The global eco-friendly laundry care market is experiencing robust growth, driven by rising consumer awareness around environmental sustainability and demand for non-toxic cleaning solutions. According to Mordor Intelligence, the green cleaning products market is projected to grow at a CAGR of over 9.5% from 2023 to 2028, with bio washing powders gaining significant traction due to their biodegradable formulations and enzyme-based cleaning agents. As regulatory frameworks tighten and eco-labeling becomes more prevalent, manufacturers are increasingly investing in plant-based ingredients and sustainable packaging. This surge in demand has elevated the competitive landscape, giving rise to innovative bio washing powder producers who combine performance with environmental responsibility. Below are the top 8 bio washing powder manufacturers leading this shift, recognized for their product efficacy, R&D investment, and commitment to sustainable practices.

Top 8 Bio Washing Powder Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 We are Bio + Eco Friendly Laundry Detergent Manufacturers

Domain Est. 1996

Website: formulacorp.com

Key Highlights: Formula Corp has the capability to manufacture Bio + Eco Friendly Laundry Detergent. We have dozens of household cleaning formulas that are ready to go….

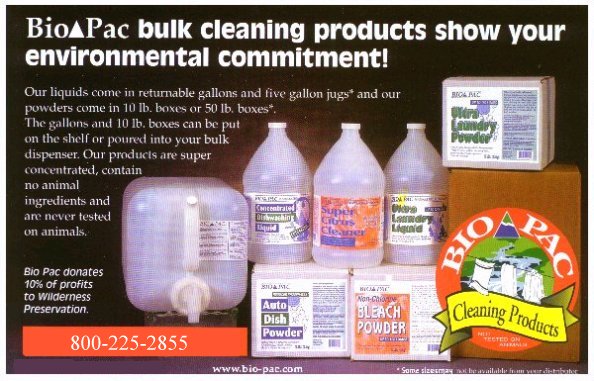

#2 Bio Pac Biodegradable Cleaning Products

Domain Est. 1995

Website: bio-pac.com

Key Highlights: Bio Pac offers a line of biodegradable cleaning products sold in refillable containers and recycled bottles. We list every ingredient used in our products….

#3 Bio Presto

Domain Est. 1999 | Founded: 1968

Website: henkel.com

Key Highlights: Bio Presto, 100% made in Italy since 1968, is on the side of millions of Italian families, guaranteeing every day the same cleanliness as always….

#4 Pure, more than soap.

Domain Est. 2007

Website: purebio.net

Key Highlights: Pure® is a Canadian brand that offers sustainable bulk cleaners & hair care for the family and household….

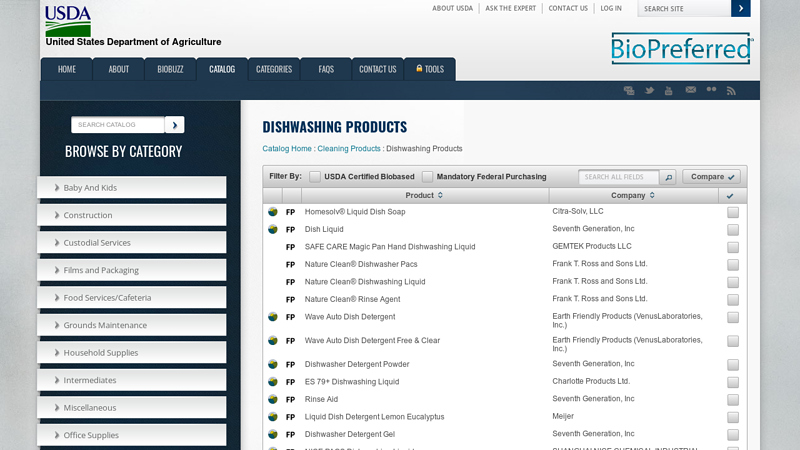

#5 BioPreferred

Domain Est. 2007

Website: biopreferred.gov

Key Highlights: Dishwashing Products ; Dishwasher Detergent Powder, Seventh Generation, Inc ; ES 79+ Dishwashing Liquid, Charlotte Products Ltd….

