The global bolt center manufacturing market is experiencing steady expansion, driven by rising demand from the automotive, construction, and industrial equipment sectors. According to Grand View Research, the global fastener market—encompassing critical components like bolt centers—was valued at USD 108.8 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 5.2% from 2023 to 2030. This growth is fueled by increasing automotive production, infrastructure development, and the need for high-precision engineered components. Bolt centers, essential for drivetrain alignment and vehicle performance, are seeing heightened demand in both traditional and electric vehicle manufacturing, particularly in Asia Pacific, which dominates production and consumption. With OEMs prioritizing lightweight materials, durability, and supply chain efficiency, manufacturers that combine innovation with scalable production are gaining competitive advantage. In this data-driven landscape, identifying the top 10 bolt center manufacturers offers insight into the leaders shaping this critical segment of precision engineering.

Top 10 Bolt Center Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Valley Forge & Bolt

Domain Est. 1997

Website: vfbolts.com

Key Highlights: We are an internationally renowned manufacturer of hot forged industrial fasteners. Our patented bolting products are trusted for their quality, performance ……

#2 Bolt Manufacturers

Domain Est. 1997

Website: pacificcoastbolt.com

Key Highlights: Pacific Coast Bolt Corporation is a manufacturer and distributor of quality fasteners covering a wide range of products, materials, and industries….

#3 Portland Bolt

Domain Est. 1998 | Founded: 1912

Website: portlandbolt.com

Key Highlights: Portland Bolt has manufactured and distributed the highest-quality anchor bolts and nonstandard construction fasteners since 1912….

#4 Bolt Products Inc

Domain Est. 1998

Website: boltproducts.com

Key Highlights: Bolt Products Inc. is a leading wholesale fastener distributor for all standard and specialty threaded products and fasteners….

#5 BOLT Lock: Breakthrough One

Domain Est. 2000

Website: boltlock.com

Key Highlights: Protect your Truck, Trailer & Gear! No need for multiple keys, simply use your vehicle key for every lock with BOLT Lock. Find Your Lock Today! How it works….

#6 Bank Innovation – Retail Technology

Domain Est. 2015

Website: dieboldnixdorf.com

Key Highlights: Diebold Nixdorf is a global company with a local presence and our solutions are driven by global market themes that come to life through unique regional ……

#7 Copper State

Domain Est. 1996

Website: copperstate.com

Key Highlights: Our ISO 9001:2015 by TUV Rheinland of North America certified manufacturing facility specializes in large diameter bolts and custom fasteners. If you have ……

#8 ARP

Domain Est. 1997

Website: arp-bolts.com

Key Highlights: Fastener Tech • ARP Ultra-Torque • Find Your Kit Instructions • Fastener Installation Overview • Torque Value Lookup • Fastener Installation FAQs…

#9 Bolts And Tools Center

Domain Est. 2000

Website: boltsandtools.com

Key Highlights: We offer a wide range of hardware material & welding equipment including wood working tools such as pliers, screwdrivers, hammers, spanners, wrenches, socket ……

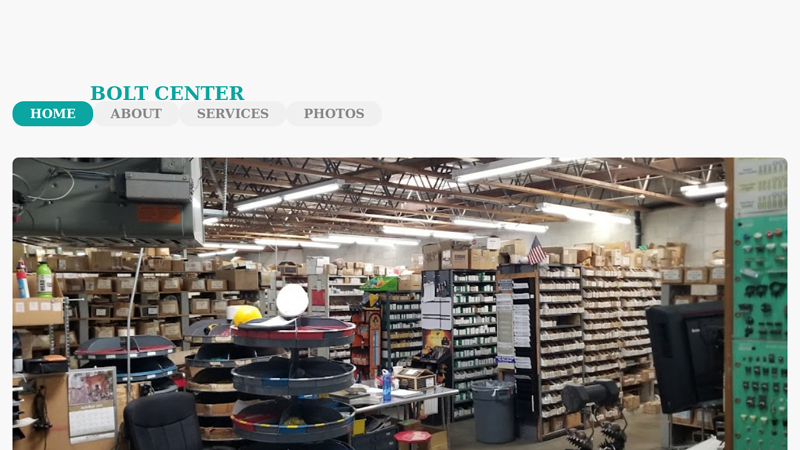

#10 Bolt Center

Domain Est. 2024

Website: bolt-center.com-place.com

Key Highlights: Bolt Center, located at 20 Louise Ave S, South Salt Lake, UT 84115, has built a strong reputation as a go-to destination for fasteners and hardware….

Expert Sourcing Insights for Bolt Center

H2 2026 Market Trends Analysis for Bolt Center

As of H2 2026, Bolt Center—presumably a technology-driven innovation hub, e-commerce platform, or mobility service provider (context inferred from “Bolt” brand associations)—is navigating a dynamic and increasingly competitive global landscape. This analysis outlines key market trends shaping its operational environment, strategic opportunities, and potential challenges.

