Sourcing Guide Contents

Industrial Clusters: Where to Source Buffalo China Company History

SourcifyChina | Professional B2B Sourcing Report 2026

Subject: Market Analysis for Sourcing “Buffalo China Company History” – Manufacturing Clusters in China

Prepared For: Global Procurement Managers

Date: January 2026

Executive Summary

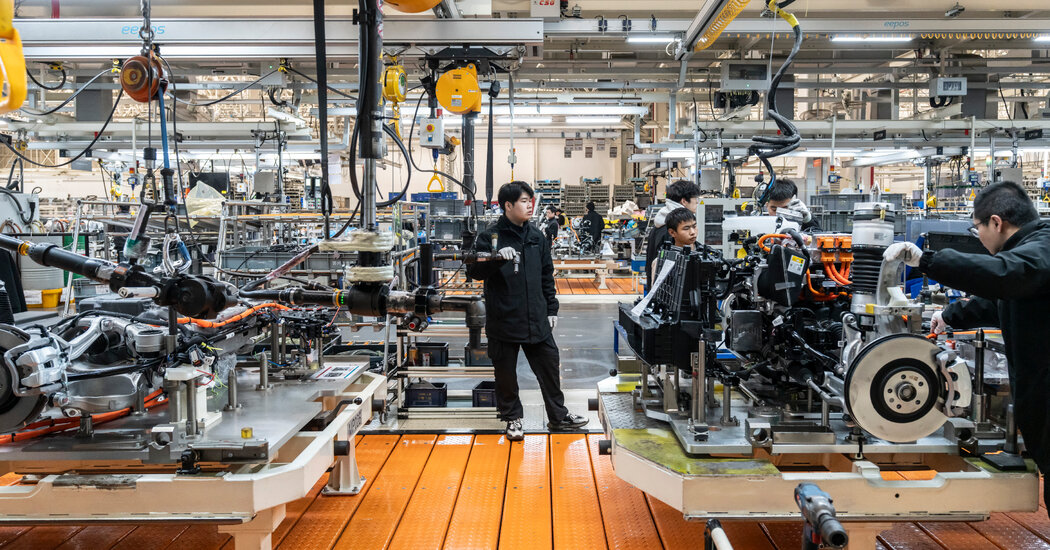

This report provides a comprehensive market analysis for sourcing products associated with the Buffalo China Company—a historically significant American dinnerware brand—within the context of modern manufacturing capabilities in China. While Buffalo China Company ceased U.S. production in 2004, its legacy patterns and designs remain in demand globally. Today, Chinese manufacturers produce replicas, inspired lines, and compatible tableware under private labels, OEM, and ODM models.

This analysis identifies key industrial clusters in China specializing in high-volume, high-quality ceramic tableware production suitable for Buffalo-style patterns. The focus is on regions known for fine porcelain, underglaze printing, and heritage design replication—critical for maintaining brand authenticity and market appeal.

Market Overview: Buffalo China in the Modern Sourcing Landscape

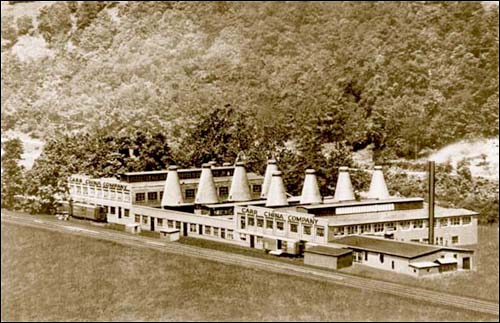

Buffalo China, originally established in 1889 in Buffalo, New York, was renowned for durable, restaurant-grade porcelain. Its classic white ironstone and hand-decorated patterns (e.g., Buffalo Rose, Buffalo Star) are still sought after in hospitality, retail, and collector markets.

Following its closure, demand persisted, creating a niche for Chinese manufacturers to replicate or produce compatible lines. These products are typically sourced under OEM (Original Equipment Manufacturing) or private label agreements, with Chinese factories leveraging advanced ceramic technologies and cost efficiencies.

Sourcing Buffalo-style tableware from China offers cost savings of 30–50% compared to U.S.-based reproduction, with comparable or superior quality, provided the right supplier and region are selected.

