The global lubricants market is experiencing steady growth, driven by rising industrialization, increased automotive production, and expanding demand for high-performance engine oils. According to a report by Mordor Intelligence, the global lubricants market was valued at USD 87.6 billion in 2023 and is projected to grow at a CAGR of over 3.5% from 2024 to 2029. With performance and efficiency becoming critical differentiators, BOOS oil—known for its high thermal stability and enhanced engine protection—has emerged as a preferred choice across automotive and industrial applications. This growing demand has catalyzed the rise of specialized BOOS oil manufacturers focusing on synthetic and semi-synthetic formulations. Based on market presence, production capacity, innovation, and regional reach, the following five manufacturers stand out as industry leaders in the rapidly evolving BOOS oil segment.

Top 5 Boos Oil Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

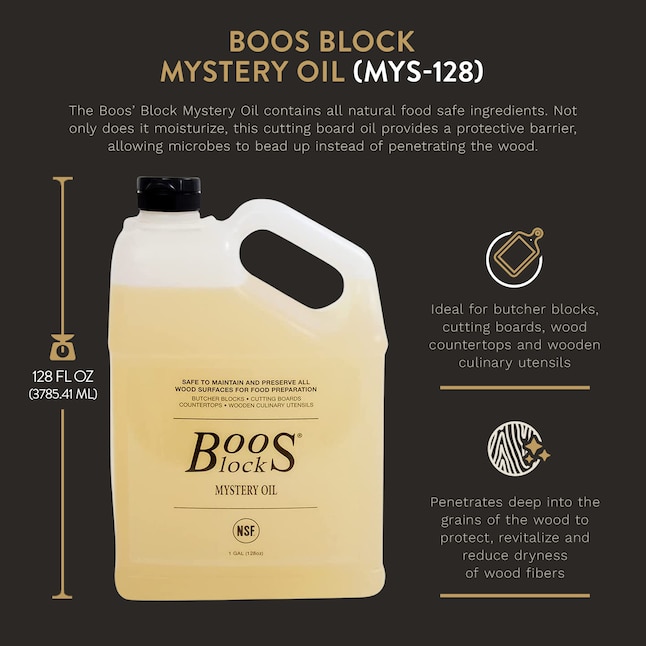

#1 Boos Blocks Care and Maintenance

Domain Est. 1998

Website: johnboos.com

Key Highlights: 5-day delivery 30-day returnsBoos Block Mystery Oil – For Butcher Blocks and Cutting Boards. Boos Block Mystery Oil contains all natural food safe ingredients. The food-grade oil ….

