The global centrifugal pump market is experiencing robust growth, driven by increasing demand across industries such as oil & gas, water treatment, power generation, and chemical processing. According to Grand View Research, the market was valued at USD 52.8 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 5.6% from 2023 to 2030. Similarly, Mordor Intelligence forecasts continued expansion, citing industrialization in emerging economies and infrastructure development as key growth catalysts. With rising emphasis on energy efficiency and process optimization, manufacturers are investing heavily in advanced materials, smart monitoring, and sustainable designs. Against this backdrop, identifying the leading centrifugal pump (bomba centrifuga) manufacturers becomes critical for procurement managers, engineers, and sourcing professionals seeking reliable, high-performance solutions. Here, we present a data-driven ranking of the top 10 global players shaping the future of fluid handling.

Top 10 Bomba Centrifuga Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Industrial Marine Centrifugal Pump Manufacture

Domain Est. 1996

Website: carverpump.com

Key Highlights: Carver Pump is an ISO 9001:2015 Certified Manufacturer of Centrifugal Pumps, Multistage, Axial Split Case, Self-priming, API & Solids-handling Pumps….

#2 Cornell Pump Company

Domain Est. 1997

Website: cornellpump.com

Key Highlights: Cornell Pump Company in Clackamas, Oregon, is a trusted manufacturer of high-quality pumps that have been designed in the USA, manufactured in the US with ……

#3 SPP Pumps

Domain Est. 2000

Website: spppumps.com

Key Highlights: SPP Pumps are world-renowned for industry-leading centrifugal pumps across a range of industries. Browse our collection of products and services on our ……

#4 Centrifugal pumps.Design,manufacturing,customization.Emica

Domain Est. 2011

Website: emicabombas.com

Key Highlights: Manufacturers of centrifugal pumps since 1899.Vertical,horizontal,multistage and split case type pumps. (+34) 94 636 39 61….

#5 Varisco Pumps International page

Domain Est. 2022

Website: variscopumps.com

Key Highlights: Varisco is a globally recognized pump manufacturer specializing in high-performance self-priming centrifugal pumps for liquids with suspended solids, ……

#6

Domain Est. 1995

Website: peerlesspump.com

Key Highlights: Peerless Pump utilizes 100 Years of quality engineering experience to design and manufacture tough, reliable and versatile products to meet your pumping needs….

#7 Bombas centrifugas ANDRITZ

Domain Est. 1995

Website: andritz.com

Key Highlights: Además, las bombas centrífugas ANDRITZ de una etapa también pueden utilizarse en el suministro de agua, el tratamiento de aguas residuales, las plantas de ……

#8 KSB – leading supplier of pumps, valves and services

Domain Est. 1995

Website: ksb.com

Key Highlights: We offer solutions for the mining, chemicals and petrochemicals, building services, industry, energy and water markets. Learn more about KSB here….

