The global bronze market is experiencing steady expansion, driven by rising demand across industrial, automotive, and electrical applications. According to Mordor Intelligence, the bronze market was valued at USD 2.8 billion in 2023 and is projected to grow at a CAGR of 4.6% through 2029. This growth is fueled by bronze’s superior corrosion resistance, conductivity, and durability, making it a preferred material in marine engineering, bushings, bearings, and architectural components. As procurement strategies become increasingly cost-sensitive, sourcing bronze per kilo at competitive prices has become a key priority for manufacturers and suppliers alike. With Asia-Pacific leading in both production and consumption—accounting for over 50% of global demand—access to high-quality, cost-effective bronze suppliers is critical. This report identifies the top 10 bronze manufacturers offering the most competitive per kilo pricing without compromising material standards, leveraging market data, production scale, and regional cost advantages to deliver actionable insights for procurement professionals.

Top 10 Bronze Per Kilo Price Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Metal Prices

Domain Est. 1995

Website: kme.com

Key Highlights: Metal prices are subject to constant fluctuations and can sometimes change dramatically within minutes. Reference prices in this webpage are therefore to be …Missing: kilo manuf…

#2 PGM prices and trading

Domain Est. 1995

Website: matthey.com

Key Highlights: Our global team of Platinum Group Metal (PGM) experts support you in effectively sourcing and managing PGMs, enabling their sustainable and circular use….

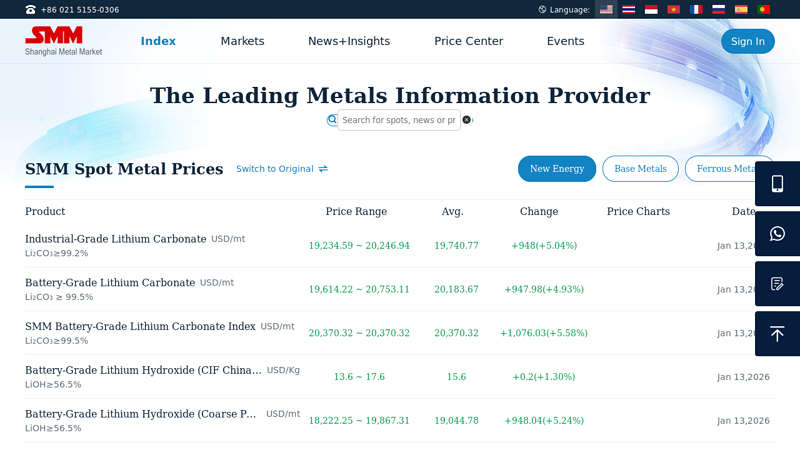

#3 Metal Prices

Domain Est. 1995

Website: metal.com

Key Highlights: Copper prices, aluminum prices, lead prices, zinc prices, tin prices, nickel prices, base metalprices, new energy prices, precious metal prices, scrap metal …Missing: bronze kil…

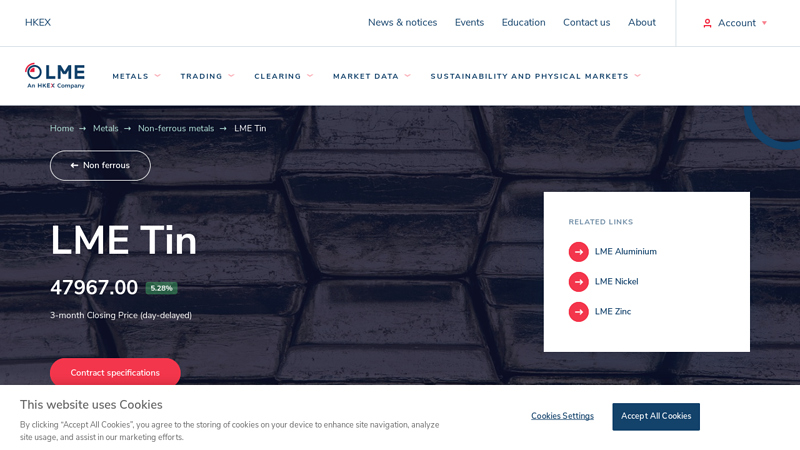

#4 LME Tin

Domain Est. 1996

Website: lme.com

Key Highlights: Current and historical Tin prices, stocks and monthly averages….

