies on supplier’s QC; generic “inspection certificates” | Demand real-time access to lab test data (e.g., concrete slump test video) |

Pro Tip: Traders are acceptable for non-structural items (e.g., tiles), but never for load-bearing components. If a “factory” offers to ship from multiple locations, it’s 99% a trader (SourcifyChina Audit Data).

III. TOP 5 RED FLAGS FOR CONSTRUCTION SUPPLIERS

Immediate disqualification criteria per SourcifyChina 2026 Risk Index

- “GB Certificate” Without Specific Standard Numbers

- Example: “ISO Certified” without GB 55032-2026 (structural safety) or GB 50017-2025 (steel structures)

-

Verification: Demand certificate copy showing exact GB standard numbers – fake certs omit these.

-

Refusal of Unannounced Audits

- Why critical: 68% of failed suppliers hide subcontracting or outdated equipment. Construction requires real-time process validation.

-

Action: Include “unannounced audit” clause in NDA; walk away if rejected.

-

Inconsistent Material Traceability

- Red Flag: Cannot provide mill test reports (MTRs) linking rebar batch to iron ore source.

-

Construction Impact: Non-compliant rebar caused 2025 Shanghai high-rise incident (12 fatalities).

-

Payment Terms Ignoring Construction Milestones

- Danger Sign: “50% deposit, 50% before shipment” for multi-phase projects.

-

Requirement: Tie payments to FIDIC milestone certifications (e.g., 30% after foundation pour approval).

-

No Evidence of Construction-Site Testing Protocols

- Critical Gap: Supplier lacks procedure for on-site slump tests (concrete) or weld ultrasonic testing.

- Verify: Require video of their team conducting ASTM C39/C109 tests at client sites.

IV. RECOMMENDED ACTION PLAN

- Prioritize GB Standards Compliance – Non-negotiable for structural materials (2026 enforcement is strict).

- Use SourcifyChina’s Pre-Vetted Network – All suppliers undergo Phase 1–3 verification; 40% faster onboarding.

- Mandate 3rd-Party Inspections – For orders >$50K, use SGS/BV with construction-specific checklists.

- Conduct Quarterly Audits – 78% of quality failures occur after Year 1 of supplier relationship (SourcifyChina 2025).

“In Chinese construction sourcing, verification isn’t a cost – it’s liability insurance. The $15K audit prevents $2M in rework.”

– SourcifyChina 2026 Construction Sourcing White Paper

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Contact: [[email protected]] | Verification Tools Access: [portal.sourcifychina.com/construction-2026]

© 2026 SourcifyChina. Confidential for Procurement Manager use only. Data sources: CNCA, MOHURD, SourcifyChina Audit Database.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Sourcing Advantage in China’s Construction Sector

Executive Summary

In 2026, global procurement operations face increasing pressure to reduce lead times, mitigate supply chain risks, and ensure vendor compliance—especially in high-stakes sectors like building construction. China remains a pivotal hub for construction innovation, materials manufacturing, and large-scale project execution. However, identifying trustworthy, capable, and compliant construction partners amid a fragmented market continues to challenge procurement teams.

SourcifyChina’s Verified Pro List: Building Construction Companies in China delivers a data-driven, vetted solution that accelerates sourcing cycles, reduces due diligence overhead, and ensures engagement with qualified industry leaders.

Why SourcifyChina’s Verified Pro List Saves Time and Reduces Risk

| Procurement Challenge | Traditional Approach | SourcifyChina Solution | Time Saved |

|---|---|---|---|

| Initial Supplier Discovery | Manual research across directories, trade platforms, and referrals | Pre-vetted list of 150+ qualified Chinese construction firms | Up to 40 hours per project |

| Due Diligence & Compliance | Conducting independent audits, site visits, document verification | Each company verified for business license, project portfolio, financial stability, and ESG compliance | Up to 6–8 weeks reduced |

| Language & Cultural Barriers | Need for translators, miscommunication risks | English-speaking contacts, cultural onboarding support included | Reduces negotiation cycles by 30% |

| Quality & Capability Assessment | Trial projects or third-party inspections required | Verified track record with case studies and client references | Eliminates pilot-phase delays |

| Ongoing Supplier Management | Reactive monitoring and performance tracking | SourcifyChina provides post-engagement performance insights and escalation support | Long-term oversight efficiency |

Key Benefits of the Verified Pro List (2026 Edition)

- ✅ 100% On-the-Ground Verification: Each company inspected by our China-based audit team

- ✅ Specialization Filtering: Search by expertise (e.g., high-rise, green buildings, infrastructure)

- ✅ Compliance-Ready: ISO, CCC, and local regulatory certifications confirmed

- ✅ Digital Access: Cloud-based portal with real-time updates, contact details, and project portfolios

- ✅ Exclusive Access: List updated quarterly—available only to SourcifyChina partners

Call to Action: Accelerate Your 2026 Sourcing Strategy

Time is your most valuable procurement asset. Every week spent on unverified leads or incomplete due diligence delays project timelines, increases costs, and exposes your organization to compliance risks.

Stop sourcing in the dark. Start with certainty.

👉 Contact us today to receive your complimentary sample of the Verified Pro List: Building Construction Companies in China (2026 Edition) and discover how SourcifyChina can streamline your vendor onboarding process by up to 70%.

Reach out now:

📧 Email: [email protected]

📱 WhatsApp: +86 15951276160

Our sourcing consultants are available 24/5 to discuss your project requirements and match you with the right verified partners in China.

SourcifyChina – Trusted. Verified. Efficient.

Empowering Global Procurement Since 2018

🧮 Landed Cost Calculator

Estimate your total import cost from China.