#6 Products

Domain Est. 2008

Website: biologicalpreparations.com

Key Highlights: Eco Laundry Detergent (Bio) combats tough stains and odours. Utilising the power of enzymes and naturally derived ingredients, a sustainable choice….

#7 Buy Ecover Concentrated Bio Washing Powder 750g

Domain Est. 2009

Website: ecoverdirect.com

Key Highlights: Rating 4.7 (58) Our bio washing powder features active consciously chosen, biodegradable ingredients. Takes on stains even at 30° leaving clothes with the delicate fresh ……

#8 Bio Enzyme Laundry Booster with Phytolase®

Domain Est. 2017

Website: dirtylabs.com

Key Highlights: A powder and liquid duo that’s optimized to make whites and colors vibrant and eliminate the toughest stains and odors….

Expert Sourcing Insights for Bio Washing Powder

2026 Market Trends for Bio Washing Powder: A Hydrogen-Powered Outlook (H2)

The global bio washing powder market is poised for significant transformation by 2026, driven by escalating environmental concerns, stringent regulations, and evolving consumer preferences. While “H2” typically refers to hydrogen in scientific contexts, within this analysis, we interpret “H2” as a metaphor for Holistic Sustainability and Hydrogen Innovation, reflecting the dual forces shaping the future: comprehensive eco-responsibility and the potential integration of green hydrogen technologies. Here’s a breakdown of key trends expected to define the market in 2026:

1. Surge in Demand for Truly Sustainable Formulations (Holistic H2: Environmental Integrity)

- Beyond “Bio” Labeling: Consumers and regulators will demand greater transparency. “Bio” claims will face scrutiny, pushing brands towards certifications (e.g., EU Ecolabel, Cradle to Cradle, Soil Association) and full ingredient disclosure. Expect a rise in plant-based, biodegradable surfactants (like alkyl polyglucosides – APGs) and enzyme optimization for lower temperatures.

- Plastic-Free Revolution: Concentrated powders (reducing water weight and transport emissions) and plastic-free packaging will dominate. Innovations include water-soluble PVOH pods, compostable cardboard boxes, refill stations in retail, and aluminum refill pouches. The “H2” principle here emphasizes minimal environmental footprint across the entire lifecycle.

- Carbon Neutrality & Net-Zero Goals: Major brands will aggressively pursue net-zero manufacturing. This is where actual green hydrogen (H2) becomes crucial. Facilities powered by renewable energy (solar, wind) and using green H2 for high-heat processes (like drying ingredients) will emerge as a key differentiator, significantly reducing Scope 1 & 2 emissions.

2. Performance Parity and Enhanced Efficacy (Holistic H2: Consumer Trust)

- Closing the Performance Gap: Historically, bio-powders lagged in stain removal, especially at low temperatures or on tough stains. By 2026, advanced enzyme cocktails (proteases, amylases, lipases) and smart chelating agents (like glutamic acid N,N-diacetic acid – GLDA, replacing phosphates) will deliver performance rivaling or exceeding conventional powders, even in cold water washes (20-30°C). This is essential for mass adoption.

- Targeted Solutions: Growth in specialized bio-powders for sensitive skin, baby clothes, dark/colored fabrics, and outdoor gear will continue, leveraging gentle yet effective plant-derived ingredients and hypoallergenic formulations.

3. Regulatory Pressure and Ingredient Scrutiny (Holistic H2: Compliance & Safety)

- Stricter Bans: Regulations (e.g., EU Detergent Regulation updates, US state-level laws) will likely further restrict or ban persistent, bioaccumulative, and toxic (PBT) chemicals, phosphates, certain optical brighteners, and synthetic fragrances/phthalates. This will accelerate the shift towards inherently safer bio-based alternatives.

- Microplastic Focus: While powders generate less microplastic than liquids, scrutiny on any synthetic polymer content (e.g., in anti-redeposition agents) will increase, pushing development towards 100% biodegradable polymers.

