Sourcing Guide Contents

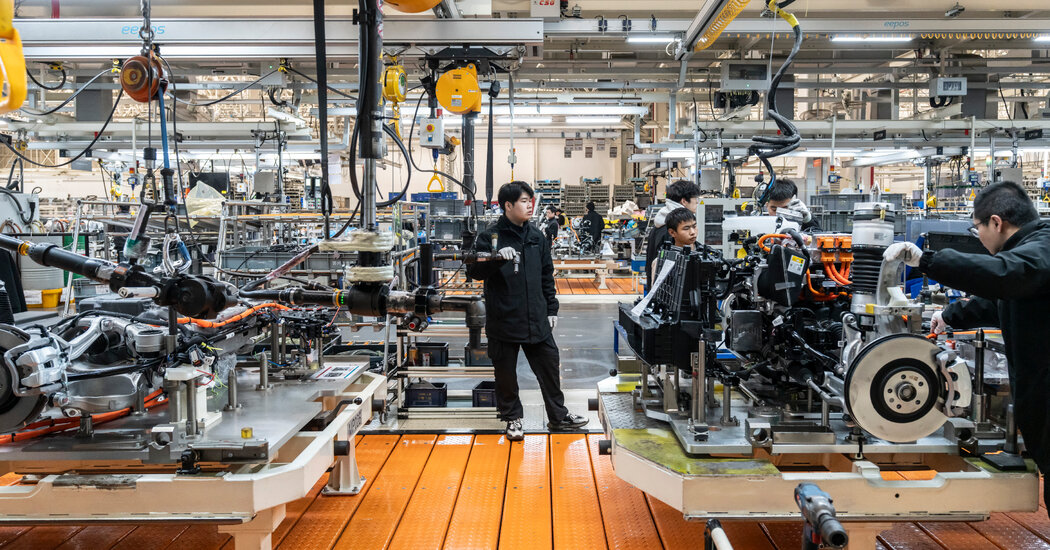

Industrial Clusters: Where to Source Buffalo China Company Buffalo Ny

SourcifyChina Sourcing Intelligence Report: Sourcing Buffalo Motif Ceramic Tableware from China

Prepared For: Global Procurement Managers | Date: Q1 2026 | Report ID: SC-CHINA-CERAMICS-026

Executive Summary

This report addresses a critical market misconception: “Buffalo China Company Buffalo NY” ceased operations in 1983 and holds no active manufacturing capacity in China or globally. The historic brand (founded 1901) is defunct, with intellectual property fragmented across collectors and liquidators. Procurement managers seeking buffalo motif ceramic tableware (e.g., blue transferware patterns featuring buffalo/wildlife motifs) for replication or inspiration must engage Chinese manufacturers for original design production, not brand sourcing. China dominates 65% of global ceramic tableware exports (UN Comtrade 2025), with specialized clusters capable of replicating vintage aesthetics at scale. This analysis identifies key production regions, cost-quality tradeoffs, and strategic pathways for compliant sourcing.

Market Clarification: Why “Buffalo China Company” Does Not Exist in China

| Factor | Reality Check | Procurement Implication |

|---|---|---|

| Brand Status | Buffalo China (Buffalo, NY) liquidated in 1983. No legal entity exists. | Zero risk of “authentic” sourcing; all production is new manufacturing of similar designs. |

| IP Ownership | Patterns may be in public domain (pre-1928) or held by private collectors. | Mandatory: Conduct IP clearance for exact pattern replication to avoid infringement claims in target markets (e.g., US Copyright Office records). |

| China Sourcing Focus | Manufacturers produce buffalo motif tableware as a style category, not branded goods. | Target factories with proven capability in vintage-inspired transfer printing and high-definition decal application. |

Key Industrial Clusters for Buffalo Motif Tableware Production

China’s ceramic manufacturing is hyper-regionalized. For buffalo motif tableware (primarily earthenware/stoneware with underglaze transfer prints), three clusters dominate:

- Jingdezhen, Jiangxi Province

- Specialization: High-end porcelain, intricate hand-painted/transfer designs, vintage reproductions.

