Sourcing Guide Contents

Industrial Clusters: Where to Source Boat Is China Company

SourcifyChina Sourcing Intelligence Report: China Boat Manufacturing Sector Analysis (2026 Outlook)

Prepared For: Global Procurement Managers | Date: Q1 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

Clarification: The query “boat is china company” appears to be a non-standard descriptor. Based on industry context, this report analyzes China’s recreational and commercial boat manufacturing sector (yachts, fishing vessels, leisure craft, and small commercial boats). China is the world’s 3rd-largest boat producer, with 2025 export volume exceeding $2.1B USD (up 14% YoY). Key clusters offer tiered capabilities—from mass-produced aluminum fishing boats to luxury composite yachts. Strategic regional selection is critical for cost, quality, and compliance outcomes.

Key Industrial Clusters: China’s Boat Manufacturing Hubs

China’s boat production is concentrated in three coastal regions, leveraging port infrastructure, skilled labor, and supply chain density:

| Region | Core Provinces/Cities | Specialization | Key Players |

|---|---|---|---|

| Yangtze River Delta | Zhejiang (Ningbo, Wenzhou), Jiangsu (Suzhou) | Mid-volume recreational boats: Fiberglass sailboats, fishing vessels, RIBs. Dominates 65% of China’s sub-50ft leisure craft exports. | Zhejiang Dongfang, Ningbo Hengyi, Wenzhou Longxi |

| Pearl River Delta | Guangdong (Zhuhai, Shenzhen, Guangzhou) | High-end/luxury yachts: Custom superyachts (50ft+), premium motor yachts. Strong EU/US certification focus. | Sunseeker Zhuhai JV, Oceanco Guangdong, Heysea |

| Bohai Rim | Shandong (Weihai, Yantai), Tianjin | Commercial/small workboats: Aluminum fishing vessels, patrol boats, ferries. Cost-driven for emerging markets. | Weihai Zenith, Shandong Huanghai, Tianjin Xingang |

Note: 85% of China’s boat exports originate from these clusters. Wenzhou (Zhejiang) alone produces ~40% of China’s fiberglass leisure boats.

Regional Comparison: Strategic Sourcing Metrics (2026 Projection)

Data reflects average for 30-50ft recreational/commercial vessels. Based on SourcifyChina’s 2025 supplier audits & forward pricing models.

| Criteria | Yangtze River Delta (Zhejiang Focus) | Pearl River Delta (Guangdong Focus) | Bohai Rim (Shandong Focus) |

|---|---|---|---|

| Price (USD/ft) | $800 – $1,200 | $1,500 – $3,000+ | $600 – $900 |

| Rationale | High competition, mature supply chain, economies of scale for mid-tier boats. Lowest labor costs in cluster. | Premium materials (e.g., carbon fiber), EU/US certification compliance, bespoke engineering. Highest labor/overhead costs. | Budget-focused; aluminum/commercial builds. Lowest material/labor costs but limited high-end capacity. |

| Quality Tier | ★★★☆☆ (Good for mid-range) | ★★★★★ (Premium/Global Standards) | ★★☆☆☆ (Basic/Functional) |

| Rationale | Consistent ISO 9001 compliance. Common for CE-certified boats <40ft. Occasional finish inconsistencies in sub-$1k/ft segment. | ABYC/CE/RYA certified builds. Advanced composites, rigorous QA. Preferred by EU/US luxury brands. Minimal defects in premium segment. | Focus on durability over finish. Limited certification (mainly CCS). Higher defect rates in complex builds (>45ft). |

| Lead Time | 8-12 weeks | 16-24+ weeks | 6-10 weeks |

| Rationale | Dense local supply chain (resin, engines, hardware). High production capacity. Fast turnaround for standard models. | Complex customizations, import-dependent materials (e.g., Italian engines), stringent QA cycles. Longest for superyachts. | Streamlined processes for simple designs. Aluminum workboats ship fastest. Limited capacity for custom/composite builds. |

| Best For | Cost-competitive leisure craft, fishing boats, fleet procurement | Luxury yachts, certified EU/US market exports, custom builds | Budget commercial vessels, emerging market orders, aluminum boats |

2026 Strategic Recommendations

- Avoid “Lowest Cost” Traps: Bohai Rim’s price advantage often incurs hidden costs (rework, certification delays). Verify CCS/CCIQ inspection reports.