4. Green Hydrogen (H2) Integration in Manufacturing (Actual H2: Technological Innovation)

- Decarbonizing Production: The most significant “H2” trend for 2026 is the pilot and early adoption of green hydrogen in manufacturing. While not yet mainstream, leading sustainable brands will invest in:

- Green H2 for Steam Generation: Replacing natural gas boilers in powder drying and processing with H2-fueled systems.

- On-site Renewable H2 Production: Utilizing electrolysis powered by dedicated solar/wind installations at production plants.

- Supply Chain Decarbonization: Using H2-powered trucks for ingredient transport (long-term vision).

- “H2-Powered” as a USP: Brands successfully implementing green H2 will leverage this as a powerful marketing claim (“Manufactured using 100% green hydrogen”), appealing to highly environmentally conscious consumers and B2B partners with net-zero commitments.

5. Price Premiums and Value Perception (Holistic H2: Economic Model)

- Persistent Premium, But Narrowing Gap: Bio powders will likely maintain a price premium over conventional detergents due to higher ingredient costs and sustainable packaging. However, economies of scale, concentrated formulas, and increased competition will gradually narrow this gap.

- Value Beyond Cleaning: Consumers will increasingly pay for the environmental and health benefits. The perceived value will shift from just cleaning power to overall sustainability impact, health safety, and contribution to circular economy goals.

6. Market Expansion and Competitive Landscape (Holistic H2: Growth)

- Mainstream Adoption: Bio washing powder will move beyond niche eco-stores into mainstream supermarkets and online platforms, driven by retailer sustainability commitments (e.g., own-brand eco-lines).

- Consolidation & Innovation: Expect consolidation among smaller players and increased R&D investment from major chemical companies (e.g., BASF, Solvay, Evonik) developing advanced bio-based raw materials. Direct-to-consumer (DTC) subscription models for refills will gain traction.

Conclusion: The H2-Driven Future (2026 Outlook)

By 2026, the bio washing powder market will be defined by the confluence of Holistic Sustainability (H2 – Environmental & Social Responsibility) and the nascent but impactful integration of Green Hydrogen (H2 – Technological Innovation). Success will belong to brands that deliver proven high performance, radical transparency, plastic-free solutions, and verifiable carbon reduction – potentially powered literally and figuratively by hydrogen. The market will be less about simply being “bio” and more about being truly sustainable, innovative, and trustworthy across the entire value chain. Green hydrogen, while not yet ubiquitous in manufacturing, will emerge as a critical differentiator for industry leaders aiming for genuine net-zero impact, making the “H2” moniker a powerful symbol of the sector’s future direction.

Common Pitfalls When Sourcing Bio Washing Powder (Quality & Intellectual Property)

Sourcing bio washing powder can support sustainability goals, but it comes with specific challenges related to quality consistency and intellectual property (IP) risks. Being aware of these pitfalls helps ensure reliable supply and legal compliance.

Quality-Related Pitfalls

Inconsistent Enzyme Activity

Bio washing powders rely on enzymes (e.g., proteases, amylases) to break down stains. A major pitfall is variability in enzyme efficacy due to poor manufacturing controls, improper storage, or inadequate stabilization. This leads to inconsistent cleaning performance and customer dissatisfaction.

Lack of Standardized Certification

Many suppliers claim “bio” or “eco-friendly” status without recognized third-party certifications (e.g., EU Ecolabel, Nordic Swan, Ecocert). Without these, it’s difficult to verify biodegradability, non-toxicity, or environmental claims, increasing the risk of greenwashing.

Raw Material Sourcing Issues

Bio washing powders often use plant-based surfactants and natural additives. Unreliable sourcing of these raw materials—due to seasonal variations, poor agricultural practices, or lack of traceability—can compromise product quality and sustainability claims.

Stability and Shelf Life Problems

Enzymes and natural ingredients can degrade faster than synthetic counterparts, especially under heat or humidity. Poor formulation or packaging can shorten shelf life, leading to inactive products upon delivery or use.

