The global biochar market is experiencing robust growth, driven by rising demand for sustainable soil enhancers, carbon sequestration solutions, and circular waste-to-energy technologies. According to Grand View Research, the global biochar market size was valued at USD 1.73 billion in 2023 and is projected to expand at a compound annual growth rate (CAGR) of 12.4% from 2024 to 2030. This momentum is further fueled by increasing agricultural investments, climate mitigation initiatives, and advancements in pyrolysis technology. As a result, demand for efficient, scalable biochar production systems has surged, positioning biochar machine manufacturers at the forefront of the clean-tech agricultural revolution. With innovation and capacity rapidly scaling across North America, Europe, and Asia-Pacific, the competitive landscape is evolving to meet the needs of commercial farms, waste management operators, and carbon credit developers alike. Here’s a data-driven look at the top 10 biochar machine manufacturers leading this transformation.

Top 10 Biochar Machine Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Biochar Systems and Equipment Manufacturers

Domain Est. 2009

Website: biochar-us.org

Key Highlights: Below are lists of biochar systems and equipment manufacturers. These companies and organizations are listed only as a service to you….

#2 Applied Carbon

Domain Est. 2011

Website: appliedcarbon.com

Key Highlights: Our mobile technology leverages natural thermal processes and precision automation to convert crop residues into biochar, a stable form of carbon that builds ……

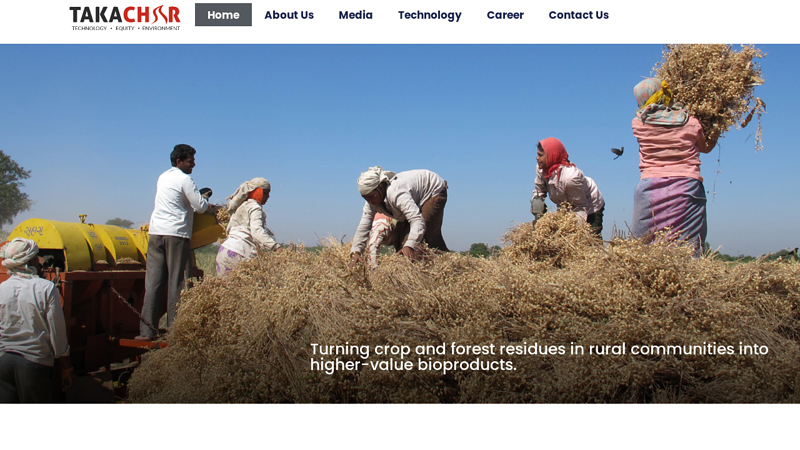

#3 Takachar

Domain Est. 2018

Website: takachar.com

Key Highlights: Takachar develop technology that drastically scales the transformation of waste biomass into higher-value, marketable bio-products for rural communities to ……

#4 Biochar

Domain Est. 2019

Website: planboo.eco

Key Highlights: We combine Biochar with innovative dMRV (measurement, reporting, and verification) technology to remove carbon from the atmosphere at scale….

#5 Biochar Now

Domain Est. 2008

Website: biocharnow.com

Key Highlights: Biochar Now is a pioneer in the biochar industry with strong engineering, manufacturing, sales and administrative personnel focused on making and selling ……

#6

Domain Est. 2010

Website: pyreg.com

Key Highlights: Biochar can be used as a valuable soil conditioner, feed additive or as a component in building materials, such as concrete and asphalt. Closing ……

