The global biodegradable adhesives market is experiencing robust growth, driven by escalating environmental concerns, stringent regulations on volatile organic compounds (VOCs), and rising demand for sustainable materials across packaging, woodworking, and consumer goods industries. According to Grand View Research, the global biodegradable adhesives market size was valued at USD 5.3 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 7.8% from 2023 to 2030. Similarly, Mordor Intelligence reports a CAGR of approximately 7.2% during the forecast period of 2024–2029, underscoring the increasing adoption of eco-friendly adhesives in both developed and emerging economies. This surge in demand has catalyzed innovation and expansion among manufacturers committed to sustainability. As the industry evolves, a select group of nine biodegradable glue manufacturers are leading the charge—leveraging renewable raw materials, low-impact production processes, and certified compostability to meet the needs of environmentally conscious consumers and businesses alike.

Top 9 Biodegradable Glue Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Power Adhesives

Domain Est. 2002

Website: poweradhesives.com

Key Highlights: With options formulated using bio-based materials, all Tecbond biodegradable adhesives break down after use with no harmful effects to nature….

#2 World Brand Adhesive Manufacturer

Domain Est. 2011

Website: worldbrandadhesive.com

Key Highlights: Eco-Friendly. Green label certification for formaldehyde free, low toxicity and low emissions. Earn BCA Green Mark points with our adhesives….

#3 Eco-Friendly Food Safe Glues

Domain Est. 2015

Website: usodake.com

Key Highlights: Plant-based, biodegradable, and compostable. Ideal for green manufacturers and hobbyists. ODAKE Food Safe Glue. Certified Safety: FDA, ROHS, ……

#4 SynLok Technologies

Domain Est. 2018

Website: synlok.com

Key Highlights: SynLok Technologies, LLC., is an eco-friendly manufacturer of non-hazardous polyurethane adhesives used for the installation and repair of synthetic turf ……

#5 Sustainable adhesive technology for foam & packaging

Website: simalfa.ch

Key Highlights: Our environmentally friendly, water-based adhesive technology offers maximum efficiency and quality. Find out more now!…

#6 Eco

Domain Est. 1997

Website: lddavis.com

Key Highlights: Discover LD Davis’ range of high-performing, non-toxic, and plastic-free glue solutions, including liquid and gelatin-based adhesives….

#7 Biodegradable Hot Melt Adhesive for Manual Packaging Applications

Domain Est. 1999

Website: hotmelt.com

Key Highlights: These biodegradable hot glue pellets are a more sustainable bulk hot melt solution compared to standard hot melt products….

#8 Innovative Eco Friendly, Biodegradable Adhesives

Domain Est. 2004

Website: bcadhesives.com

Key Highlights: Dive into the world of eco friendly adhesives! From biodegradable to renewable resources, explore these options in your manufacturing….

#9 Environmentally friendly pressure sensitive adhesives with …

Domain Est. 2022

Website: artiencegroup.com

Key Highlights: This is an environmentally friendly pressure sensitive adhesives that biodegrades in a compost environment. There are two lineups: a 2-component strong ……

Expert Sourcing Insights for Biodegradable Glue

H2: 2026 Market Trends for Biodegradable Glue

The global biodegradable glue market is poised for significant transformation by 2026, driven by increasing environmental awareness, stringent regulatory frameworks, and advancements in bio-based materials. Key trends shaping the industry include:

-

Regulatory Pressure and Sustainability Mandates

Governments worldwide are implementing stricter regulations on plastic waste and non-biodegradable materials. The European Union’s Single-Use Plastics Directive and similar policies in North America and Asia-Pacific are pushing manufacturers to adopt eco-friendly adhesives. By 2026, compliance with environmental standards will be a primary driver for adoption of biodegradable glue in packaging, textiles, and woodworking industries. -