Inadequate Performance Testing

Some suppliers may not conduct rigorous performance testing across various water hardness levels, temperatures, or fabric types. This can result in underperforming products in real-world conditions, damaging brand reputation.

Intellectual Property (IP) Risks

Unlicensed Use of Patented Enzyme Formulations

Many high-performance enzymes used in bio detergents are protected by patents (e.g., those from Novozymes or DuPont). Sourcing from manufacturers who use patented technology without proper licensing exposes buyers to legal liability and supply chain disruption.

Copycat or Generic Formulas with IP Infringement

Low-cost suppliers may replicate successful branded formulations without authorization. Using such formulations—even unknowingly—can lead to infringement claims against the buyer, especially in markets with strong IP enforcement.

Lack of Transparency in Ingredient Sources

Suppliers may not disclose the origin or IP status of key ingredients. This opacity makes it difficult to conduct due diligence and increases the risk of inadvertently using proprietary technology.

Weak Contractual IP Protections

Sourcing agreements that fail to include clear IP indemnification clauses or ownership terms leave buyers vulnerable. If the supplier is accused of IP theft, the buyer may face legal action or product recalls.

Misuse of Branding and Marketing Claims

Suppliers might overstate environmental benefits or imply endorsements from certification bodies without authorization. This not only risks misleading consumers but may also violate trademark or advertising laws.

Mitigation Strategies

- Require third-party certifications and conduct independent lab testing for performance and composition.

- Audit suppliers for compliance with IP regulations and request documentation on enzyme licensing.

- Include robust IP indemnification clauses in contracts.

- Partner with reputable, transparent manufacturers who provide full ingredient traceability.

- Consult legal experts to assess formulation and branding risks before market launch.

Avoiding these pitfalls ensures that bio washing powder sourcing supports both sustainability goals and long-term business integrity.

Logistics & Compliance Guide for Bio Washing Powder

Product Classification & Regulatory Framework

Bio washing powder, as a biodegradable and often eco-labeled laundry detergent, is subject to specific regulations depending on its formulation, claims, and destination market. Key regulatory bodies include:

– REACH (EU): Registration, Evaluation, Authorisation and Restriction of Chemicals – ensures safe use of chemicals.

– CLP Regulation (EU): Classification, Labelling and Packaging – mandates hazard communication via labels and Safety Data Sheets (SDS).

– Ecolabel (EU Ecolabel or Nordic Swan): Voluntary certification for environmentally preferable products; impacts formulation and claims.

– EPA Safer Choice (USA): Environmental certification program influencing ingredient selection.

– GHS (Globally Harmonized System): Standardized classification and labeling adopted by many countries.

– National Regulations: Countries may have additional requirements (e.g., Canada’s CMP, China’s CCC).

Ensure product is classified correctly based on ingredients (e.g., enzymes, surfactants, optical brighteners). Bio washing powders are typically classified as non-hazardous or mildly irritating (Skin Irrit. 2, H315), but formulations vary.

Packaging & Labeling Requirements

Proper packaging and labeling are critical for compliance and consumer safety:

- Primary Packaging: Use moisture-resistant, recyclable materials (e.g., cardboard boxes with biodegradable liners or recyclable plastics). Avoid over-packaging to meet sustainability standards.

- Labeling Elements (per CLP/GHS):

- Product identifier

- Supplier name, address, and contact details

- Hazard pictograms (if applicable)

- Signal word (e.g., “Warning”)

- Hazard and precautionary statements (e.g., “Causes skin irritation”, “Keep out of reach of children”)

- Net quantity

- Batch or lot number

- Expiry or use-by date (if applicable)

- Eco-Claims: Only make verifiable environmental claims (e.g., “Biodegradable”, “Phosphate-free”). Avoid greenwashing. Certified claims (e.g., “EU Ecolabel”) must include license number.

- Multilingual Labels: Required in multi-country distribution (e.g., all EU languages for pan-European sales).