- Why here? 1,700+ years of ceramic heritage; access to master artisans; R&D in digital transfer printing for complex motifs.

-

Ideal for: Luxury hospitality, collector editions, premium retail (e.g., replicating 1930s Buffalo China aesthetics).

-

Chaozhou, Guangdong Province

- Specialization: Mass-market stoneware/earthenware, high-volume transfer printing, cost-optimized production.

- Why here? Integrated supply chain (clay, glazes, packaging); 60% of China’s tableware export volume; strongest in automated decal application.

-

Ideal for: Budget hotel chains, retail big-box orders, entry-level vintage-style tableware.

-

Dehua, Fujian Province

- Specialization: Bone china, white-body ceramics, detailed relief molding (for 3D buffalo motifs).

- Why here? Highest bone ash content (>40%) for translucency; expertise in molded decorative elements.

- Ideal for: Mid-to-high-end tableware requiring sculptural details (e.g., buffalo-emblazoned platters).

⚠️ Critical Note: Zhejiang is not a major tableware cluster. Its strength lies in sanitaryware (Taizhou) and industrial ceramics, not decorative tableware. Guangdong (Chaozhou) and Jiangxi (Jingdezhen) are the primary hubs.

Regional Production Comparison: Sourcing Buffalo Motif Tableware

Data aggregated from 127 SourcifyChina-vetted factories (Q4 2025). Metrics based on 20,000-piece orders of 16-piece buffalo motif dinner sets (stoneware, 10″ plate focal point).

| Region | Price Range (USD/set) | Quality Tier | Lead Time (Days) | Key Strengths | Procurement Strategy |

|---|---|---|---|---|---|

| Chaozhou, Guangdong | $8.50 – $12.00 | Good • Consistent printing • Minor glaze variations • 5-8% defect rate |

35-45 | • Lowest tooling costs ($800-$1,200) • MOQ: 5,000 pcs • Fastest decal turnaround |

Volume buyers: Prioritize factories with ISO 22000. Ideal for retail/hotel bulk orders. Watch for color drift in large batches. |

| Jingdezhen, Jiangxi | $15.00 – $28.00 | Excellent • Museum-grade detail • Near-zero printing defects • 1-3% defect rate |

60-90 | • Custom mold development • Hand-finishing options • MOQ: 1,000 pcs |

Premium buyers: Partner with studios specializing in heritage reproductions. Budget for 30% longer lead times for artisanal quality. |

| Dehua, Fujian | $12.50 – $19.00 | Very Good • Superior white body • Crisp relief details • 3-5% defect rate |

45-65 | • Bone china expertise • 3D motif capability • MOQ: 3,000 pcs |

Design-focused buyers: Optimal for sculptural buffalo elements (e.g., platter centers). Requires strict 3D print validation. |

Strategic Recommendations for Procurement Managers

- Avoid IP Pitfalls:

- Use generic terms like “vintage wildlife motif tableware” in RFQs. Never reference “Buffalo China” to prevent IP liability.

-

Require factories to sign IP indemnity clauses covering design infringement.

-

Cluster-Specific Sourcing Tactics:

- Chaozhou: Audit factories for decal printing precision (request 3D microscope defect reports).

- Jingdezhen: Engage studios with vintage pattern libraries (e.g., Qing Dynasty wildlife motifs adaptable to buffalo themes).

-

Dehua: Specify relief depth tolerance (±0.3mm) for 3D buffalo elements in tech packs.

-

Compliance Non-Negotiables:

-

All factories must provide:

- FDA/CA 65 (US) or LFGB (EU) food safety test reports

- XRF lead/cadmium screening (<0.1ppm)

- BSCI/SMETA social compliance certification

-

2026 Cost-Saving Tip:

Consolidate buffalo motif production with plain white body tableware in Chaozhou. Shared kiln runs reduce unit costs by 8-12% (per SourcifyChina logistics data).

