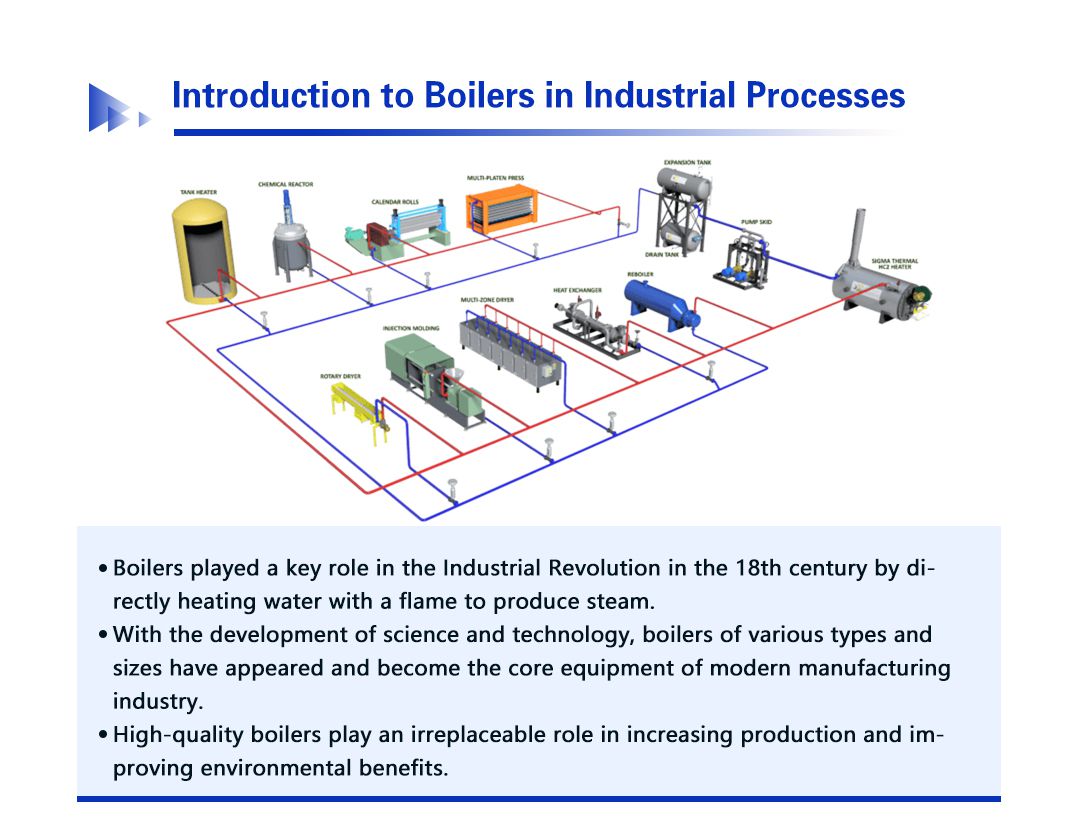

The global market for boilers and thermostats is experiencing robust growth, driven by rising demand for energy-efficient heating solutions and increasing adoption of smart home technologies. According to Mordor Intelligence, the global boiler market was valued at USD 33.8 billion in 2023 and is projected to grow at a CAGR of over 4.5% from 2024 to 2029. Similarly, the smart thermostat market, a key segment within home climate control, is expected to expand significantly, with Grand View Research valuing it at USD 2.3 billion in 2023 and forecasting a CAGR of 9.4% from 2024 to 2030. This growth is fueled by government regulations promoting energy efficiency, advancements in IoT-enabled devices, and heightened consumer awareness of sustainable living. As innovation accelerates and competition intensifies, a select group of manufacturers are leading the charge—combining cutting-edge technology, reliability, and global reach to dominate the industry. Here’s a look at the top 10 boiler and thermostat manufacturers shaping the future of heating and climate control.

Top 10 Boiler And Thermostat Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 White-Rodgers Brand

Domain Est. 1995

Website: copeland.com

Key Highlights: White-Rodgers is a leading manufacturer of thermostats, valves, controls and system protectors for the heating, air conditioning, and refrigeration ……

#2 U.S. Boiler Company

Domain Est. 2010

Website: usboiler.net

Key Highlights: US Boiler Company is a leading manufacturer of home heating equipment, water boilers, steam boilers, hot water heaters, radiators and boiler control systems….

