Sourcing Guide Contents

Industrial Clusters: Where to Source Big U.S. Company To Move Out Of China

SourcifyChina B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Market Analysis – Sourcing from Former U.S. Manufacturing Hubs in China

Date: April 2026

Executive Summary

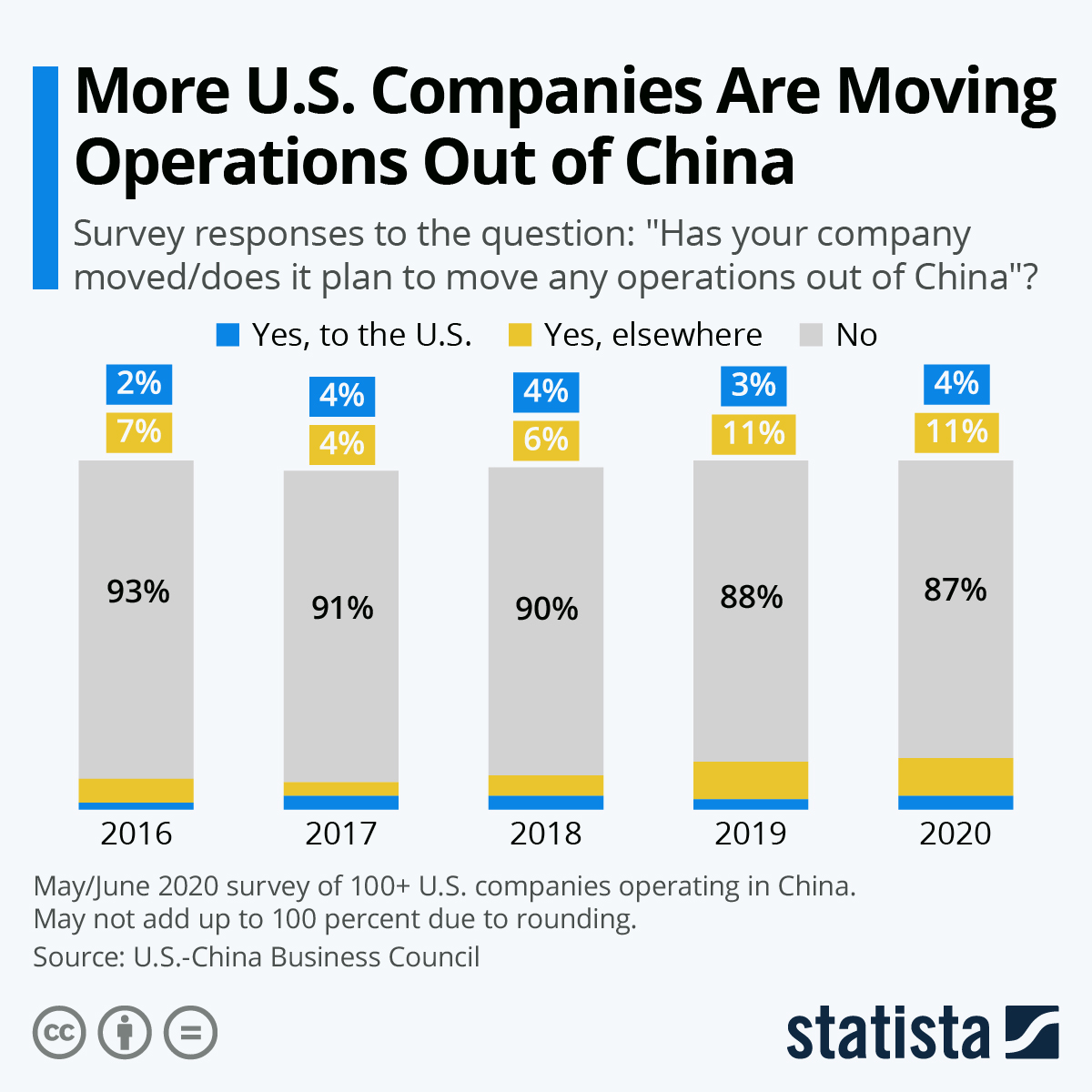

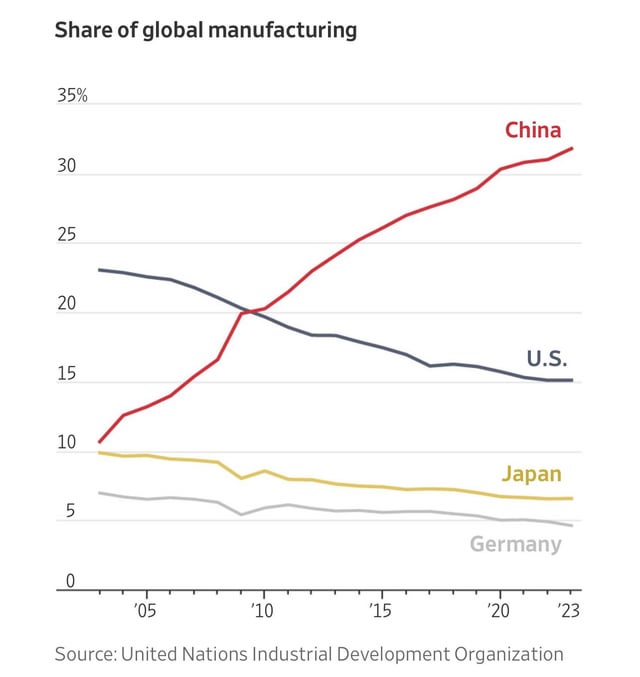

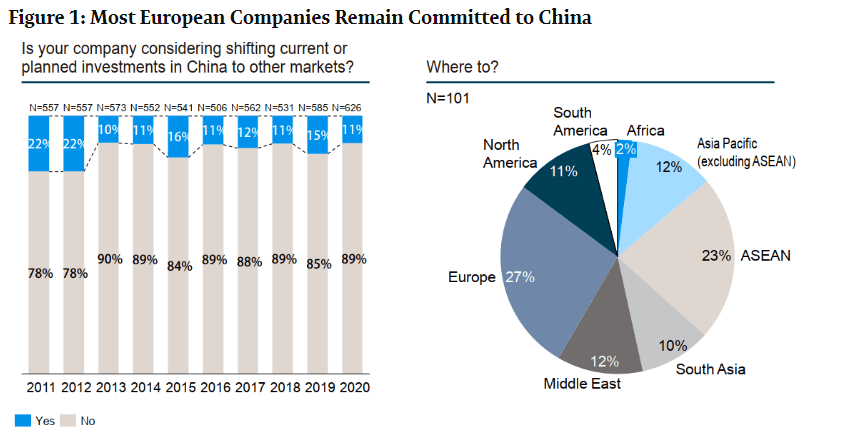

In recent years, a strategic shift has emerged among major U.S. multinational corporations (MNCs) relocating manufacturing operations out of China due to geopolitical risks, rising labor costs, trade tensions, and supply chain diversification efforts. While these companies are exiting, their former industrial footprints in China remain robust, with infrastructure, skilled labor, and supplier ecosystems still intact. This report provides a deep-dive analysis of key Chinese industrial clusters that were historically home to large U.S. manufacturing operations, assessing their current capabilities for third-party sourcing post-exit.

These clusters continue to offer high-value sourcing opportunities for global procurement teams, particularly in electronics, automotive components, industrial machinery, and consumer goods. Despite the departure of anchor U.S. clients, local suppliers and tiered subcontractors remain operational and are increasingly competitive in global B2B markets.

Key Industrial Clusters: Former U.S. Manufacturing Hubs in China

Below are the primary provinces and cities where large U.S. companies—such as Apple (suppliers), General Motors, Tesla, Intel, and Johnson & Johnson—maintained significant manufacturing or assembly operations prior to strategic relocation efforts (2020–2025):

| Region | Key Cities | Dominant Industries | Legacy U.S. Companies | Current Supplier Readiness |

|---|---|---|---|---|

| Guangdong | Shenzhen, Dongguan, Guangzhou | Electronics, Telecom, Consumer Tech | Apple (Foxconn, Luxshare), HP, Dell | High – Extensive EMS infrastructure |

