The Building Management System (BMS) controller market is experiencing robust expansion, driven by increasing demand for energy efficiency, smart infrastructure, and automation in commercial and industrial facilities. According to a 2023 report by Mordor Intelligence, the global BMS market is projected to grow at a CAGR of 10.2% from 2023 to 2028, reaching an estimated value of USD 152.8 billion by the end of the forecast period. This growth is bolstered by the rising adoption of IoT-enabled devices, stringent energy regulations, and the global push toward sustainable building operations. As central components of BMS networks, BMS controllers play a critical role in monitoring and managing HVAC, lighting, security, and power systems, making them pivotal in modern facility management. With key players investing in interoperability, cloud integration, and cybersecurity, the competitive landscape is evolving rapidly. Based on market presence, technological innovation, and global reach, the following are the top 10 BMS controller manufacturers shaping the future of intelligent buildings.

Top 10 Bms Controller Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 BMS

Domain Est. 1988

Website: buildings.honeywell.com

Key Highlights: New building management solutions tailored for you. Using our comprehensive range of controllers, field devices and software, we’ll help you customize a ……

#2 BMS (Battery management system)

Domain Est. 1994

Website: murata.com

Key Highlights: In the field of battery management systems there is demand for high added value in the form of compactness, high precision, and safety functions….

#3 BMS (electric two

Domain Est. 1999

Website: infineon.com

Key Highlights: Our comprehensive battery management system (BMS) solutions ensure safe and efficient battery operation in light electric vehicles such as electric motorcycles, ……

#4 Battery Management Systems

Domain Est. 2000

Website: victronenergy.com

Key Highlights: With the most current free-to-use monitoring solutions on the planet you can manage it all from anywhere in the world. Discover monitoring….

#5 Lithium Battery Management Systems (BMS)

Domain Est. 2007

Website: lithiumbalance.com

Key Highlights: Advanced monitoring of battery packs: Maximise safety, performance, and longevity for your lithium battery with our LiBAL Battery Management Systems (BMS)….

#6 BMS Cloud – IoT platform for real results

Domain Est. 2015

Website: bms-control.com

Key Highlights: Cloud-based IoT platform, which connects to single network any types of devices: coffee machines, vending machines, fridges, HVAC, lighting, autonomous sensors ……

#7 EMUS BMS

Domain Est. 2017

Website: emusbms.com

Key Highlights: Remote monitoring ready battery made simple. We produce world’s most flexible battery management systems….

#8

Domain Est. 2020

Website: lithionbattery.com

Key Highlights: They often include advanced Battery Management Systems (BMS) that monitor and control individual cell performance, ensuring optimal charging, temperature ……

#9 DALY BMS: LifePO4 BMS

Domain Est. 2021

Website: dalybms.com

Key Highlights: DALY BMS specializes in the manufacturing, distribution, design, research, and servicing of cutting-edge Lithium Battery Management Systems (BMS)….

#10 TDT BMS

Domain Est. 2022

Website: tdtbms.com

Key Highlights: Protect all-scenario safety of lithium batteries for electric tricycles. Deeply adapted to the heavy-load working conditions of cargo tricycles….

Expert Sourcing Insights for Bms Controller

2026 Market Trends for BMS Controllers

The Battery Management System (BMS) controller market is poised for significant transformation by 2026, driven by the accelerating global shift toward electrification, energy storage, and digitalization. As the critical “brain” of battery systems, BMS controllers are evolving rapidly to meet the demands of higher performance, safety, and intelligence across diverse applications.

