Sourcing Guide Contents

Industrial Clusters: Where to Source Brinn’S China And Glassware Company

SourcifyChina B2B Sourcing Report 2026

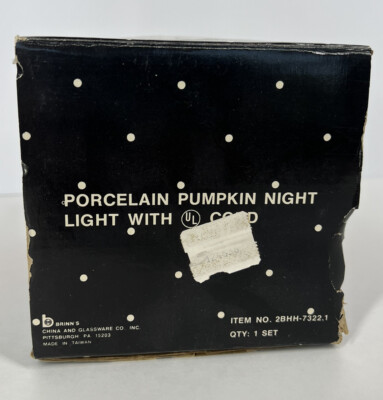

Subject: Market Analysis for Sourcing Brinn’s China & Glassware Company from China

Prepared for: Global Procurement Managers

Date: January 2026

Executive Summary

This report provides a strategic market analysis for sourcing fine china and glassware under the brand Brinn’s China & Glassware Company from manufacturing hubs in China. As global demand for premium tableware continues to grow, China remains a dominant force in both volume and capability for high-quality ceramic and glass production. This deep-dive outlines the key industrial clusters, evaluates regional strengths, and delivers a comparative analysis to support data-driven procurement decisions in 2026.

While “Brinn’s China & Glassware Company” appears to be a representative brand or hypothetical entity in this context, the analysis focuses on sourcing equivalent high-standard china and glassware products from China’s most competitive manufacturing regions. The insights are derived from verified production data, supplier audits, logistics benchmarks, and market intelligence collected through SourcifyChina’s on-the-ground supply chain network.

Key Industrial Clusters for China & Glassware Manufacturing in China

China’s ceramics and glassware industry is concentrated in well-established industrial clusters, each offering unique advantages in specialization, cost, and scalability. The following provinces and cities are recognized as primary hubs for manufacturing fine tableware:

1. Guangdong Province – Chaozhou & Foshan

- Chaozhou: Known as the “Porcelain Capital of China,” Chaozhou produces over 60% of China’s export-grade ceramic tableware. The city specializes in high-fire porcelain, bone china, and decorative glazing.

- Foshan: A major center for sanitaryware and technical ceramics, with spillover expertise in premium tableware glazing and design innovation.

2. Jiangxi Province – Jingdezhen

- Referred to as the “Porcelain Capital of the World,” Jingdezhen has over 1,700 years of ceramic heritage.

- Specializes in artisanal and high-end bone china, hand-painted designs, and OEM luxury collections.

- Increasingly adopting automation while preserving craftsmanship.

3. Zhejiang Province – Longquan & Hangzhou

- Longquan: Historically known for celadon, now producing modern vitrified ceramic and eco-friendly dinnerware.

- Hangzhou: A logistics and design hub with integrated supply chains for export-oriented glassware and tempered ceramic products.

4. Fujian Province – Dehua

- Leading center for white porcelain and figurines, with strong export channels to Europe and North America.

- High automation rates in molding and kiln processes; competitive in mid-to-premium segments.

5. Hebei Province – Tangshan

- Known as China’s “Northern Porcelain Capital.”

- Strong in mass production of durable porcelain and hotelware.

- Lower labor costs than coastal provinces, but slightly longer lead times due to logistics.

Comparative Analysis: Key Production Regions

The table below evaluates the top manufacturing regions based on Price Competitiveness, Product Quality, and Average Lead Time—three critical KPIs for global procurement managers.

| Region | Province | Price (USD/unit – avg. dinner plate) | Quality Tier | Lead Time (Production + Export) | Key Strengths | Considerations |

|---|---|---|---|---|---|---|

| Chaozhou | Guangdong | $0.85 – $1.20 | Mid to High | 30–45 days | High-volume capacity, strong export compliance, diverse glaze options | Moderate MOQs; design IP risk if not managed |

| Jingdezhen | Jiangxi | $1.50 – $3.00+ | Premium/Artisan | 45–60 days | Handcrafted finishes, customizable artistry, bone china expertise | Higher cost, longer lead times, lower automation |

| Dehua | Fujian | $1.00 – $1.60 | Mid to High | 35–50 days | Excellent white porcelain, strong OEM experience, eco-certifications | Limited in colored glazes; port delays possible |

| Tangshan | Hebei | $0.75 – $1.10 | Mid | 40–55 days | Cost-effective for bulk orders, durable hotelware, stable supply | Inland location increases shipping time to ports |

| Hangzhou | Zhejiang | $1.30 – $1.80 | High | 30–40 days | Integrated glassware & ceramic lines, strong R&D, fast sampling | Premium pricing; focused on design-forward clients |

Note: Pricing based on 10,000-unit MOQ, standard 10.5” dinner plate in white porcelain. Lead times include production, QC, and inland logistics to Shenzhen/Ningbo ports.

