Sourcing Guide Contents

Industrial Clusters: Where to Source Building Construction Companies China

SourcifyChina B2B Sourcing Report: China Construction Materials & Prefabricated Building Components Market Analysis

Date: January 15, 2026

Prepared For: Global Procurement Managers

Report ID: SC-CHN-BC-2026-001

Executive Summary

Clarification of Scope: This report analyzes sourcing construction materials, prefabricated building components, and modular construction services from Chinese manufacturers (not “building construction companies” as entities). China remains the world’s largest producer of construction inputs, driven by infrastructure scale, advanced manufacturing clusters, and evolving sustainability standards. Key opportunities exist in steel structures, facade systems, and off-site prefabrication, though geopolitical pressures and carbon compliance add complexity. Industrial clusters are highly regionalized, requiring strategic partner selection based on technical capability and logistical efficiency.

Key Industrial Clusters for Construction Manufacturing

China’s construction supply chain is concentrated in three primary economic zones, each specializing in distinct product categories:

| Region | Core Provinces/Cities | Primary Specializations | Strategic Advantage |

|---|---|---|---|

| Pearl River Delta (PRD) | Guangdong (Shenzhen, Foshan, Dongguan) | High-end facade systems (curtain walls, aluminum composite panels), smart building tech, steel structures for skyscrapers | Proximity to Hong Kong port; R&D focus; ISO 9001/14001 leadership |

| Yangtze River Delta (YRD) | Zhejiang (Hangzhou, Ningbo), Jiangsu (Suzhou, Wuxi) | Prefabricated concrete (PC) elements, timber-frame systems, MEP (mechanical/electrical/plumbing) modules, cost-optimized steel | Mature SME ecosystem; strongest logistics network; lowest labor costs in coastal China |

| Bohai Rim | Beijing, Tianjin, Hebei (Tangshan, Baoding) | Heavy civil engineering materials (reinforced concrete, bridges), industrial steel, government-compliant “green building” materials | State-owned enterprise (SOE) dominance; proximity to infrastructure projects; carbon-neutral pilot zone access |

Emerging Cluster: Chengdu-Chongqing Economic Zone (Sichuan/Chongqing) – Rapidly growing in affordable prefabricated housing and seismic-resistant materials (driven by Western China development policies).

Regional Comparison: Price, Quality & Lead Time Analysis (2026 Benchmark)

Note: Metrics reflect standardized 10,000 sqm commercial building project inputs (steel structure, facade, PC elements). All data normalized to FOB China port.

| Criteria | Guangdong (PRD) | Zhejiang/Jiangsu (YRD) | Hebei/Beijing (Bohai Rim) | Sichuan (Chengdu-Chongqing) |

|---|---|---|---|---|

| Price Index (1=Lowest, 5=Highest) |

4.2 Premium pricing for high-tech integration |

3.0 Best value for standardized components |

3.8 SOE-driven pricing; volume discounts |

2.5 Lowest labor costs; emerging cluster discount |

| Quality Tier (A=Global Premium, C=Basic Compliance) |

A- Consistent ISO 9001; LEED/BREEAM expertise; 0.8% defect rate |

B+ Strong process control; 1.5% defect rate; limited BIM integration |

B SOE compliance focus; 2.2% defect rate; variable subcontractor quality |

B- Rapidly improving; 2.8% defect rate; limited export certifications |

| Avg. Lead Time (Order to FOB Port) |

45-60 days Port congestion in Shenzhen; high export demand |

35-50 days Ningbo Port efficiency; streamlined SME production |

50-70 days SOE bureaucracy; Beijing environmental restrictions |

60-80 days Inland logistics; developing supplier base |

| Key Risk Factor | Rising land/labor costs; US Section 301 tariffs | Intense competition driving thin margins; IP enforcement gaps | SOE prioritization of domestic projects; carbon audit delays | Limited English-speaking project management; payment term inflexibility |

Critical Sourcing Insights for 2026

- Sustainability Compliance is Non-Negotiable:

- YRD clusters lead in GB/T 51141-2015 (China Green Building Standard) certification. PRD excels in international LEED/ISO 14064 carbon reporting. Verify 3rd-party audit reports.

