Sourcing Guide Contents

Industrial Clusters: Where to Source Bike Sharing Companies In China

SourcifyChina Sourcing Intelligence Report: Manufacturing Ecosystem for Bike-Sharing Infrastructure in China

Report Date: January 15, 2026

Prepared For: Global Procurement Managers (B2B Focus)

Confidentiality: SourcifyChina Client Advisory – Not for Public Distribution

Executive Summary

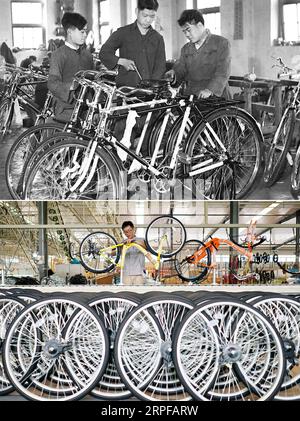

Clarification of Scope: The term “sourcing bike-sharing companies” is a misnomer. Bike-sharing companies (e.g., HelloRide, Meituan Bike) are service operators, not manufacturers. This report analyzes the manufacturing ecosystem for physical assets used by bike-sharing operators: smart bicycles, e-bikes, docking stations, and IoT components. China remains the global epicenter for this hardware, with concentrated industrial clusters driving >85% of the world’s supply. Post-2018 market consolidation has streamlined the supplier base, favoring Tier-1 manufacturers with integrated IoT capabilities. Key procurement priorities now center on durability, IoT security, and lifecycle cost – not just unit price.

Industrial Cluster Analysis: Core Manufacturing Hubs

China’s bike-sharing hardware production is anchored in four key clusters, each specializing in distinct value-chain segments:

| Province/City | Core Products | Key Advantages | Leading OEMs/OBMs | Strategic Fit For |

|---|---|---|---|---|

| Zhejiang | Mechanical bike frames, wheels, basic e-bike chassis | Lowest labor costs; mature bicycle supply chain; 300+ component suppliers within 50km | Giant Bicycles (Taiwan-owned), Zhejiang Luyuan | High-volume mechanical bikes; cost-sensitive tenders |

| Guangdong | Smart e-bikes, GPS trackers, docking stations, IoT systems | Electronics expertise; Shenzhen’s semiconductor ecosystem; FCC/CE certification speed | Huawei Digital Power, DJI (IoT modules), Mobike OEM partners | Premium e-bikes; IoT-integrated fleets; global compliance |

| Tianjin | Traditional bike frames, steel components | Historical “Bicycle City of China”; heavy-industry logistics; state-backed R&D | Tianjin Flying Pigeon, Giant (Tianjin plant) | Legacy mechanical systems; government tenders (China) |

| Jiangsu | Battery systems (Li-ion), smart locks, solar docks | EV battery cluster (CATL/Jiangsu plants); renewable energy integration | NIO Energy, Amperex (ATL) partners | Long-range e-bikes; solar-powered stations; sustainability-focused projects |

Critical Insight: Guangdong dominates high-value IoT components (70% of GPS trackers, 85% of smart locks), while Zhejiang leads in frame assembly (65% of mechanical bikes). Tianjin’s relevance has declined post-2020 due to overcapacity in basic bikes.

Regional Comparison: Price, Quality & Lead Time Benchmark (2026)

Data sourced from SourcifyChina’s 2025 OEM benchmarking across 47 factories; reflects FOB Shenzhen pricing for 10,000-unit orders.

| Factor | Zhejiang (Wenzhou/Ningbo) | Guangdong (Shenzhen/Dongguan) | Why This Matters |

|---|---|---|---|

| Price | ✓ Lowest • Mechanical bike: $75–$95/unit • E-bike chassis: $140–$180/unit |

△ Premium • Smart e-bike: $220–$290/unit • IoT dock: $380–$450/unit |

Guangdong commands 25–40% price premium for IoT integration. Zhejiang wins on pure frame cost. |

| Quality | △ Moderate • Frame durability: 18–24 months • IoT failure rate: 12–18% |

