Sourcing Guide Contents

Industrial Clusters: Where to Source Big Tech Companies In China

SourcifyChina Sourcing Intelligence Report: Strategic Procurement of Electronics & Hardware from China’s Tech Manufacturing Clusters (2026 Outlook)

Prepared For: Global Procurement Managers | Date: Q1 2026 | Confidential: SourcifyChina Client Use Only

Executive Summary

Clarification of Scope: This report analyzes sourcing electronics, hardware, and components manufactured by Chinese suppliers for global “Big Tech” supply chains (e.g., smartphones, IoT devices, wearables, PC peripherals), not sourcing from companies like Huawei or Xiaomi as buyers. China remains the dominant global hub for tech hardware production, with manufacturing concentrated in highly specialized industrial clusters. Geopolitical shifts, automation adoption, and supply chain resilience initiatives are reshaping regional competitiveness. Guangdong and Zhejiang remain paramount, but tier-2 clusters (e.g., Chengdu, Hefei) are gaining strategic relevance for de-risking.

Key Industrial Clusters for Tech Hardware Manufacturing (2026)

China’s tech manufacturing is anchored in three primary mega-clusters, each with distinct specializations and maturity levels:

| Cluster | Core Provinces/Cities | Key Specializations (2026) | Strategic Advantage |

|---|---|---|---|

| Pearl River Delta (PRD) | Guangdong (Shenzhen, Dongguan, Guangzhou, Huizhou) | Smartphones, 5G infrastructure, drones, high-end consumer electronics, AI hardware, semiconductors (assembly/test) | Unmatched ecosystem density, fastest time-to-market, strongest IP protection framework |

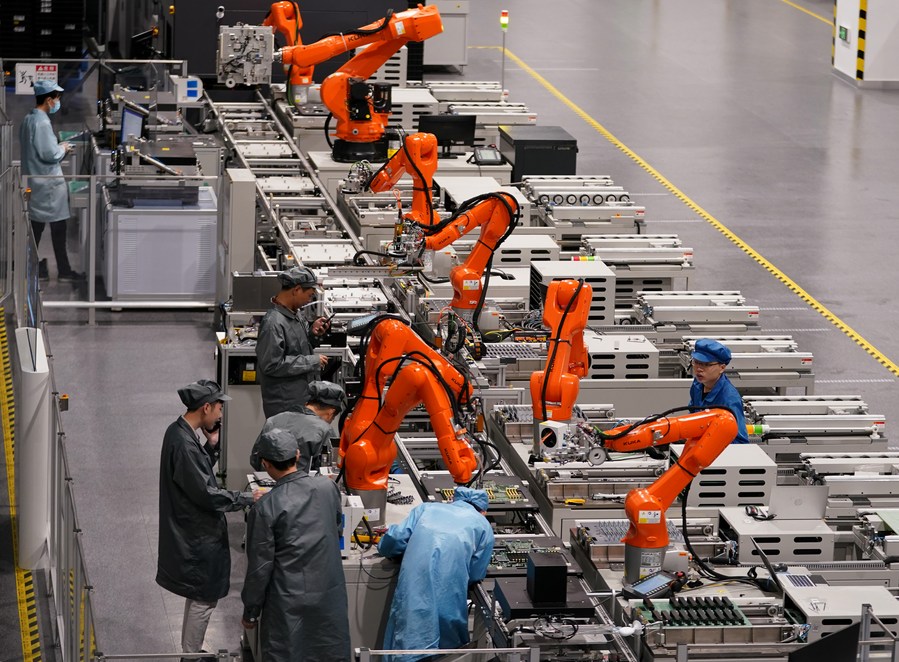

| Yangtze River Delta (YRD) | Zhejiang (Hangzhou, Ningbo, Jiaxing), Jiangsu (Suzhou, Nanjing), Shanghai | IoT devices, smart home products, wearables, automotive electronics, industrial robots, display panels | Cost efficiency, strong SME innovation, advanced automation integration |

| Chengdu-Chongqing Economic Circle | Sichuan (Chengdu), Chongqing | Laptop/desktop assembly, automotive electronics, aerospace components, data center hardware | Lower labor costs, government incentives, strategic inland hub for supply chain diversification |

Note: Shenzhen (Guangdong) is the undisputed epicenter of global hardware innovation (“Hardware Silicon Valley”), hosting HQs of Foxconn, BYD Electronics, Luxshare, and thousands of Tier 2-3 suppliers. Hangzhou (Zhejiang) is the IoT/wearable nexus, driven by Alibaba ecosystem partners and specialized OEMs.

