The global automotive aftermarket sector is experiencing robust expansion, driven by rising vehicle ownership, increasing demand for performance upgrades, and a growing preference for customized vehicle components. According to a 2023 report by Mordor Intelligence, the global automotive aftermarket wiring harness market is projected to grow at a CAGR of over 6.2% from 2023 to 2028. This growth is further supported by evolving electronic content in vehicles and the proliferation of advanced driver assistance systems (ADAS), which elevate the importance of reliable, high-performance wiring solutions. As BMW vehicles continue to be favored among enthusiasts for tuning and aftermarket modifications, demand for specialized, OEM-compatible wiring harnesses has surged. In response, a select group of manufacturers has emerged at the forefront, delivering innovative, durable, and precise harness solutions tailored to BMW’s electrical architectures. The following list highlights the top nine aftermarket wiring harness manufacturers that combine engineering excellence with data-backed reliability to meet the needs of today’s BMW performance market.

Top 9 Bmw Aftermarket Wiring Harness Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Custom Wire Harness Manufacturing Capabilities

Domain Est. 2000

Website: pca-llc.com

Key Highlights: PCA, a custom wire harness manufacturer, expertise includes custom wiring harness and cable harness assemblies for OEMs that require rugged components….

#2 Wire Harness

Domain Est. 2006

Website: getbmwparts.com

Key Highlights: In stock Free delivery over $499Shop Genuine OEM BMW Wire Harness – Part # 61-12-8-736-615 – & Enjoy FREE Shipping on Most Orders $499+ OEMG!!…

#3 BMW Aftermarket Wiring Harnesses

Domain Est. 2009

Website: condorspeedshop.com

Key Highlights: Perfect Fit for Your BMW: Our wiring harnesses are designed to attach to OEM connectors, ensuring a hassle-free installation and a perfect fit every time….

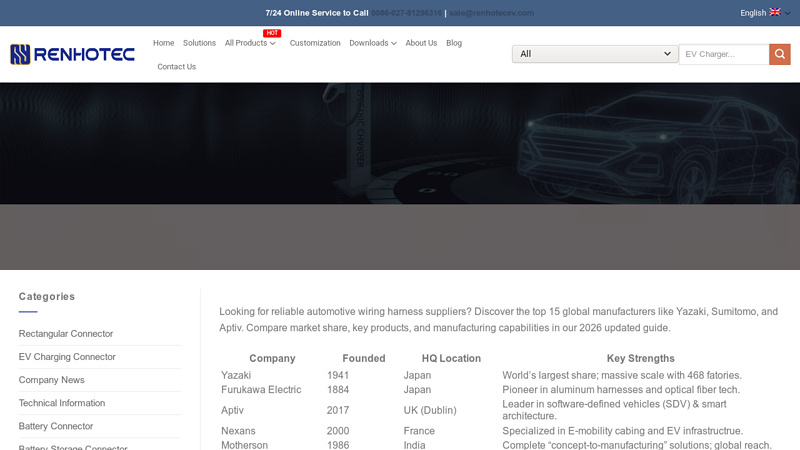

#4 The Top 15 Automotive Wiring Harness Manufacturers and …

Domain Est. 2021

Website: renhotecev.com

Key Highlights: The two largest Japanese automotive wiring harness manufacturers, Yazaki and Sumitomo Wiring Systems, have a combined market share of over 50%….

#5 Boomslang Fabrication

Domain Est. 1997

Website: boomslang.com

Key Highlights: Wire harness, specialty cable, and custom connector manufacturing. We specialize in these industry segments: aftermarket engine management systems, automotive ……

#6 Wiring Harnesses for Automobiles

Domain Est. 1998

Website: sumitomoelectric.com

Key Highlights: Wiring harnesses are indispensable in controlling these electronic components, transmitting power and signals to every part of the vehicle….

#7 Painless Performance

Domain Est. 1999

Website: painlessperformance.com

Key Highlights: All our harnesses are made out of high-grade TXL wiring and labeled every 12-inches to make installation as Painless as possible….

