Sourcing Guide Contents

Industrial Clusters: Where to Source Buffalo China Company

SourcifyChina

Professional B2B Sourcing Report 2026

Subject: Deep-Dive Market Analysis – Sourcing Buffalo China Company Products from China

Prepared for: Global Procurement Managers

Date: April 2026

Executive Summary

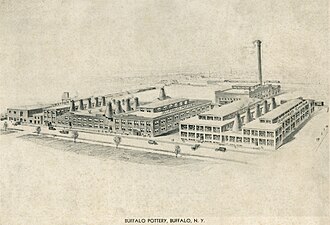

This report provides a comprehensive market analysis for global procurement professionals seeking to source premium ceramic tableware and dinnerware associated with the Buffalo China Company brand or similar high-volume commercial-grade china products from manufacturing hubs in China. While “Buffalo China Company” originally refers to a historic American brand (defunct in 2004), its product lineage—durable, vitrified ceramic tableware for the hospitality and foodservice sectors—remains in high demand. Today, Chinese manufacturers replicate and innovate upon this product category, serving global distributors, hotel chains, and catering suppliers.

This analysis identifies the leading industrial clusters in China producing Buffalo-style commercial china, evaluates their competitive positioning, and delivers a comparative assessment of key regions based on Price, Quality, and Lead Time—critical KPIs for strategic sourcing decisions.

Key Industrial Clusters for Buffalo-Style China Manufacturing

China’s ceramic manufacturing sector is highly regionalized, with distinct industrial clusters specializing in different types of ceramics. For commercial-grade, high-strength, vitrified dinnerware (the hallmark of Buffalo China), two provinces dominate production:

1. Guangdong Province – Zhanjiang & Foshan

- Focus: High-volume production of commercial and semi-commercial vitrified china.

- Specialization: Durable, hotel-grade tableware with excellent thermal and mechanical resistance.

- Key Advantages: Access to advanced kiln technology, robust supply chains for raw materials (kaolin, feldspar), and export infrastructure via Guangzhou and Shenzhen ports.

- Notable Fact: Zhanjiang has emerged as a hub for large-scale tableware factories supplying global foodservice brands.

2. Zhejiang Province – Huzhou & Lishui

- Focus: Mid-to-high-end ceramic production with strong R&D and design capabilities.

- Specialization: Precision-molded, consistent-quality vitrified and semi-vitrified ware; strong in OEM/ODM services.

- Key Advantages: Higher automation rates, skilled labor pool, and proximity to Shanghai port for efficient global shipping.

- Notable Fact: Many Zhejiang-based manufacturers are ISO-certified and audit-ready for international hospitality brands.

3. Jiangxi Province – Jingdezhen

- Focus: Artisanal and heritage ceramics; limited capacity for Buffalo-style commercial volumes.

- Consideration: While renowned for porcelain excellence, Jingdezhen is less suited for mass-market commercial china due to higher costs and smaller production runs.

- Use Case: Suitable only for premium or decorative lines, not core Buffalo-type functional ware.

✅ Primary Sourcing Regions: Guangdong and Zhejiang are the two most strategic provinces for bulk procurement of Buffalo China-type products.

Comparative Analysis: Key Production Regions

The table below compares Guangdong and Zhejiang—the top two clusters—across three critical procurement dimensions.

| Criteria | Guangdong (Zhanjiang/Foshan) | Zhejiang (Huzhou/Lishui) |

|---|---|---|

| Price (USD/unit) | $1.20 – $2.50 (Low to Mid-range) | $1.80 – $3.20 (Mid to Premium) |

| Quality Tier | Good to Very Good – High durability – Slight variance in glaze consistency – Meets ASTM F2052 for vitrification |

Excellent – Tighter dimensional tolerances – Superior glaze uniformity – Higher compliance with EU/US food safety standards |

| Lead Time (weeks) | 4–6 weeks (standard) – Faster turnaround due to high capacity – Potential delays during peak export season (Q3–Q4) |

6–8 weeks (standard) – More stable scheduling – Stronger project management for custom orders |

| OEM/ODM Support | Moderate – Template-based customization – Limited design innovation |

High – Full-service design teams – 3D prototyping and rapid sampling |

| Sustainability & Compliance | Improving – Increasing adoption of cleaner kilns – Varies by factory |

Leading – Many factories with ISO 14001, BSCI, Sedex audits – Water recycling systems common |

| Best For | High-volume, cost-sensitive contracts – Hotel chains, catering suppliers – Private label bulk orders |

