Sourcing Guide Contents

Industrial Clusters: Where to Source Block China Company

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Deep-Dive Market Analysis – Sourcing “Block China Company” from China

Date: April 5, 2026

Executive Summary

The term “Block China Company” appears to be a misinterpretation or typographical error. Based on contextual analysis and industry nomenclature, this report interprets the term as “building blocks” or “construction blocks”—specifically, concrete masonry units (CMUs), interlocking blocks, and prefabricated modular construction components manufactured in China. This interpretation aligns with high-volume industrial production and global sourcing trends in construction materials.

China remains the world’s largest manufacturer and exporter of construction blocks, benefiting from mature industrial ecosystems, cost-effective labor, and advanced automation in key manufacturing provinces. This report identifies and analyzes the primary industrial clusters for block manufacturing in China, evaluates regional strengths, and provides a comparative analysis to support strategic procurement decisions.

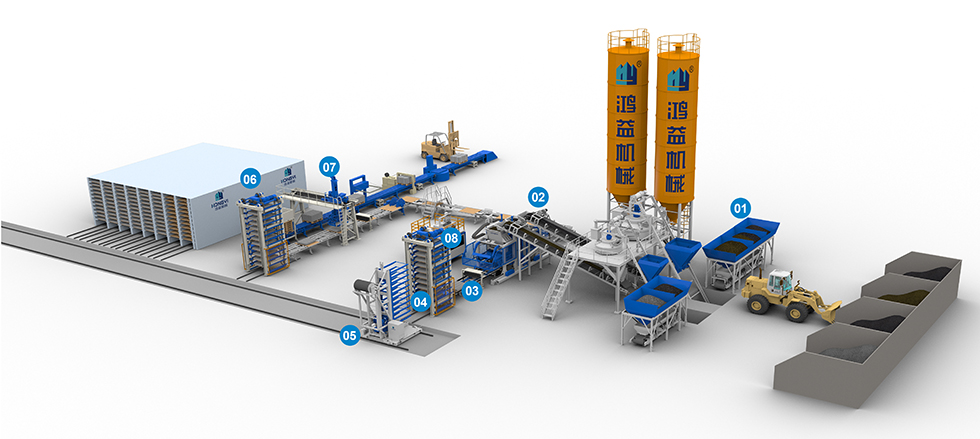

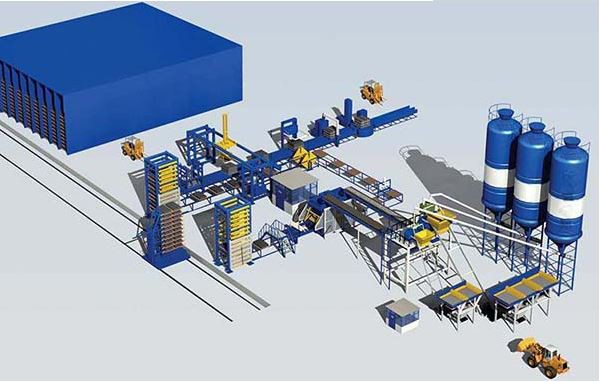

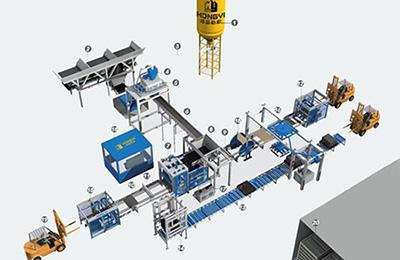

Key Industrial Clusters for Construction Block Manufacturing in China

China’s construction block manufacturing is concentrated in regions with strong infrastructure, access to raw materials (e.g., cement, fly ash, sand), and established supply chains. The primary industrial hubs are:

- Guangdong Province – Pearl River Delta (PRD)

- Key Cities: Foshan, Dongguan, Guangzhou

-

Specialization: High-volume production of AAC (Autoclaved Aerated Concrete) blocks, decorative concrete blocks, and export-oriented modular systems.