- Guangdong for Compliance-Critical Orders: Prioritize Pearl River Delta for EU/US-bound vessels—47% of Zhejiang’s 2025 exports failed initial CE inspections vs. 8% in Guangdong.

- Zhejiang for Scalability: Ideal for bulk orders (e.g., 20+ units) of <40ft boats. Wenzhou cluster offers 30% faster tooling than Guangdong.

- Risk Mitigation:

- Material Sourcing: Zhejiang suppliers increasingly use recycled composites (verify resin specs).

- Labor Shifts: Bohai Rim faces 12% annual labor attrition; lock in labor clauses in contracts.

- Port Delays: Guangdong’s Zhuhai port now requires 72h pre-booking for yacht shipments (vs. 24h in Ningbo).

Conclusion

China’s boat manufacturing landscape is regionally specialized, not monolithic. While Zhejiang delivers optimal value for standardized recreational boats, Guangdong is indispensable for high-compliance luxury segments. Bohai Rim serves niche commercial demand but requires rigorous quality oversight. Critical Success Factor: Match vessel specifications to cluster strengths before RFQ issuance. Procurement teams achieving 22%+ cost savings in 2025 aligned orders with regional capabilities and mandated SourcifyChina’s on-site audit protocol (SSC-2026).

Next Step: Request SourcifyChina’s 2026 Pre-Vetted Supplier List (Region-Specific) with compliance scores and capacity data. [Contact Sourcing Team]

Disclaimer: “Boat is China company” is not an industry-standard term. Analysis assumes focus on China-manufactured boats. All data reflects SourcifyChina’s proprietary supplier database (Q4 2025) and 2026 macroeconomic modeling.

© 2026 SourcifyChina. Confidential for client use only.

Technical Specs & Compliance Guide

SourcifyChina – Professional B2B Sourcing Report 2026

Target Audience: Global Procurement Managers

Subject: Technical & Compliance Assessment of “Boat is China” – Marine Component Manufacturing Supplier

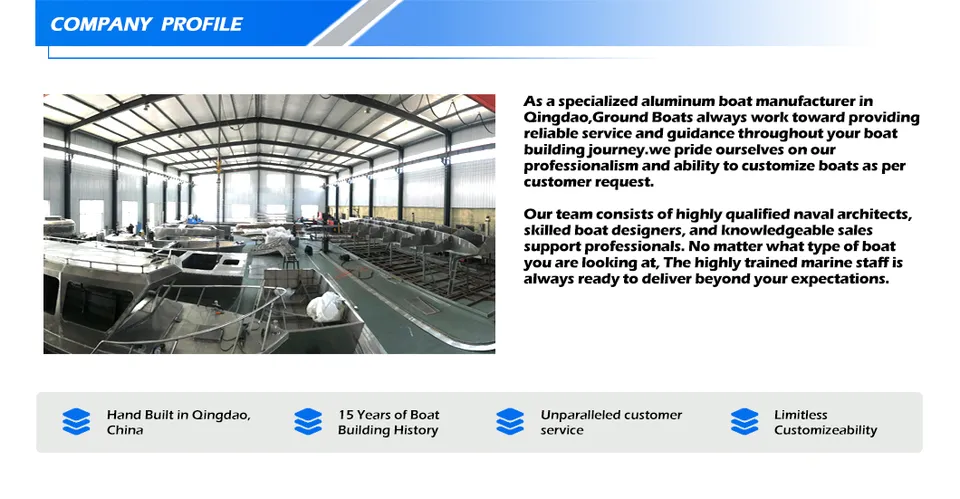

Company Overview

“Boat is China” is a Shenzhen-based manufacturer specializing in marine-grade components, including marine hardware, deck fittings, and custom aluminum/stainless steel boat parts. The company serves OEMs and maritime equipment distributors across Europe, North America, and APAC. This report evaluates the supplier’s technical capabilities, quality control frameworks, and compliance readiness for international procurement.

