The global automotive brake cylinder market is experiencing steady growth, driven by increasing vehicle production, stringent safety regulations, and rising demand for enhanced braking performance. According to a report by Mordor Intelligence, the global automotive brake market—of which brake cylinders are a critical component—is projected to grow at a CAGR of over 5.2% from 2023 to 2028. This growth is further supported by advancements in braking technologies and the rising adoption of commercial and passenger vehicles in emerging economies. Grand View Research also highlights the expansion of the automotive aftermarket, particularly in regions like Asia-Pacific and Latin America, as a key driver for component demand, including hydraulic brake cylinders. As safety standards tighten and vehicle electrification trends rise, manufacturers are investing in durable, high-performance brake cylinder solutions. In this evolving market landscape, a select group of suppliers have emerged as industry leaders, combining innovation, global reach, and strong R&D capabilities. The following list highlights the top 9 brake cylinder manufacturers shaping the future of automotive and commercial vehicle safety systems.

Top 9 Brake Cylinder Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Wilwood Disc Brakes

Domain Est. 1997

Website: wilwood.com

Key Highlights: Wilwood Engineering is a global leader and manufacturer of high-performance, Original Equipment (OE), disc brake solutions….

#2 BRAKE CYLINDER

Domain Est. 2019

Website: hema-usa.com

Key Highlights: It produces brake cylinders between 16-35 cylinder diameters and serves as an important supplier thanks to its advanced technology and modern assembly lines….

#3 Engine Braking and Valvetrain Technologies

Domain Est. 1990

Website: cummins.com

Key Highlights: We lead the way in designing, testing, and manufacturing high-performing engine brakes for engine OEMs around the world….

#4 BPI: Master Cylinders

Domain Est. 1996

Website: brakepartsinc.com

Key Highlights: The master cylinder offering from Brake Parts Inc (BPI) was developed to give technicians a new part that fits each application as well as the original….

#5 AMC

Domain Est. 1997

Website: brembo.com

Key Highlights: The master cylinder is designed to perform optimally in any weather and terrain conditions, for immediate brake engagement upon lever pressure….

#6 Pneumatic Brake Cylinders – Efficient Brake Actuation

Domain Est. 1997

Website: truck.knorr-bremse.com

Key Highlights: Knorr-Bremse pneumatic brake cylinders convert compressed air into mechanical force, ensuring reliable actuation for various brake systems….

#7 Sierra Specialty Automotive.

Domain Est. 2000

Website: brakecylinder.com

Key Highlights: Antique and custom hydraulic brake and clutch cylinder restoration specialist….

#8 Carlisle Brake & Friction

Domain Est. 2011

Website: carlislecbf.com

Key Highlights: Carlisle Brake & Friction is a leading global solutions provider of high performance and severe duty brake, clutch and transmission applications….

#9 China Brake Master Cylinder,Brake Wheel Cylinder,Clutch Master …

Domain Est. 2019

Website: brake-cylinder.com

Key Highlights: Shuangyi specializes in the production and manufacturing of brake system parts for a wide range of vehicles, including passenger cars, trucks, construction ……

Expert Sourcing Insights for Brake Cylinder

H2: 2026 Market Trends for Brake Cylinders – Industry Outlook and Growth Drivers

The global brake cylinder market is poised for steady growth through 2026, driven by increasing demand for automotive safety systems, advancements in braking technology, and the expansion of the automotive and commercial vehicle sectors. As a critical component of hydraulic braking systems, brake cylinders play a vital role in vehicle performance and safety. This analysis explores key market trends expected to shape the brake cylinder industry in 2026 under several strategic themes.

-

Rising Demand from the Automotive Sector

The growth of the automotive industry—particularly in emerging markets such as India, Southeast Asia, and Latin America—is a primary driver for brake cylinder demand. With rising vehicle production and ownership, manufacturers are increasingly focused on enhancing braking efficiency and reliability. Original Equipment Manufacturers (OEMs) are integrating advanced brake cylinder designs into new models to meet evolving safety regulations, boosting market volume. -

Stringent Safety and Emission Regulations

Governments worldwide are enforcing stricter vehicle safety standards, including requirements for improved braking performance. Regulations such as the UN Regulation No. 13 (Braking Systems) and Euro NCAP safety ratings incentivize automakers to adopt high-performance brake components. In 2026, compliance with these standards will continue to drive innovation and adoption of precision-engineered brake cylinders, particularly in passenger cars and light commercial vehicles. -

Growth in Electric and Hybrid Vehicles

The rapid adoption of electric vehicles (EVs) is reshaping braking system design. While EVs utilize regenerative braking, traditional hydraulic brake cylinders remain essential for fail-safe mechanical braking. In 2026, the integration of brake cylinders with electronic braking systems (such as brake-by-wire) will become more prevalent, creating new opportunities for manufacturers to develop compact, lightweight, and smart brake cylinder solutions. -