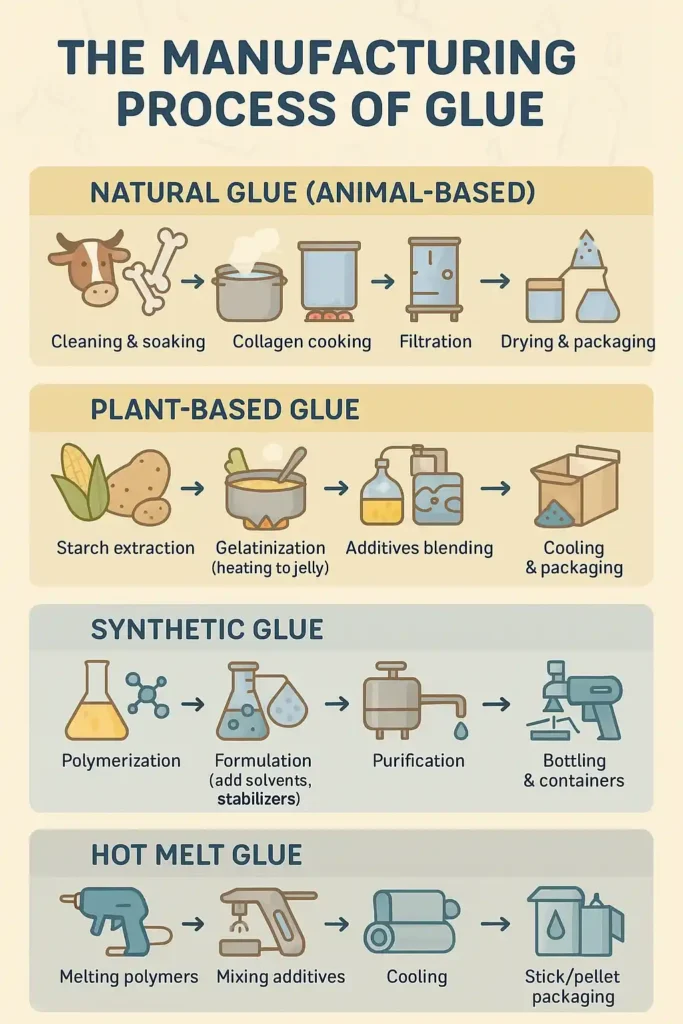

Growth in Packaging and Consumer Goods

The packaging sector remains the largest consumer of biodegradable adhesives, particularly in food and beverage, pharmaceuticals, and e-commerce. Rising demand for compostable and recyclable packaging solutions will accelerate innovation in starch-based, protein-based, and polylactic acid (PLA)-derived glues. Companies are investing in adhesives that maintain performance while ensuring end-of-life biodegradability. -

Technological Advancements in Bio-Based Formulations

Research and development are yielding improved performance characteristics—such as enhanced water resistance, heat stability, and bonding strength—in biodegradable adhesives. Innovations using lignin, cellulose derivatives, and microbial polymers are expected to expand application scope into automotive, electronics, and construction sectors by 2026. -

Corporate Sustainability Goals

Major consumer brands are committing to circular economy models and net-zero emissions. As part of these initiatives, companies like IKEA, Unilever, and Amazon are increasingly specifying biodegradable adhesives in their supply chains. This corporate demand is creating a ripple effect across adhesive manufacturers to scale sustainable production. -

Regional Market Expansion

While North America and Europe lead in adoption due to mature regulatory environments, the Asia-Pacific region is projected to witness the highest growth rate by 2026. Rapid industrialization in countries like India and Vietnam, coupled with rising environmental consciousness, will fuel demand for green adhesives. -

Cost Competitiveness and Scalability Challenges

Despite progress, biodegradable glues often remain more expensive than conventional petroleum-based alternatives. However, economies of scale, improved feedstock sourcing (e.g., agricultural waste), and government subsidies are expected to narrow the cost gap by 2026, making biodegradable options more accessible. -

Consumer Preference Shifts

End-user awareness of environmental impact is influencing purchasing decisions. Products labeled as “eco-friendly” or “compostable” are gaining preference, incentivizing manufacturers to reformulate with biodegradable adhesives to meet market demand.