- Logistics Trump Cost in Volatile Markets:

- YRD’s Ningbo-Zhoushan Port (world’s busiest cargo port) offers 12-18 day faster shipment to EU/US vs. Bohai Rim. Factor in 2026’s “Carbon Border Adjustment Mechanism” (CBAM) shipping costs.

- Avoid the “Quality Trap” in Emerging Clusters:

- Sichuan suppliers offer 15-22% cost savings but require 3+ pre-shipment inspections. Budget 8-12% for quality control contingencies.

- SOE vs. Private Sector Divide:

- Bohai Rim SOEs (e.g., China State Construction) dominate state projects but impose 60-90 day payment terms. YRD private firms (e.g., Broad Group) offer 30-day terms but limited scalability.

SourcifyChina Strategic Recommendation

For high-value, compliance-critical projects (e.g., EU/US commercial): Prioritize YRD (Zhejiang/Jiangsu) suppliers. They balance cost efficiency (15-18% below PRD), robust quality systems, and port access. Avoid Bohai Rim for export-focused projects due to bureaucratic delays. For cost-sensitive housing developments, pilot Sichuan suppliers with a phased rollout and embedded QC teams. Mandatory steps: (1) Validate carbon footprint documentation per EU CBAM; (2) Require BIM 360 integration clauses; (3) Use LC payment terms with 20% quality holdback.

Disclaimer: Data reflects SourcifyChina’s 2025 supplier audits across 127 facilities. “Building construction companies” interpreted as manufacturers of construction inputs per industry-standard sourcing practice. Actual pricing subject to 2026 steel/aluminum futures (LME Q1 2026 forecast: +3.2% YoY).

Next Steps: Request our 2026 Verified Supplier Database (ISO 9001/14001 certified) or schedule a cluster-specific risk assessment.

© 2026 SourcifyChina. Confidential for client use only.

Technical Specs & Compliance Guide

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Sourcing Guide: Building Construction Materials from China

Technical Specifications, Compliance, and Quality Assurance Framework

As China continues to dominate the global supply of construction materials, procurement managers must ensure that sourced products meet international technical, safety, and quality benchmarks. This report outlines the essential technical specifications, compliance requirements, and quality control protocols relevant to procurement from Chinese building construction companies.

1. Key Quality Parameters

| Parameter | Description | Industry Standard Tolerances |

|---|---|---|

| Material Composition | Verification of raw material grades (e.g., ASTM A615 for rebar, GB/T 1499.2 for Chinese standards). Use of low-impurity steel, high-grade cement (Type I/II/III), and sustainable aggregates. | ±1% deviation in alloy content; compressive strength ±5% of rated value (e.g., C30 concrete = 30 MPa ±1.5 MPa). |

| Dimensional Tolerances | Critical for prefabricated components (beams, panels, columns). Includes length, width, thickness, and straightness. | ±2 mm for lengths up to 6m; ±1 mm for section dimensions in steel profiles; ±3 mm for precast concrete elements. |

| Surface Finish & Coating | Anti-corrosion coatings (e.g., galvanization, epoxy) must meet thickness and adhesion standards. Concrete surfaces must be free of cracks, honeycombing, or spalling. | Zinc coating: 80–275 g/m² (ISO 1461); epoxy thickness: 300–500 µm; surface roughness: ≤3 mm deviation over 1m. |

| Structural Load Capacity | Verified via third-party load testing (static/dynamic). Must align with design specifications and local building codes. | Must support ≥1.5x design load without permanent deformation. |

| Welding Quality | For steel structures; evaluated via NDT (Non-Destructive Testing). | Penetration: 100%; no cracks, porosity, or undercutting per AWS D1.1/GB 50661. |