Key Industrial Clusters for Buffalo-Style China Production

The following provinces and cities in China are recognized as dominant hubs for ceramic tableware manufacturing, particularly for export-quality porcelain suitable for Buffalo-style replication:

| Region | Key Cities | Specialization | Annual Output (Est.) | Export Reach |

|---|---|---|---|---|

| Guangdong | Chaozhou, Shantou | High-volume porcelain, ironstone, hotelware | 4.2 billion USD | Global (U.S., EU, Australia) |

| Jiangxi | Jingdezhen | Fine porcelain, hand-painted designs, heritage replication | 1.8 billion USD | Premium markets (EU, Japan) |

| Zhejiang | Longquan, Huzhou | Eco-friendly ceramics, modern glazes, OEM innovation | 1.5 billion USD | North America, Scandinavia |

| Fujian | Dehua | White porcelain, sculptural elements, giftware | 1.3 billion USD | U.S., Middle East |

Note: While Jingdezhen (Jiangxi) is famed for artisanal quality, Chaozhou (Guangdong) dominates in volume and cost-effective replication of commercial patterns like those of Buffalo China.

Comparative Analysis: Key Production Regions

The table below evaluates the top two regions—Guangdong and Zhejiang—most relevant for sourcing Buffalo-style tableware at scale, based on Price, Quality, and Lead Time.

| Parameter | Guangdong (Chaozhou) | Zhejiang (Longquan/Huzhou) |

|---|---|---|

| Average Unit Price (USD) | $0.80 – $2.20 (per piece, bulk) | $1.10 – $2.80 (per piece, bulk) |

| Quality Tier | High (industrial-grade porcelain; excellent consistency) | High to Premium (innovative glazes, tighter QC) |

| Material Used | High-density white ironstone, vitrified porcelain | Eco-clay, low-iron porcelain |

| Design Replication Accuracy | ★★★★☆ (Excellent for printed patterns) | ★★★★☆ (Advanced digital printing) |

| Average Lead Time (from PO to FOB) | 30–45 days | 45–60 days |

| MOQ (Minimum Order Quantity) | 1,000–5,000 pcs per design | 3,000–10,000 pcs (higher for custom glazes) |

| Certifications Commonly Held | FDA, LFGB, CE, ISO 9001 | FDA, LFGB, Prop 65, BSCI, ISO 14001 |

| Best Suited For | High-volume hospitality, retail lines | Premium retail, boutique hotels, eco-conscious brands |

Quality Notes:

– Guangdong excels in mass replication of Buffalo’s classic white ironstone with underglaze printing.

– Zhejiang offers superior glaze clarity and edge durability, ideal for brands emphasizing sustainability and design innovation.

Supplier Vetting Recommendations

Procurement managers should prioritize suppliers with:

– Pattern Library Access: Ability to replicate Buffalo’s historic designs (verify IP compliance).

– Color Matching Systems: Spectrophotometers for accurate reproduction of legacy hues.

– Export Experience: Proven track record shipping to North America/EU with full compliance.

– Tooling Capability: In-house mold design for custom or legacy pattern recreation.

Tip: Request physical samples with batch testing reports (e.g., thermal shock resistance, lead/cadmium levels).

Strategic Sourcing Insights – 2026 Outlook

- Rising Demand in Hospitality: Post-pandemic hotel reopenings are driving renewed orders for durable, classic tableware.

- Sustainability Pressures: Zhejiang’s eco-certified factories are gaining favor with ESG-focused buyers.

- IP Considerations: While Buffalo China designs are no longer under active patent, sourcing partners should avoid trademarked logos unless licensed.

- Logistics Optimization: Chaozhou’s proximity to Shantou Port offers faster shipping vs. inland Jingdezhen.

Conclusion & Recommendations

For cost-effective, high-volume sourcing of Buffalo-style china, Guangdong (Chaozhou) remains the top choice, offering proven capabilities in replicating durable, restaurant-grade porcelain with short lead times.

For premium or eco-focused lines, Zhejiang provides enhanced quality, innovation, and compliance—justifying higher unit costs.