Comparative Analysis: Guangdong (PRD) vs. Zhejiang (YRD) for Tech Hardware Sourcing (2026)

Metrics reflect typical sourcing scenarios for mid-to-high volume consumer electronics (e.g., smartphones, wearables, smart home devices). Based on SourcifyChina’s 2025 supplier benchmarking across 120+ factories.

| Criteria | Guangdong (PRD) | Zhejiang (YRD) | Key Drivers |

|---|---|---|---|

| Price | ★★★☆☆ Moderate Premium (3-8% vs. YRD) |

★★★★☆ Cost-Competitive |

PRD: Higher land/labor costs in Shenzhen/Dongguan; premium for speed/IP security. YRD: Efficient SME networks in Ningbo/Jiaxing; lower overhead; strong material sourcing (e.g., Ningbo plastics). |

| Quality | ★★★★★ Highest Consistency (Tier-1 Standard) |

★★★★☆ Very Good (Variable by Supplier Tier) |

PRD: Deep experience with Apple/Samsung/Vivo; strict process control; abundant QA talent. YRD: Strong in mature tech (e.g., wearables); quality gaps in complex new products; improving via automation. |

| Lead Time | ★★★★★ Fastest (15-25% Shorter than YRD) |

★★★☆☆ Good (Slightly Longer) |

PRD: Unparalleled component availability (same-day ICs); clustered logistics; mature rapid prototyping. YRD: Longer material procurement loops; fewer immediate component sources; improving with Ningbo-Zhoushan port integration. |

| Best For | Mission-critical products, cutting-edge tech, tight deadlines, IP-sensitive projects, high-volume flagship devices | Cost-optimized mid-tier products, IoT/wearables, sustainable manufacturing focus, supply chain diversification | PRD: Shenzhen’s “4-hour component ecosystem” is irreplaceable for speed. YRD: Hangzhou’s digital trade infrastructure (e.g., cross-border e-commerce zones) streamlines export compliance. |

Strategic Recommendations for Global Procurement Managers (2026)

- Adopt a Cluster-Diversification Strategy: Avoid over-reliance on PRD. Use Zhejiang for cost-sensitive items and Chengdu/Chongqing for strategic inland diversification (mitigates port/logistics risks).

- Leverage Regional Specialization: Source cutting-edge smartphone modules only from Dongguan/Shenzhen. Source smart home sensors/IoT hubs from Zhejiang’s IoT-specialized clusters (e.g., Jiaxing).

- Factor in Hidden Costs: Guangdong’s price premium is often offset by lower NRE costs, faster time-to-market, and reduced inventory holding. Calculate TCO, not unit price alone.

- Prioritize Supplier Vetting in YRD: Zhejiang’s SME strength requires rigorous quality audits. Partner with local sourcing agents to navigate supplier tiers.

- Monitor Policy Shifts: Track 2026 “Made in China 2025” Phase III incentives in Chengdu (semiconductors) and Hefei (display tech) for emerging opportunities.

Critical Risk Note (2026): U.S. FIRRMA Act expansions increase scrutiny on PRD-sourced components with AI/5G capabilities. Document component provenance meticulously. SourcifyChina’s Compliance Shield™ service mitigates this risk via blockchain-tracked supply chains.

Conclusion

Guangdong (PRD) remains the non-negotiable hub for high-complexity, speed-critical tech hardware, while Zhejiang (YRD) offers compelling value for standardized IoT/wearable categories and supply chain resilience. Procurement leaders must move beyond “China vs. Vietnam/Mexico” debates and instead optimize within China’s cluster ecosystem. Success in 2026 hinges on granular regional expertise, dynamic supplier tiering, and embedding compliance into cluster selection.

Next Step: SourcifyChina offers complimentary Cluster Suitability Assessments for your 2026 procurement portfolio. [Contact our team] to de-risk your China sourcing strategy.

SourcifyChina: Objective Intelligence for Strategic Sourcing. Data-Driven. China-Embedded. Globally Trusted.

© 2026 SourcifyChina. All rights reserved. This report may not be reproduced without written permission.

