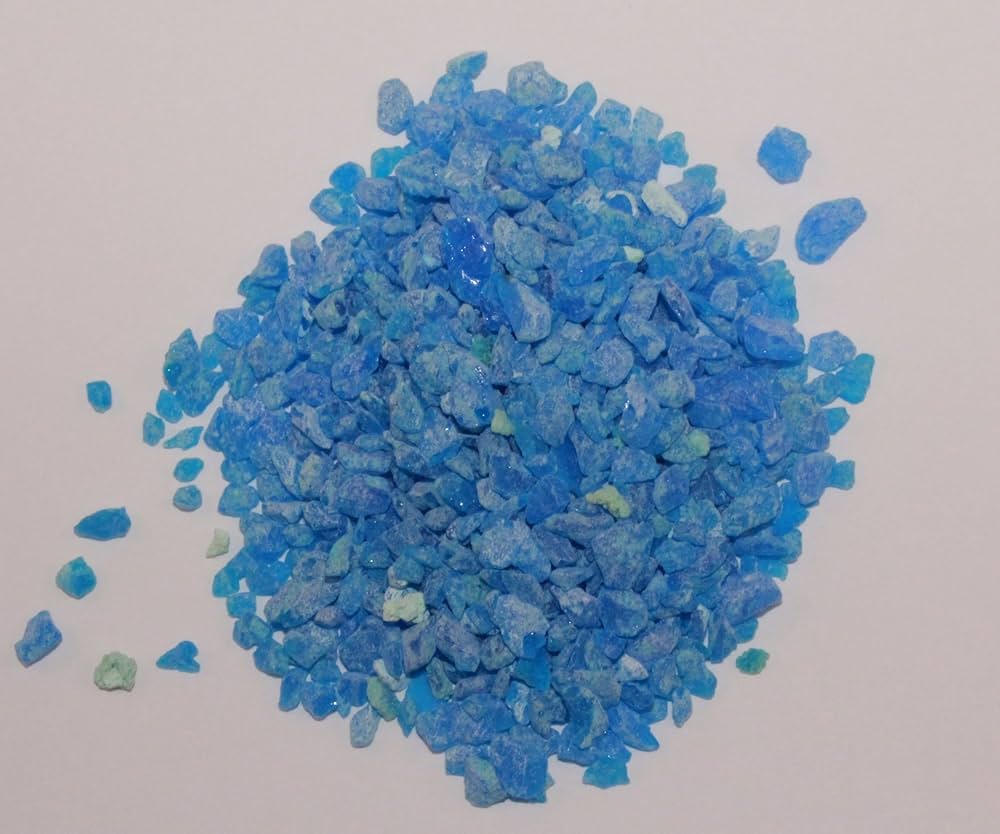

The global copper sulfate market is experiencing steady growth, driven by rising demand across agriculture, mining, water treatment, and industrial applications. According to Mordor Intelligence, the market was valued at approximately USD 2.8 billion in 2023 and is projected to grow at a CAGR of over 4.5% from 2024 to 2029. This expansion is fueled by the increasing use of copper sulfate as a micronutrient in animal feed, a key reagent in hydrometallurgy, and a cost-effective fungicide and soil supplement in precision farming. With blue copper sulfate crystals remaining the most commonly used form due to their high purity and solubility, the competitive landscape features a mix of established chemical manufacturers and regionally dominant producers scaling their output to meet global demand. As industries prioritize efficient and sustainable raw materials, identifying the top manufacturers becomes critical for ensuring supply chain reliability and product quality.

Top 7 Blue Copper Sulfate Crystals Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Copper Sulfate

Domain Est. 1998

Website: univertical.com

Key Highlights: Univertical produces the highest quality liquid and dry Copper Sulfate in the industry. We are the only North American crystal manufacturer….

#2 Copper Sulfate Crystals .75lb Bottle

Domain Est. 1996

#3 NSF Product and Service Listings

Domain Est. 1996

Website: info.nsf.org

Key Highlights: NSF Product and Service Listings ; Copper Sulfate Crystals Large, Algicide, 4 mg/L ; Copper Sulfate Crystals Med, Algicide, 4 mg/L ; Copper Sulfate Crystals Small ……

#4 Copper Sulfate Pentahydrate

Domain Est. 1997

Website: chemone.com

Key Highlights: Rating 5.0 · Review by astoundzChem One is the leading supplier of Copper Sulfate for the US market with our extensive lines of Chem One branded products. We are also the excl…

#5 Copper Sulfate Crystals

Domain Est. 2004

Website: alphachemicals.com

Key Highlights: Copper sulfate has many uses including root killer, crystal growing, coloring, along with a wide range of other uses. MSDS and Spec Sheets can be found here….