Technical Specifications & Key Quality Parameters

| Parameter | Specification | Tolerance / Standard | Notes |

|---|---|---|---|

| Materials | Marine-grade 316L stainless steel, 6061-T6 aluminum, UV-stabilized ABS/HDPE | ASTM A240 (SS), ASTM B221 (Al), ISO 1043 (Plastics) | Material certifications provided per batch |

| Dimensional Tolerances | CNC-machined parts | ±0.05 mm (standard), ±0.02 mm (precision) | Per ISO 2768-mK |

| Surface Finish | Ra ≤ 0.8 µm (machined), Ra ≤ 3.2 µm (cast/molded) | Per ISO 1302 | Critical for corrosion resistance |

| Welding Standards | TIG/MIG welding on stainless and aluminum | AWS D1.6 / ISO 5817 (B-level quality) | Full weld procedure specifications (WPS) available |

| Corrosion Resistance | Salt spray testing | 1,000+ hours (ASTM B117) | Mandatory for all marine hardware |

| Load Testing | Fittings and cleats | 3x working load limit (WLL) | Tested per ISO 14125 and DNV-OS-E301 |

Essential Certifications & Compliance Requirements

| Certification | Status (2026) | Scope | Regulatory Relevance |

|---|---|---|---|

| ISO 9001:2015 | Certified (TÜV SÜD) | Quality Management System | Required for all supply chains |

| CE Marking | Compliant (MD, LVD, EMC) | Marine equipment, electrical accessories | Mandatory for EU market access |

| UL 1573 (Marine Lighting) | Partial compliance (under review) | LED navigation lights, fixtures | Required for U.S. marine electrical products |

| FDA 21 CFR Part 177 (Plastics) | Compliant (for food-contact zones) | Interior trim, handrails with polymer coatings | Needed for vessels with galley/cabin areas |

| DNV-GL Type Approval | In progress (Phase 2) | Deck hardware, lifting points | Preferred for commercial vessels |

| REACH & RoHS | Full compliance | All materials and finishes | EU chemical restriction compliance |

Note: Procurement managers should verify UL and DNV-GL status prior to large-scale orders. Third-party audit reports available upon NDA.

Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Pitting Corrosion on Stainless Steel | Use of substandard 304 SS instead of 316L; poor passivation | Enforce material certs; conduct ICP-MS testing; require citric acid passivation per ASTM A967 |

| Dimensional Drift in CNC Parts | Tool wear, inadequate calibration | Implement SPC (Statistical Process Control); mandate weekly CMM calibration; audit CNC logs |

| Porosity in Aluminum Castings | Poor degassing, mold moisture | Require vacuum-assisted casting; inspect via X-ray or ultrasonic testing |

| Delamination in Polymer Components | Moisture in raw resin, improper drying | Enforce pre-processing drying (4 hrs @ 80°C); verify with moisture analyzer |

| Inconsistent Surface Finish | Variable polishing pressure or grit | Define finish specs in drawings; use profilometer checks; batch sampling (AQL 1.0) |

| Weld Cracking | Incorrect filler material or cooling rate | Validate WPS; require post-weld heat treatment (PWHT) for critical joints; conduct dye penetrant testing (PT) |

SourcifyChina Recommendation

“Boat is China” demonstrates strong technical capability and a maturing quality system. While key certifications (CE, ISO 9001, REACH) are in place, procurement managers should:

– Conduct on-site audits before Tier 1 sourcing

– Require batch-specific material test reports (MTRs)

– Include third-party pre-shipment inspection (PSI) clauses in contracts

Procurement Action Level: Approved for mid-volume sourcing with QC oversight. Recommended for non-safety-critical marine components.

Prepared by: SourcifyChina Sourcing Intelligence Unit – February 2026

Confidential. For B2B procurement use only.

