The global demand for high-performance portable power solutions continues to surge, driven by increasing reliance on reliable lighting across outdoor, industrial, and emergency applications. According to a 2023 report by Mordor Intelligence, the global battery market for portable electronics is projected to grow at a CAGR of 6.8% from 2023 to 2028, with significant contributions from specialty segments such as high-capacity square batteries used in premium flashlights. This growth is fueled by advancements in battery chemistry, rising outdoor recreational activities, and expanding use cases in law enforcement and industrial maintenance. As flashlight manufacturers seek longer runtimes, enhanced durability, and compact energy solutions, big square batteries—known for their high energy density and stable power delivery—have become a preferred choice. In response, a select group of battery manufacturers has emerged as leaders in innovation, scale, and reliability. Based on market presence, technological capability, and product performance data, here are the top 10 manufacturers shaping the big square battery landscape for flashlights worldwide.

Top 10 Big Square Battery For Flashlight Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Battery Products

Domain Est. 1997

Website: batteryproducts.com

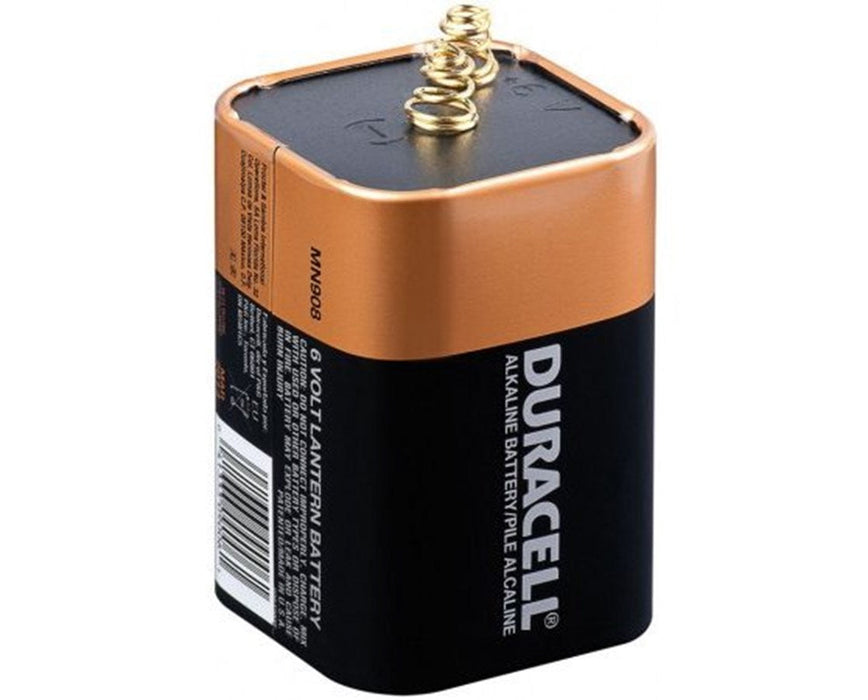

Key Highlights: We offer batteries from industry leaders like Energizer, Rayovac, and Duracell at wholesale prices. We carry lithium, alkaline and rechargeable batteries….

#2 Lantern

Domain Est. 2000

#3 VARTA BRAND

Domain Est. 1995

Website: varta.com

Key Highlights: VARTA AG, based in Ellwangen (Baden-Württemberg), combines the Consumer Batteries, Micro Batteries, Lithium-Ion Small Cells, Lithium-Ion Battery Packs and ……

#4 Replacement Lantern Battery

Domain Est. 1997

#5 Handheld Flashlights

Domain Est. 1997

Website: streamlight.com

Key Highlights: Find durable, high-performance handheld flashlights from Streamlight. Explore LED, rechargeable, and tactical options built for work, adventure, ……

#6 Flashlight Batteries

Domain Est. 1998

#7 zBattery.com

Domain Est. 1999

#8 Superfire

Domain Est. 2005

Website: superfire.com

Key Highlights: SUPERFIRE provides a wide range of high-quality lighting products, including LED flashlights, headlamps, work lights, bicycle lights, camping lights, ……