#3 tekmar

Domain Est. 1995

Website: watts.com

Key Highlights: Products You and Your Customers Will Love · Boiler & Mixing · Setpoint · Zoning · Thermostats · Snow Melting · Accessories · Help With tekmar Apps….

#4 Rheem Manufacturing Company

Domain Est. 1995

Website: rheem.com

Key Highlights: Learn about Rheem’s innovative and efficient heating, cooling, and water heating solutions for homes and businesses….

#5 Robertshaw

Domain Est. 1995

Website: robertshaw.com

Key Highlights: Robertshaw® is a leading global design, engineering and manufacturing company that sells highest quality components and systems….

#6 White-Rodgers Brand

Domain Est. 1995

Website: emerson.com

Key Highlights: With over 75 years of expertise in Heating and Cooling Controls, White-Rodgers is proud to offer a full line of furnace controls, gas valves, air conditioning ……

#7 Bradford White Water Heaters

Domain Est. 1996

Website: bradfordwhite.com

Key Highlights: Bradford White designs, engineers & builds water heating, space heating, combination heating and storage solutions for residential, commercial, ……

#8 HTP

Domain Est. 1997

Website: htproducts.com

Key Highlights: HTP, part of Ariston USA, produces a wide range of highly efficient products and system components for space heating and water heating….

#9 Honeywell

Domain Est. 2002

Website: honeywellhome.com

Key Highlights: Experience smart home comfort, advanced automation, and energy efficiency with Honeywell Home solutions designed for safer, more connected living….

#10 NTI Boilers

Domain Est. 2013

Website: ntiboilers.com

Key Highlights: Residential. Gas Boilers · Water Heating · Combi Furnaces · Heat Pumps · Oil & Wood Boilers · Accessories · Discontinued · View All · Compare. Commercial….

Expert Sourcing Insights for Boiler And Thermostat

H2: 2026 Market Trends for Boilers and Thermostats

The boiler and thermostat market is poised for significant transformation by 2026, driven by advancements in energy efficiency, smart home integration, regulatory pressures, and shifting consumer preferences. This analysis explores key trends shaping the industry landscape in the coming years.

Energy Efficiency and Decarbonization Push

Governments worldwide are intensifying efforts to meet climate goals, with stricter emissions standards impacting heating systems. By 2026, high-efficiency condensing boilers will dominate new installations, particularly in Europe and North America, as regions phase out low-efficiency models. The UK’s Future Homes Standard and EU Green Deal are accelerating the shift toward low-carbon heating, favoring hybrid systems that pair gas boilers with heat pumps. Additionally, hydrogen-ready boilers are expected to gain traction, with pilot programs expanding across key markets, positioning them as transitional solutions in the move toward net-zero heating.

Smart Thermostats as Standard Equipment

Smart thermostats will become increasingly standard in both new builds and retrofits by 2026. Integration with home automation platforms (e.g., Google Home, Apple HomeKit, Amazon Alexa) enhances user control and energy savings. Machine learning algorithms will enable predictive heating schedules based on occupancy patterns, weather forecasts, and utility pricing. Vendors like Nest, Ecobee, and Honeywell are expected to expand their ecosystems, offering deeper HVAC system diagnostics and remote maintenance alerts, thereby increasing consumer appeal and reducing energy consumption by up to 20%.

Growth of Connected Boiler Systems

The convergence of boilers and IoT is a key trend, with manufacturers embedding connectivity into boiler units for real-time monitoring and diagnostics. By 2026, connected boilers will support predictive maintenance, reducing repair costs and downtime. Service providers will leverage data from these systems to offer proactive maintenance contracts, improving customer retention and system longevity. This trend is supported by rising consumer demand for reliability and lower lifetime costs.

Regulatory and Incentive Landscape

Regulations will play a pivotal role in shaping market dynamics. Incentive programs, such as tax credits and rebates for energy-efficient upgrades (e.g., U.S. Inflation Reduction Act), will drive consumer adoption of advanced boilers and smart thermostats. Simultaneously, building codes will increasingly require smart controls in new constructions, further boosting thermostat penetration.

Regional Market Variations

Europe will lead in adoption of high-efficiency and low-carbon boilers due to aggressive decarbonization policies. In contrast, North America will see strong growth in smart thermostat adoption, driven by consumer tech-savviness and utility-sponsored energy efficiency programs. Emerging markets in Asia-Pacific will experience rising demand for basic and mid-tier boilers, with gradual uptake of smart controls as infrastructure improves.