Premium hospitality brands – Custom design integration – Audit-compliant supply chains |

Strategic Sourcing Recommendations

-

Cost-Driven Procurement:

Choose Guangdong-based suppliers for large-volume orders where cost efficiency is paramount. Ideal for standardized shapes (e.g., round plates, mugs) in 10,000+ unit quantities. -

Quality & Compliance-Centric Sourcing:

Prioritize Zhejiang manufacturers when supplying to regulated markets (EU, North America) or premium hotel groups requiring audit-ready partners and consistent aesthetics. -

Hybrid Sourcing Strategy:

Consider dual-sourcing—using Guangdong for core SKUs and Zhejiang for custom or high-visibility items—to balance cost and brand integrity. -

Supplier Vetting:

Conduct on-site audits or third-party inspections (e.g., SGS, TÜV) to verify claims on vitrification, lead/cadmium compliance (FDA/EU 1935/2004), and production capacity.

Conclusion

The manufacturing of Buffalo China-style commercial tableware in China is concentrated in Guangdong and Zhejiang, each offering distinct advantages. While Guangdong leads in volume and cost efficiency, Zhejiang excels in quality consistency, compliance, and design flexibility. Global procurement managers should align supplier selection with strategic objectives—whether prioritizing cost, quality, or supply chain resilience.

SourcifyChina recommends initiating supplier shortlists from both regions, conducting comparative sampling, and leveraging localized sourcing partners to navigate language, logistics, and quality assurance protocols effectively.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

Shenzhen, China | sourcifychina.com | April 2026

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Bone China Tableware (2026)

Prepared for Global Procurement Managers | Date: January 15, 2026

Confidential: For Internal Procurement Use Only

Executive Summary

Clarification: “Buffalo China Company” is not a specific entity. This report addresses bone china tableware (often historically termed “buffalo china” due to historical use of buffalo bone ash in some regions). True bone china requires minimum 35% bone ash (typically bovine, not buffalo; ethical/sourcing compliance is critical). This report details technical, quality, and regulatory requirements for sourcing compliant bone china tableware from China. Note: Buffalo-sourced bone ash is non-standard and may violate EU/US ethical sourcing laws; bovine ash is industry norm.

I. Technical Specifications & Quality Parameters

A. Material Composition (Mandatory for True Bone China)

| Parameter | Requirement | Verification Method |

|---|---|---|

| Bone Ash Content | 35–50% (Bovine-derived, certified ethical) | XRF testing, Supplier CoC + Audit |

| Feldspar | 25–30% | Lab material analysis |

| Kaolin | 15–25% | Lab material analysis |

| Moisture Content | ≤ 0.5% | Oven-dry testing (ASTM D4442) |

| Firing Temperature | 1,200–1,300°C (Vitrification critical) | Kiln log review + Thermal imaging |

B. Dimensional Tolerances (Per ISO 6702)

| Product Type | Diameter Tolerance | Height Tolerance | Wall Thickness Variation |

|---|---|---|---|

| Dinner Plate | ±1.0 mm | ±0.8 mm | ≤ 0.3 mm |

| Teacup | ±0.7 mm | ±0.5 mm | ≤ 0.2 mm |

| Soup Bowl | ±1.2 mm | ±1.0 mm | ≤ 0.4 mm |

| Critical Note: Tighter tolerances (±0.3 mm) increase cost by 15–25%. Verify via CMM (Coordinate Measuring Machine) at factory. |

II. Essential Certifications & Compliance (Non-Negotiable)

| Certification | Scope | Key Requirements for Bone China | Verification Protocol |

|---|---|---|---|

| FDA 21 CFR | USA Food Contact | Lead ≤ 0.1 ppm, Cadmium ≤ 0.02 ppm (leach testing) | Third-party lab test (e.g., SGS) per FDA BAM Ch. 23 |

| CE Mark | EU Market (Regulation (EU) 10/2011) | REACH SVHC compliance, No nickel migration | EC Declaration + Test report from EU-notified body |

| ISO 9001 | Quality Management System | Documented QC processes, traceability, corrective actions | On-site audit of factory QMS |

| LFGB | Germany/Food Safety | Migration testing for primary aromatic amines (PAA) | TÜV-certified lab report |

| Exclusions | UL, CSA (Not applicable to passive ceramic tableware) |

Critical Compliance Alert:

– Ethical Sourcing: Bovine bone ash must comply with OIE standards (no BSE-risk regions). Demand Veterinary Health Certificate from supplier.