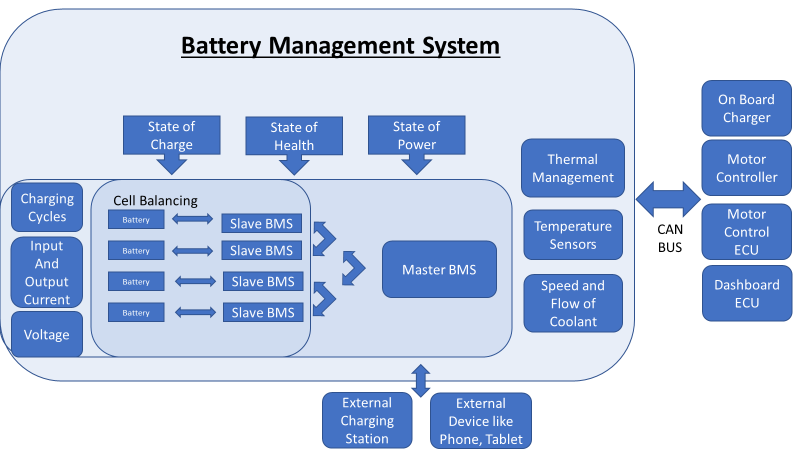

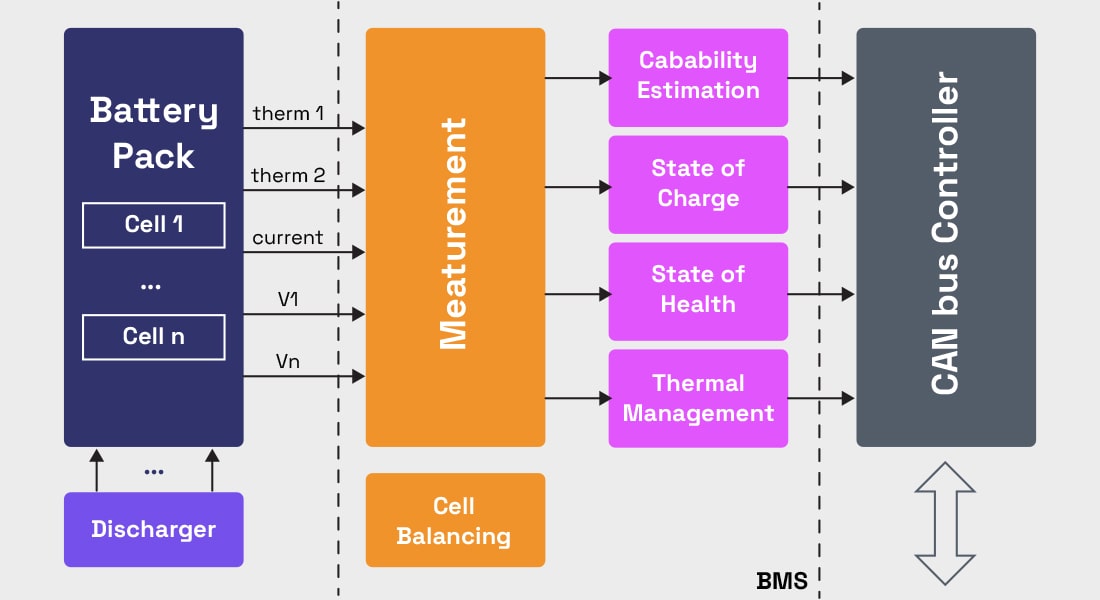

Growing Demand from Electric Vehicles and E-Mobility

The electric vehicle (EV) sector remains the primary growth engine for BMS controllers. By 2026, increasing EV adoption—fueled by stringent emissions regulations, government incentives, and consumer demand—will necessitate more sophisticated BMS solutions. Automakers are focusing on longer ranges, faster charging, and enhanced safety, all of which depend on advanced BMS controllers capable of precise cell monitoring, state estimation (SoC, SoH, SoF), and thermal management. The rise of premium and luxury EVs, along with the expansion of electric buses and two-wheelers, will further amplify demand for high-reliability and scalable BMS architectures.

