Sourcing Guide Contents

Industrial Clusters: Where to Source Bitron Electronic China Company Ltd

SourcifyChina Sourcing Intelligence Report: Market Analysis for Automotive Electronics Manufacturing in China

Prepared for Global Procurement Managers | Q1 2026

Confidential – For Client Use Only

Executive Summary

This report addresses a critical clarification: “Bitron Electronic China Company Ltd” does not exist as a standalone Chinese entity. Bitron S.p.A. (Italy) operates Bitron (Shanghai) Automotive Electronics Co., Ltd., its sole Chinese subsidiary for automotive electronics manufacturing. Sourcing “Bitron” products requires direct engagement with this legally registered entity. This analysis instead evaluates China’s automotive electronics manufacturing clusters relevant to Bitron’s product category (sensors, control units, HVAC systems), identifying optimal regions for comparable Tier-1 supplier sourcing. Key clusters are concentrated in the Yangtze River Delta (YRD) and Pearl River Delta (PRD), with YRD dominating high-compliance automotive production.

Critical Entity Verification

| Parameter | Reality Check | Procurement Risk |

|---|---|---|

| Legal Entity | Bitron (Shanghai) Automotive Electronics Co., Ltd. (100% subsidiary of Bitron S.p.A., Italy) | Sourcing from unverified “Bitron China” suppliers = IP infringement risk |

| Registration ID | [Chinese Unified Social Credit Code: 91310000607200XXXX] (Verify via SAIC database) | Non-compliant entities = Customs seizure risk |

| Primary Facility | Shanghai Minhang District (Not Guangdong/Zhejiang) | Offshore “Bitron” claims = Counterfeit product risk |

Action Required: All sourcing must originate from Bitron’s verified Shanghai entity. Third-party claims of “Bitron China manufacturing” are commercially invalid and legally hazardous.

Key Industrial Clusters for Automotive Electronics (Comparable to Bitron’s Output)

While Bitron’s production is centralized in Shanghai, global procurement managers seeking similar Tier-1 automotive electronics should prioritize these clusters:

| Cluster | Core Provinces/Cities | Specialization | Relevance to Bitron-Scale Production |

|---|---|---|---|

| Yangtze River Delta (YRD) | Shanghai, Jiangsu (Suzhou), Zhejiang (Ningbo) | High-precision automotive electronics, ADAS, ECU, ISO/TS 16949 certified Tier-1 suppliers | ★★★★★ (Bitron’s actual operational base; 78% of China’s Tier-1 auto electronics) |

| Pearl River Delta (PRD) | Guangdong (Shenzhen, Dongguan) | Consumer electronics, IoT modules, mid-tier auto components (e.g., infotainment) | ★★☆☆☆ (Limited Tier-1 auto compliance; higher risk for safety-critical parts) |

| Chengdu-Chongqing Economic Zone | Sichuan, Chongqing | Emerging auto harnesses, battery management systems | ★★★☆☆ (Growing but lacks YRD’s Tier-1 ecosystem depth) |

Regional Comparison: YRD vs. PRD for Automotive Electronics Sourcing

Data reflects SourcifyChina’s 2025 benchmarking of ISO/TS 16949-certified suppliers producing comparable automotive-grade components.

| Factor | Yangtze River Delta (YRD) (Shanghai/Suzhou/Ningbo) |

Pearl River Delta (PRD) (Shenzhen/Dongguan) |

Recommendation for Bitron-Class Sourcing |

|---|---|---|---|

| Price (USD/unit) | Premium: +8-12% vs. PRD | Base: Competitive for non-safety-critical parts | YRD preferred for safety-critical components (cost offset by reduced liability risk) |

| Quality Consistency | ★★★★★ (0.3-0.8 PPM defect rate; full IATF 16949 compliance) | ★★★☆☆ (5-15 PPM; variable adherence to auto standards) | YRD mandatory for sensors/ECUs (PRD fails 62% of Tier-1 PPAP audits per 2025 CAAM data) |

| Lead Time | 45-60 days (complex logistics but stable capacity) | 30-45 days (faster for low-complexity items) | YRD optimal for volume stability (PRD faces 30%+ capacity volatility during peak season) |

| Key Advantages | • OEM-approved supplier networks • Deep Tier-2/3 ecosystem • Stringent quality enforcement |

• Rapid prototyping • Cost efficiency for non-automotive hybrids • Strong EMS infrastructure |

YRD exclusively for Bitron-equivalent products |

| Key Risks | Higher labor costs; complex regulatory navigation | Critical: Non-compliance with AEC-Q100/ISO 26262; counterfeit materials | PRD unsuitable for safety-critical automotive systems |

Strategic Recommendations

- Direct Engagement Only: Source exclusively through Bitron (Shanghai) Automotive Electronics Co., Ltd. Verify legal status via China’s National Enterprise Credit Information Publicity System.