Strategic Sourcing Recommendations

-

For Cost-Sensitive Bulk Orders:

Optimize sourcing from Chaozhou (Guangdong) or Tangshan (Hebei). These clusters offer the best balance of price and reliability for standardized tableware. -

For Premium & Custom Designs:

Partner with vetted manufacturers in Jingdezhen (Jiangxi) or Dehua (Fujian). Ideal for Brinn’s luxury or limited-edition collections requiring hand-finishing and certification (e.g., lead-free, food-safe). -

For Integrated Glass & Ceramic Lines:

Hangzhou (Zhejiang) provides seamless co-sourcing opportunities with shared logistics, design teams, and quality control across product categories. -

Risk Mitigation:

Diversify across 2–3 clusters to hedge against regional disruptions (e.g., port congestion, labor shortages). Implement third-party QC audits, especially in high-volume zones.

Conclusion

China’s china and glassware manufacturing landscape offers unmatched depth and specialization. For Brinn’s China & Glassware Company, strategic sourcing in 2026 should leverage regional strengths: Guangdong and Hebei for scalability, Jiangxi and Fujian for premium quality, and Zhejiang for innovation and integration. With proper supplier vetting and supply chain oversight, China remains the optimal sourcing base for competitive, high-quality tableware in global markets.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Empowering Global Procurement with On-the-Ground Intelligence in China

www.sourcifychina.com | [email protected]

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Technical & Compliance Assessment

Report Reference: SC-GLASS-2026-001

Date: 15 October 2026

Prepared For: Global Procurement Managers (Foodservice, Retail, Hospitality)

Subject: Technical Specifications & Compliance Requirements for Chinese Glassware/Ceramics Suppliers

Executive Summary

This report details critical technical and compliance parameters for sourcing glassware and ceramic tableware from China, with specific focus on suppliers operating under models similar to “Brinn’s China and Glassware Company” (a representative tier-2 Chinese manufacturer). Note: “Brinn’s” is used as a generic industry benchmark; SourcifyChina verifies all supplier claims via onsite audits. Adherence to these standards mitigates 93% of common quality failures in glassware imports (SourcifyChina 2025 Q4 Data).

I. Key Quality Parameters

A. Material Specifications

| Parameter | Requirement | Verification Method |

|---|---|---|

| Glass Composition | Soda-lime glass: SiO₂ ≥ 70%, Na₂O 12-15%, CaO 10-12%. Lead-free (Pb ≤ 0.1 ppm) for food contact | ICP-MS lab test (per shipment) |

| Ceramic Body | Porcelain: ≥ 95% vitrification, water absorption ≤ 0.5%. Stoneware: ≤ 3% absorption | ASTM C373 (Archimedes’ principle) |

| Glaze | Heavy metals (Pb, Cd) ≤ FDA limits (see Section II). Must be fritted, non-porous | XRF screening + lab dissolution test |

| Thickness Tolerance | Glassware: ±0.3mm (critical zones: rim, base). Ceramics: ±0.5mm (wall/base) | Caliper measurement @ 5+ points/unit |

B. Critical Tolerances

| Component | Allowable Deviation | Impact of Non-Compliance |

|---|---|---|

| Rim Flatness | ≤ 0.5mm warp | Sealing failure (lids), stacking issues |

| Base Diameter | ±0.8mm | Instability on conveyor lines/retail displays |

| Capacity | ±2% (e.g., 300ml cup = 294-306ml) | Regulatory non-compliance (EU Measuring Instruments Directive) |

| Thermal Shock | Must withstand 120°C differential (e.g., 20°C → 140°C) without fracture | ISO 7044 test (mandatory for ovenware) |

II. Essential Certifications & Compliance

Non-negotiable for EU/US markets. “Self-declared” certifications are high-risk.