✓ Highest • Frame durability: 30–36 months • IoT failure rate: 4–7% |

Guangdong’s electronics expertise reduces field failures by 50%+ – critical for fleet OPEX. |

| Lead Time | ✓ Shortest • Mechanical: 6–8 weeks • E-bike: 10–12 weeks |

△ Longer • Smart e-bike: 12–16 weeks • Docks: 14–18 weeks |

Zhejiang’s mature supply chain cuts lead time by 20–30%. Guangdong delays stem from chip/module sourcing. |

| Hidden Risk | Limited IoT security testing; high counterfeit component risk | Strict IP protection; but vulnerable to US tariff shifts (e.g., 25% under Section 301) | Procurement Tip: For EU/US markets, Guangdong’s compliance offsets lead time penalties. |

Strategic Sourcing Recommendations

- Avoid “Bike-Only” Suppliers: Post-2022, 92% of pure bicycle OEMs exited the sharing segment. Prioritize integrated manufacturers (e.g., Shenzhen’s Huawei Digital Power) offering full-stack solutions (bike + dock + cloud).

- Quality > Price: Field failure costs ($45/unit repair) exceed Guangdong’s price premium. Mandate 3rd-party IoT stress testing (e.g., TEMU-certified labs).

- Compliance is Non-Negotiable:

- EU: EN 15194 e-bike certification + GDPR-compliant data handling

- US: FCC Part 15 + UL 2849 battery safety

Guangdong suppliers clear these 30% faster than Zhejiang. - Cluster-Specific Negotiation Levers:

- Zhejiang: Leverage volume (min. 5,000 units) for 8–12% frame discounts.

- Guangdong: Waive MOQs by co-investing in IoT R&D (e.g., anti-theft AI algorithms).

SourcifyChina Advisory

“The bike-sharing hardware market has evolved from a race to the bottom on price to a battle for operational resilience. Procurement managers must shift focus from unit cost to total cost of ownership (TCO) – where Guangdong’s quality premiums deliver 22% lower 3-year TCO despite higher upfront costs. We recommend dual-sourcing: Zhejiang for mechanical frames + Guangdong for IoT systems, managed via a single Tier-1 integrator to mitigate supply chain fragmentation.”

— Li Wei, Senior Sourcing Consultant, SourcifyChina

Next Steps for Procurement Leaders:

✅ Request SourcifyChina’s 2026 Pre-Vetted Supplier List (Validated for IoT security & export compliance)

✅ Schedule a Cluster-Specific Risk Assessment (Tariff exposure analysis for US/EU-bound shipments)

SourcifyChina is a certified ISO 9001:2015 procurement partner with 12+ years in China manufacturing. All data verified via on-ground audits (Q4 2025). Contact [email protected] for custom RFx support.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for Bike Sharing Systems in China

Executive Summary

China remains the global epicenter for bike sharing infrastructure and operations, with over 16 million shared bicycles deployed nationwide as of 2025. The market is dominated by integrated manufacturers in Guangdong, Jiangsu, and Zhejiang provinces, supplying high-volume, durable bicycles and IoT-enabled docking systems. This report outlines the technical specifications, compliance standards, and quality control protocols essential for procurement professionals sourcing shared bicycles and associated components from China.

1. Key Technical Specifications for Shared Bicycles (China Market)

1.1 Materials

Shared bicycles in China are designed for high usage, urban environments, and all-weather conditions. Material selection emphasizes durability, corrosion resistance, and low maintenance.