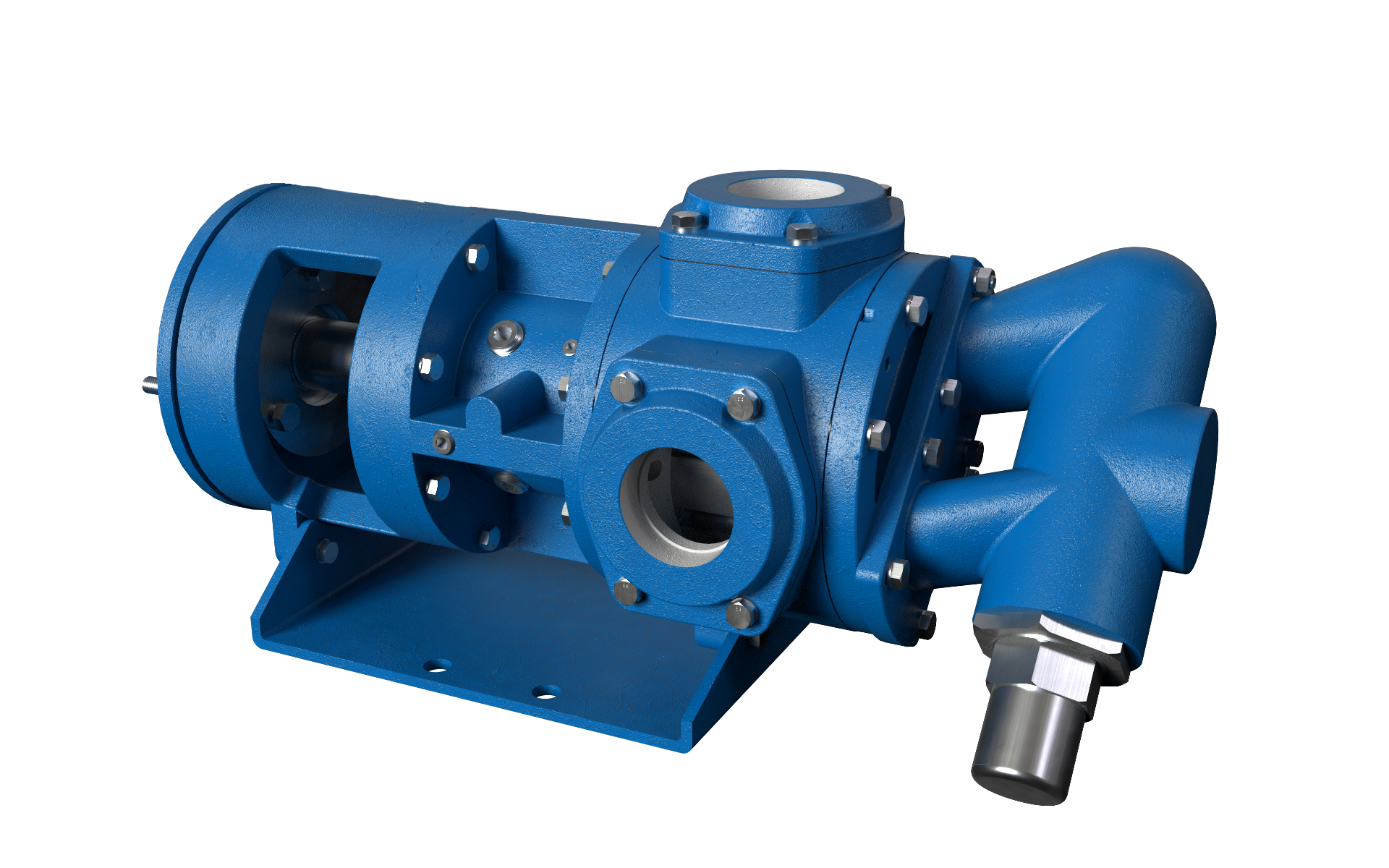

#9 Sundyne Pumps and Compressors

Domain Est. 1996

Website: sundyne.com

Key Highlights: Sundyne is the world leader in delivering low-flow, high-head, integrally geared centrifugal pumps and compressors, sealless magnetic drive pumps and diaphragm ……

#10 gear pumps

Founded: 1965

Website: elias.es

Key Highlights: Our experience in the world of gear pumps started more than fifty years ago. We have been manufacturing, assembling and testing them since 1965….

Expert Sourcing Insights for Bomba Centrifuga

H2: 2026 Market Trends for Bomba Centrífuga (Centrifugal Pump)

The centrifugal pump market is poised for dynamic evolution by 2026, driven by technological innovation, sustainability mandates, and shifting industrial demands. Here’s a comprehensive analysis of the key trends shaping the sector:

1. Accelerated Digitalization and Smart Pumping Systems

By 2026, the integration of IoT and AI into centrifugal pumps will become standard in industrial applications. Smart pumps equipped with real-time monitoring sensors will dominate sectors like water treatment, oil & gas, and manufacturing. These systems enable predictive maintenance, reducing downtime by up to 30% and improving energy efficiency by 15–25%. Cloud-based analytics platforms will allow remote diagnostics and fleet management, particularly favored by large-scale operators seeking operational excellence.