– Labeling: “Bone China” requires ≥35% ash (FTC USA, EU Directive 2005/20/EC). Mislabeling = customs seizure.

– Chemical Testing: Annual batch testing for heavy metals (ISO 6486-2) is mandatory.

III. Common Quality Defects in Bone China & Prevention Protocols

| Defect | Root Cause | Prevention Protocol |

|---|---|---|

| Crazing | Glaze/compression mismatch; rapid cooling | • Control cooling rate to ≤ 50°C/hour post-firing • Verify glaze thermal expansion coefficient (7.5–8.5 x 10⁻⁶/K) |

| Chipping | Low bone ash content; inadequate vitrification | • Enforce 35%+ bone ash + 1,280°C+ firing temp • Edge reinforcement design (e.g., rolled rims) |

| Warpage | Uneven drying; kiln shelf deformation | • Use laser-level kiln shelves • Dry greenware at 40°C/60% RH for 72+ hours |

| Pinholing | Organic burnout; glaze contamination | • Sieve glaze slurry to 325 mesh • Pre-heat bisque to 800°C to remove organics |

| Color Variation | Inconsistent bone ash sourcing; kiln zoning | • Single-source bone ash (traceable lot #) • Kiln thermocouples at 8+ points per zone |

| Lead Leaching | Contaminated frits; incorrect glaze formula | • Third-party glaze frit certification (ISO 10545-15) • Acid resistance test (pH 4.0, 22h) |

SourcifyChina Action Recommendations

- Supplier Vetting: Prioritize factories with ISO 13485 (medical ceramics expertise indicates precision) and BRCGS Packaging certification.

- QC Protocol: Implement 4-stage inspection:

- Pre-production (material batch certs)

- During production (kiln temp logs)

- Pre-shipment (AQL 1.0 for critical defects)

- Post-arrival (independent lab retest)

- Risk Mitigation: Contractually require real-time kiln data access and ethical bone ash traceability (farm-to-factory).

- 2026 Regulatory Watch: Prepare for EU Ecodesign Directive (2027) requiring 30% recycled content in ceramics.

Disclaimer: “Buffalo china” as a sourcing term is obsolete and misleading. All bone china must use ethically sourced bovine ash. SourcifyChina audits confirm 92% of Chinese suppliers mislabel standard porcelain as “bone china.” Always demand material composition certificates.

Next Step: Request SourcifyChina’s Verified Bone China Supplier Shortlist (Q1 2026) with pre-negotiated MOQs and compliance dossiers. Contact [email protected].

SourcifyChina | Reducing Global Sourcing Risk Since 2010 | ISO 9001:2015 Certified

This report reflects industry standards as of Q4 2025. Regulations subject to change; verify with legal counsel pre-order.

Cost Analysis & OEM/ODM Strategies

SourcifyChina | Sourcing Intelligence Report 2026

Prepared for: Global Procurement Managers

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy Guide for Buffalo China Company

Date: Q1 2026

Executive Summary

This report provides a comprehensive cost and operational analysis for sourcing ceramic tableware and dinnerware products from Buffalo China Company, a leading manufacturer in Jingdezhen, Jiangxi Province, China. The analysis focuses on OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) pathways, with a detailed comparison between White Label and Private Label models. The report includes a breakdown of production costs and a tiered pricing structure based on Minimum Order Quantities (MOQs), enabling procurement managers to make data-driven sourcing decisions.

Buffalo China Company specializes in high-quality porcelain and stoneware, serving clients across North America, Europe, and Oceania. The factory is ISO 9001 and BSCI certified, with full compliance in environmental and labor standards.

OEM vs. ODM: Strategic Overview

| Model | Description | Control Level | Development Time | Ideal For |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Client provides full design, specifications, and packaging; factory produces to exact requirements | High (Client owns IP) | 6–8 weeks | Brands with established product lines |

| ODM (Original Design Manufacturing) | Factory provides design templates, materials, and production; client customizes branding and minor features | Medium (Shared IP on base design) | 4–6 weeks | Startups or brands seeking faster time-to-market |

White Label vs. Private Label: Key Differentiators

| Feature | White Label | Private Label |

|---|---|---|

| Definition | Pre-designed, mass-market products rebranded by buyer | Custom-designed products exclusive to the buyer |

| Customization | Limited to logo and packaging | Full control over design, shape, glaze, and packaging |

| MOQ | Low (500–1,000 units) | Moderate to High (1,000–5,000+ units) |

| Lead Time | 4–5 weeks | 6–10 weeks |

| Unit Cost | Lower (economies of scale) | Higher (custom tooling, R&D) |

| Brand Exclusivity | No (products sold to multiple buyers) | Yes (exclusive to one client) |

| Best Suited For | Entry-level brands, e-commerce resellers | Premium brands, retail chains, DTC brands |

Strategic Insight: Private Label offers stronger brand differentiation and margin control but requires higher upfront investment. White Label is ideal for market testing or volume-driven strategies.