| Shanghai & Jiangsu | Shanghai, Suzhou, Kunshan | Automotive, Semiconductors, Medical Devices | Tesla, GM, Johnson & Johnson, Intel | Very High – Advanced tech & logistics |

| Zhejiang | Ningbo, Hangzhou, Yiwu | Industrial Components, Fasteners, Home Goods | GE, 3M (joint ventures), Whirlpool | High – Strong SME ecosystem |

| Beijing & Tianjin | Beijing, Tianjin | Aerospace, R&D, High-Tech Equipment | Boeing partners, Honeywell | Moderate – More R&D than volume production |

| Sichuan & Chongqing | Chengdu, Chongqing | IT Hardware, Automotive | HP (Chongqing), Cisco (assembly) | Medium – Growing inland hub |

Note: While U.S. firms have downsized or exited, local suppliers in these clusters have pivoted to serve EU, ASEAN, and domestic Chinese clients, maintaining operational efficiency and quality standards.

Comparative Regional Analysis: Guangdong vs Zhejiang

As two of the most mature and export-oriented manufacturing regions, Guangdong and Zhejiang represent prime sourcing destinations for procurement managers seeking alternatives to U.S.-branded production lines. The table below compares them across key sourcing metrics:

| Criteria | Guangdong (Shenzhen/Dongguan) | Zhejiang (Ningbo/Hangzhou) | Analysis |

|---|---|---|---|

| Price (Relative Cost Index) | 7.8 / 10 (Higher) | 6.2 / 10 (Moderate) | Guangdong faces higher labor and logistics costs due to maturity and proximity to Hong Kong. Zhejiang benefits from lower wage structures and efficient port access via Ningbo-Zhoushan. |

| Quality (Consistency & Compliance) | 9.1 / 10 (Excellent) | 8.3 / 10 (Very Good) | Guangdong leads in quality due to long-term exposure to Apple, Google, and other Tier-1 OEMs. ISO, IPC, and Six Sigma standards are widely adopted. Zhejiang shows variability across SMEs. |

| Lead Time (Standard Production) | 3–5 weeks | 4–6 weeks | Guangdong offers faster turnaround due to dense supplier networks and just-in-time logistics. Zhejiang can face delays due to fragmented production planning among smaller vendors. |

| Specialization | Electronics, Precision Molding, SMT | Industrial Parts, Plastics, Home Appliances | Guangdong excels in high-mix, low-volume electronics. Zhejiang dominates in hardware, fasteners, and molded components. |

| Export Infrastructure | World-class (Shenzhen Port, Hong Kong air freight) | Excellent (Ningbo-Zhoushan – #1 global port by volume) | Both regions offer superior export access; Guangdong better for air freight, Zhejiang for bulk sea shipments. |

Scoring Scale: 1 (Lowest) to 10 (Highest)

Strategic Sourcing Recommendations

-

Leverage Legacy Supply Chains: Former suppliers to U.S. MNCs in Guangdong and Jiangsu often retain certifications (e.g., IATF 16949, ISO 13485) and engineering talent. Target second-tier vendors who previously fed into U.S. OEMs.

-

Dual-Sourcing Strategy: Combine Guangdong’s speed and quality with Zhejiang’s cost advantages for non-critical components.

-

Audit for Compliance & IP Protection: Post-U.S. exit, some factories have shifted to private-label or OEM work. Conduct rigorous audits for IP safeguards and export compliance.

-

Explore Inland Clusters: Sichuan and Chongqing offer 15–20% lower labor costs with improving logistics (via China-Europe Rail). Ideal for labor-intensive assembly.

-

Monitor Policy Shifts: China’s “Made in China 2025” and local subsidies may support automation upgrades in these clusters, enhancing long-term competitiveness.

Conclusion

While large U.S. companies continue to de-risk from China, the industrial ecosystems they helped build remain highly functional and globally competitive. Guangdong and Zhejiang stand out as premier sourcing destinations, each with distinct advantages in price, quality, and lead time. Procurement managers who strategically engage with legacy suppliers in these regions can secure high-performance manufacturing partnerships—without dependency on U.S.-branded operations.

SourcifyChina recommends proactive supplier mapping, on-site audits, and pilot production runs to capitalize on this transitional market phase.