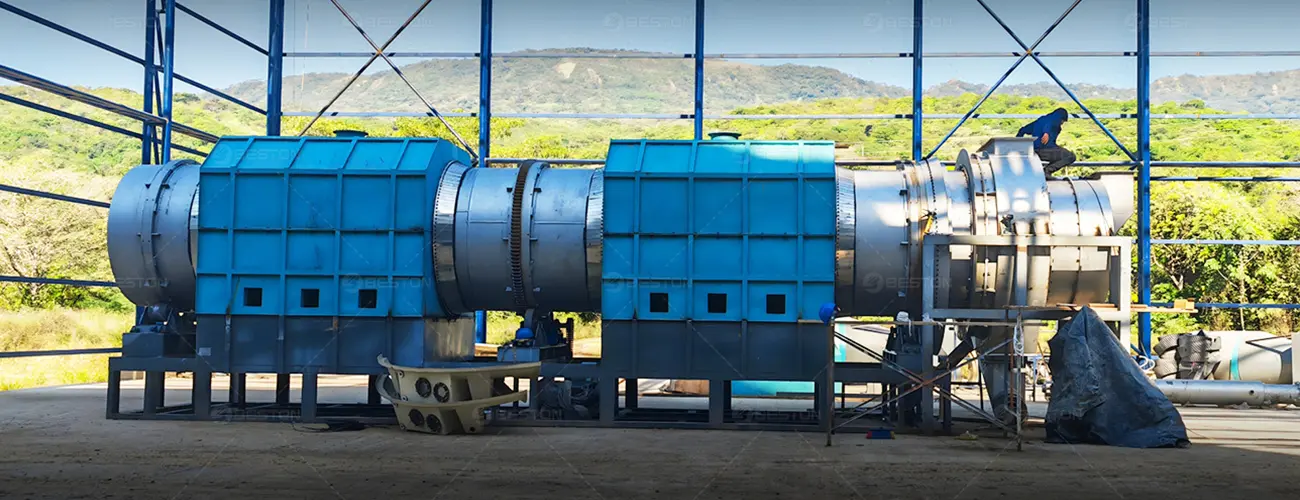

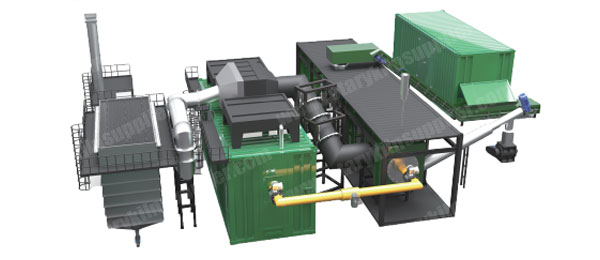

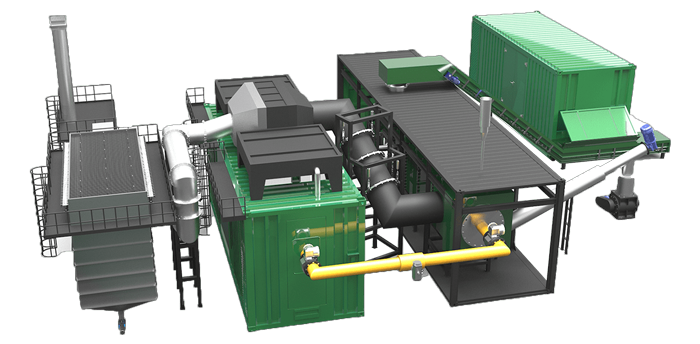

#7 Biochar Production Equipment

Domain Est. 2013

Website: bestongroup.com

Key Highlights: Beston biochar production equipment provides verifiable, traceable, and dMRV-integrated solutions for compliant and durable CDR projects….

#8 MASH Makes Biochar

Domain Est. 2021

Website: mashmakes.com

Key Highlights: MASH Makes biochar is a win-win for crops and the planet. This premium, stable, carbon-rich form of charcoal is created through the pyrolysis of waste biomass ……

#9 PyroCCS

Domain Est. 2021

Website: pyroccs.com

Key Highlights: We leverage the massive potential of BCR in the Global South by developing projects and providing affordable and profitable pyrolysis solutions….

#10 WasteX: Waste

Domain Est. 2021

Website: wastex.io

Key Highlights: Our flagship solution is a small-scale carbonizer that can be deployed anywhere and converts biomass waste into biochar. WasteX’s biochar equipment is a game- ……

Expert Sourcing Insights for Biochar Machine

H2: Projected 2026 Market Trends for Biochar Machines

By 2026, the global biochar machine market is expected to experience significant growth driven by increasing environmental awareness, government support for carbon sequestration technologies, and rising demand for sustainable soil amendments in agriculture. Several key trends are shaping the trajectory of this market:

-

Growing Emphasis on Carbon Neutrality and Climate Goals

As nations intensify efforts to meet Paris Agreement targets and achieve net-zero emissions, biochar production has emerged as a scalable carbon removal solution. Biochar machines, which convert biomass into stable carbon-rich charcoal through pyrolysis, are increasingly recognized for their role in carbon capture and storage (CCS). By 2026, policies incentivizing carbon farming and negative emissions technologies are expected to boost investment in biochar infrastructure. -

Technological Advancements and Efficiency Improvements

Manufacturers are focusing on enhancing the efficiency, scalability, and automation of biochar machines. Innovations such as continuous-feed pyrolysis systems, modular designs, and integration with renewable energy sources (e.g., syngas recovery for self-powered operation) are improving operational cost-effectiveness. These advancements make biochar machines more accessible to smallholder farmers and large-scale agribusinesses alike. -

Expansion in Agricultural Applications

Biochar’s benefits—improving soil fertility, water retention, and nutrient efficiency—are gaining traction among sustainable agriculture practitioners. By 2026, the integration of biochar machines into circular farming systems, particularly in regions with organic waste surpluses (e.g., Southeast Asia, Sub-Saharan Africa), is expected to rise. Governments and NGOs are supporting pilot programs that couple waste-to-energy biochar systems with regenerative agriculture initiatives. -