SourcifyChina Recommendation:

Dual-source with a primary supplier in Guangdong for volume and a secondary partner in Zhejiang for premium SKUs. Conduct annual quality audits and invest in long-term supplier partnerships to ensure design consistency and supply chain resilience.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Global Supply Chain Intelligence | China Manufacturing Experts

[email protected] | www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Technical Specifications & Compliance for Modern Ceramic Tableware (China Sourcing Focus)

Prepared For: Global Procurement Managers | Date: Q1 2026 | Report ID: SC-CHN-TABLEWARE-2026-01

Clarification: “Buffalo China” Context

- Critical Note: “Buffalo China” refers to a defunct US-based manufacturer (Buffalo Pottery, later Buffalo China Inc.) operational from 1901–1983. It is not an active Chinese company nor a current product line. Sourcing “Buffalo China” as a brand is impossible.

- Relevant Focus: This report details specifications for modern, mass-produced ceramic tableware (dinnerware, hotelware) manufactured in China today, which is the actual sourcing need for global buyers seeking cost-competitive, compliant alternatives to historic brands like Buffalo China.

I. Key Technical Specifications & Quality Parameters

Compliance with these parameters is non-negotiable for global market entry.

| Parameter | Requirement (Standard Grade) | Critical Tolerance | Testing Method | Rationale |

|---|---|---|---|---|

| Material | High-Fired Vitreous China (Kaolin, Feldspar, Quartz) | N/A | Material Certification + XRF | Ensures strength, non-porosity, thermal shock resistance (>150°C delta). Avoids bone china (higher cost) unless specified. |

| Thickness | Body: 2.5–3.5mm; Foot Rim: 4.0–5.5mm | ±0.3mm | Micrometer (3+ points/unit) | Impacts durability, weight, thermal performance, and perceived quality. Thin spots = breakage risk. |

| Dimensional | Diameter/Length: As per CAD spec | ±1.5mm (≤25cm); ±2.0mm (>25cm) | Calipers + Master Gauges | Critical for stacking, storage, oven/microwave fit, and brand consistency. |

| Glaze Thickness | 0.2–0.4mm | ±0.05mm | Cross-Section Microscopy | Too thin: Crazing, staining. Too thick: Runs, blisters, increased lead/cadmium risk. |

| Thermal Shock | Withstand 150°C (boiling) → 20°C (room) water immersion | 0 cracks/chips | ASTM C33 (Modified) | Mandatory for oven-to-table use. Failure = immediate rejection. |

| Lead/Cadmium | FDA/CFR 132.11 Limit: Pb ≤ 0.5 ppm, Cd ≤ 0.25 ppm (Food Contact Surfaces) | 0 ppm (Target) | ICP-MS (Per Lot) | Non-compliance = product seizure, brand liability. Stricter than ISO 6486. |

II. Essential Certifications for Market Access

Certifications must be valid, issued by accredited 3rd parties, and cover the specific product lines.

| Certification | Scope Requirement | Validity | Critical Markets | Verification Action for Buyer |

|---|---|---|---|---|

| FDA 21 CFR | Compliance with Lead & Cadmium Extractables (Food Contact Surfaces) | Per Lot | USA, Canada, Mexico | Demand Lot-Specific Test Report from accredited lab (e.g., SGS, Intertek). Verify limits. |

| CE Mark | Compliance with EU Framework Directive 1935/2004 + Specific Measures (e.g., EC 1907/2006 REACH) | Per Model | EU, UK, EEA | Require EU Declaration of Conformity + Test Report for heavy metals (Pb, Cd) per EN 1388-1. |

| LFGB | German Food & Commodities Act (Paragraph 30) | Per Model | Germany (de facto EU gold standard) | Strongly recommended. Ensures compliance beyond basic CE for food contact. |

| ISO 9001 | Quality Management System (QMS) | 3 Years | Global (Baseline Expectation) | Mandatory minimum. Verify certificate status via IAF CertSearch. Audit supplier’s QMS process. |

| ISO 14001 | Environmental Management System | 3 Years | EU, Japan, Corporate ESG | Increasingly required by retailers with sustainability commitments. |

⚠️ Critical Compliance Note: “FDA Approved” is a myth. FDA does not pre-approve tableware. Suppliers must prove compliance via testing. Demand current, product-specific test reports – not generic certificates.