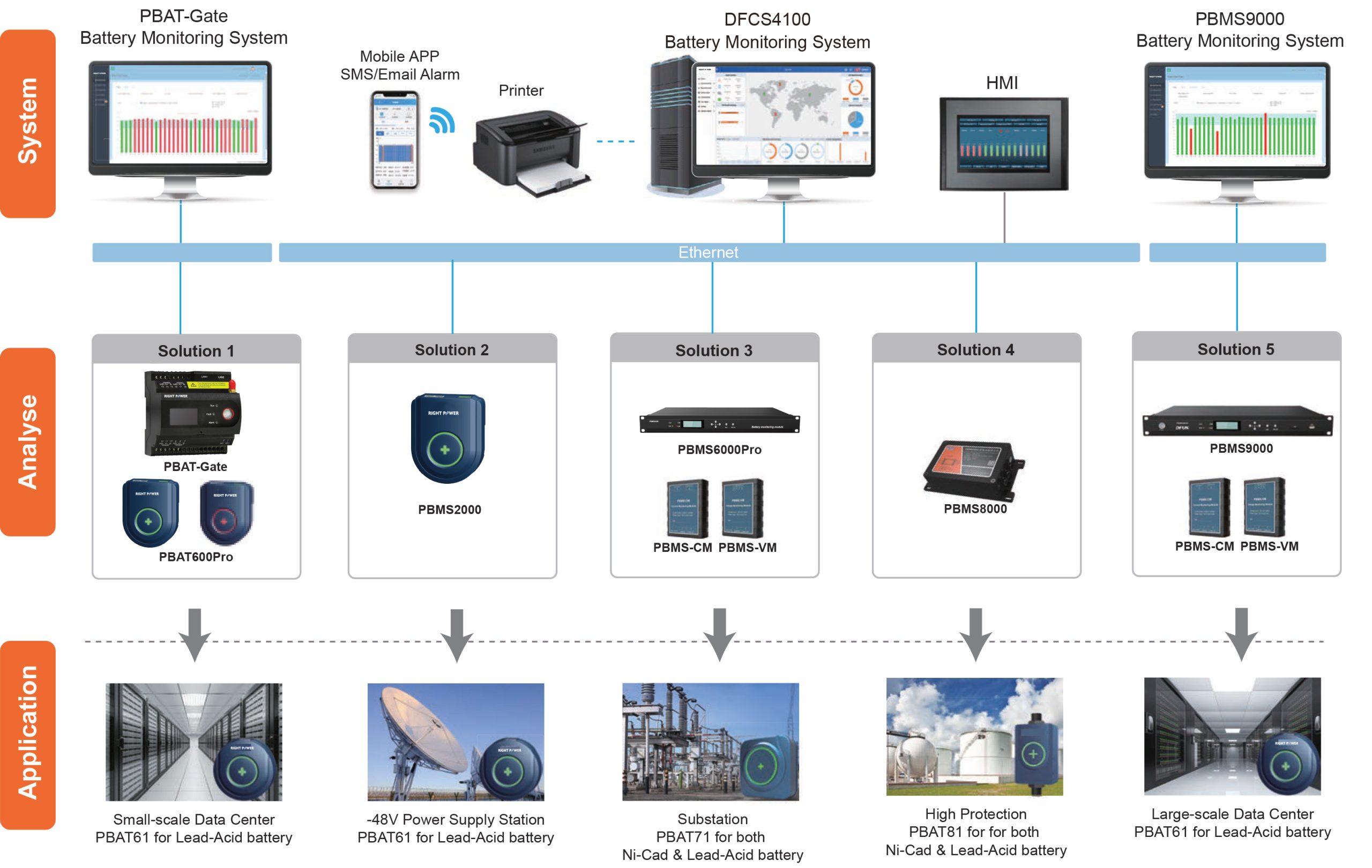

Expansion in Energy Storage Systems (ESS)

Utility-scale, commercial, and residential energy storage systems are gaining momentum as renewable energy integration intensifies. By 2026, BMS controllers will be essential in managing large-format lithium-ion and emerging chemistries (e.g., LFP, sodium-ion) used in stationary storage. These systems require BMS solutions with robust communication protocols (e.g., Modbus, CAN, Ethernet), remote monitoring capabilities, and high scalability to ensure grid stability, optimize cycle life, and support peak shaving or time-of-use applications.

