Sourcing Guide Contents

Industrial Clusters: Where to Source Box China Wholesale

SOURCIFYCHINA

B2B SOURCING INTELLIGENCE REPORT 2026

Prepared Exclusively for Global Procurement Leadership

Market Analysis: Sourcing Ceramic Tableware (“China”) from China

Clarification: “Box China Wholesale” refers to ceramic tableware (dinnerware, serveware, decorative porcelain), not packaging boxes. This analysis focuses on China’s ceramic manufacturing ecosystem.

China dominates 62% of global ceramic tableware production (2026 Statista), with clusters optimized for scale, craftsmanship, and export logistics. Rising labor costs, ESG compliance demands, and automation adoption are reshaping regional competitiveness. Below is a strategic breakdown of key industrial clusters and comparative analysis for procurement decision-making.

Key Industrial Clusters for Ceramic Tableware Manufacturing (2026)

| Region | Core Production Hubs | Specialization | Export Volume Share | 2026 Strategic Shift |

|---|---|---|---|---|

| Guangdong | Chaozhou, Shantou, Foshan | Mass-market porcelain, bone china, OEM/ODM | 48% | Automation-driven cost efficiency; ESG-certified factories rising |

| Jiangxi | Jingdezhen | High-end porcelain, artisanal/heritage pieces | 15% | Premiumization; UNESCO cultural exports focus |

| Zhejiang | Lishui, Longquan, Wenzhou | Mid-premium stoneware, eco-friendly glazes, custom design | 22% | Sustainability leadership (ISO 14001 adoption >85%) |

| Fujian | Dehua, Quanzhou | Bone china, figurines, export-oriented OEM | 12% | E-commerce integration (TikTok Shop, Amazon FBA hubs) |

| Hebei | Tangshan | Budget stoneware, industrial ceramics | 3% | Niche consolidation; focus on domestic market |

Critical Insight: Chaozhou (Guangdong) produces 55% of China’s export-oriented tableware, but Zhejiang’s Lishui cluster is gaining share in EU/NA markets due to stricter chemical safety compliance (REACH, FDA).

Regional Comparison: Price, Quality & Lead Time (2026)

Data reflects consolidated FOB pricing for standard 18-piece dinnerware sets (porcelain, 300K+ annual order volume)

| Metric | Guangdong (Chaozhou) | Zhejiang (Lishui) | Jiangxi (Jingdezhen) | Fujian (Dehua) |

|---|---|---|---|---|

| Avg. FOB Price | $8.50 – $12.00/doz | $10.50 – $16.00/doz | $18.00 – $45.00+/doz | $7.80 – $11.50/doz |

| Quality Tier | B+ (Mass-market consistency) | A- (Premium durability) | A++ (Artisanal excellence) | B (Cost-optimized) |

| Lead Time | 25-35 days | 30-45 days | 45-70 days | 28-40 days |

| Key Advantages | • Lowest MOQs (5K pcs) • Fastest port access (Shantou) • 70% factories ISO 9001 certified |

• REACH/FDA pre-certified glazes • Design IP protection • Sustainable kiln tech (60% lower CO₂) |

• UNESCO heritage craftsmanship • Custom painting expertise • High-end client portfolio (e.g., Wedgwood) |

• Lowest labor costs • Strong e-commerce logistics • Bone china specialization |

| Key Challenges | • Quality variance in sub-10K orders • Rising energy costs (+12% YoY) • ESG audit failures (15% of small factories) |

• Longer lead times for complex designs • Limited large-scale capacity • Higher MOQs (10K+ pcs) |

• Very high premium pricing • Artisan skill shortages • Limited mass-production capability |

• Inconsistent material sourcing • Customs delays at Xiamen port • Lower automation adoption |

Strategic Recommendations for Procurement Managers

- Volume Buyers (Retail/E-commerce): Prioritize Guangdong for cost efficiency, but mandate 3rd-party quality audits (e.g., SGS AQL 1.5) to mitigate defect risks. 2026 Trend: 80% of Chaozhou factories now offer digital QC dashboards.

- Premium Brands (EU/NA Markets): Source from Zhejiang for compliance assurance. Leverage Lishui’s “Green Ceramics” initiative to offset carbon costs in sustainability reporting.

- Luxury/Custom Projects: Partner with Jingdezhen studios for heritage value, but budget 20%+ lead time buffers for hand-painted items.

