The global brushless motor market is experiencing robust growth, driven by increasing demand for energy-efficient and high-performance electric motors across industries such as automotive, industrial automation, consumer electronics, and aerospace. According to a report by Mordor Intelligence, the brushless DC (BLDC) motor market was valued at USD 17.13 billion in 2023 and is projected to reach USD 25.91 billion by 2029, growing at a CAGR of approximately 7.1% during the forecast period. This expansion is fueled by technological advancements, rising adoption of electric vehicles, and the growing integration of automation in manufacturing. As demand surges, a select group of manufacturers have emerged as industry leaders, driving innovation in power density, efficiency, and smart control capabilities. Below are the top 9 brushless motor manufacturers shaping the future of motion control technology.

Top 9 Brushless Engine Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 X

Domain Est. 2011

Website: x-teamrc.com

Key Highlights: X-TEAM was created in 2007.Is a leader in DC brushless motor & drives for hobby, military and industrial markets. Factory established in Dongguan city of China….

#2 EC Motors (Brushless)

Domain Est. 1996

Website: johnsonelectric.com

Key Highlights: Johnson Electric, an industry leader in brushless motor technology has customized EC motors for many applications in Automotive and Industrial segments. Inquiry….

#3 Flash Hobby

Domain Est. 2019

Website: flashhobby.com

Key Highlights: Flash Hobby is one of the leading manufacturers who specializing in the producing and marketing of brushless motors,Industrial Motors, gimbal motors, ……

#4 HOBBYWING

Domain Est. 2005

Website: hobbywing.com

Key Highlights: HOBBYWING is recognised as the world’s leading brushless power system manufacturer. It has obtained a series of patents and technical certifications, ……

#5 ThinGap

Domain Est. 1999

Website: thingap.com

Key Highlights: High precision and smooth motion make the LS Series of motors the perfect fit for uses in high performance applications….

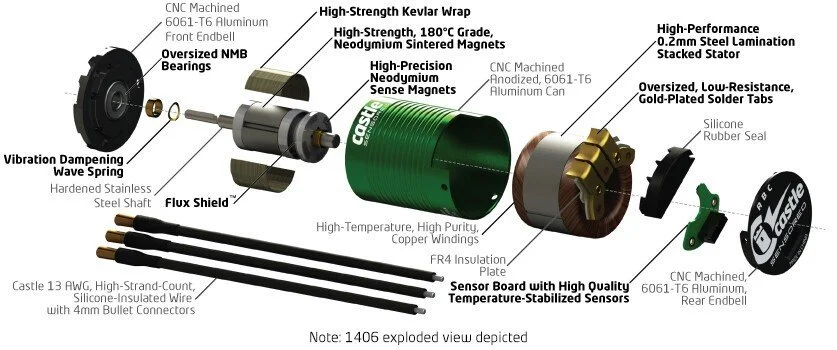

#6 Castle Homepage

Domain Est. 2000

Website: home.castlecreations.com

Key Highlights: Brushless motors and ESCs for RC, UAVs, robotics, and more—engineered in the USA for high power, precision control, and lasting reliability….

#7 BRUSHLESS MOTOR ENGINEERING

Domain Est. 2004

Website: neumotors.com

Key Highlights: Neumotors offers brushless motor engineering and manufacturing. Our product line includes brushless motors and controllers from 50 watts to 50kW output….

#8 Brushless DC Motors

Domain Est. 2008

#9 O.S.Brushless Motor Line

Website: os-engines.co.jp

Key Highlights: Features of O.S. Brushless motor. Among the many brushless motors, there is a reason why many enthusiasts choose the O.S. motor….

Expert Sourcing Insights for Brushless Engine

H2: 2026 Market Trends for Brushless Motors

The global brushless motor market is poised for significant transformation and expansion by 2026, driven by technological advancements, rising energy efficiency standards, and growing demand across key industries. Below is an analysis of the primary market trends expected to shape the brushless motor landscape in 2026.