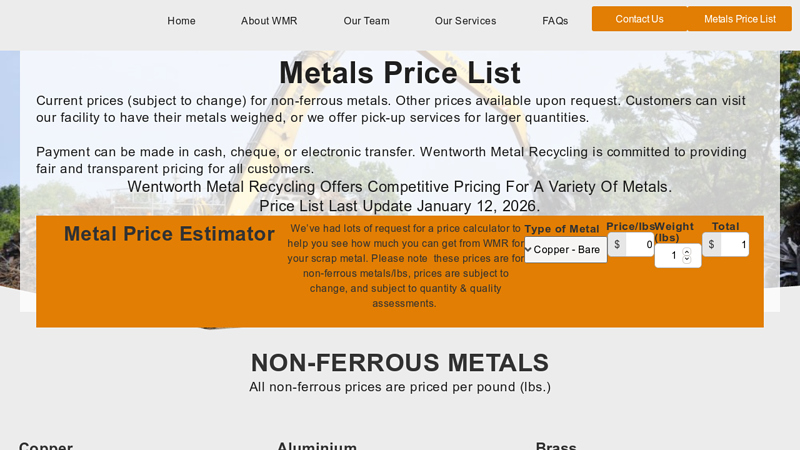

#5 Metals Price List

Domain Est. 1999

Website: wentworthrecycling.com

Key Highlights: Wentworth Metal Recycling offers competitive pricing for a variety of metals. Current prices (subject to change) for non-ferrous metals….

#6 Prices

Domain Est. 2001

Website: pmm.umicore.com

Key Highlights: Overview of Umicore purchase price for each precious metals and their graphs over time.Missing: bronze kilo…

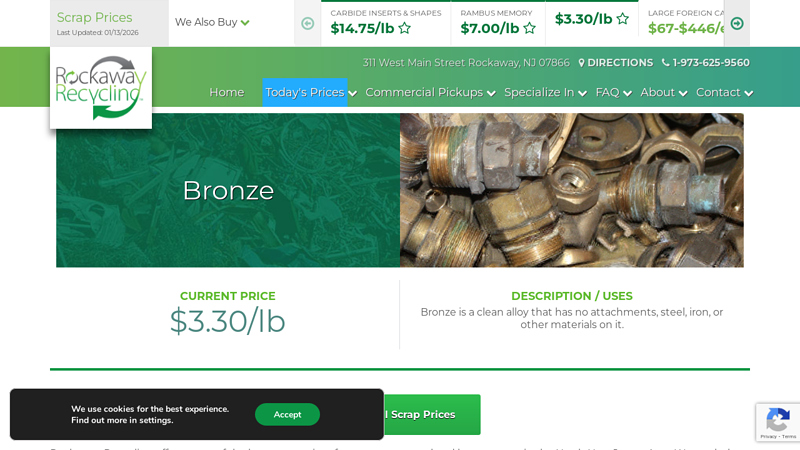

#7 Bronze Scrap Prices

Domain Est. 2007

Website: rockawayrecycling.com

Key Highlights: CURRENT PRICE $3.30/lb Bronze is a clean alloy that has no attachments, steel, iron, or other materials on it….