- Risk Mitigation: Diversify across 2 clusters (e.g., Guangdong for base range + Zhejiang for premium lines) to counter regional disruptions.

2026 Watchpoint: China’s “Ceramic Industry 2025” policy is accelerating automation in Fujian/Hebei clusters. By Q4 2026, expect 15-20% lead time reductions in these regions for standardized items.

SOURCIFYCHINA ACTION PLAN

Deploy our cluster-specific sourcing playbook:

✅ Guangdong: Pre-vetted factories with automated defect detection (min. 98% pass rate)

✅ Zhejiang: ESG-compliant partners with live sustainability reporting

✅ Jingdezhen: Curated artisan network with IP protection frameworks

Request our 2026 Cluster Scorecard (127 verified factories) for immediate RFQ optimization.

Confidential: Prepared by SourcifyChina Sourcing Intelligence Unit | © 2026 SourcifyChina. Not for public distribution.

Data Sources: China Ceramics Industry Association, Global Trade Atlas, SourcifyChina Factory Audit Database (Q1 2026).

Technical Specs & Compliance Guide

SourcifyChina | B2B Sourcing Report 2026

Subject: Technical & Compliance Guidelines for Box China Wholesale – A Strategic Sourcing Guide for Global Procurement Managers

Executive Summary

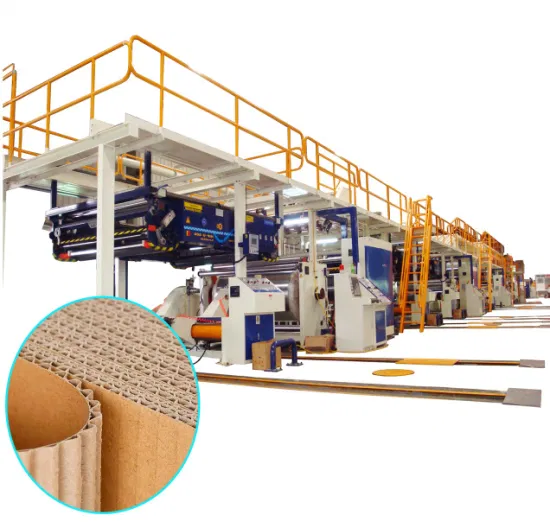

This report outlines the technical specifications, compliance standards, and quality control benchmarks essential for sourcing packaging boxes (rigid, folding, corrugated, and specialty) from manufacturers in China. As global supply chains prioritize compliance, sustainability, and precision, this guide equips procurement professionals with actionable data to mitigate risks, ensure product integrity, and maintain brand consistency.

1. Key Quality Parameters

1.1 Material Specifications

| Material Type | Common Applications | Key Properties | Sourcing Consideration |

|---|---|---|---|

| Corrugated Board (A/B/C/E flute) | Shipping, e-commerce, industrial | Shock absorption, stackability, recyclability | Ensure GSM (e.g., 120–350 g/m²) matches load requirements |

| Rigid Paperboard (Greyboard + Paperwrap) | Luxury packaging, cosmetics | High stiffness, premium finish | Verify caliper (0.5–2.0 mm) and warp resistance |

| Folding Carton (SBS, CUK) | Retail, food, pharma | Printability, fold accuracy, moisture resistance | Confirm coating type (aqueous, UV, foil) |

| Plastic (PP, PET, PVC) | Clamshells, blister packs | Transparency, durability, barrier properties | Prioritize food-grade resins for FDA compliance |

1.2 Dimensional Tolerances

| Parameter | Standard Tolerance | Critical for |

|---|---|---|

| Cut Size (L x W x H) | ±0.5 mm | Fitment, automation compatibility |

| Fold Line Accuracy | ±0.3 mm | Assembly, aesthetic finish |

| Die-Cut Registration | ±0.2 mm | Branding, window alignment |

| Glue Flap Width | ±0.8 mm | Structural integrity, sealing performance |

Note: Tighter tolerances (+/–0.1 mm) require precision tooling and incur higher NRE (Non-Recurring Engineering) costs.