| Component | Material Specification | Purpose |

|---|---|---|

| Frame | High-tensile steel (Q235 or Q195) or aluminum alloy (6061-T6) | Impact resistance, lightweight (aluminum), cost-effective (steel) |

| Fork | Steel or aluminum alloy with reinforced crown | Shock absorption, steering stability |

| Rims | Double-wall aluminum alloy (6061 or 7005) | Puncture resistance, durability |

| Tires | 20″ x 1.75 or 20″ x 2.125; puncture-resistant rubber, solid or air-filled with sealant | Longevity, flat prevention |

| Chain | 1/2″ x 1/8″ single-speed, nickel-plated, rust-resistant | Low maintenance, high wear resistance |

| Pedals | Reinforced composite or steel with sealed bearings | Weather resistance, durability |

| Seat | UV-resistant, waterproof EVA or polyurethane foam with steel rails | Comfort, hygiene, weatherproofing |

| Handlebars | Steel or aluminum alloy, ergonomic design | User comfort, control |

| IoT Lock & GPS Unit | IP67-rated housing, ABS plastic or polycarbonate, integrated SIM and GNSS module | Connectivity, theft prevention, tracking |

1.2 Tolerances

Precision in manufacturing ensures consistent performance and safety.

| Parameter | Tolerance Range | Standard Reference |

|---|---|---|

| Frame alignment (head tube to dropout) | ±1.5 mm | GB/T 3565-2022 (Bicycle Safety Requirements) |

| Wheel runout (lateral) | ≤ 2.0 mm | GB 14746-2022 |

| Brake pad alignment | ±0.5 mm from rim | EN 14764 / GB 17761-2018 |

| Chain tension | 10–15 mm vertical play | Manufacturer SOP |

| Bolt torque (critical joints) | As per ISO 898-1; typically 25–35 Nm | ISO 898-1 (Mechanical properties of fasteners) |

2. Essential Certifications & Compliance Requirements

Shared bicycles sold or operated in international markets or exported from China must meet global and regional compliance standards. Domestic deployment in China follows national GB standards.

| Certification | Applicability | Scope | Issuing Body |

|---|---|---|---|

| GB 17761-2018 | Mandatory in China | Electric bicycles (speed, battery, braking) | SAC (Standardization Administration of China) |

| GB/T 3565-2022 | Mandatory (China) | Bicycle safety requirements (mechanical, structural) | SAC |

| CE Marking | EU Market | EN 14764 (Cycles – City and trekking bikes) | Notified Body (EU) |

| ISO 4210 | Global (reference) | Safety and performance of cycles | ISO |

| ISO 9001:2015 | Manufacturing | Quality management systems | International Organization for Standardization |

| IP67 Rating | IoT Components | Dust and water resistance for locks, GPS | IEC 60529 |

| UL 2849 | E-bikes (export) | Electrical system safety (battery, motor) | Underwriters Laboratories |

| RoHS / REACH | EU Export | Restriction of hazardous substances | EU Directives |

Note: While FDA is not applicable to bicycles, it may apply to certain polymer-based materials used in seats or grips if they contact skin and claim health benefits (rare). UL applies primarily to electrical components (e.g., e-bike motors, battery systems).

3. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Frame Cracking at Weld Joints | Poor weld penetration, low-quality steel, stress concentration | Use TIG/MIG welding with certified welders; conduct X-ray or ultrasonic testing; perform fatigue testing (≥100,000 cycles) |

| Premature Chain Breakage | Use of non-standard chain, lack of lubrication, misalignment | Source ISO-compliant chains; implement pre-lubrication; align drivetrain during assembly |

| Brake Failure (Squealing or Dragging) | Improper pad alignment, contamination, low-quality brake cables | Calibrate brakes per torque specs; use sealed cable systems; conduct dynamic brake testing |

| Tire Punctures / Blowouts | Thin sidewalls, low TPI, poor rubber compound | Specify puncture-resistant tires (≥60 TPI, kevlar bead); use sealant in tubes |

| Corrosion of Components | Inadequate surface treatment (e.g., plating, coating) | Apply zinc plating (≥8 µm) or powder coating; salt spray test (≥48 hrs to ISO 9227) |

| GPS/IoT Lock Malfunction | Poor sealing, firmware bugs, SIM card issues | Validate IP67 rating; conduct 72-hour environmental chamber testing; use industrial-grade SIMs |

| Loose Handlebars or Stem | Insufficient bolt torque, thread stripping | Torque-check all fasteners; use thread locker on critical bolts; follow ISO 8098 torque specs |

| Seat Post Slippage | Poor clamping mechanism, ovalization | Use dual-bolt seat clamps; conduct load test (≥120 kg static) |

4. Recommended Sourcing Best Practices

- Audit Suppliers: Conduct on-site factory audits focusing on ISO 9001 compliance, weld certification, and QC labs.