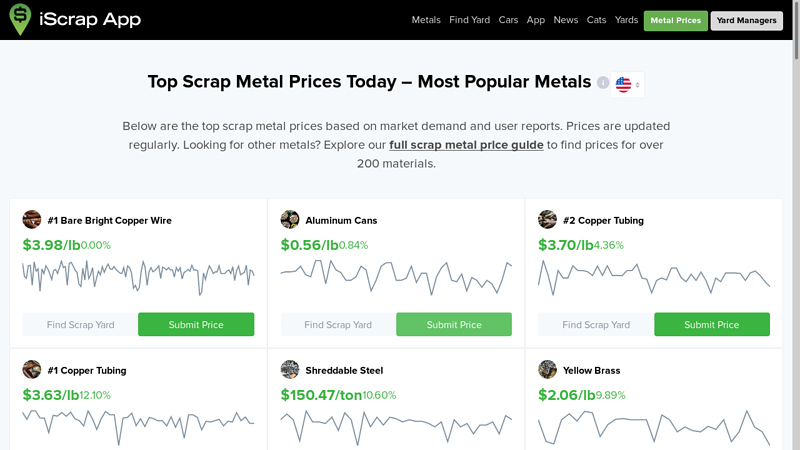

#8 Top Scrap Metal Prices Today – Most Popular Metals

Domain Est. 2010

Website: iscrapapp.com

Key Highlights: Below are the top scrap metal prices based on market demand and user reports. Prices are updated regularly. Looking for other metals? Explore our full scrap ……

#9 Todays Metal Prices

Domain Est. 2012

Website: mtlexs.com

Key Highlights: Mtlexs.com is the World’s first and only database-driven marketplace, dedicated specifically to Non-Ferrous metals, leveraging the speed and power of internet….

#10 Understanding the Price of Bronze Per Pound

Domain Est. 2022

Website: okonrecycling.com

Key Highlights: According to industry experts, aluminum bronze is priced around $2.21 per pound, often surpassing the value of common scrap metals like ……

Expert Sourcing Insights for Bronze Per Kilo Price

H2: 2026 Market Trends for Bronze Price Per Kilo

The global bronze market is poised for notable shifts by 2026, driven by evolving industrial demand, supply chain dynamics, and macroeconomic factors. As a copper-tin alloy prized for its durability, corrosion resistance, and machinability, bronze remains critical in sectors such as marine engineering, electrical components, art, and industrial machinery. This analysis outlines the key trends expected to influence bronze prices per kilogram in 2026.

1. Rising Industrial Demand

By 2026, increased infrastructure development in emerging economies—particularly in Southeast Asia, India, and parts of Africa—is anticipated to boost demand for bronze components. Applications in water treatment systems, shipbuilding, and high-performance bearings will contribute to higher consumption. Additionally, the green energy transition may indirectly support bronze usage in specialized gears and bushings for wind turbines and hydroelectric systems.

2. Influence of Base Metal Prices

Bronze prices are closely tied to the cost of copper (typically 85–90% of bronze composition) and tin. In 2026, copper prices are expected to remain elevated due to supply constraints and growing demand from electrification and renewable energy projects. Tin, though a smaller component, faces geopolitical supply risks (e.g., from Indonesia and Myanmar), which could lead to price volatility and upward pressure on bronze costs. Market analysts project copper prices to average between $9,500 and $11,000 per metric ton in 2026, potentially pushing refined bronze prices to $8.50–$10.50 per kilogram, depending on alloy type and regional premiums.

3. Recycling and Sustainability Trends

Sustainability initiatives will play a growing role in the bronze market. Recycled bronze (scrap bronze) is expected to account for a larger share of supply, helping to moderate price increases. Governments and industries are increasingly incentivizing closed-loop recycling systems, which could stabilize input costs. However, sorting and refining scrap bronze require energy and infrastructure, so logistics and regional recycling capacity will affect local pricing.