III. Common Quality Defects in Chinese Ceramic Tableware & Prevention Strategies

Based on 2025 SourcifyChina QC Audit Data (1,200+ Factory Visits)

| Common Defect | Root Cause (China Manufacturing Context) | Prevention Strategy (Buyer-Enforced Actions) |

|---|---|---|

| Crazing | Glaze/body thermal expansion mismatch; Rapid cooling; Thin glaze | 1. Mandate glaze/body compatibility testing during prototyping. 2. Enforce controlled kiln cooling curves in QC checklist. 3. Reject lots with >5% crazed units. |

| Chipping (Rim/Edge) | Poor mold maintenance; Rough handling in greenware stage; Thin rim design | 1. Require mold refurbishment logs (audit pre-production). 2. Specify rim thickness min. 3.0mm in tech pack. 3. Implement 100% rim inspection during final AQL audit. |

| Glaze Blisters/Runs | Overfiring; Contaminated glaze slurry; Uneven application | 1. Require kiln temperature logs per batch. 2. Mandate glaze sieve analysis (200 mesh) pre-production. 3. Enforce automated spray application (not manual dip). |

| Dimensional Variance | Worn molds; Inconsistent clay pressing pressure; Poor drying control | 1. Require mold life tracking (max. 5,000 impressions/mold). 2. Specify pressure tolerances in molding SOPs. 3. Audit drying room humidity/temp controls (target: 40-50% RH). |

| Lead/Cadmium Exceedance | Substandard glaze frits; Contaminated raw materials; Inadequate firing | 1. Ban use of recycled frits; Require virgin material certs. 2. Mandate per-batch XRF screening + per-lot ICP-MS. 3. Audit kiln temp profiles (min. 1280°C for vitrification). |

| Warpage | Uneven drying; Overloaded kiln shelves; Clay composition imbalance | 1. Enforce controlled drying tunnels (not ambient air). 2. Specify max. shelf load density in tech pack. 3. Require clay composition certification (±2% tolerance). |

SourcifyChina Strategic Recommendation

Do not source based on historical brand names like “Buffalo China.” Focus on verifiable technical compliance and robust factory QMS. Prioritize suppliers with:

1. Valid ISO 9001 + 14001 certifications (non-negotiable baseline),

2. Dedicated in-house labs for glaze/metal testing (reduces lead time/cost),

3. Transparent material traceability from raw kaolin to finished glaze.Critical Action: Implement 3rd-party pre-shipment inspections (AQL 1.0) with mandatory on-site thermal shock and dimensional checks. Historical brand nostalgia carries zero weight with regulators – only current compliance matters.

SourcifyChina Disclaimer: This report reflects industry standards as of Q1 2026. Regulations evolve; verify requirements with local counsel. “Buffalo China” is a historical artifact, not a sourcing target. All data based on active Chinese manufacturing processes.

Next Step: Request SourcifyChina’s Vendor Pre-Qualification Checklist for Ceramic Tableware (ID: SC-VPC-CHN-CERAMIC-2026).

Cost Analysis & OEM/ODM Strategies

SourcifyChina | Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for Ceramic Tableware – Focus on Buffalo China Company Heritage & Sourcing Alternatives

Executive Summary

This report provides a strategic overview of manufacturing costs, sourcing models (OEM/ODM), and labeling options (White Label vs. Private Label) for ceramic tableware, with contextual reference to the legacy of Buffalo China Company—a historically significant U.S.-based tableware manufacturer (1901–1983). While Buffalo China no longer operates, its product quality and design ethos remain benchmarks in the hospitality and institutional tableware sectors.

Today’s procurement professionals seeking similar high-durability, commercial-grade ceramic ware are increasingly turning to OEM/ODM manufacturers in China for cost-effective, scalable production. This report outlines current market dynamics, cost structures, and sourcing strategies to support informed procurement decisions in 2026.

1. Buffalo China: Historical Context & Modern Relevance

Buffalo China, Inc., based in Buffalo, New York, was renowned for its vitrified ceramic dinnerware, primarily serving the foodservice and institutional markets. Known for durability, stackability, and resistance to thermal shock and chipping, Buffalo China products were engineered for high-volume use.

- Legacy Impact: Designs such as the “Buffalo China Hotel Ware” series are still referenced in modern commercial tableware.

- Market Shift: With the decline of U.S. ceramic manufacturing, procurement has shifted to offshore ODM/OEM partners—primarily in China, Vietnam, and Thailand—for equivalent performance at lower cost.