Safety Data Sheet (SDS) Management

An up-to-date SDS is mandatory for transport and occupational safety:

– Prepare SDS in accordance with REACH Annex II (EU) or local regulations (e.g., OSHA HazCom in USA).

– Include sections on composition, first-aid measures, fire-fighting, accidental release, handling and storage, exposure controls, and toxicological information.

– Provide SDS in the official language(s) of the destination country.

– Distribute SDS to logistics partners, customs brokers, and downstream users.

Transport & Handling

Bio washing powder is generally classified as a non-hazardous good for transport when packaged for retail sale (UN number not required under ADR/IMDG/IATA). However:

– Confirm classification with a qualified expert—some formulations may contain regulated substances.

– For bulk transport, consider potential dust generation; use sealed containers and ventilated storage areas.

– Store in dry, cool conditions to prevent caking or degradation.

– Use pallets and stretch wrap for unit loads; ensure stackability and protection from moisture.

– Avoid exposure to extreme temperatures during transit.

Transport documentation must include:

– Commercial invoice

– Packing list

– Certificate of Analysis (CoA)

– SDS

– Eco-certification documents (if applicable)

Import & Customs Compliance

Ensure smooth customs clearance by:

– Classifying the product under the correct HS Code (e.g., 3402.20 for synthetic organic surface-active washing preparations in the EU).

– Providing accurate value declarations and origin information.

– Complying with local import regulations (e.g., product registration in some countries).

– Including any required permits or certificates (e.g., eco-label verification).

– Verifying tariff rates and potential import duties or taxes.

Environmental & Sustainability Compliance

Bio washing powders are marketed on their environmental benefits—ensure compliance with green standards:

– Confirm biodegradability claims per OECD 301 or equivalent standards.

– Avoid restricted substances (e.g., phosphates, NPEs, certain dyes).

– Comply with eco-label criteria (e.g., EU Ecolabel decision 2017/2139 for laundry detergents).

– Report environmental data if required under ESG or corporate sustainability programs.

Record Keeping & Audits

Maintain comprehensive records for at least 10 years (per REACH):

– Formulation details and raw material specifications

– SDS and label versions

– Batch records and CoAs

– Certifications (e.g., eco-label, ISO 14001)

– Import/export documentation

Be prepared for audits by regulators, retailers, or certification bodies.

Incident Response & Recall Preparedness

Establish procedures for:

– Handling customer complaints or adverse reactions

– Managing product recalls (voluntary or mandated)

– Reporting serious incidents to relevant authorities (e.g., via RAPEX in the EU)

– Communicating with stakeholders (retailers, consumers, regulators)

Summary

Successful logistics and compliance for bio washing powder require proactive management of chemical regulations, accurate labeling, proper transport documentation, and adherence to environmental claims. Partner with certified suppliers, stay updated on regulatory changes, and prioritize transparency to ensure market access and consumer trust.

Conclusion for Sourcing Bio Washing Powder:

Sourcing bio washing powder presents a sustainable and environmentally responsible choice for both consumers and businesses aiming to reduce their ecological footprint. As demand for eco-friendly household products continues to grow, bio washing powders—formulated with biodegradable ingredients, plant-based surfactants, and free from harsh chemicals, phosphates, and synthetic fragrances—offer effective cleaning performance while minimizing harm to aquatic life and ecosystems.

When sourcing bio washing powder, it is essential to prioritize suppliers that uphold ethical production practices, hold credible certifications (such as EU Ecolabel, Ecocert, or USDA BioPreferred), and provide transparency in ingredient sourcing and manufacturing processes. Additionally, considering factors such as packaging sustainability (e.g., recyclable or compostable materials), supply chain reliability, and cost-effectiveness ensures long-term viability and customer satisfaction.

In conclusion, sourcing bio washing powder not only aligns with global sustainability goals but also meets increasing consumer preferences for green, non-toxic cleaning solutions. By partnering with responsible suppliers and promoting eco-conscious products, businesses can contribute to a cleaner planet while building trust and loyalty among environmentally aware customers.