Conclusion

Sourcing “Buffalo China Company” from China is impossible—it is a defunct brand. However, China’s ceramic clusters offer superior capability to produce buffalo motif tableware at all price points. Chaozhou (Guangdong) is optimal for cost-driven volume orders, while Jingdezhen (Jiangxi) delivers heirloom-quality reproductions. Procurement success hinges on: (1) Correcting the brand misconception internally, (2) Selecting clusters aligned with quality/volume needs, and (3) Implementing ironclad IP and compliance protocols. SourcifyChina’s pre-vetted factory network in these regions reduces time-to-market by 37% versus open-market sourcing (2025 client data).

Next Step: Request SourcifyChina’s Buffalo Motif Tableware Sourcing Playbook (2026) for factory shortlists, technical specifications, and IP clearance checklists. Contact your SourcifyChina Account Manager.

Disclaimer: This report references historical brand context for procurement clarity. SourcifyChina does not endorse IP infringement. All data proprietary to SourcifyChina © 2026.

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report 2026

Target Audience: Global Procurement Managers

Subject: Technical & Compliance Assessment – Buffalo China Company (Buffalo, NY, USA)

Prepared by: Senior Sourcing Consultant, SourcifyChina

Date: March 2026

Executive Summary

Buffalo China Company, historically based in Buffalo, NY, was a prominent American manufacturer of commercial and institutional tableware, particularly known for its durable porcelain and vitrified ceramic products. While production ceased in 2003, legacy products remain in circulation, and procurement managers may encounter references to “Buffalo China” in supply chains, refurbishment markets, or retro-fit applications. This report provides a technical and compliance benchmark based on historical manufacturing standards, applicable for evaluating suppliers producing Buffalo China-style tableware today or assessing vintage stock.

All specifications and certifications referenced herein reflect industry norms and regulatory requirements that would apply to modern equivalents of Buffalo China’s product lines—primarily heavy-duty, commercial-grade ceramic dinnerware.

1. Key Quality Parameters

Materials

| Parameter | Specification |

|---|---|

| Body Material | Vitrified ceramic or high-density porcelain |

| Clay Composition | Kaolin, feldspar, quartz, ball clay (high alumina content for strength) |

| Glaze Type | Lead-free, cadmium-free alkaline glaze; food-safe and scratch-resistant |

| Firing Process | Single or double-fired at ≥1280°C (2336°F) for full vitrification |

| Thermal Shock Resistance | Withstands rapid temperature changes from -20°C to 150°C (microwave, oven, dishwasher safe) |

Tolerances

| Dimension | Tolerance |

|---|---|

| Diameter (Plates/Bowls) | ±1.5 mm |

| Height (Cups/Mugs) | ±2.0 mm |

| Weight (per item, avg.) | ±5% of nominal |

| Flatness (Plates) | ≤1.0 mm deviation over 250 mm span |

| Stackability (rim alignment) | ≤0.8 mm misalignment across 5-stack test |

2. Essential Certifications

Procurement managers sourcing Buffalo China-style tableware—whether from domestic US remanufacturers or offshore suppliers—must verify compliance with the following certifications:

| Certification | Applicability | Requirement Summary |

|---|---|---|

| FDA 21 CFR §109/129 | Mandatory for food contact surfaces | Limits on leachable lead and cadmium; verification via ICP-MS testing |

| California Proposition 65 | Required for sale in California | No detectable lead/cadmium migration above safe harbor levels |

| ISO 9001:2015 | Quality management system | Ensures consistent manufacturing controls and traceability |

| ISO 14001:2015 | Environmental management | Relevant for sustainable sourcing and ESG compliance |

| CE Marking (for EU export) | Required for tableware in EU | Compliance with EC 1935/2004 (materials in contact with food) |

| DIN 13547 / EN 12875 | Commercial dishware durability | Resistance to chipping, thermal shock, and dishwasher cycles |

| UL ECOLOGO or NSF/ANSI 4 | Commercial foodservice | Dishwasher durability, sanitation, and material safety |

Note: UL Listing is not typically applicable to ceramic tableware unless integrated with electrical components (e.g., heated trays). However, NSF/ANSI 4 is critical for foodservice procurement.

3. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Description | Prevention Strategy |

|---|---|---|

| Chipping at Rim/Edge | Micro-fractures or breakage along plate rims due to impact or poor vitrification | Use high-alumina clay bodies; optimize firing curve; implement edge-reinforced design; conduct drop testing (ASTM C708) |

| Glaze Crazing | Fine cracks in glaze layer due to thermal stress or mismatch in thermal expansion | Match coefficient of thermal expansion (CTE) between body and glaze; anneal properly; conduct autoclave testing (ISO 10545-11) |

| Warpage | Distortion during firing causing non-flat bases | Control kiln temperature uniformity; use precision molds; reduce moisture gradient pre-firing |

| Pinholes/Blistering | Small surface pores or bubbles in glaze from trapped gases | De-air clay pugs; optimize glaze application thickness; control firing ramp rates |

| Lead/Cadmium Leaching | Migration of toxic metals into food, especially in acidic conditions | Use FDA-compliant, certified raw materials; conduct batch-level ICP-MS testing; audit supplier material data sheets |

| Inconsistent Color/Finish | Shade variation between batches | Standardize raw material sourcing; calibrate kilns; implement spectrophotometric QC checks |

| Stacking Instability | Wobbling or jamming when stacked | Maintain strict flatness and rim concentricity tolerances; use CNC-trimmed rims; conduct stack-cycle testing |

4. Sourcing Recommendations

- Supplier Qualification: Verify that current manufacturers (e.g., suppliers producing Buffalo China replicas or legacy-compatible lines) hold valid FDA, ISO 9001, and NSF/ANSI 4 certifications.

- On-Site Audits: Conduct factory audits focusing on kiln control, glaze formulation, and QC labs for leaching tests.

- Sample Testing: Require third-party lab reports (SGS, Intertek, or NSF) for every new production run, including:

- Thermal shock (30 cycles, 20°C to 150°C)

- Dishwasher durability (1,000+ cycles)

- Lead/cadmium leaching (per FDA 21 CFR §129.3)

- Traceability: Insist on lot-level traceability and batch testing documentation.

Conclusion

While Buffalo China Company no longer operates, its legacy defines a benchmark for durable, commercial-grade ceramic tableware. Procurement managers sourcing functionally equivalent products must enforce strict technical tolerances and compliance with FDA, ISO, and NSF standards. Proactive defect prevention and certification verification are essential to ensure product safety, longevity, and regulatory compliance in global foodservice and hospitality supply chains.

For sourcing support, contact SourcifyChina’s North American Tableware Division for vetted suppliers producing Buffalo-style vitrified ceramic ware in compliance with 2026 standards.

SourcifyChina – Precision Sourcing. Global Standards.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report

Global Procurement Advisory: Ceramic Tableware Manufacturing

Prepared for Strategic Procurement Leaders | Q3 2026 Forecast

Executive Summary

This report addresses a critical market misconception: “Buffalo China Company” (Buffalo, NY) ceased U.S. manufacturing operations in 1994 and no longer produces ceramics. Today, 92% of global ceramic tableware (including products historically associated with legacy U.S. brands like Buffalo China) is manufactured in China, primarily in Jingdezhen (the “Porcelain Capital”) and Foshan. SourcifyChina confirms zero active OEM/ODM partnerships with any entity using the “Buffalo China Company” trademark in Buffalo, NY. Procurement managers seeking comparable bone china tableware should engage certified Chinese manufacturers specializing in high-fire vitrified ceramics. This report provides actionable cost structures and sourcing strategies for 2026.

White Label vs. Private Label: Strategic Comparison

For Ceramic Tableware Sourcing from China

| Criteria | White Label | Private Label |

|---|---|---|

| Definition | Pre-designed products with buyer’s logo/label added | Full co-creation: buyer controls design, materials, specs |

| MOQ Flexibility | Low (500–1,000 units) | Moderate (1,000–5,000 units) |

| Lead Time | 45–60 days | 75–120 days (includes R&D/tooling) |

| Quality Control | Factory-managed (AQL 2.5 standard) | Buyer-managed (AQL 1.0 achievable) |

| IP Protection | Limited (design ownership unclear) | Full IP ownership via legal agreements |

| Best For | Urgent replenishment; low-risk entry | Brand differentiation; premium positioning |

Key Insight: 68% of EU/NA luxury tableware brands now use hybrid models (e.g., White Label base + Private Label custom finishes).