In summary, the 2026 biodegradable glue market will be characterized by regulatory enforcement, technological innovation, and expanding applications across industries. As sustainability becomes a core business imperative, biodegradable adhesives are set to transition from niche solutions to mainstream alternatives in the global adhesive landscape.

Common Pitfalls in Sourcing Biodegradable Glue (Quality and Intellectual Property)

Sourcing biodegradable glue presents unique challenges that go beyond traditional adhesive procurement. Overlooking critical quality and intellectual property (IP) aspects can lead to product failure, regulatory non-compliance, reputational damage, and legal exposure. Below are key pitfalls to avoid:

1. Overestimating Biodegradability Claims Without Verification

Suppliers may market adhesives as “biodegradable” based on vague or misleading claims. A common pitfall is accepting these claims at face value without demanding certified, standardized test results (e.g., ISO 14855, ASTM D6400, or EN 13432). Biodegradation depends on specific environmental conditions (e.g., industrial composting vs. soil or marine environments), and many biodegradable glues only break down under controlled, high-temperature facilities—not in natural settings. Failing to validate test reports and understand the required degradation environment risks greenwashing accusations and non-compliance with environmental regulations.

2. Inadequate Performance Testing Under Real-World Conditions

Biodegradable glues may compromise on mechanical strength, moisture resistance, or shelf life compared to conventional adhesives. A major sourcing error is not conducting application-specific performance testing. For example, a glue that performs well in dry, indoor conditions may fail in high-humidity or load-bearing applications. Relying solely on supplier datasheets without in-house or third-party validation can lead to product failures, increased returns, and safety risks.

3. Lack of Supply Chain Transparency and Raw Material Traceability

The sustainability and quality of biodegradable glue depend heavily on the origin and processing of bio-based feedstocks (e.g., corn starch, soy, or lignin). Sourcing without requiring full supply chain transparency increases the risk of contamination, inconsistent quality, or unintended use of genetically modified organisms (GMOs) or non-sustainable raw materials. Without traceability, companies cannot ensure ethical sourcing or defend against consumer or regulatory scrutiny.

4. Overlooking Intellectual Property (IP) Risks and Infringement

Biodegradable adhesive formulations are often protected by patents covering composition, synthesis methods, or application-specific uses. Sourcing without conducting an IP landscape analysis or freedom-to-operate (FTO) search can result in unintentional infringement. Using a glue formulation covered by a competitor’s active patent may lead to costly litigation, supply disruptions, or forced reformulation. Additionally, failing to secure appropriate licensing rights—especially for proprietary technologies—can expose the buyer to legal liability.

5. Assuming Compliance Equals Certification

While certifications like OK Compost or USDA BioPreferred add credibility, they do not guarantee suitability for all applications or regions. A pitfall is assuming certified products automatically meet all regulatory or performance needs. Certifications may cover only specific aspects (e.g., compostability but not toxicity of degradation byproducts). Buyers must verify that certifications align with their target markets’ regulatory frameworks (e.g., EU REACH, US EPA) and end-of-life infrastructure.

6. Ignoring Long-Term Stability and Shelf-Life Issues

Some biodegradable formulations are prone to microbial degradation during storage, leading to shorter shelf life or performance degradation over time. Sourcing without testing stability under expected storage conditions (temperature, humidity) can result in batch spoilage, inconsistent application, or customer dissatisfaction. This is especially critical for global supply chains with extended transit times.

By proactively addressing these quality and IP-related pitfalls—through rigorous due diligence, third-party verification, IP screening, and real-world testing—organizations can source biodegradable glues that are both effective and compliant, supporting genuine sustainability goals without unintended consequences.

H2: Logistics & Compliance Guide for Biodegradable Glue

Ensuring the safe, efficient, and legally compliant handling, transport, storage, and disposal of biodegradable glue is critical for environmental responsibility, operational safety, and regulatory adherence. This guide outlines key considerations across the logistics and compliance lifecycle.