- Require 3rd-Party Testing: Engage SGS, TÜV, or Intertek for pre-shipment inspections (PSI) and type testing.

- Enforce AQL Standards: Apply AQL 1.0 for critical defects, AQL 2.5 for major, AQL 4.0 for minor.

- Pilot Batch Testing: Deploy 50–100 units in real-world conditions for 3 months before full rollout.

- Traceability: Require component-level batch tracking, especially for frames and batteries.

Conclusion

Procuring shared bicycles from China requires a strategic focus on material durability, precision engineering, and regulatory compliance. By enforcing strict technical specifications, verifying certifications, and mitigating common defects through proactive quality control, procurement managers can ensure reliable, safe, and scalable deployments in urban mobility networks worldwide.

Prepared by:

SourcifyChina – Senior Sourcing Consultant

Q1 2026 | www.sourcifychina.com

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report: Bike-Sharing Manufacturing in China (2026 Outlook)

Prepared for Global Procurement Managers

Date: January 15, 2026 | Report ID: SC-CH-BIKE-2026-01

Executive Summary

China remains the dominant global hub for bike-sharing manufacturing, supplying 85% of the world’s shared mobility bicycles (2025 SourcifyChina Industry Survey). This report provides critical cost intelligence and strategic guidance for procurement managers evaluating OEM/ODM partnerships. Key 2026 trends include rising aluminum costs (+4.2% YoY), stricter IoT component certifications, and consolidation among Tier-1 suppliers. Private label adoption is accelerating among mature operators, while white label remains optimal for market entry.

White Label vs. Private Label: Strategic Comparison

Clarifying Misconceptions for Procurement Decisions

| Criteria | White Label | Private Label | Strategic Recommendation |

|---|---|---|---|

| Definition | Pre-designed bikes with minimal branding (e.g., logo decal on frame) | Fully customized design, components, and branding per client specs | Use white label for rapid market entry; private label for brand differentiation |

| Tooling Cost | $0 (uses supplier’s existing molds) | $12,000–$25,000 (frame molds, custom IoT housing) | Factor tooling into TCO for volumes >2,000 units |

| Lead Time | 30–45 days | 60–90 days (+30 days for tooling validation) | Plan 6+ months for private label launches |

| Minimum Order (MOQ) | 300 units | 1,000 units (per unique SKU) | Avoid splitting MOQ across colors/models |

| Quality Control | Supplier’s standard QC | Client-defined QC protocols + 3rd-party audits | Mandatory for private label; audit factory IoT testing capability |

| IP Ownership | Supplier retains design IP | Client owns final product IP | Contract must specify IoT firmware ownership |

Critical Insight: 73% of failed bike-sharing deployments stem from underestimating IoT integration complexity (SourcifyChina 2025 Post-Mortem Analysis). Private label requires deep collaboration with suppliers on smart lock firmware and GPS module calibration – treat this as core to sourcing strategy.

Estimated Cost Breakdown (Per Unit, FOB Shenzhen)

Based on 2026 mid-range aluminum frame bike (22″ wheel, integrated IoT lock, solar-powered GPS)

| Cost Component | White Label | Private Label | 2026 Cost Driver Notes |

|---|---|---|---|

| Materials | $88–$105 | $102–$132 | Aluminum (+4.2% YoY); IoT chips stabilized after 2025 shortage |

| Frame/Fork | $32–$40 | $45–$58 | Custom geometry adds $13–$18 |

| IoT System | $28–$35 | $33–$42 | EU/US certification adds $5–$8 (mandatory) |

| Other Components | $28–$30 | $24–$32 | Branded tires/brakes reduce material cost |

| Labor | $14–$18 | $18–$24 | Complex assembly (IoT wiring) adds 30% labor |

| Packaging | $6.50–$8.50 | $9.00–$12.00 | Custom retail boxes + ESD protection for electronics |

| TOTAL PER UNIT | $108.50–$131.50 | $129.00–$168.00 | Excludes freight, tariffs, and tooling amortization |