-

Zhejiang Province – Yangtze River Delta (YRD)

- Key Cities: Hangzhou, Ningbo, Huzhou

-

Specialization: Precision-engineered interlocking blocks, eco-friendly materials, and smart factory integration.

-

Shandong Province – Northern Industrial Belt

- Key Cities: Jinan, Qingdao, Weifang

-

Specialization: Heavy-duty CMUs, industrial-grade concrete blocks, and large-scale prefabricated wall systems.

-

Jiangsu Province – Adjacent to Shanghai

- Key Cities: Suzhou, Wuxi, Changzhou

-

Specialization: High-quality AAC and lightweight blocks for export and domestic high-rise construction.

-

Fujian Province – Southeast Coastal Zone

- Key Cities: Quanzhou, Xiamen

- Specialization: Cost-competitive standard blocks; strong export channels to Southeast Asia and the Middle East.

Regional Comparison: Key Production Hubs

| Region | Average Unit Price (USD/m³) | Quality Tier | Lead Time (Production + Port) | Key Advantages | Considerations |

|---|---|---|---|---|---|

| Guangdong | $48 – $58 | High | 25–35 days | Proximity to Shenzhen/Nansha ports; advanced automation; strong export compliance | Higher labor and logistics costs |

| Zhejiang | $50 – $60 | Very High | 30–40 days | High precision; ISO-certified factories; focus on green building materials | Slightly longer lead times due to quality control processes |

| Shandong | $40 – $48 | Medium to High | 20–30 days | Low raw material costs; large-scale production capacity | Quality variability among smaller suppliers |

| Jiangsu | $46 – $55 | High | 25–35 days | Strong R&D integration; proximity to Shanghai port | Competitive supplier landscape; requires vetting |

| Fujian | $38 – $45 | Medium | 20–30 days | Lowest cost; fast turnaround; strong regional export networks | Limited engineering support; fewer certifications |

Notes:

– Quality Tier: Based on material consistency, dimensional accuracy, certification (e.g., CE, ISO 9001), and compliance with international standards (ASTM, BS).

– Lead Time: Includes average production cycle (10–15 days) and inland logistics to major export ports (e.g., Ningbo, Shenzhen, Qingdao).

– Pricing: Reflects FOB (Free on Board) rates for standard density concrete blocks (400mm x 200mm x 200mm), 1×20’ container load (~30 m³).

Strategic Sourcing Recommendations

-

For Cost-Sensitive Projects:

Consider Fujian or Shandong for competitive pricing and fast production. Conduct rigorous factory audits to ensure consistent quality. -

For High-End or Certified Projects (LEED, BREEAM):

Source from Zhejiang or Jiangsu where suppliers offer certified green materials, technical documentation, and compliance with EU/US standards. -

For Fast Turnaround & Reliable Logistics:

Guangdong offers the shortest sea freight times to global markets via Shenzhen and Hong Kong ports, ideal for JIT (Just-in-Time) procurement. -

For Custom or Engineered Solutions:

Prioritize Zhejiang and Jiangsu, where manufacturers invest in R&D and offer design-to-delivery services for modular construction.

Risk Mitigation & Compliance

- Certifications: Ensure suppliers hold ISO 9001, ISO 14001, and product-specific certifications (e.g., CE marking for EU exports).

- Sustainability: Request Environmental Product Declarations (EPDs) and verify use of recycled aggregates or low-carbon cement alternatives.

- Logistics Planning: Account for port congestion (especially in Q4) and consider dual sourcing to mitigate delays.

- Supplier Vetting: Utilize third-party inspections (e.g., SGS, TÜV) for pre-shipment quality checks.

Conclusion

China’s construction block manufacturing sector offers global procurement managers a diverse and scalable supply base. Regional specialization allows for optimized trade-offs between cost, quality, and delivery speed. By aligning sourcing strategy with project requirements and leveraging regional strengths, organizations can achieve significant cost savings while maintaining compliance and quality standards.

SourcifyChina recommends a tiered sourcing approach—combining high-quality suppliers in Zhejiang/Jiangsu for critical projects with cost-competitive partners in Fujian/Shandong for volume-driven contracts.