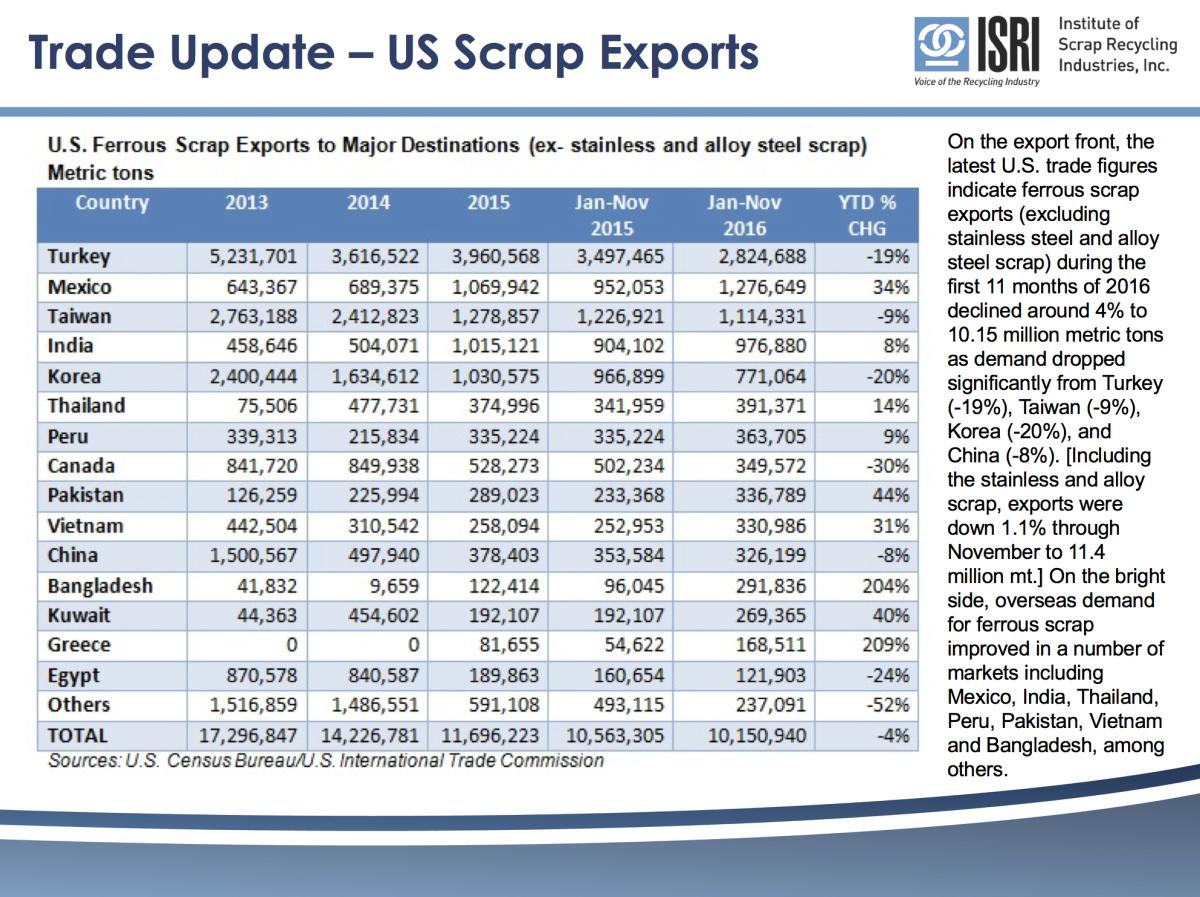

4. Geopolitical and Trade Dynamics

Trade policies, tariffs, and logistics disruptions could impact bronze prices in 2026. Ongoing tensions in global supply chains—especially involving copper- and tin-producing countries—may lead to regional price disparities. For example, China’s dominance in tin refining and alloy production could influence export availability and pricing in global markets.

5. Technological Substitution and Innovation

While bronze remains irreplaceable in many high-wear applications, advances in composite materials and alternative alloys (e.g., aluminum bronzes or engineered plastics) may limit growth in certain sectors. However, bronze’s superior performance in high-load, low-friction environments ensures continued demand. Innovations in bronze manufacturing, such as additive manufacturing (3D printing) with bronze powders, may open new markets and support price resilience.