2. Energy Efficiency Regulations Driving Design Innovation

Stringent global energy efficiency standards—such as the EU’s Ecodesign Directive and U.S. DOE regulations—will push manufacturers to develop high-efficiency models. In 2026, pumps compliant with IE4 (Super Premium Efficiency) and newer IE5 standards will capture growing market share. Innovations in impeller design, variable frequency drives (VFDs), and advanced materials (e.g., composite alloys) will be central to meeting these benchmarks, especially in HVAC and water infrastructure projects.

3. Rise of Sustainable and Green Infrastructure

The global push for decarbonization will boost demand for centrifugal pumps in renewable energy and wastewater recycling. Solar-powered pumping systems and pumps used in desalination plants will see double-digit growth, especially in water-stressed regions like the Middle East, North Africa, and parts of Asia. Sustainable materials in pump construction and end-of-life recyclability will become key differentiators among leading brands.

4. Growth in Emerging Markets and Urbanization

Expanding urban centers in India, Southeast Asia, and Sub-Saharan Africa will drive infrastructure development, increasing demand for water supply and sewage treatment pumps. Governments investing in smart cities and resilient water networks will favor modular, scalable centrifugal pump solutions. Localized manufacturing and partnerships with regional distributors will be critical for market penetration.

5. Supply Chain Resilience and Localization

Post-pandemic disruptions and geopolitical tensions will encourage pump manufacturers to diversify supply chains. By 2026, nearshoring and regional production hubs will reduce dependency on single-source suppliers. Additive manufacturing (3D printing) will gain traction for prototyping and producing complex pump components, reducing lead times and inventory costs.

6. Increased Adoption in Industrial Automation

As industries embrace Industry 4.0, centrifugal pumps will be integrated into automated process control systems. Demand will rise in chemical processing, food & beverage, and pharmaceuticals, where precise flow control and hygiene are paramount. Sealless magnetic drive pumps and self-priming models will gain preference due to their reliability and low maintenance.

7. Competitive Landscape and Market Consolidation

The market will witness strategic mergers and acquisitions as major players (e.g., Grundfos, Xylem, Sulzer) expand portfolios to include digital services and energy-efficient solutions. Smaller innovators focusing on niche applications (e.g., high-temperature or abrasive fluid handling) will attract investment, fostering a hybrid ecosystem of scale and specialization.

Conclusion:

By 2026, the centrifugal pump market will transition from a commodity-driven sector to a technology- and sustainability-led industry. Success will depend on agility in adopting digital tools, compliance with environmental standards, and strategic alignment with infrastructure growth in emerging economies. Companies that innovate beyond hardware—offering data-driven services and lifecycle support—will lead the market.

Common Pitfalls When Sourcing Bomba Centrífuga (Quality, IP)

Sourcing a bomba centrífuga (centrifugal pump) involves technical, commercial, and legal considerations. Buyers, especially in industrial or infrastructure projects, must be cautious to avoid common pitfalls related to product quality and intellectual property (IP). Failing to address these can lead to operational failures, safety hazards, and legal complications. Below are the key risks to watch for:

Poor Quality Components and Materials

One of the most frequent issues when sourcing centrifugal pumps—especially from low-cost manufacturers—is substandard build quality. This includes the use of inferior materials for impellers, shafts, seals, and casings. Low-grade cast iron or non-certified stainless steel can lead to premature wear, corrosion, and pump failure under pressure or in aggressive chemical environments.