#8 LS Swap Standalone Harnesses for 4.8, 5.3, 5.7, 6.0, 6.2, GM LS1 …

Domain Est. 2012

Website: bp-automotive.com

Key Highlights: BP Automotive is the go to source for all of your LS Swap needs! We build standalone harnesses for GM engines from 1992 to present day!…

#9 Buy BMW Motorcycle Cable Harnesses

Domain Est. 2017

Website: shopbmwmotorcycles.com

Key Highlights: 30-day returnsOur auto parts store has the selection you’ve been looking for — cable harnesses for the engine, topcase, chassis, main wiring harnesses, and more…

Expert Sourcing Insights for Bmw Aftermarket Wiring Harness

H2: 2026 Market Trends for BMW Aftermarket Wiring Harness

The global aftermarket wiring harness market for BMW vehicles is poised for significant transformation by 2026, driven by technological advancements, increasing vehicle electrification, and rising consumer demand for performance upgrades and customized solutions. The following key trends are expected to shape the industry landscape:

1. Growth in Electric and Hybrid BMW Models

With BMW’s accelerated shift toward electrification—including the expansion of its i-series and plug-in hybrid lineup—the demand for specialized wiring harnesses designed for high-voltage systems is projected to rise. Aftermarket suppliers will need to develop compatible, safety-certified harnesses that support battery management, regenerative braking, and onboard charging systems, creating new opportunities in the EV-specific aftermarket segment.

2. Increased Demand for Performance and Customization

Enthusiasts and tuning communities continue to drive demand for upgraded electrical systems that support aftermarket modifications such as enhanced lighting, advanced infotainment, and performance engine management. By 2026, modular and plug-and-play wiring harness solutions tailored for BMW platforms (e.g., B58, S58 engines, and CLAR architecture) will gain popularity, offering improved reliability and easier installation.

3. Integration with Advanced Driver Assistance Systems (ADAS)

As BMW vehicles come standard with ADAS features like adaptive cruise control, lane-keeping assist, and parking sensors, the complexity of wiring systems increases. Aftermarket harnesses that support retrofitting or upgrading these systems—especially in older BMW models—will see growing demand. Suppliers offering CAN bus-compatible harnesses with OBD-II integration will have a competitive advantage.

4. Rise of Smart Diagnostics and Plug-and-Play Solutions

Consumers and technicians are gravitating toward intelligent wiring harnesses with built-in diagnostics, error suppression, and coding capabilities. By 2026, aftermarket harnesses equipped with microcontrollers or firmware that auto-configure based on vehicle model and year will become mainstream, reducing installation time and compatibility issues.

5. Regional Market Expansion and Localization

North America and Europe remain dominant markets due to high BMW ownership and a mature tuning culture. However, emerging markets in Asia-Pacific—particularly China and India—are expected to experience rapid growth in luxury vehicle ownership, fueling demand for localized aftermarket wiring solutions. Regional suppliers may partner with German engineering firms to meet quality standards.

6. Emphasis on Quality and OEM-Compliance

As vehicle electronics become more sophisticated, consumers are prioritizing reliability and compatibility. Aftermarket harness manufacturers will need to adhere to OEM specifications, using materials like oxygen-free copper and high-temperature insulation. Certifications such as ISO/TS 16949 will become critical for market entry and brand credibility.

7. Sustainability and Supply Chain Resilience

Environmental regulations and supply chain disruptions are pushing manufacturers toward sustainable sourcing and localized production. By 2026, leading aftermarket players may adopt circular economy practices—such as recycling harness components and reducing plastic use—while diversifying suppliers to mitigate semiconductor and raw material shortages.

Conclusion

The BMW aftermarket wiring harness market in 2026 will be defined by innovation, electrification, and digital integration. Companies that invest in R&D, embrace smart technologies, and align with BMW’s evolving vehicle architectures will be best positioned to capture market share in this dynamic and high-value niche.