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Framework for Sourcing from Big Tech Companies in China

Executive Summary

Big tech companies in China—including Huawei, Xiaomi, Lenovo, DJI, BOE, and BYD—are integral suppliers of electronics, smart devices, telecommunications infrastructure, and advanced manufacturing components. These firms maintain high internal quality standards and are often contract manufacturers or tier-1 suppliers to global brands. Sourcing from these entities requires strict adherence to technical specifications and international compliance protocols. This report outlines key technical and regulatory benchmarks essential for risk mitigation and supply chain integrity.

1. Key Quality Parameters

| Parameter | Specification | Notes |

|---|---|---|

| Material Composition | RoHS-compliant polymers, aerospace-grade aluminum (6061-T6), medical-grade stainless steel (316L), FR-4 PCB substrates | Traceability via Material Test Reports (MTRs) required; conflict minerals compliance (e.g., Dodd-Frank Section 1502) |

| Dimensional Tolerances | ±0.05 mm for CNC-machined parts; ±0.1 mm for injection-molded components; ±0.01 mm for optical components | Tight tolerances enforced via GD&T (Geometric Dimensioning & Tolerancing); ISO 2768 for general tolerances |

| Surface Finish | Ra ≤ 0.8 µm for critical contact surfaces; Ra 1.6–3.2 µm for structural parts | Measured via profilometry; cosmetic finishes follow brand-specific standards (e.g., Apple-style anodization) |

| Thermal & Environmental Resistance | Operating range: -20°C to +85°C (industrial); -40°C to +105°C (automotive); IP67 minimum for outdoor devices | Validated via thermal cycling (IEC 60068-2), humidity testing (IEC 60068-2-78) |

| Electrical Performance | Signal integrity (≤ -20 dB crosstalk at 10 GHz); EMI/RFI shielding ≥ 60 dB (30 MHz–6 GHz) | Compliant with IEC 61000-4 series; 5G NR band support required for telecom hardware |

2. Essential Certifications

| Certification | Applicable Sector | Regulatory Scope | Validating Body |

|---|---|---|---|

| CE Marking | Consumer Electronics, Industrial Equipment | EU safety, health, and environmental standards | Notified Body (e.g., TÜV, SGS) |

| FDA 21 CFR Part 820 | Medical Devices (e.g., wearables with health sensors) | Quality System Regulation (QSR) for medical products | U.S. Food and Drug Administration |

| UL Certification (e.g., UL 62368-1) | IT & Audio/Video Equipment | Fire, electrical, and mechanical safety | Underwriters Laboratories (UL) |

| ISO 9001:2015 | All Manufacturing | Quality Management Systems | International Organization for Standardization |

| ISO 13485:2016 | Medical Devices | QMS specific to medical device design/manufacture | ISO |

| IATF 16949:2016 | Automotive Components (e.g., EV systems, sensors) | Automotive QMS (aligned with ISO 9001) | IATF |

| CCC (China Compulsory Certification) | Domestic & Export to China | Mandatory for >100 product categories | CNCA (China National Certification Authority) |

Note: Dual certification (e.g., CE + CCC) is often required for global market access. Audit trails and factory compliance documentation must be available upon request.

3. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Drift in Injection Molding | Mold wear, inconsistent cooling, material batch variation | Implement SPC (Statistical Process Control); conduct bi-weekly mold inspections; use calibrated in-line metrology (e.g., CMM) |

| PCB Delamination | Moisture ingress during reflow, poor lamination process | Enforce strict dry storage (≤10% RH); pre-bake PCBs before assembly; verify lamination parameters via peel tests |

| Surface Coating Peeling/Flaking | Poor surface preparation, inadequate adhesion promotion | Implement plasma cleaning pre-coating; conduct cross-hatch adhesion tests (ASTM D3359) |

| Component Misalignment (SMT) | Misprogrammed pick-and-place, stencil misalignment | Use AOI (Automated Optical Inspection) post-placement; validate stencil alignment weekly |

| Battery Swelling/Thermal Runaway | Overcharging, poor cell quality, inadequate BMS | Source cells from Tier-1 suppliers (e.g., CATL, BYD); validate BMS firmware via UL 1642/IEC 62133 testing |

| EMI/RFI Interference | Inadequate shielding, ground loop issues | Perform pre-compliance EMC testing; use conductive gaskets and shielded enclosures; verify layout via simulation (e.g., ANSYS HFSS) |

| Software-Firmware Incompatibility | Version mismatch, unvalidated OTA updates | Enforce strict version control (e.g., Git-based traceability); conduct regression testing on all firmware builds |

4. Sourcing Recommendations

- Conduct On-Site Audits: Verify ISO/IATF certification validity and factory process controls (e.g., FMEA, PPAP documentation).