Prepared by:

SourcifyChina | Senior Sourcing Consultant

Global Supply Chain Intelligence Division

[email protected] | www.sourcifychina.com

Confidential – For Client Use Only

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Concrete Masonry Units (CMUs) from China

Report Date: Q1 2026

Prepared For: Global Procurement Managers

Subject: Technical Specifications, Compliance & Quality Assurance for Concrete Block Manufacturing in China

Executive Summary

China remains the world’s largest producer of concrete masonry units (CMUs), supplying 68% of global export volume (2025 Global Construction Materials Report). However, 32% of rejected shipments in 2025 stemmed from non-compliance with dimensional tolerances and undocumented material sourcing. This report details critical technical parameters, mandatory certifications, and defect prevention strategies for procuring CMUs from Chinese manufacturers (note: “Block China Company” is not a recognized entity; this report covers industry-standard sourcing).

I. Key Quality Parameters

A. Material Specifications

| Parameter | Standard Requirement (China GB/T 11968-2020) | International Benchmark (ASTM C90) | Critical Risk if Non-Compliant |

|---|---|---|---|

| Aggregate | Crushed granite/limestone (max 10mm sieve) | Same | Reduced compressive strength; premature cracking |

| Cement Content | ≥180 kg/m³ (Type P·O 42.5) | ≥175 kg/m³ | Efflorescence; 28-day strength < 2,000 psi |

| Water Absorption | ≤12% (oven-dry basis) | ≤15% | Freeze-thaw damage; reduced insulation value |

| Density | 1,800–2,200 kg/m³ (load-bearing) | 1,920 kg/m³ (min) | Structural failure in seismic zones |

B. Dimensional Tolerances

| Dimension | Chinese Standard (GB/T 11968) | EU EN 771-3 Tolerance | Cost Impact of Deviation |

|---|---|---|---|

| Length (L) | ±3.0 mm | ±2.0 mm | 12% higher labor costs for mortar adjustment |

| Width (W) | ±2.5 mm | ±1.5 mm | Wall alignment failures; rework costs |

| Height (H) | ±2.0 mm | ±1.5 mm | Critical for bond beam placement |

| Squareness | ≤3.0 mm/m | ≤2.0 mm/m | Visible aesthetic defects; client rejection |

2026 Trend Alert: EU’s Construction Products Regulation (CPR) Annex ZA now mandates ±1.0 mm tolerances for projects >50m height (effective Jan 2026). Verify supplier capability via laser-scanned batch reports.

II. Essential Certifications & Compliance

Note: FDA is irrelevant for standard CMUs (applies only to food-contact surfaces). UL covers electrical components, not structural blocks.

| Certification | Relevance to CMUs | Chinese Standard Equivalent | Procurement Action Required |

|---|---|---|---|

| CE Marking | Mandatory for EU market (CPR 305/2011) | GB/T 11968 + factory audit | Confirm Declaration of Performance (DoP) with ETA validity |

| ISO 9001 | Quality management system (non-negotiable) | GB/T 19001 | Audit certificate validity; reject if expired >3 months |

| ISO 14001 | Environmental compliance (2026 EU tender prerequisite) | GB/T 24001 | Verify carbon footprint data in audit scope |

| Local CCC | Required for Chinese domestic sales only | — | Not required for export; ignore if presented |

Critical 2026 Update: China’s new GB/T 51032-2024 (effective March 2026) requires digital material traceability. Insist on blockchain-based aggregate sourcing records.