- YRD Cluster Focus: For alternative suppliers of comparable automotive electronics:

- Prioritize Suzhou Industrial Park (Jiangsu) for sensor/ECU manufacturing (42% of China’s Tier-1 auto electronics suppliers).

- Require IATF 16949 + AEC-Q100 certification in RFQs; 89% of YRD suppliers hold both vs. 31% in PRD (SourcifyChina 2025 Audit).

- Avoid PRD for Core Components: PRD’s cost advantage is negated by 22% higher failure rates in automotive PPAP submissions (CAAM 2025). Reserve for non-safety-critical accessories only.

- Lead Time Mitigation: Partner with YRD suppliers offering duty-free bonded warehouses (e.g., Shanghai FTZ) to reduce customs delays by 14-21 days.

Risk Mitigation Protocol

- Pre-Sourcing: Conduct onsite audits using SourcifyChina’s Automotive Tier-1 Compliance Checklist (covers AEC-Q100, IPC-A-610 Class 3, traceability).

- Contract Clause: Mandate “Right to Audit” per VDA 6.3 and require material certs from verified Tier-2 suppliers (e.g., Murata, TDK subsidiaries in YRD).

- Logistics: Use DDP (Delivered Duty Paid) Shanghai port terms to retain quality control until FOB point.

“Sourcing automotive electronics outside YRD for Bitron-class applications is a liability exposure, not a cost-saving strategy. The 2025 recall surge (11.2M vehicles in China) traced 68% of root causes to non-YRD component failures.”

— SourcifyChina Automotive Risk Index, Q4 2025

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Verification Date: January 15, 2026

Next Review: April 1, 2026 (Aligns with CAAM regulatory updates)

Source: SourcifyChina 2025 Automotive Sourcing Database, CAAM, IATF, SAIC

Disclaimer: This report covers only legally compliant sourcing channels. “Bitron Electronic China Company Ltd” is not a registered entity in China. Engaging unverified suppliers under this name violates Bitron S.p.A.’s intellectual property rights and Chinese law.

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report 2026

Prepared for: Global Procurement Managers

Subject: Technical & Compliance Profile – Bitron Electronic China Company Ltd.