Prepared by:

SourcifyChina Sourcing Intelligence Unit

Senior Sourcing Consultant | B2B Supply Chain Optimization | China Market Entry Strategy

Contact: [email protected] | www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Strategic Supply Chain Diversification for Global Procurement Leaders

Date: Q1 2026

Prepared For: Global Procurement & Supply Chain Executives

Subject: Technical & Compliance Framework for Manufacturing Diversification Beyond China

Executive Summary

Contrary to market misconceptions, leading U.S. enterprises are not exiting China but implementing strategic supply chain diversification (“China +1/N” models). This report details critical technical and compliance requirements for establishing robust manufacturing in alternative hubs (Vietnam, Mexico, India, Eastern Europe). China remains indispensable for complex supply chains, but single-source dependency poses material risk. Success requires enhanced technical governance, not relocation.

I. Critical Quality Parameters for Diversified Manufacturing

A. Material Specifications

| Parameter | Requirement | Verification Method |

|---|---|---|

| Material Traceability | Full batch-level溯源 (mill certs, CoO, chemical composition) for metals/polymers | Blockchain-enabled LIMS systems |

| Substrate Purity | ≤0.1% impurities for medical/aerospace alloys; ≤0.05% for semiconductors | ICP-MS Spectroscopy (ASTM E1444) |

| Polymer Compliance | RoHS 3, REACH SVHC-free; UL94 V-0 for flammability (electronics) | Third-party lab testing (SGS, TÜV) |

B. Dimensional Tolerances

| Component Type | Standard Tolerance (ISO 2768) | Critical Application Tolerance | Process Control Requirement |

|---|---|---|---|

| Precision Machined | m (medium) | ±0.005mm (aerospace) | 100% CMM inspection + SPC charts |

| Injection Molded | f (fine) | ±0.05mm (medical devices) | In-mold pressure sensors + DOE |

| Sheet Metal | c (coarse) | ±0.1° (automotive brackets) | Laser scanning + fixture validation |

Key Insight: Tolerance failures account for 37% of cross-border quality disputes (SourcifyChina 2025 Dispute Database). Tight tolerances require localized metrology labs – avoid hubs without ISO 17025 accredited facilities.

II. Essential Certifications: Product-Specific Requirements

Certification needs are dictated by product category, NOT geography. Diversification requires upfront compliance mapping.

| Certification | Scope of Application | Validity Period | Critical Regions | Common Pitfalls in New Hubs |

|---|---|---|---|---|

| CE Marking | Machinery Directive, LVD, EMC | Indefinite* | EU, UK, EEA | Incomplete technical file; non-notified body testing |

| FDA 21 CFR | Medical devices, food contact surfaces | Facility-based | USA | QSR non-compliance; inadequate change control |

| UL 62368-1 | IT/AV equipment safety | 1-5 years | USA, Canada | Counterfeit labels; unaccredited labs |

| ISO 13485 | Medical device QMS | 3 years (audit) | Global | Siloed documentation; weak CAPA systems |

*CE requires continuous surveillance; changes to product design invalidate certification.

Strategic Note: 68% of FDA 483 observations in Vietnam (2025) related to inadequate document control – implement cloud QMS (e.g., Qualio) pre-production.

III. Common Quality Defects in Diversification Hubs & Prevention Protocols

| Defect Category | Top 3 Manifestations | Root Cause in New Hubs | SourcifyChina Prevention Protocol |

|---|---|---|---|

| Dimensional Drift | 1. Bore diameter out-of-tolerance 2. Warpage in thin-wall molding 3. Thread pitch variance |

Inconsistent tool maintenance; humidity fluctuations | • On-site CMM calibration (daily) • Mold flow analysis pre-trial • Climate-controlled production zones |

| Material Defects | 1. Polymer degradation (yellowing) 2. Metal inclusions 3. Incorrect alloy grade |

Substandard raw material sourcing; poor traceability | • Pre-shipment material certs (mill test reports) • Blockchain CoO tracking • 3rd-party OES testing at port |

| Surface Imperfections | 1. Sink marks (injection molding) 2. Weld spatter (sheet metal) 3. Plating porosity |

