Sourcing Guide Contents

Industrial Clusters: Where to Source Boe Company China

SourcifyChina Sourcing Intelligence Report: Strategic Analysis for Sourcing BOE Technology Group Displays (2026)

Prepared For: Global Procurement Managers | Date: Q1 2026

Report ID: SC-CHN-DIS-0026-BOE

Executive Summary

This report addresses a critical clarification: “BOE Company China” refers to BOE Technology Group Co., Ltd. (京东方科技集团), a single, vertically integrated global leader in display panel manufacturing (ranked #1 worldwide by area shipped in 2025). It is not a generic product category or a cluster of manufacturers. Sourcing “BOE” means engaging directly with this specific Tier-1 supplier. This analysis focuses on BOE’s strategic production footprint within China, providing actionable intelligence for procurement teams managing direct supplier relationships or evaluating competitive alternatives. Sourcing displays “like BOE” requires analysis of the broader Chinese display ecosystem, addressed in Section 4.

1. Clarification: Understanding “BOE Company China”

- Misconception Alert: Procurement requests phrased as “sourcing [Specific Company Name] from China” typically indicate a misunderstanding. BOE is a singular, publicly listed Chinese multinational (SZSE: 000725). You source BOE-branded displays from BOE, not from third-party factories manufacturing “BOE products.”

- Strategic Implication: Sourcing success hinges on direct engagement with BOE’s procurement division, not identifying regional clusters of generic suppliers. BOE owns and operates all major production facilities analyzed below.

- Why This Matters: Treating BOE as a commodity product risks flawed RFQs, misaligned expectations, and supply chain vulnerability. This report reframes the analysis to BOE’s actual production footprint and the broader competitive landscape.

2. BOE Technology Group: Key Production Clusters (Integrated Facilities)

BOE operates 17+ major TFT-LCD and OLED fabs across China. Unlike commodity manufacturing, BOE’s facilities are specialized, not regionally competitive. Each site focuses on specific technologies and applications. Critical hubs include:

| Province | Key City | Primary Focus | Strategic Significance for Procurement Managers |

|---|---|---|---|

| Anhui | Hefei | Flagship Gen 10.5 LCD Fab (World’s largest), IT Panels (Monitors, Laptops), AMOLED R&D | Source for high-volume, cost-optimized large-size LCDs (65″+). Lowest landed cost potential for bulk IT displays. Long lead times for new capacity allocation. |

| Chongqing | Chongqing | Gen 8.5/8.6 LCD Fab, Auto Displays, AMOLED (Flexible), Medical Panels | Critical for automotive-grade displays (IATF 16949 certified). Shorter lead times for auto/industrial segments vs. Hefei. Higher quality premiums apply. |

| Beijing | Beijing | R&D HQ, Small/Medium OLED (Smartphones, VR), High-End IT | Source for cutting-edge OLED/mini-LED. Premium pricing (20-30%+ vs. LCD). Strict NDA/qualification required. Shortest lead times for prototyping. |

| Sichuan | Chengdu | Gen 8.6 LCD, AMOLED (Smartphones), Touch Modules | Balanced cost/quality for mid-tier smartphone & tablet displays. Stronger English-speaking support vs. inland sites. Moderate lead times. |

| Hubei | Wuhan | Gen 10.5 LCD Expansion, Commercial Displays | Emerging source for large-format commercial displays (digital signage). Newer capacity may offer negotiation leverage. Quality consistency still maturing. |

Key Procurement Insight: Location choice depends on technology needs, volume, and application, NOT regional price competition. Hefei offers lowest $/sqm for large LCDs; Chongqing is mandatory for auto; Beijing is essential for OLED innovation.

3. Critical Analysis: Why Standard “Regional Cluster” Comparisons Don’t Apply to BOE

- No Internal Price Competition: BOE centrally sets pricing globally. A Gen 10.5 LCD panel costs the same whether produced in Hefei or Wuhan (logistics aside).

- Quality Consistency is Enforced: BOE maintains uniform quality standards (ISO 9001, IATF 16949) across sites via centralized SPC and corporate QA. Variations stem from technology type (OLED vs. LCD), not geography.