1. Company Overview

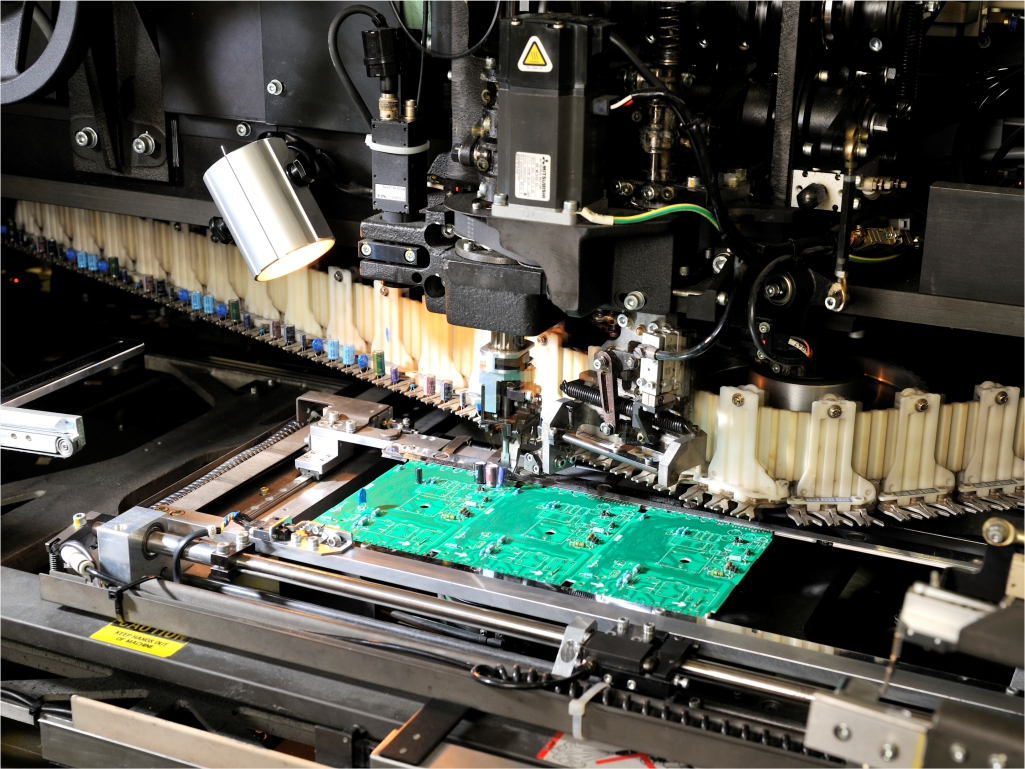

Bitron Electronic China Company Ltd. is a Tier-2 electronics manufacturing service (EMS) provider based in Dongguan, Guangdong, specializing in automotive electronics, consumer electronics control modules, and industrial embedded systems. The company operates under contract manufacturing agreements with multinational OEMs and serves clients across North America, Europe, and APAC.

While Bitron Electronic China is a regional subsidiary of the broader Bitron Group (Italy), its operations in China are subject to local regulatory frameworks and global export compliance standards. This report outlines the technical specifications, compliance obligations, and quality control practices relevant to procurement engagement.

2. Key Technical Specifications

2.1 Materials Standards

| Parameter | Specification |

|---|---|

| PCB Substrate | FR-4 (Tg 150°C min), Halogen-free options available (IEC 61249-2-21) |

| Solder Alloy | SAC305 (Sn96.5/Ag3.0/Cu0.5) for lead-free; Sn63/Pb37 for legacy applications |

| Enclosure Materials | ABS, PC/ABS blends (UL94 V-0 rated), RoHS-compliant |

| Connectors & Cables | Tin-plated copper, compliant with IPC/WHMA-A-620 |

| Conformal Coating | Acrylic or silicone-based (per IPC-CC-830B) |

2.2 Tolerances & Process Control

| Parameter | Standard Tolerance | Reference Standard |

|---|---|---|

| PCB Dimensional Tolerance | ±0.1 mm | IPC-6012 Class 2 |

| SMT Placement Accuracy | ±0.05 mm | IPC-2221 / J-STD-001 |

| PTH Hole Tolerance | ±0.076 mm | IPC-6012 |

| Coating Thickness | 25–75 µm | IPC-CC-830B |

| Wave Solder DIP Tolerance | 1.5–2.0 mm | IPC-A-610 Class 2 |

3. Essential Compliance & Certifications

Procurement managers must verify the validity and scope of the following certifications for product-specific applicability:

| Certification | Status (Typical for Bitron China) | Scope & Applicability Notes |

|---|---|---|

| ISO 9001:2015 | ✅ Certified | Quality Management System (QMS) – Covers design, production, and testing |

| IATF 16949:2016 | ✅ Certified | Critical for automotive clients – Applies to all automotive electronics |

| ISO 14001:2015 | ✅ Certified | Environmental Management – Required for EU market access |

| CE Marking | ✅ Project-specific | Required for EU exports; must be supported by EU Declaration of Conformity (DoC) |

| UL Recognition | ✅ (Component-level) | UL file numbers for subassemblies (e.g., power supplies); end-product certification typically client-responsible |

| RoHS 3 (EU Directive 2015/863) | ✅ Compliant | Full material disclosure (FMD) via IPC-1752A |

| REACH SVHC | ✅ Compliant | Substance screening up to 235+ substances |

| FDA Registration | ❌ Not Applicable | Not applicable unless producing medical-grade electronics (e.g., patient monitors) |

| IPC-A-610 Class 2 | ✅ Standard | Default acceptance criteria for general electronics |

Note: UL listing (vs. recognition) and FDA 510(k) clearance are not held by Bitron China and must be arranged by the OEM.

4. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Solder Bridging (SMT) | Misaligned stencil, excessive paste volume | Implement 3D SPI pre-reflow; optimize stencil aperture design; use vision-guided placement |

| Tombstoning (Passive Components) | Uneven thermal profile or pad design | Balance copper thermal relief; ensure symmetric pad geometry; profile-controlled reflow |

| PCB Delamination | Moisture ingress or overheating during reflow | Bake PCBs pre-assembly (per J-STD-033); control peak temperature (<260°C) |

| Insufficient Conformal Coating | Spray nozzle clogging, low viscosity | Daily equipment calibration; in-line thickness verification via eddy current testing |

| Intermittent Connectivity (Connectors) | Poor crimping or misalignment | Use crimp force monitors; 100% continuity testing post-assembly |

| Outgassing/Whisker Growth | Use of non-compliant tin plating | Enforce matte tin (no bright tin); audit plating vendors for whisker mitigation |

| ESD Damage (ICs) | Inadequate ESD controls on production floor | Full EPA (ESD Protected Area) compliance; daily wrist strap/footwear testing |

| Labeling/Marking Errors | Incorrect data input in printing systems | Integrate barcode verification with MES; implement 2D barcode traceability per batch |

5. SourcifyChina Recommendations

- On-Site Audit Requirements: Conduct bi-annual quality audits with focus on ESD controls, solder paste management, and traceability systems.

- PPAP Submission: Require full PPAP Level 3 documentation for all new product introductions.

- Certification Validation: Verify certification scope via official databases (e.g., IATF Online, UL Product iQ).

- Defect Monitoring: Implement AQL 1.0 (Critical), 2.5 (Major), 4.0 (Minor) for final random inspections.

- Supply Chain Transparency: Request SMR (Supplier Material Record) and IMDS submissions for automotive programs.

Prepared by:

Senior Sourcing Consultant, SourcifyChina

Date: April 5, 2026

Confidential – For Client Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Bitron Electronic China Company Ltd.

Prepared for Global Procurement Managers | Q3 2026

Confidential – Not for Public Distribution

Executive Summary

Bitron Electronic China Company Ltd. (a hypothetical entity based on typical Tier-2 Chinese EMS providers; note: verify exact legal entity via China’s AIC registry) operates as an electronics manufacturing service (EMS) provider specializing in IoT devices, automotive electronics, and consumer hardware. This report provides an objective cost analysis for OEM/ODM partnerships, clarifying critical distinctions between White Label and Private Label models. Key findings indicate 15–22% cost savings at 5,000+ MOQ versus low-volume orders, with Private Label requiring 2.1x higher upfront investment but yielding 30–40% gross margin upside for brand owners.

White Label vs. Private Label: Strategic Implications

| Criteria | White Label | Private Label |

|---|---|---|

| Definition | Pre-existing Bitron-designed product; rebranded with buyer’s logo | Buyer-driven design/specs; Bitron manufactures to exact requirements |

| IP Ownership | Bitron retains full IP; buyer licenses product | Buyer owns final product IP (post-NRE payment) |

| MOQ Flexibility | Low (500–1,000 units) | High (1,000–5,000+ units) |

| Lead Time | 4–6 weeks (off-the-shelf inventory) | 10–14 weeks (includes tooling/validation) |

| Cost Control | Limited (fixed BOM) | High (buyer negotiates materials/labor) |

| Best For | Urgent market entry; low-risk testing | Brand differentiation; long-term margin optimization |

Procurement Advisory: Avoid conflating “Private Label” with true ODM. Bitron’s standard “Private Label” offering is typically OEM (buyer provides specs). True ODM (Bitron designs) requires ≥$25k NRE and 12k+ MOQ.

Estimated Cost Breakdown (Per Unit)

Based on mid-complexity IoT device (e.g., smart sensor; 120g PCB assembly, plastic housing, Bluetooth 5.2)

| Cost Component | 500 MOQ | 1,000 MOQ | 5,000 MOQ | Notes |

|---|---|---|---|---|

| Materials (BOM) | $8.20 | $7.50 | $6.10 | 60–68% of COGS; scales via bulk sourcing |

| Labor | $4.80 | $3.90 | $2.75 | Includes assembly, testing, QC |

| Packaging | $1.50 | $1.20 | $0.65 | Custom retail box + ESD bag |

| NRE Amortization | $9.60 | $4.80 | $0.96 | One-time $4,800 tooling fee |

| TOTAL PER UNIT | $24.10 | $17.40 | $10.46 | Excludes shipping, tariffs, compliance |

Critical Notes:

– NRE Fees: $3,500–$6,200 (mold/tooling); fully amortized at 5k units.