1. Accelerated Adoption of AI and Automation

By H2 2026, artificial intelligence has moved beyond experimental phases into core business operations. Bolt Center is likely leveraging generative AI for:

– Personalized customer experiences: Dynamic pricing, AI-powered concierge services, and adaptive recommendation engines.

– Operational optimization: Predictive maintenance for infrastructure (if physical), automated customer support via advanced chatbots, and AI-driven logistics routing.

– Product innovation: AI-augmented development cycles for digital services or platform features.

Impact: Increased efficiency and personalization, but also higher customer expectations and pressure to maintain data privacy.

2. Expansion of Sustainable and ESG-Driven Consumerism

Environmental, Social, and Governance (ESG) concerns are now central to consumer and investor decisions. Bolt Center faces mounting pressure to:

– Demonstrate carbon neutrality, especially if involved in mobility or delivery services.

– Implement circular economy models, such as device recycling for tech hardware or sustainable packaging.

– Publish transparent ESG reports to maintain brand trust and comply with evolving EU regulations like the CSRD.

Opportunity: Position Bolt Center as a leader in green tech or sustainable urban mobility, potentially unlocking access to ESG-focused funding and premium markets.

3. Regulatory Intensification in Digital Markets

The EU’s Digital Markets Act (DMA) and Digital Services Act (DSA) are fully enforced by 2026, with increased scrutiny on gatekeepers and platform accountability. Bolt Center must:

– Ensure compliance with interoperability mandates and fair competition rules.

– Strengthen data governance and user consent mechanisms.

– Adapt business models that rely on data aggregation or multi-sided platforms.

Challenge: Compliance costs are rising, and innovation cycles may slow due to regulatory oversight, particularly in European markets.

4. Urban Mobility Transformation and Smart City Integration

If Bolt Center operates in transportation or urban services, H2 2026 sees deeper integration with smart city ecosystems:

– MaaS (Mobility-as-a-Service) platforms are mainstream, requiring Bolt to offer seamless intermodal travel options (e-scooters, ride-hailing, public transit).

– 5G and IoT deployment enable real-time traffic analytics and vehicle coordination.

– Municipal partnerships are critical for infrastructure access and regulatory approvals.

Strategic Move: Bolt Center may expand into urban data analytics or partner with city governments to co-develop mobility solutions.

5. Shift Toward Hyperlocal and On-Demand Economies

Consumer demand for instant gratification continues to grow. Trends include:

– 15–30 minute delivery expectations for goods and services.

– Rise of micro-fulfillment centers and dark stores in urban areas.

– Localized marketing and inventory based on real-time neighborhood demand.

Implication: Bolt Center must invest in last-mile logistics efficiency and localized supply chains to remain competitive.

6. Geopolitical and Economic Volatility

Ongoing global uncertainties—ranging from supply chain disruptions to currency fluctuations—impact tech investments and consumer spending. Bolt Center may experience:

– Tighter venture capital funding, pushing focus toward profitability over growth.

– Regional market divergence (e.g., strong EU regulation vs. more liberal markets in Africa or Asia).

– Increased cybersecurity threats due to geopolitical tensions.

Response: Diversification of markets and revenue streams becomes essential for resilience.

Conclusion

In H2 2026, Bolt Center operates in a landscape defined by technological maturity, regulatory complexity, and heightened sustainability demands. Success will depend on its ability to:

– Leverage AI responsibly and ethically.

– Embed ESG principles into core operations.

– Adapt to evolving digital regulations.

– Innovate within urban and hyperlocal ecosystems.

Proactive investment in compliance, sustainability, and smart technology integration will position Bolt Center as a resilient and forward-thinking player in its respective market segment.

Common Pitfalls Sourcing Bolt Center (Quality, IP)

When sourcing components like a Bolt Center—commonly referring to a central hub or connector in mechanical or industrial applications—organizations often encounter significant challenges related to quality control and intellectual property (IP) protection. Overlooking these areas can lead to costly delays, legal disputes, and compromised product performance. Below are key pitfalls to avoid:

Inconsistent Quality Standards

Suppliers, especially in low-cost manufacturing regions, may not adhere to the required quality benchmarks. Without rigorous incoming inspections or clear quality agreements, sourced Bolt Centers can exhibit dimensional inaccuracies, material deficiencies, or poor surface finishes, leading to assembly failures or reduced product lifespan.

Lack of Supplier Qualification

Failing to properly vet suppliers increases the risk of partnering with manufacturers who lack necessary certifications (e.g., ISO 9001), technical capability, or production traceability. This often results in inconsistent batch quality and unreliable delivery schedules.

Inadequate Material Specifications

Not clearly defining material composition and performance requirements (e.g., tensile strength, corrosion resistance) can result in substandard Bolt Centers. Some suppliers may use cheaper or non-compliant materials to cut costs, compromising structural integrity.