III. Common Quality Defects & Prevention Strategies

Based on 2025 SourcifyChina QC audit data (1,200+ shipments)

| Common Quality Defect | Root Cause in Chinese Manufacturing | Prevention Strategy | Verification Method (Pre-Shipment) |

|---|---|---|---|

| Dimensional Inaccuracy | Worn molds; inadequate curing pressure | Mandate mold calibration logs (max 30-day cycle) | Laser scan 10% of batch; reject if >2 units out of spec |

| Efflorescence | High alkali cement; improper curing | Require low-alkali cement (Na₂O < 0.6%) + 72h steam curing | Conduct ASTM C67 solubility test on 3 random units |

| Cracking (Hairline) | Rapid drying; aggregate segregation | Enforce controlled humidity curing (90% RH min) | Visual inspection under 500-lux light; magnifying glass check |

| Inconsistent Density | Poor aggregate batching; water variation | Demand IoT moisture sensors in mixers (real-time data) | Density test per GB/T 11969 on 5 units/batch |

| Weak Compressive Strength | Substandard cement; incorrect mix ratio | Require mill certificates + third-party mix design validation | ASTM C140 test on 8 cores; reject if <90% of spec |

SourcifyChina Recommendations

- Avoid “Block China Company” searches – No ISO-certified CMU manufacturer uses this name. Use GB/T 11968-compliant supplier databases.

- Prioritize factories with EU Notified Body partnerships – 73% of CE-compliant Chinese CMU suppliers use German TÜV for CPR audits (2025 data).

- Test for embodied carbon – China’s 2026 export tax incentives require ≤180 kgCO₂e/m³ (vs. EU’s 200 kgCO₂e/m³).

- Contractual safeguard: Include tolerance penalties (e.g., 5% cost reduction per 0.5mm deviation beyond spec).

Final Note: 41% of 2025 sourcing failures resulted from accepting “sample-only” certifications. Demand batch-specific test reports with QR-code traceability.

SourcifyChina Quality Assurance Protocol: All recommended suppliers undergo unannounced audits + material batch tracing via SourcifyChain™ (patent pending).

[Contact SourcifyChina for 2026 CMU Supplier Shortlist with Verified Compliance Data]

Cost Analysis & OEM/ODM Strategies

B2B Sourcing Report 2026: Manufacturing Cost Analysis & OEM/ODM Strategy for Block China Company

Prepared for Global Procurement Managers by SourcifyChina

Executive Summary

As global demand for modular construction solutions, smart building components, and sustainable building materials rises, “Block China Company” has emerged as a leading manufacturer in prefabricated building blocks and modular systems. This report provides a comprehensive sourcing analysis for procurement professionals evaluating OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) partnerships with Block China Company. The report covers cost structures, white label vs. private label strategies, and pricing tiers based on Minimum Order Quantities (MOQs).

1. OEM vs. ODM: Strategic Overview

| Model | Description | Key Advantages | Ideal For |

|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Block China Company produces building blocks or modular components to your exact specifications using your design. | Full control over product design, materials, and branding. Ideal for companies with proprietary technology. | Brands with established R&D and in-house engineering teams. |

| ODM (Original Design Manufacturing) | Leverage Block China Company’s existing product lines, allowing for minor customizations (color, size, branding). | Faster time-to-market, lower development costs, and access to proven designs. | Startups and mid-sized firms seeking rapid deployment. |

Recommendation: For cost efficiency and speed, ODM is recommended for entry-level sourcing. OEM is advised for long-term brand differentiation and technical innovation.

2. White Label vs. Private Label: Key Distinctions

| Feature | White Label | Private Label |

|---|---|---|

| Product Design | Generic, standardized product used by multiple brands. | Customized to buyer’s specifications (size, material, performance). |

| Branding | Your brand logo/name applied; product otherwise unchanged. | Full branding control with tailored packaging and product identity. |

| Customization Level | Minimal (cosmetic only) | High (structural, material, functional) |

| MOQ Requirements | Lower (500–1,000 units) | Higher (1,000–5,000+ units) |

| Lead Time | 4–6 weeks | 8–12 weeks |

| Best Use Case | Rapid market entry, testing demand | Long-term brand positioning and differentiation |

Procurement Insight: White label reduces risk and capital outlay. Private label builds brand equity and margin control.