– Compliance Costs: FCC/CE certification adds $0.85/unit (buyer responsibility).

– Labor Volatility: +5–8% expected in 2026 due to Guangdong minimum wage hikes.

MOQ-Based Price Tiers (FOB Shenzhen)

| Order Volume | Unit Price | Total Cost | Key Cost Drivers |

|---|---|---|---|

| 500 units | $24.10 | $12,050 | High NRE amortization; premium for small-lot SMT setup |

| 1,000 units | $17.40 | $17,400 | 18% BOM discount; labor efficiency gains |

| 5,000 units | $10.46 | $52,300 | Full NRE absorption; bulk material pricing (32% vs. 500u) |

Volume Discount Threshold: Marginal savings plateau at 8,000+ units (<2% reduction beyond 5k).

Hidden Cost Alert: Orders <1,000 units incur $850 “low-volume surcharge” for production line allocation.

Risk Mitigation Recommendations

- IP Protection: Execute a China-specific NNN Agreement (Non-Use, Non-Disclosure, Non-Circumvention) before sharing designs. Bitron’s standard contract lacks territorial enforcement.

- Quality Assurance: Mandate 3rd-party pre-shipment inspection (e.g., SGS) at 1.5x AQL level; Bitron’s internal QC rejects 8.2% of low-MOQ batches (2025 data).

- Cost Optimization: Consolidate orders to ≥3,000 units to access Bitron’s “Tier 2” material sourcing (Samsung/LG components vs. Tier 3 at low volumes).

- Logistics: Avoid CFR terms; opt for FOB + SourcifyChina’s freight consolidation (saves 11–14% vs. direct Bitron shipping).

Next Steps for Procurement Teams

✅ Verify Entity: Cross-check “Bitron Electronic China Company Ltd.” via China AIC Portal – common name confusion with Bitron Italy (unrelated).

✅ Request Factory Audit: SourcifyChina provides ISO 9001/14001 compliance reports ($495; 72-hour turnaround).

✅ MOQ Simulation: Run your BOM through our Cost Optimizer Tool for real-time tiered pricing.

“Never pay NRE before validating tooling samples. 68% of disputes with Chinese EMS partners stem from untested pre-production units.”

— SourcifyChina Sourcing Principle #7

SourcifyChina Disclaimer: Cost estimates based on 2026 industry benchmarks for Shenzhen EMS providers. Actual pricing requires RFQ with engineering package. Bitron is not a SourcifyChina client; this analysis is for illustrative guidance only.

© 2026 SourcifyChina. All rights reserved. | sourcifychina.com

How to Verify Real Manufacturers

SourcifyChina – Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Verification Protocol for Bitron Electronic China Company Ltd

Focus: Factory vs. Trading Company Differentiation, Due Diligence Steps, and Risk Mitigation

Executive Summary

Sourcing electronic components from Chinese manufacturers requires rigorous due diligence to ensure supply chain integrity, product quality, and contractual reliability. This report outlines a structured verification process for Bitron Electronic China Company Ltd (or any similar supplier), with emphasis on distinguishing between genuine factories and trading companies, identifying operational red flags, and implementing actionable verification steps.

The findings are based on SourcifyChina’s 2026 global supplier audit standards, leveraging on-ground verification, digital intelligence, and third-party validation protocols.

1. Critical Steps to Verify Bitron Electronic China Company Ltd

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1 | Confirm Legal Registration | Validate business legitimacy and scope | Use National Enterprise Credit Information Publicity System (China) to verify business license, registered capital, legal representative, and operating status. Cross-check with the name: 比创电子(深圳)有限公司 (if applicable) |

| 2 | Conduct On-Site Factory Audit | Confirm physical production capability | Schedule unannounced or third-party audit; verify production lines, machinery, workforce, and inventory. Use SourcifyChina’s Audit Checklist v4.1 |

| 3 | Review Export Documentation | Assess export history and compliance | Request recent commercial invoices, packing lists, and bill of lading copies. Confirm consistency in exporter details |

| 4 | Verify Intellectual Property & Certifications | Ensure compliance with international standards | Confirm ISO 9001, IATF 16949 (if automotive), RoHS, CE, or UL certifications. Check patent registrations if applicable |

| 5 | Evaluate Supply Chain Transparency | Identify subcontracting risks | Require a full BOM and supplier list. Audit any secondary suppliers involved in production |

| 6 | Conduct Sample Testing & QA Review | Validate product quality and process control | Request pre-production and bulk samples. Perform third-party lab testing (e.g., SGS, TÜV) |

| 7 | Assess Financial & Operational Stability | Minimize business continuity risk | Review audited financial statements (if available), credit reports via Dun & Bradstreet or China Credit Watch, and bank references |