Technological Advancements and Intelligence Integration

BMS controllers in 2026 will increasingly incorporate artificial intelligence (AI) and machine learning (ML) to improve predictive analytics for battery health and failure detection. Cloud-connected BMS platforms will enable over-the-air (OTA) updates, real-time diagnostics, and fleet-level data aggregation, paving the way for predictive maintenance and enhanced lifecycle management. Additionally, the integration of digital twins—virtual models of physical battery systems—will allow for simulation-based optimization and performance forecasting.

Standardization and Interoperability

As the BMS ecosystem matures, there will be a stronger push toward standardization in communication protocols and functional safety (e.g., ISO 26262, IEC 61508). This trend will promote interoperability across different battery packs, OEMs, and secondary applications (e.g., second-life EV batteries for ESS). Standardized BMS controllers will reduce development time and costs while improving system reliability and scalability.

Supply Chain Diversification and Localization

Geopolitical factors and supply chain disruptions will drive efforts to localize BMS production and component sourcing by 2026. Regions such as North America and Europe are investing in domestic battery and BMS manufacturing to reduce dependency on Asia. This shift will benefit local BMS controller developers and foster innovation in modular, flexible designs that support regional regulatory and environmental requirements.

Emerging Chemistries and Modular Architectures

The commercialization of next-generation battery chemistries—such as solid-state and sodium-ion—will require BMS controllers with adaptive algorithms capable of managing different voltage profiles, impedance characteristics, and safety thresholds. Modular BMS designs that support plug-and-play integration and daisy-chaining will gain traction, particularly in scalable ESS and commercial EV applications.

In summary, the 2026 BMS controller market will be characterized by heightened intelligence, connectivity, and scalability, underpinned by strong growth in EVs and energy storage. Innovators who deliver safe, efficient, and data-driven BMS solutions will be well-positioned to lead this dynamic and expanding market.

Common Pitfalls When Sourcing BMS Controllers (Quality, IP)

Sourcing Battery Management System (BMS) controllers involves significant technical and legal considerations. Overlooking key pitfalls related to quality and intellectual property (IP) can lead to product failures, safety risks, and legal disputes. Below are critical issues to avoid:

Poor Component Quality and Reliability

Many low-cost BMS controllers—especially from less-regulated suppliers—use substandard components such as counterfeit ICs, low-grade capacitors, or poorly calibrated sensors. These components may fail under real-world conditions, leading to inaccurate cell monitoring, thermal runaway, or premature system failure. Always verify component sourcing and demand third-party test reports (e.g., AEC-Q100 for automotive-grade parts).

Inadequate Functional Safety Compliance

A major quality concern is the lack of compliance with functional safety standards like ISO 26262 (automotive) or IEC 61508. Without proper safety mechanisms (e.g., redundant voltage sensing, fail-safe states), the BMS may not detect or respond correctly to faults. Ensure suppliers provide documented safety analysis (FMEA, FMEDA) and certification where required.

Insufficient Testing and Validation

Some BMS controllers are sold without rigorous environmental or lifecycle testing. Controllers may not be validated for temperature extremes, vibration, or long-term battery cycling. Request evidence of HALT (Highly Accelerated Life Testing) and field performance data to assess real-world durability.

Hidden IP Infringement Risks

Using a BMS controller that incorporates third-party firmware, algorithms, or hardware designs without proper licensing can expose your company to IP litigation. Common issues include unauthorized use of patented cell balancing methods, SOC (State of Charge) estimation algorithms, or communication protocols. Conduct IP due diligence and require suppliers to sign IP indemnification clauses.

Lack of Transparency in Firmware and Software

Proprietary or closed-source firmware can mask security vulnerabilities or performance limitations. If the supplier does not allow code review or updates, you lose control over critical functions and future-proofing. Insist on access to firmware documentation, update procedures, and, where possible, source code escrow agreements.

Misrepresentation of Technical Specifications

Some suppliers exaggerate accuracy, response time, or supported cell counts. This can result in system incompatibility or unsafe operation. Always validate specifications through independent lab testing or reference designs before full-scale procurement.