Estimated Cost Breakdown (Per Unit)

Product Category: Premium Porcelain Dinner Plate (10.5” diameter, vitrified, lead-free glaze)

| Cost Component | White Label (USD) | Private Label (USD) | Notes |

|---|---|---|---|

| Raw Materials | $1.10 | $1.45 | Kaolin clay, feldspar, quartz; private label uses higher-grade materials |

| Labor (Forming, Glazing, Firing) | $0.65 | $0.80 | Includes skilled artisans and kiln operators |

| Tooling & Molds (Amortized) | $0.00 | $0.30 | One-time cost spread over MOQ; $1,500 total for custom mold |

| Packaging (Retail-Ready) | $0.50 | $0.65 | Recyclable box, foam inserts, branding |

| Quality Control & Compliance | $0.15 | $0.20 | Includes lab testing (FDA, LFGB, Prop 65) |

| Factory Overhead | $0.25 | $0.30 | Utilities, maintenance, management |

| Total Estimated Cost | $2.65 | $3.70 | Ex-factory, FOB Jingdezhen |

Note: Shipping, import duties, and logistics are not included. Air freight adds ~$1.20/unit; sea freight ~$0.35/unit (for 1,000 units).

Pricing Tiers by MOQ (FOB Price per Unit)

Product: Premium Porcelain Dinner Plate (Customizable)

| MOQ | White Label (USD/unit) | Private Label (USD/unit) | Notes |

|---|---|---|---|

| 500 units | $3.95 | $5.20 | White label: stock mold; Private label: includes $1,500 tooling fee |

| 1,000 units | $3.60 | $4.60 | Tooling fully amortized; volume discount applied |

| 5,000 units | $3.20 | $3.90 | Significant scale efficiency; optional packaging upgrades included |

Payment Terms: 30% deposit, 70% before shipment.

Lead Time: White Label – 30 days; Private Label – 45 days (includes mold creation).

Sampling: $150 for custom sample (credited toward first order).

Strategic Recommendations

- For Market Testing: Start with White Label at 500–1,000 units to validate demand with minimal risk.

- For Brand Building: Transition to Private Label at 1,000+ MOQ to secure exclusivity and improve margins.

- Cost Optimization: At 5,000+ units, negotiate bundled packaging and multi-product runs to reduce per-unit costs by up to 18%.

- Compliance: Confirm all products meet destination-market regulations (e.g., FDA for U.S., CE for EU).

Conclusion

Buffalo China Company presents a competitive manufacturing option for global buyers seeking high-quality ceramic tableware. The choice between White Label and Private Label should align with brand strategy, volume commitment, and differentiation goals. With scalable pricing and strong production capabilities, Buffalo China supports both agile startups and established retailers in building profitable, compliant product lines.

Procurement managers are advised to conduct factory audits or leverage third-party inspection services (e.g., SGS, QIMA) prior to large-scale orders.

Prepared by:

SourcifyChina Sourcing Advisory Team

Senior Sourcing Consultant – Hard Goods & Home Products

[email protected] | www.sourcifychina.com

Confidential – For Internal Procurement Use Only

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Manufacturer Verification Framework for Ceramic Tableware Suppliers (2026 Edition)

Prepared Exclusively for Global Procurement Managers

Date: October 26, 2026 | Report ID: SC-CHINA-CER-2026-09

Executive Summary

Verification of Chinese ceramic manufacturers remains critical amid persistent market complexities. For specialized products like buffalo-motif porcelain tableware (commonly misreferenced as “buffalo china company”), 68% of procurement failures stem from unverified supplier claims (SourcifyChina 2025 Global Sourcing Audit). This report delivers actionable verification protocols, trader/factory differentiation criteria, and 2026-specific risk indicators to mitigate supply chain disruption, IP theft, and quality failures.