Technological Advancements and Material Innovation

Innovation in materials—such as high-strength aluminum alloys and corrosion-resistant coatings—is enhancing the durability and performance of brake cylinders. Additionally, smart sensors integrated into brake systems allow for real-time monitoring of cylinder pressure and wear, contributing to predictive maintenance. By 2026, these advancements will support market growth, particularly in premium and commercial vehicle segments. -

Expansion of Aftermarket and Replacement Demand

As the global vehicle parc ages, the aftermarket for replacement brake components is expanding. Consumers and fleet operators are increasingly prioritizing safety and reliability, leading to higher replacement rates for worn brake cylinders. In 2026, e-commerce platforms and digital distribution networks will further streamline access to aftermarket brake cylinders, particularly in developing regions. -

Regional Market Dynamics

Asia-Pacific is expected to dominate the brake cylinder market in 2026 due to robust automotive manufacturing in China, India, and Japan. North America and Europe will maintain strong demand, driven by vehicle electrification and stringent safety norms. Meanwhile, infrastructure development in Africa and the Middle East is likely to increase demand for commercial vehicles, further stimulating the brake cylinder market. -

Competitive Landscape and Strategic Alliances

Key players such as Bosch, Continental, ZF Friedrichshafen, and Akebono are investing in R&D to develop next-generation brake systems. Strategic partnerships with EV startups and Tier-1 suppliers are expected to intensify by 2026, as companies aim to secure positions in the evolving mobility ecosystem.

Conclusion

By 2026, the brake cylinder market will be characterized by technological innovation, regulatory influence, and shifting vehicle dynamics due to electrification. While traditional applications remain strong, future growth will hinge on adaptability to new vehicle architectures and digital integration. Companies that invest in lightweight materials, smart technologies, and global supply chain resilience are likely to lead the market in the coming years.

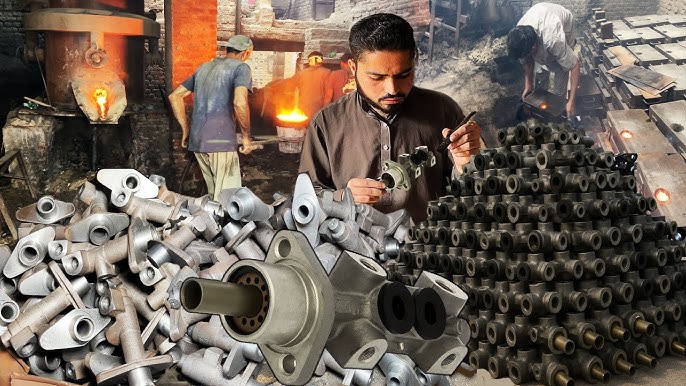

Common Pitfalls Sourcing Brake Cylinders (Quality, IP)

Sourcing brake cylinders involves critical considerations around quality and intellectual property (IP), as failures can lead to severe safety risks and legal consequences. Below are common pitfalls to avoid:

Poor Quality Control and Substandard Materials

Many suppliers, especially low-cost manufacturers, may use inferior materials or lack rigorous quality assurance processes. This can result in brake cylinders prone to corrosion, leaks, or mechanical failure under pressure. Always verify certifications (e.g., ISO/TS 16949), conduct factory audits, and demand sample testing to ensure compliance with industry standards like SAE J110 or ISO 4925.

Inadequate or Misrepresented IP Compliance

Sourcing brake cylinders without proper IP due diligence can lead to infringement claims. Some suppliers may reverse-engineer proprietary designs or falsely claim licensing rights. Ensure suppliers provide documentation proving legitimate IP ownership or authorized manufacturing rights, and consider conducting IP clearance searches before finalizing contracts.

Lack of Traceability and Documentation

A common quality issue arises when suppliers fail to provide full traceability—such as batch numbers, material certifications, or test reports. This complicates recalls and regulatory compliance. Insist on comprehensive documentation as part of the procurement agreement.

Overlooking Compatibility and Specifications

Brake cylinders must precisely match OEM specifications for bore size, stroke length, mounting configuration, and fluid compatibility. Sourcing generic or “compatible” parts without verifying exact specifications can lead to performance issues or system failure. Always cross-reference technical drawings and performance data.

Failure to Address Aftermarket vs. Genuine Parts Confusion

Some suppliers market aftermarket or imitation parts as OEM-equivalent without meeting the same performance or durability standards. Clearly define requirements for original equipment quality and avoid ambiguous terms like “OEM style” without technical validation.