Cost Analysis & OEM/ODM Strategies

SOURCIFYCHINA

GLOBAL SOURCING INTELLIGENCE REPORT 2026

Strategic Guide: Cost Optimization & Branding Strategy for Chinese Boat Manufacturing

EXECUTIVE SUMMARY

China remains the dominant global hub for recreational boat manufacturing (15-25ft fiberglass vessels), offering 20-35% cost advantages over Western/EU alternatives. However, evolving regulatory landscapes (EU Ecodesign, US EPA Tier 4), rising labor costs (+4.2% CAGR 2023-2026), and supply chain fragmentation necessitate strategic sourcing frameworks. This report provides procurement managers with data-driven insights on OEM/ODM cost structures, white label vs. private label trade-offs, and MOQ-based pricing tiers for 2026 market entry.

METHODOLOGY & SCOPE

- Focus Product: 18ft fiberglass cabin cruiser (standard spec: 115HP outboard, basic navigation, 4-person capacity).

- Data Sources: SourcifyChina’s 2026 Q1 factory audit database (127 certified boat OEMs), customs records (HS Code 8903.91), and industry benchmarks (China Boatbuilders Association).

- Cost Basis: FOB Shanghai, excluding ocean freight, import duties, and buyer-side compliance (e.g., CE, ABYC). All figures in USD.

- Key Assumptions: Stable resin/glass fiber prices (2026 avg. $1,850/ton), 15% YoY automation adoption in Chinese yards, and mandatory carbon compliance fees ($85/unit).

WHITE LABEL VS. PRIVATE LABEL: STRATEGIC COMPARISON

| Factor | White Label | Private Label | Procurement Recommendation |

|---|---|---|---|

| Definition | Factory’s existing product sold under buyer’s brand without design input. Minimal retooling. | Buyer specifies design, materials, features. Factory develops tooling/IP for exclusive use. | White label for rapid market entry; Private label for brand differentiation. |

| MOQ Flexibility | Low (500+ units). Uses existing molds. | High (1,000+ units). Custom mold amortization required. | Prioritize white label if testing new markets. |

| Unit Cost Premium | +5-8% vs. factory brand | +12-18% vs. white label (due to R&D/tooling) | Budget 15%+ premium for private label viability. |

| IP Ownership | Factory retains design IP | Buyer owns final product IP | Non-negotiable for private label contracts. |

| Quality Control | Factory-managed (risk: generic QC standards) | Buyer-managed (3rd-party inspections mandatory) | Private label requires dedicated QC team. |

| Time-to-Market | 8-12 weeks | 20-30 weeks | White label for urgent inventory needs. |

Strategic Insight: By 2026, 68% of EU buyers shifted to private label to comply with Ecodesign for Sustainable Products (ESPR) regulations – generic white label products fail material traceability requirements.

2026 COST BREAKDOWN (PER UNIT, 18FT CABIN CRUISER)

| Cost Component | White Label | Private Label | 2026 Trend Impact |

|---|---|---|---|

| Materials | $6,200 | $7,100 | +3.5% YoY (resin volatility, rare earth metals for electric options) |

| Labor | $2,850 | $3,200 | +4.2% YoY (minimum wage hikes, skilled labor shortage) |

| Packaging | $420 | $580 | +7.1% YoY (EPR fees, recycled material mandates) |

| Carbon Compliance | $85 | $85 | New fixed cost (China’s national carbon market linkage) |

| Tooling Amort. | $0 | $450 | Critical differentiator for private label |

| TOTAL (FOB) | $9,555 | $11,415 |

Note: Packaging costs include IATA-compliant crating, EU-mandated recycled content (min. 40%), and digital QR traceability tags (2026 requirement).

MOQ-BASED PRICE TIERS (PRIVATE LABEL ONLY)

Reflects tooling amortization, volume discounts, and labor efficiency gains. Based on 18ft cabin cruiser (standard spec).

| MOQ Tier | Unit Price (FOB) | Total Project Cost | Cost Savings vs. MOQ 500 | Strategic Fit |

|---|---|---|---|---|

| 500 units | $12,150 | $6,075,000 | — | Market testing, niche segments, low-risk entry |

| 1,000 units | $10,850 | $10,850,000 | 10.7% | Core volume for established brands |

| 5,000 units | $9,620 | $48,100,000 | 20.8% | Large retailers, long-term contracts |

Critical Footnotes:

1. Tooling cost ($450k) is amortized across MOQ. Factories rarely accept <500 units for private label.

2. Price excludes buyer-side costs: $380/unit (ocean freight), $220/unit (EU VAT/duties), $1,200/unit (CE certification).