Regional Market Growth and Policy Support

North America and Europe are leading in biochar adoption due to strong environmental regulations and carbon credit programs. In contrast, Asia-Pacific is projected to be the fastest-growing region, fueled by agricultural waste management needs and supportive policies in countries like China and India. By 2026, regional subsidies, carbon pricing mechanisms, and inclusion of biochar in national climate strategies will further stimulate machine deployment. -

Integration with Circular Economy and Waste Management

Urban and agricultural waste streams are increasingly being viewed as feedstocks for biochar production. Municipal solid waste, crop residues, and forestry byproducts can be converted into biochar, reducing landfill use and methane emissions. Biochar machine systems integrated into waste-to-resource hubs are expected to proliferate, especially in developing economies seeking dual environmental and economic benefits. -

Rising Investment and Industry Consolidation

Venture capital and green financing are flowing into clean tech startups specializing in pyrolysis and biochar solutions. By 2026, increased M&A activity and strategic partnerships between equipment manufacturers, agritech firms, and carbon credit platforms are anticipated, leading to more standardized and commercially viable biochar machine offerings.

In conclusion, the 2026 biochar machine market will be characterized by technological innovation, policy-driven demand, and expanding applications across agriculture and waste management. As the world seeks scalable climate solutions, biochar machines are poised to play a critical role in the transition to a low-carbon, circular economy.

Common Pitfalls When Sourcing a Biochar Machine: Quality and Intellectual Property (IP) Concerns

Sourcing a biochar machine involves significant investment and long-term operational impact. Overlooking key quality and intellectual property (IP) aspects can lead to performance issues, financial losses, and legal complications. Below are the most common pitfalls to avoid.

Quality-Related Pitfalls

Inadequate Machine Build and Material Quality

Many low-cost suppliers use substandard materials (e.g., thin-gauge steel, non-refractory linings) that degrade quickly under high-temperature conditions. This results in frequent breakdowns, safety hazards, and shortened machine lifespan. Always verify material specifications and request third-party inspection reports.

Poor Process Efficiency and Inconsistent Output

Some machines fail to maintain optimal pyrolysis conditions (temperature, residence time, oxygen control), leading to low biochar yields and inconsistent quality (e.g., high ash content, low carbon stability). Demand performance data under real-world conditions and request trial runs or third-party validation.

Lack of Automation and Monitoring Systems

Manual or poorly automated systems increase operator error and reduce process repeatability. Machines without integrated sensors for temperature, pressure, and emissions monitoring make quality control difficult and regulatory compliance risky.

Insufficient After-Sales Support and Spare Parts Availability

Suppliers, especially overseas manufacturers, may offer limited technical support or long lead times for spare parts. This causes extended downtime. Ensure clear service agreements, local support networks, and availability of critical components before purchase.

Misrepresentation of Capacity and Scalability

Suppliers may advertise unrealistic throughput or scalability. Machines often underperform under continuous operation. Request verifiable operational references and conduct site visits to validate performance claims.

Intellectual Property (IP) Pitfalls

Use of Unlicensed or Copied Technology

Some manufacturers replicate patented reactor designs (e.g., auger, rotary kiln, or retort systems) without authorization. Purchasing such machines exposes buyers to legal risks, including injunctions or fines if the original IP holder takes action.

Lack of Transparency in Technology Ownership

Suppliers may be vague about the origins of their technology or avoid discussing patents. This opacity can signal IP infringement. Conduct due diligence: request patent numbers, licensing agreements, or independent legal verification.

No IP Protection for Custom or Upgraded Systems

If you invest in custom modifications or process improvements, ensure contractual agreements clearly assign or license resulting IP rights. Without this, the supplier may claim ownership, limiting your control over process innovations.

Dependency on Proprietary Control Software

Some machines rely on proprietary software for operation and optimization. If not properly licensed or documented, this creates vendor lock-in and hampers troubleshooting or integration with other systems. Ensure software licensing terms and access to source code (if applicable) are clearly defined.

Mitigation Strategies

- Conduct thorough due diligence on suppliers, including site audits and reference checks.

- Require third-party testing and performance guarantees.

- Engage legal counsel to review IP clauses in contracts.

- Prioritize suppliers with transparent technology origins and strong after-sales infrastructure.

Avoiding these pitfalls ensures a reliable, compliant, and legally secure biochar production operation.

Logistics & Compliance Guide for Biochar Machine

Overview

This guide outlines the key logistics considerations and regulatory compliance requirements for the transportation, installation, operation, and maintenance of a biochar machine. Adhering to these guidelines ensures safe, legal, and efficient deployment of biochar production systems across different regions.

Transportation and Shipping

Packaging and Handling

- Securely package the biochar machine using robust, weather-resistant materials to prevent damage during transit.