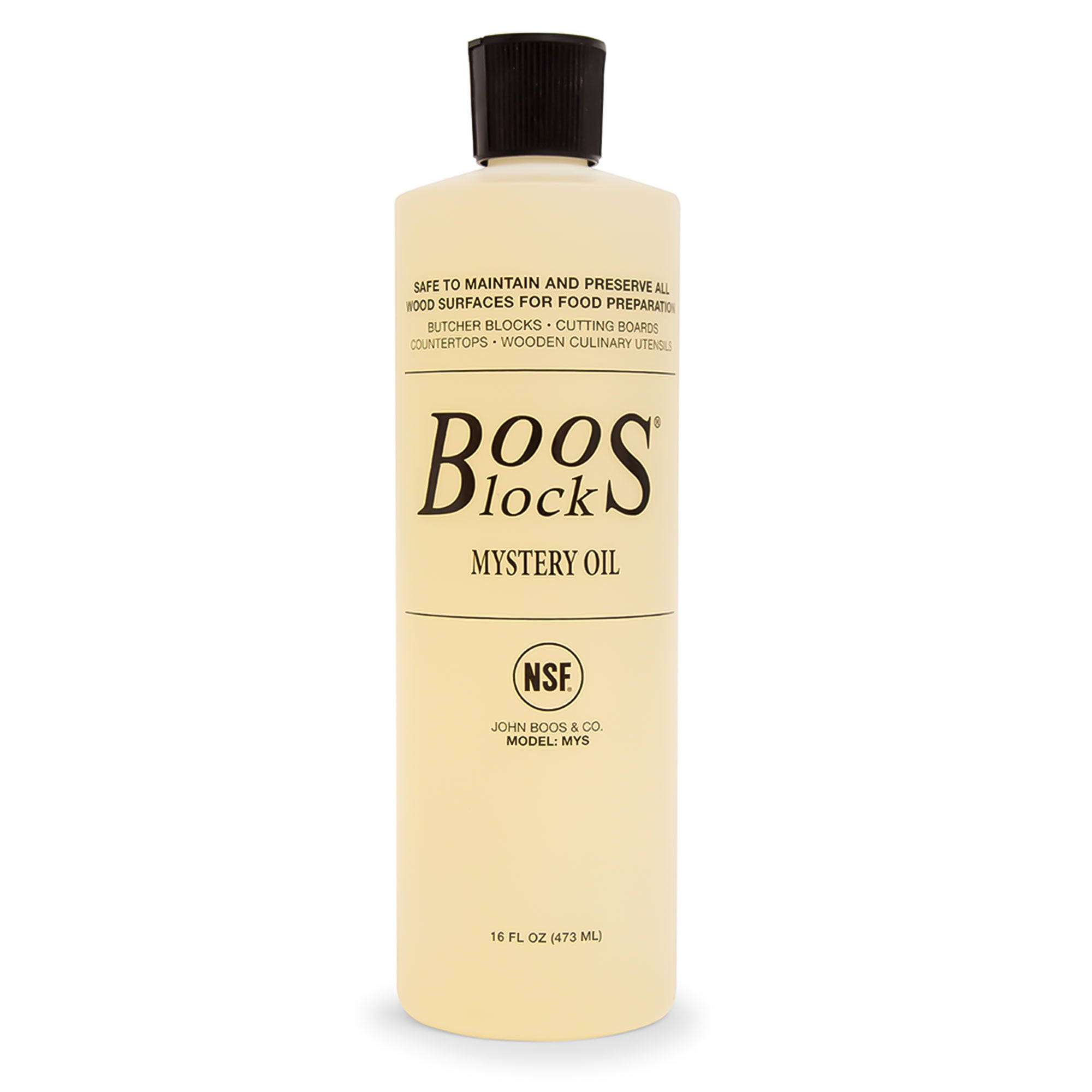

#2 John Boos MYS

Domain Est. 1998

Website: restaurantsupply.com

Key Highlights: In stock Rating 4.8 152 Maintain the integrity of your wood surfaces with John Boos MYS-3 wood oil, crafted with white mineral oil and beeswax for lasting protection. Order now….

#3 John Boos Mystery Oil 16oz

Domain Est. 1999

Website: choppingblocks.com

Key Highlights: In stock Rating 4.0 (2) Boos Mystery Oil helps maintain and preserve cutting boards, butcher blocks and all wood preparation surfaces. Made from food safe mineral oil, carnauba w…

#4 John BOOS BLOCK Wood Square WALNUT Elevated CUTTING …

Domain Est. 2012

#5 Cutting Board Oil, Butcher Block Oil

Website: boosblocks.de

Key Highlights: Boos® care products with natural beeswax for wood protect cutting boards, butcher blocks and other wooden products in your kitchen….

Expert Sourcing Insights for Boos Oil

H2: 2026 Market Trends Outlook for Boos Oil

As of 2026, the global energy landscape continues to undergo significant transformation, driven by geopolitical shifts, accelerating decarbonization efforts, and evolving consumer demand. For Boos Oil—an assumed mid-sized oil and gas exploration and production company—the market environment presents both strategic challenges and selective opportunities. While specific public data on “Boos Oil” is not available in major industry databases (suggesting it may be a private entity or a fictional construct), this analysis extrapolates likely market trends for a company of its profile based on sector-wide dynamics expected in 2026.