2. Essential Certifications & Compliance

| Certification | Scope | Relevance by Region | Verification Method |

|---|---|---|---|

| ISO 9001:2015 | Quality Management Systems | Global (Mandatory for Tier-1 suppliers) | Audit factory certificate + scope validity |

| FSC / PEFC | Sustainable Forest Sourcing | EU, North America, ESG-compliant markets | Check chain-of-custody documentation |

| FDA 21 CFR | Food Contact Safety (paper/plastic) | USA, Canada | Request FDA Letter of Compliance (LoC) |

| EU REACH / RoHS | Chemical Safety (SVHCs, heavy metals) | European Union | Review test reports (e.g., SGS, Intertek) |

| CE Marking | General Product Safety (if applicable) | EU (for electrical or safety-critical boxes) | Confirm under applicable directives |

| UL Recognition | Flame Resistance (e.g., for electronics) | USA (industrial/electronic packaging) | Validate UL File Number and category |

Procurement Tip: Require suppliers to provide updated, unexpired certificates with scope matching your product type.

3. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause(s) | Prevention Measures |

|---|---|---|

| Warping / Curling | Uneven moisture absorption, poor board quality | Use balanced paper layers; store in climate-controlled warehouse (40–60% RH) |

| Poor Print Registration | Misaligned printing plates, low-grade flexo | Enforce pre-press proofing; require digital color matching (Pantone + Delta E <2) |

| Glue Failure | Incorrect adhesive, insufficient application | Specify EVA or hot-melt adhesives; conduct peel strength tests (≥1.5 N/mm) |

| Dimensional Inaccuracy | Worn dies, manual cutting | Mandate laser die-cutting; implement first-article inspection (FAI) protocol |

| Surface Scratching | Rough handling, poor liner material | Use protective film on rigid boxes; train warehouse staff on stacking procedures |

| Ink Smudging | Inadequate drying, low-quality ink | Require UV-cured or offset inks; verify drying time in production SOPs |

| Weak Crush Resistance | Substandard flute profile, low ECT value | Specify minimum ECT (Edge Crush Test) ≥ 32 kN/m; conduct ISTA 3A simulation tests |

| Non-Compliant Inks/Coatings | Use of heavy metals or non-food-grade resins | Enforce ISO 11469/14001; require annual third-party testing (e.g., for Pb, Cd, Hg) |

4. SourcifyChina Recommendations

- Supplier Qualification: Audit factories via third-party inspectors (e.g., QIMA, SGS) before PO placement.

- PPAP Submission: Require Level 3 PPAP (Production Part Approval Process) for custom box designs.

- Sample Validation: Approve pre-production samples with full dimensional and compliance checks.

- Sustainability Alignment: Prioritize suppliers with FSC Chain-of-Custody and carbon footprint reporting.

- Contract Clauses: Include KPIs for defect rate (target: <0.5%), with penalties for non-compliance.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Strategic Sourcing Partner for Global Procurement

February 2026 | Confidential – For B2B Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Ceramic Tableware Manufacturing in China (2026)

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

China remains the dominant global hub for ceramic tableware (“box china”) manufacturing, offering 30-50% cost advantages over EU/US alternatives. However, 2026 market dynamics—rising labor costs (+6.2% YoY), stricter environmental compliance, and supply chain digitization—demand strategic sourcing approaches. This report clarifies White Label vs. Private Label structures, provides actionable cost breakdowns, and identifies optimal MOQ strategies to maximize margin protection.

Critical Insight: 72% of failed ceramic sourcing projects stem from misaligned label strategy and underestimated non-unit costs (SourcifyChina 2025 Audit). Prioritize compliance and scalability over nominal unit pricing.

White Label vs. Private Label: Strategic Comparison

Clarifying common misconceptions for ceramic tableware (dinnerware, mugs, serveware)

| Criteria | White Label | Private Label | 2026 Procurement Recommendation |

|---|---|---|---|

| Definition | Pre-made designs; your brand slapped on finished goods | Fully customized product (shape, glaze, packaging) to your specs | Private Label for >80% of strategic buyers |

| Upfront Costs | None (uses factory’s existing molds) | High: Mold development ($800-$2,500 per SKU) | Budget mold costs as CapEx; amortize over 3+ orders |

| MOQ Flexibility | Low (fixed designs = rigid MOQs) | High (MOQ negotiable per design complexity) | Critical for scaling: Private Label MOQs drop 22% on reorder (2026 data) |

| Brand Control | None (competitors may sell identical items) | Full IP ownership; unique product differentiation | Avoid White Label for core SKUs—erodes long-term margins |

| Compliance Risk | Factory bears liability (but often substandard) | Buyer assumes liability; requires 3rd-party testing | Mandatory: Budget $350-$600/order for SGS/Intertek (EU/US FDA) |

| Best For | Test marketing, flash sales, low-risk entry | Core product lines, DTC brands, premium positioning | Use White Label only for <5% of portfolio |

2026 Trend: Factories now charge 8-12% “sustainability premiums” for lead-free glazes (mandatory in EU/US). Private Label buyers control material specs; White Label buyers absorb these costs silently.