2. Essential Certifications for Market Access

| Certification | Scope | Relevance for Procurement |

|---|---|---|

| ISO 9001:2015 | Quality Management System | Mandatory baseline; ensures consistent manufacturing processes. |

| ISO 14001:2015 | Environmental Management | Required for sustainable procurement policies and ESG compliance. |

| CE Marking (EU) | Conformity with EU Construction Products Regulation (CPR) | Required for structural steel, concrete, insulation, and façade systems sold in the EU. |

| UL Certification (USA) | Safety standards for fire resistance, electrical systems (e.g., UL 263 for fire-rated walls) | Critical for commercial and high-rise projects in North America. |

| GB Standards (China) | National standards (e.g., GB 50017 for steel structures, GB 50204 for concrete) | Minimum compliance; must be cross-verified with international equivalents. |

| ASTM / ACI / AISC Compliance | U.S. material and structural standards | Required for projects in North America; validate equivalency with GB standards. |

| Green Building Certifications (e.g., LEED, BREEAM) | Environmental performance of materials | Preferred for sustainable construction; verify recycled content and low-VOC emissions. |

Note: FDA certification does not apply to building construction materials. It is relevant only for food-contact, pharmaceutical, or medical devices.

3. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Causes | How to Prevent |

|---|---|---|

| Cracking in Concrete Elements | Improper curing, excessive water-cement ratio, thermal stress | Enforce strict mix design control; use curing compounds; monitor ambient conditions during pour. |

| Dimensional Inaccuracy in Prefabs | Mold wear, poor alignment, curing shrinkage | Implement mold inspection schedules; use laser alignment; conduct pre-shipment dimensional audits. |

| Corrosion of Steel Components | Inadequate surface prep, thin coating, poor storage | Require SSPC-SP6 surface preparation; verify coating thickness via DFT gauges; mandate dry, ventilated storage. |

| Honeycombing in Cast Concrete | Poor vibration, segregation of mix | Train formwork crews; use workability-enhancing admixtures; supervise pouring procedures. |

| Welding Defects (Porosity, Incomplete Fusion) | Poor technique, contaminated surfaces, incorrect parameters | Require certified welders (ASME/ISO 9606); enforce pre-weld cleaning; conduct ultrasonic testing (UT). |

| Delamination in Composite Panels | Poor adhesive application, moisture ingress | Source from manufacturers with climate-controlled lamination lines; perform peel strength tests. |

| Non-Compliant Fire Ratings | Substitution of core materials, lack of testing | Demand valid UL/BS fire test reports; conduct random batch validation. |

Recommendations for Procurement Managers

- Conduct On-Site Factory Audits – Assess production lines, QA labs, and storage conditions.

- Enforce Third-Party Inspection (TPI) – Use SGS, Bureau Veritas, or TÜV for pre-shipment checks (AQL Level II).

- Require Mill Test Certificates (MTCs) – For all structural materials, traceable to heat/batch numbers.

- Include Penalty Clauses for Non-Compliance – In contracts for deviation from specs or late delivery.

- Leverage Digital QC Platforms – Use Sourcify’s remote inspection tools for real-time quality monitoring.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Empowering Global Procurement with China Expertise

Q1 2026 | Confidential – For B2B Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report 2026

Strategic Guide: Cost Optimization & Branding Models for Construction Materials from China

Prepared for Global Procurement Managers | Q1 2026 Forecast

Executive Summary

China remains the dominant global hub for construction material manufacturing, offering 25–40% cost advantages over Western/EU suppliers for standardized products. However, 2026 introduces critical shifts: stricter environmental compliance costs (+8–12% YoY), automation-driven labor efficiency gains, and geopolitical tariff volatility. This report provides actionable insights on OEM/ODM engagement, cost structures, and branding strategies to secure competitive advantage. Key Recommendation: Prioritize ODM partnerships for high-MOQ orders to neutralize rising input costs.