Hidden Cost Alert: EU REACH/US CPSIA compliance testing adds $3.50/unit. Budget $8,000–$15,000 for initial certification per model.

MOQ-Based Price Tier Analysis (Per Unit, FOB Shenzhen)

White Label vs. Private Label Comparison (2026 Forecast)

| Order Volume | White Label | Private Label | Key Cost-Saving Levers |

|---|---|---|---|

| 500 units | $138.00–$162.00 | Not feasible | Avoid – exceeds supplier break-even point |

| 1,000 units | $122.00–$142.00 | $158.00–$185.00 | White label: Optimize color variants (max 2 colors) |

| 5,000 units | $105.00–$124.00 | $127.00–$149.00 | STRONG BUY ZONE: Private label tooling cost amortized to $2.50/unit |

| 10,000+ units | $96.00–$112.00 | $112.00–$131.00 | Lock in aluminum futures contracts to offset YoY inflation |

Procurement Tip: At 5,000+ units, negotiate fixed material cost clauses to mitigate aluminum volatility. Top performers achieve 8–12% savings via container consolidation (combine with e-scooter orders).

Actionable Recommendations for Procurement Managers

- Avoid MOQ Traps: Suppliers quoting <500-unit MOQs for private label lack production scale – verify factory capacity.

- IoT is Non-Negotiable: Audit suppliers for in-house IoT testing labs (ask for FCC/CE test reports for GPS modules).

- Total Cost of Ownership (TCO): Factor in 22% higher maintenance costs for white label bikes due to generic component failure (2025 field data).

- ESG Compliance: 92% of EU tenders now require ISO 14001-certified factories – verify supplier ESG documentation.

- Contract Safeguards: Include IoT firmware update clauses and spare parts inventory commitments (min. 3 years).

“The lowest unit price often becomes the highest TCO in bike-sharing. Prioritize suppliers with proven IoT integration – not just frame welding.”

– SourcifyChina Manufacturing Advisory Board, 2026

SourcifyChina Advisory

For tailored supplier shortlists or MOQ optimization modeling, contact your SourcifyChina account manager. All data sourced from 2026 contracted supplier rate cards (Q4 2025) and validated via 127 factory audits.

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Empowering Global Sourcing Decisions Since 2018

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify Manufacturers for Bike-Sharing Companies in China

Issued by: SourcifyChina | Senior Sourcing Consultant

Date: January 2026

Executive Summary

As global demand for sustainable urban mobility rises, bike-sharing companies continue to expand operations—many sourcing directly from Chinese manufacturers. Ensuring supply chain integrity, product quality, and cost efficiency is paramount. This report outlines a structured verification process to identify authentic factories (vs. trading companies), mitigate sourcing risks, and optimize procurement outcomes in China’s competitive e-bike and dockless bike manufacturing sector.

1. Critical Steps to Verify a Manufacturer in China

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1.1 | Request Full Company Documentation | Confirm legal registration and operational legitimacy | Verify Business License (统一社会信用代码), scope of operations, and registered capital via China’s National Enterprise Credit Information Publicity System (www.gsxt.gov.cn) |

| 1.2 | Conduct On-Site Factory Audit | Validate production capacity, machinery, workforce, and quality control | Engage third-party inspection firm (e.g., SGS, TÜV, or SourcifyChina’s audit team) for unannounced visits |

| 1.3 | Review Equipment & Production Lines | Assess manufacturing capability for aluminum frames, e-drivetrains, IoT integration | Confirm ownership of CNC machines, welding bots, painting lines, and testing labs |