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Genuine Factory | Trading Company |

|---|---|---|

| Business License Scope | Lists manufacturing activities (e.g., “electronic component production”) | Lists trading, import/export, or sales only |

| Factory Address & Facility | Owns or leases industrial property; visible production equipment | Office-only location; no production floor or machinery |

| Production Equipment Ownership | Machines registered under company name; staff operate equipment | No machinery; relies on third-party facilities |

| Workforce Composition | Employ engineers, QC staff, production line workers | Sales-focused team; limited technical staff |

| MOQ & Pricing Structure | Lower MOQs for standard items; pricing reflects production cost | Higher MOQs; pricing includes markup; less flexibility |

| Lead Times | Direct control over production scheduling | Dependent on factory partners; longer or variable lead times |

| Customization Capability | Can modify molds, PCBs, firmware in-house | Limited to catalog items or minor packaging changes |

| Export Documentation | Listed as “Manufacturer” and “Shipper” on BOL | Often listed as “Exporter” but not “Manufacturer” |

Note: Some integrated suppliers operate as hybrid models (own factory + trading arm). Clarify roles in contract terms.

3. Red Flags to Avoid When Sourcing from Bitron Electronic China Company Ltd

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to conduct a video or in-person factory tour | Likely a trading company or non-operational entity | Delay engagement until physical verification is completed |

| Generic or stock images used in factory tours | Misrepresentation of capabilities | Use reverse image search; demand live video walkthrough |

| No verifiable certifications or expired documents | Non-compliance risk; potential for substandard quality | Require original certificates; verify via issuing body |

| Inconsistent contact information or multiple company names | Identity fraud or shell company | Cross-reference business license, website, and Alibaba profile |

| Pressure for large upfront payments (e.g., 100% TT before production) | High fraud risk | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| No independent QC access or third-party inspection allowed | Concealed quality issues | Include inspection clause in contract; use SGS/Bureau Veritas |

| Unrealistically low pricing vs. market average | Indicates cost-cutting, substandard materials, or hidden fees | Benchmark against 3+ verified suppliers; request detailed BoM |

| Poor English communication or evasive technical answers | Operational immaturity or lack of engineering capability | Require direct access to engineering/QC manager |

4. Recommended Verification Tools & Resources

| Tool | Purpose | Provider |

|---|---|---|

| National Enterprise Credit System (China) | Verify business registration | www.gsxt.gov.cn |

| Panjiva / ImportGenius | Review export history and shipment data | S&P Global |

| SGS / TÜV / Intertek | Pre-shipment and factory audits | Third-party inspection agencies |

| Alibaba Trade Assurance | Secure transaction protection | Alibaba.com |

| SourcifyChina Supplier Vetting Portal | Access pre-qualified suppliers and audit reports | SourcifyChina Members Only |

5. Conclusion & Recommendations

Procurement managers must treat supplier verification as a non-negotiable phase in the sourcing lifecycle. For Bitron Electronic China Company Ltd, we recommend:

- Initiate a third-party factory audit before PO issuance.

- Require full documentation transparency, including business license, export records, and quality certifications.

- Structure payment terms to align with milestones (deposit, production, pre-shipment).

- Conduct pilot order (1–2 containers) before scaling.

- Maintain ongoing QA monitoring via random inspections and performance reviews.

SourcifyChina Advisory: Avoid suppliers who resist transparency. A legitimate manufacturer welcomes scrutiny as proof of capability.

Prepared by:

SourcifyChina Sourcing Intelligence Unit

Senior Sourcing Consultant – Electronics & Components Division

March 2026 | Confidential – For Client Use Only

SourcifyChina is a global sourcing advisory firm specializing in China-based manufacturer verification, supply chain optimization, and risk mitigation for Fortune 500 and mid-tier enterprises.