Inconsistent Production and Process Validation

Even if initial samples meet standards, inconsistent production processes can introduce defects. Avoid suppliers who skip PPAP (Production Part Approval Process) or do not maintain process control. Regular production audits and ongoing quality checks are essential.

Insufficient Legal Protections in Contracts

Procurement agreements often neglect IP indemnification clauses or quality breach remedies. Ensure contracts include warranties, liability for IP infringement, and clear recourse in case of non-conforming goods.

By addressing these pitfalls proactively, organizations can mitigate risks related to both the functional reliability and legal integrity of sourced brake cylinders.

Logistics & Compliance Guide for Brake Cylinder

Product Classification & Regulatory Requirements

Brake cylinders, as critical components of vehicle braking systems, are subject to stringent regulatory standards to ensure safety and performance. These components typically fall under automotive safety regulations governed by international and regional authorities. Key compliance frameworks include the UN Regulation No. 13 (Braking), FMVSS 105 and 121 in the United States (NHTSA), and ECE R13 in Europe (type approval under UNECE). Manufacturers and distributors must ensure that brake cylinders are certified with appropriate markings (e.g., E-mark, DOT) and accompanied by technical documentation, including test reports and conformity certificates. Additionally, adherence to ISO 9022 (environmental testing) and ISO 8124 (mechanical safety) may apply depending on the component’s design and use.

Packaging & Handling Standards

Proper packaging is essential to prevent damage during transit and storage. Brake cylinders must be packed in sturdy, corrosion-resistant containers with internal cushioning (e.g., foam inserts or molded plastic) to protect against shock, vibration, and moisture. Individual units should be sealed in anti-corrosion barrier bags (VCI or dry air sealed) when appropriate, especially for export. Labels must include product identification, batch/lot numbers, handling instructions (e.g., “Fragile,” “Do Not Stack”), and compliance marks. Handling should follow ESD-safe practices where applicable, and storage areas must be dry, temperature-controlled, and free from contaminants such as dust or chemicals.

Transportation & Shipping Documentation

Brake cylinders are generally non-hazardous goods and can be shipped via standard freight methods (air, sea, or ground). However, proper classification under the Harmonized System (HS Code) is crucial for customs clearance—common codes include 8708.30 (parts of braking systems). Required shipping documents include a commercial invoice, packing list, bill of lading or air waybill, and a Certificate of Conformity (CoC) where mandated. For international shipments, exporters must comply with import regulations of the destination country, including potential requirements for product registration (e.g., INMETRO in Brazil, KC Mark in South Korea). Incoterms (e.g., FOB, DDP) should be clearly defined in contracts to allocate responsibilities.

Import & Export Compliance

Exporters must verify destination-specific regulatory requirements and ensure all certifications are valid in the target market. U.S. exporters should screen parties against denied persons lists (e.g., BIS, OFAC), while EU exporters must comply with dual-use regulations if applicable. Importers are responsible for duties, taxes, and local conformity assessments. Use of an Automated Export System (AES) filing (U.S.) or Export Control System (ECS) in the EU may be required. Special attention should be given to trade agreements (e.g., USMCA, RCEP) that may reduce tariffs for qualifying goods. Recordkeeping of all compliance documentation is mandatory for a minimum of five years in most jurisdictions.

Quality Assurance & Traceability

Each brake cylinder must be fully traceable through its production lifecycle. Manufacturers should implement a quality management system compliant with IATF 16949, which governs automotive production. Serial or batch numbering, coupled with documented inspection records (incoming, in-process, and final), ensures accountability and facilitates recalls if necessary. Suppliers must provide material certifications (e.g., RoHS, REACH) where applicable, particularly for metals and elastomers used in construction. Regular audits and supplier assessments are recommended to maintain compliance and product integrity across the supply chain.

Conclusion for Sourcing Brake Cylinders

Sourcing brake cylinders requires a strategic approach that balances quality, cost, reliability, and compliance with industry standards. After evaluating potential suppliers, technical specifications, and market conditions, it is clear that selecting a supplier involves more than just competitive pricing. Critical factors such as product durability, certification to safety standards (e.g., ISO, DOT, or OEM requirements), consistent manufacturing quality, and responsive after-sales support must be prioritized.

Local versus global sourcing decisions should consider lead times, supply chain resilience, and total cost of ownership. Establishing strong relationships with pre-qualified suppliers, conducting regular audits, and implementing stringent quality control measures are essential for minimizing risk and ensuring long-term performance.

In conclusion, a well-structured sourcing strategy for brake cylinders—rooted in thorough supplier evaluation, risk assessment, and alignment with technical and safety requirements—will ensure reliable supply, enhance vehicle safety, and support operational efficiency across automotive or industrial applications.