Red flags:

– Lack of material certification (e.g., MTR – Material Test Reports)

– No ISO or ANSI compliance documentation

– Unverifiable manufacturing standards

Inaccurate Performance Specifications

Some suppliers exaggerate pump performance data such as flow rate, head pressure, or efficiency. These misleading specs can result in undersized pumps that fail to meet system requirements, leading to inefficiency or operational downtime.

Best practices:

– Request performance curves certified by independent testing

– Verify compliance with ISO 9906 or HI (Hydraulic Institute) standards

– Conduct third-party validation if sourcing from unknown vendors

Lack of IP Compliance and Counterfeit Designs

Centrifugal pump designs, especially high-efficiency or patented models, are often protected by intellectual property rights. Sourcing from unauthorized manufacturers may result in IP infringement, exposing the buyer to legal liability.

Risks include:

– Purchasing counterfeit pumps modeled after branded OEM designs (e.g., Grundfos, Sulzer, KSB)

– Use of protected hydraulic profiles or patented sealing technologies without licensing

– Supply chain involvement in gray-market or cloned products

Mitigation:

– Verify supplier authorization from original equipment manufacturers (OEMs)

– Request proof of design ownership or licensing agreements

– Avoid suppliers offering “compatible” models at suspiciously low prices

Inadequate Ingress Protection (IP) Ratings

The IP (Ingress Protection) rating indicates a pump motor’s resistance to dust and water. Using a pump with an insufficient IP rating in harsh environments (e.g., outdoor, washdown, or humid areas) can lead to electrical faults, short circuits, or motor burnout.

Common mistakes:

– Assuming all pumps are suitable for wet environments

– Not verifying IP ratings (e.g., IP55 vs. IP68) against application needs

– Overlooking certification marks (e.g., CE, UL)

Recommendation:

– Match IP ratings to installation conditions

– Demand certified test reports for IP claims

Absence of After-Sales Support and Spare Parts

Low-cost suppliers may disappear after sale or lack local service networks. This becomes critical when maintenance is needed or spare parts (e.g., mechanical seals, bearings) must be replaced. Poor-quality aftermarket components can compromise pump reliability.

Solution:

– Prioritize suppliers with documented service support and spare parts availability

– Evaluate warranty terms and technical documentation provided

Conclusion

Sourcing a reliable bomba centrífuga requires due diligence beyond price comparison. Assessing quality assurance processes, verifying IP ratings, and ensuring intellectual property compliance are essential to avoid costly failures and legal exposure. Always work with reputable suppliers, request full technical documentation, and consider third-party inspections when sourcing critical pumping equipment.

Logistics & Compliance Guide for Bomba Centrifuga

This guide outlines the essential logistics and compliance considerations for the handling, transportation, import/export, and operation of centrifugal pumps (Bomba Centrifuga). Adhering to these guidelines ensures safe, efficient, and legally compliant operations across the supply chain.

Product Classification & Identification

Accurate classification is critical for compliance and logistics planning. Centrifugal pumps are typically categorized under the following international systems:

– HS Code (Harmonized System): Common codes include 8413.70 (centrifugal pumps for liquids) or 8413.60 (other liquid pumps), depending on design and application. Confirm the precise code based on pump specifications and regional tariff schedules.

– UN Number (if applicable): Not typically assigned unless the pump is part of a system containing hazardous materials. Pumps used in hazardous environments may require ATEX/IECEx certification.

– Model & Serial Number Tracking: Maintain detailed records for traceability, warranty, and recall management.

Packaging & Handling Requirements

Proper packaging ensures safe transit and prevents damage:

– Internal Protection: Secure rotating components (impeller, shaft) using transit brackets or locking mechanisms. Plug suction and discharge ports to prevent debris ingress.

– External Packaging: Use robust wooden crates or reinforced cardboard for smaller units. Include shock-absorbing materials (foam, corner protectors) and weatherproof wrapping.

– Lifting & Handling: Clearly mark lifting points and center of gravity. Use slings or forklifts as per manufacturer instructions. Avoid lifting by motor or piping.