#9 Batteries

Domain Est. 2014

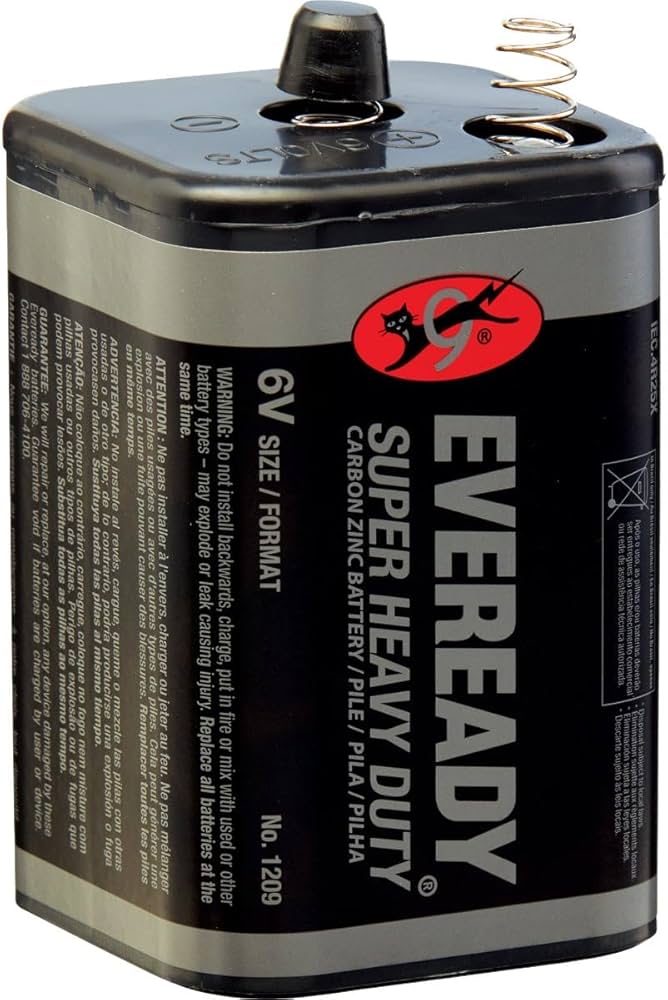

#10 Eveready MAX 6

Domain Est. 2015

Website: santafebid.org

Key Highlights: In stock Rating 4.2 (81) 3 days ago · Eveready MAX 6-Volt Alkaline Lantern Battery – For Calculator, Pencil Sharpener, Flashlight, Tape Recorder – 6 V DC – 6 / Carton ; New $113….

Expert Sourcing Insights for Big Square Battery For Flashlight

H2: 2026 Market Trends for Big Square Battery for Flashlight

The market for big square batteries used in flashlights is poised for notable transformation by 2026, driven by advancements in energy storage technology, rising demand for high-performance portable lighting, and evolving consumer preferences. These batteries—commonly referring to configurations such as 26650, 21700, or custom prismatic lithium-ion cells—offer higher capacity and improved power delivery compared to traditional cylindrical or button cells. Below are key trends expected to shape the 2026 landscape:

1. Increased Adoption of High-Capacity Lithium-Ion Chemistries

By 2026, the shift toward advanced lithium-ion chemistries—such as lithium iron phosphate (LiFePO4) and nickel manganese cobalt (NMC)—will accelerate in big square batteries. These chemistries offer enhanced safety, longer cycle life, and better thermal stability, making them ideal for high-drain flashlight applications. Manufacturers are expected to prioritize energy density and fast-charging capabilities, aligning with user demands for extended runtime and rapid recharging.

2. Growth in Tactical and Outdoor Lighting Segments

The tactical flashlight and outdoor recreation markets are significant drivers for big square batteries. Law enforcement, military, and emergency response users require reliable, high-output lighting systems powered by robust, long-lasting batteries. As demand grows for compact yet powerful flashlights, OEMs will increasingly integrate big square cells to meet performance benchmarks. The 2026 market will see a surge in flashlights designed specifically around these larger-format batteries for superior lumen output and heat dissipation.