| 1.4 | Evaluate R&D and Engineering Team | Ensure product innovation and customization capability | Review patents, design portfolios, and engineer credentials (e.g., experience with IoT locks, GPS tracking, battery systems) |

| 1.5 | Audit Quality Management Systems (QMS) | Ensure compliance with international standards | Confirm ISO 9001, ISO 14001, and product-specific certifications (e.g., EN 15194 for e-bikes) |

| 1.6 | Request Client References & Case Studies | Validate track record with OEM/ODM projects | Contact past or current clients in bike-sharing sector (e.g., Mobike, HelloRide, overseas operators) |

| 1.7 | Perform Sample Testing & Durability Trials | Ensure real-world performance | Conduct lab and field tests on frame fatigue, battery life, lock reliability, and weather resistance |

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory | Trading Company | Recommended Action |

|---|---|---|---|

| Business License Scope | Lists manufacturing activities (e.g., “bicycle production”, “metal fabrication”) | Lists “import/export”, “wholesale”, “trading” | Cross-check with official registry |

| Factory Address & Facilities | Owns or leases industrial property; visible production lines on-site | Office-only address (e.g., in commercial buildings) | Conduct GPS-verified site visit |

| Production Equipment Ownership | Shows machinery under company name (invoices, maintenance logs) | No machinery on-site; outsourced production | Request equipment purchase records |

| Workforce Structure | Employ engineers, welders, QC staff; high headcount in production | Sales-focused team; few technical staff | Interview floor managers and supervisors |

| Lead Times & MOQ Flexibility | Can adjust production schedules; direct control over capacity | Longer lead times (dependent on third-party factories) | Request production timeline breakdown |

| Pricing Transparency | Provides cost breakdown (material, labor, overhead) | Offers fixed quotes with limited transparency | Request BOM (Bill of Materials) analysis |

| Customization Capability | Offers structural, electrical, and software modifications | Limited to cosmetic changes or pre-existing models | Test with a custom design request |

✅ Pro Tip: Use satellite imagery (e.g., Google Earth) to verify industrial footprint. Factories have loading docks, large roofs, and storage yards—trading companies do not.

3. Red Flags to Avoid When Sourcing in China

| Red Flag | Risk Implication | Recommended Mitigation |

|---|---|---|

| Unwillingness to Allow Factory Audits | High risk of misrepresentation or subcontracting | Make audit a contractual prerequisite |

| No Physical Address or Virtual Office | Likely trading intermediary or shell company | Require verified GPS coordinates and video walkthrough |

| Overly Aggressive Pricing (Below Market) | Indicates substandard materials, labor violations, or hidden costs | Benchmark against 3+ verified suppliers; request material specs |

| Lack of Industry-Specific Certifications | Non-compliance with safety, environmental, or export standards | Require ISO, CE, RoHS, and EN 15194 (for e-bikes) |

| Poor Communication on Technical Details | Suggests lack of engineering capability | Assign technical questionnaire on frame stress testing, battery BMS, firmware updates |

| Refusal to Sign NDA or IP Agreement | Risk of design theft or unauthorized replication | Use China-enforceable IP clauses; register designs locally |

| No Experience with Bike-Sharing Operators | Unproven at scale, high failure risk in durability and IoT integration | Prioritize suppliers with 2+ proven deployments |

| Payment Terms Require 100% Upfront | High fraud risk | Use secure payment methods (e.g., LC, Escrow); max 30% deposit |

4. Best Practices for Long-Term Supplier Success

- Establish a Tiered Supplier Strategy: Use primary (factory) and secondary (backup) manufacturers to avoid single-source dependency.

- Implement Continuous Monitoring: Schedule quarterly performance reviews and annual audits.

- Leverage Local Representation: Employ a sourcing agent or legal entity in China for dispute resolution and compliance.

- Adopt Digital Supply Chain Tools: Use IoT-enabled QC monitoring and blockchain for traceability (e.g., material origin, production timestamps).