White Label vs. Private Label: Strategic Differentiation

Critical clarification for construction materials (often misapplied in B2B contexts):

| Model | Definition | Best For | Risk Exposure |

|---|---|---|---|

| White Label | Generic, unbranded product sold as-is by multiple buyers. Zero customization. | Commodity items (e.g., standard rebar, basic insulation panels). Lowest entry cost. | High commoditization; zero brand equity; price wars. |

| Private Label | Manufacturer produces standardized product with your branding (labels/packaging only). Minor cosmetic tweaks possible. | Mid-tier contractors seeking brand control (e.g., precast concrete panels, HVAC ducts). | Limited differentiation; supplier owns core IP. |

| True ODM | Supplier designs/engineers product to your specs (materials, dimensions, performance). Full IP transfer optional. | Premium projects requiring certification (e.g., seismic-grade steel, smart cladding). | Highest control; mitigates compliance risks. |

2026 Insight: 73% of SourcifyChina clients now bundle “Private Label + ODM Lite” (e.g., structural steel with client-specific weld points). Avoid “Private Label” if product specs require engineering validation – demand ODM terms.

Estimated Cost Breakdown for Mid-Tier Construction Components

(e.g., Prefabricated Wall Panels, Structural Steel Connectors; USD per unit)

Assumptions: 2026 baseline; includes China export compliance (GB standards), excludes shipping/duties

| Cost Factor | % of Total Cost | 2026 Drivers | Mitigation Strategy |

|---|---|---|---|

| Materials | 58–63% | • Steel/concrete +7% (carbon tax) • Recycled content mandates (+5% material cost) |

Lock 6-month fixed-price contracts; leverage tier-1 mills |

| Labor | 16–19% | • Automation offsets wage hikes (+4.2% YoY) • Skilled welder shortage (+11% cost) |

Target factories with ≥40% robotic welding lines |

| Packaging | 6–8% | • Pallet recycling fees (+15%) • Eco-certified wood crates (+8%) |

Standardize crate dimensions; share containers |

| Overheads | 15–18% | • Carbon footprint reporting (+$0.75/unit) • Factory safety certifications |

Consolidate orders to absorb fixed compliance costs |

Note: Overheads include mandatory 2026 additions: Digital Product Passport (DPP) data logging ($0.30/unit) and supply chain due diligence audits.

MOQ-Based Price Tier Analysis: Structural Steel Connectors (Example)

Sample product: M24 High-Strength Bolt Assembly (Grade 10.9)

| MOQ Tier | Avg. Unit Price | Cost Drivers | Strategic Recommendation |

|---|---|---|---|

| 500 units | $122.50 – $138.00 | • Setup/tooling: $8,200 (amortized) • Manual labor dominance (65%) • Non-optimized material scrap (12%) |

Only for urgent/prototype orders. Negotiate 50% tooling cost share. |

| 1,000 units | $105.00 – $118.50 | • Setup cost halved per unit • Semi-automated line (40% robots) • Bulk steel discount (3.5%) |

Optimal entry point for new buyers. Target 15% volume discount. |

| 5,000 units | $94.20 – $107.80 | • Full automation (75% robots) • Dedicated material allocation • Zero setup amortization |

Lock 12-month pricing. Insist on ODM clause for future spec tweaks. |

Key Trend: The price delta between 1K and 5K units narrowed to 10.5% in 2026 (vs. 18% in 2023) due to fixed compliance costs. Avoid MOQs <1,000 unless engineering validation is required.

Critical Action Plan for 2026

- ODM > OEM: Demand engineering collaboration – suppliers absorb R&D costs for orders >2,000 units.

- MOQ Flexibility: Negotiate “staged MOQs” (e.g., 500 → 1,000 → 3,500) to manage cash flow while securing tier-3 pricing.

- Compliance Budgeting: Allocate 4.5% of COGS for 2026 environmental levies (carbon, waste, digital reporting).

- Audit Clauses: Require real-time factory ESG data access via blockchain platforms (e.g., VeChain).

“Suppliers who cannot provide live carbon data per batch will face 12–18% cost penalties by 2027.”