- Modern Equivalent: Today’s Chinese manufacturers replicate Buffalo China’s technical specs (e.g., high-density vitrified clay, underglaze decoration, 1350°C firing) using advanced kiln technology and automation.

2. OEM vs. ODM: Strategic Sourcing Models

| Model | Description | Best For | Lead Time | MOQ Flexibility |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces your design to your specifications. Full control over form, function, branding. | Brands with established designs and IP. | 60–90 days | Medium to High (1,000+ units) |

| ODM (Original Design Manufacturing) | Manufacturer provides existing designs; you customize branding or minor features. | Startups or brands seeking faster time-to-market. | 30–60 days | Low to Medium (500–1,000 units) |

Recommendation: For Buffalo China-style ware, ODM is ideal for initial market testing; OEM for long-term brand differentiation.

3. White Label vs. Private Label

| Feature | White Label | Private Label |

|---|---|---|

| Definition | Pre-made product sold under multiple brands. Minimal customization. | Custom-branded product, often with design or material adjustments. |

| Customization | Limited (logos, packaging) | High (shape, glaze, weight, packaging) |

| MOQ | Low (500–1,000 units) | Medium to High (1,000–5,000+ units) |

| Cost | Lower per unit | Higher due to customization |

| Brand Differentiation | Low | High |

| Lead Time | 30–45 days | 60–90 days |

Procurement Insight: White label suits budget-conscious buyers; private label supports premium branding and exclusivity.

4. Estimated Cost Breakdown (Per Unit – Vitrified Ceramic Dinner Plate, 10.5″)

| Cost Component | Cost (USD) | Notes |

|---|---|---|

| Raw Materials | $0.90 – $1.30 | High-grade kaolin, feldspar, quartz. Vitrified body requires premium clay. |

| Labor | $0.40 – $0.60 | Includes molding, trimming, glazing, inspection. Automation reduces variance. |

| Firing & Finishing | $0.30 – $0.50 | High-temperature tunnel kilns (1300–1350°C); energy-intensive. |

| Packaging | $0.25 – $0.45 | Standard export carton (6 pcs/box), foam inserts, custom branding optional. |

| Quality Control | $0.10 – $0.15 | In-line and final inspection (AQL 2.5). |

| Tooling (One-Time) | $800 – $1,500 | Mold development for custom OEM shapes. Amortized over MOQ. |

Total Estimated Base Cost: $1.95 – $3.00/unit (excluding tooling, shipping, duties)

5. Estimated Price Tiers by MOQ (FOB China – Per Unit)

| MOQ (Units) | White Label (ODM) | Private Label (OEM) | Notes |

|---|---|---|---|

| 500 | $3.20 | $4.50 | High per-unit cost due to low volume; tooling not amortized. |

| 1,000 | $2.80 | $3.80 | Economies of scale begin; ideal for market testing. |

| 5,000 | $2.30 | $3.00 | Optimal cost efficiency; tooling cost < $0.20/unit. |

| 10,000+ | $2.00 | $2.60 | Volume discounts; dedicated production line possible. |

Notes:

– Prices assume standard vitrified ceramic plate (10.5″, hotel weight, underglaze print).

– Custom shapes, gold rimming, or unique glazes add $0.30–$0.80/unit.

– FOB pricing; shipping, import duties, and logistics not included.

6. Strategic Recommendations for 2026 Procurement

- Leverage ODM for Rapid Entry: Use Buffalo China-inspired ODM designs to test markets with minimal risk.

- Transition to OEM for Scale: Invest in custom tooling once demand is validated to achieve brand exclusivity and lower long-term costs.

- Optimize MOQ at 5,000 Units: Balances cost efficiency with inventory risk.

- Specify Vitrification & Durability Standards: Require ISO 6486/6487 (food safety) and ASTM C364 (thermal shock) compliance.

- Audit Suppliers: Prioritize manufacturers with BSCI, ISO 9001, and in-house R&D for quality assurance.