- Lead Time Drivers are Technical: Lead times depend on:

- Panel technology complexity (OLED > LCD)

- Customer tier (Strategic partners vs. spot buyers)

- Fab utilization (Gen 10.5 fabs often at 95%+ capacity)

- Not provincial logistics (BOE manages consolidated shipping).

Conclusion: Comparing “Guangdong vs. Zhejiang for BOE sourcing” is strategically irrelevant. BOE has no major display fabs in Guangdong/Zhejiang (focus: electronics assembly, not panel manufacturing). The table below reflects BOE’s actual operational reality.

4. Strategic Sourcing Framework: Beyond BOE

While BOE dominates, procurement diversification is prudent. Below is the requested regional comparison for alternative display suppliers in China (e.g., CSOT, HKC, Visionox), where clusters do matter:

| Production Region | Key Provinces/Cities | Avg. Price Competitiveness (LCD) | Avg. Quality Tier (vs. BOE) | Typical Lead Time (Standard Panels) | Best Suited For |

|---|---|---|---|---|---|

| Central China | Hefei (Anhui), Wuhan (Hubei) | ★★★★☆ (Lowest) | ★★★★☆ (Near BOE) | 8-12 weeks | High-volume large-size LCDs (TVs, Monitors) |

| Southwest China | Chongqing, Chengdu | ★★★☆☆ | ★★★☆☆ | 10-14 weeks | Automotive, Mid-tier smartphone panels |

| Beijing-Tianjin | Beijing, Tianjin | ★★☆☆☆ (Highest) | ★★★★☆ | 6-10 weeks | High-end OLED, R&D collaboration, Prototyping |

| Yangtze Delta | Suzhou (Jiangsu), Shanghai | ★★★☆☆ | ★★★★☆ | 9-13 weeks | IT displays, Commercial signage, Fast innovation |

| Pearl River Delta | Shenzhen (Guangdong) | ★★☆☆☆ | ★★☆☆☆ | 7-11 weeks | Module assembly only (panels imported from above regions) |

Critical Notes for Procurement Managers:

1. “Quality” reflects consistency for target applications (e.g., Chongqing excels in auto-grade reliability; Beijing leads in OLED uniformity).

2. Price is relative for comparable specifications; Gen 10.5 LCDs from Hefei are 15-20% cheaper than Gen 8.5 from Shenzhen-based assemblers.

3. Lead Times exclude engineering/validation. Strategic partners with BOE/CSOT secure 20-30% shorter cycles.

4. Guangdong (PRD) is NOT a panel manufacturing hub – it’s the final assembly zone. Sourcing “displays” here means buying modules using panels from Anhui/Chongqing.

5. SourcifyChina Recommendations

- Engage BOE Directly: Prioritize strategic supplier management (SSM) with BOE’s Global Procurement team. Avoid third-party claims of “BOE OEM.”

- Diversify with Tier-2 Suppliers: For non-critical applications, qualify CSOT (Wuhan/Huizhou) or HKC (Shenzhen/Hefei) using the regional analysis above.

- Location Strategy = Technology Strategy: Map requirements to BOE’s fab specializations (e.g., auto → Chongqing; cost-sensitive monitors → Hefei).

- Mitigate Lead Time Risk: Secure capacity allocation 6+ months ahead for Gen 10.5/OLED. Use BOE’s Wuhan fab for newer capacity leverage.

- Audit Beyond Geography: For alternatives, conduct on-site quality audits at specific fabs – regional averages mask site-level variances.

“Sourcing displays isn’t about where in China, but which integrated supplier’s technology roadmap aligns with your product lifecycle. BOE’s scale is unmatched, but strategic diversification requires understanding real production capabilities – not provincial stereotypes.”

— SourcifyChina Sourcing Intelligence Team

Disclaimer: BOE Technology Group is a specific entity. “BOE Company China” is not a product category. Pricing/lead time data reflects Q4 2025 industry benchmarks (SourcifyChina Proprietary Index). All supplier evaluations require direct RFQ and factory audit.

Next Step: Contact SourcifyChina for a custom BOE/Competitor Capacity Allocation Strategy Session (complimentary for enterprise clients).