- Clearly label all components with handling instructions (e.g., “Fragile,” “This Side Up”) and include a detailed packing list.

- Disassemble major components if necessary to meet shipping size and weight restrictions.

- Use wooden crates or metal frames for heavy machinery; include shock-absorbing padding.

Shipping Documentation

- Prepare all required shipping documents: commercial invoice, packing list, bill of lading, and certificate of origin.

- Include machine specifications (weight, dimensions, power requirements) for customs clearance.

- For international shipments, ensure compliance with Incoterms (e.g., FOB, CIF) as agreed with the buyer.

Import/Export Regulations

- Verify export controls: Some countries regulate the export of industrial equipment, especially with combustion or high-temperature systems.

- Check import requirements of the destination country (e.g., import duties, VAT, biosecurity standards).

- Obtain necessary export licenses if required (e.g., from the U.S. Department of Commerce for certain technologies).

Site Preparation and Installation

Location Requirements

- Select a well-ventilated, fire-safe area with adequate space for machine operation, feedstock storage, and biochar handling.

- Ensure access to required utilities: electrical supply (voltage, phase, amperage), water (if needed for cooling or emissions control), and gas (if applicable).

- Provide stable, level ground or foundation to support machine weight and reduce vibration.

Safety and Zoning Compliance

- Confirm local zoning laws permit industrial or agricultural processing activities.

- Comply with fire safety codes: maintain safe distances from combustible materials, install fire extinguishers, and follow NFPA standards where applicable.

- Adhere to noise ordinances; consider sound barriers if operating in residential-adjacent zones.

Regulatory Compliance

Environmental Regulations

- Air Emissions: Comply with local air quality regulations (e.g., EPA in the U.S., Environment Agency in the UK). Biochar machines may require emissions controls (e.g., afterburners, cyclones, scrubbers) to limit particulate matter, VOCs, and PAHs.

- Permitting: Obtain an air quality permit if processing above threshold volumes. Submit a stack test report if required.

- Feedstock Restrictions: Avoid prohibited feedstocks (e.g., treated wood, plastics, hazardous waste) as defined by environmental agencies.

Occupational Health & Safety

- Install required safety guards, emergency shutoffs, and warning labels per OSHA (U.S.) or equivalent standards.

- Provide operator training on safe start-up, shutdown, and emergency procedures.

- Use PPE (heat-resistant gloves, eye protection, respirators) during operation and maintenance.

Waste and Byproduct Management

- Store and handle biochar according to local soil amendment or waste disposal regulations.

- If biochar is sold or distributed, comply with fertilizer or soil product registration standards (e.g., state departments of agriculture).

- Ensure condensate (bio-oil/water mixture) is captured and disposed of properly, as it may be classified as hazardous waste.

Operational Compliance

Recordkeeping

- Maintain logs of feedstock sources, processing temperatures, run times, and emissions control system performance.

- Keep copies of permits, safety data sheets (SDS), and maintenance records on-site.

- Document biochar quality testing (e.g., pH, carbon content, heavy metals) if used in agriculture or carbon credit programs.

Carbon Credit and Certification Programs (Optional)

- If claiming carbon removal, follow protocols such as Puro.earth, Verra, or the IPCC guidelines.

- Ensure traceability from feedstock to final biochar product.

- Undergo third-party audits for certification (e.g., EBC or IBI biochar standards).

Maintenance and Decommissioning

Routine Maintenance

- Follow manufacturer’s maintenance schedule for burners, augers, fans, and control systems.

- Regularly inspect for wear, leaks, and buildup in gas pathways.

- Calibrate sensors and safety systems periodically.

Decommissioning

- Safely shut down and purge the system before disassembly.

- Recycle metal components and dispose of any contaminated parts per local waste regulations.

- De-register permits if production ceases permanently.

Conclusion

Proper logistics planning and regulatory compliance are critical for the successful and lawful operation of a biochar machine. Always consult with local authorities, environmental agencies, and legal experts to ensure adherence to all applicable laws and standards in your jurisdiction.

Conclusion for Sourcing a Biochar Machine

Sourcing a biochar machine is a strategic decision that supports sustainable waste management, carbon sequestration, and soil health improvement. After evaluating technical specifications, production capacity, feedstock compatibility, energy efficiency, emissions control, and after-sales support, it is evident that selecting the right machine requires a balanced approach between performance, reliability, and cost-effectiveness.

Priority should be given to suppliers offering proven technology, compliance with environmental regulations, and transparent maintenance and training services. Additionally, considering long-term operational goals—such as scalability and integration into existing systems—will ensure the investment delivers both environmental and economic returns.

Ultimately, choosing a high-quality, appropriately sized biochar machine from a reputable manufacturer not only enhances project viability but also aligns with global sustainability objectives, making it a worthwhile investment for agricultural, industrial, or municipal applications.