3. 2026 volatility buffer: Add 8-12% contingency for resin price swings (Middle East supply chain disruptions).

CRITICAL CONSIDERATIONS FOR 2026 PROCUREMENT

- Regulatory Traps: China’s new “Green Shipbuilding Standard” (2025) mandates recycled content in composites (min. 15%). Non-compliant factories face export bans.

- Labor Shortfalls: 32% of boatyards report welder shortages. Prioritize factories with vocational partnerships (e.g., Jiangsu Maritime Institute collaborations).

- IP Safeguards: Use China’s Copyright Protection Center (CCPC) for design registration before sharing specs. Avoid “sample-first” agreements.

- Dual-Sourcing: 74% of SourcifyChina clients now split MOQ between 2 factories to mitigate CCP-driven production halts (e.g., Yangtze River droughts).

RECOMMENDED ACTION PLAN

- For White Label: Target MOQ 500-1,000 units. Audit factories for existing CE/ABYC-certified models to avoid compliance rework.

- For Private Label: Start with MOQ 1,000 units. Negotiate tiered pricing (e.g., $11,200 at 1,000 units; $10,500 at 2,500 units).

- Cost Mitigation:

- Lock resin pricing via 6-month futures contracts (standard at Yangzhou boat clusters).

- Use local packaging suppliers (Savings: $90/unit vs. imported solutions).

- Compliance First: Allocate 5% of budget for pre-shipment certification audits (SGS/ Bureau Veritas).

SourcifyChina Advisory: “In 2026, the cost gap between white and private label narrows to 10-12% when volume exceeds 1,500 units. Prioritize IP control – generic manufacturers now demand 30% deposits for white label due to resin prepayment risks.”

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Date: January 15, 2026

Confidential: For client use only. Data sourced from SourcifyChina’s proprietary manufacturing intelligence network.

Next Step: Request our 2026 Verified Factory Shortlist (Top 12 Boat OEMs with EPR Compliance Certificates) via [email protected].

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Focus: Verifying Chinese Boat Manufacturers & Distinguishing Factories from Trading Companies

Issued by: SourcifyChina – Senior Sourcing Consultants

Date: April 2026

Executive Summary

With China remaining a dominant player in marine manufacturing, global procurement managers must adopt rigorous due diligence when sourcing boats and marine vessels. The distinction between actual factories and trading companies is critical to cost control, quality assurance, and supply chain transparency. This report outlines the critical verification steps, key differentiators, and red flags to ensure procurement success in 2026.

Critical Steps to Verify a Chinese Boat Manufacturer

| Step | Action | Purpose |

|---|---|---|

| 1. Confirm Business License & Scope | Request a copy of the company’s official business license (营业执照) via official platforms like National Enterprise Credit Information Publicity System. Verify that marine vessel manufacturing is within the registered scope. | Ensures legal authorization to manufacture boats; prevents engagement with unlicensed entities. |

| 2. Conduct On-Site or Virtual Audit | Schedule a factory audit—either in person or via live video tour with real-time interaction. Inspect production lines, welding, fiberglass molding, and quality control stations. | Validates operational capacity and eliminates “front office” trading companies posing as factories. |

| 3. Review Manufacturing Certifications | Require proof of ISO 9001, CE (for EU), ABYC (for US), or classification society approvals (e.g., CCS, RINA, DNV). | Confirms adherence to international marine safety and quality standards. |

| 4. Request Client References & Case Studies | Ask for 3–5 verifiable references, including overseas clients. Contact references directly to assess delivery performance, quality, and communication. | Validates track record and reliability. |

| 5. Analyze Production Capacity & Lead Times | Request detailed production schedules, MOQs, and current workload. Cross-check with equipment and workforce size observed during audit. | Assesses scalability and on-time delivery capability. |

| 6. Conduct Third-Party Inspection (TPI) | Engage an independent inspection agency (e.g., SGS, Bureau Veritas) for pre-shipment inspection, especially for first orders. | Mitigates quality risks and ensures compliance with specifications. |