H2. Common Pitfalls When Sourcing BMW Aftermarket Wiring Harnesses (Quality & Intellectual Property)

Sourcing aftermarket wiring harnesses for BMW vehicles can offer cost savings and customization options, but it also comes with significant risks—especially concerning quality control and intellectual property (IP) issues. Being aware of these common pitfalls can help buyers and resellers make informed decisions and avoid costly mistakes.

1. Substandard Materials and Poor Build Quality

Many aftermarket wiring harnesses use inferior copper wiring, low-grade insulation, and poorly molded connectors. These materials can lead to electrical failures, intermittent connections, or even fire hazards. Unlike OEM harnesses, which undergo rigorous testing, aftermarket versions may not meet the same durability or performance standards.

2. Inaccurate Pinouts and Compatibility Issues

Aftermarket harnesses may not perfectly replicate the original BMW pin configurations, especially for newer models with complex CAN bus systems. Incorrect pinouts can cause communication errors between modules, leading to dashboard warnings, ECU malfunctions, or component failure.

3. Lack of Environmental and Safety Certifications

Reputable OEM harnesses comply with international standards such as ISO, RoHS, and UL. Many aftermarket alternatives lack proper certification, increasing the risk of non-compliance with safety regulations and reduced resistance to heat, moisture, and vibration.

4. Counterfeit or IP-Infringing Products

Some aftermarket harnesses are direct copies of BMW’s proprietary designs, violating intellectual property rights. These counterfeit products may look identical but lack engineering validation. Distributing or installing such items can expose businesses to legal liability and damage brand reputation.

5. Inadequate Testing and Quality Assurance

Unlike OEM manufacturers, many aftermarket suppliers skip comprehensive testing procedures such as signal integrity checks, temperature cycling, and long-term durability tests. This increases the likelihood of field failures and warranty claims.

6. Limited Traceability and Support

Low-cost suppliers often provide little to no documentation, batch traceability, or technical support. If a harness fails, diagnosing the root cause becomes difficult, and obtaining replacements or refunds can be challenging.

7. Misleading Marketing and False Claims

Some vendors falsely advertise their harnesses as “OEM-equivalent” or “BMW-certified” without substantiating these claims. Buyers should verify certifications and request test reports before procurement.

8. Supply Chain and IP Legal Risks

Sourcing from manufacturers in regions with weak IP enforcement increases the risk of inadvertently purchasing or distributing infringing products. This could lead to customs seizures, legal action, or supply chain disruptions.

To mitigate these risks, buyers should conduct thorough due diligence—verify supplier credentials, request sample testing, review compliance documentation, and prioritize partners with transparent manufacturing practices and respect for intellectual property.

Logistics & Compliance Guide for BMW Aftermarket Wiring Harness

This guide outlines key logistics and compliance considerations for the distribution, import, and sale of aftermarket wiring harnesses compatible with BMW vehicles. Adherence to these standards ensures legal operation, product safety, and customer satisfaction.

Regulatory Compliance

Ensure all products meet applicable regional and international regulations. Non-compliance can result in shipment rejection, fines, or legal action.

Safety & Electromagnetic Standards

Aftermarket wiring harnesses must comply with electrical safety and electromagnetic compatibility (EMC) requirements. Key standards include:

– EU: CE marking under the Low Voltage Directive (LVD) 2014/35/EU and Electromagnetic Compatibility Directive (EMC) 2014/30/EU.

– USA: FCC Part 15 Subpart B for unintentional radiators; UL certification not mandatory but often expected by retailers.

– Canada: ICES-003 (Interference-Causing Equipment Standard) enforced by Innovation, Science and Economic Development Canada (ISED).

– China: CCC (China Compulsory Certification) may apply depending on product classification.

Automotive-Specific Regulations

- E-Mark Certification (ECE R10): Required for sale in many European countries. Validates electromagnetic compatibility in automotive environments.

- RoHS (EU) and China RoHS: Restrict use of hazardous substances like lead, mercury, and cadmium in electrical components.

- REACH (EU): Regulates chemical substances; ensure wiring materials do not contain SVHCs (Substances of Very High Concern) above thresholds.