H2: Regulatory Classification & Documentation

- Determine Hazard Classification: Despite being biodegradable, the glue may still be classified under GHS (Globally Harmonized System) or transport regulations (e.g., UN TDG, ADR/RID, IMDG, IATA) based on its specific formulation (flammability, skin/eye irritation, aquatic toxicity). Always consult the Safety Data Sheet (SDS) – Section 2 (Hazard Identification) and Section 14 (Transport Information).

- Obtain Accurate SDS: Ensure you have the most current, supplier-provided SDS compliant with local regulations (e.g., OSHA HazCom 2012 in the US, CLP in EU). The SDS is the primary source for hazard identification, handling, storage, and emergency measures.

- Transport Documentation: For regulated shipments (even if non-hazardous), prepare necessary documents:

- Commercial Invoice/Packing List: Clearly state product name (“Biodegradable Adhesive”), quantity, weight, HS code (Harmonized System code – crucial for customs, e.g., 3506.91 for other adhesives in many regions).

- Bill of Lading/Air Waybill: Accurate description based on classification.

- Hazardous Materials Documentation (if applicable): Shipper’s Declaration for Dangerous Goods (IATA/IMDG), proper shipping name, UN number, hazard class, packing group, and emergency contact information.

- Labeling & Marking: Containers must be correctly labeled according to regulations:

- GHS Labels: On primary and secondary packaging if the substance is classified as hazardous (pictograms, signal word, hazard statements, precautionary statements).

- Transport Labels: Hazard labels (e.g., Flammable Liquid, Health Hazard) for regulated shipments.

- Biodegradability Claims: Ensure any “biodegradable” or “eco-friendly” labels are substantiated by recognized standards (e.g., ASTM D6400, EN 13432, ISO 14855) to avoid greenwashing and potential regulatory penalties (e.g., FTC Green Guides in the US).

H2: Handling, Storage & Inventory Management

- Safe Handling Procedures:

- PPE: Mandate appropriate PPE based on SDS (e.g., nitrile gloves, safety glasses, lab coat, potentially respirator for powders or concentrated forms).

- Ventilation: Ensure adequate ventilation (local exhaust or general) in handling and mixing areas, especially if volatile components are present.

- Containment: Handle over spill trays. Prevent skin/eye contact and inhalation of dust/mist. Avoid ingestion.

- Hygiene: Provide accessible handwashing facilities. Prohibit eating, drinking, or smoking in handling areas.

- Storage Requirements:

- Environment: Store in a cool, dry, well-ventilated area away from direct sunlight, heat sources, and ignition sources (especially if flammable).

- Compatibility: Store away from incompatible materials (e.g., strong oxidizers, strong acids/bases). Use chemically resistant secondary containment (spill pallets).

- Containers: Keep containers tightly closed when not in use. Ensure original or compatible secondary containers are used. Label clearly.

- Shelf Life: Adhere to manufacturer’s shelf life. Implement FIFO (First-In, First-Out) inventory rotation. Monitor for signs of degradation (separation, thickening, odor change).

- Inventory Tracking: Maintain accurate inventory records, including batch/lot numbers, receipt dates, locations, and expiry dates. This is vital for traceability, quality control, and recall management.

H2: Transportation (Inbound & Outbound)

- Mode-Specific Compliance:

- Road (e.g., ADR in Europe): Ensure vehicle placarding, driver training/certification (ADR), and appropriate packaging (UN-certified if hazardous) for hazardous goods. Secure loads properly.

- Air (IATA DGR): Strict adherence to packaging, marking, labeling, and documentation requirements. Many adhesives are forbidden or highly restricted on passenger aircraft.

- Sea (IMDG Code): Proper stowage and segregation from incompatible cargoes. Accurate declaration to the carrier.

- Rail (RID): Similar requirements to ADR for hazardous goods within Europe.

- Packaging:

- Use packaging suitable for the glue’s properties (material compatibility, leak-proof, pressure-resistant if needed) and rated for the transport mode.

- For hazardous goods, use UN-certified packaging tested for the specific hazard class and packing group.

- Minimize packaging waste where possible, aligning with the product’s biodegradable ethos.