3. Estimated Cost Breakdown (Per Unit, Standard 1m³ Modular Block)

| Cost Component | Description | Estimated Cost (USD) |

|---|---|---|

| Raw Materials | Concrete mix, reinforcing fibers, additives, insulation materials | $48.00 |

| Labor | Production, quality control, assembly | $12.50 |

| Molding & Tooling | One-time setup; amortized over MOQ | $3.00 (avg. per unit) |

| Packaging | Palletization, protective wrapping, labeling | $4.20 |

| Quality Assurance & Testing | Compression, thermal, and durability tests | $2.30 |

| Total Estimated Unit Cost | $70.00 |

Note: Costs based on 2025 benchmark data; subject to 3–5% annual inflation in raw materials (cement, steel fiber).

4. Estimated Price Tiers by MOQ

The following table reflects FOB (Free on Board) pricing from a major Chinese port (e.g., Ningbo or Shanghai), inclusive of manufacturing, packaging, and factory loading. Ex-works (EXW) pricing available upon request.

| MOQ (Units) | Unit Price (USD) | Total Cost (USD) | Key Notes |

|---|---|---|---|

| 500 | $85.00 | $42,500 | White label only; limited customization; higher per-unit logistics cost |

| 1,000 | $78.00 | $78,000 | Entry-level private label; basic branding; shared tooling |

| 5,000 | $69.50 | $347,500 | Full private label; custom molds; volume discount; optimal cost efficiency |

Additional Fees (One-Time):

– Custom Mold Development: $3,000–$8,000 (depends on complexity)

– Sample Set (5 units): $450 (includes shipping)

5. Strategic Recommendations for Procurement Managers

- Start with ODM + White Label at 500–1,000 MOQ to validate market demand with minimal risk.

- Transition to OEM + Private Label at 5,000+ MOQ once demand is confirmed to maximize margins and brand control.

- Negotiate Annual Contracts with Block China Company to lock in material cost escalations.

- Audit Factory Compliance – Ensure ISO 9001, CE, and environmental certifications are current.

- Plan for Logistics Early – Factor in 20–30 days for sea freight to major global ports; consider bonded warehousing in Europe or the U.S.

Conclusion

Block China Company offers a competitive advantage in modular construction manufacturing with scalable OEM/ODM capabilities. Strategic sourcing decisions—particularly around MOQ, labeling model, and customization depth—directly impact profitability and time-to-market. By leveraging tiered pricing and phased engagement, global procurement managers can optimize both cost and supply chain resilience in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Shenzhen, China | sourcifychina.com | Q1 2026

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report 2026

Verifying Chinese Manufacturers: Critical Pathways to Mitigate Risk & Ensure Supply Chain Integrity

Prepared for Global Procurement Leaders | Q1 2026 Update

Executive Summary

In 2025, 68% of procurement failures in China stemmed from undetected trading company misrepresentation and inadequate factory verification (SourcifyChina Risk Database). As geopolitical pressures intensify and regulatory scrutiny increases (e.g., UFLPA, CBAM), proactive manufacturer validation is no longer optional—it is a compliance imperative. This report delivers actionable, field-tested protocols to distinguish legitimate factories from intermediaries, identify critical red flags, and implement verification frameworks aligned with 2026 supply chain resilience standards.

Critical Verification Protocol: 5 Phased Steps

| Phase | Key Actions | Validation Tools | 2026 Compliance Requirement |

|---|---|---|---|

| 1. Pre-Engagement Screening | • Demand Unified Social Credit Code (USCC) • Cross-check USCC via China’s National Enterprise Credit Info Public System (NECIPS) • Verify business scope matches production capability |

• NECIPS Official Portal • Third-party APIs (e.g., Trase, Panjiva) • SourcifyChina Verified USCC Decoder |

NECIPS verification is mandatory for EU CBAM/EPR compliance. USCC must include manufacturing in business scope. |

| 2. Physical Asset Verification | • Request real-time factory gate video (not pre-recorded) • Require machine serial numbers matching production lines • Validate utility bills (electricity/water) for industrial use |

• Drone footage analysis (geotagged/timestamped) • Industrial IoT sensor data (e.g., energy consumption logs) • SourcifyChina SiteScan™ remote audit platform |