Labeling & Documentation

- Clearly label products with manufacturer details, model compatibility, compliance marks (CE, FCC, E-Mark), and date of production.

- Provide multilingual user manuals and installation instructions, especially when selling across EU countries.

- Maintain Technical Files and Declaration of Conformity (DoC) for each product variant.

Import & Customs Clearance

Proper classification and documentation are essential for smooth customs processing.

HS & Tariff Classification

- Use accurate Harmonized System (HS) codes. Typical codes may fall under:

- 8544.42 – Insulated wiring sets for vehicles (varies by region and construction).

- Confirm with local customs authorities or a licensed customs broker to avoid misclassification and overpayment of duties.

Required Documentation

- Commercial Invoice (with full product description, value, and country of origin)

- Packing List

- Bill of Lading or Air Waybill

- Certificate of Origin (preferably Form A for preferential tariffs under trade agreements)

- Test Reports (e.g., EMC, RoHS)

- Declaration of Conformity (DoC)

Duty & Tax Considerations

- Duty rates vary by destination country. For example:

- USA: Generally duty-free under HTSUS 8544.42.90 if originating from qualifying countries.

- EU: Typically 0–4% depending on origin and material composition.

- Account for VAT (EU), GST (Canada, Australia), or sales tax (USA) upon import or sale.

Packaging & Shipping Requirements

Ensure products are protected during transit and meet carrier and regulatory standards.

Packaging Standards

- Use anti-static bags for electronic components.

- Secure harnesses with form-fitting inserts to prevent tangling or physical damage.

- Include moisture barrier bags if shipping to humid climates.

- Label outer cartons with handling symbols (e.g., “Fragile,” “This Way Up,” “Do Not Stack”).

Carrier & Shipping Compliance

- Declare contents accurately to prevent delays; avoid terms like “auto parts” without specification.

- Comply with IATA regulations if shipping by air (especially regarding battery-powered test devices, if included).

- Use tracked and insured shipping methods; retain proof of delivery.

Product Compatibility & Intellectual Property

Avoid legal risks related to design and branding.

Compatibility vs. Imitation

- Clearly state that the product is “aftermarket” and “compatible with BMW models,” not an OEM part.

- Avoid using BMW trademarks, logos, or part numbers in branding or marketing unless authorized.

- Do not imply OEM affiliation or endorsement.

Technical Accuracy

- Provide detailed fitment guides specifying compatible models, years, and engine types (e.g., N55, B48).

- Conduct thorough validation testing to ensure plug-and-play functionality and avoid customer complaints or returns.

Returns, Warranty & After-Sales Support

Establish clear policies to manage customer expectations and ensure compliance with consumer laws.

Warranty Compliance

- Offer minimum warranty periods as required by local law (e.g., 2 years in the EU under consumer rights directives).

- Clearly state warranty terms, including exclusions (e.g., improper installation, water damage).

Returns & Recalls

- Implement a returns process that complies with local consumer protection laws (e.g., 14-day right of withdrawal in EU).

- Have a product recall plan in place in case of safety defects, including notification procedures and customs coordination if applicable.

Conclusion

Successfully managing logistics and compliance for BMW aftermarket wiring harnesses requires attention to technical standards, accurate documentation, and regulatory diligence. Partnering with experienced customs brokers, testing laboratories, and legal advisors can mitigate risks and support scalable, compliant operations across global markets.

In conclusion, sourcing a BMW aftermarket wiring harness requires careful consideration of quality, compatibility, and supplier reliability. While aftermarket harnesses can offer cost-effective alternatives to OEM parts and provide enhanced customization options, it is essential to choose products from reputable manufacturers that adhere to industry standards. Verifying compatibility with your specific BMW model, year, and engine type is crucial to ensure seamless integration and optimal performance. Additionally, reading customer reviews, consulting with knowledgeable technicians, or seeking recommendations from BMW enthusiast communities can help in making an informed decision. Ultimately, investing time in thorough research will help secure a durable and reliable wiring harness that supports the vehicle’s electrical integrity and long-term reliability.