-

Increased Demand in Electric Vehicles (EVs)

The automotive sector, particularly electric vehicle (EV) production, is a major growth driver for brushless motors. By 2026, as governments worldwide push for carbon neutrality and stricter emissions regulations, EV adoption is expected to surge. Brushless DC (BLDC) motors, known for their high efficiency, reliability, and power density, are becoming the preferred choice for EV propulsion systems. This trend is further supported by advancements in motor control algorithms and integration with battery management systems. -

Expansion in Industrial Automation and Robotics

The rise of Industry 4.0 and smart manufacturing is accelerating the adoption of brushless motors in robotics, CNC machines, and automated guided vehicles (AGVs). By 2026, these motors are expected to dominate in precision applications due to their superior speed control, low maintenance, and longer operational life compared to brushed motors. Investments in factory automation across Asia-Pacific, North America, and Europe will fuel this demand. -

Growth in Consumer Electronics and Drones

The consumer electronics sector continues to be a key market, with brushless motors used in cooling fans, hard drives, and camera gimbals. Additionally, the commercial and recreational drone market is projected to grow substantially by 2026, largely dependent on brushless motors for propulsion. Lightweight, high-performance motors with improved thermal management will be in high demand. -

Adoption in HVAC and Appliance Industries

Energy efficiency regulations are pushing manufacturers of heating, ventilation, and air conditioning (HVAC) systems, as well as home appliances, to transition from brushed to brushless motors. By 2026, brushless motors are expected to become standard in premium refrigerators, washing machines, and air conditioners due to their quiet operation and energy savings—aligning with global sustainability goals. -

Advancements in Motor Design and Materials

Ongoing innovations in rare-earth magnet alternatives, such as ferrite and neodymium-iron-boron (NdFeB) composites, are expected to reduce dependency on scarce materials and lower production costs. Additionally, integration with IoT-enabled sensors and predictive maintenance software will enhance motor performance monitoring, leading to smarter, more resilient systems. -

Regional Market Dynamics

Asia-Pacific, led by China, Japan, and South Korea, will remain the largest market for brushless motors due to strong manufacturing bases and government support for green technologies. North America and Europe will also see robust growth, driven by EV incentives and industrial modernization. -

Sustainability and Regulatory Pressures

Stricter energy efficiency standards, such as the IE4 and upcoming IE5 efficiency classes under IEC 60034-30-1, are compelling industries to adopt high-efficiency brushless motors. By 2026, compliance with such regulations will be a key purchasing criterion, further boosting market penetration.

In conclusion, the 2026 brushless motor market will be characterized by strong cross-sectoral demand, technological innovation, and a clear shift toward energy-efficient and intelligent motor solutions. Companies that invest in R&D, sustainable materials, and smart motor integration are likely to gain a competitive edge in this evolving landscape.

Common Pitfalls When Sourcing Brushless Motors (Quality, IP Protection)

Sourcing brushless motors presents several critical challenges, particularly concerning product quality and intellectual property (IP) protection. Overlooking these aspects can lead to performance issues, supply chain disruptions, and legal risks. Below are the most common pitfalls to avoid.

Inadequate Quality Assurance Processes

Many suppliers, especially low-cost manufacturers, lack rigorous quality control systems. This can result in inconsistent motor performance, premature failures, and high defect rates. Buyers often assume all motors meet industry standards, but without on-site audits or independent testing, subpar components—such as inferior magnets, windings, or bearings—may go undetected until after integration.

Misrepresentation of IP and Design Ownership

A significant risk is sourcing motors that infringe on third-party patents or use copied designs. Some suppliers falsely claim proprietary technology when, in reality, they are replicating branded products. This exposes the buyer to legal liability, product recalls, and reputational damage. Always verify design originality and ensure the supplier provides IP indemnification in contracts.

Overstated IP (Ingress Protection) Ratings

Suppliers may advertise high IP ratings (e.g., IP67 or IP68) without proper certification or testing. In practice, these motors may not withstand dust, water, or harsh environments as claimed. This misrepresentation can lead to field failures in demanding applications. Validate IP claims with test reports from accredited labs and request real-world environmental testing data.

Lack of Traceability and Documentation

Poor documentation—such as missing material certifications, performance test records, or traceability codes—hampers quality monitoring and compliance. Without these, diagnosing failures or proving conformity to regulations becomes difficult. Ensure suppliers provide full technical dossiers and batch traceability for every motor batch.

Supply Chain Transparency Issues

Hidden subcontracting is common, where the quoted supplier outsources production to unqualified third parties. This breaks quality consistency and complicates IP oversight. Conduct factory audits and require disclosure of all manufacturing sites to maintain control over production standards and IP integrity.

Insufficient Long-Term Support and Scalability

Some suppliers cannot support long production runs or future design iterations. This becomes a problem when scaling up or needing design modifications. Confirm the supplier’s capacity, engineering support, and willingness to co-develop, protecting both quality and your IP throughout the product lifecycle.

Logistics & Compliance Guide for Brushless Motors

Overview and Scope

This guide outlines the logistics handling, transportation, and regulatory compliance considerations specific to brushless motors. These electric motors are widely used in drones, electric vehicles, industrial automation, and consumer electronics. While they do not contain hazardous materials under normal conditions, proper packaging, labeling, and regulatory adherence are essential for safe and legal international and domestic shipment.