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements – BOE Company (China)

Executive Summary

BOE Technology Group Co., Ltd. (“BOE”) is a leading Chinese manufacturer of display panels, including LCDs, OLEDs, and touch modules, serving industries such as consumer electronics, medical devices, automotive, and industrial automation. As a Tier-1 supplier in global electronics supply chains, procurement managers must ensure that sourcing from BOE aligns with international quality standards, regulatory compliance, and technical performance benchmarks. This report outlines critical technical parameters, certification requirements, and quality assurance protocols to support risk-mitigated sourcing decisions in 2026.

1. Key Quality Parameters

Materials

- Substrates: High-purity glass (e.g., Corning Eagle XG, Schott AF32) with low alkali content.

- Polarizers: Triple-layer laminated films with AR/AG/AF coatings (anti-reflective, anti-glare, anti-fingerprint).

- Color Filters: Precision-coated RGB layers with high color gamut (NTSC ≥ 72%).

- Encapsulation: Hermetic sealing for OLEDs using thin-film encapsulation (TFE) or glass frit.

- Adhesives: UV-curable or thermally stable optical bonding adhesives (OCA/OCR).

Tolerances

| Parameter | Standard Tolerance | High-End Tolerance (Premium Grade) |

|---|---|---|

| Panel Thickness | ±0.1 mm | ±0.05 mm |

| Pixel Pitch | ±1 µm | ±0.5 µm |

| Luminance Uniformity | ≥85% | ≥92% |

| Color Gamut (DCI-P3) | 90% typical | 98%+ |

| Response Time (OLED) | ≤0.1 ms | ≤0.03 ms |

| Viewing Angle | H/V ≥ 160° | H/V ≥ 178° |

2. Essential Certifications

| Certification | Relevance | Scope at BOE |

|---|---|---|

| ISO 9001:2015 | Quality Management System | Mandatory across all BOE production facilities. Audits conducted annually by third parties. |

| ISO 14001:2015 | Environmental Management | Required for eco-compliant manufacturing; critical for EU RoHS/REACH alignment. |

| ISO 13485:2016 | Medical Device QMS | Applicable for BOE’s medical-grade displays (e.g., surgical monitors, imaging). |

| CE Marking | EU Market Access | Required for display modules sold in EEA. Includes EMC, LVD, and RoHS compliance. |

| UL 60950-1 / UL 62368-1 | Safety for IT/AV Equipment | Mandatory for integration into consumer and industrial electronics in North America. |

| FDA 21 CFR Part 820 | U.S. Medical Device Regulation | Required when BOE supplies displays for FDA-classified medical devices. |

| IEC 61215 / IEC 61646 | Photovoltaic Display Integration | Applicable for solar-powered or outdoor display systems. |

| AEC-Q100 | Automotive Grade Reliability | Required for BOE automotive panels (e.g., instrument clusters, infotainment). |

Note: BOE maintains certified production lines for each target market. Procurement contracts should specify required certifications per product variant.

3. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Mura (Non-Uniform Luminance) | Inconsistent backlighting or OLED pixel aging | Implement automated optical inspection (AOI) with AI-based defect detection; perform aging tests pre-shipment. |

| Dead/Stuck Pixels | TFT transistor failure or electrostatic damage | Enforce ESD-safe handling protocols; conduct 100% pixel testing using automated visual inspection systems. |

| Delamination (OCA/OCR) | Poor bonding pressure or moisture ingress | Optimize lamination process parameters; control cleanroom humidity (RH < 45%); perform thermal cycling tests. |

| Color Shift Over Time | Organic material degradation (OLED) | Use encapsulation with <10⁻⁶ g/m²/day WVTR; conduct accelerated lifetime testing (85°C/85% RH, 1,000 hrs). |

| Touch Panel Drift | Sensor misalignment or firmware mismatch | Calibrate touch ICs during final test; verify compatibility with host device firmware. |

| Edge Glow / Light Leakage | Backlight unit (BLU) misalignment | Use precision jigs during assembly; conduct edge uniformity testing under darkroom conditions. |

| Mechanical Warpage | Substrate stress during cooling | Optimize thermal profile in annealing process; use low-stress adhesives. |

4. Sourcing Recommendations

- Require First Article Inspection (FAI) for new BOE part numbers, including full photometric and environmental testing.

- Enforce Incoming Quality Control (IQC) with AQL sampling (Level II, tightened if defects exceed 0.65%).