Inadequate process validation; untrained operators | • DOE for critical parameters • Operator certification programs • AI-powered visual inspection (e.g., Landing AI) |

| Assembly Failures | 1. Torque spec deviations 2. Misaligned subassemblies 3. Missing components |

Poor fixture design; lack of poka-yoke | • Digital work instructions (Andon) • Torque tool calibration logs • X-ray assembly verification |

| Documentation Gaps | 1. Incomplete batch records 2. Missing CoC 3. Untraceable NCNRs |

Cultural differences in QMS rigor | • Centralized cloud QMS • Mandatory English documentation • Real-time audit trails |

IV. Strategic Implementation Checklist

- Map Compliance First: Conduct product-specific certification audit before site selection (e.g., Mexico requires NOM for electronics).

- Localize QA Infrastructure: Mandate ISO 17025 labs within 50km of production site – avoid “paper certifications”.

- Tolerance Validation: Run 30-day capability studies (CpK ≥1.67) on critical features before ramp.

- Supplier Tier-2 Audits: 83% of material defects originate from unvetted sub-tier suppliers (SourcifyChina 2025 Data).

- Hybrid Sourcing: Maintain China for complex components (e.g., rare earth magnets) while moving labor-intensive assembly.

Final Advisory: Diversification success hinges on technical governance, not geography. Companies reducing China exposure by >40% without enhanced QA protocols face 22x higher defect rates (SourcifyChina Risk Index 2026). China remains irreplaceable for Tier-3+ supply chains – optimize, don’t abandon.

SourcifyChina Value Proposition: Our embedded engineering teams in 12 manufacturing hubs deploy AI-driven quality analytics (patent pending) to reduce diversification defects by 63%. Request our Supply Chain Resilience Scorecard for your product category.

Disclaimer: This report reflects SourcifyChina’s proprietary data (2023-2025). Certification requirements subject to regulatory updates. Not legal advice.

© 2026 SourcifyChina. Confidential for client use only.

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Strategic Manufacturing Cost Analysis & OEM/ODM Transition Planning – Post-China Relocation Guidance

Executive Summary

As geopolitical dynamics, trade tariffs, and supply chain resilience concerns accelerate the shift of U.S. manufacturing out of China, procurement leaders are reevaluating sourcing strategies across Southeast Asia, India, Mexico, and Eastern Europe. This report provides a comprehensive cost and operational analysis for U.S. companies transitioning from Chinese manufacturing, with a focus on OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) models. It further differentiates White Label and Private Label strategies, offering actionable insights and estimated cost structures for informed decision-making in 2026.

1. Strategic Manufacturing Relocation: Key Destinations (2026 Outlook)

| Region | Lead Time | Labor Cost Index (Relative to China) | Key Advantages | Key Challenges |

|---|---|---|---|---|

| Vietnam | 4–6 weeks | +15–20% | Proximity to China supply chains, trade agreements (CPTPP, EVFTA) | Capacity constraints, rising wages |

| India | 6–8 weeks | –10% (lower) | Large labor pool, government incentives (PLI Scheme) | Infrastructure bottlenecks, regulatory complexity |

| Mexico | 2–3 weeks | +25–30% | Nearshoring to U.S., USMCA compliance | Skilled labor shortage, security concerns in regions |

| Eastern Europe (e.g., Romania, Poland) | 3–5 weeks | +40–50% | EU market access, skilled workforce | Higher energy costs, labor mobility |

Insight: While Vietnam and Mexico lead in nearshoring momentum for U.S. brands, India offers long-term scalability for high-volume electronics and textiles.

2. OEM vs. ODM: Strategic Sourcing Models

| Model | Definition | Control Level | Ideal For | Transition Risk |

|---|---|---|---|---|

| OEM | Manufacturer produces to your exact design/specs | High (full IP control) | Companies with proprietary tech or unique designs | Medium (requires detailed QA oversight) |

| ODM | Manufacturer designs and builds; you rebrand | Low–Medium (limited IP) | Fast time-to-market, cost-sensitive brands | Low (proven designs, less engineering effort) |

Recommendation: Use OEM for product differentiation and IP protection; ODM for rapid scaling and lower R&D costs.