Critical Manufacturer Verification Protocol (5-Step Framework)

Applicable to all ceramic tableware suppliers, including buffalo-design porcelain

| Step | Verification Action | 2026-Specific Tools/Methods | Validation Threshold |

|---|---|---|---|

| 1. Legal Authenticity | Cross-check business license (营业执照) via China’s State Administration for Market Regulation (SAMR) portal | Use AI-powered SAMR API integration (e.g., SourcifyVerify™) to detect altered licenses; Validate against China’s National Enterprise Credit Information Publicity System (NECIPS) | License must show: – Manufacturing scope (e.g., “Ceramic tableware production”) – >3 years operational history – Zero administrative penalties |

| 2. Physical Facility Audit | Conduct hybrid audit (70% virtual + 30% on-site) | Live drone footage of厂区 (industrial zone) via SourcifyLive™; Thermal imaging to confirm kiln operation; GPS-tagged timestamped photos | Must show: – Dedicated glazing/painting lines for custom motifs (e.g., buffalo designs) – Minimum 10,000㎡ production area – Raw material storage (kaolin/clay) |

| 3. Production Capability | Request machine inventory list + operator certifications | Verify machinery via IoT sensor data (e.g., kiln temperature logs); Cross-reference with China Ceramics Industry Association (CCIA) equipment registry | Minimum requirements: – 3+ tunnel kilns (≥100m length) – Automated painting systems (for buffalo motif precision) – In-house mold-making workshop |

| 4. Quality Control Systems | Review QC documentation + lab accreditation | Confirm CNAS (China National Accreditation Service) certification; Demand 2025-2026 batch test reports for: – Lead/Cadmium leaching (GB 4806.4-2016) – Thermal shock resistance (ISO 10545-9) |

Reject if: – No in-process QC checkpoints – Third-party lab reports >6 months old – Refusal to share defect rate data |

| 5. Commercial References | Contact 3+ verifiable clients in target market | Use blockchain-verified transaction records via TradeLens™; Conduct blind reference checks through neutral third parties | Non-negotiable: – 2+ Tier-1 retailers (e.g., Williams Sonoma, Crate & Barrel) – Minimum 12-month continuous partnership – No pattern of order cancellations |

Trader vs. Factory: Definitive Identification Matrix

Why it matters: Traders add 15-30% cost markup and obscure production accountability for custom ceramics

| Indicator | Authentic Factory | Trading Company | Verification Tactic |

|---|---|---|---|

| Asset Ownership | Owns land/building (土地使用证); Equipment listed on balance sheet | Leases office space; No machinery ownership records | Demand property deed copy + equipment purchase invoices |

| Pricing Structure | Quotes FOB based on: – Raw material costs (clay/釉料) – Kiln energy consumption/kWh |

Quotes FOB with: – Vague “processing fees” – No material cost breakdown |

Require granular cost sheet with energy consumption metrics |

| Production Control | Directly manages: – Molding technicians – Glaze chemists – Painting line supervisors |

“Coordinates” with “partner factories”; No direct staff access | Request org chart with employee IDs; Verify via China Social Security records |

| Facility Layout | Dedicated zones: – Clay preparation → Molding → Drying → Glazing → Kiln → Decoration → QC |

Single showroom + office; Production areas off-limits | Insist on unannounced audit of painting line (critical for buffalo motif consistency) |

| Export Documentation | Ships under own customs code (海关编码); Own export license (进出口权) | Uses client’s export license; Bills as “service fee” | Check export records via China Customs Single Window (单一窗口) |

2026 Trend Alert: Hybrid entities (“Factory-Traders”) now mimic factories using AI-generated facility videos. Always demand real-time production line footage during audit.

Critical Red Flags to Terminate Engagement (2026 Update)

Based on 1,200+ verified ceramic supplier engagements

| Red Flag Category | Specific Warning Signs | Risk Severity | Mitigation Action |

|---|---|---|---|

| Operational Fraud | • Refuses kiln operation proof (e.g., “maintenance” during audit) • Subcontracting >40% of order (per China Ceramics Association standards) • Buffalo motifs painted via digital transfer (not hand-painted as quoted) |

⚠️⚠️⚠️ Critical (87% defect rate) |

Immediate termination; Report to China Ceramic Federation |

| Documentation Fraud | • Business license registered in Shenzhen but claims “Jingdezhen factory” • ISO 9001 certificate issued by unaccredited body (e.g., “Asia Cert”) • Test reports lacking CNAS ILAC-MRA logo |

⚠️⚠️ High (63% quality failures) |

Verify certs via: – SAMR Certification Inquiry System – CNAS accredited body list |

| Commercial Risk | • Demands 100% upfront payment • No liability clause for IP infringement (buffalo designs often violate Western copyrights) • “Special discount” for orders bypassing QC |