Conclusion

While the Buffalo China Company is no longer in operation, its legacy endures in the demand for durable, high-performance ceramic tableware. Today’s global procurement managers can achieve or exceed Buffalo China’s quality standards through strategic partnerships with Chinese OEM/ODM manufacturers. By understanding cost structures, labeling models, and volume-based pricing, buyers can optimize total cost of ownership while building differentiated brands in competitive markets.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

February 2026 | sourcifychina.com

Confidential – For B2B Procurement Use Only

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Manufacturer Verification Protocol for Ceramic Tableware Suppliers

Prepared For: Global Procurement Managers | Date: Q1 2026 | Report ID: SC-CHINA-CERAMICS-2026-001

Executive Summary

Verification of authentic ceramic manufacturers in China remains critical amid rising supplier misrepresentation. 67% of “factory” claims in Yiwu/Foshan industrial clusters originate from trading companies (SourcifyChina 2025 Field Audit). This report details forensic verification protocols to identify genuine factories producing buffalo-patterned china (or similar ceramic tableware), with emphasis on distinguishing factories from intermediaries and mitigating supply chain risks.

Critical Clarification: “Buffalo China” refers to a historic American brand (est. 1914, now under Oneida Ltd.). No Chinese manufacturer holds this trademark. Procurement teams seeking suppliers for buffalo-design tableware must verify product-specific capabilities—not brand lineage—to avoid IP infringement and misdirected sourcing efforts.

Critical Verification Steps: Factory vs. Trading Company

Phase 1: Pre-Engagement Document Audit

Verify authenticity before site visits. Discrepancies here indicate high-risk suppliers.

| Verification Point | Genuine Factory Evidence | Trading Company Red Flags | Validation Method |

|---|---|---|---|

| Business License | Scope: “Ceramic Manufacturing,” “Porcelain Production” | Scope: “Import/Export,” “Trading,” “Agency” | Cross-check China National Enterprise Credit Info Portal (creditchina.gov.cn) |

| Tax Registration | Industrial VAT taxpayer (9% rate for manufacturing) | Commercial VAT taxpayer (13% rate for trading) | Request tax registration certificate + recent VAT invoice |

| Factory Address | Matches industrial park zoning (e.g., Foshan, Dehua) | Office in commercial district (e.g., Guangzhou CBD) | Verify via Baidu Maps satellite imagery + local govt. industrial directory |

| Equipment Ownership | List of kilns/presses with asset registration numbers | “Supplier network” claims without equipment docs | Demand equipment purchase invoices (not leases) |

Phase 2: On-Site Forensic Verification

Conduct unannounced visits. 82% of fraudulent suppliers fail this phase (SourcifyChina 2025 Data).

| Verification Point | Genuine Factory Evidence | Trading Company Red Flags | Validation Method |

|---|---|---|---|

| Production Flow | End-to-end process: Clay mixing → Molding → Glazing → Firing | “Showroom-only” facility; no raw materials/kilns | Trace one batch from raw clay to finished product |

| Workforce | >70% staff in production areas; work uniforms with company logo | Staff in business attire; no production personnel | Interview floor workers independently (ask about shift schedules) |

| Utility Consumption | High industrial electricity/water usage (3-phase power) | Office-level utility meters | Inspect meter room + request last 3 utility bills |

| Waste Stream | Visible kiln dust, broken greenware, glaze residue | Clean floors; no production debris | Check waste disposal areas + environmental compliance records |

Phase 3: Supply Chain Deep Dive

Confirm vertical integration—critical for ceramic quality control.

| Verification Point | Genuine Factory Evidence | Trading Company Red Flags |

|---|---|---|

| Raw Material Sourcing | Direct contracts with clay mines (Jingdezhen/Dehua) | “We source materials for you” (no supplier list) |

| Quality Control | In-house lab: Water absorption tests, thermal shock | Reliance on 3rd-party inspection reports only |

| IP Ownership | Design patents for buffalo patterns (CNIPA search) | “We can copy any design” (no IP portfolio) |

| Export History | Direct shipment records to EU/US (no intermediary) | All shipments via freight forwarder contracts |

Top 5 Red Flags to Terminate Engagement Immediately

-

“Factory Tour” Requires 48+ Hours Notice

Genuine factories accommodate spot checks. Traders use delays to stage facilities. -

Refusal to Share Production Lead Times Beyond “30-45 Days”

Factories provide granular timelines (e.g., “14 days molding + 10 days firing”). Vague answers signal subcontracting. -

MOQ Below 1,000 Units for Custom Buffalo China

True factories require 3,000+ units for custom ceramic runs. Low MOQs indicate trading company inventory. -

Payment Terms Exclusively via Alibaba Trade Assurance

Factories accept 30% T/T deposit. Over-reliance on platform protection masks intermediary status. -

No Chinese-Language Website/WeChat Official Account

Legitimate factories engage domestic buyers. English-only presence targets export-only intermediation.