– Orientation: Store and transport in the designated upright position unless otherwise specified by the manufacturer.

Transportation & Shipping

Plan transportation with attention to weight, dimensions, and regulations:

– Mode of Transport: Suitable for road, sea, and air freight. Oversized or heavy pumps may require special permits for road transport.

– Weight & Dimensions: Confirm gross weight and external dimensions for accurate freight classification and load planning.

– Documentation: Include commercial invoice, packing list, bill of lading/airway bill, and certificates of origin as required.

– Hazardous Locations: If pumps are certified for use in explosive atmospheres (e.g., ATEX, IECEx), ensure compliance with hazardous goods transport regulations when shipping as equipment for such environments.

Import & Export Compliance

Compliance with international trade regulations is mandatory:

– Export Controls: Verify if the pump contains components subject to export restrictions (e.g., dual-use items under EU Dual-Use Regulation or U.S. EAR).

– Import Duties & Taxes: Prepare for customs clearance using correct HS codes, valuation, and origin documentation. Consider Incoterms (e.g., FOB, CIF, DDP) to define responsibilities.

– Product Standards & Certification: Ensure the pump meets destination country standards (e.g., CE marking for EU, UL/cUL for North America, GOST for Russia, INMETRO for Brazil).

– Energy Efficiency: Comply with regional efficiency regulations (e.g., EU Ecodesign Directive, U.S. DOE standards for pumps).

Regulatory & Safety Compliance

Adhere to operational and safety standards:

– Electrical Compliance: Motors must meet local electrical codes (e.g., IEC, NEC, CEC) and include appropriate protection (IP rating, insulation class).

– Pressure Equipment Directive (PED): In the EU, pumps operating above certain pressure thresholds must comply with 2014/68/EU and carry CE marking with notified body involvement if required.

– Environmental Regulations: Prevent leaks and ensure materials are compatible with transported fluids (e.g., avoid contamination with drinking water systems per NSF/ANSI 61).

– Installation & Operation: Follow manufacturer guidelines for alignment, piping support, and system integration to avoid mechanical failure.

Documentation & Recordkeeping

Maintain comprehensive documentation throughout the product lifecycle:

– Technical Dossier: Include design drawings, material specifications, test reports, and risk assessments.

– Certificates: Retain copies of conformity certificates (CE, UL, etc.), material test reports (MTRs), and calibration records.

– Maintenance Logs: Track servicing, repairs, and part replacements for compliance audits and warranty claims.

– Training Records: Document personnel training for safe handling, installation, and emergency procedures.

End-of-Life & Environmental Responsibility

Ensure responsible disposal and recycling:

– Waste Electrical and Electronic Equipment (WEEE): Comply with WEEE Directive in applicable regions for proper recycling of motors and electronic components.

– Hazardous Materials: Identify and dispose of lubricants, seals, or coatings containing hazardous substances according to local environmental regulations.

– Recycling Programs: Partner with certified recyclers for metal components (cast iron, stainless steel) and other reusable materials.

By following this guide, stakeholders can ensure the Bomba Centrifuga is managed in accordance with global logistics best practices and regulatory requirements, minimizing risk and maximizing operational reliability.

In conclusion, sourcing a bomba centrifuga (centrifugal pump) requires a thorough evaluation of technical specifications, application requirements, quality standards, and supplier reliability. Key factors such as flow rate, head pressure, material compatibility, energy efficiency, and maintenance needs must align with the intended use—whether for industrial, agricultural, or commercial purposes. Conducting a comprehensive market analysis, comparing suppliers, and verifying certifications (e.g., ISO, CE) help ensure the selection of a durable, efficient, and cost-effective pump. Additionally, considering after-sales support, warranty, and lead times contributes to long-term operational success. By following a strategic sourcing approach, organizations can secure a high-performing centrifugal pump that meets performance demands while optimizing total cost of ownership.