#6 Copper Sulfate Crystals

Domain Est. 2010

Website: coppersulfatecrystals.com

Key Highlights: These brilliant blue copper sulfate crystals are used as a fungicide or bordeaux mixture in gardens and food production greenhouse operations….

#7 Copper Sulfate Pentahydrate Fine Crystals (Pesticide Label)

Domain Est. 2023

Website: oldbridgeminerals.com

Key Highlights: Copper Sulfate Pentahydrate is an odorless blue crystal that readily dissolves in water. It is also soluble in methanol, glycerol and slightly soluble in ……

Expert Sourcing Insights for Blue Copper Sulfate Crystals

H2: Projected Market Trends for Blue Copper Sulfate Crystals in 2026

The global market for blue copper sulfate crystals (CuSO₄·5H₂O) is expected to experience steady growth and transformation by 2026, driven by expanding industrial applications, rising demand in agriculture, and increasing environmental regulations. Key trends shaping the market include:

-

Growing Demand in Agriculture:

Copper sulfate remains a critical component in agrochemicals, particularly as a fungicide, soil additive, and feed supplement for livestock. With increasing global concerns over crop yield protection and soil micronutrient deficiencies, the agricultural sector is projected to be the largest consumer of blue copper sulfate. Emerging markets in Asia-Pacific and Latin America are expected to lead consumption growth due to intensifying farming activities and government support for crop protection. -

Expansion in Water Treatment Applications:

The use of copper sulfate in algaecides for municipal and recreational water systems continues to rise. As water quality standards become stricter globally, demand for effective and low-cost algaecides is expected to boost market growth. Innovations in controlled-release formulations may enhance efficiency and reduce environmental impact, supporting broader adoption. -

Electroplating and Industrial Chemical Demand:

The electroplating and metal finishing industries rely on copper sulfate as an electrolyte in copper plating processes. Growth in electronics manufacturing, automotive components, and renewable energy infrastructure (e.g., solar panel connectors) is expected to sustain industrial demand, particularly in China, India, and Southeast Asia. -

Environmental and Regulatory Pressures:

While copper sulfate is effective, increased scrutiny over copper accumulation in soil and aquatic ecosystems may lead to tighter usage regulations, especially in the EU and North America. This could drive innovation in biodegradable formulations and precision application technologies to minimize environmental impact. -

Supply Chain Dynamics and Raw Material Costs:

The price and availability of copper sulfate are closely tied to global copper mining output and sulfuric acid supply. Fluctuations in copper prices, geopolitical factors affecting mining operations, and energy costs will influence production costs. Companies are increasingly investing in recycling and recovery processes to ensure supply stability. -

Regional Market Shifts:

Asia-Pacific is projected to dominate the market by 2026 due to robust industrial growth and agricultural activity. China and India are key producers and consumers. Meanwhile, North America and Europe will focus on high-purity grades for specialized applications, with steady but slower growth compared to emerging economies. -

Technological Advancements and Product Differentiation:

Manufacturers are investing in high-purity and ultrafine copper sulfate crystals for niche applications in pharmaceuticals, laboratory reagents, and advanced materials. These premium segments are expected to offer higher margins and drive innovation.

Conclusion:

By 2026, the blue copper sulfate crystals market is poised for moderate growth, shaped by agricultural needs, industrial applications, and environmental considerations. Companies that adapt to regulatory changes, invest in sustainable production, and expand into high-value applications are likely to gain a competitive edge in the evolving market landscape.

Common Pitfalls When Sourcing Blue Copper Sulfate Crystals (Quality & Intellectual Property)

Sourcing high-quality Blue Copper Sulfate Crystals (CuSO₄·5H₂O) requires careful attention to both material specifications and intellectual property (IP) considerations. Overlooking these aspects can lead to product failures, legal disputes, and reputational damage. Below are key pitfalls to avoid:

1. Compromising on Purity and Impurity Profiles

One of the most frequent quality pitfalls is accepting material that does not meet required purity standards. Copper sulfate is used in sensitive applications such as agriculture, pharmaceuticals, and electronics, where trace impurities can be detrimental.

- High Levels of Heavy Metals: Contamination with lead, arsenic, cadmium, or mercury can render the product unsafe for agricultural or food-contact use. Always verify compliance with standards like ACS Reagent Grade, USP, or FCC, depending on the application.