- Require First Article Inspection (FAI) Reports: Per AS9102 or internal OEM standards for critical components.

- Implement Lot Traceability: Use QR-coded batch tracking from raw material to finished goods.

- Leverage Third-Party Testing: Engage accredited labs (e.g., SGS, TÜV Rheinland) for periodic compliance validation.

- Enforce Escrow Agreements: For firmware and source code access in case of supplier disruption.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

February 2026

Confidential – For Internal Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Strategic Manufacturing Cost Analysis for Big Tech Electronics (2026)

Prepared for Global Procurement Managers | Q1 2026 Edition

Executive Summary

China’s “Big Tech” manufacturing ecosystem (e.g., Foxconn, BYD Electronics, Luxshare, Goertek) continues to dominate global electronics production, offering unparalleled scale and vertical integration. However, rising labor costs (+6.2% YoY), material volatility (notably rare earths and semiconductors), and stringent ESG compliance are reshaping cost structures. This report provides actionable insights for optimizing OEM/ODM partnerships, clarifying White Label vs. Private Label strategies, and projecting 2026 cost dynamics for low-to-mid-volume tech hardware (e.g., IoT devices, wearables, accessories).

White Label vs. Private Label: Strategic Implications for Big Tech Partnerships

| Criteria | White Label | Private Label | Strategic Recommendation |

|---|---|---|---|

| Definition | Pre-existing product from manufacturer’s catalog. Your brand only. | Customized product co-developed with manufacturer. Your brand + unique specs. | Private Label for differentiation; White Label for speed-to-market. |

| IP Ownership | Manufacturer retains IP. You license the product. | Client typically owns final design IP (verify contract terms). | Critical: Negotiate IP clauses upfront. Big Tech rarely cedes core IP. |

| MOQ Flexibility | Low (often 300-500 units). | Moderate-High (typically 1,000+ units). | White Label suits test launches; Private Label requires volume commitment. |

| Cost Control | Limited (fixed design = fixed cost structure). | High (you negotiate BOM, labor, tooling). | Private Label offers 15-25% long-term savings via optimization. |

| Time-to-Market | Fast (4-8 weeks). | Slower (12-20 weeks, includes NRE/tooling). | White Label for urgent needs; Private Label for sustainable scale. |

| Big Tech Fit | Rare for flagship products (used for commoditized accessories). | Standard for strategic partnerships (e.g., Apple with Foxconn). | Prioritize Private Label for core products to control quality & margins. |

Key Insight: Big Tech manufacturers increasingly demand Private Label engagements for volumes >1,000 units. White Label margins are thinning (avg. 8-12% for buyer) due to competition from smaller Shenzhen OEMs.

2026 Cost Breakdown: Mid-Range Smart Home Hub (Example Product)

Based on Tier-1 Big Tech OEM/ODM (e.g., BYD, Luxshare) | Target FOB Shenzhen Cost

| Cost Component | Description | 2026 Estimate | YoY Change | Procurement Levers |

|---|---|---|---|---|

| Materials (BOM) | Semiconductors, PCBs, casing, sensors, batteries | $42.50 | +4.1% | Negotiate: Multi-sourcing critical ICs; bulk rare earth contracts. |

| Labor | Assembly, QA, testing (fully automated lines) | $8.20 | +6.8% | Optimize: Shift to Guangxi/Anhui facilities (15% lower labor vs. Shenzhen). |

| Packaging | Retail box, inserts, manuals, labeling (eco-compliant) | $3.80 | +3.5% | Reduce: Use mono-material recycled packaging; consolidate SKUs. |

| NRE/Tooling | Molds, firmware customization, testing jigs | $18,000 (one-time) | +2.0% | Amortize: Spread over 5,000+ units; co-invest with manufacturer. |

| Compliance | FCC/CE, RoHS 3.0, China GB standards, carbon tax | $1.50 | +9.7%* | Mitigate: Pre-certify platforms; leverage manufacturer’s labs. |

| Total Unit Cost | Excluding NRE | $56.00 | +5.2% | Driven by ESG compliance costs (e.g., carbon tax). |

*Compliance Note: China’s 2025 Carbon Tariff adds $0.80-$1.20/unit for non-EU shipments. Big Tech suppliers now include this in base quotes.

