The global biomass fuel pellets market is experiencing robust growth, driven by increasing demand for renewable energy and supportive government policies aimed at reducing carbon emissions. According to Grand View Research, the market was valued at USD 10.3 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 6.8% from 2023 to 2030. This growth is fueled by rising energy security concerns, advancements in pellet production technologies, and expanding applications in residential, industrial, and power generation sectors. As the world shifts toward sustainable energy solutions, biomass pellets have emerged as a reliable, low-carbon alternative to fossil fuels. Against this backdrop, a select group of manufacturers are leading innovation, scaling production, and shaping the future of the bioenergy industry. Here are the top 9 biomass fuel pellets manufacturers contributing significantly to this dynamic and expanding market.

Top 9 Biomass Fuel Pellets Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Yulong-Gattuwala

Website: yulonggattuwala.com

Key Highlights: We specialize in offering customized biomass pellet machines that cater to various needs, whether for small-scale production or large industrial applications….

#2 Providing Stable Supplies of Biomass Fuel for a Low

Domain Est. 1995

Website: sumitomocorp.com

Key Highlights: Raizen Biomassa develops pellet fuel made from sugarcane residue. It is a subsidiary of Brazilian firm Raizen, one of the world’s largest sugar manufacturer….

#3 Pellet Fuels Institute

Domain Est. 1998

Website: pelletheat.org

Key Highlights: The Pellet Fuels Institute (PFI) is a trade association representing the manufacturers of wood pellets in the United States and the companies and organizations ……

#4 Bioenergy – heat and power production based on biomass

Domain Est. 2004

Website: orsted.com

Key Highlights: Bioenergy uses only sustainably sourced wood chips, pellets, and straw for fuel, providing an eco-friendly and deeply sustainable alternative to coal….

#5 CM Biomass

Domain Est. 2009

Website: cmbiomass.com

Key Highlights: Wood pellets are part of sustainable forestry – a closed green loop. At CM Biomass, we produce wood pellets using residues from the wood industry, like sawdust ……

#6 Enviva Biomass

Domain Est. 2010

Website: envivabiomass.com

Key Highlights: Enviva — a leading provider of wood pellets. We serve customers around the globe who are seeking to reduce their reliance on fossil fuels. About Enviva ……

#7 Biomass

Domain Est. 2013

Website: onecpm.com

Key Highlights: With our advanced biomass processing equipment, CPM empowers our customers to efficiently convert a wide range of organic materials into sustainable energy ……

#8 Biomass / Wood Pellets

Domain Est. 2022

Website: patel-energy.com

Key Highlights: At Patel Energy, we make our pellets from sustainable biomass generated from the harvest and manufacturing of other wood products….

#9 Biomass Fuels, LLC

Domain Est. 2024

Expert Sourcing Insights for Biomass Fuel Pellets

H2: Projected 2026 Market Trends for Biomass Fuel Pellets

The global biomass fuel pellets market is poised for significant transformation by 2026, driven by increasing energy demand, decarbonization goals, and supportive regulatory frameworks. As nations intensify their commitments to renewable energy under international climate agreements such as the Paris Accord, biomass fuel pellets are expected to play a pivotal role in the transition from fossil fuels to sustainable energy sources.

One of the dominant trends shaping the 2026 outlook is the growing adoption of biomass pellets in power generation and residential heating, particularly in Europe, North America, and parts of Asia-Pacific. The European Union remains a leading consumer due to stringent renewable energy directives and carbon pricing mechanisms, including the EU Emissions Trading System (ETS). Countries like the UK, Germany, and Denmark continue to co-fire biomass pellets in coal power plants, a strategy expected to expand as coal phase-out timelines accelerate.

Another key trend is the expansion of production capacity in North America—especially in the southeastern United States and Canada—where abundant forest residues and supportive logistics infrastructure enable cost-effective pellet manufacturing. These regions are anticipated to remain primary exporters to European and Asian markets, with trade volumes likely to increase by 2026 due to rising import demand.