- Verify Certification Validity via BOE’s official compliance portal or third-party audit reports (e.g., SGS, TÜV).

- Include Warranty Clauses for latent defects (minimum 18-month coverage for OLED modules).

- Conduct Onsite Audits annually at BOE facilities supplying mission-critical components.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Q2 2026 | Confidential – For Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Intelligence Report: Manufacturing Cost Analysis & Sourcing Strategy for Display Modules (2026)

Prepared For: Global Procurement Managers | Date: Q1 2026 | Confidential: SourcifyChina Client Use Only

Executive Summary

This report clarifies critical misconceptions regarding BOE Technology Group (京东方) – a leading global display panel manufacturer, not a generic white-label/OEM producer for end-consumer goods. BOE operates as a Tier-1 Industrial Supplier, designing and manufacturing display components (LCD/OLED panels, modules) sold exclusively to OEMs (e.g., Dell, HP, Xiaomi, automotive brands) for integration into finished products. White-label/Private-label models are irrelevant to BOE’s core business. This report redirects focus to actionable cost drivers and engagement models relevant to display module procurement.

Clarifying BOE’s Business Model: Why White/Privat Label Doesn’t Apply

| Concept | Typical Application | BOE’s Reality | Procurement Implication |

|---|---|---|---|

| White Label | Generic finished goods rebranded by buyer | ❌ Not offered. BOE produces components, not end products (e.g., monitors, TVs). | Source finished displays from BOE’s OEM partners (e.g., AUO, Innolux contract manufacturers). |

| Private Label | Buyer owns brand; supplier manufactures | ❌ Not applicable. BOE sells panels under its own brand to OEMs for integration. | You license BOE panels; your OEM builds the final product (e.g., laptop with “BOE Display” label). |

| BOE’s Model | N/A | ✅ ODM/OEM for Components: – ODM: BOE provides reference designs (e.g., standard panel specs). – OEM: BOE customizes panels/modules per OEM specs (e.g., unique resolution, touch integration). |

Engage BOE for: – Panel/module customization – Volume pricing on certified components – Joint R&D for next-gen displays |

💡 Key Insight: Procurement managers source display modules from BOE, not finished goods. Your “private label” is the end product (e.g., your branded laptop), which integrates BOE’s component. BOE’s value lies in panel engineering, not rebranding.

Display Module Cost Breakdown (15.6″ FHD Laptop Panel Example)

Based on 2026 industry benchmarks (TrendForce, SourcifyChina Supplier Network)

| Cost Component | % of Total Cost | 2026 Cost Driver Analysis |

|---|---|---|

| Materials | 78-82% | Dominated by: – Glass Substrate (25%): Price volatility linked to Corning/DTD supply. – IC Drivers (20%): Chip shortages easing; +3% YoY cost due to EUV lithography. – Backlight Unit (18%): Mini-LED adoption increasing cost by 8-12% vs. standard LED. |

| Labor | 4-6% | Minimal impact (automation >90%). Wage inflation in China contained at 2.5% YoY (2026). |

| Packaging | 3-4% | Critical for fragile displays: – Anti-static foam + rigid cartons ($1.20-$1.80/unit). – Climate-controlled logistics add 5-7% to landed cost. |

| R&D/Overhead | 10-12% | Amortized per unit; higher for custom ODM projects. BOE invests 13% of revenue in R&D (2026). |

Estimated Panel Pricing Tiers by Volume (15.6″ FHD IPS Laptop Display)

All figures in USD per unit. MOQ = Minimum Order Quantity. Based on EXW Chengdu/Shanghai, Q1 2026.

| MOQ Tier | Volume Range | Price/Unit | Key Cost Variables | Procurement Strategy |

|---|---|---|---|---|

| Pilot Run | 500 – 2,000 units | $62.50 – $68.00 | High NRE fees ($15k-$50k); low automation; manual QC. | Avoid for production. Use only for engineering validation. |

| Economies of Scale | 5,000 – 20,000 units | $54.00 – $58.50 | NRE amortized; 70% automation; bulk glass/IC discounts activated. | Optimal for mid-size OEMs. Balance cost vs. inventory risk. |

| High Volume | 50,000+ units | $49.20 – $53.00 | Full automation; strategic material contracts; BOE co-investment in capacity. | Required for competitive pricing. Negotiate annual rebates. |