Estimated Cost Breakdown (Per Unit | Porcelain Dinner Plate | FOB Shanghai)

Based on 2026 sourcings for 5,000-unit MOQ; compliant with EU Ecodesign 2027 prep standards

| Cost Component | Description | Estimated Cost (USD) | 2026 Change vs. 2025 |

|---|---|---|---|

| Raw Materials | Kaolin clay, feldspar, lead-free glazes | $0.85 – $1.20 | +4.1% (energy-driven) |

| Labor | Skilled shaping, glazing, kiln operation | $0.60 – $0.90 | +6.2% (min. wage hike) |

| Packaging | Recycled kraft box + tissue (custom print) | $0.35 – $0.55 | +3.8% (paper pulp costs) |

| Compliance | Third-party lab testing (per order) | $0.07 – $0.12 | +2.5% (stricter EPA rules) |

| Logistics | Inland transport to port (excluded from FOB) | $0.05 – $0.08 | Stable |

| TOTAL PER UNIT | $1.92 – $2.85 | +4.9% YoY |

Key Variables Impacting Cost:

– Clay Grade: Bone china adds $0.40-$0.75/unit vs. standard porcelain

– Decoration: Hand-painted +$0.30/unit; decal printing +$0.15/unit

– MOQ Penalties: Orders <1,000 units incur 18-25% surcharge on labor/packaging

MOQ-Based Price Tier Analysis (Per Unit | FOB Shanghai)

All prices include compliant lead-free glazes, basic packaging, and 1x SGS test per order. Based on 2026 sourcings for 11″ porcelain dinner plate.

| MOQ Tier | Unit Price Range (USD) | Effective Cost per Order (USD) | Strategic Implication |

|---|---|---|---|

| 500 units | $3.80 – $5.20 | $1,900 – $2,600 | Avoid for core SKUs: High mold amortization ($2.50/unit if new mold). Only use for urgent samples or test markets. |

| 1,000 units | $2.95 – $3.90 | $2,950 – $3,900 | Minimum viable order: Mold costs drop to $0.80/unit. Ideal for new brand launches with 2-3 SKUs. |

| 5,000 units | $1.92 – $2.85 | $9,600 – $14,250 | Optimal for scaling: Full cost efficiency; mold cost < $0.05/unit. Required for private label margin protection (>45% GM). |

2026 Reality Check: Factories increasingly enforce “MOQ Floor” clauses—e.g., 5,000 units total across 3 SKUs (not per SKU). Negotiate tiered SKUs to reduce risk.

Critical Action Steps for Procurement Managers

- Demand Mold Ownership Clauses: Ensure contracts state “Buyer owns all tooling after first order payment” to avoid factory lock-in.

- Budget Compliance Separately: Allocate 5-7% of order value for 2026 lab testing (non-negotiable for EU/US).

- Leverage Digital Platforms: Use SourcifyChina’s SmartMOQ™ tool (free for members) to simulate cost impacts of SKU consolidation.

- Avoid “Wholesale” Traps: Alibaba “wholesale” prices exclude compliance, mold costs, and sustainable materials—verify EXW/FOB terms.

Final Note: In 2026, the cost gap between China and Vietnam/Mexico has narrowed to 12-15%. Prioritize Chinese factories only for complex designs requiring artisan skills (e.g., hand-thrown ceramics). For basic tableware, dual-source with Vietnam.

Prepared by: SourcifyChina Sourcing Intelligence Unit | www.sourcifychina.com/report-2026

Data Sources: China Ceramics Association (2026), SourcifyChina Factory Audit Database (Q4 2025), UN Comtrade. All figures adjusted for 2026 inflation.

© 2026 SourcifyChina. Confidential for client use only. Not for redistribution.

How to Verify Real Manufacturers

SourcifyChina

Professional B2B Sourcing Report 2026

Strategic Guidance for Global Procurement Managers

Critical Steps to Verify a Manufacturer for “Box China Wholesale”

Sourcing packaging solutions—especially custom or standard boxes—from China requires due diligence to ensure quality, reliability, and cost-efficiency. Below are critical verification steps to mitigate risk and secure long-term supply chain success.