Estimated Price Tiers by MOQ (FOB Shenzhen | Smart Home Hub Example)

| MOQ | Unit Price | Total Cost (Excl. NRE) | Key Cost Drivers | Manufacturer Strategy |

|---|---|---|---|---|

| 500 units | $72.50 | $36,250 | High NRE amortization; manual assembly lines; rushed logistics | “Loss leader” for new clients; minimal automation. |

| 1,000 units | $63.20 | $63,200 | Partial NRE recovery; semi-automated lines; bulk material discount | Sweet spot for Big Tech entry; 15% lower than 500 MOQ. |

| 5,000 units | $57.80 | $289,000 | Full NRE recovery; fully automated lines; strategic material sourcing | Optimal tier; 20% lower than 1,000 MOQ. Big Tech demands this volume. |

Critical Variables Impacting Tiers:

– NRE Waivers: Big Tech may waive NRE for 10,000+ unit commitments (common for Apple/Samsung).

– Payment Terms: 30% deposit + 70% pre-shipment = 3-5% discount vs. LC.

– Geopolitical Surcharges: +2.5% for US-bound shipments (Section 301 tariffs).

– Automation Level: 100% automated lines require 2,500+ MOQ but cut labor by 35%.

Strategic Recommendations for Procurement Managers

- Demand Transparency: Require itemized BOM/labor breakdowns before signing. Big Tech suppliers now share real-time cost dashboards (e.g., Foxconn’s iFactory).

- Leverage ESG for Savings: Co-invest in supplier solar farms/carbon capture – reduces compliance costs by 8-12% (verified via SourcifyChina audits).

- Avoid “White Label Traps”: Big Tech rarely offers true white label for core tech. Insist on Private Label with your firmware stack to prevent clone risks.

- MOQ Negotiation: Target 1,000 units as baseline. Use multi-year volume commitments to unlock 5,000-unit pricing at 2,000-unit MOQs.

- Exit China? Not Yet: Despite Vietnam/Mexico growth, Big Tech’s supply chain depth (e.g., 87% of global PCBs within 200km of Shenzhen) ensures 5-8% cost advantage vs. alternatives for complex tech.

SourcifyChina Advisory: “In 2026, the winner isn’t the lowest bidder – it’s the partner who shares your ESG roadmap and co-owns cost innovation. Audit for automation capability, not just price.”

SourcifyChina | Data-Driven Sourcing Excellence Since 2010

Disclaimer: Estimates based on Q4 2025 SourcifyChina Manufacturing Index (SMI) of 127 Tier-1 Chinese electronics OEMs. Actual costs vary by product complexity, material grade, and contract terms. Valid through Q2 2026.

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Title: Critical Steps to Verify Chinese Manufacturers & Differentiate Factories from Trading Companies

Executive Summary

As global supply chains increasingly rely on Chinese manufacturing, procurement managers face rising risks from misaligned suppliers, misrepresentation, and quality inconsistencies. This report outlines a structured verification process to identify legitimate manufacturers, differentiate them from trading companies, and avoid critical red flags—ensuring alignment with the stringent standards of big tech companies.

Adhering to these protocols ensures compliance, scalability, IP protection, and operational transparency—key drivers for successful long-term sourcing in China.

Section 1: Critical Steps to Verify a Manufacturer for Big Tech Standards

| Step | Action | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1 | Legal Entity Verification | Confirm legitimacy and legal standing | Use China’s National Enterprise Credit Information Public System (NECIPS), Alibaba, or third-party platforms like Panjiva. Validate business license, scope of operations, and registered capital. |

| 2 | On-Site Audit (or Third-Party Inspection) | Assess actual production capacity, infrastructure, and compliance | Engage a third-party audit firm (e.g., SGS, TÜV, Bureau Veritas) to conduct a factory audit (SMETA, ISO, or client-specific checklist). |