Conclusion

By H2 2026, the price of bronze per kilogram is expected to reflect a combination of strong underlying demand, base metal cost pressures, and sustainability trends. While exact prices will vary by region and alloy grade, a baseline forecast suggests bronze could trade between $8.00 and $11.00 per kilogram, with peaks during supply disruptions. Market participants should monitor copper and tin markets, geopolitical developments, and industrial output indicators to anticipate price movements.

Common Pitfalls When Sourcing Bronze Per Kilo (Quality and Price)

Sourcing bronze by the kilo based solely on price can lead to significant issues if quality and supplier integrity are overlooked. Below are key pitfalls to avoid:

Overlooking Alloy Composition and Grade Specifications

Bronze is an alloy primarily of copper and tin, but variations in composition (e.g., phosphor bronze, aluminum bronze) greatly affect performance. Suppliers may quote low prices for lower-grade alloys that don’t meet your technical requirements. Always verify the exact alloy designation (e.g., C51000, C95400) and request material test reports (MTRs) to confirm chemical and mechanical properties.

Ignoring Impurity Levels and Material Consistency

Low-cost bronze may contain high levels of impurities (e.g., lead, iron, or sulfur), which compromise durability, machinability, and corrosion resistance. Inconsistent batches can disrupt production and lead to part failure. Ensure suppliers adhere to international standards (e.g., ASTM, ISO) and provide certified analysis.

Focusing Only on Unit Price Without Assessing Total Cost

A low per-kilo price may mask hidden costs such as poor packaging, long lead times, or high shipping fees. Inferior quality may also increase machining time, scrap rates, and warranty claims. Evaluate total cost of ownership, including logistics, quality control, and reliability.

Choosing Suppliers Without Verifying IP and Certification

Unverified suppliers may offer counterfeit or mislabeled materials. Intellectual property (IP) concerns arise when proprietary alloy formulations are involved. Partner with suppliers who provide traceability documentation, mill certifications, and, where applicable, proof of licensed manufacturing rights.

Neglecting Minimum Order Quantities and Scalability

Some suppliers offer attractive per-kilo rates but require high minimum order quantities (MOQs), leading to excess inventory or cash flow strain. Confirm scalability and flexibility in supply terms to align with your production needs.

Relying on Inadequate Quality Control Processes

Low-cost suppliers may lack robust quality assurance systems. Conduct audits or request third-party inspection reports. Poor QC can result in dimensional inaccuracies, internal defects, or non-compliance with industry standards.

Underestimating Lead Times and Supply Chain Risks

Geopolitical factors, customs delays, or supplier capacity issues can disrupt delivery schedules. A slightly higher price from a reliable, local supplier may be more cost-effective than a cheaper international option with unpredictable lead times.

By addressing these pitfalls, buyers can secure bronze at competitive prices without compromising on quality, compliance, or long-term project success.

Logistics & Compliance Guide for Bronze Per Kilo Price

When sourcing or trading bronze by the kilo, understanding the logistics and compliance requirements is essential to ensure smooth operations, cost efficiency, and adherence to legal and industry standards. This guide outlines key considerations related to transportation, documentation, import/export regulations, quality control, and pricing transparency.

Understanding Bronze Pricing Factors

Bronze price per kilo is influenced by several variables, including copper and tin market rates (primary components), alloy composition, form (ingot, scrap, sheet, etc.), purity, and market demand. Prices may also vary based on location, supplier reliability, and order volume. Always verify pricing with up-to-date market benchmarks such as the London Metal Exchange (LME) or regional commodity indices.

Procurement & Supplier Verification

Ensure suppliers are certified and compliant with industry standards (e.g., ISO 9001 for quality management). Request material test reports (MTRs) to confirm alloy composition and mechanical properties. Conduct due diligence on supplier logistics capabilities, lead times, and past performance to avoid delays or quality issues.