Technological advancements are also influencing the market, with innovations in pellet densification, moisture control, and feedstock diversification (e.g., agricultural residues, energy crops) improving efficiency and reducing environmental impact. Additionally, the development of torrefied pellets—offering higher energy density and better hydrophobic properties—is gaining traction among industrial users, potentially capturing a larger share of the premium biomass market by 2026.

Sustainability certification is becoming increasingly critical, as both consumers and regulators demand transparency in sourcing and carbon accounting. Programs such as the Sustainable Biomass Program (SBP) and ENplus are expected to see broader adoption, shaping supply chain practices and influencing market access.

However, the market faces challenges, including competition from other renewable sources like solar and wind, supply chain vulnerabilities, and concerns over indirect land-use change and deforestation. Regulatory scrutiny in key markets may tighten sustainability criteria, potentially impacting feedstock availability and production costs.

In summary, the 2026 biomass fuel pellets market is projected to grow steadily, with compound annual growth rates (CAGR) estimated between 6% and 8%, depending on regional dynamics. Growth will be underpinned by policy support, energy security concerns, and the need for dispatchable renewable energy, positioning biomass pellets as a strategic component of the global low-carbon energy mix.

Common Pitfalls When Sourcing Biomass Fuel Pellets (Quality & Intellectual Property)

Sourcing biomass fuel pellets involves navigating complex supply chains where quality inconsistencies and intellectual property (IP) concerns can significantly impact performance, cost-efficiency, and legal compliance. Being aware of these pitfalls is crucial for buyers, especially in industrial or energy-generation applications.

Quality-Related Pitfalls

Inconsistent Pellet Specifications

One of the most frequent issues is receiving pellets that do not consistently meet agreed-upon specifications. Variations in moisture content, ash content, calorific value, and durability (measured by PDI – Pellet Durability Index) can lead to inefficient combustion, increased maintenance, and equipment damage. Suppliers may batch products from different feedstocks or production runs without adequate quality control, resulting in fluctuating performance.

Poor Feedstock Traceability

The quality of biomass pellets heavily depends on the source material—whether it’s softwood, hardwood, agricultural residues, or energy crops. Lack of transparency in the supply chain can result in contamination with undesirable materials (e.g., bark, soil, or treated wood), increasing ash and emissions. Without proper traceability, verifying sustainability certifications (like ENplus or ISO 17225) becomes difficult.

Inadequate Testing and Certification

Relying solely on supplier-provided certificates without independent third-party verification is risky. Some suppliers may falsify test results or use outdated certifications. Buyers should require recent, accredited laboratory reports for each shipment and conduct periodic spot checks to ensure compliance with specifications.

Storage and Handling Degradation

Even high-quality pellets can degrade if improperly stored. Exposure to moisture during transport or storage leads to swelling, mold growth, and reduced energy content. Buyers often overlook the need for dry, ventilated storage and may accept deliveries that have been compromised during transit, especially in humid climates.

Intellectual Property (IP) Pitfalls

Unlicensed Use of Proprietary Pellet Formulations

Some advanced biomass pellets involve proprietary blends or additives (e.g., binders, combustion enhancers) protected by patents or trade secrets. Sourcing pellets from unauthorized manufacturers or reverse-engineering formulations without permission can lead to IP infringement claims. This is particularly relevant when sourcing from regions with weak IP enforcement.

Misuse of Certification Trademarks

Certification schemes like ENplus have strict usage guidelines. Suppliers may falsely claim certification or use certification logos without authorization. Buyers who rely on these claims for marketing or regulatory compliance may face reputational or legal consequences if the pellets are later found to be non-compliant.

Lack of IP Due Diligence in Supplier Contracts

Many procurement agreements fail to address IP ownership, especially when custom formulations or co-developed products are involved. Without clear contractual terms, disputes can arise over who owns improvements, formulations, or process innovations developed during the supply relationship.