Consolidation and Innovation Among Players

The competitive landscape will see increased consolidation, as traditional HVAC manufacturers partner with or acquire smart technology firms. Innovation will focus on interoperability, cybersecurity for connected devices, and user-friendly interfaces. Sustainability claims and carbon footprint transparency will become key differentiators in marketing.

In summary, by 2026, the boiler and thermostat market will be defined by smarter, more efficient, and interconnected systems, shaped by environmental regulations, digital innovation, and evolving consumer expectations. Companies that prioritize integration, sustainability, and data-driven service models will lead the market transformation.

Common Pitfalls Sourcing Boilers and Thermostats (Quality, IP)

Sourcing boilers and thermostats involves significant technical, regulatory, and quality considerations. Overlooking key aspects—particularly around product quality and intellectual property (IP)—can result in performance issues, safety hazards, legal liabilities, and reputational damage. Below are common pitfalls to avoid:

Poor Quality Components and Materials

One of the most frequent issues is selecting boilers or thermostats made with substandard materials or inadequate manufacturing processes. Low-quality heat exchangers, pumps, or sensors can lead to premature failure, reduced efficiency, and safety risks such as leaks or overheating. Always verify that components meet recognized industry standards (e.g., EN, ASME, UL) and request material certifications.

Inadequate IP Due Diligence

Failing to verify intellectual property rights can expose buyers to legal risks. Some suppliers, especially in competitive manufacturing regions, may offer products that infringe on patented designs, software algorithms, or user interface layouts. Ensure that the supplier can provide proof of IP ownership or valid licensing for proprietary technologies, particularly in smart thermostats with embedded software.

Misrepresentation of IP Ratings

For thermostats and control units, the Ingress Protection (IP) rating indicates resistance to dust and moisture. Suppliers may falsely claim high IP ratings (e.g., IP65 or IP67) without third-party certification. Using a thermostat with an inaccurate IP rating in humid or outdoor environments can lead to short circuits or system failure. Always request test reports from accredited laboratories.

Lack of Compliance with Regional Standards

Boilers must comply with local safety and emissions regulations (e.g., CE in Europe, DOE in the U.S., GOST in Russia). Sourcing non-compliant units—even if they meet basic quality standards—can result in installation rejection or legal penalties. Similarly, thermostats must meet electromagnetic compatibility (EMC) and safety standards. Confirm compliance documentation before procurement.

Overlooking Software and Firmware IP

Modern thermostats often run proprietary firmware for energy optimization, learning algorithms, or cloud integration. Sourcing units with unauthorized or pirated software not only violates IP laws but may also introduce cybersecurity vulnerabilities. Ensure firmware is licensed and regularly updated by the original developer.

Insufficient Supplier Vetting

Relying solely on price or marketing materials without auditing the supplier’s manufacturing practices, quality control systems, or IP portfolio increases risk. Conduct on-site audits or third-party inspections, and request references from other clients to assess reliability and authenticity.

Hidden Design or Component Copying

Some manufacturers reverse-engineer leading brands’ boilers or thermostats and sell near-identical replicas. While not always illegal, these clones may lack performance validation, safety testing, or support. They also carry higher IP infringement risks. Compare technical specifications and design elements carefully and consult legal experts if similarities are suspicious.

Incomplete or Falsified Certification Documentation

Suppliers may provide counterfeit or outdated certification documents to appear compliant. Always validate certifications through official databases or independent testing bodies. For example, check notified bodies for CE marking or UL’s online certification directory.

Avoiding these pitfalls requires thorough due diligence, technical expertise, and ongoing supplier relationship management. Prioritize transparency, compliance, and verifiable quality over cost savings alone.

Logistics & Compliance Guide for Boiler and Thermostat

This guide outlines the essential logistics and compliance considerations for the distribution, installation, and operation of boilers and thermostats. Adherence to these standards ensures safety, regulatory compliance, and efficient supply chain management.

Product Classification and Regulatory Framework

Boilers and thermostats are classified as regulated products due to their impact on energy efficiency, environmental performance, and user safety. Key regulatory frameworks include:

– Energy-related Products (ErP) Directive (EU) – Mandates energy labeling and ecodesign requirements.