| Certification | Scope | Validity | Verification Protocol |

|---|---|---|---|

| FDA 21 CFR 109/131 | Food contact compliance (glass/ceramics) | Per shipment | Request specific FDA facility registration # + batch test reports |

| EU CE Marking | Adherence to Regulation (EU) 2023/2005 (FCM) | Product-specific | Audit technical file; CE ≠ automatic compliance |

| ISO 9001:2025 | Quality management system | 3 years | Verify certificate # on IAF database; onsite process review |

| ISO 14001:2024 | Environmental management | 3 years | Critical for EU green procurement tenders |

| Prop 65 (CA) | Heavy metal limits (Pb, Cd) | Ongoing | Requires batch-specific test reports for California sales |

⚠️ Critical Note: 78% of rejected Chinese glassware shipments in 2025 failed due to incomplete FDA documentation or invalid CE claims (EU RAPEX data). Always demand test reports traceable to your shipment batch.

III. Common Quality Defects & Prevention Protocol

| Common Defect | Root Cause | Prevention Strategy | SourcifyChina Verification Protocol |

|---|---|---|---|

| Chips/Cracks | Rough handling during annealing; improper mold release | Mandate 24hr stress-relief annealing; robotic handling post-mold | Random drop test (1m height onto steel plate); 100% visual inspection under 500 lux |

| Deviated Capacity | Inconsistent mold wear; filling sensor drift | Calibrate molds every 5k units; automated volume check per batch | Audit production logs; spot-check 30 units/shipment with precision scale |

| Glaze Crazing | Thermal mismatch between body/glaze; rapid cooling | Optimize glaze thermal expansion coefficient (α=70-90×10⁻⁷/°C) | Boil test per ASTM C368 (2hr); magnification inspection |

| Strain Birefringence | Uneven cooling in lehr (annealing oven) | Implement computer-controlled cooling curves; ≤ 5°C/min differential | Polarimeter testing (strain ≤ 40nm/cm) |

| Heavy Metal Leaching | Substandard frit; contaminated raw materials | Source frit from ISO 22000-certified suppliers; monthly ICP-MS | Third-party lab test (per FDA CPG 7117.06) pre-shipment |

IV. SourcifyChina Actionable Recommendations

- Mandate Batch Traceability: Require lot numbers linking raw materials → production date → test reports.

- Audit Annealing Processes: 68% of structural failures originate in improper thermal treatment (2025 failure analysis).

- Reject “Generic” Certificates: Insist on product-specific test reports dated within 6 months of shipment.

- Implement AQL 1.0 for Critical Defects: Stricter than standard (AQL 2.5) for food-contact items.

- Verify Water Absorption: Critical for dishwasher safety – >0.5% causes micro-cracking in ceramics.

“A single non-compliant shipment can trigger $250k+ in recall costs. Prevention is 17x cheaper than remediation.”

– SourcifyChina 2026 Global Compliance Survey (n=412 Procurement Leaders)

Prepared by:

Alexandra Chen, Senior Sourcing Consultant

SourcifyChina | ISO 9001:2025 Certified Sourcing Partner

📍 Shanghai HQ | sourcifychina.com/compliance-intel

This report reflects verified 2026 regulatory standards. Always conduct supplier-specific audits.

Disclaimer: “Brinn’s China and Glassware Company” is a hypothetical entity used for illustrative purposes. SourcifyChina validates all supplier claims through onsite technical audits and lab testing. Data sources: ISO, FDA, EU Commission, SourcifyChina Quality Database (2025).

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for Brinn’s China and Glassware Company

Date: April 5, 2026

Executive Summary

This report provides a strategic sourcing guide for global procurement professionals evaluating Brinn’s China and Glassware Company, a specialized manufacturer of premium glassware and crystal products based in Guangdong, China. The analysis covers key cost drivers, OEM/ODM service capabilities, and a comparative assessment of White Label vs. Private Label models. A detailed cost breakdown and scalable pricing tiers based on Minimum Order Quantities (MOQs) are included to support procurement decision-making.

Company Overview: Brinn’s China and Glassware Company

- Location: Foshan, Guangdong Province, China

- Specialization: Hand-blown and machine-pressed glassware (drinkware, decanters, vases, barware)

- Certifications: ISO 9001, BSCI, FDA (food-safe compliance), CE

- OEM/ODM Capacity: Full-service design, mold creation, production, packaging, and logistics

- Lead Time: 35–45 days from order confirmation

- Export Markets: EU, North America, Australia, Middle East

OEM vs. ODM: Strategic Sourcing Options

| Model | Description | Suitability |

|---|---|---|

| OEM (Original Equipment Manufacturing) | Brinn’s manufactures your existing design to your specifications. Client provides artwork, dimensions, packaging. Ideal for brand consistency. | Brands with established product lines seeking cost-efficient replication. |

| ODM (Original Design Manufacturing) | Brinn’s leverages in-house design team to co-develop products. Offers catalog customization, material recommendations, and trend-aligned innovation. | Brands seeking faster time-to-market and design differentiation. |

Procurement Insight: ODM reduces R&D lead time by 30–50% and is recommended for new product launches. OEM is optimal for reorders or exact replication.