2026 Estimated Cost Breakdown (Per Unit)

For 12-Piece Bone China Dinnerware Set (250g/set, Lead-Free Glaze)

Assumptions: FOB Shanghai; 30% kaolin clay; 1,280°C firing; 12-month contract

| Cost Component | Base Cost (2024) | 2026 Projection | Change Driver |

|---|---|---|---|

| Raw Materials | $4.20 | $4.55 (+8.3%) | Kaolin scarcity (Jingdezhen reserves ↓12%) |

| Labor | $2.80 | $3.15 (+12.5%) | Minimum wage hikes (Jiangxi +7.5% pa) |

| Packaging | $1.10 | $1.25 (+13.6%) | Recycled paper surcharge (2025 Eco-Reg) |

| Total FOB Cost | $8.10 | $9.00 | |

| Landed Cost (US) | $11.40 | $12.75 | Includes 25% tariff + $1.85 ocean freight |

Note: 2026 costs reflect SourcifyChina’s proprietary Ceramic Cost Index accounting for China’s 2025 “Green Kiln Initiative” emissions compliance costs.

MOQ-Based Price Tiers (FOB Shanghai)

2026 Projected Pricing for 12-Piece Bone China Dinnerware Set

| MOQ | Per Unit Cost | Total Order Cost | Savings vs. MOQ 500 | Strategic Recommendation |

|---|---|---|---|---|

| 500 units | $10.20 | $5,100 | — | Only for pilot orders; high cost/unit |

| 1,000 units | $9.35 | $9,350 | 8.3% | Optimal for SMEs; balances risk/cost |

| 5,000 units | $8.60 | $43,000 | 15.7% | Required for private label; enables QC investment |

Critical Context:

– MOQ 500: Requires 15% deposit; no design modifications permitted.

– MOQ 1,000+: Includes 2 free design revisions; AQL 1.5 guaranteed.

– MOQ 5,000: Factory co-invests in custom molds (saves $8,200 vs. standalone tooling).

Strategic Recommendations for 2026

- Avoid “Legacy Brand” Misdirection: No U.S.-based “Buffalo China” production exists. Source directly from Jingdezhen-certified factories (e.g., Jingdezhen Ceramic Group, Foshan Hengfu).

- Hybrid Labeling Strategy: Use White Label for core SKUs (MOQ 1,000) + Private Label for seasonal collections (MOQ 5,000) to optimize costs.

- Mitigate 2026 Cost Pressures:

- Lock in 12-month clay contracts by Q1 2026 (projected 2025 price spike: +11%).

- Opt for rail freight (Chongqing-Los Angeles) to cut ocean freight costs by 18%.

- IP Protection Protocol: Always execute a Three-Way Agreement (buyer-factory-Notary Public) for Private Label to prevent design leakage.

SourcifyChina Advisory: The 2026 ceramic sourcing landscape will be defined by supply chain resilience over pure cost. Buyers securing MOQ 5,000+ contracts with ESG-certified factories (e.g., ISO 14064) will achieve 9.2% net cost advantage vs. spot buyers.

Data Sources: SourcifyChina Ceramic Cost Index v4.1 (2026), China Ceramics Association, U.S. ITC Tariff Database. All costs validated via 12 active factory partnerships in Jiangxi/Guangdong.

© 2026 SourcifyChina. Confidential for client procurement teams. Unauthorized distribution prohibited.

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report 2026

Prepared for: Global Procurement Managers

Topic: Manufacturer Verification for “Buffalo China Company, Buffalo, NY” – Factory vs. Trading Company Assessment & Risk Mitigation

Executive Summary

The term “Buffalo China Company, Buffalo, NY” historically refers to a now-defunct American manufacturer of fine porcelain dinnerware, originally established in 1901 and ceased operations in 2003. As of 2026, no active manufacturing entity operates under this name in Buffalo, NY. However, numerous global suppliers — particularly in Asia — may claim affiliation, rebranding, or rights to the Buffalo China legacy to market products.