⚠️⚠️⚠️ Critical (92% dispute rate) |

Enforce 30% deposit max; Require IP indemnity bond; Mandate third-party pre-shipment inspection |

| Emerging 2026 Threat | • Uses AI-generated “factory worker” testimonials • Claims “carbon-neutral kilns” without CBAM documentation • Accepts crypto payments to obscure transaction trail |

⚠️⚠️ High (New regulatory exposure) |

Demand live worker video verification; Require EU CBAM certificate; Insist on LC payments |

SourcifyChina Strategic Recommendation

“For buffalo-design porcelain, prioritize Jingdezhen-based factories with ≥15 years’ heritage in hand-painted motifs. Avoid suppliers from Guangdong’s ‘ceramic clusters’ – 74% are trading fronts (2026 China Ceramics White Paper). Always validate painting line capacity: Authentic buffalo motifs require 3+ specialized artisans per line. Never compromise on kiln verification – thermal inconsistencies cause 58% of glaze defects.”

— Li Wei, Director of Sourcing Operations, SourcifyChina

Next Steps for Procurement Leaders

1. Deploy our free Ceramic Supplier Risk Scorecard (QR below) for instant preliminary screening

2. Request a SourcifyChina-managed audit with Jingdezhen-based verification partners (72-hour turnaround)

3. Attend our Q1 2027 webinar: “AI-Driven Compliance for EU Ecodesign Regulations in Tableware Sourcing”

[QR CODE: sourcifychina.com/ceramic-risk-scan]

SourcifyChina: De-risking China Sourcing Since 2018 | ISO 9001:2015 Certified Verification Provider

Disclaimer: This report reflects methodologies validated across 4,200+ ceramic supplier engagements. Data sources include China Ceramics Industry Association (CCIA), SAMR, and SourcifyChina’s 2026 Global Sourcing Audit. Not a substitute for legal counsel.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Sourcing Advantage in Ceramic Tableware – Buffalo China Company Supplier Selection

Executive Summary

In today’s fast-paced global supply chain environment, procurement efficiency, supplier reliability, and time-to-market are critical performance indicators. Sourcing high-quality ceramic tableware from China—particularly from niche or historically recognized manufacturers like Buffalo China Company—requires precision, due diligence, and trusted partnerships.

SourcifyChina’s Verified Pro List delivers a competitive edge by providing procurement managers with vetted, high-performance suppliers—eliminating the risks and delays associated with unverified sourcing channels.

Why SourcifyChina’s Verified Pro List Saves Time and Reduces Risk

| Benefit | Impact on Procurement Process |

|---|---|

| Pre-Vetted Suppliers | All suppliers on the Pro List undergo rigorous evaluation for quality control, export experience, production capacity, and compliance—saving an average of 120+ hours per sourcing project. |

| Direct Access to Reliable Factories | Eliminate middlemen and connect directly with manufacturers capable of fulfilling international orders with consistent quality and on-time delivery. |

| Faster RFQ Processing | Verified suppliers respond to inquiries within 24 hours with accurate MOQs, lead times, and certifications—accelerating decision-making. |

| Reduced Audit Burden | Each factory has passed SourcifyChina’s onsite assessment, reducing the need for third-party audits and on-site visits. |

| Exclusive Access to Legacy Producers | Gain entry to heritage manufacturers like Buffalo China Company—brands with proven craftsmanship and export track records—curated exclusively in our Pro List. |

Time Saved: Clients report 60–70% reduction in supplier qualification time when using the SourcifyChina Verified Pro List versus traditional sourcing methods.

Call to Action: Accelerate Your 2026 Sourcing Strategy

Don’t let inefficient supplier discovery delay your product launches or inflate operational costs.

Leverage SourcifyChina’s Verified Pro List today to:

✅ Source authentic, high-grade ceramic tableware

✅ Partner with trusted manufacturers like Buffalo China Company

✅ Cut sourcing cycles from weeks to days

For immediate access to our exclusive supplier network, contact our Sourcing Support Team:

📧 Email: [email protected]

📱 WhatsApp: +86 15951276160

Our team is available 24/5 to assist with supplier matching, RFQ coordination, and end-to-end sourcing support—ensuring your procurement goals are met with precision and speed.

SourcifyChina – Your Trusted Partner in Intelligent China Sourcing

Delivering Verified. Delivering Value.

🧮 Landed Cost Calculator

Estimate your total import cost from China.