Sourcing from IP-Infringing Manufacturers

In some cases, low-cost suppliers may be producing pellets that infringe on patented technologies (e.g., specific pelletizing processes or emission-reduction methods). Buyers importing such products could be held liable for contributory infringement, particularly in jurisdictions with strong IP laws.

Mitigation Strategies

- Demand detailed, verifiable quality documentation for every shipment, including third-party lab results.

- Conduct supplier audits to assess production practices, feedstock sourcing, and quality control systems.

- Include IP clauses in contracts specifying compliance with IP laws, certification authenticity, and indemnification for IP violations.

- Use trusted certification bodies and verify certification status independently.

- Implement proper storage protocols to preserve pellet integrity post-delivery.

By proactively addressing these quality and IP pitfalls, buyers can ensure reliable fuel supply, avoid operational disruptions, and minimize legal and financial risks.

Logistics & Compliance Guide for Biomass Fuel Pellets

Overview of Biomass Fuel Pellets

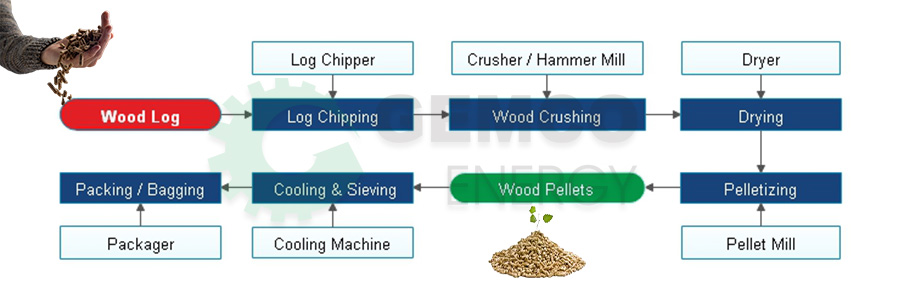

Biomass fuel pellets are a renewable energy source made from compressed organic materials such as wood residues, agricultural byproducts, and energy crops. Due to their high energy density, low moisture content, and standardized size, biomass pellets are increasingly used in residential, commercial, and industrial heating and power generation. Proper logistics and compliance are critical to ensuring safe, efficient delivery and adherence to international, national, and local regulations.

International and National Regulatory Compliance

Environmental and Sustainability Standards

Biomass fuel pellets must meet stringent environmental and sustainability criteria, especially when exported to regions like the European Union or North America. Key compliance frameworks include:

- ENplus Certification (Europe): The leading quality certification for wood pellets based on the EN 14961-2 standard. It ensures consistent quality in terms of calorific value, moisture content, ash content, and durability.

- Pellet Fuels Institute (PFI) Standards (USA/Canada): The PFI U.S. Industrial and Residential Pellet Fuel Standards classify pellets into premium, standard, and utility grades based on defined parameters.

- Sustainability Certification (e.g., SBP, FSC, PEFC): For biomass derived from forest sources, chain-of-custody certifications such as the Sustainable Biomass Program (SBP), Forest Stewardship Council (FSC), or Programme for the Endorsement of Forest Certification (PEFC) may be required to demonstrate sustainable sourcing.

Import/Export Regulations

Exporters and importers must comply with customs and biosecurity regulations:

- Phytosanitary Certificates: Required by many countries to prevent the spread of pests and diseases through wood-based products.

- Customs Documentation: Includes commercial invoices, packing lists, bills of lading, and certificates of origin. Harmonized System (HS) Code 4401.31 typically applies to wood pellets.

- REACH and CLP (EU): Registration, Evaluation, Authorization, and Restriction of Chemicals (REACH) and Classification, Labeling, and Packaging (CLP) regulations may apply if chemical binders or additives are used in pellet production.

Transportation and Logistics

Packaging and Handling

Biomass pellets are sensitive to moisture and mechanical degradation. Proper packaging and handling are essential:

- Bulk Transport: Commonly used for large-scale shipments via rail or ship. Pellets are loaded into silos or covered hoppers to prevent moisture absorption and dust generation.