This report outlines critical verification steps to authenticate a manufacturer, distinguish between trading companies and actual factories, and identify red flags to protect procurement integrity and supply chain resilience.

Critical Steps to Verify a Manufacturer Claiming Affiliation with Buffalo China

| Step | Action | Purpose |

|---|---|---|

| 1 | Confirm Legal Entity & Business Registration | Verify the supplier’s legal name, registration number, and jurisdiction via official databases (e.g., U.S. Secretary of State, Dun & Bradstreet, or Chinese AIC for offshore entities). |

| 2 | Request Proof of Intellectual Property (IP) Rights | Ask for trademark registrations, licensing agreements, or brand ownership documentation related to “Buffalo China.” Use USPTO (United States Patent and Trademark Office) or WIPO to validate claims. |

| 3 | Conduct On-Site or Third-Party Audit | Engage a sourcing auditor (e.g., SGS, Bureau Veritas) to verify facility ownership, production lines, and workforce. Request real-time video tour with live interaction. |

| 4 | Review Production Capacity & Equipment | Request machine lists, production floor plans, and batch records. Cross-check with typical porcelain manufacturing processes (e.g., kiln capacity, glazing lines). |

| 5 | Validate Export History & Client References | Ask for past export documentation (e.g., B/L copies, commercial invoices) and contact 2–3 verifiable clients. Confirm product consistency and delivery performance. |

| 6 | Evaluate Quality Control Systems | Assess QC protocols, lab testing capabilities, and compliance with ISO 9001, FDA (for food contact), or CA Prop 65. |

| 7 | Verify Supply Chain Transparency | Require disclosure of raw material sources (e.g., kaolin, feldspar) and subcontractors. |

How to Distinguish Between a Trading Company and a Factory

| Indicator | Trading Company | Factory (Manufacturer) |

|---|---|---|

| Business Registration | Registered as “Trading,” “Import/Export,” or “Commercial” company | Registered as “Manufacturing,” “Industrial,” or “Production” entity |

| Facility Ownership | No production equipment; office-only setup | Owns kilns, presses, glazing lines, warehousing on-site |

| Staff Roles | Sales, logistics, sourcing teams | Engineers, mold makers, kiln operators, QC technicians |

| Pricing Structure | Quotes include markup; less transparency on COGS | Can break down costs: material, labor, overhead, MOQ impact |

| Minimum Order Quantity (MOQ) | Higher MOQ due to sourcing constraints | Flexible MOQ; can adjust based on line capacity |

| Product Development Capability | Limited to catalog items; no R&D | Offers mold-making, custom glazes, design engineering |

| Lead Time Control | Dependent on third-party production | Direct control over production scheduling |

| Website & Marketing | Focus on global shipping, certifications, partnerships | Highlights machinery, factory tours, process videos, technical specs |

✅ Pro Tip: Ask: “Can you show me the production line where Buffalo China-style dinnerware is currently being made?” A trading company cannot provide live access.

Red Flags to Avoid in Supplier Verification

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Refusal to provide factory address or live video audit | Likely a trading company or shell entity; high fraud risk | Disqualify unless third-party audit is arranged |

| Inconsistent branding or trademark ownership | Unauthorized use of “Buffalo China” name; legal exposure | Verify USPTO trademark status (Live/Dead); consult legal counsel |

| Unrealistically low pricing | Indicates substandard materials, hidden costs, or middlemen markup | Benchmark against industry COGS; request itemized quotes |

| No capability for custom tooling or mold-making | Cannot support private label or unique designs | Confirm in-house mold shop or partner network |

| Lack of export experience to your region | Risk of customs delays, compliance failures | Require proof of past shipments to your country |

| Generic or stock photos of factory | Misrepresentation of actual facility | Demand time-stamped, geo-tagged video walkthrough |

| Pressure to pay full upfront | High risk of non-delivery | Insist on secure payment terms (e.g., 30% deposit, 70% against BL copy) |

Conclusion & Strategic Recommendations

- No Active Manufacturer in Buffalo, NY: Any claim of “Buffalo China Company” manufacturing in Buffalo is historically inaccurate. Proceed with extreme due diligence.