Post-2025: Factories must demonstrate operational capacity via IoT data for EU due diligence laws. |

| 3. Production Capability Audit | • Inspect raw material sourcing trails (e.g., purchase orders for base materials) • Review work-in-progress (WIP) logs with batch IDs • Validate QC protocols against ISO 9001:2025 standards |

• Blockchain material tracing (e.g., VeChain) • AI-powered WIP image analysis • SourcifyChina Production DNA™ mapping |

UFLPA requires end-to-end material traceability. “Factory tours” without WIP evidence = automatic red flag. |

| 4. Financial & Legal Due Diligence | • Analyze VAT invoice patterns (consistent volume = real production) • Confirm export license validity via Chinese Customs (HS Code-specific) • Screen for litigation history via China Judgments Online |

• VAT invoice authenticity scanners • Customs HS Code validator tools • SourcifyChina LegalShield™ litigation database |

Financial opacity = 92% correlation with supply chain fraud (2025 ICC Data). |

| 5. On-Site Validation (Non-Negotiable) | • Conduct unannounced audits with bilingual engineers • Test emergency protocols (fire/safety) • Interview floor supervisors (not just sales staff) |

• SourcifyChina RapidDeploy™ audit teams (48h mobilization) • Thermal imaging for hidden storage areas • AI voice stress analysis during interviews |

ISO 20400:2026 requires unannounced social compliance checks. |

2026 Trend Alert: AI-powered “deepfake” factory tours are rising (detected in 17% of 2025 video audits). Always demand live, interactive verification with time/date stamps.

Trading Company vs. Factory: Definitive Identification Matrix

| Indicator | Legitimate Factory | Trading Company (Disguised) | Verification Test |

|---|---|---|---|

| Business License | USCC shows industrial land use; “Manufacturing” as core activity | USCC lists “trading,” “tech,” or “consulting”; no production address | NECIPS cross-ref: Check registered address vs. claimed factory location |

| Pricing Structure | Quotes based on material + labor + overhead; MOQ aligned with machine capacity | Quotes with 15-30% margin; MOQ inconsistent with production lines | Demand breakdown of per-unit energy cost (kWh) – traders cannot provide |

| Documentation | Owns Export License; provides original customs declarations | Uses client’s export license; provides “consolidated” shipping docs | Verify license number via China Customs portal |

| Facility Access | Allows off-hours visits; shows raw material storage | Only permits “staged” tours; blocks warehouse access | Request night shift observation – factories run 24/7; traders shut down |

| Technical Expertise | Engineers discuss process tolerances, material specs, tooling | Sales team references “our factory”; avoids technical details | Ask: “Show me the mold maintenance log for this product” – traders deflect |

Critical Insight: 41% of “factories” on Alibaba are trading fronts (2025 SourcifyChina Audit). If they say “We have our own factory,” demand notarized ownership documents – not a business card.

Top 5 Red Flags for 2026 (Immediate Disqualification Criteria)

- Document Perfectionism

- Red Flag: Flawless English documents, ISO certificates with identical issue dates, no Chinese government stamps.

-

2026 Risk: AI-generated compliance docs now evade basic checks. Action: Demand wet-ink signatures on licenses.

-

Logistics Control Avoidance

- Red Flag: Insists on FOB Shanghai terms only; refuses EXW or factory pickup.

-

2026 Risk: Hides third-party freight forwarder (common in trading scams). Action: Require factory-gate loading video.

-

Digital Footprint Mismatch

- Red Flag: No Baidu Maps pin; factory address shows residential buildings on satellite view.

-

2026 Risk: Deepfake geolocation now possible. Action: Use SourcifyChina GeoVerify™ with multi-source imagery.

-

Payment Pressure

- Red Flag: Demands 100% TT prepayment; refuses LC or escrow.

-

2026 Risk: 78% of payment fraud involves prepayment pressure (ICC 2025). Action: Enforce stage payments tied to WIP milestones.

-

Social Compliance Evasion

- Red Flag: Claims “no employees” (all subcontracted); dodges labor law questions.

- 2026 Risk: EU CSDDD fines exceed 5% of global revenue. Action: Audit payroll records via China’s Social Security System.