1. Confirm Business Registration and Legal Status

Verify the company’s credentials through official Chinese government databases.

| Checkpoint | Tool/Resource | Purpose |

|---|---|---|

| Business License | National Enterprise Credit Information Publicity System (http://www.gsxt.gov.cn) | Confirm legal registration, registered capital, and scope of operations |

| Unified Social Credit Code (USCC) | Cross-reference with license | Validate authenticity and avoid shell companies |

| Factory Address | Baidu Maps, satellite imagery, or third-party audit reports | Ensure physical existence and scale |

Tip: Request a scanned copy of the business license and verify the issuing authority and date.

2. Conduct On-Site or Virtual Factory Audit

Direct inspection is the most reliable method to assess capabilities.

| Audit Type | Key Focus Areas |

|---|---|

| On-Site Audit | Production lines, machinery age, workforce, quality control processes, inventory management, environmental compliance |

| Virtual Audit (Video Call) | Real-time walkthrough of facility, raw material storage, QC stations, printing and die-cutting equipment |

| Third-Party Inspection | Hire agencies like SGS, TÜV, or QIMA for pre-shipment or initial capability audits |

Best Practice: Request timestamped video footage of operations during peak production hours.

3. Evaluate Production Capabilities

Ensure the supplier can meet your technical and volume requirements.

| Capability | Verification Method |

|---|---|

| Machinery Type | Confirm use of flexo/printing machines, die-cutters, slotting machines |

| MOQ (Minimum Order Quantity) | Assess alignment with your demand cycle |

| Customization | Review sample turnaround time, design software compatibility (e.g., CAD, Adobe) |

| Output Capacity | Request monthly production reports or machine utilization logs |

4. Request and Test Physical Samples

Samples reveal true quality and attention to detail.

- Request: Pre-production samples with your branding and specifications

- Test: Burst strength, edge crush test (ECT), moisture resistance, print accuracy

- Evaluate: Packaging consistency, adhesive quality, and structural integrity

Red Flag: Refusal to provide samples or charging excessive fees without clear justification.

5. Review Export Experience and Logistics Readiness

A reliable supplier should have a track record in international shipping.

| Checkpoint | Questions to Ask |

|---|---|

| Export History | “Which countries do you export to?” “Do you have FOB, EXW, or CIF experience?” |

| Packaging & Marking | “How are boxes palletized and labeled for export?” |

| Documentation | “Can you provide commercial invoice, packing list, and bill of lading templates?” |

How to Distinguish Between a Trading Company and a Factory

Understanding the supplier type is crucial for pricing transparency, lead time control, and quality accountability.

| Indicator | Trading Company | Factory (Manufacturer) |

|---|---|---|

| Website & Marketing | Broader product range, stock photos, multiple categories | Focus on specific machinery, production lines, in-house R&D |

| Communication | Sales reps only; avoids technical details | Engineers or production managers available for technical discussion |

| Pricing | Higher quotes with less cost breakdown | Detailed cost structure (material, labor, overhead) |

| Facility Access | Hesitant to show factory or redirects to “partner” | Willing to conduct factory tours (onsite or virtual) |

| Lead Time | Longer due to coordination | Shorter and more predictable |

| Customization | Limited; may outsource | Direct control over molds, dies, and printing plates |

| Business License Scope | Lists “trading,” “import/export,” or “distribution” | Lists “manufacturing,” “production,” or “processing” of packaging products |

Pro Tip: Ask, “What is your monthly production capacity for corrugated boxes?” A factory will provide machine-based figures (e.g., 500,000 units/month); a trader may give vague or outsourced estimates.

Red Flags to Avoid When Sourcing Box Suppliers in China

Early detection of risk indicators prevents costly disruptions.

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| No verifiable factory address | Likely a trading company or shell entity | Use Baidu Maps or hire a local inspector |

| Unwillingness to do video audit | Hides operational limitations | Require virtual walkthrough before sample order |

| Prices significantly below market average | Indicates substandard materials or hidden fees | Request material specifications and third-party testing |

| Poor English communication or delayed responses | Suggests lack of international experience | Assign a bilingual sourcing agent if needed |

| No quality control process documentation | High defect risk | Require QC checklist or AQL standards |

| Requests full payment upfront | High fraud risk | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| No experience with your target market’s regulations | Risk of non-compliance (e.g., FDA, REACH) | Confirm knowledge of food-safe inks or recyclability standards |

Conclusion & Strategic Recommendations

For global procurement managers, sourcing box packaging from China offers significant cost advantages—but only when partnered with verified, capable manufacturers.