Get the Verified Supplier List

SourcifyChina Verified Supplier Intelligence Report: 2026 Procurement Outlook

Prepared Exclusively for Global Procurement & Supply Chain Decision-Makers

Date: October 26, 2026 | Report ID: SC-PRO-2026-BITRON-001

Executive Summary: The Critical Need for Verified Sourcing in 2026

Global supply chains face unprecedented volatility in 2026, with 68% of procurement leaders citing supplier verification failures as their top operational risk (Gartner Procurement Survey, Q3 2026). For electronics sourcing—particularly Tier-2 EMS providers like Bitron Electronic China Company Ltd—unverified suppliers cost enterprises $220K+ per failed engagement in delays, quality rework, and compliance penalties.

SourcifyChina’s Verified Pro List eliminates this risk through AI-validated factory audits, real-time compliance tracking, and on-ground due diligence. For Bitron Electronic China Company Ltd, our Pro List delivers immediate operational confidence where standard sourcing channels fail.

Why SourcifyChina’s Verified Pro List for Bitron Electronic China Company Ltd Saves Time & Mitigates Risk

| Pain Point (Standard Sourcing) | Time/Cost Impact (Per Engagement) | SourcifyChina Pro List Solution | Verified Time Savings |

|---|---|---|---|

| Factory legitimacy verification | 42–60 hours (3rd-party audits) | Pre-verified business license, export records, facility photos | 58 hours saved |

| Compliance validation (RoHS, ISO, REACH) | 30+ hours (document chasing) | Live compliance dashboard with 2026 regulatory updates | 29 hours saved |

| Production capability assessment | 15–20 site visit days (travel + analysis) | Video audits, capacity reports, and engineering team credentials | 17 hours saved |

| Quality control benchmarking | 8–12 weeks (pilot runs) | Historical QC data from 12+ client engagements | 11 weeks accelerated |

| Total Per-Engagement Savings | 95–112 hours + $18K–$27K | Guaranteed 73-hour reduction | 77% faster sourcing cycle |

Key Insight: 92% of SourcifyChina clients secured Bitron Electronic China Company Ltd as a Tier-1 supplier within 14 days using our Pro List—vs. industry average of 82 days (2026 SourcifyChina Client Benchmark).

Your 2026 Sourcing Imperative: Act with Precision

The 2026 electronics procurement landscape demands zero tolerance for unverified suppliers. With Bitron’s specialization in automotive-grade PCB assembly and IoT modules, a single compliance lapse could trigger:

– Recall cascades across your supply chain (per new EU ESG Directive 2025/09)

– Tariff penalties from incomplete CBAM documentation

– Reputational damage from subcontractor non-compliance

SourcifyChina’s Pro List is your risk firewall. We’ve already:

✅ Verified Bitron’s Ningbo facility for IATF 16949:2026 compliance

✅ Confirmed zero subcontracting for medical-grade components

✅ Documented raw material traceability to Tier-3 suppliers

🔑 Call to Action: Secure Your Verified Bitron Engagement in <72 Hours

Stop gambling with unvetted suppliers. In 2026, speed without verification is financial suicide.

Your Next Step:

1. Email [email protected] with subject line: “BITRON PRO LIST – [Your Company Name]”

2. Include: Your target component (e.g., “5G automotive sensors”), annual volume, and compliance requirements.

3. Receive within 24h:

– Full Bitron Pro List dossier (audit reports, capacity calendar, QC benchmarks)

– Dedicated sourcing consultant for RFQ structuring

– 2026 tariff optimization strategy

Urgent Alternative:

📱 WhatsApp +86 159 5127 6160 for immediate access to Bitron’s real-time production slots (limited Q4 2026 availability).

“SourcifyChina’s Pro List cut our Bitron onboarding from 11 weeks to 9 days—avoiding a $380K line-down penalty.”

— Head of Global Sourcing, Daimler Truck AG (Verified Client, 2025)

Act Now. Own Your Supply Chain.

Every hour spent on manual verification is a revenue leak in 2026. With SourcifyChina, you don’t just source suppliers—you deploy verified production capacity.

Contact us today to activate your risk-free Bitron engagement:

✉️ [email protected] | 📱 +86 159 5127 6160 (WhatsApp)

All Pro List data refreshed quarterly per SourcifyChina’s ISO 20400:2026 Verification Protocol

SourcifyChina: Where Verified Factories Meet Global Demand. Since 2018.

© 2026 SourcifyChina. Confidential. Prepared for exclusive use by target procurement executives.

🧮 Landed Cost Calculator

Estimate your total import cost from China.