3. Rise of Rechargeable and Smart Battery Systems

By 2026, disposable batteries will continue to lose ground to rechargeable big square batteries. Consumers are favoring cost-effective, eco-friendly solutions, leading to increased integration of USB-C and wireless charging. Moreover, smart battery features—such as built-in fuel gauges, overcharge protection, and Bluetooth connectivity for usage tracking—are expected to become standard. These features enhance user experience and safety, particularly in professional-grade lighting tools.

4. Expansion of Custom and Proprietary Battery Designs

Flashlight manufacturers are moving toward proprietary big square battery designs optimized for specific product lines. This trend allows for better integration, improved thermal management, and enhanced performance. Companies like Fenix, Olight, and Acebeam are likely to expand their ecosystems with custom battery packs by 2026, creating lock-in effects and boosting brand loyalty.

5. Sustainability and Regulatory Pressures

Environmental regulations, particularly in Europe and North America, will influence battery design and disposal practices. The EU’s Battery Regulation and similar frameworks will push manufacturers to improve recyclability, reduce hazardous materials, and provide clear labeling. As a result, big square battery producers will invest more in sustainable materials and modular designs that support easy recycling.

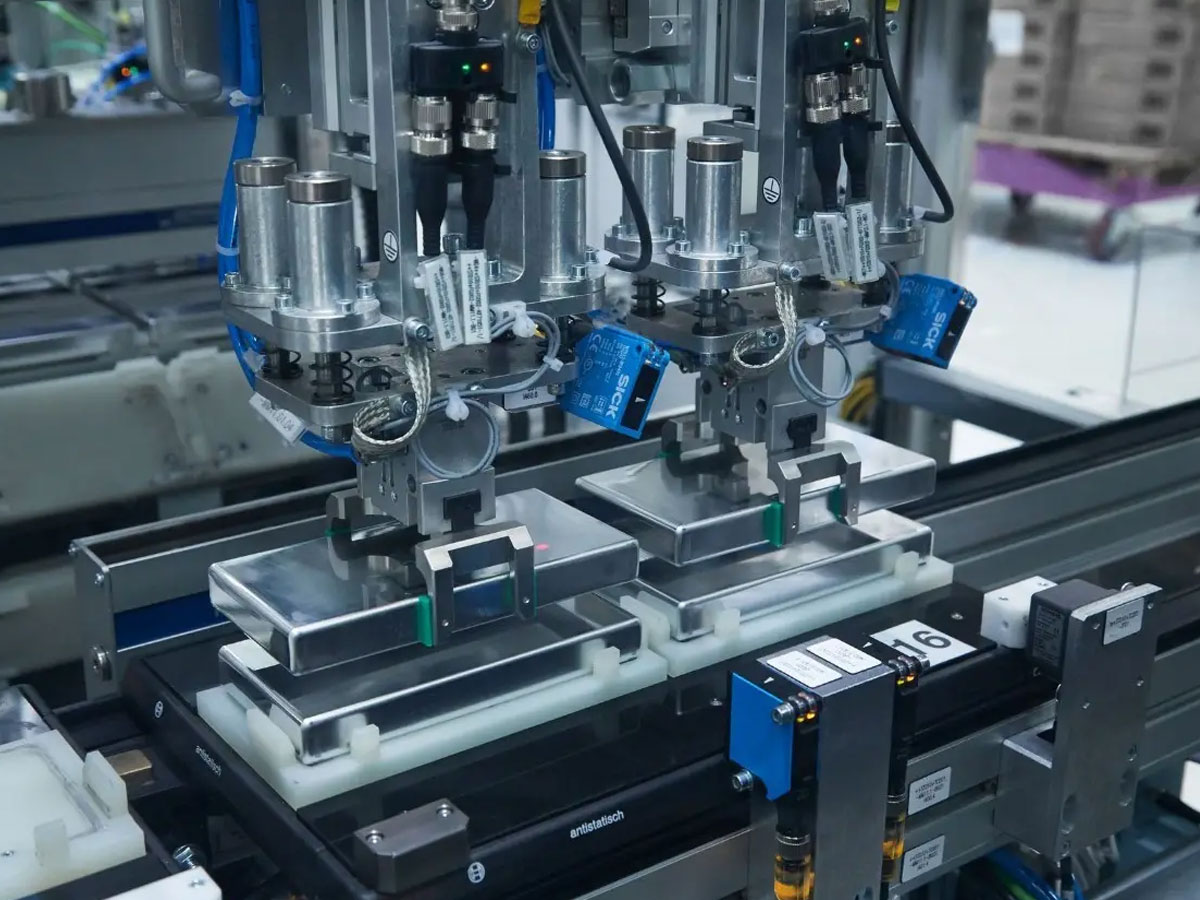

6. Supply Chain Optimization and Regional Manufacturing

Geopolitical factors and raw material volatility (e.g., lithium, cobalt) will drive a shift toward localized battery production. By 2026, we expect increased investment in North American and European battery manufacturing facilities to reduce dependency on Asian supply chains. This localization will improve lead times and reduce logistics costs for flashlight OEMs.

7. Integration with Renewable Energy and Off-Grid Applications

Big square batteries are increasingly being used in solar-powered or hand-crank emergency flashlights. As off-grid and disaster preparedness markets grow, especially in developing regions, demand for durable, high-capacity batteries will rise. These applications will benefit from the robust power delivery and longevity of square-format cells.

In conclusion, the 2026 market for big square batteries in flashlights will be defined by technological innovation, sustainability, and specialized applications. As performance expectations grow across consumer, professional, and industrial sectors, big square batteries will play a central role in powering the next generation of advanced lighting solutions.

Common Pitfalls When Sourcing Big Square Batteries for Flashlights (Quality & IP)

Sourcing large square batteries—often lithium-ion or lithium-polymer cells—for high-performance flashlights can be fraught with challenges, especially when balancing cost, quality, and intellectual property (IP) concerns. Being aware of these pitfalls helps ensure reliability, safety, and legal compliance.