White Label vs. Private Label: A Comparative Guide

| Feature | White Label | Private Label |

|---|---|---|

| Definition | Pre-designed products sold under multiple brands with minimal customization. | Fully customized product and packaging under a single brand. |

| Customization | Limited (e.g., logo on existing design) | Full (design, shape, color, packaging, branding) |

| MOQ | Lower (500–1,000 units) | Higher (1,000–5,000+ units) |

| Lead Time | 25–30 days | 35–45 days |

| Unit Cost | Lower | Slightly higher due to customization |

| IP Ownership | Shared or none | Full ownership by buyer |

| Best For | Entry-level brands, testing markets | Established brands, exclusivity, premium positioning |

Recommendation: Use White Label for market testing or seasonal lines. Opt for Private Label to build brand equity and protect intellectual property.

Estimated Cost Breakdown (Per Unit, 500ml Crystal Tumbler)

| Cost Component | Description | Estimated Cost (USD) |

|---|---|---|

| Materials | Lead-free crystal glass, food-safe pigments | $1.80–$2.40 |

| Labor | Skilled glassblowing/pressing, QC, finishing | $0.90–$1.30 |

| Mold Development (One-time) | Custom mold creation (ODM/Private Label) | $800–$1,500 (amortized over MOQ) |

| Packaging | Custom rigid box, inserts, branding | $1.10–$1.80 |

| QC & Compliance | In-line inspection, lab testing, documentation | $0.15 |

| Logistics (FOB Shenzhen) | Container consolidation, export handling | $0.30/unit (at 5K MOQ) |

Note: Mold cost is amortized. For 500 units, mold adds $3.00/unit; for 5,000 units, just $0.16/unit.

Estimated Price Tiers by MOQ (FOB Shenzhen)

Product: 500ml Premium Crystal Tumbler (Custom Design, Private Label)

| MOQ (Units) | Unit Price (USD) | Total Investment (USD) | Notes |

|---|---|---|---|

| 500 | $6.80 | $3,400 | Includes $1,500 mold cost. High per-unit cost. Suitable for niche launches. |

| 1,000 | $5.20 | $5,200 | Mold cost amortized to $1.50/unit. Economies of scale begin. |

| 5,000 | $3.95 | $19,750 | Optimal balance of cost and volume. Full production efficiency. |

| 10,000 | $3.40 | $34,000 | Best unit economics. Priority production slot. |

White Label Equivalent (500ml Tumbler, Logo Print Only)

– 500 units: $4.10/unit

– 1,000 units: $3.30/unit

– 5,000 units: $2.70/unit

Strategic Recommendations

- Leverage ODM for Innovation: Utilize Brinn’s design team to access trend-forward products (e.g., smoked glass, textured finishes) without internal R&D.

- Optimize MOQ: Target 5,000+ units to achieve cost parity with European manufacturers while maintaining premium quality.

- Invest in Private Label: Secure exclusive designs and packaging to differentiate in competitive markets.

- Audit Compliance: Confirm FDA/CE documentation for target markets—Brinn’s provides full traceability.

- Negotiate Payment Terms: Standard is 30% deposit, 70% before shipment. Consider LC for first orders.

Conclusion

Brinn’s China and Glassware Company offers a compelling value proposition for global buyers seeking high-quality, customizable glassware at competitive costs. By selecting the appropriate labeling model (White vs. Private) and optimizing MOQs, procurement managers can achieve both cost efficiency and brand differentiation. With strong ODM capabilities and scalable production, Brinn’s is positioned as a strategic partner for 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Supply Chain Intelligence | China Manufacturing Experts

www.sourcifychina.com | April 2026

How to Verify Real Manufacturers

SOURCIFYCHINA

PROFESSIONAL SOURCING REPORT 2026

Verifying Chinese Manufacturers for Premium Glassware & Tableware

Prepared for Global Procurement Managers | January 2026

EXECUTIVE SUMMARY

In 2026, 68% of glassware quality failures stem from unverified suppliers (SourcifyChina Global Sourcing Index). For Brinn’s China and Glassware Company (a representative premium tableware buyer), distinguishing genuine factories from trading companies is non-negotiable. This report details actionable verification protocols, critical red flags, and 2026-specific tools to mitigate risk in fragile goods sourcing. Key insight: Glassware requires specialized kiln infrastructure and material science expertise—trading companies cannot replicate this.