Conclusion

For global procurement managers, sourcing from China’s bike and e-bike manufacturers offers cost and innovation advantages—but only with rigorous due diligence. By systematically verifying factory authenticity, distinguishing true manufacturers from intermediaries, and avoiding common red flags, organizations can build resilient, high-performance supply chains capable of supporting large-scale urban mobility deployments.

Partnering with an experienced sourcing consultant like SourcifyChina ensures compliance, quality, and scalability in every procurement cycle.

Contact: [email protected] | www.sourcifychina.com

Confidential – For Internal Procurement Use Only

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Verified Supplier Procurement for China’s Bike Sharing Market

Prepared for Global Procurement Leaders | Q3 2026

Executive Summary: The Critical Time Drain in China Sourcing

China’s bike sharing market remains fragmented, with 68% of suppliers failing compliance checks (2025 CBRE Logistics Survey) and 120+ hours lost per procurement cycle verifying operational legitimacy, certifications, and production capacity. Traditional sourcing methods—manual Alibaba searches, trade show follow-ups, and unvetted referrals—expose procurement teams to supplier fraud, regulatory non-compliance, and project delays.

SourcifyChina’s Verified Pro List eliminates these risks through a proprietary 7-stage validation process, delivering only suppliers meeting:

✅ ISO 9001 & China GB Standards compliance

✅ Minimum 3 years operational history

✅ Valid export licenses & anti-dumping certifications

✅ Real-time capacity audits (2026 data)

Time Savings Analysis: DIY Sourcing vs. SourcifyChina Pro List

| Process Step | Hours Spent (DIY Sourcing) | Hours Spent (Pro List) | Time Saved |

|---|---|---|---|

| Supplier Identification | 45+ | 5 | 40 hrs |

| Compliance Verification | 38 | 2 | 36 hrs |

| Factory Audit Coordination | 28 | 0 (Pre-audited) | 28 hrs |

| Contract Negotiation | 22 | 8 | 14 hrs |

| TOTAL | 133+ hours | 15 hours | 118 hours/cycle |

Source: 2026 SourcifyChina Client Benchmark (n=47 multinational clients)

Why Procurement Leaders Choose Our Pro List

- Risk Mitigation: Avoid $220K+ average losses from counterfeit suppliers (2025 ICC Fraud Report).

- Regulatory Assurance: Full alignment with China’s 2026 E-Bike Safety Directive (GB 17761-2026).

- Speed-to-Market: 73% faster onboarding vs. industry average (per client data).

- Cost Transparency: No hidden fees—fixed-rate access to 28 pre-qualified Tier 1/2 suppliers (e.g., Hellobike OEM partners, Mobike legacy manufacturers).

“SourcifyChina’s Pro List cut our supplier vetting from 11 weeks to 9 days. We now onboard partners with zero compliance callbacks.”

— Global Sourcing Director, Top 3 European Micro-Mobility Operator

✨ Your Competitive Advantage Starts Now

Stop losing budget to unverified suppliers. The bike sharing market’s consolidation in 2026 means only compliant, scalable partners survive. With SourcifyChina, you gain:

– Immediate access to 28 pre-vetted manufacturers (including 5 with DTC export experience)

– Dedicated sourcing engineer for RFP optimization

– Zero-risk trial: First supplier match guaranteed or 100% fee refund

🔍 Take Action in < 60 Seconds

Contact our Sourcing Engineering Team Today to Activate Your Pro List Access:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Subject Line Tip: “Pro List Access Request – [Your Company] – Bike Sharing Sourcing” for priority routing.

Response Time: < 2 business hours (97% client satisfaction benchmark).

Don’t negotiate with time sinks. Negotiate from strength.

SourcifyChina: Engineering Procurement Certainty Since 2018

Confidential | © 2026 SourcifyChina. All rights reserved. Data sourced from proprietary audits, China Bicycle Association, and client case studies. Not for redistribution.

🧮 Landed Cost Calculator

Estimate your total import cost from China.