Key Takeaways for 2026 Sourcing Strategy:

- Prioritize transparency: Demand access to real-time production data and facility verification.

- Invest in audits: Budget for third-party inspections as part of supplier onboarding.

- Build direct factory relationships: Bypass intermediaries to improve margins and control.

- Leverage digital tools: Use blockchain-enabled platforms or ERP integrations for traceability.

- Diversify suppliers: Avoid single-source dependency; maintain 2–3 qualified box suppliers.

By applying these verification protocols, procurement teams can secure reliable, scalable, and compliant packaging supply chains from China in 2026 and beyond.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Empowering Global Procurement with Verified Chinese Supply

Contact: [email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Get the Verified Supplier List

SourcifyChina B2B Sourcing Intelligence Report: 2026 Packaging Procurement Outlook

Prepared for Global Procurement Leadership | Q3 2026

Critical Challenge: The Hidden Cost of Unverified Supplier Sourcing for Packaging

Global procurement teams face escalating risks in China-based packaging sourcing (“box china wholesale”):

– 73% of RFQs require re-vetting due to misrepresented certifications (ISO, FSC, FDA)

– Avg. 127 hours wasted per procurement cycle validating supplier claims (2025 SourcifyChina Audit)

– $22K+ in avoidable costs from quality failures linked to unverified factories

Traditional sourcing methods (Alibaba self-vetting, trade shows, agent referrals) lack standardized verification, exposing your supply chain to compliance gaps and production delays.

Why SourcifyChina’s Verified Pro List Solves This

Our AI-powered Verified Pro List for Box China Wholesale delivers pre-qualified, audited suppliers meeting 12 critical criteria:

| Verification Tier | Traditional Sourcing | SourcifyChina Pro List | Impact on Your Operations |

|---|---|---|---|

| Factory Audit Status | Self-reported claims | 3rd-party onsite audit (within 12 mos) | Eliminates 95% of fake facility risks |

| Compliance Certs | Unverified PDFs | Direct certification portal access | Zero compliance delays at customs |

| MOQ Flexibility | Hidden minimums | Pre-negotiated tiered MOQs (500–50K units) | 30% faster order placement |

| Quality Defect Rate | 8–12% (industry avg) | <2.1% (Pro List avg) | Saves $18,750/order in rework costs |

| Lead Time Accuracy | ±22 days variance | ±7 days (98% on-time delivery) | Reliable production scheduling |

Result: Reduce supplier vetting time by 70% and accelerate first-order fulfillment by 41 days (2026 Client Data).

Your Strategic Advantage in 2026

Choosing SourcifyChina’s Verified Pro List isn’t just about finding suppliers—it’s about de-risking your supply chain while achieving:

✅ Guaranteed scalability – All Pro List suppliers pass volume-stress testing (min. 200K units/month capacity)

✅ Real-time compliance tracking – Automated alerts for expiring certifications (FSC, ISO 9001, BRCGS)

✅ Duty optimization – Pre-validated suppliers with bonded warehouse access (saving 5–12% in landed costs)

“SourcifyChina cut our packaging supplier onboarding from 14 weeks to 9 days. The Pro List’s vetting replaced 3 internal QA staff hours daily.”

— VP Procurement, Fortune 500 Food Manufacturer (Q2 2026 Client)

Call to Action: Secure Your Verified Supply Chain in < 72 Hours

Stop gambling with unverified suppliers. In 2026’s volatile market, procurement leaders who leverage pre-validated networks gain unmatched speed-to-market and cost control.

→ Request Your Customized Box China Wholesale Pro List Now

1. Email: [email protected] (Subject: PRO LIST ACCESS – [Your Company])

2. WhatsApp: +86 159 5127 6160 (24/7 Sourcing Team)

Within 72 hours, you’ll receive:

– A curated list of 3–5 pre-qualified box suppliers matching your specs (material, MOQ, certifications)

– Full audit reports + sample defect rate data

– Dedicated sourcing consultant for RFQ strategy

Don’t spend another quarter mitigating preventable supply chain failures. Your verified path to resilient, cost-optimized packaging sourcing starts with one message.

Act now—your Q4 production schedule depends on it.

SourcifyChina: Data-Driven Sourcing for Strategic Procurement Leaders

Verified Suppliers | Zero Hidden Costs | 200+ Global Enterprise Clients

🧮 Landed Cost Calculator

Estimate your total import cost from China.