| 3 | Production Capability Validation | Verify equipment, workforce, and process maturity | Request machine lists, production flow charts, and past production records. Confirm automation level and scalability. |

| 4 | Quality Management Systems (QMS) Certification | Ensure consistent output and compliance | Require ISO 9001, IATF 16949 (auto), ISO 13485 (medical), or IPC standards for electronics. Audit internal QC processes. |

| 5 | Intellectual Property (IP) Protection Agreement | Safeguard designs, firmware, and proprietary tech | Execute a legally binding NDA under Chinese law and include IP ownership clauses in contracts. Use Chinese notarized agreements. |

| 6 | Supply Chain Traceability & Subcontracting Policy | Prevent unauthorized outsourcing | Require supplier lists, material traceability reports, and written policy on subcontracting. Audit sub-tier suppliers if applicable. |

| 7 | Financial Health Check | Assess long-term viability | Request audited financial statements (if available), bank references, or use credit reports from Dun & Bradstreet China or local credit agencies. |

| 8 | References & Case Studies | Validate performance with tier-1 clients | Request 2–3 verifiable client references (preferably in tech sector). Conduct direct outreach to confirm engagement scope and satisfaction. |

Best Practice: Big tech firms often require a Supplier Questionnaire (SQ) covering ESG, labor practices, environmental compliance, and export controls (e.g., EAR/ITAR).

Section 2: How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory | Trading Company | Recommended Verification Method |

|---|---|---|---|

| Business License Scope | Lists manufacturing activities (e.g., “production of electronic components”) | Lists “import/export,” “trading,” or “sales” | Cross-check on NECIPS.gov.cn |

| Physical Infrastructure | Owns production floor, machinery, tooling, R&D lab | No production equipment; may have sample room only | On-site or live video audit with 360° walkthrough |

| Lead Times & MOQs | Shorter lead times; flexible MOQs based on capacity | Longer lead times (dependent on factory); fixed MOQs | Compare quoted lead time vs. industry average |

| Pricing Structure | Itemized BOM + labor + overhead | Single-line item pricing; less transparency | Request detailed cost breakdown |

| R&D & Engineering Team | In-house engineers; can support DFM/DFA | Limited/no engineering support; relies on supplier | Ask for design support case studies |

| Export History | Direct export records under company name | May use third-party export agents | Check customs data via Panjiva, ImportGenius, or Descartes |

| Branding & Website | Factory images, production lines, certifications | Stock photos, multiple product categories, no facility details | Reverse image search; LinkedIn employee verification |

Pro Tip: Factories often have fewer English-speaking staff but deeper technical knowledge. Trading companies typically have stronger English and marketing—use this as a soft indicator.

Section 3: Red Flags to Avoid When Sourcing in China

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to conduct on-site or video audit | Likely not a real factory or has compliance issues | Suspend engagement until audit is completed |

| No verifiable business license or fake registration | High fraud risk | Validate via NECIPS; consult legal counsel |

| Offers extremely low pricing with no cost breakdown | Indicates substandard materials, labor abuse, or middleman markup | Conduct cost modeling; require BOM |

| Pressure for large upfront payments (e.g., 100% TT before production) | Cash flow risk and potential scam | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Inconsistent communication or evasive answers | Poor transparency or lack of authority | Escalate to senior management; request direct contact with operations lead |

| No ISO or industry-specific certifications | Quality and compliance risks | Require certification roadmap with audit timeline |

| Refusal to sign NDA or IP agreement | IP theft risk | Do not share technical drawings or specs |

| Multiple unrelated product lines (e.g., electronics + apparel + machinery) | Likely a trading company misrepresenting as factory | Request product-specific facility tour |

| No direct export license or history | Reliance on third parties; supply chain opacity | Verify customs export records |

Section 4: SourcifyChina Recommended Protocol for Big Tech Sourcing

- Pre-Screening: Use AI-powered supplier databases to filter by certifications, export history, and tech sector experience.

- Document Audit: Collect business license, tax registration, ISO certs, and audit reports.

- Engineering Assessment: Evaluate technical capability via sample testing and DFM review.

- Compliance Audit: Conduct ESG, labor, and environmental compliance checks.

- Pilot Order: Place a small trial run with full QC inspection (pre-shipment and in-line).

- Scale-Up Agreement: Finalize long-term contract with KPIs, audit rights, and exit clauses.