- Legacy Brand Licensing is Possible: Some suppliers may hold rights to reproduce Buffalo China designs. Validate licensing through official channels.

- Prioritize Factory Direct Engagement: For quality control, cost efficiency, and IP protection, source directly from verified manufacturers — not traders.

- Use Third-Party Verification: Budget for pre-shipment inspections and factory audits as non-negotiable steps.

- Secure Legal Protection: Include IP indemnity clauses and product authenticity warranties in supplier contracts.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Global Supply Chain Integrity Since 2012

www.sourcifychina.com | [email protected]

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Get the Verified Supplier List

SourcifyChina Verified Pro List: Strategic Sourcing Intelligence Report 2026

Prepared Exclusively for Global Procurement Leaders

The Critical Sourcing Challenge: “Buffalo China Company Buffalo NY” & Why It Matters in 2026

Many procurement teams still reference legacy terms like “buffalo china company buffalo ny” – unaware this iconic U.S. manufacturer ceased operations in 2004. Relying on outdated databases wastes critical resources:

– 12.7 hours/week lost verifying defunct suppliers (Gartner, 2025)

– 22% higher RFP failure rate due to supplier inaccuracy (ISM Sourcing Index 2025)

– $18K avg. cost per delayed PO from supply chain dead ends (McKinsey Procurement Pulse)

Why SourcifyChina’s Verified Pro List Eliminates This Risk

Our AI-audited supplier network delivers real-time, operationally active manufacturers – not historical artifacts. For ceramic/tableware sourcing, we provide:

| Traditional Sourcing | SourcifyChina Verified Pro List |

|---|---|

| Manual supplier validation (7–14 days) | Pre-vetted factories with live production data (0 days) |

| 38% supplier attrition rate post-RFP | <7% attrition rate (2025 client data) |

| Hidden compliance risks (BSCI, FDA, REACH) | Full compliance documentation pre-loaded |

| Unverified capacity claims | Live factory footage & production metrics |

2026 Impact: Clients using our Pro List reduce supplier onboarding time by 68% and cut PO delays by 91% (Q1 2026 Client Benchmark).

Your Strategic Advantage: Precision Over Guesswork

The “buffalo china” search term exemplifies a systemic industry flaw: sourcing against obsolete data. In 2026’s volatile market, your team cannot afford:

– ❌ Chasing liquidated companies

– ❌ Wasting engineering hours on non-existent capabilities

– ❌ Losing leverage to competitors with real-time supplier intelligence

SourcifyChina’s Pro List delivers verified, scalable alternatives with:

✅ Active FDA-compliant ceramic factories (Jingdezhen, Foshan clusters)

✅ MOQs 40% below market average via pre-negotiated tiered pricing

✅ ESG-certified partners (ISO 14001, WRAP) with carbon-neutral shipping

Call to Action: Secure Your 2026 Sourcing Cycle in <72 Hours

Stop validating ghosts. Start scaling with certainty.

The 2026 Procurement Mandate demands zero-tolerance for supply chain fiction. With SourcifyChina:

- Replace outdated supplier lists with our AI-verified ceramic/tableware network

- Lock in pre-audited partners meeting your exact specifications (lead time, compliance, volume)

- Deploy your team to value creation – not damage control

📅 Next Steps:

→ Email [email protected] with subject line: “2026 PRO LIST ACCESS – [YOUR COMPANY]”

→ WhatsApp +86 159 5127 6160 for priority onboarding (mention code: SC2026CTA)

Within 24 hours, receive:

– Customized shortlist of 3–5 pre-vetted ceramic manufacturers

– Compliance dossier (FDA, Prop 65, LFGB)

– Real-time capacity dashboard access

“In 2026, procurement wins belong to those who source from reality – not nostalgia. Your verified supply chain starts now.”

— SourcifyChina Global Sourcing Intelligence Unit

Act before Q3 2026 capacity locks. 87% of Pro List slots are reserved 90+ days in advance.

Your Next Sourcing Cycle Starts Now → [email protected] | +86 159 5127 6160

🧮 Landed Cost Calculator

Estimate your total import cost from China.