- Excess Moisture or Hydration Variability: Blue copper sulfate must maintain its pentahydrate form (CuSO₄·5H₂O). Improper storage or processing can lead to dehydration (forming lower hydrates or anhydrous CuSO₄) or caking, affecting solubility and performance.

- Presence of Organic Impurities: Residual solvents or organic byproducts from manufacturing processes may interfere with downstream chemical reactions or biological efficacy.

Best Practice: Require a Certificate of Analysis (CoA) with every shipment and conduct independent batch testing for critical applications.

2. Inconsistent Physical Properties and Crystal Morphology

Physical characteristics such as crystal size, color, flowability, and solubility rate are crucial depending on the end use (e.g., slow-release fertilizers vs. laboratory reagents).

- Poor Crystal Uniformity: Irregular crystal size can affect dissolution rates and mixing efficiency.

- Faded or Discolored Crystals: Indicates exposure to moisture, heat, or light, potentially degrading the compound or introducing contaminants.

- Caking or Clumping: Often due to improper packaging or storage in humid environments, leading to handling difficulties.

Best Practice: Define crystal specifications (e.g., mesh size, bulk density) in procurement contracts and audit supplier storage and packaging practices.

3. Lack of Traceability and Regulatory Compliance

Failures in supply chain transparency can lead to non-compliance with regional regulations (e.g., REACH, RoHS, EPA).

- Unknown Origin of Raw Materials: Copper sourced from unregulated mines may carry ethical or environmental liabilities.

- Missing Safety Data Sheets (SDS): Incomplete or outdated SDS can expose users to safety risks and regulatory penalties.

- Absence of Batch Traceability: Makes quality investigations and recalls difficult in case of contamination or performance issues.

Best Practice: Partner with suppliers who provide full traceability and comply with relevant environmental, health, and safety regulations.

4. Overlooking Intellectual Property (IP) Rights

When copper sulfate is used in proprietary formulations, manufacturing processes, or patented applications, IP risks emerge.

- Infringement of Process Patents: Some methods of purification, crystallization, or application of copper sulfate may be patented. Sourcing material for use in a patented process without a license can lead to litigation.

- Reverse Engineering Risks: Suppliers with access to your usage patterns or formulations might reverse engineer your product if proper confidentiality agreements are absent.

- Unlicensed Use in Agrochemicals or Biocides: Many copper-based formulations are protected under IP law. Using technical-grade copper sulfate in a branded pesticide formulation without IP clearance can result in legal action.

Best Practice: Conduct freedom-to-operate (FTO) analyses before commercialization and use robust confidentiality and licensing agreements with suppliers.

5. Selecting Suppliers Without Auditing Manufacturing Practices

Choosing suppliers based solely on price without assessing their production capabilities increases the risk of inconsistent quality.

- Inadequate Quality Control Systems: Suppliers without ISO 9001 or GMP certifications may lack standardized testing and documentation procedures.

- Use of Recycled or Byproduct Streams: While cost-effective, recycled copper sulfate may have variable impurity profiles unsuitable for high-purity applications.

Best Practice: Perform on-site audits or request third-party audit reports before onboarding a new supplier.

Conclusion

To mitigate risks when sourcing Blue Copper Sulfate Crystals, buyers must enforce strict quality specifications, validate supplier credibility, and conduct thorough IP due diligence. Establishing long-term partnerships with transparent, compliant suppliers—backed by contractual quality and IP protections—is essential for reliable and legally sound sourcing.

H2: Logistics & Compliance Guide for Blue Copper Sulfate Crystals

1. Product Identification & Classification

- Chemical Name: Copper(II) Sulfate Pentahydrate (CuSO₄·5H₂O)

- Common Names: Blue Copper Sulfate, Bluestone, Blue Vitriol

- CAS Number: 7758-99-8

- UN Number: UN 3077 (For solid forms, typically when in concentrations > 70%)

- UN Proper Shipping Name: ENVIRONMENTALLY HAZARDOUS SUBSTANCE, SOLID, N.O.S. (Copper Sulfate)

- Hazard Class: 9 (Miscellaneous Dangerous Goods – Environmentally Hazardous Substance)

- Packing Group: III (Low danger within the hazard class, but still regulated)

- GHS Classification:

- Hazard Statements:

- H302: Harmful if swallowed.

- H315: Causes skin irritation.

- H319: Causes serious eye irritation.