Packaging & Handling Requirements

Bronze materials must be packaged to prevent oxidation, contamination, and physical damage. Ingots and scrap should be stored in dry, ventilated areas, preferably on pallets and covered with moisture-resistant wrapping. For international shipping, use corrosion-inhibiting VCI (Vapor Corrosion Inhibitor) packaging where applicable.

Transportation & Freight Logistics

- Domestic Shipping: Use secure, enclosed trucks or containers to prevent theft and weather exposure. Clearly label loads with weight, alloy type, and handling instructions.

- International Shipping: Comply with Incoterms (e.g., FOB, CIF) agreed upon with the supplier. Bronze shipments typically move via containerized海运 (sea freight) or air freight for urgent orders. Ensure proper customs documentation is prepared in advance.

- Weight Management: Since pricing is per kilogram, accurate weighing (using certified scales) at both origin and destination is crucial for invoicing and dispute resolution.

Import/Export Compliance

- HS Codes: Use the correct Harmonized System (HS) code for bronze (e.g., 7404.00 for bronze scrap, 7408.29 for unwrought bronze). Misclassification can lead to delays and penalties.

- Customs Declarations: Provide accurate invoices, packing lists, certificates of origin, and bills of lading. Declare the precise alloy composition and value per kilo.

- Duties & Tariffs: Research import duties, anti-dumping measures, or trade restrictions in the destination country. Some nations impose restrictions on scrap metal exports.

- Regulatory Approvals: In certain countries, non-ferrous metal imports require permits from trade or environmental authorities.

Environmental & Safety Regulations

- REACH & RoHS Compliance: For shipments to the EU, ensure bronze alloys comply with REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) and RoHS (Restriction of Hazardous Substances) directives, especially regarding lead or other restricted elements.

- Hazardous Materials: While bronze is generally non-hazardous, contaminated scrap (e.g., oil-coated or mixed with toxic residues) may be classified as hazardous waste under local laws (e.g., EPA regulations in the U.S.).

- Recycling Standards: If handling scrap bronze, follow local environmental regulations for metal recycling and waste handling.

Quality Assurance & Testing

Conduct independent third-party testing upon receipt to verify:

– Chemical composition (via spectrometry)

– Weight accuracy

– Absence of contamination or counterfeit materials

Discrepancies in quality or weight should be reported immediately to the supplier, with documentation supporting claims for adjustment or return.

Recordkeeping & Traceability

Maintain complete records of transactions, including:

– Purchase orders and contracts

– Certificates of analysis and origin

– Weighbridge tickets

– Customs filings

– Payment records

Traceability is critical for audit purposes and compliance with anti-fraud and anti-money laundering regulations in metal trading.

Risk Mitigation Strategies

- Use letters of credit (LCs) for high-value international transactions.

- Insure shipments against loss, damage, or theft.

- Monitor geopolitical and market risks that may affect supply chains or metal prices.

By following this logistics and compliance guide, businesses can ensure reliable, legal, and cost-effective handling of bronze priced per kilogram across global supply chains.

Conclusion:

Sourcing bronze per kilo price requires a comprehensive evaluation of several factors including the specific bronze alloy composition, market demand, supplier location, order volume, and prevailing metal market trends. Prices can vary significantly based on whether the bronze is new, recycled, or custom-fabricated. Additionally, global copper and tin prices—primary components of bronze—have a direct impact on per-kilo costs. To secure the most competitive pricing, it is essential to obtain quotes from multiple reputable suppliers, consider long-term contracts for price stability, and explore bulk purchasing options. Conducting regular market analysis and maintaining strong supplier relationships will further enable cost-effective and reliable bronze sourcing. Ultimately, balancing quality, cost, and supply chain efficiency is key to successful procurement.