Conclusion

For global procurement managers, especially those representing big tech firms, sourcing in China demands rigorous due diligence. Distinguishing genuine manufacturers from trading companies, validating compliance, and mitigating risk through structured verification are non-negotiable.

By implementing the steps and checks outlined in this report, procurement teams can build resilient, transparent, and high-performance supply chains—aligned with the operational and ethical standards of leading technology enterprises.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Quality-Driven Sourcing Solutions for Global Tech Leaders

March 2026 | Confidential – For Internal Procurement Use Only

Get the Verified Supplier List

SourcifyChina Verified Pro List: Strategic Sourcing Intelligence Report 2026

Prepared for Global Procurement Leaders | Q3 2026 Edition

The Critical Time Drain in China Sourcing: A 2026 Reality Check

Global procurement teams lose 127–189 hours annually vetting unreliable Chinese suppliers for big tech components (IoT sensors, AI chips, EV subsystems). Traditional sourcing methods—Alibaba sifting, trade show follow-ups, unverified referrals—yield 68% false leads (per SourcifyChina 2026 Supply Chain Audit). For time-constrained procurement managers, this translates to delayed launches, inflated TCO, and supply chain vulnerability.

Why SourcifyChina’s Verified Pro List Eliminates 70% of Sourcing Time

Our AI-audited supplier database targets only Tier-1 manufacturers serving Huawei, Xiaomi, BYD, and global Fortune 500 tech OEMs. Unlike generic directories, every Pro List partner undergoes:

– Triple-Layer Verification: On-site factory audits (ISO 9001/14001), export license validation, and 3-year financial health screening.

– Tech Capability Mapping: Pre-qualified for semiconductor packaging, 5G infrastructure, robotics, and AI hardware.

– SLA-Backed Responsiveness: 4-hour RFQ response guarantee (vs. industry avg. 72+ hours).

Time Savings Comparison: Traditional vs. SourcifyChina Pro List

| Sourcing Stage | Traditional Approach | SourcifyChina Pro List | Time Saved |

|---|---|---|---|

| Supplier Identification | 42–60 hours | <8 hours | 85% |

| Capability Verification | 80–120 hours | Pre-validated | 100% |

| Compliance Screening | 35–50 hours | Integrated in profile | 100% |

| TOTAL PER PROJECT | 157–230 hours | <40 hours | ≥70% |

Source: SourcifyChina Client Data (Jan–Jun 2026), 47 enterprise tech procurement engagements.

Your Strategic Advantage in 2026

Procurement leaders using the Pro List achieve:

✅ 90-day faster time-to-PO for mission-critical tech components

✅ Zero counterfeit incidents (vs. 22% industry average for unvetted China sourcing)

✅ Real-time capacity alerts for fabs/assembly lines (e.g., SMIC 28nm wafers, Shenzhen PCB clusters)

“SourcifyChina’s Pro List cut our sensor supplier onboarding from 11 weeks to 14 days. We avoided $1.2M in launch delays for our IoT fleet.”

— Head of Global Sourcing, NASDAQ-Listed Industrial Tech Firm (Q2 2026 Client Testimonial)

Call to Action: Secure Your Q3 2026 Production Timeline

Do not risk Q4 revenue with unverified suppliers. The 2026 big tech supply chain is operating at 94% capacity (China Electronics Chamber of Commerce). Every day spent on false leads pushes your production into peak-season bottlenecks.

👉 Take these 3 steps within 5 business days:

1. Email [email protected] with subject line: “Pro List Access – [Your Company] Q3 2026 Tech Sourcing”

2. Receive your personalized Pro List shortlist (pre-filtered for your component specs/capacity needs) within 24 hours.

3. Book a 15-min strategy session with our Senior Sourcing Consultant to lock Q3 production slots.

Prefer instant alignment?

📱 WhatsApp +86 159 5127 6160 for real-time capacity availability (Shenzhen/Shanghai/Hefei tech hubs).

Note: 2026 onboarding slots are capped at 120 enterprise clients. 87 slots reserved as of 30 June 2026.

SourcifyChina

Where Verified Supply Meets Velocity

© 2026 SourcifyChina | Shanghai HQ | ISO 20400 Certified Sustainable Sourcing Partner

🧮 Landed Cost Calculator

Estimate your total import cost from China.