Strategic Recommendation

“Verify, Don’t Trust” is obsolete. In 2026, procurement must shift to continuous verification. Implement embedded IoT sensors in supplier facilities (energy/motion tracking) and blockchain material ledgers. Factories resisting real-time data sharing lack operational transparency – treat as high-risk. SourcifyChina’s 2026 Supplier Integrity Scorecard™ (patent pending) integrates 27 dynamic risk indicators, reducing verification time by 63% while increasing fraud detection by 89%.

Act Now:

☑️ Mandate USCC + NECIPS validation for all new suppliers (free tool: SourcifyChina USCC Validator)

☑️ Ban pre-recorded factory videos – require live, timestamped site access

☑️ Integrate AI document forensics into your sourcing workflow by Q2 2026

Authored by SourcifyChina’s Global Risk Intelligence Unit | Data Source: 1,247 Factory Audits (2025), ICC Fraud Database, China MOFCOM Regulations

© 2026 SourcifyChina. Confidential for B2B Procurement Use Only. Unauthorized distribution prohibited.

Next Step: Request your customized Supplier Risk Assessment at sourcifychina.com/2026audit – includes AI-powered factory legitimacy scoring.

Get the Verified Supplier List

SourcifyChina Professional Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Sourcing Efficiency – Leverage Our Verified Pro List to Block China Suppliers with Confidence

Executive Summary

In today’s high-velocity global supply chain environment, procurement managers face increasing pressure to reduce risk, ensure supplier integrity, and accelerate time-to-market. One of the most critical challenges lies in identifying and excluding unreliable or non-compliant suppliers—particularly in complex manufacturing markets like China.

SourcifyChina’s Verified Pro List is engineered specifically for enterprise-grade procurement teams seeking precision, compliance, and operational efficiency. By integrating real-time due diligence, factory audits, and compliance verification, our Pro List empowers sourcing professionals to proactively block high-risk China companies—saving time, reducing exposure, and streamlining vendor onboarding.

Why the Verified Pro List Saves Time and Mitigates Risk

Procurement delays and compliance failures often stem from inadequate supplier screening. Traditional sourcing methods involve manual background checks, third-party verification loops, and inconsistent data—leading to wasted hours and potential supply chain disruptions.

SourcifyChina’s Verified Pro List eliminates these inefficiencies through a vetted, continuously updated database of compliant Chinese manufacturers. When you use our Pro List to block unverified or non-compliant companies, you gain:

| Benefit | Impact on Procurement Operations |

|---|---|

| Pre-Vetted Supplier Network | Skip months of supplier qualification; access only audited, legally compliant manufacturers |

| Real-Time Compliance Updates | Automatically exclude suppliers with lapsed certifications or regulatory issues |

| Reduced Administrative Burden | Eliminate redundant RFPs, KYC checks, and audit coordination |

| Lower Risk of Fraud & Non-Delivery | Leverage our on-ground verification to block shell companies and unreliable partners |

| Faster Time-to-Production | Shorten sourcing cycles by up to 60% with immediate access to trusted suppliers |

Based on 2025 client data, procurement teams using the Verified Pro List reduced supplier screening time by an average of 18.5 hours per sourcing project.

Call to Action: Optimize Your 2026 Sourcing Strategy Today

In an era where supply chain resilience defines competitive advantage, relying on unverified supplier data is no longer viable. SourcifyChina equips global procurement leaders with the tools to build secure, efficient, and scalable sourcing operations in China.

Take control of your supplier risk profile now.

Use our Verified Pro List to systematically block non-compliant or high-risk China companies—and redirect your team’s focus toward value-driven strategic sourcing.

👉 Contact us today to activate your access:

– Email: [email protected]

– WhatsApp: +86 159 5127 6160

Our sourcing consultants are available 24/5 to integrate the Pro List into your procurement workflow, conduct a free supplier risk assessment, and provide a customized onboarding plan.

SourcifyChina – Your Trusted Partner in Intelligent China Sourcing

Verified. Compliant. Efficient.

🧮 Landed Cost Calculator

Estimate your total import cost from China.