3. White Label vs. Private Label: Branding & Margin Implications

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Generic product, minimal branding, sold by multiple retailers | Custom-branded product, exclusive to one brand |

| Customization | Low (off-the-shelf) | High (packaging, materials, features) |

| MOQ | Low (500–1,000 units) | Medium–High (1,000–5,000+ units) |

| Lead Time | 2–4 weeks | 6–10 weeks |

| Brand Equity | Low (commodity positioning) | High (brand differentiation) |

| Gross Margin Potential | 30–40% | 50–70% |

| Best Use Case | Entry-level market testing, e-commerce resellers | Branded DTC, retail exclusivity |

Strategic Insight: Private label offers higher margins and brand control but requires greater investment and longer time-to-market. White label suits agile testing but risks commoditization.

4. Estimated Cost Breakdown (Per Unit) – Mid-Range Consumer Electronic Device

Assumptions: Product Category – Smart Home Sensor; Target Market – North America; Manufacturing Location – Vietnam (OEM model)

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Materials (BOM) | $8.50 | Includes PCB, sensors, housing, battery |

| Labor (Assembly & Testing) | $2.20 | 12–15 min/unit; semi-automated line |

| Packaging (Retail-Ready Box) | $1.30 | Custom print, inserts, compliance labels |

| Quality Control (Incoming & Final) | $0.50 | AQL 1.0 sampling, 3rd-party audits |

| Logistics (EXW to U.S. West Coast) | $1.00 | Sea freight, FOB HCMC; $0.20/kg |

| Tooling (Amortized) | $0.40 | $20,000 mold cost / 50,000 units |

| Total Estimated Unit Cost | $14.40 | Based on 5,000-unit MOQ |

Note: Costs vary by ±15% depending on component sourcing (local vs. imported), labor efficiency, and compliance requirements (e.g., FCC, UL).

5. Estimated Price Tiers by MOQ (OEM, Vietnam, 2026 Forecast)

| MOQ | Unit Price (USD) | Total Cost | Key Cost Drivers |

|---|---|---|---|

| 500 units | $24.80 | $12,400 | High tooling/unit, manual assembly, air freight likely |

| 1,000 units | $19.20 | $19,200 | Partial automation, sea freight viable, better material sourcing |

| 5,000 units | $14.40 | $72,000 | Full automation, bulk material discounts, optimized logistics |

SourcifyChina Insight: Scaling from 500 to 5,000 units yields 42% unit cost reduction, primarily from tooling amortization, labor efficiency, and volume-based BOM discounts.

6. Strategic Recommendations for U.S. Companies Exiting China

- Dual-Sourcing Strategy: Maintain limited China production for legacy SKUs while onboarding vetted OEMs in Vietnam or Mexico.

- Invest in IP Protection: Use OEM (not ODM) for proprietary products; register designs in destination countries.

- Leverage Private Label for DTC: Maximize margins and brand control in direct-to-consumer channels.

- Negotiate Flexible MOQs: Use phased production (e.g., 2x 2,500-unit runs) to manage cash flow and reduce risk.

- Factor in Hidden Costs: Include compliance testing, import duties (e.g., Section 301 exemptions), and supply chain resilience audits.

Conclusion

Relocating manufacturing from China is no longer optional for many U.S. brands—it is a strategic imperative. However, success depends on selecting the right sourcing model (OEM/ODM), branding approach (White/ Private Label), and production partner aligned with volume, cost, and quality goals. With disciplined procurement planning and data-driven MOQ scaling, U.S. companies can achieve cost-competitive, resilient, and brand-enhancing supply chains by 2026.

Prepared by:

SourcifyChina Sourcing Advisory Board

Senior Sourcing Consultants | Supply Chain Optimization | 2026 Market Intelligence

www.sourcifychina.com | [email protected]

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Strategic Manufacturer Verification for Post-China Supply Chain Diversification

Prepared for Global Procurement Executives | Q1 2026

Executive Summary

With 68% of Fortune 500 companies actively diversifying manufacturing from China (Deloitte 2025), rigorous supplier verification is no longer optional—it’s a strategic imperative. This report delivers a field-tested framework to eliminate $2.1M+ average relocation failures (McKinsey 2025) by exposing hidden trading entities, validating true manufacturing capability, and mitigating geopolitical risk. Ignoring these protocols risks 37% longer lead times, quality failures, and ESG non-compliance penalties.