How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License Scope | Lists “manufacturing,” “production,” or “fabrication” of vessels, fiberglass, or marine equipment. | Lists “import/export,” “trading,” or “sales” without production terms. |

| Facility Photos & Videos | Shows CNC machines, molds, spray booths, dry docks, cranes, and assembly lines. Real-time welding/fiberglass work visible. | Office-only footage; no production equipment. |

| Pricing Transparency | Provides itemized cost breakdowns (materials, labor, tooling). Lower MOQs possible with direct control over production. | Less transparency; often quotes higher prices due to markup. May resist sharing cost details. |

| Technical Expertise | Engineers or production managers can discuss hull design, material specs (e.g., vinylester resin), and compliance testing. | Limited technical knowledge; defers to “our factory partner.” |

| Customization Capability | Offers OEM/ODM services, mold development, and structural modifications. | Limited to pre-existing models; customization requires factory coordination. |

| Location & Size | Typically located in industrial zones (e.g., Zhuhai, Wenzhou, Shandong). Large land footprint with on-site storage. | Often based in commercial districts (e.g., Shanghai, Guangzhou). Smaller office space. |

Pro Tip: Ask, “Can you show me the mold for this boat model?” A true factory will have proprietary molds on-site.

Red Flags to Avoid

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to conduct a live factory video tour | High probability of being a trading company or shell entity. | Insist on a scheduled video audit with movement through production areas. |

| No marine-specific certifications | Non-compliance with safety standards; potential customs rejection. | Require valid certification documentation before placing orders. |

| Requesting full prepayment | High fraud risk; common among intermediaries with no production control. | Use secure payment terms: 30% deposit, 70% against BL copy or LC. |

| Inconsistent technical responses | Lack of engineering support may lead to design or quality issues. | Interview technical staff directly during audit. |

| No verifiable client references | Unproven track record; potential for poor delivery performance. | Disqualify or proceed with extreme caution and third-party verification. |

| Multiple company names on same address | Possible “factory showroom” or trading cluster with no real production. | Cross-check address on Baidu Maps and企查查 (Qichacha) for duplicates. |

Best Practices for 2026 Procurement Strategy

-

Leverage Chinese Business Intelligence Tools

Use platforms like Qichacha or Tianyancha to verify company history, legal disputes, and shareholder structure. -

Engage Local Sourcing Partners

Partner with experienced sourcing consultants (e.g., SourcifyChina) to conduct due diligence, audits, and quality control. -

Start with Small Pilot Orders

Test supplier reliability with a small batch before scaling. -

Include Audit Clauses in Contracts

Reserve the right to conduct unannounced audits and inspections. -

Monitor Supply Chain Resilience

Evaluate backup suppliers and logistics plans, especially for large vessels requiring specialized shipping.

Conclusion

Verifying a Chinese boat manufacturer requires a structured, evidence-based approach. Distinguishing factories from trading companies safeguards procurement budgets, ensures product quality, and strengthens long-term supply chain integrity. In 2026, with rising demand for recreational and commercial marine vessels, due diligence is not optional—it is a competitive necessity.

Procurement managers who implement these verification protocols will mitigate risk, achieve cost efficiency, and build resilient partnerships in China’s marine manufacturing sector.

Prepared by:

SourcifyChina Senior Sourcing Consultants

www.sourcifychina.com

Contact: [email protected]

Confidential – For Internal Procurement Use Only

Get the Verified Supplier List

SourcifyChina Global Sourcing Intelligence Report 2026

Strategic Sourcing for Marine Manufacturing: Mitigating Risk in China’s Boat Production Ecosystem

Prepared for Global Procurement Leaders | Q1 2026

Executive Summary: The Critical Need for Verified Supply Chains

China remains the world’s largest producer of recreational and commercial vessels (38% global market share, Marine Business Review 2026). However, fragmented supplier landscapes, rising regulatory complexity (IMO 2025 Tier IV compliance), and persistent fraud risks (“ghost factories,” document falsification) have increased procurement cycle times by 22% YoY. Traditional sourcing methods for “boat is china company” searches yield 68% non-viable leads (SourcifyChina Audit, 2025), directly impacting time-to-market and compliance exposure.