Poor Cell Quality and Performance Inconsistencies

Many suppliers, particularly from less-regulated markets, offer batteries that appear to meet specifications on paper but fail under real-world conditions. These cells may have lower actual capacity (e.g., advertised 5000mAh but deliver only 3000mAh), inconsistent voltage output, or shortened cycle life. Using substandard cells can lead to flashlight performance issues such as dimming, premature shutdown, or reduced runtime.

Safety Risks from Non-Certified or Counterfeit Cells

Low-quality batteries often lack essential safety certifications (e.g., UL, UN38.3, IEC 62133). Some may use recycled or rewrapped cells passed off as new. These pose serious risks including overheating, swelling, leakage, or even thermal runaway and fire—especially in high-drain flashlight applications. Always verify cell authenticity and demand proper test reports and safety documentation.

Misleading IP (Intellectual Property) Claims

Suppliers may falsely claim their batteries are “compatible with” or “equivalent to” branded cells (e.g., Samsung, LG, or Sanyo), infringing on trademarks or implying OEM origin without authorization. This not only raises legal risks but may also mislead buyers about quality. Ensure suppliers do not misuse brand names and clarify whether designs or packaging infringe on existing patents or trademarks.

Lack of Genuine IP Protection for Custom Designs

If you’re developing a proprietary battery design or form factor, failing to secure patents, design rights, or trademarks leaves your innovation vulnerable. Suppliers might copy and resell your design to competitors. Always establish clear IP ownership in contracts and consider filing for protection in key markets before mass production.

Inadequate Protection for Sourcing Agreements

Without clear contracts, suppliers might claim partial ownership of custom tooling, battery designs, or performance data. Ambiguities in IP clauses can result in disputes or loss of control over your product. Use comprehensive agreements that define IP ownership, restrict reverse engineering, and include confidentiality terms.

Inconsistent IP68 or IP69K Ratings (Ingress Protection)

Many flashlight batteries claim high IP ratings (e.g., IP68 for dust/water resistance), but these are often self-certified or unverified. Poor sealing, substandard gaskets, or design flaws can compromise protection, leading to moisture ingress and battery failure. Always request third-party test reports for IP ratings and conduct your own environmental testing.

Supply Chain Transparency and Traceability Gaps

Hidden layers in the supply chain can obscure the true origin of cells. A seemingly reputable supplier might source from unauthorized or uncertified sub-suppliers. This increases the risk of receiving non-compliant or counterfeit components. Conduct factory audits and require full material traceability documentation.