- Bagged Pellets: Typically packed in polypropylene or multi-wall paper bags (15–25 kg) for retail or small commercial use. Bags must be palletized and stretch-wrapped for stability.

- Big Bags (FIBCs): Used for intermediate bulk handling (500–1000 kg), ideal for semi-automated loading/unloading.

Storage Requirements

- Dry, Ventilated Facilities: Pellets must be stored in dry, covered areas with good airflow to prevent moisture uptake, which can lead to mold, degradation, and reduced energy efficiency.

- Avoid Ground Contact: Use pallets or raised platforms to prevent water absorption from floors.

- Fire Safety: While low-risk, biomass pellets can self-heat under certain conditions (e.g., high moisture, poor ventilation). Follow NFPA 61 or local fire codes for bulk storage.

Modes of Transportation

- Maritime Shipping: Most common for international trade. Use covered cargo holds or containers with desiccants to control humidity. Containerized shipping may use 20’ or 40’ dry or bulk containers.

- Rail Transport: Efficient for long-distance domestic transport, especially in North America and Europe. Covered hopper cars prevent weather exposure.

- Road Transport: Ideal for regional distribution. Use tarps or enclosed trailers to protect bagged or bulk loads from rain and dust.

- Intermodal Solutions: Combine rail, road, and sea for cost-effective long-haul logistics.

Quality Control and Testing

Regular quality testing ensures compliance and customer satisfaction:

- Key Parameters to Test:

- Moisture content (<10% typical)

- Ash content (<0.7% for premium grade)

- Calorific value (typically 16–19 MJ/kg)

- Bulk density (≥650 kg/m³)

- Durability (≥97.5%)

-

Chlorine and heavy metal content (especially for emissions compliance)

-

Testing Frequency: Sample batches at production, before shipment, and upon receipt. Use accredited laboratories where required.

Health, Safety, and Environmental Considerations

Dust and Explosion Hazards

- Biomass pellet dust is combustible. Follow ATEX (EU) or NFPA 652 (US) standards for dust control in processing and handling areas.

- Install dust collection systems, explosion vents, and fire suppression systems in storage and transfer points.

- Provide PPE (respirators, safety goggles) for workers handling bulk pellets.

Emissions Compliance

- End-use combustion must comply with local air quality regulations (e.g., EPA standards in the U.S., Emission Limit Values under EU’s Medium Combustion Plant Directive).

- Ensure pellet quality supports low-emission burning to meet environmental targets.

Documentation and Traceability

Maintain complete records throughout the supply chain:

- Batch production logs

- Test reports (quality and emissions)

- Sustainability certification documentation

- Shipping and customs paperwork

- Certificates of Analysis (CoA) and Conformity (CoC)

Digital tracking systems (e.g., blockchain or ERP platforms) improve transparency and audit readiness.

Conclusion

Effective logistics and compliance for biomass fuel pellets require coordination across production, transportation, regulatory, and environmental domains. Adherence to international standards, proper handling practices, and robust documentation ensure market access, product quality, and sustainability. As demand for renewable energy grows, a proactive approach to compliance and logistics will enhance competitiveness and long-term viability in the biomass sector.

In conclusion, sourcing biomass fuel pellets presents a sustainable and viable alternative to traditional fossil fuels, offering environmental, economic, and energy security benefits. With increasing global emphasis on renewable energy and carbon reduction, biomass pellets derived from organic waste, forestry residues, and energy crops provide a promising solution for clean, reliable heat and power generation. Successful sourcing depends on ensuring a consistent supply chain, verifying sustainability certifications, evaluating cost-efficiency, and prioritizing feedstock quality. By partnering with reputable suppliers and adhering to international standards such as ENplus or Pellet Fuels Institute (PFI) guidelines, organizations can ensure high-performance pellets that meet emission and efficiency requirements. Ultimately, strategic sourcing of biomass fuel pellets supports the transition to a low-carbon economy while promoting energy independence and rural development.