– Boiler Efficiency Regulations (e.g., UK Boiler Plus) – Set minimum efficiency standards and smart control requirements.

– Electromagnetic Compatibility (EMC) Directive – Governs electronic thermostats to prevent interference.

– Low Voltage Directive (LVD) – Applies to electrical components in thermostats and boiler controls.

– Pressure Equipment Directive (PED) – Applicable to boilers based on pressure and volume thresholds.

– National Building Codes and Gas Safety Regulations – Such as IPC (International Plumbing Code) or Gas Safety (Installation and Use) Regulations (UK).

Ensure all products carry relevant conformity markings (CE, UKCA, etc.) and are supported by Declarations of Conformity.

Import and Export Requirements

When shipping boilers and thermostats across borders, consider:

– Customs Classification (HS Codes):

– Boilers: Typically 8402 (for central heating boilers) or 8403.

– Thermostats: Usually 9032 (automatic regulating/control instruments).

– Import Duties and Taxes – Vary by country; consult local tariff schedules.

– Energy Efficiency Documentation – Required for customs clearance in many jurisdictions (e.g., EU energy labels).

– Restricted Substances – Confirm compliance with RoHS (Restriction of Hazardous Substances) for electronic thermostats.

– Packaging and Labeling – Must include language-specific instructions, safety warnings, and compliance marks.

Transportation and Handling

Due to weight, size, and fragility:

– Boilers: Secure heavy units on pallets using straps; protect controls and flue connections. Use forklift-accessible packaging.

– Thermostats: Protect from electrostatic discharge (ESD) and moisture; use anti-static packaging for electronic models.

– Temperature and Humidity Control: Avoid extreme conditions during transit, especially for digital thermostats.

– Fragile and Heavy Labels: Clearly mark packages to prevent damage.

Storage Conditions

- Boilers: Store indoors in dry, temperature-stable environments. Protect from corrosion and physical impact.

- Thermostats: Keep in original packaging; avoid exposure to dust, moisture, and extreme temperatures.

- Shelf Life: Electronic components may degrade over time; follow manufacturer storage guidelines.

Installation and Commissioning Compliance

Installation must comply with local regulations and manufacturer instructions:

– Qualified Personnel: Only licensed HVAC or gas engineers may install boilers in most regions.

– Thermostat Compatibility: Ensure thermostat is compatible with boiler type (e.g., OpenTherm, on/off).

– Smart Thermostat Data Privacy: Comply with GDPR or CCPA if devices collect user data.

– Commissioning Records: Maintain logs for warranty and regulatory audits (e.g., UK Gas Safe registration).

Environmental and Disposal Regulations

- WEEE (Waste Electrical and Electronic Equipment) – Thermostats must be recycled under WEEE schemes in applicable regions.

- Boiler Disposal – May involve hazardous materials (e.g., insulation, heat exchangers); follow local waste disposal laws.

- Refrigerants (if applicable) – Some heat pumps integrate boiler systems; ensure proper handling under F-Gas regulations.

Documentation and Traceability

Maintain complete records:

– Technical files and conformity assessments.

– Batch/serial number tracking for recalls.

– Installation manuals, user guides, and safety data sheets.

– Certificates of compliance (e.g., CE, UL, CSA).

Summary

Proper logistics and compliance management for boilers and thermostats ensures legal operation, user safety, and environmental responsibility. Regularly review evolving regulations and work with certified partners throughout the supply chain.

Conclusion:

After evaluating various options for sourcing a boiler and thermostat, it is clear that selecting the right combination involves balancing energy efficiency, compatibility, brand reliability, long-term cost savings, and ease of installation. High-efficiency condensing boilers paired with smart thermostats offer the best return on investment by reducing energy consumption and improving temperature control. It is essential to choose products from reputable manufacturers with strong warranty support and to ensure compatibility between the boiler and thermostat—especially when opting for smart or learning thermostats that integrate with existing heating systems.

Additionally, sourcing through certified suppliers or HVAC professionals ensures proper installation, compliance with regulations, and access to technical support. While upfront costs may be higher for advanced systems, the long-term benefits in energy savings, comfort, and system longevity make them a worthwhile investment. Therefore, the recommended approach is to source a high-efficiency boiler and a programmable or smart thermostat from trusted brands through qualified providers, ensuring optimal performance, reliability, and sustainability of the heating system.