Avoiding these pitfalls requires due diligence: vet suppliers thoroughly, insist on certifications, secure legal IP protections, and validate claims through independent testing. Prioritizing quality and IP integrity ensures safer, more reliable flashlight performance and protects your brand long-term.

Logistics & Compliance Guide for Big Square Battery For Flashlight

Product Classification & HS Code

Identify the correct Harmonized System (HS) code for international shipping. Big square batteries for flashlights typically fall under HS Code 8506.50 (Primary batteries, non-rechargeable) or 8507.80 (Rechargeable batteries, if applicable). Confirm based on battery chemistry (e.g., lithium, alkaline). Accurate classification ensures proper customs clearance and duty assessment.

Battery Type & Chemistry

Specify the battery chemistry (e.g., lithium iron disulfide, alkaline, or lithium-ion). This determines compliance requirements. For lithium-based batteries, additional regulations apply under IATA, IMDG, and ADR depending on transport mode (air, sea, road). Clearly mark battery type on packaging and documentation.

UN Number & Transportation Regulations

- Lithium batteries: Assign the appropriate UN number:

- UN 3090: Lithium metal batteries (non-rechargeable)

- UN 3480: Lithium-ion batteries (rechargeable)

- Comply with IATA DGR for air freight, IMDG Code for sea freight, and ADR for road transport in Europe.

- Ensure proper classification, packaging, labeling, and documentation.

Packaging Requirements

Use packaging that meets UN 38.3 test criteria for lithium batteries. Packaging must:

– Prevent short circuits (terminals protected)

– Withstand stacking and shocks

– Include inner insulation and rigid outer packaging

– For air transport, use packaging certified for PI 965 (for lithium metal) or PI 966/967 (for lithium-ion) as applicable.

Labeling & Marking

All shipments must display:

– Proper shipping name (e.g., “LITHIUM METAL BATTERIES”)

– UN number (e.g., UN 3090)

– Class 9 Miscellaneous Dangerous Goods label

– Lithium battery handling label (required for air transport)

– Manufacturer or supplier name and contact information

– Quantity and battery type on outer packaging

Documentation

Include with each shipment:

– Commercial invoice with accurate product description, HS code, and value

– Packing list detailing number of batteries and packaging type

– Dangerous Goods Declaration (for regulated lithium batteries shipped by air or sea)

– Safety Data Sheet (SDS) compliant with GHS standards

Regulatory Compliance

Ensure compliance with:

– REACH & RoHS (EU): Restrict hazardous substances in electrical equipment

– Proposition 65 (California, USA): Warning labels if batteries contain listed chemicals

– EPA & DOT (USA): Environmental and transportation regulations

– CBTA (China): China Compulsory Certification may apply if integrated into devices

Storage & Handling

Store batteries in a cool, dry environment away from direct sunlight and flammable materials. Avoid stacking heavy items on packages. Train personnel in safe handling of lithium batteries to prevent fire risks.

Import Restrictions & Duties

Check destination country regulations. Some countries restrict or ban certain battery types. Duty rates vary by HS code and trade agreements. Use a licensed customs broker to ensure smooth clearance.

Returns & Reverse Logistics

Establish a process for defective or recalled batteries. Use compliant packaging for return shipments and follow local waste disposal regulations (e.g., WEEE in EU). Never return lithium batteries via regular mail without proper labeling.

Sustainability & Disposal

Provide end-of-life instructions. Encourage recycling through certified programs. Comply with local battery take-back laws to support environmental responsibility.

In conclusion, sourcing big square batteries for flashlights requires careful consideration of several key factors including voltage output, capacity (mAh), physical dimensions, brand reliability, and compatibility with the specific flashlight model. These batteries, often lithium-ion such as the 26650 or custom square cells, offer higher energy density and longer runtime compared to smaller cells, making them ideal for high-performance or extended-use flashlights. It is essential to source from reputable suppliers or manufacturers to ensure safety, quality, and consistency. Additionally, evaluating cost-effectiveness, availability, and adherence to safety standards (such as overcharge and short-circuit protection) will contribute to a reliable and efficient power solution. By prioritizing these elements, users and businesses can make informed decisions that enhance flashlight performance while ensuring long-term value and safety.