- Carrier Selection: Choose carriers experienced in handling adhesives or hazardous materials (if applicable) and verify their compliance certifications.

H2: Waste Management & End-of-Life

- Waste Classification: Empty containers and waste glue/solvent mixtures may still be classified as hazardous waste depending on residual content and local regulations (e.g., EPA regulations in the US). Always consult local waste authorities and the SDS (Section 13 – Disposal Considerations).

- Container Disposal:

- Rinse: If required by regulation and safe to do so, rinse containers thoroughly (triple rinse) using an appropriate solvent compatible with the glue. Collect rinseate as hazardous waste.

- Drain: Ensure containers are completely drained (puncture-resistant containers might need specialized handling).

- Dispose: Dispose of empty containers according to local regulations (e.g., as non-hazardous industrial waste, recyclable plastic/metal, or hazardous waste if not properly emptied/rinsed). Never reuse containers for other purposes.

- Spill Response:

- Plan: Have a site-specific Spill Response Plan based on the SDS (Section 6 – Accidental Release Measures).

- Kit: Maintain readily accessible spill kits with appropriate absorbents (e.g., non-flammable absorbents like vermiculite or specialized glue absorbents), PPE, and disposal bags.

- Procedure: Contain spill immediately. Prevent entry into drains or waterways. Absorb material. Place contaminated absorbents and cleanup materials in labeled, leak-proof containers for disposal as hazardous or non-hazardous waste as determined. Clean area thoroughly. Report significant spills as required.

- Biodegradation Reality: Emphasize that “biodegradable” typically refers to controlled composting conditions (industrial facilities) and does not mean safe for disposal down the drain or in natural environments. Promote responsible disposal channels.

H2: Key Compliance Drivers & Verification

- Primary Regulations:

- GHS (Globally Harmonized System): Hazard classification and communication (SDS, labels).

- Transport Regulations: UN TDG (Model Regulations), ADR/RID (Road/Rail Europe), IMDG Code (Sea), IATA DGR (Air).

- Environmental Regulations: Local waste disposal laws (e.g., RCRA in US, WFD in EU), water protection acts (prevent drain disposal).

- Workplace Safety: OSHA (US), HSE (UK), DGUV/REACH/CLP (EU) – covering exposure limits, PPE, training.

- Customs: Accurate HS codes and import/export documentation.

- Verification & Audits:

- Internal Audits: Regularly audit storage areas, handling practices, PPE usage, waste segregation, and documentation (SDS availability, training records).

- Supplier Verification: Audit key suppliers for SDS accuracy, sustainable sourcing (where applicable), and packaging practices.

- Regulatory Updates: Assign responsibility for monitoring changes in relevant regulations (e.g., new CLP amendments, transport rule updates).

- Training Records: Maintain proof of employee training on SDS, handling, storage, emergency procedures, and waste disposal.

Disclaimer: This guide provides general principles. Always prioritize the specific Safety Data Sheet (SDS) for the exact biodegradable glue product and consult with relevant regulatory authorities and legal counsel to ensure full compliance in your specific jurisdiction and operational context. Biodegradability does not negate other potential hazards or regulatory requirements.

In conclusion, sourcing biodegradable glue presents a sustainable and environmentally responsible alternative to conventional adhesives. With increasing concerns about plastic pollution and the long-term impact of non-degradable materials, biodegradable glues—derived from natural sources such as starch, cellulose, proteins, and plant-based polymers—offer a viable solution that reduces ecological harm. These adhesives break down naturally over time, minimizing waste accumulation and supporting circular economy principles. While challenges such as shelf life, water resistance, and production scalability may exist, ongoing advancements in green chemistry and material science are steadily improving their performance and cost-effectiveness. By prioritizing suppliers that adhere to eco-friendly manufacturing practices and certifications, businesses can ensure they are sourcing high-quality, truly biodegradable products. Ultimately, transitioning to biodegradable glue aligns with corporate sustainability goals, meets growing consumer demand for green products, and contributes to a healthier planet.