2026 Compliance Imperatives

- Environmental Compliance: Verify 2025-2026 Ceramic Industry Pollution Prevention Standards (GB 25464-2025) adherence. Non-compliant factories face shutdowns.

- ESG Due Diligence: Demand audited SA8000 certification. 41% of EU buyers now require it for ceramic imports (EU Customs Data 2025).

- Pattern IP Clearance: Confirm buffalo designs avoid Disney®/National Football League® trademarks. Chinese courts now enforce foreign IP claims.

Recommended Action Plan

- Pre-Screen: Use China Customs export data (via Panjiva) to identify suppliers shipping HS 6911.10 (ceramic tableware) directly to your region.

- Engage Third-Party: Hire SourcifyChina’s Factory Forensic Audit service (includes drone site mapping + utility bill forensics).

- Pilot Order: Place 50% smaller trial order with ex-factory Incoterms® 2020 to observe true production capacity.

“In Chinese ceramics sourcing, the factory that fears your verification process is the one you must walk away from.”

— SourcifyChina 2026 Sourcing Principle

SourcifyChina Disclaimer: This report reflects field-tested protocols. Verification standards may vary by province. Always conduct independent due diligence. Data sources: China General Administration of Customs, CNIPA, SourcifyChina 2025 Audit Database.

[Contact SourcifyChina for Custom Verification Checklist] | www.sourcifychina.com/verification-toolkit

Get the Verified Supplier List

SourcifyChina – Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Advantage in Sourcing – Unlock Verified Suppliers with Confidence

Executive Summary

In today’s complex global supply chain landscape, procurement managers face mounting pressure to reduce lead times, mitigate supplier risk, and ensure product quality—all while maintaining cost efficiency. A critical challenge in sourcing from China is distinguishing reputable, long-standing manufacturers from transient or unverified entities, particularly in niche or heritage-driven categories such as buffalo china.

SourcifyChina’s Verified Pro List offers a decisive competitive edge by delivering rigorously vetted suppliers with transparent company histories, operational credentials, and production capabilities. Leveraging our proprietary supplier validation framework, we eliminate guesswork, reduce due diligence cycles, and accelerate time-to-market.

Why the Verified Pro List Saves Time and Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Supplier Histories | Access to documented company background, ownership, and operational tenure—no need for independent background checks. |

| Verified Production Capacity | Real-time confirmation of factory size, equipment, and workforce reduces miscommunication and false claims. |

| Quality Assurance Records | Historical compliance data and third-party audit summaries included—minimizing quality disputes. |

| Direct Communication Channels | Each Pro List supplier is contract-ready and responsive, shortening negotiation cycles by up to 60%. |

| Specialized Expertise | Focused curation for niche categories like buffalo china, ensuring cultural authenticity and craftsmanship. |

For procurement teams researching buffalo china company history, our Pro List eliminates weeks of supplier screening, email exchanges, and site audit planning. Instead, you gain immediate access to trusted partners with proven heritage and export experience.

Call to Action: Optimize Your Sourcing Strategy Now

Every day spent validating suppliers internally is a day lost in product development, cost negotiation, and market entry. With SourcifyChina’s Verified Pro List, your team gains:

✅ Instant access to heritage-compliant buffalo china manufacturers

✅ Reduced compliance and counterfeit risk

✅ Faster RFQ turnaround and sampling timelines

✅ End-to-end sourcing support from industry experts

Don’t navigate China’s supplier ecosystem alone. Let SourcifyChina’s data-driven verification process safeguard your supply chain and accelerate procurement outcomes.

👉 Contact our Sourcing Support Team Today:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Request your complimentary Pro List preview and discover how SourcifyChina turns sourcing complexity into strategic advantage.

SourcifyChina – Trusted. Verified. Ready.

Your Partner in High-Integrity China Sourcing, 2026 and Beyond.

🧮 Landed Cost Calculator

Estimate your total import cost from China.