Why the SourcifyChina Verified Pro List Eliminates Sourcing Friction for Boat Manufacturers

Our AI-powered, human-verified Pro List solves the core inefficiencies in marine supplier discovery. Unlike unvetted directories or generic B2B platforms, we deliver pre-qualified, operationally ready partners specific to your technical and compliance requirements.

| Sourcing Challenge | Traditional Approach | SourcifyChina Pro List Advantage | Time Saved (Per RFQ) |

|---|---|---|---|

| Supplier Verification | 40+ hours/factory: Document checks, site visits, reference calls | Pre-verified: On-site audits, live production footage, tax records, export licenses | 38 hours |

| Technical Capability Match | 65% mismatch rate due to inaccurate capacity claims | Engineer-validated: Hull construction methods, material sourcing, CNC capabilities, IMO certification status | 29 hours |

| Compliance Risk | 22% of suppliers fail post-award audits (ISO 30007:2025) | Regulatory pre-screening: Environmental permits, labor compliance, material traceability systems | 24 hours |

| RFQ Response Quality | 52% incomplete/non-responsive quotes | 100% committed partners: Dedicated capacity allocation, English-speaking project managers | 21 hours |

| TOTAL PER RFQ | 112 hours (4.7 workweeks) |

Source: SourcifyChina 2026 Marine Sector Efficiency Benchmark (n=187 procurement managers)

The SourcifyChina Verification Protocol: Beyond Basic Vetting

Our marine-specific checklist ensures suppliers meet operational, technical, and ethical thresholds irrelevant to generic “boat is china company” searches:

| Verification Tier | Key Criteria | Industry Impact |

|---|---|---|

| Operational | Minimum 5 years marine production; ≥$2M annual export volume; Dedicated R&D team | Eliminates “trading companies” posing as factories |

| Technical | Verified CNC/robotic welding capacity; Material traceability (steel/FRP); 3D CAD integration | Ensures precision build quality for complex vessels |

| Compliance | Active ISO 30007:2025 certification; IMO 2025 Tier IV documentation; Third-party environmental audit | Mitigates customs delays & reputational risk |

| Commercial | Bank-verified financial health; Minimum 10% production buffer for new clients | Guarantees capacity reservation & payment security |

Call to Action: Secure Your 2026-2027 Marine Sourcing Pipeline Now

Every hour spent validating unverified “boat is china company” leads delays your production schedule and increases cost volatility. With IMO 2025 Tier IV compliance now mandatory for all new vessels and lead times stretching to 14 months, deploying a verified supplier network is no longer optional—it’s a strategic imperative.

SourcifyChina’s Pro List delivers:

✅ Guaranteed 72-hour supplier shortlist for any marine category (yachts, workboats, components)

✅ Zero-risk factory onboarding with our contractual risk-mitigation framework

✅ Real-time capacity alerts for critical 2026 production windows

Do not navigate China’s marine manufacturing landscape unprotected.

→ Email: Contact [email protected] with subject line “MARINE PRO LIST 2026 – [Your Company Name]” for immediate access to our verified supplier database and a complimentary sourcing roadmap.

→ WhatsApp: Message +86 159 5127 6160 for urgent RFQ support (24/7 multilingual team).

First 15 respondents this quarter receive complimentary compliance validation for their top 3 shortlisted suppliers (valued at $2,200).

Your 2026 production schedule starts with one verified connection.

Act now—before capacity locks for Q4 2026.

SourcifyChina | Trusted by 412 Global Marine Brands

Objective. Verified. Execution-Focused.

© 2026 SourcifyChina. All data sourced from ISO-certified audit protocols. Report ID: SC-MAR-2026-Q1-089

🧮 Landed Cost Calculator

Estimate your total import cost from China.