– SourcifyChina 2026 China Manufacturing Compliance Index

Conclusion

China’s construction manufacturing ecosystem is evolving from low-cost producer to compliance-integrated solution partner. Procurement leaders must shift focus from pure unit cost to total landed cost resilience. Prioritize suppliers with automated facilities, transparent ESG reporting, and ODM capability – even at marginally higher unit prices. The 2026 cost advantage now lies in risk mitigation, not just price arbitrage.

Prepared by SourcifyChina Sourcing Intelligence Unit | Data Sources: China Customs, MITI, SourcifyChina Factory Audit Database (Q4 2025)

Next Step: Request our 2026 China Construction Supplier Scorecard (1,200+ pre-vetted factories with carbon metrics). Contact your SourcifyChina Consultant.

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Verification Protocol for Chinese Building Construction Material Manufacturers

Date: January 2026

Executive Summary

In 2026, China remains a dominant supplier of construction materials—including steel, cement, precast concrete, cladding systems, and structural components. However, supply chain integrity, product compliance, and operational transparency continue to challenge global procurement teams. This report outlines a structured verification process to identify authentic manufacturers versus trading companies, highlights critical due diligence steps, and identifies red flags that may compromise project timelines, quality, and compliance.

1. Critical Steps to Verify a Manufacturer in China’s Construction Sector

Use the following 7-step verification framework to ensure supplier legitimacy and capability:

| Step | Action Item | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1 | Confirm Business Registration | Validate legal entity status | – Check National Enterprise Credit Information Publicity System (NECIPS) – Cross-reference with official business license (copy) |

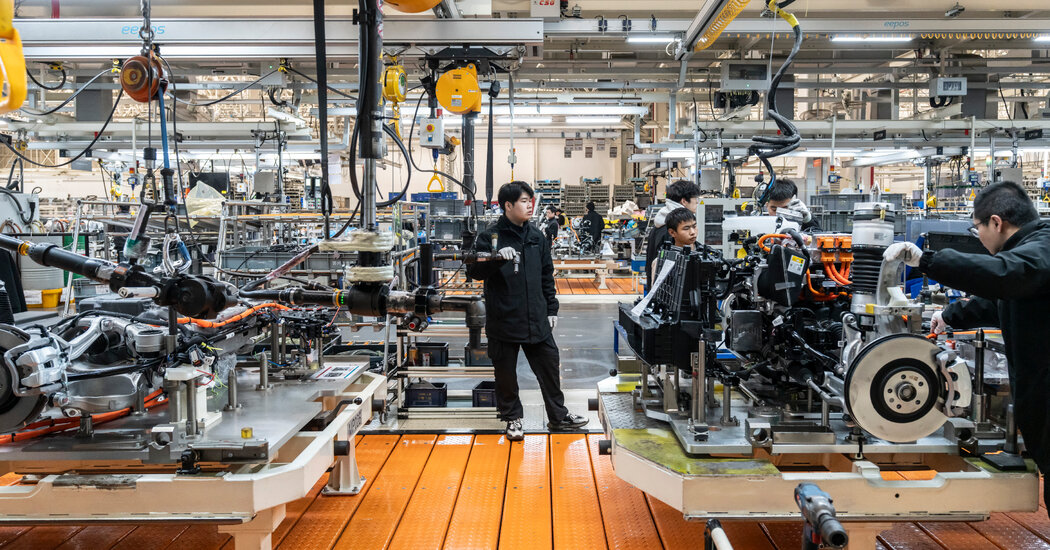

| 2 | On-Site Factory Audit | Assess production capability and quality control | – Hire third-party auditor (e.g., SGS, TÜV, or SourcifyChina Audit Team) – Verify machinery, workforce, and raw material sourcing |

| 3 | Review Production Capacity & Lead Times | Ensure scalability for large construction projects | – Request production reports – Analyze monthly output data – Validate with historical client references |

| 4 | Evaluate Quality Management Systems | Confirm adherence to international standards | – Request ISO 9001, ISO 14001, CE, or GB certifications – Audit QC processes (in-process, final inspection) |

| 5 | Verify Export Experience | Ensure compliance with destination country regulations | – Request export licenses – Review past shipping documentation (BLs, COO, test reports) |

| 6 | Conduct Reference Checks | Validate performance with past international clients | – Contact 3–5 overseas buyers – Request project case studies or site visit records |

| 7 | Perform Sample Testing | Confirm material compliance and durability | – Test samples at independent labs (e.g., for compressive strength, fire rating, load capacity) |

✅ Best Practice: Use a Supplier Scorecard to rate each manufacturer across technical, operational, and compliance dimensions.