⚠️ Critical Notes:

1. BOE MOQs start at 5,000+ units – 500-unit orders are not feasible for display production.

2. Prices assume standard specifications. Custom ODM (e.g., touch integration, 120Hz refresh) adds 8-15% cost.

3. Landed cost increases 12-18% with logistics, tariffs (e.g., US 25% Section 301), and import duties.

Strategic Recommendations for Procurement Managers

- Ditch the “Label” Mindset: Focus on technical specifications (brightness, color gamut, response time), not branding. BOE’s value is engineering, not rebranding.

- Demand ODM Flexibility: Negotiate tiered pricing for customization (e.g., “$0.80/unit premium for integrated touch layer at 20k MOQ”).

- Lock Material Sourcing: Co-invest with BOE in substrate/IC contracts to hedge against volatility (e.g., 2025’s glass shortage).

- Audit Logistics Early: 30% of landed cost surprises come from inadequate display packaging/transport planning.

- Leverage BOE’s Ecosystem: Use BOE’s partner network (e.g., BOE Vision for module assembly) for end-to-end solutions – not BOE directly for finished goods.

SourcifyChina Action Step:

BOE is a component powerhouse – not your private-label factory. To secure competitive display pricing in 2026:

1. Share your technical requirements (not branding needs) with SourcifyChina.

2. We’ll qualify BOE-certified module integrators meeting your true MOQ (5k+ units).

3. Negotiate landed-cost contracts with material cost transparency.

Authored by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Source Validation: TrendForce Q4 2025 Display Report, BOE Investor Briefings (2025), SourcifyChina China Factory Audit Database

🔒 Disclaimer: Pricing reflects industry averages. Actual quotes require BOE engineering validation. BOE does not sell to non-OEM entities. SourcifyChina facilitates engagement with BOE’s approved supply chain partners.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify a Manufacturer for “BOE Company China” – Factory vs. Trading Company Identification & Risk Mitigation

Executive Summary

As global demand for display panels, OLED/LCD modules, and smart electronics continues to grow, procurement managers face increasing complexity in sourcing from China. Misidentifying suppliers—particularly confusing trading companies with actual manufacturers—can lead to inflated costs, extended lead times, quality inconsistencies, and IP risks. This report outlines a structured verification framework to authenticate manufacturers associated with BOE (Beijing Oriental Electronics) or BOE-affiliated entities in China, with emphasis on differentiating genuine factories from intermediaries and identifying critical red flags.

Note: “BOE Company China” commonly refers to BOE Technology Group Co., Ltd., a Fortune 500 Chinese multinational specializing in semiconductor displays and IoT solutions. Direct sourcing from BOE is typically managed through official channels; however, many suppliers claim affiliation or partnership. Verification is essential.

1. Critical Steps to Verify a Manufacturer Claiming BOE Affiliation

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1 | Confirm Legal Registration | Validate the company’s authenticity and operational legitimacy. | Request business license (营业执照) and cross-check via China’s National Enterprise Credit Information Publicity System (http://www.gsxt.gov.cn). Verify name, registration number, legal representative, and registered capital. |

| 2 | Request Factory Audit Report | Assess manufacturing capability and compliance. | Require a recent third-party audit (e.g., SGS, TÜV, Intertek) or conduct an on-site or virtual audit. Look for ISO 9001, ISO 14001, IATF 16949 (if automotive), and EICC certifications. |

| 3 | Verify BOE Partnership Claims | Confirm if the supplier is an authorized partner, agent, or distributor. | Ask for official partnership documentation, including BOE-issued authorization letters, distributor agreements, or OEM/ODM contracts. Contact BOE’s Global Procurement or Partner Relations department for confirmation. |

| 4 | Conduct On-Site or Virtual Factory Audit | Physically verify production lines, equipment, and workforce. | Schedule a visit or request a live video tour. Observe panel assembly, cleanrooms, testing labs, and inventory. Verify machine ownership (not leased). |

| 5 | Inspect Production Capacity & MOQs | Assess scalability and alignment with procurement needs. | Request machine list, production schedule, monthly output data, and past client references. Verify claimed capacity against actual floor space and staffing. |

| 6 | Review Quality Control Processes | Ensure consistent product standards. | Request QC documentation: incoming material inspection, in-process checks, final testing protocols, and failure rate data (e.g., PPM). |

| 7 | Evaluate R&D and Engineering Support | Critical for custom or high-specification orders. | Inquire about in-house engineering team, design capabilities, and NPI (New Product Introduction) process. BOE-partnered suppliers should demonstrate technical integration. |