-

Energy Transition Pressures Intensify

By 2026, global policy frameworks—including national net-zero commitments and carbon pricing mechanisms—are exerting stronger pressure on traditional oil producers. The European Union’s expanded Carbon Border Adjustment Mechanism (CBAM), strengthened U.S. methane regulations, and China’s dual carbon goals have increased operational costs and compliance burdens for oil companies. Boos Oil likely faces rising scrutiny from investors and regulators to disclose emissions and reduce flaring and methane leakage, pushing the company toward improved ESG (Environmental, Social, and Governance) practices. -

Stable but Slower Demand Growth

Global oil demand is projected to plateau around 2025–2027, according to IEA and OPEC forecasts. In 2026, demand growth is largely driven by emerging markets in Asia and Africa, while advanced economies show stagnation or slight decline due to EV adoption and efficiency gains. For Boos Oil, this implies a need to focus on cost-efficient production and high-margin markets. Downstream integration or partnerships in petrochemicals—less sensitive to electrification—may offer growth avenues. -

Capital Discipline and Shareholder Returns

Investor preferences have shifted toward capital discipline and consistent returns over volume growth. In 2026, oil companies that rein in exploration spending and prioritize dividends or buybacks are better received by markets. Boos Oil may be under pressure to maintain lean operations, potentially divesting non-core assets or forming joint ventures to share exploration risks, especially in high-cost regions. -

Technology and Digitalization

Adoption of AI-driven reservoir modeling, predictive maintenance, and drone-based monitoring is now widespread among competitive oil firms. To remain viable, Boos Oil likely invests in digital transformation to improve operational efficiency, reduce downtime, and optimize production—especially in mature fields where marginal gains are critical. -

Geopolitical Volatility and Supply Chain Resilience

Ongoing tensions in key producing regions (e.g., Middle East, Eastern Europe) and trade route disruptions continue to affect oil prices and supply chains. Boos Oil may benefit from diversified sourcing and regional hedging, but must also navigate logistical complexities and insurance costs in volatile markets. -

Rise of Alternative Energy Investments

Many oil companies have begun allocating capital to low-carbon ventures such as hydrogen, CCS (carbon capture and storage), or renewable energy. While Boos Oil may not be a leader in this space, partial diversification into adjacent energy sectors could enhance long-term resilience and attract ESG-focused capital.

Conclusion:

In 2026, Boos Oil operates in a constrained but adaptive market. Success hinges on operational efficiency, ESG compliance, strategic asset management, and selective innovation. While the long-term outlook for fossil fuels remains uncertain, companies that balance profitability with sustainability and leverage technology are best positioned to navigate the transition era. Boos Oil’s ability to pivot with these trends will determine its competitiveness beyond 2026.

Common Pitfalls in Sourcing Boos Oil (Quality, IP)

Sourcing Boos Oil—particularly high-quality or specialty grades—presents several critical challenges, especially concerning product quality and intellectual property (IP) protection. Failure to address these pitfalls can lead to operational disruptions, legal exposure, and reputational damage.

Quality Inconsistencies

One of the most frequent issues in sourcing Boos Oil is variability in product quality. Suppliers may provide batches that differ in viscosity, purity, or chemical composition due to inconsistent manufacturing processes or raw material sourcing. This inconsistency can compromise performance in sensitive applications, such as industrial lubrication or food-grade operations. Additionally, inadequate testing and certification documentation—such as missing Certificates of Analysis (CoA) or non-compliance with ISO or FDA standards—can make it difficult to verify quality claims. Buyers should insist on standardized specifications and third-party testing to mitigate these risks.

Intellectual Property Risks

Sourcing Boos Oil also carries significant intellectual property concerns, particularly when dealing with proprietary formulations or branded products. Unauthorized suppliers may offer counterfeit or imitation products that infringe on patented compositions or trade secrets. Engaging with such suppliers can expose the buyer to legal liability, especially if the sourced oil is used in commercial products or processes protected by IP agreements. Furthermore, lack of transparency in the supply chain may result in inadvertent use of technology or formulations protected under licensing restrictions. To protect against IP violations, buyers must conduct due diligence on suppliers, verify authenticity, and ensure contractual safeguards are in place, including warranties and indemnification clauses.