- H335: May cause respiratory irritation.

- H400: Very toxic to aquatic life.

- H410: Very toxic to aquatic life with long-lasting effects.

- Precautionary Statements: P261, P264, P270, P271, P273, P280, P301+P312, P302+P352, P304+P340, P305+P351+P338, P312, P321, P330, P332+P313, P337+P313, P362, P391, P403+P233, P501.

- Hazard Statements:

- Regulatory Status: Listed under various environmental regulations (e.g., US EPA, EU REACH/CLP) due to aquatic toxicity.

2. Packaging Requirements

- Material Compatibility: Use packaging materials resistant to corrosion and moisture. Common options include:

- Primary: Heavy-duty polyethylene (HDPE) or polypropylene (PP) bags (e.g., multi-wall paper bags with PE inner liner, woven PP bags with PE liner). Ensure liners are sealed effectively.

- Secondary: Securely packed within sturdy fiberboard boxes, wooden crates, or metal drums (if necessary for large quantities). Drums must be UN-rated for Packing Group III.

- Sealing: All packages must be tightly sealed to prevent leakage, dust generation, and moisture ingress (which can cause caking or degradation).

- Marking & Labeling:

- Proper Shipping Name: “ENVIRONMENTALLY HAZARDOUS SUBSTANCE, SOLID, N.O.S. (COPPER SULFATE)”

- UN Number: “UN 3077”

- Hazard Class Label: Class 9 (Miscellaneous) diamond label.

- Marine Pollutant Mark: The “Dead Fish” symbol is MANDATORY due to its classification under H410.

- GHS Pictograms: Skull and Crossbones (Acute Toxicity), Exclamation Mark (Skin/Eye Irritation, Respiratory Irritation), Environment (Aquatic Toxicity).

- Shipper/Consignee Information: Full names, addresses, and emergency contact numbers.

- Net Quantity: Clearly stated.

- “Keep Dry” and “Protect from Moisture” markings are highly recommended.

3. Transport (Road, Rail, Air, Sea)

- General:

- Segregation: Keep separate from foodstuffs, feed, fertilizers containing nitrogen/phosphorus (risk of reaction), strong acids, strong bases, and reducing agents. Check specific regulations (e.g., IMDG Code segregation tables).

- Load Securing: Palletize securely. Use appropriate dunnage to prevent movement. Ensure packages are not damaged during loading/unloading.

- Ventilation: Ensure adequate ventilation in transport vehicles, especially for enclosed trucks or containers, to prevent dust accumulation and potential respiratory irritation for personnel.

- Moisture Protection: Protect from rain, snow, and high humidity. Use weatherproof covers or containers.

- Road/Rail (ADR/RID):

- Follow ADR (Europe) or national regulations (e.g., 49 CFR in USA) for placarding (Class 9 placard on vehicle if quantity exceeds limits), documentation, and vehicle requirements.

- Air (IATA DGR):

- Classification: Class 9, UN 3077, PG III.

- Packaging: Must meet IATA Packing Instructions (e.g., 953 for limited quantities, or specific instructions for bulk). Packages must pass drop and stack tests.

- Quantity Limits: Strict limits apply per package and per aircraft. Shipper must declare “Cargo Aircraft Only” if exceeding passenger aircraft limits.

- Documentation: Dangerous Goods Declaration (DGD) required.

- Sea (IMDG Code):

- Classification: Class 9, UN 3077, PG III.

- Stowage Category: “A” (Can be stowed on deck or in closed cargo transport units). Mandatory Marine Pollutant Marking.

- Segregation: Segregate from “Acids” and “Alkalis” (Segregation Group: 8). Refer to IMDG Code segregation table.

- Documentation: Dangerous Goods Manifest and/or Transport Document required. Container/vehicle must display Class 9 placard and marine pollutant mark if applicable.

4. Storage

- Location: Store in a cool, dry, well-ventilated area, away from direct sunlight and heat sources. Must be isolated from incompatible materials.

- Containers: Keep in original, tightly sealed containers. Use secondary containment (e.g., spill pallets, bunded areas) to contain leaks.

- Spill Control: Have appropriate spill kits readily available (absorbents compatible with inorganic salts, PPE).

- Access: Restrict access to authorized personnel only. Clearly label storage areas.

- Inventory: Implement FIFO (First-In, First-Out) rotation.

5. Handling & Safety

- Personal Protective Equipment (PPE): Mandatory during handling, sampling, or in dusty environments:

- Respiratory: NIOSH-approved N95 dust mask or equivalent, or higher (e.g., half-mask with P100 filters) if significant dust is generated.