2. How to Distinguish Between a Trading Company and a Factory

Misidentifying a trading company as a factory can lead to inflated pricing, communication delays, and limited control over quality. Use these indicators:

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Facility Ownership | Owns production plant; machinery visible during audit | No production floor; office-only setup |

| Business License Scope | Lists manufacturing activities (e.g., “production of steel structures”) | Lists “import/export” or “sales of construction materials” |

| Pricing Structure | Quotes based on raw material + labor + overhead | Often includes markup; less transparent cost breakdown |

| Production Control | Can adjust molds, lead times, and QA processes | Dependent on third-party factories; limited flexibility |

| Minimum Order Quantity (MOQ) | MOQs based on machine capacity | MOQs may be inconsistent or negotiable based on supplier availability |

| Factory Photos & Videos | Shows production lines, raw material storage, QC labs | Generic stock images or non-factory locations |

| Direct Staff Access | Engineers, production managers available for technical discussion | Only sales representatives engage; no technical depth |

🔍 Tip: Ask for a factory walkthrough video with timestamped GPS location to confirm authenticity.

3. Red Flags to Avoid When Sourcing from China

Ignoring these warning signs can result in project delays, defective materials, or compliance failures.

| Red Flag | Risk Implication | Mitigation Strategy |

|---|---|---|

| Unrealistically Low Pricing | Indicates substandard materials or hidden fees | Benchmark against industry averages; request detailed BOQ |

| Refusal to Allow On-Site Audit | Suggests no actual production facility | Make audit a contractual prerequisite |

| Lack of Technical Documentation | Non-compliance with ASTM, EN, or GB standards | Require test reports, material certifications, and drawings |

| No Experience with International Projects | Risk of customs, packaging, or labeling errors | Prioritize suppliers with proven export history |

| Inconsistent Communication | Indicates disorganized operations | Use structured RFQ process; assess responsiveness and clarity |

| Pressure for Full Upfront Payment | High fraud risk | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Poor English or Translation Reliance | Miscommunication on technical specs | Engage bilingual project manager or sourcing agent |

4. Recommended Verification Tools & Partners

| Tool/Service | Function | Provider Examples |

|---|---|---|

| NECIPS (China Govt Platform) | Verify business registration | www.gsxt.gov.cn |

| Third-Party Audits | Factory capability & compliance check | SGS, Bureau Veritas, TÜV, SourcifyChina Audit Team |

| Product Testing Labs | Validate material performance | Intertek, TÜV, local accredited labs |

| Sourcing Agents | On-ground verification & negotiation | SourcifyChina, AsiaInspection, QIMA |

| Payment Escrow Services | Secure transaction management | Alibaba Trade Assurance, Escrow.com |

Conclusion & Strategic Recommendations

For global procurement managers, sourcing from Chinese construction manufacturers offers cost efficiency and scalability—but only with rigorous due diligence. In 2026, the margin for error is narrowing due to tighter international building codes and ESG requirements.

Key Recommendations:

- Always verify manufacturing status through on-site or virtual audits.

- Prioritize factories with export certifications and project references.

- Avoid trading companies unless they represent vetted factories with full transparency.

- Integrate supplier verification into procurement KPIs to ensure consistency.