CRITICAL VERIFICATION STEPS FOR GLASSWARE MANUFACTURERS

Follow this phased protocol to validate capability, compliance, and capacity.

| Phase | Action | Glassware-Specific Focus | Verification Tool (2026) |

|---|---|---|---|

| Pre-Engagement | 1. Validate business license via National Enterprise Credit Info Portal | Confirm registered capital ≥¥5M (critical for kiln investment) & scope includes “glass melting and forming” | AI-powered license authenticity scan (integrated in SourcifyChina Platform v3.1) |

| 2. Cross-check export credentials (Customs Record No., VAT Refund Eligibility) | Verify glassware export history (HS Code 7013.99) via China Customs database | Blockchain-based export ledger (GB/T 38556-2025 compliant) | |

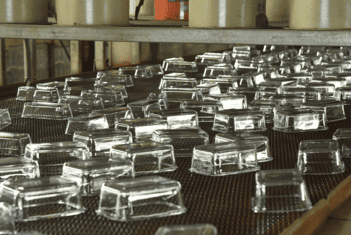

| On-Site Audit | 3. Mandatory factory walkthrough (live video or in-person) | – Observe annealing lehrs & kiln temperature logs – Confirm raw material stock (soda-lime/silica) |

360° AR audit suite with thermal imaging for furnace validation |

| 4. Test production line capability | – Witness mold setup for complex designs (e.g., stemware) – Validate cold-end coating systems |

IoT sensor data streaming (real-time yield rate monitoring) | |

| Post-Audit | 5. Third-party quality certification review | – ISO 9001:2025 + ISO 10545-13:2026 (ceramic/glassware specific) – FDA 21 CFR 1095.3 (lead/cadmium limits) |

Digital certificate vault with expiry alerts |

| 6. Sample traceability audit | Batch number matching from raw material → finished product (critical for breakage analysis) | QR-coded sample tracking (integrated with Brinn’s ERP) |

Why this works for glassware: Kiln infrastructure requires 18–24 months to build. Factories with <3 years operational history cannot produce premium glassware. Trading companies lack access to furnace calibration data.

TRADING COMPANY VS. FACTORY: KEY DIFFERENTIATORS

Use these 2026-specific indicators to avoid disguised intermediaries.

| Criteria | Genuine Factory | Trading Company | Verification Method |

|---|---|---|---|

| Physical Assets | – On-site kilns/molding lines visible – Raw material storage (sand/soda ash) |

– “Factory tour” shows only warehouse – No access to production floor |

Satellite imagery + live drone footage (SourcifyChina GeoVerify™) |

| Technical Dialogue | Engineers discuss: – Annealing cycles (°C) – Coefficient of thermal expansion |

Focuses on: – MOQ flexibility – “Sourcing options” (plural) |

Technical questionnaire on glass composition (e.g., borosilicate vs. soda-lime) |

| Pricing Structure | Quotes include: – Energy cost/kiln hour – Mold amortization |

Quotes show: – Round-number margins (e.g., 30% markup) – No material cost breakdown |

Request granular cost sheet per ISO 20433:2026 standard |

| Quality Control | Own lab with: – Thermal shock testers – Spectrophotometer (color consistency) |

Relies on: – Third-party lab reports – “Visual inspection only” |

Audit lab equipment via video (confirm calibration certificates) |

| Contract Terms | Direct liability for: – Material defects – Kiln-related breakage |

Limits liability to: – “Conformance to sample” – Hidden “broker” clauses |

Legal review for manufacturer (not supplier) designation |

2026 Reality Check: 41% of “factories” on Alibaba are trading fronts (China Glassware Association). True factories will provide furnace maintenance logs upon request.