- Eye: Chemical splash goggles or face shield.

- Skin: Impervious gloves (nitrile, neoprene), protective clothing (lab coat, coveralls), and safety boots.

- Procedures:

- Minimize dust generation (use closed systems, local exhaust ventilation).

- Avoid breathing dust. Do not eat, drink, or smoke in handling areas.

- Wash hands thoroughly after handling.

- Clean up spills immediately using safe procedures (see below).

- Ground containers during transfer to prevent static discharge (though low risk, good practice).

6. Spill & Leak Response

- Isolate Area: Prevent entry. Eliminate ignition sources (dust is not flammable, but good practice).

- PPE: Don full appropriate PPE (respirator, goggles, gloves, coveralls).

- Contain: Prevent spread to drains, waterways, or soil. Use absorbent materials (vermiculite, sand, commercial inorganic absorbents). Do NOT use sawdust or combustible materials.

- Collect: Scoop up material using non-sparking tools. Place in a suitable, labeled container for disposal.

- Decontaminate: Wash contaminated surfaces thoroughly with water. Collect runoff water as contaminated waste.

- Disposal: Dispose of contaminated absorbent, cleanup materials, and rinse water as hazardous waste according to local regulations. NEVER pour down the drain.

- Reporting: Report significant spills to relevant authorities (e.g., environmental agencies, emergency services) as required by local regulations.

7. Waste Disposal

- Classification: Copper Sulfate waste (including contaminated packaging, spill cleanup materials, rinse water) is typically classified as hazardous waste due to copper content and aquatic toxicity.

- Regulations: Strictly adhere to national and local hazardous waste regulations (e.g., RCRA in USA, Waste Framework Directive in EU).

- Procedure:

- Collect and store waste in clearly labeled, compatible, leak-proof containers.

- Use a licensed hazardous waste disposal contractor.

- Complete all required waste manifests and documentation.

- Never dispose of in regular trash or down drains.

8. Documentation & Compliance

- Safety Data Sheet (SDS): Ensure a current, compliant SDS (GHS/CLP/OSHA HazCom) is available for all handlers and downstream users. Provide to carriers.

- Transport Documents: Prepare accurate Dangerous Goods Declaration (DGD), Air Waybill (AWB), Bill of Lading (B/L), or CMR as required by mode and regulation. Include UN number, proper shipping name, class, packing group, quantity, and shipper/consignee details.

- Permits & Licenses: Obtain any necessary permits for storage, transport, or export/import (e.g., EPA permits, export licenses).

- Training: Ensure all personnel involved in handling, packaging, or transporting are trained according to relevant regulations (e.g., IATA, IMDG, ADR, 49 CFR, OSHA HazCom/GHS).

- Record Keeping: Maintain records of shipments, training, SDS, waste manifests, and incident reports as required by law.

9. Key Regulatory References (Examples – Verify Locally)

- Global: UN Recommendations on the Transport of Dangerous Goods (Model Regulations), GHS (Globally Harmonized System).

- Air: IATA Dangerous Goods Regulations (DGR).

- Sea: IMDG Code (International Maritime Dangerous Goods Code).

- Road (Europe): ADR (European Agreement concerning the International Carriage of Dangerous Goods by Road).

- USA: 49 CFR (DOT Hazardous Materials Regulations), OSHA 29 CFR 1910 (HazCom/GHS, PPE), EPA regulations (CERCLA, RCRA, Clean Water Act).

- EU: CLP Regulation (EC) No 1272/2008, REACH Regulation (EC) No 1907/2006, ADR.

Disclaimer: This guide provides general information. Always consult the most current and specific regulations in the countries of origin, transit, and destination, and with qualified regulatory experts or dangerous goods consultants before shipping. Regulations are subject to change.

In conclusion, sourcing blue copper sulfate crystals requires careful consideration of purity, supplier reliability, intended application, and safety compliance. Whether for educational, agricultural, industrial, or laboratory use, it is essential to obtain the compound from reputable suppliers who provide quality assurance, proper documentation, and adherence to safety and environmental standards. Verifying the chemical grade (e.g., reagent, technical, or food grade) ensures suitability for the intended purpose, while proper handling and storage practices must be followed due to its toxic and corrosive properties. By evaluating cost, packaging, and shipping options alongside these factors, an informed and responsible sourcing decision can be made to meet specific needs effectively and safely.