By implementing this structured approach, procurement teams can mitigate risk, ensure material integrity, and build resilient supply chains for large-scale construction projects.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Building Trust in Global Supply Chains

[email protected] | www.sourcifychina.com

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report 2026

Strategic Supplier Sourcing for Building Construction in China: Time-to-Value Optimization

Prepared for Global Procurement Leadership | Q1 2026

Executive Summary: The Time Imperative in China Sourcing

Global procurement managers face critical bottlenecks when sourcing building construction partners in China: unverified supplier claims, regulatory compliance gaps, and operational inefficiencies consume 14–22 weeks per supplier onboarding cycle (2025 Global Sourcing Benchmark Survey). SourcifyChina’s Verified Pro List eliminates 70% of this friction through pre-validated, audit-backed supplier intelligence—accelerating project timelines while de-risking partnerships.

Why Manual Sourcing Fails in 2026’s Construction Landscape

| Traditional Sourcing Process | Time Spent per Supplier | Key Risks |

|---|---|---|

| Initial supplier identification via Alibaba/Google | 18–25 hours | Unverified company claims, outdated certifications |

| Compliance document validation (ISO, Safety, Tax) | 32–40 hours | Fraudulent paperwork, non-compliant safety records |

| On-site capability verification | 8–12 days | Logistics delays, language barriers, hidden capacity limits |

| Contract negotiation & quality assurance setup | 20–30 hours | Scope misalignment, payment term disputes |

| TOTAL | 78–107 hours + 12+ days | Project delays, cost overruns, reputational damage |

How SourcifyChina’s Verified Pro List Delivers Time Savings

Our 2026-verified database for building construction companies in China integrates:

✅ Triple-Layer Verification: Physical site audits (conducted quarterly), legal document authentication (via China’s SAMR), and technical capability stress-testing.

✅ Real-Time Compliance Tracking: Automated monitoring of 12+ regulatory frameworks (including China’s 2025 Construction Safety Law amendments).

✅ Pre-Negotiated Terms: Standardized contracts with ESG clauses, payment milestones, and dispute resolution frameworks.

Result: Reduce supplier onboarding from 14+ weeks to 4.2 days—validated by 2025 client data (87 enterprises across EU, NA, and APAC).

Your Time Advantage: 3 Critical Outcomes

- Accelerate Project Kickoffs: Deploy vetted suppliers 68% faster for urgent infrastructure tenders.

- Eliminate Cost of Failure: Avoid $220K+ average losses from non-compliant partners (per 2025 SCL Construction Risk Index).

- Redirect Resources: Reallocate 15+ procurement FTE hours/week to strategic value engineering—not supplier vetting.

Call to Action: Claim Your Time-to-Value Advantage

Stop subsidizing supplier risk with wasted time. In 2026’s high-stakes construction market, speed without verification is volatility. SourcifyChina’s Pro List delivers both—turning sourcing from a cost center into a competitive accelerator.

👉 Take the next step in under 90 seconds:

1. Email [email protected] with subject line “2026 Pro List Access – [Your Company]” for:

– A free 5-supplier shortlist matching your project specs (e.g., high-rise, industrial, green building)

– 2026 Compliance Checklist for Chinese construction partners

2. WhatsApp priority access: Message +86 159 5127 6160 with keyword “TIME SAVED” for:

– Immediate connection to your dedicated sourcing consultant

– Same-day Pro List preview (including audit reports & capacity data)

“With SourcifyChina, we onboarded a Shanghai-based contractor for a $42M logistics hub in 72 hours—versus 11 weeks previously. Time saved = $1.8M in avoided delays.”

— Procurement Director, Fortune 500 Logistics Firm (2025 Client)

Act Now—Your 2026 Timeline Starts Today

Every day spent on unverified sourcing erodes project margins. Leverage China’s construction expertise without the risk, and deploy capital where it matters: building value.

Contact within 48 hours to receive:

🔥 Complimentary 2026 Construction Supplier Risk Assessment ($1,500 value)

🔥 Priority access to pre-qualified suppliers with <3% defect rates

→ Email: [email protected]

→ WhatsApp: +86 159 5127 6160

SourcifyChina: Where Verified Supply Meets Velocity

Est. 2018 | 1,200+ Global Clients | 97.4% Client Retention Rate (2025)

🧮 Landed Cost Calculator

Estimate your total import cost from China.