No Long-Term Supply or Support Guarantee

BMS controllers based on obsolete or non-automotive-grade components may face supply chain discontinuation. Without a long-term availability commitment or migration path, your product lifecycle could be jeopardized. Confirm component lifecycle status and request a product longevity agreement.

Avoiding these pitfalls requires thorough supplier vetting, technical validation, and clear contractual safeguards—especially around quality assurance and IP ownership.

Logistics & Compliance Guide for BMS Controller

This guide outlines the essential logistics and compliance considerations for the safe, efficient, and legal handling, transport, and deployment of Battery Management System (BMS) controllers.

Packaging and Handling

Ensure BMS controllers are packaged in anti-static, shock-resistant materials to prevent electrostatic discharge (ESD) and physical damage. Use manufacturer-recommended packaging with adequate cushioning. Label packages clearly with “Fragile,” “Electrostatic Sensitive Device,” and orientation arrows. Handle units with ESD-safe gloves and tools in controlled environments.

Transportation Requirements

Transport BMS controllers via ground or air according to IATA, IMDG, or local hazardous materials regulations if integrated with lithium batteries. If shipped standalone (without batteries), standard electronics shipping protocols apply. Maintain stable temperature (typically -20°C to +60°C) and low-humidity conditions during transit to avoid condensation or thermal stress.

Import/Export Compliance

Verify export control classifications (e.g., EAR99 or ECCN under the U.S. Export Administration Regulations). Comply with international trade laws including ITAR, sanctions, and embargo restrictions if applicable. Prepare accurate commercial invoices, packing lists, and certificates of origin. For dual-use technology, confirm licensing requirements based on destination country and end-use.

Regulatory Standards and Certifications

Ensure BMS controllers meet relevant international standards such as:

– IEC 61508 (Functional Safety)

– ISO 15118 / ISO 6469 (for EV applications)

– UL 1987 or UL 9540A (fire safety for energy storage)

– CE, UKCA, or FCC marks as required by region

Maintain documentation of certifications and test reports for audit purposes.

Environmental and RoHS Compliance

Confirm that BMS controllers comply with the Restriction of Hazardous Substances (RoHS) Directive (EU 2011/65/EU) and its amendments. Ensure materials used are free from lead, mercury, cadmium, and other restricted substances. Provide a Declaration of Conformity (DoC) and material substance data sheets (MSDS/SDS) upon request.

Documentation and Traceability

Maintain complete traceability through batch/lot numbers and serialized unit tracking. Provide user manuals, safety data, compliance certificates, and firmware version logs. Retain records for a minimum of 5–10 years depending on regional regulatory requirements.

End-of-Life and Recycling

Adhere to WEEE (Waste Electrical and Electronic Equipment) Directive requirements for proper disposal and recycling. Provide take-back programs or partner with certified e-waste recyclers. Clearly label products with the crossed-out wheeled bin symbol to indicate proper disposal methods.

Conclusion for Sourcing a BMS Controller:

Sourcing the right Battery Management System (BMS) controller is a critical decision that directly impacts the safety, efficiency, longevity, and performance of a battery system. After evaluating key factors such as compatibility with battery chemistry (e.g., Li-ion, LFP), voltage and cell count requirements, communication protocols (e.g., CAN, RS485, Modbus), and protection features (over-voltage, under-voltage, over-current, temperature monitoring), it becomes clear that a well-matched BMS controller is essential for reliable operation.

Cost should not be the sole deciding factor; instead, emphasis should be placed on quality, certifications (e.g., CE, UL), technical support, and scalability for future needs. Sourcing from reputable suppliers—whether established OEMs or specialized BMS manufacturers—ensures better reliability and after-sales service. Additionally, considering customization options and ease of integration with existing systems can streamline deployment and reduce long-term maintenance costs.

In conclusion, a strategic and thorough approach to sourcing a BMS controller—balancing technical requirements, supplier credibility, and lifecycle value—will lead to improved system performance, enhanced safety, and optimal return on investment.