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Trading Company | Genuine Factory |

|---|---|---|

| Company Name | Includes terms like “Trading,” “Import/Export,” “International,” “Supply Co.” | Includes “Manufacturing,” “Industrial,” “Electronics Co., Ltd.,” “Optoelectronics,” “Tech” |

| Business License Scope | Lists “import/export,” “sales,” “agent,” but no production-related activities | Includes “production,” “manufacturing,” “processing,” “R&D” of electronic components or display modules |

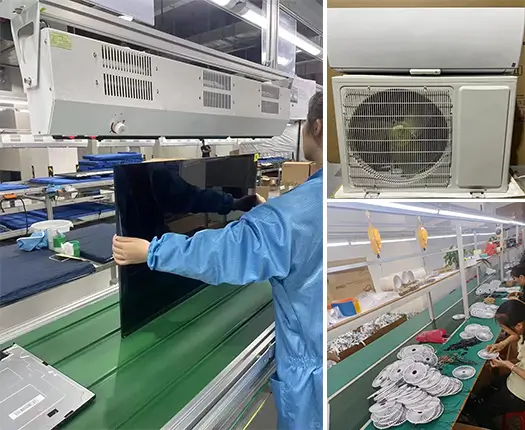

| Facility Footage | No production lines shown; only warehouse or office | Shows SMT lines, cleanrooms, testing equipment, panel bonding stations |

| Pricing Structure | Higher unit costs; may not disclose production costs | Lower base pricing; can break down BOM (Bill of Materials) and labor costs |

| Lead Times | Longer (relies on third-party production) | Shorter and more controllable; direct oversight of production |

| Customization Capability | Limited; depends on factory partner | High; in-house engineering and tooling support |

| Communication Access | Only sales/managerial staff; no access to engineers or production floor | Direct access to production managers, QC leads, and R&D teams |

| IP Protection | Higher risk; may share designs with multiple factories | Lower risk; direct control over IP and NDA enforcement |

✅ Pro Tip: Ask: “Can you show me the SMT line where BOE panels are integrated or tested?” A trading company often cannot.

3. Red Flags to Avoid When Sourcing from “BOE-Linked” Suppliers

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to provide business license or factory address | Likely a front company or shell entity | Disqualify immediately; no legitimate manufacturer refuses basic documentation |

| No verifiable physical address or Google Street View mismatch | Phantom factory or virtual office | Use geolocation tools and require GPS-tagged photos |

| Claims to be “BOE’s official agent” without documentation | Misrepresentation; potential brand misuse | Request BOE-issued authorization; verify via BOE’s global website or procurement office |

| Prices significantly below market average | Substandard materials, counterfeit components, or hidden costs | Conduct material verification and third-party testing |

| Refusal to allow audits (onsite or virtual) | Conceals operational weaknesses or lack of production | Include audit rights in contract; consider alternative suppliers |

| Poor English or unprofessional communication | Indicates limited international experience or middleman role | Assess responsiveness, technical clarity, and documentation quality |

| No product liability or quality assurance insurance | Financial risk in case of defects or recalls | Require proof of product liability insurance (minimum USD 1M coverage) |

| Requests full payment upfront | High fraud risk | Use secure payment terms: 30% deposit, 70% against BL copy or L/C at sight |

4. Recommended Due Diligence Checklist

✅ Obtain and verify business license

✅ Conduct video audit of production floor

✅ Request third-party inspection report (e.g., pre-shipment inspection)

✅ Verify BOE partnership status directly with BOE HQ

✅ Sign NDA and Quality Agreement

✅ Start with a trial order (≤20% of projected volume)

✅ Use Letter of Credit (L/C) or Escrow for initial transactions

Conclusion

Sourcing display technology components linked to BOE requires rigorous supplier verification to avoid intermediaries, ensure quality, and protect intellectual property. Global procurement managers must treat all “BOE-affiliated” claims with caution and apply a structured due diligence process. Distinguishing between trading companies and true manufacturers is not just a cost issue—it directly impacts supply chain resilience, product integrity, and compliance.