Classification and Regulatory Framework

Brushless motors are generally classified under the Harmonized System (HS) code 8501.31 or 8501.32, depending on power output and application (e.g., motors with output not exceeding 750W or over 750W). They are typically not classified as dangerous goods under IATA, IMDG, or ADR regulations when shipped without batteries. However, compliance with export controls, including ITAR or EAR (in the U.S.), may apply if the motor is designed for military or aerospace applications.

Packaging Requirements

Brushless motors must be securely packaged to prevent physical damage during transit. Use rigid, corrugated cardboard boxes with internal cushioning (e.g., foam inserts or bubble wrap) to protect housing, shafts, and connectors. Motors should be individually wrapped if shipped in bulk. Ensure terminals or wiring leads are insulated or taped to avoid short circuits. Avoid moisture exposure by including desiccants if shipping in high-humidity environments.

Labeling and Documentation

Each shipment must include accurate labeling: product name, model number, voltage, power rating, manufacturer information, and CE/FCC marks where applicable. Include a commercial invoice, packing list, and bill of lading. For international shipments, provide an HS code and country of origin. If the motor contains magnets, label the package with “Magnetized Material” per IATA guidelines (PI 902) to alert handlers, even if the magnetic field strength is below regulated thresholds.

Transportation Considerations

Brushless motors can typically be shipped via air, sea, or ground freight without restrictions when standalone. However, if packaged with lithium batteries, the entire shipment may fall under Class 9 hazardous materials regulations. Always verify with carriers whether motors trigger special handling due to magnetic properties. For air transport, ensure magnetic field strength is less than 0.159 A/m at 2.1 meters from the package to avoid IATA Special Provision A48 requirements.

Import/Export Compliance

Verify export licensing requirements based on destination country and motor specifications. High-performance brushless motors may be subject to dual-use regulations under the Wassenaar Arrangement or U.S. Commerce Control List (CCL). End-user screening and compliance with sanctions lists (e.g., OFAC, EU Consolidated List) are mandatory. Import duties and taxes vary by jurisdiction; provide accurate technical specifications to customs authorities to ensure proper tariff classification.

Environmental and RoHS Compliance

Brushless motors must comply with environmental directives such as the EU’s RoHS (Restriction of Hazardous Substances) and REACH regulations. Confirm that materials used (e.g., copper, rare earth elements in magnets) meet substance restrictions. Provide a Certificate of Compliance (CoC) upon request. Proper disposal and recycling information should be available for end-of-life products.

Quality Assurance and Traceability

Maintain batch-level traceability for motors shipped in volume. Record serial numbers or lot codes on shipping documents to support recalls or warranty claims. Conduct pre-shipment inspections to verify performance and packaging integrity. Partner with logistics providers that support tracking and temperature/humidity monitoring if required for sensitive components.

Special Handling for High-Performance or Custom Motors

Motors designed for aerospace, medical, or defense applications may require ITAR or EAR compliance, end-use statements, or special export licenses. These motors often need controlled access during storage and transport. Coordinate with legal and compliance teams early in the logistics process to avoid shipment delays or penalties.

Summary and Best Practices

To ensure smooth logistics and regulatory compliance:

– Clearly classify motors by HS code and verify export controls.

– Package securely with protective materials and moisture protection.

– Label accurately and provide complete shipping documentation.

– Screen for magnetic properties and battery integration risks.

– Maintain compliance with environmental and trade regulations.

– Implement traceability and quality control protocols.

Regularly review international trade regulations and update internal procedures to remain compliant with evolving standards.

Conclusion on Sourcing Brushless Motors

Sourcing brushless motors requires a comprehensive evaluation of technical specifications, supplier reliability, cost-efficiency, and long-term support. These motors offer significant advantages over brushed alternatives, including higher efficiency, longer lifespan, reduced maintenance, and superior performance in demanding applications. When selecting a supplier, it is critical to consider motor quality, customization capabilities, compliance with industry standards, and post-purchase support.

Global sourcing presents opportunities for competitive pricing, especially from manufacturers in Asia, but must be balanced with risks related to quality control, lead times, and logistics. Partnering with reputable suppliers—whether OEMs, established distributors, or certified manufacturers—ensures consistent product quality and technical compatibility. Additionally, considering factors such as scalability, innovation, and sustainability can future-proof procurement strategies.

In conclusion, a strategic approach to sourcing brushless motors—centered on balancing performance requirements with supply chain resilience—enables organizations to optimize operational efficiency and maintain a competitive edge in industries ranging from robotics and automotive to aerospace and renewable energy.