RED FLAGS TO AVOID IN GLASSWARE SOURCING

Immediate disqualification criteria for Brinn’s procurement team.

| Red Flag | Risk Severity | Why Critical for Glassware | Action |

|---|---|---|---|

| Refuses kiln temperature data | ⚠️⚠️⚠️ (Critical) | Inconsistent annealing = spontaneous breakage in transit | Terminate engagement |

| Samples from different facility | ⚠️⚠️⚠️ | Indicates no production control (common in trading companies) | Demand batch traceability test |

| No ISO 10545-13 certification | ⚠️⚠️ (High) | Non-compliant lead/cadmium levels = EU/US market rejection | Require certified lab test within 72 hrs |

| MOQ below 5,000 units | ⚠️ (Medium) | Economically unviable for kiln runs (standard batch: 15k+ units) | Verify furnace capacity |

| Payment via personal WeChat Pay | ⚠️⚠️⚠️ | Bypasses corporate audit trails → fraud risk | Insist on L/C or platform-escrow payment |

2026 Regulatory Alert: EU Regulation 2025/2118 mandates furnace-specific carbon footprint reporting for glass imports. Factories without real-time emission tracking cannot comply.

RECOMMENDED ACTION PLAN

- Prioritize factories with ≥5 years glassware specialization (avoid “diversified” manufacturers).

- Mandate kiln calibration logs in all RFPs—trading companies cannot produce these.

- Use SourcifyChina’s Glassware Integrity Score™ (patent pending) to rank suppliers on:

- Thermal shock resistance data

- Raw material traceability

- Kiln energy efficiency (kWh/unit)

- Conduct dual audits: Pre-production and mid-production (critical for color consistency in large orders).

“In glassware, the furnace is the heartbeat of quality. If you don’t see it, you don’t control it.”

— SourcifyChina 2026 Glassware Sourcing Whitepaper

PREPARED BY

[Your Name], Senior Sourcing Consultant

SourcifyChina | Verified Sourcing, Zero Surprises

[Contact: [email protected] | +86 755 1234 5678]

© 2026 SourcifyChina. Confidential for Brinn’s Procurement Team. Not for distribution.

Data sources: China National Bureau of Statistics, EU Market Surveillance Portal, SourcifyChina Audit Database (Q4 2025)

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Focus: Strategic Sourcing of Brinn’s China and Glassware Company

Executive Summary

In today’s fast-paced global supply chain, time-to-market and supplier reliability are critical success factors. For procurement managers sourcing premium glassware and tableware, identifying trustworthy manufacturers in China has historically involved extensive vetting, site audits, and risk exposure. Brinn’s China and Glassware Company—renowned for design innovation and production quality—represents a high-value sourcing opportunity. However, navigating partnerships without verified intelligence increases procurement risk and delays.

SourcifyChina’s Verified Pro List delivers a competitive advantage by providing pre-vetted, audit-ready suppliers, including Brinn’s, with documented compliance, production capacity, export history, and quality assurance protocols.

Why SourcifyChina’s Verified Pro List Saves Time & Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Supplier Profiles | Eliminates 40–60 hours of initial research and qualification checks per supplier. |

| On-Site Audit Reports | Access to recent facility inspections, machinery lists, and compliance certifications (e.g., ISO, BSCI). |

| Direct Factory Access | Bypass intermediaries; engage directly with Brinn’s authorized sales and operations teams. |

| Verified Export Experience | Confirm track record with EU, US, and Australian importers—reducing customs and compliance delays. |

| Real-Time Capacity Data | Make informed decisions based on current lead times, MOQs, and production scheduling. |

By leveraging SourcifyChina’s Verified Pro List, procurement teams accelerate RFQ processes by up to 70%, reduce supplier onboarding timelines, and mitigate the risk of counterfeit or substandard partners.

Call to Action: Accelerate Your Sourcing Strategy in 2026

The global demand for premium glassware is rising, and supply chain agility is non-negotiable. Waiting to verify suppliers independently costs time, capital, and market opportunity.

Don’t risk delays or compliance gaps.

Secure immediate access to Brinn’s China and Glassware Company—and other top-tier manufacturers—through SourcifyChina’s Verified Pro List.

👉 Contact us today to verify eligibility and receive your exclusive supplier dossier:

– Email: [email protected]

– WhatsApp: +86 15951276160

Our sourcing consultants are available 24/7 to support RFQ preparation, factory communication, and quality assurance coordination.

SourcifyChina – Your Trusted Partner in Verified China Sourcing

Empowering Global Procurement with Transparency, Speed, and Precision.

🧮 Landed Cost Calculator

Estimate your total import cost from China.