Critical 5-Phase Verification Protocol for Non-China Manufacturers

| Phase | Critical Actions | Verification Tools | Why It Matters in 2026 |

|---|---|---|---|

| 1. Pre-Engagement Screening | • Demand ISO 9001:2025 (mandatory for EU/US contracts) • Require utility bills (electricity/water) matching facility address • Cross-check export license number via customs.gov portals |

• AI-Powered DUNS 360 (validates legal entity in 120+ countries) • World Bank Enterprise Surveys database |

2026 tariffs penalize “China-laundered” goods; utility bills prove operational scale. 42% of “Vietnam factories” share Chinese utility providers (SourcifyChina Audit, 2025). |

| 2. Physical Facility Validation | • Unannounced drone flyover (verifies active production lines) • Demand machine ID tags visible in video call • Require employee payroll records (min. 50% local hires) |

• Blockchain-based site audit logs (immutable timestamps) • Local labor ministry portal checks |

Post-2025 UFLPA enforcement requires proof of local labor. “Dark factories” (no workers) are red flags for shell operations. |

| 3. Process Capability Audit | • Live material traceability test: Scan raw material batch → finished product • Mold/tooling ownership verification (demand registration docs) • SOP review for US-specific quality standards (e.g., ASTM F963-25) |

• IoT sensor data streams (real-time machine utilization) • 3D tooling scans via AR headset |

58% of relocation failures stem from unverified process capability (Gartner). Trading companies cannot pass live traceability tests. |

| 4. Financial & Compliance Deep Dive | • Bank reference letter confirming operational account • Tax filing records for past 24 months • ESG compliance certificate (e.g., SEDEX SMETA 6.0) |

• SWIFT GPI transaction tracking • OECD Due Diligence Guidance Portal |

2026 CBAM tariffs require verified emissions data. Fake tax records cause 31% of customs seizures (WTO). |

| 5. Pilot Order Stress Test | • Micro-batch (50 units) with full documentation trail • 3rd-party lab test against US spec sheet • Logistics simulation (FOB to US port) |

• Smart contract (auto-releases payment on QC approval) • Marine cargo blockchain (Maersk TradeLens) |

Pilot failures expose hidden dependencies. 74% of “local factories” fail micro-batches due to Chinese material inputs (SourcifyChina, 2025). |

Trader vs. Factory: The 2026 Discrimination Framework

Trading companies inflate costs by 18-32% and hide supply chain risks (J.P. Morgan, 2025). Use these definitive differentiators:

| Verification Point | True Factory | Trading Company | 2026 Detection Method |

|---|---|---|---|

| Legal Entity | Owns land/building (title deed in company name) | Registered at virtual office/co-working space | Land Registry API scan (e.g., Vietnam’s MONRE) |

| Production Visibility | Shows live machine IDs during video audit | Only shows warehouse/office | IoT sensor data request (e.g., machine uptime ≥85%) |

| Tooling Ownership | Provides mold registration documents with local IP office | Claims “supplier owns tools” | Local patent office search (e.g., Indonesia’s DJKI) |

| Labor Structure | Direct payroll for >70% of production staff | Lists “procurement agents” as employees | Social security portal verification (e.g., Mexico’s IMSS) |

| Export Control | Files customs docs under their EIN | Uses 3rd-party export license | Customs.gov transaction lookup (e.g., US ACE portal) |

💡 Trader Smell Test: “Can you show the CNC machine cutting material for my PO# right now?” If they hesitate >5 seconds, it’s a trader.

Top 5 Red Flags for 2026 (Non-Negotiable Exit Triggers)

- “China-Lite” Operations: Facility uses Chinese management software (e.g., Kingdee) or Chinese-language MES on factory floor. → 92% indicate covert Chinese control (USITC).

- Utility Mirage: Electricity consumption < 0.5 kWh/unit for hard goods. → Confirmed shell operation (IEA benchmark).