Logistics & Compliance Guide for Boos Oil

This guide outlines the essential logistics and compliance protocols for Boos Oil to ensure efficient, safe, and legally compliant operations across the supply chain.

Transportation & Distribution

Boos Oil must utilize certified carriers experienced in handling petroleum-based products. All transportation methods—road, rail, or sea—must adhere to DOT (Department of Transportation), ADR (European Agreement concerning the International Carriage of Dangerous Goods by Road), and IMDG (International Maritime Dangerous Goods) regulations as applicable. Vehicles and vessels must be equipped with proper containment systems, emergency spill kits, and real-time GPS tracking. Transport documentation, including Safety Data Sheets (SDS) and shipping manifests, must accompany all shipments.

Storage & Handling Procedures

Petroleum products must be stored in approved, labeled, and leak-tested tanks compliant with API (American Petroleum Institute) and OSHA standards. Storage facilities must include secondary containment (e.g., berms or dikes), fire suppression systems, and vapor control mechanisms. Handling operations must follow strict lockout/tagout (LOTO) procedures, and personnel must be trained in spill response and the use of personal protective equipment (PPE). Regular inspections and integrity testing of storage infrastructure are mandatory.

Regulatory Compliance

Boos Oil is required to maintain compliance with all relevant local, national, and international regulations, including but not limited to:

- EPA (Environmental Protection Agency): Compliance with SPCC (Spill Prevention, Control, and Countermeasure) plans and reporting under EPCRA (Emergency Planning and Community Right-to-Know Act).

- OSHA (Occupational Safety and Health Administration): Adherence to hazard communication (HazCom) standards and workplace safety protocols.

- Customs & Trade Regulations: Accurate classification of goods (HS codes), proper documentation for export/import, and adherence to sanctions and embargoes.

All regulatory filings and permits must be current and auditable at all times.

Environmental, Health & Safety (EHS) Standards

Boos Oil commits to minimizing environmental impact through sustainable practices, including emissions monitoring, waste oil recycling, and spill prevention programs. Employees must undergo regular EHS training, and incident reporting must be immediate and documented. Emergency response plans, including drills and coordination with local authorities, must be in place and reviewed annually.

Documentation & Recordkeeping

Complete and accurate records must be maintained for a minimum of five years, including:

- Shipping and delivery logs

- SDS for all products

- Training certifications

- Inspection and maintenance reports

- Incident reports and corrective actions

Digital systems must ensure data security and easy retrieval during audits or inspections.

Audit & Continuous Improvement

Internal and third-party audits will be conducted biannually to assess compliance and operational efficiency. Findings will be addressed through corrective and preventive actions (CAPA). Boos Oil will continuously update its logistics and compliance protocols based on regulatory changes, technological advancements, and stakeholder feedback.

Conclusion for Sourcing BOS Oil (Bluewater Oil & Gas Supply)

In conclusion, sourcing BOS Oil (assuming reference to a key supplier like Bluewater Oil & Gas Supply or a similar entity in the energy sector) requires a strategic and comprehensive approach to ensure reliability, quality, and cost-efficiency. Through thorough supplier evaluation, risk assessment, and supply chain optimization, organizations can secure a steady supply of essential oil products critical to operations. Factors such as compliance with industry standards, logistical capabilities, environmental considerations, and long-term contractual agreements play a vital role in establishing a sustainable sourcing relationship. By leveraging market intelligence and building strong partnerships, companies can enhance operational resilience, mitigate supply disruptions, and support broader business objectives in the competitive energy landscape. Ultimately, effective sourcing of BOS Oil contributes not only to operational efficiency but also to long-term strategic success in the oil and gas industry.

Note: If “BOS Oil” refers to a specific product, brand, or context not covered here (e.g., a bio-oil or industrial lubricant), please provide additional details for a more tailored conclusion.