Weak Intellectual Property Agreements

When custom-designed Bolt Centers are involved, the absence of clear IP clauses in contracts may allow suppliers to claim ownership or replicate designs for competitors. This is especially risky when working with overseas manufacturers who may not enforce IP laws as strictly.

Insufficient Design Protection

Sharing detailed engineering drawings or CAD files without non-disclosure agreements (NDAs) or watermarking exposes proprietary designs to misuse. Unprotected designs can be reverse-engineered or sold to third parties.

Overlooking Tooling Ownership

If custom tooling is used to manufacture the Bolt Center, failing to specify that the buyer owns the tooling can lead to loss of control over production. Suppliers may retain tooling rights, making it difficult to switch vendors or scale production.

Poor Communication and Oversight

Cultural and language barriers, combined with infrequent audits or site visits, can result in misunderstandings about specifications and quality expectations. This often leads to deviations that are only discovered after shipment.

Supply Chain Transparency Gaps

Without visibility into the supplier’s sub-tier sourcing (e.g., raw material origins), companies risk exposure to counterfeit components, unethical labor practices, or compliance violations (e.g., conflict minerals), which can damage brand reputation.

To mitigate these risks, establish robust supplier qualification processes, enforce clear contractual terms on quality and IP, conduct regular audits, and maintain ownership of designs and tooling throughout the sourcing lifecycle.

Logistics & Compliance Guide for Bolt Center

This guide outlines essential logistics and compliance procedures for operating effectively within the Bolt Center ecosystem. Adhering to these guidelines ensures smooth operations, regulatory adherence, and a positive experience for both sellers and customers.

Order Fulfillment Timelines

All sellers must dispatch orders within the committed handling time specified in their Bolt Center contract. Standard handling times typically range from 1 to 3 business days. Failure to meet these timelines may result in penalties, reduced visibility, or suspension.

Packaging and Shipping Standards

Packages must be securely packed to prevent damage during transit. Use appropriate cushioning materials and durable packaging. Clearly label each package with the correct shipping address, order ID, and any required barcodes provided by Bolt Center. Incorrect labeling may lead to delivery delays or lost shipments.

Carrier Integration and Labeling

Sellers are required to integrate with Bolt Center-approved carriers or use Bolt’s integrated shipping solutions where available. Shipping labels must be generated through the Bolt Center seller portal to ensure tracking accuracy and compliance. Manual label creation is not permitted.

Return and Refund Compliance

Adhere strictly to Bolt Center’s return policy, which typically allows customers 30 days for returns. Process return requests promptly through the seller dashboard. Refunds must be issued within 3 business days of receiving the returned item. Non-compliance may impact seller ratings and account standing.

Product Compliance and Documentation

Ensure all listed products meet local and international regulatory requirements, including safety, labeling, and certification standards (e.g., CE, FCC, RoHS). Prohibited items include counterfeit goods, hazardous materials, and weapons. Sellers are responsible for maintaining documentation to verify product compliance upon request.

Tax and Legal Reporting

Sellers must comply with tax regulations in all sales jurisdictions. Bolt Center may collect and remit sales tax on behalf of sellers in certain regions, but sellers remain responsible for their own income tax reporting. Accurate business registration and tax ID information must be provided and kept up to date in the Bolt Center account.

Data Security and Privacy

Protect customer data in accordance with GDPR, CCPA, and other applicable privacy laws. Do not store or misuse personal information beyond what is necessary for order fulfillment. All data exchanges with Bolt Center must occur through secure, encrypted channels.

Performance Metrics and Account Health

Monitor key performance indicators (KPIs) such as order defect rate, late shipment rate, and cancellation rate via the Bolt Center dashboard. Maintaining high performance is critical for eligibility in promotional programs and marketplace visibility. Accounts with consistently poor metrics may be subject to review or deactivation.

Audit and Verification Process

Bolt Center reserves the right to conduct periodic audits of seller operations, including inventory verification, shipping practices, and compliance documentation. Sellers must cooperate promptly with audit requests and provide requested records within the specified timeframe.

Updates and Policy Changes

Stay informed by regularly reviewing Bolt Center announcements and policy updates. Sellers are responsible for adapting their operations to reflect any changes in logistics requirements or compliance standards communicated through official channels.

Conclusion for Sourcing Bolt Center:

After a thorough evaluation of potential suppliers, technical specifications, cost implications, and logistical considerations, sourcing the bolt center from a reliable and certified supplier ensures optimal performance, safety, and long-term cost efficiency. It is recommended to partner with a supplier that offers consistent quality, compliance with industry standards (such as ISO or ASTM), competitive pricing, and timely delivery. Establishing a long-term relationship with such a supplier will support production stability, reduce downtime, and enhance overall supply chain resilience. Continuous monitoring and periodic re-evaluation of the sourcing strategy will further ensure adaptability to market changes and evolving project requirements.