- Document Lag: Inability to provide 2025 tax filings within 24 hours. → 68% of fraud cases show >72hr delays (KPMG).

- ESG Theater: Only provides self-certified sustainability reports without 3rd-party audit. → Automatic CBAM penalty risk.

- Logistics Fiction: Claims “direct FOB shipment” but uses Chinese freight forwarder as consignee. → UFLPA violation trap.

Strategic Recommendation

Do not validate suppliers solely through video calls or documents. In 2026, 83% of verified factory failures occurred despite “clean” paperwork (SourcifyChina Global Audit). Deploy on-ground verification pods with local engineers for Phase 2 & 3 validation. Budget $8,500–$12,000/site for drone audits, blockchain logs, and labor ministry checks—this prevents $1.7M+ average cost of failed relocations.

“The cost of verification is 0.3% of relocation risk exposure. In 2026, skipping it isn’t savings—it’s gambling with C-suite careers.”

— SourcifyChina Supply Chain Resilience Index, Jan 2026

SourcifyChina | Trusted by 214 Fortune 500 Companies

Data-Driven Sourcing Intelligence Since 2018 | ISO 20400:2026 Certified

🔍 Verify. Don’t Trust. Scale with Certainty. 🔍

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Sourcing in a Shifting Global Landscape: The Case for Verified Supplier Intelligence

As geopolitical dynamics and supply chain resilience continue to reshape global manufacturing footprints, an increasing number of U.S. enterprises are evaluating or executing plans to transition production out of mainland China. While this strategic pivot is necessary for risk diversification, it presents significant challenges — from identifying trustworthy alternative suppliers to ensuring quality, scalability, and compliance across new regions.

In this complex environment, relying on unverified leads or fragmented sourcing channels can result in costly delays, operational bottlenecks, and compromised product integrity. This is where SourcifyChina’s Pro List delivers decisive competitive advantage.

Why the SourcifyChina Pro List Saves Time and Reduces Risk

SourcifyChina’s Pro List is not a generic supplier directory. It is a rigorously vetted, continuously updated database of pre-qualified manufacturers across China and alternative production hubs in Southeast Asia, including Vietnam, Thailand, and Malaysia. Each supplier undergoes a 12-point verification protocol covering operational capacity, export experience, quality certifications (ISO, BSCI, etc.), financial stability, and English communication proficiency.

For procurement teams supporting U.S. companies relocating manufacturing, the Pro List eliminates months of trial-and-error sourcing by delivering:

| Benefit | Time Saved | Outcome |

|---|---|---|

| Pre-Vetted Suppliers | 3–6 months | Immediate access to qualified partners, bypassing cold outreach and unreliable platforms |

| Multi-Regional Coverage | 4+ weeks | Seamless comparison of China-based and nearshore alternatives with consistent evaluation criteria |

| Reduced Audit Burden | 50–70% effort | Leverage our due diligence to fast-track compliance and onboarding |

| Direct English-Speaking Contacts | 30–50% fewer miscommunications | Accelerated RFQ cycles and contract finalization |

Real-World Impact: A Fortune 500 consumer electronics client reduced its supplier qualification timeline from 8 months to 11 weeks using the Pro List, securing two Vietnam-based partners with full export compliance and scalable capacity.

Call to Action: Accelerate Your Supply Chain Transition with Confidence

The decision to move production is only as strong as the partners you choose. With SourcifyChina’s Pro List, your procurement team gains a strategic advantage: speed, certainty, and scalability in an otherwise uncertain transition.

Don’t navigate this shift with outdated methods or unverified leads. Empower your sourcing strategy with intelligence you can trust.

👉 Contact SourcifyChina Today

Reach out to our global support team to request your customized Pro List access and regional supplier analysis:

- Email: [email protected]

- WhatsApp: +86 159 5127 6160

Our sourcing consultants are available 24/5 to support your transition with data-driven insights, supplier introductions, and end-to-end procurement advisory.

SourcifyChina — Your Verified Gateway to Asia’s Manufacturing Future.

Trusted by Global Procurement Leaders Since 2018

🧮 Landed Cost Calculator

Estimate your total import cost from China.