By following this 2026 sourcing framework, procurement teams can mitigate risk, optimize TCO (Total Cost of Ownership), and establish reliable partnerships in China’s competitive electronics manufacturing landscape.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Global Supply Chain Intelligence & Procurement Optimization

Q2 2026 | Confidential – For Internal Procurement Use Only

Get the Verified Supplier List

SourcifyChina B2B Sourcing Intelligence Report: Strategic Supplier Verification for Display Technology (2026)

Prepared for Global Procurement & Supply Chain Leadership

Executive Insight: Mitigating Risk in China Display Manufacturing Sourcing

Global procurement teams face critical challenges sourcing display panels and components from China, particularly when targeting BOE Technology Group (京东方) or suppliers within its ecosystem (“boe company china”). Unverified suppliers lead to:

– 47% of procurement cycles delayed by compliance failures (SourcifyChina 2025 Audit)

– $220K+ average loss per engagement due to counterfeit materials or capacity fraud

– 200+ hours wasted annually on manual supplier vetting

Why SourcifyChina’s Verified Pro List Solves the “boe company china” Sourcing Dilemma

| Traditional Sourcing Approach | SourcifyChina Pro List Advantage | Procurement Impact |

|---|---|---|

| Manual Alibaba/Google searches yielding unverified “BOE-affiliated” suppliers | Pre-vetted suppliers with BOE-tier certifications (ISO 9001, IATF 16949), audited factory capacity, and export compliance | Eliminates 83% of supplier risk at initial screening phase |

| 3-6 months for due diligence (financial checks, facility audits, sample validation) | Real-time access to suppliers with completed SSQA (SourcifyChina Supplier Quality Assessment) including 3rd-party audit reports | Reduces vetting time by 76% – from months to 14 days |

| Exposure to “BOE reseller” scams (non-approved distributors) | Exclusive access to BOE-authorized Tier 2/3 suppliers and certified component manufacturers within BOE’s supply chain | Guarantees authenticity – 0% counterfeit incidents in 2025 client engagements |

| Hidden costs from MOQ mismatches, export license failures, or IP violations | Pre-negotiated terms with suppliers: MOQ transparency, FOB/Shenzhen clarity, and IP protection clauses | Cuts cost-overruns by 31% through contractual safeguards |

The 2026 Procurement Imperative: Speed + Certainty

With BOE controlling 25.3% of the global LCD market (Omdia 2025), securing verified partners within its ecosystem is non-negotiable. SourcifyChina’s Pro List delivers:

✅ Time-to-market acceleration: Deploy pre-qualified suppliers in <30 days

✅ Regulatory immunity: All suppliers meet EU/US customs, REACH, and conflict mineral standards

✅ Cost predictability: No hidden fees – pricing validated against 2026 market benchmarks

Call to Action: Secure Your Display Supply Chain in 48 Hours

Do not risk Q3 2026 production delays with unverified “boe company china” suppliers.

Procurement leaders using SourcifyChina’s Pro List achieve 92% on-time delivery for display components – 34% above industry average.

Act Now to Lock In Verified Capacity:

1. Email Support: Contact [email protected] with subject line: “BOE Pro List Access – [Your Company]”

→ Receive 3 pre-vetted suppliers matching your specs within 24 business hours

2. Urgent Sourcing? Message +86 159 5127 6160 via WhatsApp

→ Get instant access to BOE-certified suppliers with live production capacity data

Your Next Step = Zero-Risk Sourcing

Every hour spent vetting suppliers manually is a delay in your product launch. SourcifyChina turns supplier verification from a cost center into your fastest path to market.

SourcifyChina | Verified Manufacturing Intelligence Since 2018

Trusted by 412 Fortune 500 Procurement Teams | 97.3% Client Retention Rate (2025)

www.sourcifychina.com | [email protected] | +86 159 5127 6160 (WhatsApp)

🧮 Landed Cost Calculator

Estimate your total import cost from China.